Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Dec 27, 2019

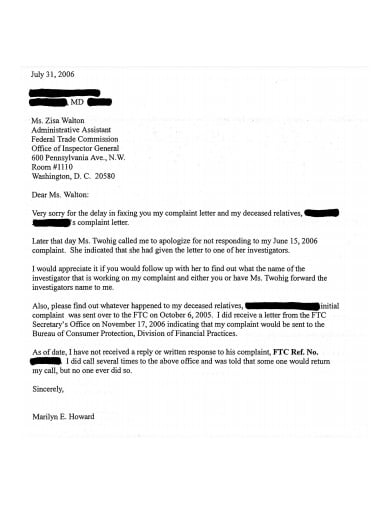

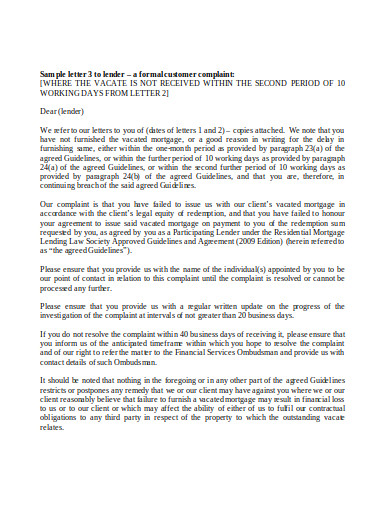

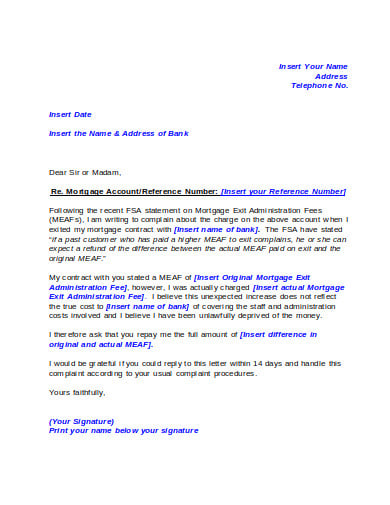

Customers and clients can have a say when they are at the receiving end of a problem. Thus, complaints are necessary for the business to be aware of its misgives while at the same time, a point of reference for improvement. Although the clients feel discomfort due to failed transactions, sudden changes, and errors, no industry is perfect, and problems are inevitable. However, it does not mean that any enterprise should not strive to better their processes. So consider your complaint letters as an avenue for your complaining and paying clients. Allow them to have a free voice within the transaction. Moreover, you can view it as a status check and an assessment of your business. Thus, make room for informative complaint letters within the service chain.

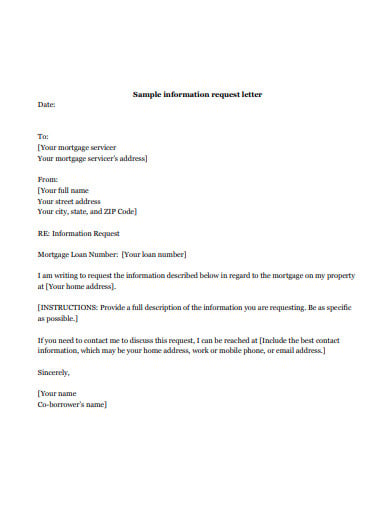

Any complaint letter is a document showing dissatisfaction coming from problems in the services or products. And if a client sends such a letter to the mortgage business, then the raised issues should be well within the industry. It could be faulty bank calculations, a mortgage broker’s incompetence, unfair foreclosure, and many more. Through this letter, the client can express dismay with the hopes of finding resolutions.

Problems come because there is no perfect system. And if you are a faithful paying customer who neve skips an obligation, it will sound outrageous. However, you can transform an ugly experience as an avenue for effective communication with the service providers. Although situations like these are not easy to forgive, the issues should not go down the drain as if nothing happened. So release your qualms about the experiences you have and say it straight to anybody in the mortgage business who you think deserves to hear it. And do not forget to add a touch of civility as troubleshooting will become easier minus the emotional burst that even a psychologist will have a hard time getting by. If you come across any problems, then do so with a polite no holds barred letter with love.

files.consumerfinance.gov

files.consumerfinance.gov ftc.gov

ftc.gov files.consumerfinance.gov

files.consumerfinance.gov lawsociety.ie

lawsociety.ie bbc.co.uk

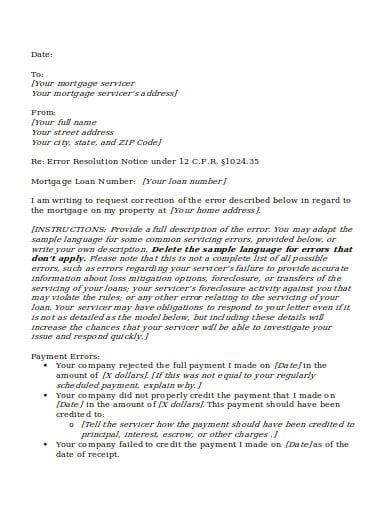

bbc.co.ukAll businesses deal with complaints from their clients, ranging from the services they received to the products that they experienced. As for the mortgage industry, it could be about a loan modification without your consent or additional bank charges, which are not real. And a caring business always allows room for their clients to express their concerns, and if you are the unlucky recipient of questionable hardships, then follow the simple list below to get your voice heard.

Every letter has a destination, and in the mortgage business, it could be the bank, loan officer, or a real estate firm. Better grab the company details either through an *informative letterhead you have with their documents or through their business cards inside your wallet. Make sure to get the address right with the company’s name or a key individual for the specific situation.

Your complaints act like a status report of what you experienced in the business. And if there are many to mention, create a list to make the reader easy to recognize the contents. Consider it as an itemized list of problems that the receiver needs to address. So better get your facts straight with your complaints as it would be a laughing stock if you are making up complaints which are not there.

Once a customer raises complaints, they already have a feeling of discomfort. No matter the distaste or anger one experiences in the whole situation, decency and politeness should still be in the air. Pointing out the errors in a civilized manner gives the impression that you are a negotiable person, which every business would prefer. With a friendly attitude, troubleshooting becomes easy because the company will not anymore deal with the client’s emotional state.

Avoid making your letters confusing by keeping the contents simple. The same should also be the case for your cover letters. You do want to make your complaints sound clear and vivid enough for the receiver to understand and find quick answers.

The contents must be coherent so that the flow is easy to grasp. Other than using a complicated language, an unorganized letter will make it prone to misunderstandings. So make sure, as you are making a list of complaints, you already did a comprehensive outline of your letter structure.

A complaint letter’s authenticity appears when the author does not hide. Companies usually throw the paper to the shredder if it is anonymous because it might be that every situation has a particular slant to attend to with each client. Moreover, having yourself known makes the company capable of sending a letter back or can invite you to a meaningful conference about the situation. And do not forget to sign!

Present your complaints as feedbacks, and the company will give you a thank you with solutions. Thus, make your complaint letters sound friendly and diplomatic, so that finding solutions will be at the core of the situation rather than doing anger management.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…