Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Apr 15, 2024

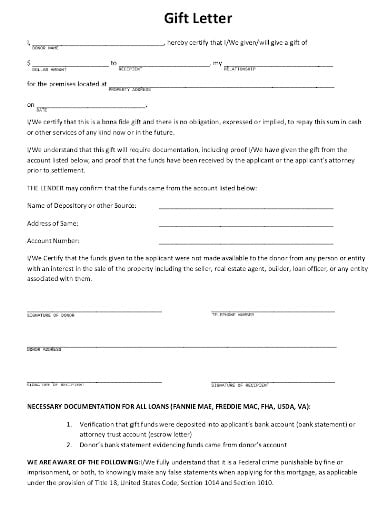

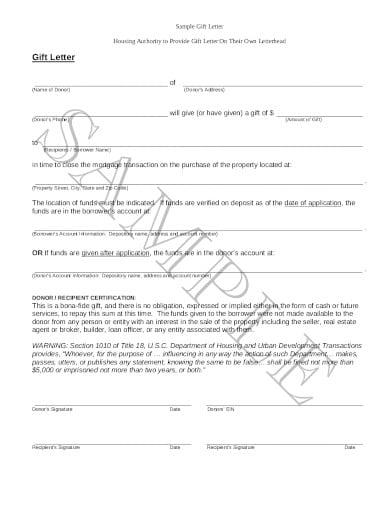

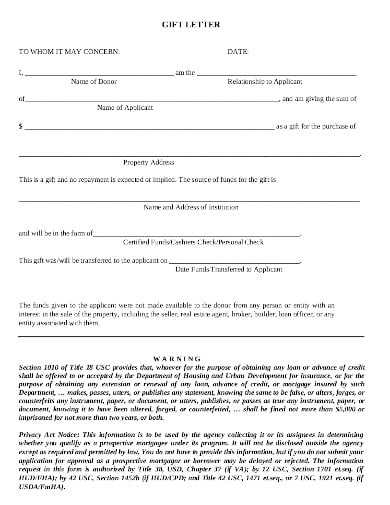

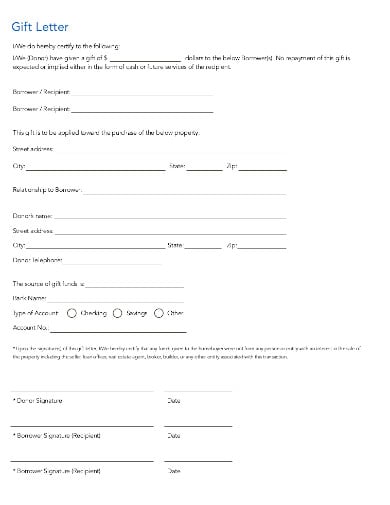

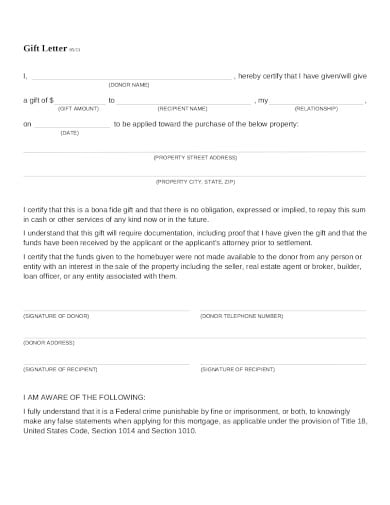

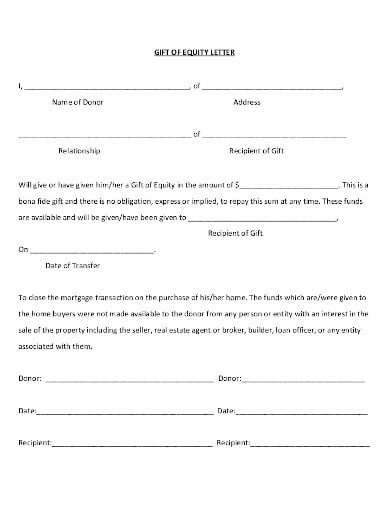

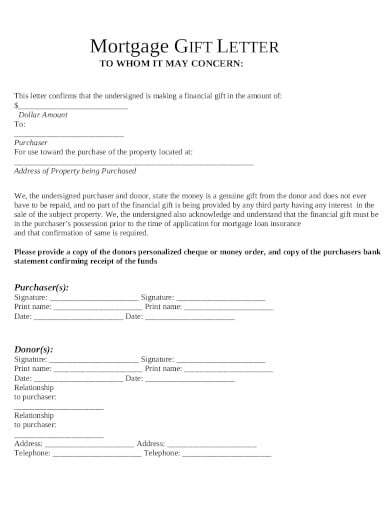

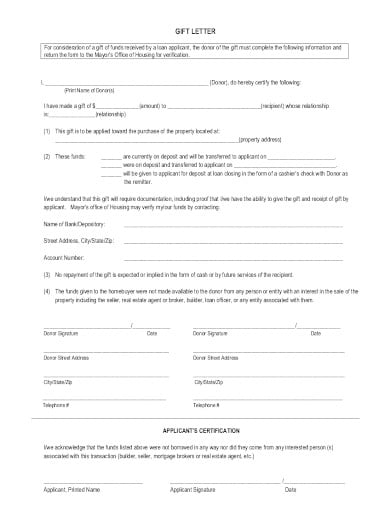

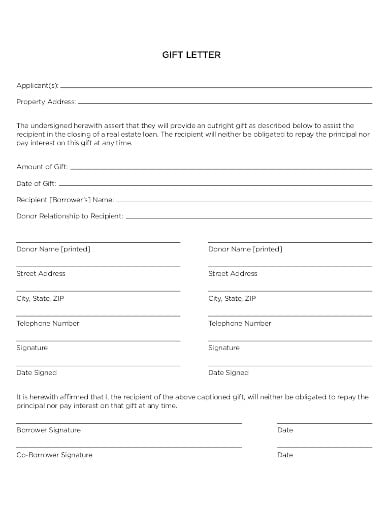

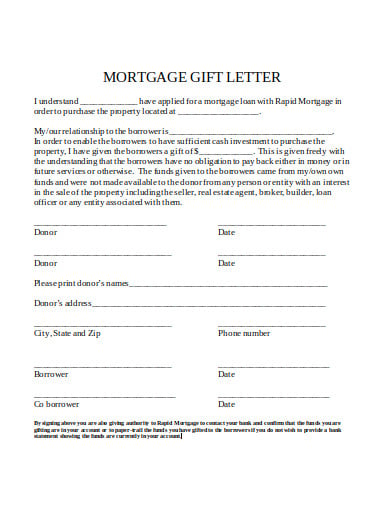

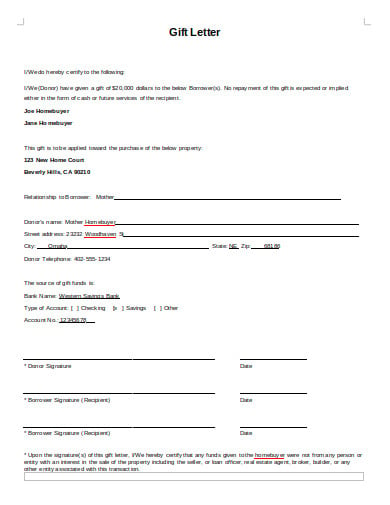

Written letters and snail mails are a thing during the olden times until the invention of the email by Ray Tomlinson during the 70s. People never have to use pens and papers because delivering instant messages is made possible with an internet connection. However, letter templates, whether those are emails or written documents, should be created with care to ensure the message gets delivered and that the information stated inside is correct. The same carefulness should apply when you create a mortgage gift letter to help a family or relative who is currently struggling with his/her mortgage fee or bank account. Donors themselves must be knowledgeable in writing upon using printable templates like the sample letters in Word, Pages, and more.

While a mortgage is understandably a loan agreement between borrowers and lenders, a mortgage gift letter focuses more on how much the amount a borrower received from a financial donor. A gift letter usually works when borrowers receive financial aid for their house loan down payment. The excellent news for mortgagors about this monetary gift is that they do not have to pay it back. Borrowers use the letter as proof for lenders that they did not borrow another money since it got gifted. It surely is a pleasant experience for anyone who lacks cash, and that high down payment is required since the donation will fix the problem.

