Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Apr 10, 2024

When you have a complex business matter at hand, then along with it, you also have an intricate process. It is undeniable that legality and business come in hand in hand, and that documentation is a necessary step to do in all transactions. Proper and complete papers protect the deals and ensure careful monitoring. Consider the intricacies of the mortgage and real estate industry with the shelling out of loans, refunds, returns, transfer of ownership, buyouts, etc. Without a keen effort to make business letters to either document or send instructions to all concerned parties, then you have a loose communication line. Thus, exert effort to make your letters fit the industry’s serious tone and demand. For samples of different letters, check out our collection of more escrow letter templates on our official website template.net that you can use.

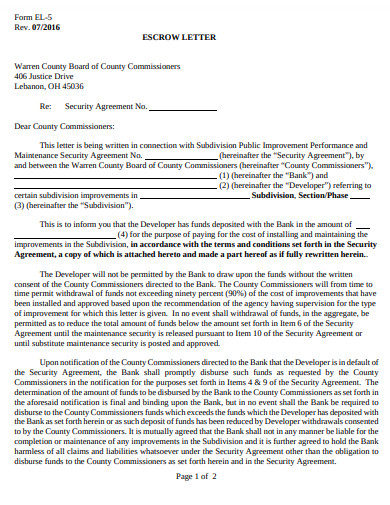

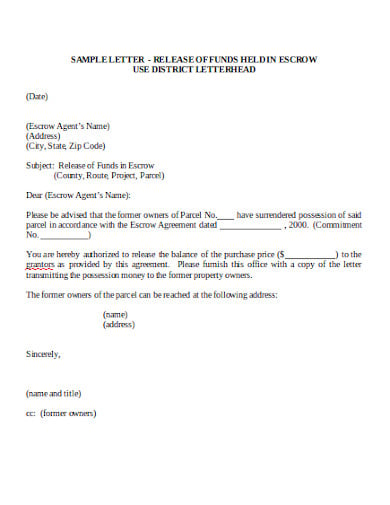

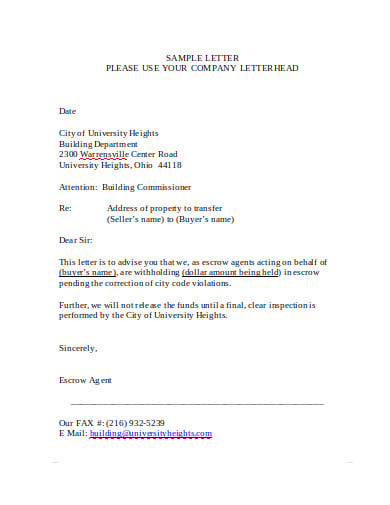

Escrow letters are famous within the real estate and mortgage industries wherein escrow agreements are also common. The letter is a transmittal document that aims to serve the purpose within the arrangement. Its uses can include payments, refunds, updates, or simple information concerning the deal.

Imagine all concerned parties left confused due to vague and convoluted directions. You have money sent to the wrong person, or collateral being at the unfortunate receiving end of an action. Plus, you have notices and updates which are even outside the contract document’s bounds. Situations like these are worst-case scenarios; however, it does not mean avoiding them is not impossible. With vigilance and care from, your escrow letters will properly function if you get the data right. That is why, when significant transactions are on the line, line by line accuracy will keep the flow smooth and free from the ire of any discontented party. You may also see more different types of escrow letters in Word from our official website template.net.

redmond.gov

redmond.gov nyc.gov

nyc.gov massdocs.com

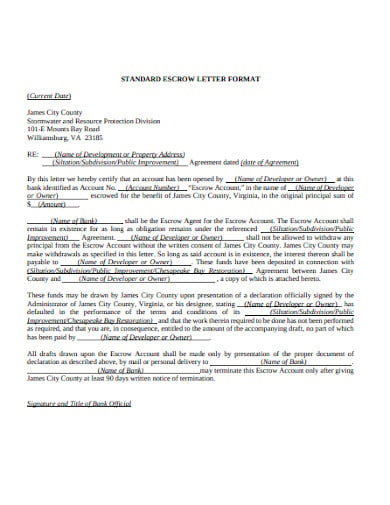

massdocs.com jamescitycountyva.gov

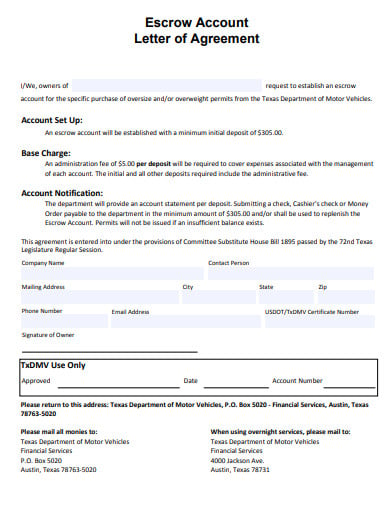

jamescitycountyva.gov txdmv.gov

txdmv.govThe Escrow Letter of Agreement Template outlines the terms and conditions of holding assets in escrow, ensuring a secure and neutral agreement between transaction parties.

