11+ Logistics Note Templates in PDF | MS Word

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

Sep 25, 2023

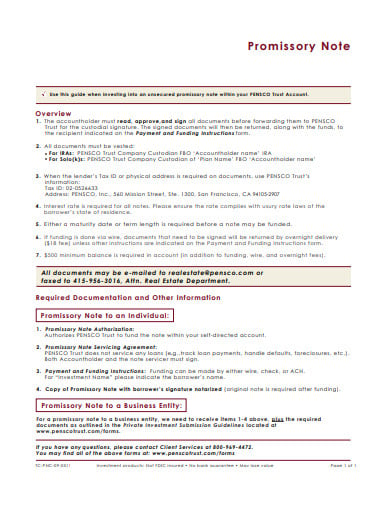

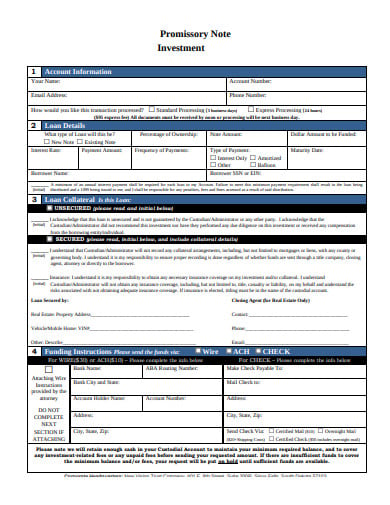

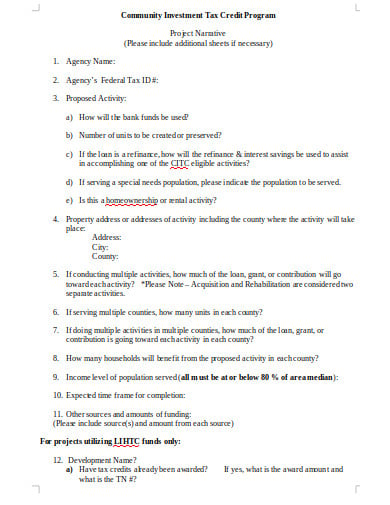

An investment promissory note can be referred to as a legal document that compels the person who signs this form to pay a certain amount of money to another person on a certain date. This also outlines the terms of payment. The person who owes the money is known as the payor, maker, or issuer. And the person who gives the money is known as the payee or promissee. An investment promissory note can also be termed as a note payable or a note.

