11+ Logistics Note Templates in PDF | MS Word

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

Sep 22, 2023

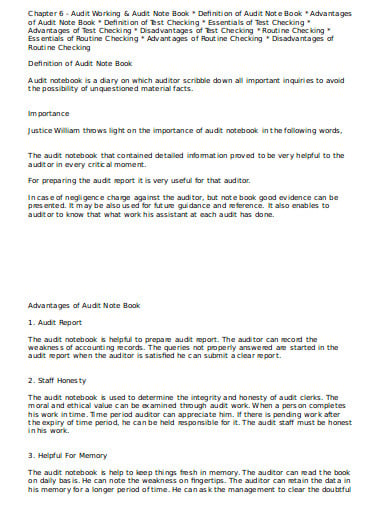

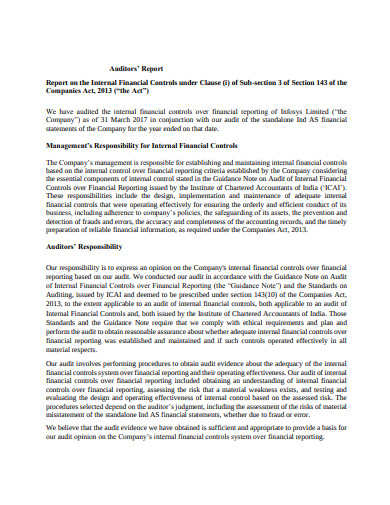

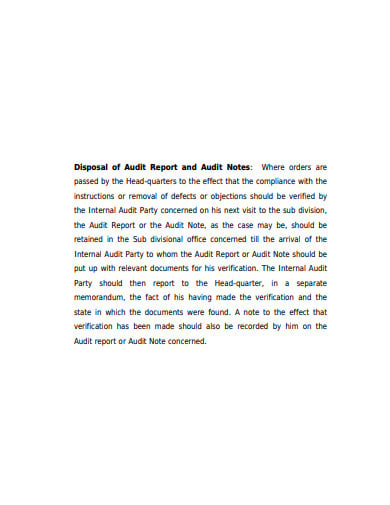

A register or a set of notes that is maintained by the audit staff to record some important points observed, any errors, some doubtful queries, explanation, etc is known as an audit note. It also carries definite information regarding the day-to-day work that is executed by the audit clerks. In simple words, it usually records a large variety of matters that are observed during the course of the audit. It should be maintained systematically and clearly as it serves as authentic evidence in support of work that is done to protect the auditor against any legal charge.

faisalsial.yolasite.com

faisalsial.yolasite.com dirco.gov.za

dirco.gov.za dhc.co.in

dhc.co.in infosys.com

infosys.com dhbvn.org.in

dhbvn.org.in in.kpmg.com

in.kpmg.com energysafetycanada.com

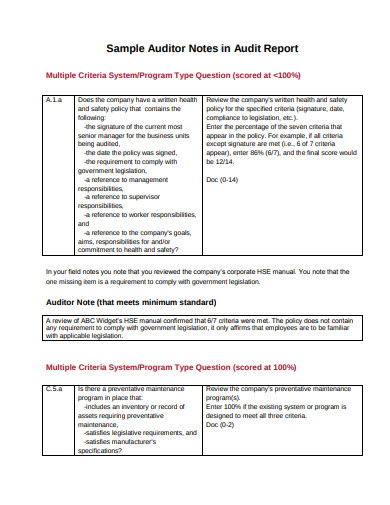

energysafetycanada.comThe following matters are the content that is incorporated into an audit note.

This facilitates the job of an auditor as all the important details about the audit are recorded in the notes which the audit clerk cannot recall everything all the time. It also helps in recalling and remembering the important matters that are related to the audit work.

An audit note also helps in providing some required data for the preparation of the audit report. An auditor must analyze the audit note before preparing and finalizing the audit report.

An audit note works as a piece of documentary evidence in the court of law in case a suit is filed against the auditor for his negligence.

In case an audit assistant is changed before the completion of audit work, the audit note works as a guide after the completion of the balance work. Besides, it also acts as a guide for carrying out the following audits.

A proper audit note helps in evaluating the work performed by the audit staff and helps in evaluating their level of efficiency.

An audit note also helps in fixing responsibility on the concerned clerk who is responsible for any undetected errors and some frauds in the course of the audit.

An audit note includes all the important details about the audit. Therefore, any change in the audit staff will not disturb or disrupt the audit work.

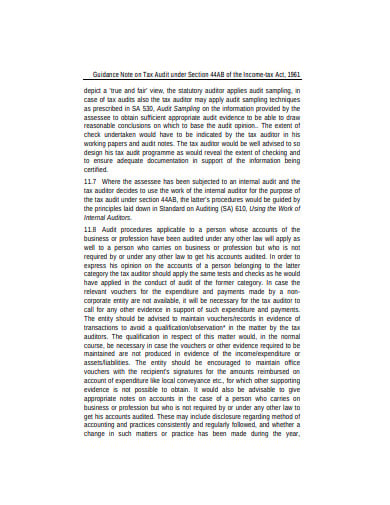

It has been observed that the maintenance of the audit notes creates some misunderstanding between the client’s staff and the audit staff very often.

An audit note may lead to the development of a complaining or a fault-finding attitude in the minds of the staff.

Audit notes must be prepared with great caution as it serves as a piece of evidence in the court of law. If the audit note is prepared without due care it cannot be used as evidence against the auditor for negligence.

Any mistakes in the note may have adverse impacts on the next audit since the audit notes are used in performing subsequent audits.

As an audit note is important because it is usually taken as a piece of reliable evidence even by the court of law in case any dispute occurs or if the auditor is charged with negligence. It is also useful for drawing audit programs.

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

A printable doctor’s note is a crucial document for employees needing to verify medical absences. It serves as official proof…

A doctor attends to many patients in a day thereby making it difficult to remember the case history of each…

A doctor’s note, or commonly referred to as a medical certificate or sick note, is a verification from a doctor…

An investment promissory note can be referred to as a legal document that compels the person who signs this form…

A credit note is a statement issued and sent to the purchaser by a vendor which certifies that a credit…

A register or a set of notes that is maintained by the audit staff to record some important points observed,…

An absent note is any formally framed letter that’s self-addressed to any senior or body member for not attaining the…

In the simplest of terms, a promissory note refers to a ‘promise to pay.’ In other words, it is a…