Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Nov 22, 2024

A Loan Application Letter, often referred to as a Loan Letter, is a formal document written to request a loan from a financial institution or individual. It highlights your loan purpose, repayment ability, financial credibility, and demonstrates your seriousness about the loan. This letter typically includes key details such as the loan amount, intended use, repayment timeline, and any supporting documentation. A clear, persuasive, and well-structured Loan Letter improves your chances of approval by building trust and ensuring effective communication.

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Date]

[Bank Manager’s Name]

[Bank Name]

[Bank Address]

[City, State, ZIP Code]

Subject: Application for Loan

Dear [Bank Manager’s Name],

I am writing to formally request a loan of [amount] from [bank name] to [state the purpose of the loan, e.g., purchase a house, finance education, expand business]. I have been a loyal customer of your bank since [year], and I hold a [type of account] account under the account number [your account number].

Details of Loan Request:

I have attached all the required documents, including my income proof, identification, and any other necessary paperwork as per your bank’s loan policy. I assure you of my capability to repay the loan within the stipulated time, as I have a stable income from [state your source of income or employment details].

I request you to kindly consider my application at the earliest and inform me about the subsequent process. I am willing to provide additional information or documents if needed.

Thank you for your time and consideration. I look forward to a positive response.

Yours sincerely,

[Your Name]

If you are planning to craft an effective loan application letter in pdf, it would be easier for you to make one if you refer to the loan application letters available on this page. These sample loan are available in PDF and loan word formats, thus making it easier for you to access and edit these should you deem it appropriate. Scroll down below to view our templates!