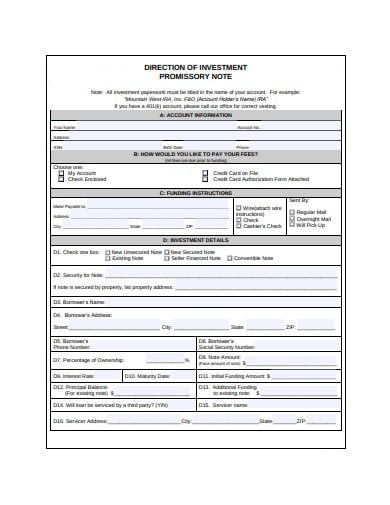

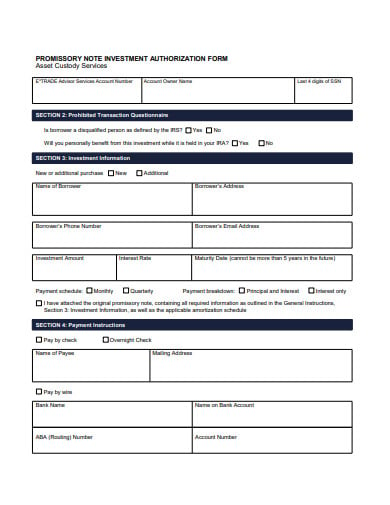

pensco.com

pensco.com americanira.com

americanira.com mountainwestira.com

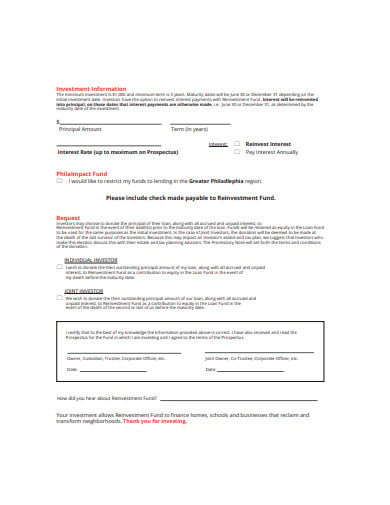

mountainwestira.com reinvestment.com

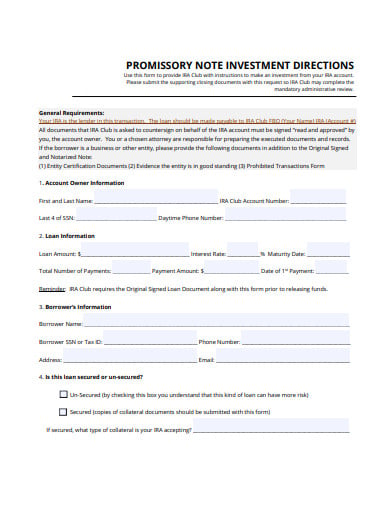

reinvestment.com iraclub.org

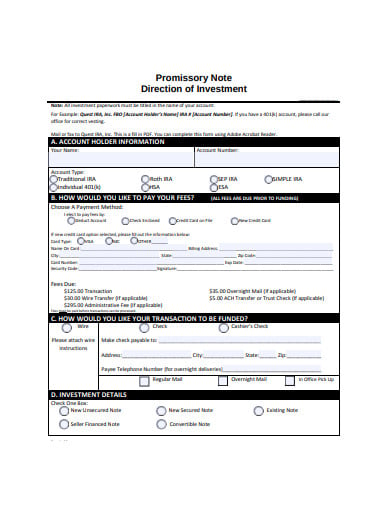

iraclub.org questira.com

questira.com ira.trustamerica.com

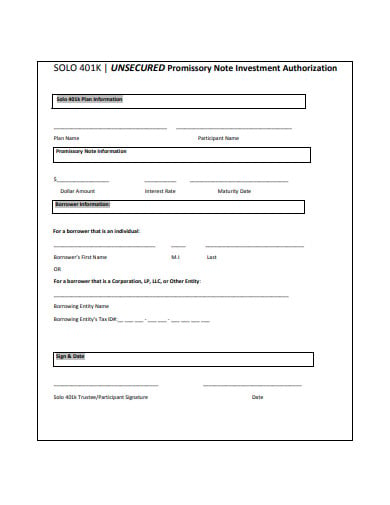

ira.trustamerica.com mysolok.net

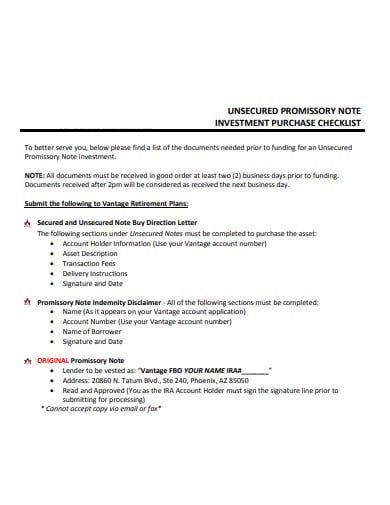

mysolok.net vantageiras.com

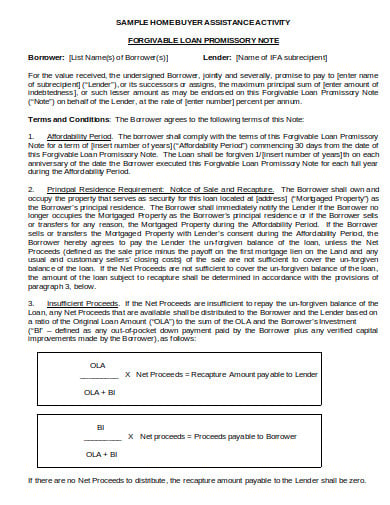

vantageiras.com cityofnevadaiowa.org

cityofnevadaiowa.org amazonaws.com

amazonaws.comPromissory notes, moreover known as bills of exchange, additionally stipulate that the term “investment promissory note” ought to be inserted within the body of the instrument and may contain an unconditional promise to pay.

