Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Oct 16, 2023

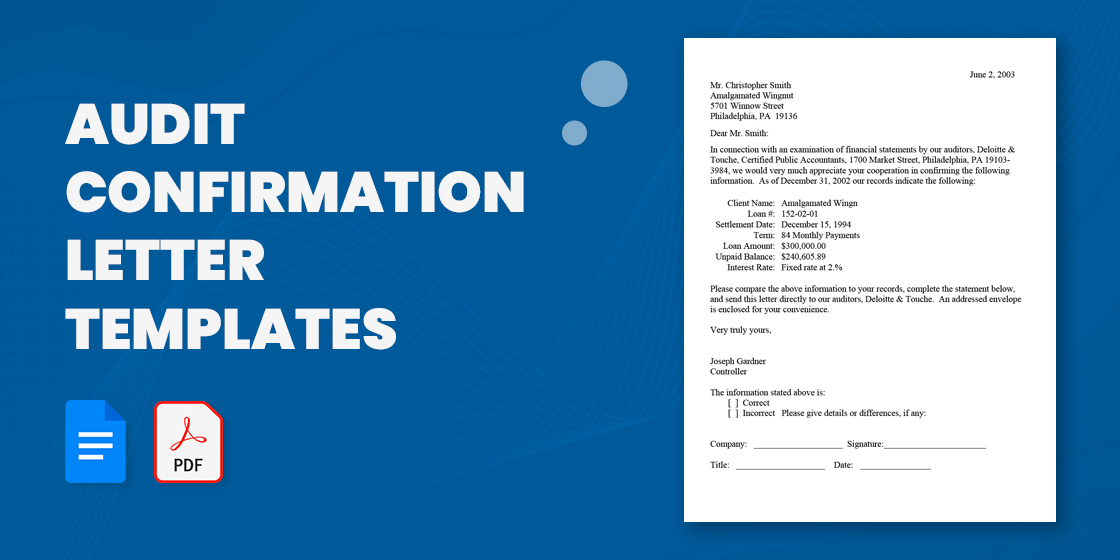

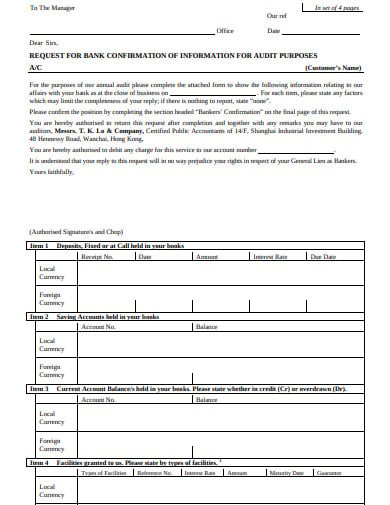

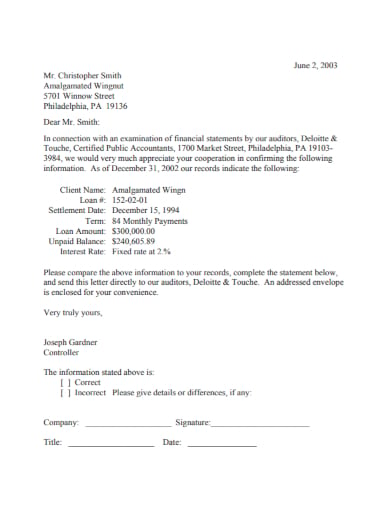

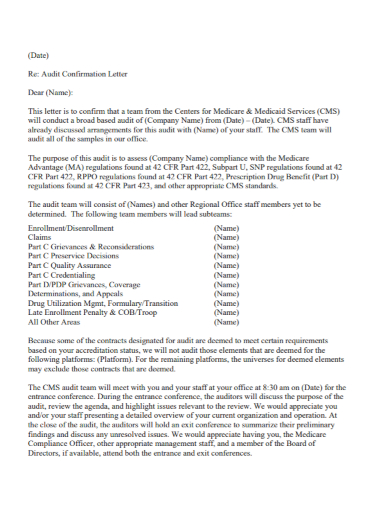

An audit confirmation letter is a particular type of interrogation or a legal request from an internal or external customer and party. The requested response data may be about the current financial conditions of debtors or any supplier like the positive and negative balance, bank loan, inventory, account receivable, accounts payable, petty cash, and more.

