Best AI Text to Video Models & Templates

Introduction: AI Video Generation Is No Longer Experimental What began as short, unstable demo clips has evolved into production-grade systems…

Sep 06, 2023

Every person and business will always require some sort of insurance. The purpose of having it is mainly for protection as there will always be risks present no matter what you may do. It’s all a matter of choosing which insurance is best to cover specific risks that pose the most danger.

However, one cannot just acquire insurance unless all of the necessary agreements have been made and that all of the paperwork has been properly done. This means that you’re going to need a document that provides all of the information regarding how one can acquire insurance. And that’s why this article is going to teach you how to come up with an insurance contract.

assb.gov.sg

assb.gov.sg lawreform.ie

lawreform.ie illinois.gov

illinois.gov tamus.edu

tamus.edu tdi.texas.gov

tdi.texas.govRemember that the entire purpose as to why you would want to make and utilize an insurance contract is to point out everything regarding the details of the insurance. This means that the document must be able to outline everything from the type of insurance that’s wanted by the client to the terms and conditions that need to be met before anything can take place. So long as everything presented is clear, then one shouldn’t worry about the means of acquiring the insurance needed.

With that in mind, here are the steps that will allow you to come up with a proper insurance contract:

The first thing that needs to be done is to point out exactly which party involved is the “client” and which is the “provider”. This is very important as there will be situations wherein one may need to prove his or her role in the contract. A good example would be when a lawsuit is filed against the particular party member, whether that be the client or the service provider. By sharing exactly who belongs to what role, then being able to figure out the agreements.

So what you will need to do is to write down the complete name of the client into the contract. Whether it’s an individual client or one that represents a company, you’re going to have to ask that person to provide a complete name to ensure that he or she is easily identifiable. If that person is a representative, best to include the name of the company as well.

Once that’s done, then the next is to write down the name of the company that is in charge of handling the insurance. Just make sure that you are able to do all of this so that those that are involved in the contract, as well as their roles, can be easily identified.

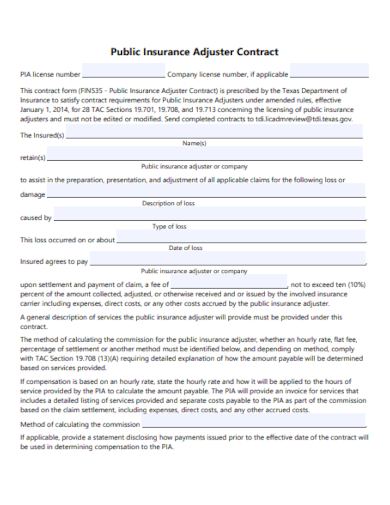

If one were to apply for insurance, then the first step in which that person has to take is to get the proposal form of a particular insurance company. After filling in the requested details, that person must then send the document to the insurance company. This is what you would call as the “offer” and it’s necessary for insurance companies so that they may evaluate as to whether or not someone is able to acquire a specific type of insurance. In the event that the insurance company agrees to the offer, then that’s what you would call as the “acceptance”.

There will be cases wherein the insurer may only decide to agree to the offer after certain changes have been made. The client must be aware of these changes to ensure that a fair compromise is reached. Should there be no more issues regarding the acceptance of the offer, then all one needs to do next is to write both down into the contract.

A consideration is what one would call the premiums or the future premiums that the client must be able to pay to the insurance company. For insurers, consideration also refers to the money that’s being paid out to the client in the event that he or she were to file an insurance claim. The reason as to why considerations need to be shared in the contract is because the parties involved must provide some sort of value to the relationship that they are about to engage in.

Doing this will guarantee that the insurer will pay nothing more than the actual loss that was suffered by the client. The purpose of having insurance is so that the client is left in the same financial situation that he or she was in prior to the incident that lead to the insurance claim. So let’s say that a particular client has attained fire insurance and that one day his or her establishment has been demolished entirely due to a fire-related incident. This means that the insurance will kick in, but that the client will only be compensated for what was lost and what will be replaced will be equivalent of value.

It’s never going to be possible for an insurance client to receive superior products or services as opposed to the ones that was lost due to the incident. So long as the insurance contract states as to what will be covered and how much of these losses will be covered, then there shouldn’t be any sort of misunderstanding or misconceptions regarding the matter.

You must the proceed to provide exactly what will be covered by the insurance should the client decide to push through in acquiring it. This is very important as the client should be knowledgeable in regards to the means of security that the insurance should be able to provide.

What needs to be written down first is specifically the type of damages that are going to be covered. It’s important that the contract specifically points out the type of insurance that the client is going to attain should he or she decide to sign it. This will tell the client all of the conditions that need to be meet before he or she may be able to avail the insurance.

Once you’re done pointing out what’s going to be covered, then the next thing to do is to share the amount of damages that the insurance plans on covering. This is to guarantee that the client knows exactly just how much he or she can expect from the insurance plan that he or she decides to acquire. This can potentially avoid any sort of misunderstandings or issues pertaining to the amount that will be used to cover for any damages or losses.

So as you’re writing the information for this section, you must make sure that you are able to provide an accurate figure in regards to the amount that will be used should the client make use of the insurance claim. Also, it should be noted that there has to be a statement which says that the money provided will only be issued and used to situations that have met the required conditions that would allow the client to make an insurance claim. That way, the insurance agency will be protected from any client that wishes to commit insurance fraud.

This is where you will be pointing out everything in regards to how the insurance is to be claimed, information on how one can acquire the insurance, what procedures need to be followed and so on. The reason as to why this needs to be shared is so that the client may make insurance claims in a manner that’s acceptable and only when needed.

Also, it’s the responsibility of the insurance agency to disclose all the relevant facts to your insurer. Normally, a breach of the principle of utmost good faith arises in the event that the insurance agency fails to divulge or eludes any facts pertaining to insurance claims. There are two kinds of non-disclosure:

Should the client be provided with inaccurate information with the intention to deceive, then the contract is immediately void. If this deliberate breach was discovered at the time of the claim, then the insurance company will not pay the claim. If the insurer considers the breach as innocent but significant to the risk, then there should be statement which says that the client should be able to collect additional premiums.

If you would like to learn about the other types of contracts that you can make, then all you have to do is to go through our site. It has many different articles, all of which should have the information that you’re going to need. Just make sure that you are able to read the ones you’ve gathered thoroughly so that you can make the most out of what they have to offer.

Introduction: AI Video Generation Is No Longer Experimental What began as short, unstable demo clips has evolved into production-grade systems…

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

Hospitality Induction Templates are structured guides created specifically for the hospitality industry to facilitate the onboarding process for new employees.…

Whether you are a business or an organization, it is important for you to keep track of your business bank…

A Company Description provides meaningful and useful information about itself. The high-level review covers various elements of your small business…

A smartly designed restaurant menu can be a massive leverage to any food business.

Whether you need to keep neat records of received payments, or are looking for a template that helps you look…

The most widely recognized use for a sample letter of planning is the understudy who, after finishing secondary school, wishes…

The term “quotation” can refer to several things. While to some it may refer to a quote, which is proverbial.…