Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Jan 05, 2021

If you ever receive a donation for a charity or some other cause, then you should always be sure to send a thank you letter for the donation. This would naturally be expected of you since it would be considered well-mannered to do so. However, there are some other reasons why you should send a letter template, some of which have to do with making sure that the donor can receive certain benefits, to say nothing of contributing to having a record of the donation.

Donation acknowledgment letters are actually a requirement in order to avail of benefits like tax exemption, which can help confirm your organization’s status as a tax-exempt organization. But in order to be sure that your letters can do their jobs well, it pays to know how to prepare donor acknowledgment letters so that they can function properly. After all, you do need to keep some things in mind in order to be sure that you can be certain that you can avail of those benefits.

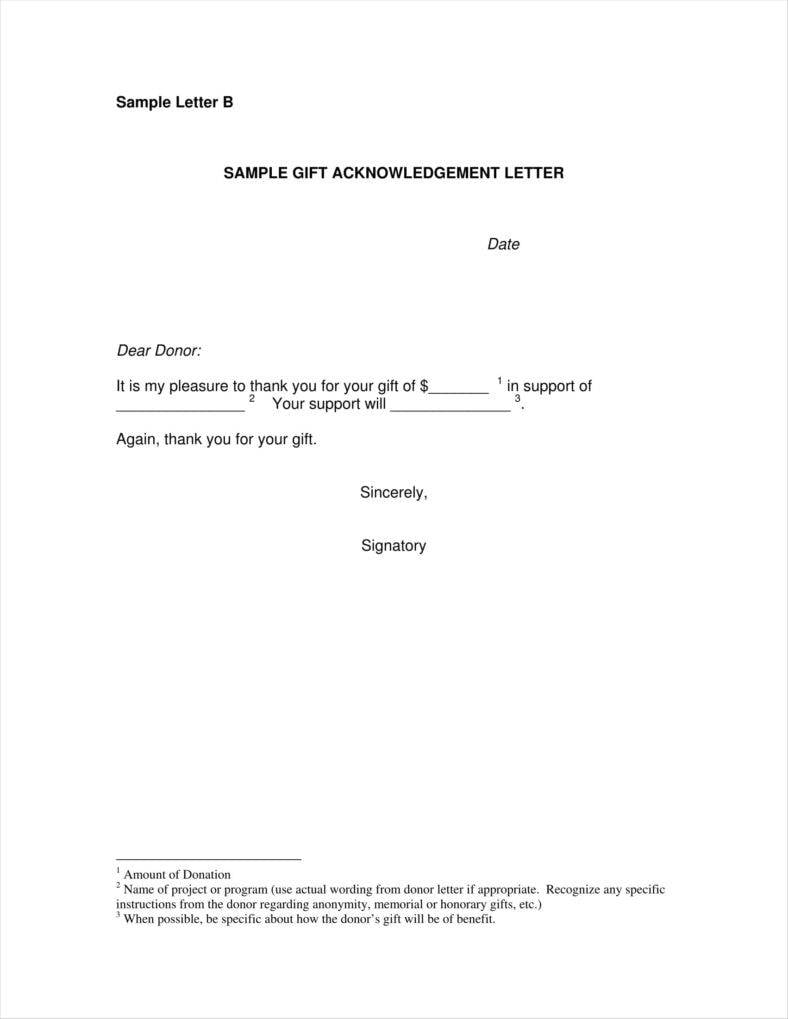

engrscholarships.umd.edu

ucanr.edu

tarleton.edu

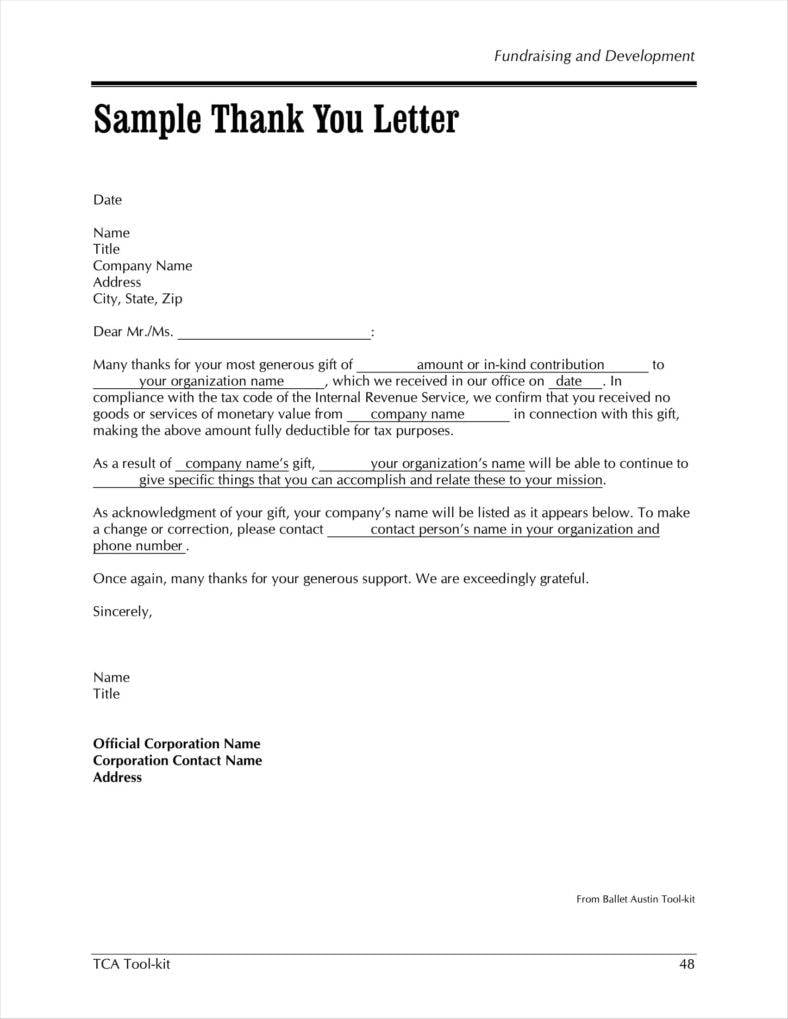

arts.texas.gov

lsc.gov

One of the things that you definitely need to understand is the significance of donation acknowledgment letters. You may already have some idea of why they are important, but it would be prudent to know about some of the other reasons why such letters matter. Other than what such a letter can mean in terms of etiquette, there are some practical considerations you should keep in mind.