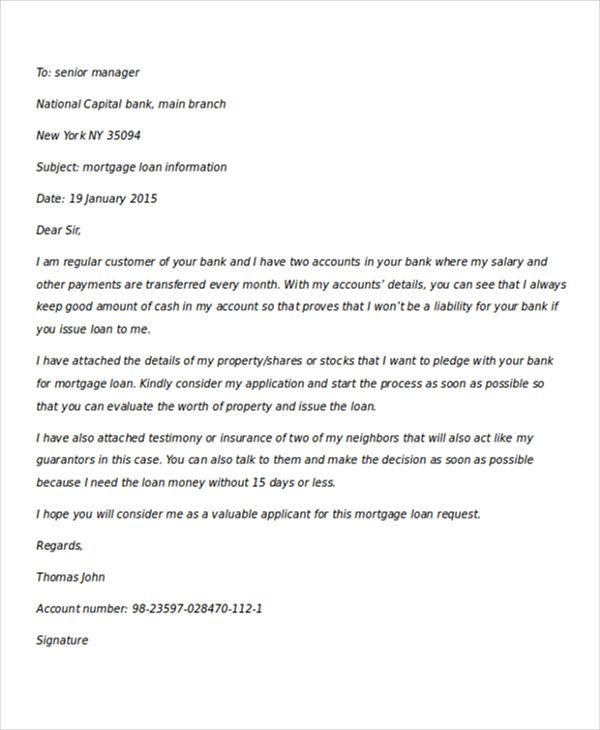

sampleletterz.com

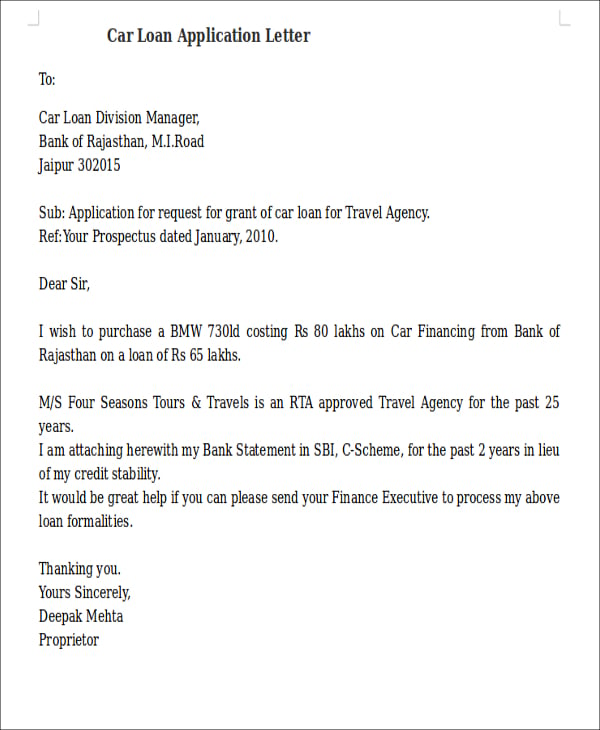

sampleletterz.com sampleletters.in

sampleletters.in onovativebanking.com

onovativebanking.com indiastudychannel.com

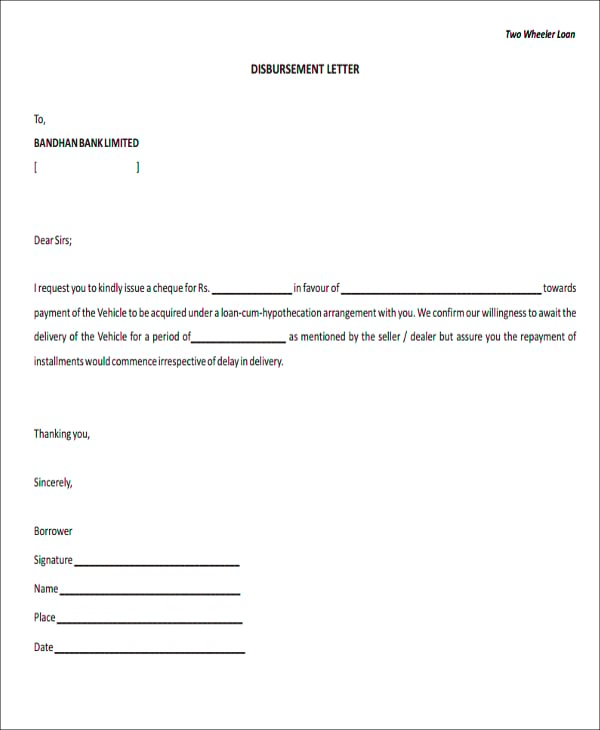

indiastudychannel.com bandhanbank.com

bandhanbank.com foundletters.com

foundletters.com

sampleletterz.com

sampleletterz.comLoans can be differentiated based on the purpose where they will be used. Any amount that is borrowed and will be under a loan transaction will be subjected to interest rates over time. A loan agreement serves as a formal document that can serve as proof that both the lender and the buyer are aware of the terms and conditions of what they have talked about. Before you sign a loan simple agreement, you must first be knowledgeable of the entire loan application process so you can take note of the responsibilities and obligations that you will be adhered to. A simple process of loan application is listed below.

Aside from loan application letters, we also have College Application Letter and Scholarship Application Letter which you can use for future needs. Simply click on their corresponding links.