Whether sent via email or printed document, the letter formally confirms accounting and other data. You can exude professionalism and credibility by submitting a request fast with our audit confirmation letter. Have a look at the letter templates below and choose the one that best fits your purpose.

pidcphila.com

pidcphila.com bba.org.uk

bba.org.uk tklo.com.hk

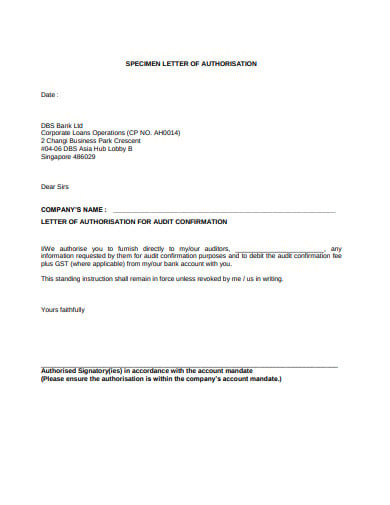

tklo.com.hk dbs.com.sg

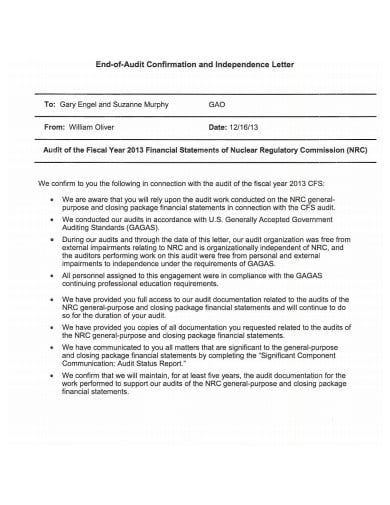

dbs.com.sg nrc.gov

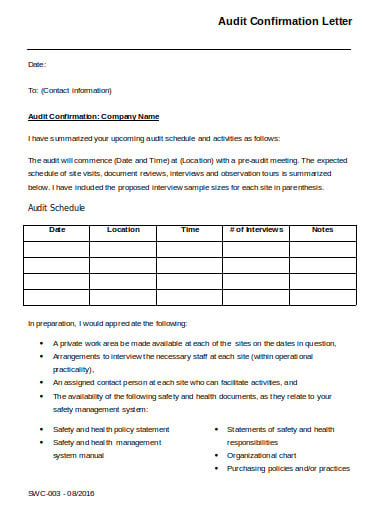

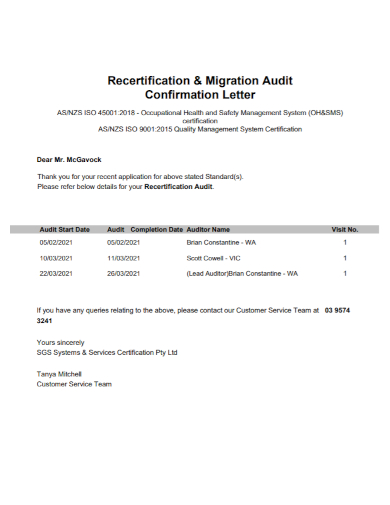

nrc.gov safemanitoba.com

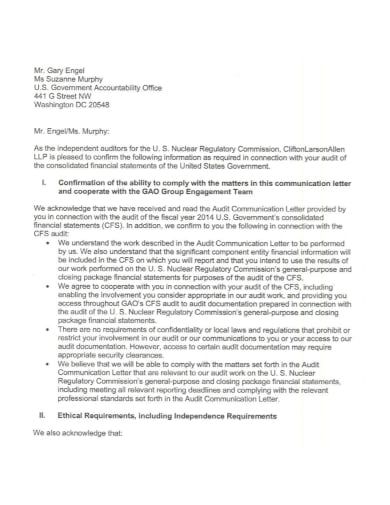

safemanitoba.com  nrc.gov

nrc.gov dfm.ae

dfm.ae solargain.com.au

solargain.com.au pidcphila.com

pidcphila.com pidcphila.com

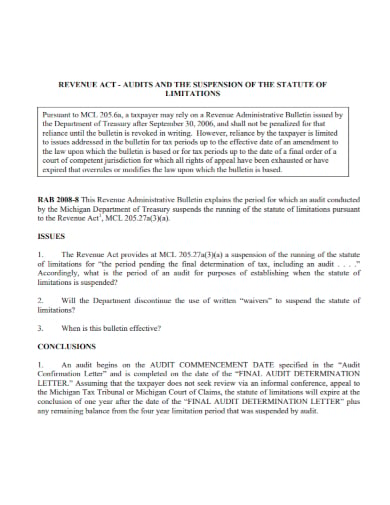

pidcphila.com michigan.gov

michigan.govAn audit sample letter of representation is a form letter developed by an organization’s service auditor and signed by a member of senior management. In the simple letter, management attests to the exactness and completeness of the data given to the service auditors for their examination.

Confirmation letters in Pages serve multiple objectives. A confirmation letter is also a written record of data already explained in a meeting or through a telephonic conversation. Here, it helps as a source of recommendation, rectification, and or conformity to the previous oral sample agreement.

Appointment letters give out particulars about salary and profits when a candidate first enters into a job, the same way appointment letter sample templates operate. Confirmation letters, on the other hand, give out particulars about added advantages that general employees have comprising salary increase.

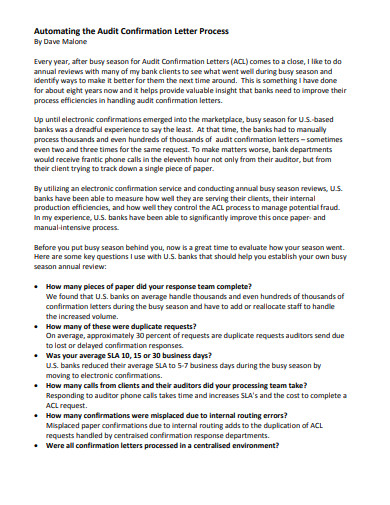

Audit procedures are the methods and systems that auditors present to collect audit evidence which allows them to make an outcome on the set audit objective and state their view.