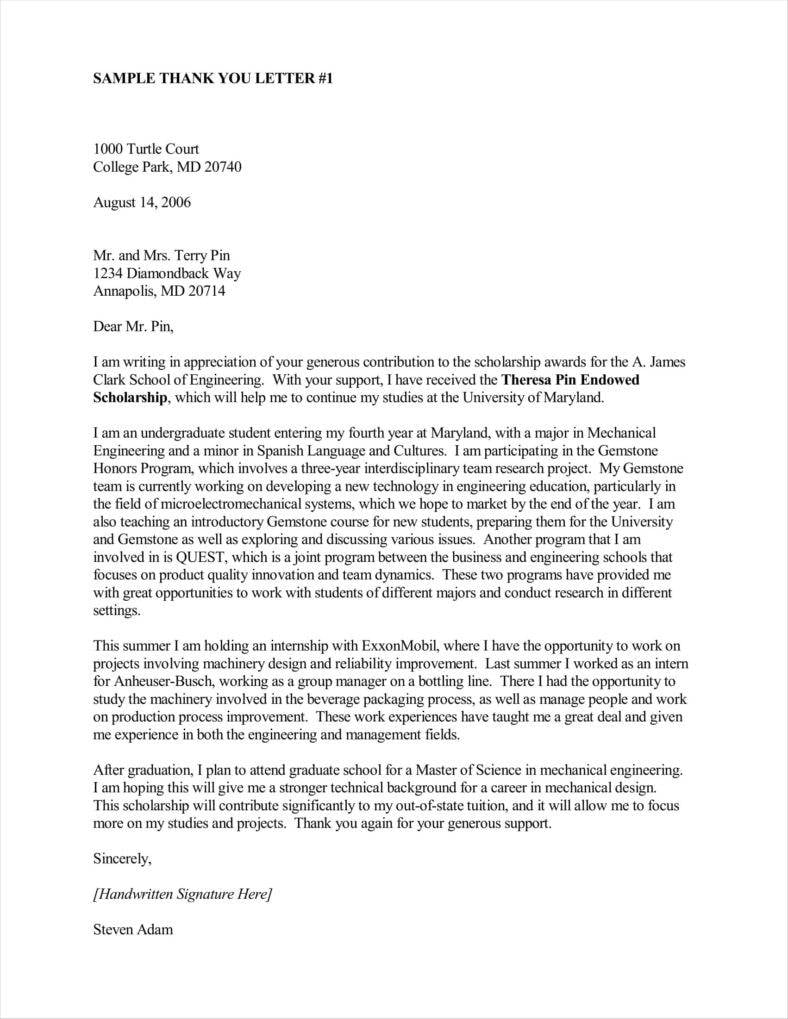

The most basic function of any donation acknowledgment letter is enabling you to thank your donors. Naturally, this is a basic courtesy as it shows your donors that you do appreciate their donations to your cause. Sending a letter can be an effective way of conveying that gratitude because it can demonstrate a personal connection with your donors, even if you should use a template to make the letter. Using these letters to thank your donors is also an effective way of maintaining good relations, which may well pay off.

Speaking of paying off, using donation acknowledgment letters can contribute to any decision on your donors’ part to donate to your organization again. Apart from the written declaration of your gratitude, the letter can make life more convenient for your donors, especially if they want to avail of tax reductions by donating to you. Being prompt with using your donation receipt templates to send these letters can make that process go more smoothly for your donors, which may well increase their goodwill toward you, which could lead to further collaboration in the future.