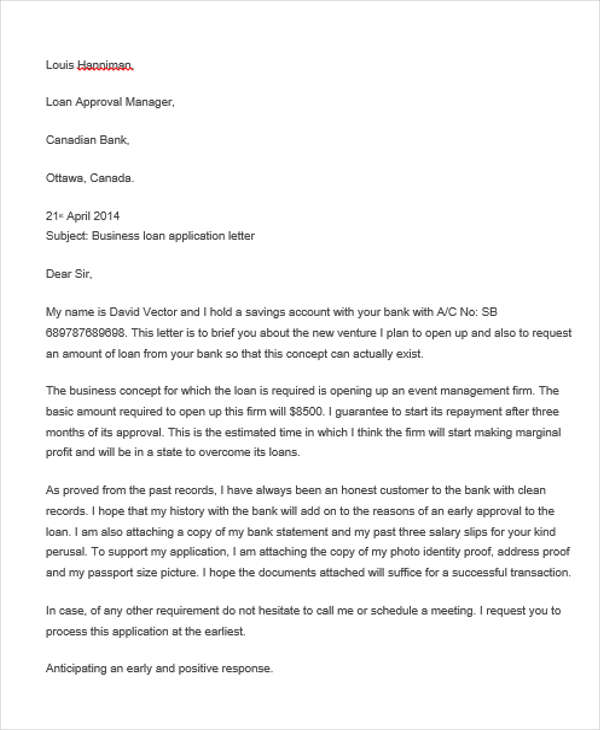

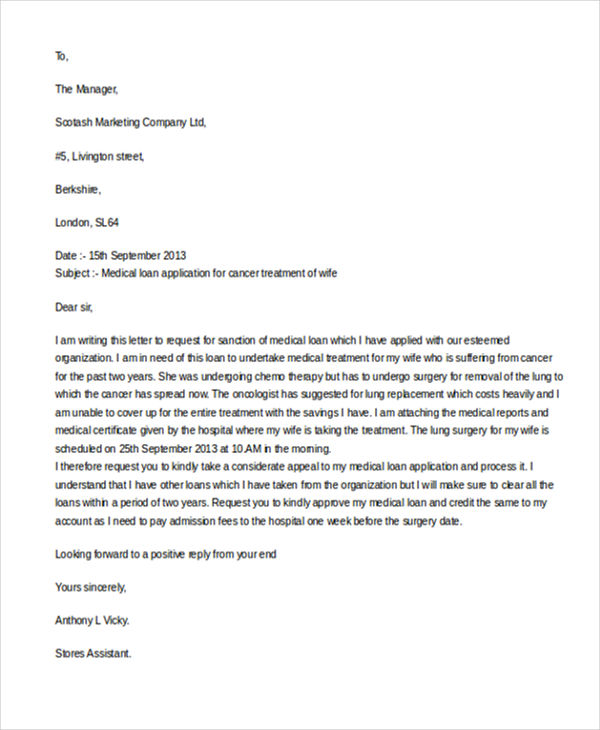

effective-business-letters.com

effective-business-letters.com smartletters.org

smartletters.org sampleletterz.com

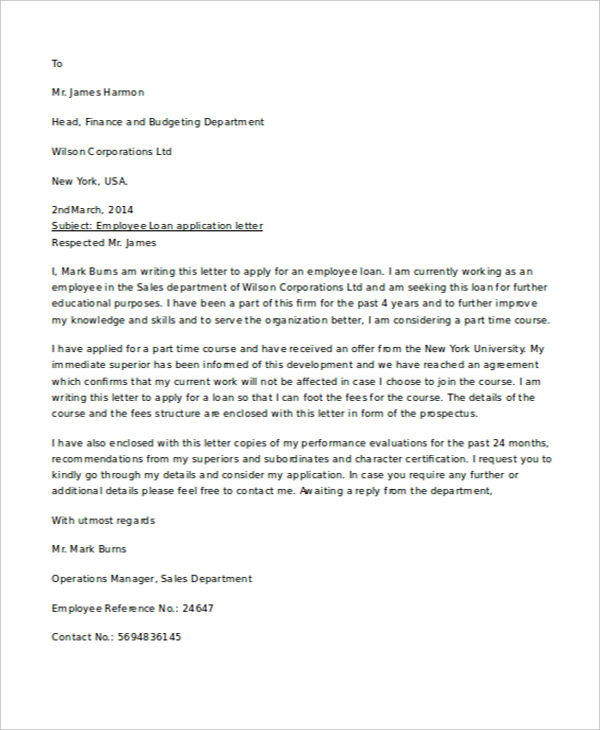

sampleletterz.com livecareer.com

livecareer.com requestletters.com

requestletters.com sampleletterz.com

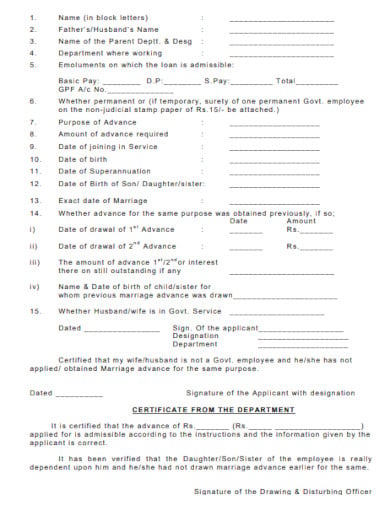

sampleletterz.com gjust.ac.in

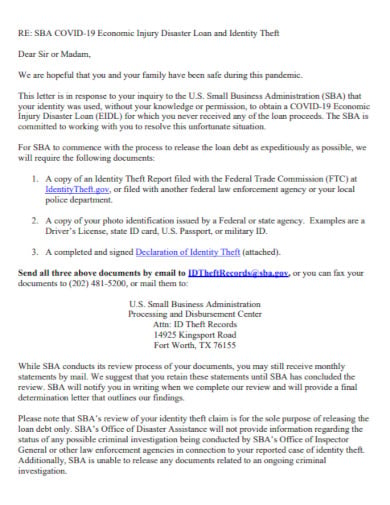

gjust.ac.in sba.gov

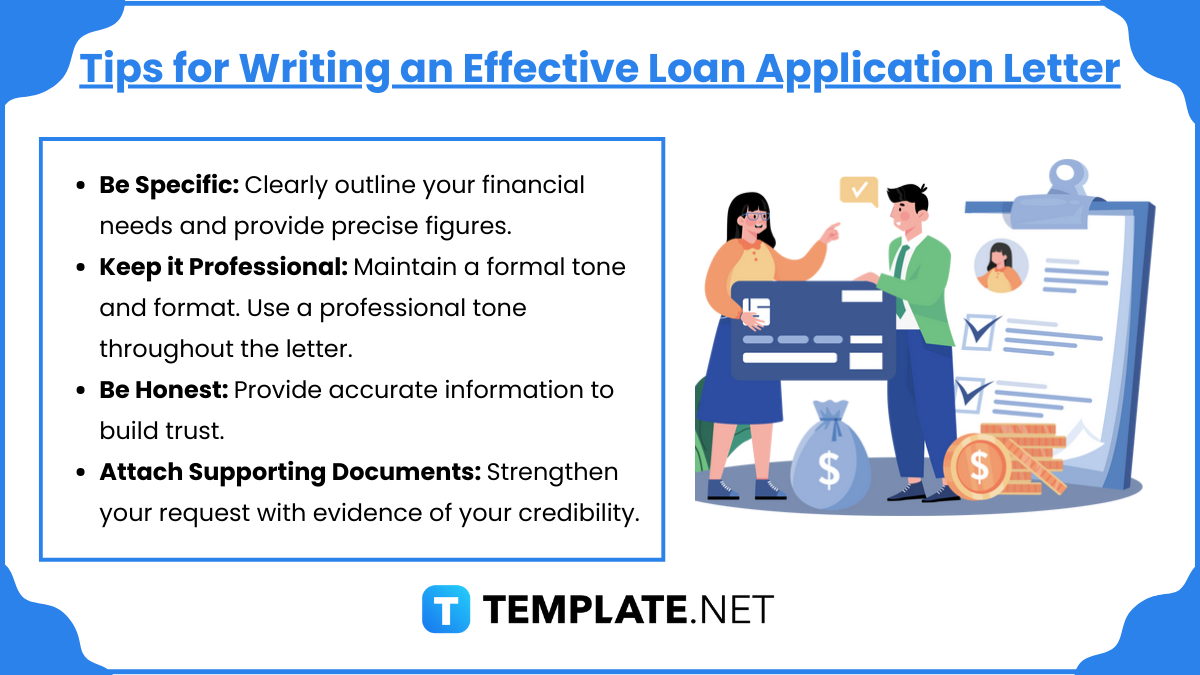

sba.govHere are some guidelines to help guide you in writing an effective loan application letter:

For more reference, download our templates on this page. If you have other application needs, simply check our Business templates on our website’s archives. You can also use our collections of Job Application Letters and Employment Application Job Letters should you decide to apply for a job instead.

For the best experience, explore a wider range of loan application letters in google docs directly from our official website, template.net.