A mortgagor will naturally be grateful for receiving monetary gifts but investigations are required. You don’t simply accept a gift without thorough inspection like if that money was actually one disguised loan. A donation from a another loan can be rejected which is why most companies need a financial statement along with the letter as evidence if that is true cash or not. It is mostly preferred that donations are given by a domestic partner, fiance, family member, or relative to remain trustworthy here. Lesser rejections happen if you really review where such gifts come from or you might fall into a scam.

planites.org

planites.org acf.hhs.gov

acf.hhs.gov oswegomortgage.com

oswegomortgage.com deephavenmortgage.com

deephavenmortgage.com greatlender.com

greatlender.com insightloans.com

insightloans.com terrymoore.ca

terrymoore.ca sfmohcd.org

sfmohcd.org mortgagecenter.com

mortgagecenter.com rmtexas.com

rmtexas.com assets.mymortgageinsider.com

assets.mymortgageinsider.comGift letters can sometimes be compared with a sample gift certificate. However, letters have longer content compared to certificates as the certificate merely mentions the sender, receiver, and amount in most cases. Letters are also more personalized because it’s as if you are conversing rather than stating information only. You can also discover a greater variety of gift letters in Pages on our official website, template.net. You can always go for the manual way of writing but it will be more professional to have an email or printed document for the letter so the handwriting, spacing, and format will be in great shape.

A letter sets a tone by starting with a kind greeting. This part begins your way of personalizing the document since you acknowledge to whom this letter is for in the salutation. Start with an introduction that states what the message is about, so it should sum up that the form tackles on a mortgage gift. What commonly follows is the content proving that this letter certifies a donor who gave a financial donation to the receiver. For a wider selection of Formal Letter Templates, check out more options here. Their complete names must be present to identify these individuals accurately.

Maybe you focused too much on personalizing the letter that it is more like a casual conversation. The thing is you can’t forget about maintaining professionalism also, so you have to observe limits, especially when this form marks as an official document in case mortgage gifts require proof of certification. Be sure you emphasized primarily on the borrower name, donor name, contact details, addresses, date, and gift amount. More than that, you can mention the sender-receiver relationship, so it answers the question of how the donor is related to the borrower. You can also find a wider variety of gift letters in Pdf format on our official website at template.net. The most important note is to specify that such a gift doesn’t require repayment. Paying it back proves that the money isn’t legally a gift.

Clarify the details carefully wherein the whole sentences and information placed are perceived easily. If that barely makes you understand, then think of the struggle on the reader too. Another concern for maintaining clarity is to review if you got the correct spelling and information of the names mentioned. Maybe the borrower’s name is misspelled, so the letter may be null as the incorrect spelling can refer to another person. Find more Letter Format Templates by visiting this link.

It is a standard to observe excellent grammar for letters. Professionals may question the validity of such messages in case there are lots of grammatical errors. Poor grammar can send off negative impressions anyway, so you have to correct everything. Explore a variety of Professional Letter Templates here. You don’t have to depend on too many fancy words because what matters is that whoever checks the document will understand it completely.

You can use the same format of letter for different donors and receivers while you only leave out blanks to write down the names after being printed. At least you never have to struggle in creating another mortgage gift letter since a template or format is available for you. Mind the spacing of the blanks, though, because maybe some names cannot fit since the blanks were too short. You may also see more on Business Letter templates here. Blanks also matter for the part where signatures are required, so those cannot be absent.

While gifts are beneficial, borrowers shouldn’t merely depend on donors forever. Indeed, that extra cash is useful for emergencies like if you can’t afford the down payment at the moment. For the best experience, explore a wider range of gift letters in Google Docs directly from our official website, template.net. However, you should remain prepared that loaning requires financial responsibilities. You learn to save money and avoid lavish spending to commit to mortgage fees continuously. Most importantly, borrowers should learn to thank their donors because they were willing to help. Looking for more insights? Dive into our blog post about thank you letter for gift templates.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…