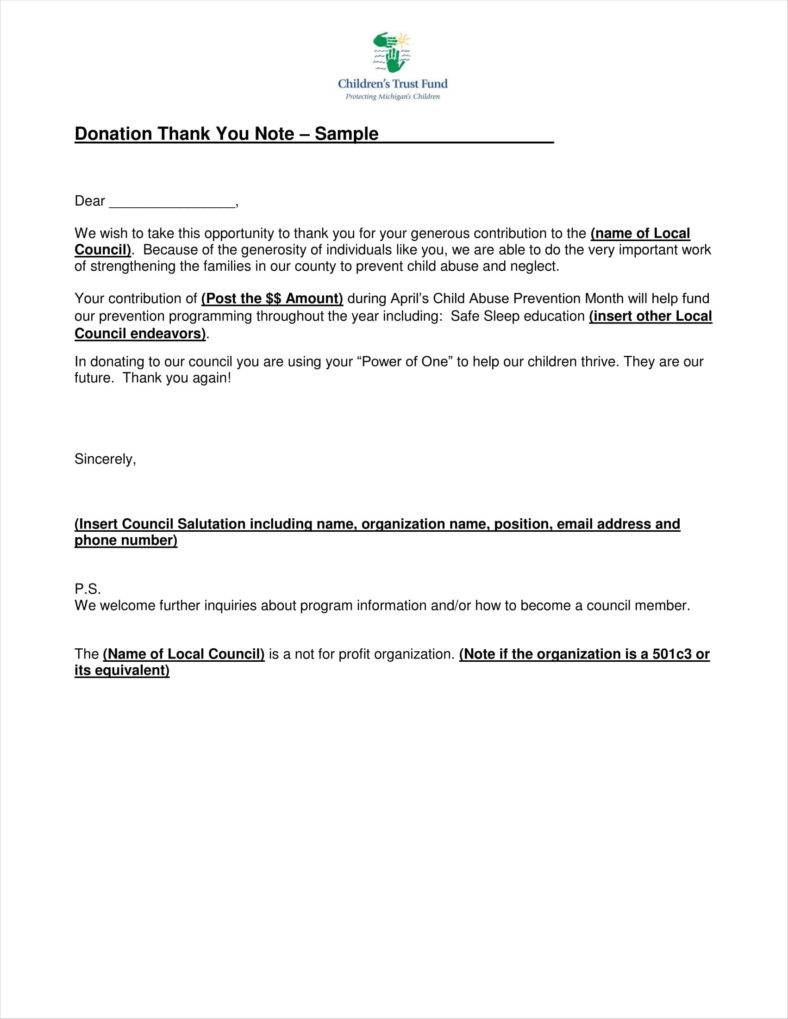

Non-profit organizations like charitable organizations can actually extend similar benefits to their donors in the form of tax reductions by virtue of having donated to a charitable cause. As such, your donation letter templates can be used to secure this status for your donors by confirming their having donated to you. This entitles your donors to reductions in their taxes. However, you do need to make sure to send in a donation acknowledgment letter in order to confirm that they did donate to you and that you actually received it. Tax exemptions can be a strong incentive for your donors to donate funds to you, so it pays to help them achieve those deductions in order to secure more potential donors, which also serves to benefit your organization and cause.

Some of your donors may also decide that they would like to confirm your tax-exempt status, which is why you should take the time to include certain elements in your letter like an employer identification number. This can make it easier to verify the actual status of your organization in order to make sure that you are a legitimate charitable organization. After all, it may be that your donors would like extra proof in order to verify that you are a legitimate charity. As such, you should be able to provide some credentials in order to supply more scrupulous donors with all the proof they need of your proper status. This can also serve to assure the authorities that you are indeed exempt from taxes, which can help you avoid legal troubles down the road.

Donation acknowledgment letters can also contain some of the details of a given donation. Much like acknowledgment letters, these letters can serve to confirm the details, and in so doing provide a written record of it in case anyone should want to inspect the donation themselves. Your letters may also serve as records of the donation, which can prove useful in case you or your donors need to prove something to the authorities. It always pays to have accurate records in order to provide some kind of sense of continuity regarding your incomes. Other than making it possible to keep track of your donations for the benefit of donors and the authorities, this should also make it easier to keep track of your organization’s finances, which you would need to know in order to determine how much money you have to carry out your plans in the first place.