An audit confirmation letter in Google Docs is received from autonomous sources outside the entity. Received quickly by the auditor is more stable than audit evidence received indirectly or by inference. It endures in documentary form, whether paper, electronic, or another medium.

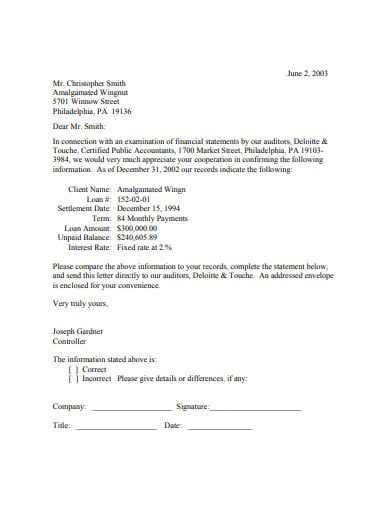

Positive confirmation is an auditing analysis that needs the client to reply, authenticating the efficiency of an item. Positive confirmation needs evidence of accuracy by asserting that the original data was accurate or by giving the correct data is incorrect.

A negative confirmation is a document declared by an auditor to the clients of a customer company. The formal letter asks the customers to reply to the auditor only if they find a mistake between their word documents and the data about the client organization’s financial records that are provided by the auditor.

A confirmation letter is a printable letter addressed to validate several informal and formal activities. Several such activities pertain to appointments, conferences, events, meetings, reservations, resignations, and travel. Confirmation letter layout serve multiple objectives.

Account receivables confirmation is usually performed by auditors to affirm the existence of accounts receivable that are recorded in the client’s financial statements. These confirmations also attempt to confirm the exactness of accounts balance that is excellent at the reporting date.

The goal of the control account is to keep the common ledger nice and clean without any details, yet include the right balances to be used in the financial statements. Many of the accounts seen in the financial statements, take cash, for instance, are displayed as the control account in the balance sheet.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…