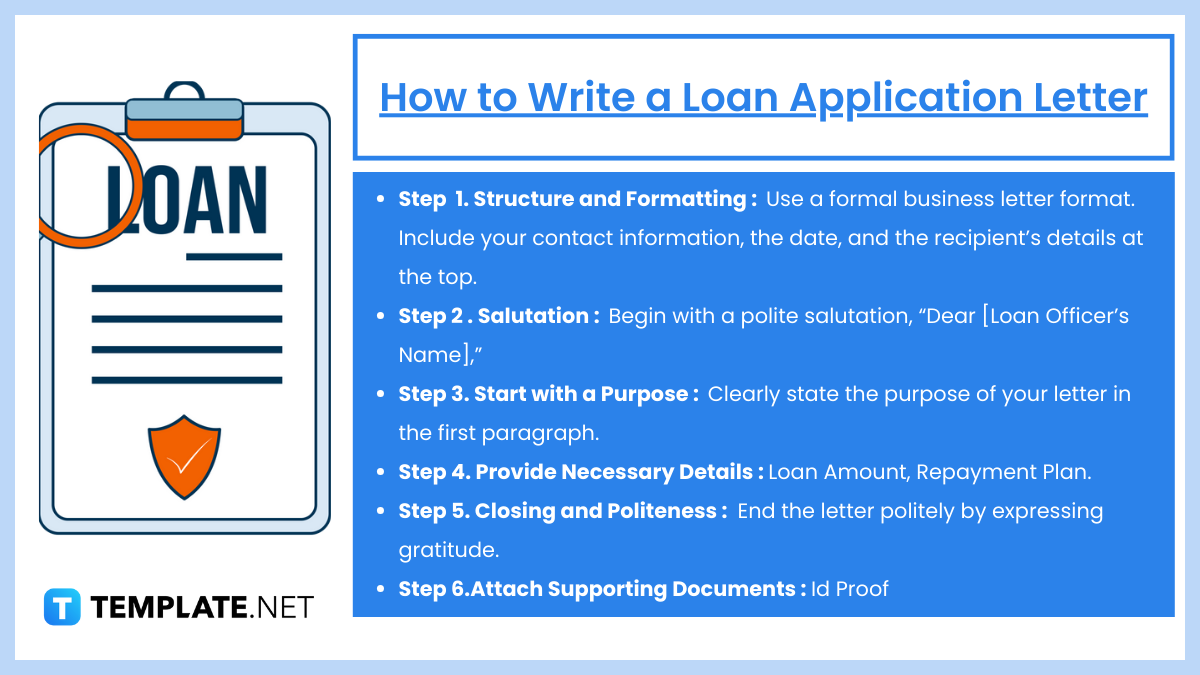

Writing a loan application letter requires a clear, concise, and professional tone to convey your purpose effectively. Here’s a step-by-step guide to crafting a compelling loan application letter:

Begin with a polite salutation, such as:

Clearly state the purpose of your letter in the first paragraph. For example:

Include specific details to support your application:

End the letter politely by expressing gratitude and requesting consideration:

List attached documents, such as:

A concise, professionally written Loan Application Letter is crucial for loan approval. Focus on clarity, honesty, and supporting documents to enhance your credibility.

Key elements include the loan amount, purpose, repayment plan, financial details, and contact information. Writing professionally increases approval chances.

A loan application letter should be concise, typically one page long, focusing on necessary details to make it easy for lenders to review.

Lenders assess the loan purpose to determine risk and feasibility. Specific, legitimate purposes like starting a business or home improvement can increase approval odds compared to vague or risky ventures.

Yes, briefly mention your credit history if it’s positive. Highlighting a good credit score demonstrates your reliability and strengthens your application.

For personal loans, focus on personal needs and repayment ability. For business loans, emphasize your business plan, projected revenues, and how the loan supports growth.

Letters expressing words that convey appreciation is a methodology that has been in existence since time immemorial yet many of…

Always have your letter written on time before the day you want to quit the job. A period of two…

It isn’t easy to talk to someone you have only met for the first time. Opening up to them, especially…

There will always come a time when a nurse decides to leave an institution and move on to other opportunities,…

Do you want to adopt a child or a sister and brother and become the best parents? You may have…

From time to time, you may be called upon to write a reference letter for a colleague. In that case,…

How to Write Invitation Letter Heading Living in a fast-paced world is never easy, but thanks to modern-day internet technology,…

Writing a termination letter is not easy. The situation is usually further complicated if the parties involved in termination are…

When the bell to put away your work cloth rings, you know it is time to pick up a retirement…