michigan.gov

alumni.rpi.edu

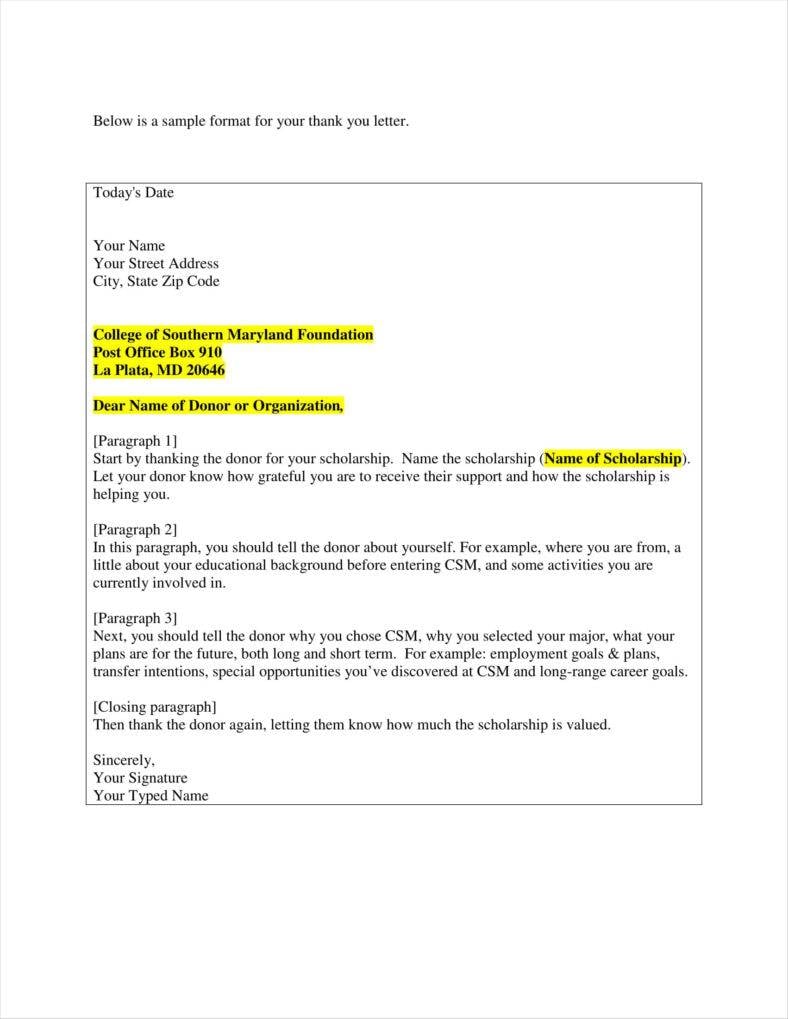

csmd.edu

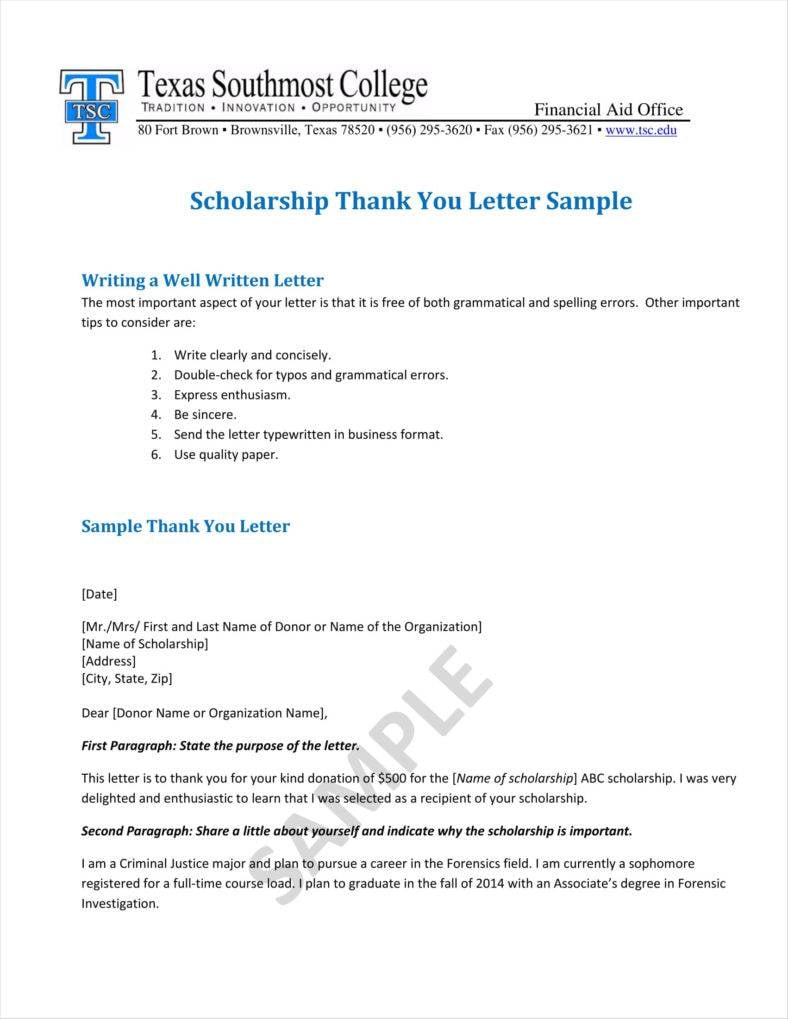

tsc.edu

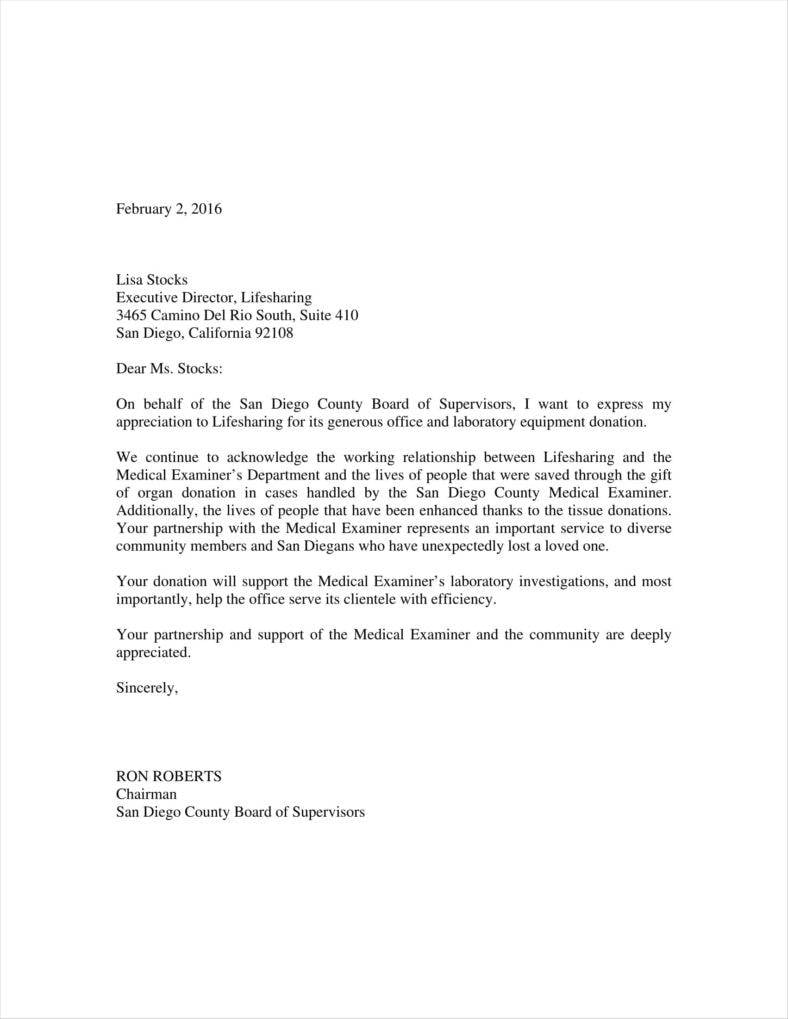

sandiegocounty.gov

When making your donation acknowledgment letters, you also need to remember that there are some requirements you cannot forget. These matters are part and parcel of how to effectively write business acknowledgment letters as these help give your letters even more legitimacy, which can make it easier for your documents to be proforma. In any case, these tips can help ensure that your letters can do their job more effectively, which can only benefit you.

Your donation acknowledgment letters do always need to include the amount given to your organization, if only to confirm exactly how much was given. In most cases, the letter needs to specify the amount if it exceeds 250 dollars. In the case of non-monetary items, you need only provide a description of the item, not the value. Including the amount in your donation acknowledgment letter serves to help the authorities determine exactly how much was given, which is needed in order to determine the tax reductions your donors should receive. This data should also make it easier for you to find out how much money was donated from each donor, which should make your accounting much easier.