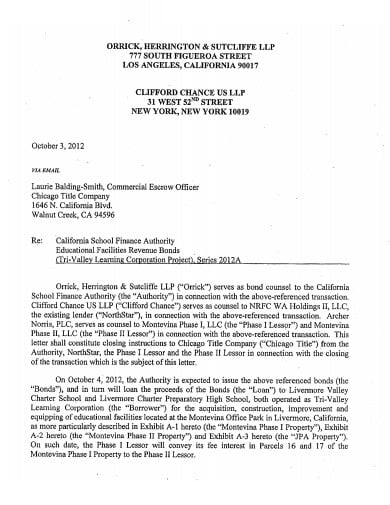

reformourcharterschools.org

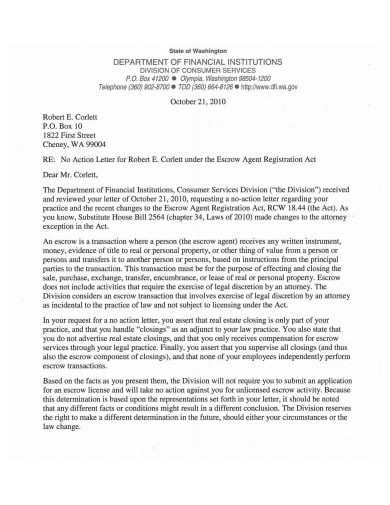

reformourcharterschools.org dfi.wa.gov

dfi.wa.gov wceo.us

wceo.us modot.mo.gov

modot.mo.gov universityheights.com

universityheights.com hmpadmin.com

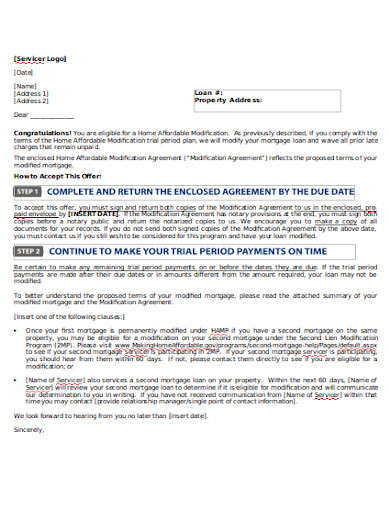

hmpadmin.comAny business cannot make do without letters as they are one of the most critical documents for transactions. Moreover, when one is in the real estate industry, mortgage deals concerning refunds or payments are a staple. All of these deals need to have a simple letter to formalize the process. You can grab letter templates online for a good start. And when you do, follow the simple list below to begin making your document.

Knowing the full extent of the agreement document will help you determine the content of your letter. Whether the concern is about a deposit, rent, release, or an explanation, all must well be within the scope of the negotiations. You do want to keep everything in line with the signed contract papers.

Escrow letters always have a third party known as an escrow agent. Make sure you address the letter correctly and get the details right of the receiver. Whether you are solely making a letters in Pages for the seller, agent, or the client, getting to know them is a must. You do not want to mix up your messages and send them to the wrong people. This is a critical step, especially when you make a letter transparent to all parties.

Getting the date right is vital as it is a time indicator for the transaction. You can establish parameters for valid dates, even with the actual date that the letter is complete. Also, you can mention the dates as part of the content and make sure it is error-free. For a wider selection of Formal Letter Templates, check out more options here.

If you want a bank to release or withhold a certain amount, then do so with clarity to have a smooth transaction. Critical business transactions are on the line, and giving vague or wrong directions can mean significant backlashes. Thus, as you are making your letter in google docs, always have a keen eye for every statement you are writing.

Always take time to review the letter before actually setting it to motion. Inspect errors, and try to ask for legal advice if the letter is well within the bounds of the agreement. There is no harm done in being a perfectionist by doing necessary reviews before sending the document. Find more Letter Format Templates by visiting this link.

Aside from making multiple copies for each party, affixing signatures is a principal symbolic act. Not only does it formalizes the letter, but there is also acknowledgment coming from all concerned parties. So always leave a dotted line for people to sign.

With a wide choice of free letter templates online, starting from scratch will be a far-fetched situation. Thus, making escrow letters will be a matter of content accuracy and formalities and not about the format anymore. Anyways, getting sued and miscommunication happens when care is absent in the writing process. Explore additional escrow letter templates on our website, template.net, to find a variety of options that suit your needs.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…