You do also need to state whether or not anything was provided to donors in return for their donations. If you received the donation and that was the end of the matter, then a gift acknowledgment letter might be sufficient. This is not to say that the donation was something like a business transaction, as is the case in fundraising dinners, where donors pay for their own dinners, with the rest being the donation to your organization. In any case, this information can help to delimit the precise nature of that particular donation, which can help assure the authorities that it was a donation and not a business transaction. This is true even in the case of you giving small giveaways to your donors like mugs or other knickknacks.

Remember to confirm your organization’s tax-exempt status since you need to state clearly that you are a tax-exempt organization. As such an organization, you are entitled to certain privileges, as are your donors. However, in order to qualify for such privileges, you do need to adhere to certain standards, which include stating your status clearly. This is also what enables your donors to avail of the benefits of donating to you, so this tip is of greater consequence than you might expect at first glance.

You should also remember to include the names in a thank you letter format as this helps specify the details of each donation. Your organization’s name is a given since you need to state it for the benefit of the authorities. However, you should take the time to include the specific names of each donor in order to make clear who donated what. After all, it could be counted as a faux pas to mislabel names and donations, to say nothing of how your donors cannot claim the benefits of donating to you if you happen to list the names incorrectly.

You also have to include the specific date of donation, if only to provide convenient records of each donation. After all, your donation acknowledgment letters are also meant to serve as records of each donation, so for the sake of completeness they ought to include the dates. This can serve as further confirmation that a donation happened in the first place since you can attach a date that can serve to verify that something was given and then received.

If you need to make your own donation acknowledgment letters, then these insights should be able to make your task all the easier. After all, given all the things you need to keep in mind, these can make it easier to make your letters more beneficial to both yourself and your donors.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…