In terms of their legal enforceability, promissory notes lie somewhere between the informality of any associated note and also the rigidity of a loan contract.

A loan contract, on the opposite hand, sometimes states the lender’s right to recourse—such as foreclosure—in the event of default by the borrower; such provisions are typically absent in an exceeding certificate of indebtedness. Whereas it would create a note of the results of non-payment or untimely payments (such as late fees), it doesn’t sometimes make a case for ways of recourse if the establishment doesn’t pay on time.

Many people sign their initial secured promissory notes or dedication notes as a part of the method of obtaining a student loan. Non-public lenders generally need students to sign dedication notes for every separate loan that they do away with. Some colleges, however, permit federal student loan borrowers to sign a one-time, master certificate of indebtedness. After that, the coed recipient will receive multiple federal student loans as long because the faculty certifies the student’s continuing eligibility.

Student loan promissory notes define the rights and responsibilities of student borrowers moreover because of the conditions and terms of the loan. With the help of a master certificate of indebtedness for federal student loans, for example, the coed guarantees to repay the loan amounts and interest and charges to the U.S. Department of Education. The master certificate of indebtedness additionally includes the student’s contact data and employment data moreover because of the names and get in touch with data for the student’s references.

The composition of the certificate of indebtedness is kind of necessary. it’s higher, from a tax perspective, to induce better sales worth for your home and charge the customer a lower charge per unit. This way, the capital gains are untaxed on the sale of the house, however, the interest on the note are taxed.

Conversely, an occasional sales worth and a high-interest rate are higher for the customer as a result of he or she are going to be ready to write off the interest and, when reliably paying the vendor for a year approximately, finance at a lower charge per unit through a conventional mortgage from a bank. Ironically, currently that the customer has engineered up equity within the house, he or she most likely will not have a problem obtaining finance from the bank to shop for it.

These notes sometimes got to be registered with the govt. within the state during which they’re sold and/or with the Securities and Exchange Commission. Regulators can review the note to decide whether or not the corporation is capable of meeting its guarantees. If the note isn’t registered, the capitalist needs to do his or her analysis on whether or not the corporation is capable of mating the debt. During this case, the investor’s legal avenues are also somewhat restricted within the case of default. Corporations in desperate straits could rent high-commission brokers to push unregistered notes on the general public.

Investing in various promissory notes, even within the case of a take-back mortgage, involves risk. To assist minimize these risks, associated with the capitalist has to register the note or have it notarized so the duty is each publically recorded and legal. Also, within the case of the take-back mortgage, the buyer of the note could even go to this point on do away with insurance on the issuer’s life. This is often absolutely acceptable as a result of if the establishment dies, in case someone has borrowed money and has signed a promissory note, the holder of the note can assume possession of the house and connected expenses that he or she might not be ready to handle.

To make a proper secured promissory note, make sure you follow certain tips.

Most of the promissory notes are unsecured, so there should a valid reason if you want to make your note secured. For example, you can use a secured promissory note when a huge amount of loan is being borrowed by an individual who owns a luxury piano. In this particular case, the piano is not prone to any damage and it retains its value and can be used as a security instrument. If the borrower defaults on the repayment, the lender can reimburse their losses by claiming the piano. If there is nothing that is of equal value to the loan principal, there is no use to having a promissory not getting secured.

The most important part of a secured promissory note is the terms that are set out in the agreement. Make sure that all the terms that are included in the promissory notes are addressed properly. Some of the major terms that are included in a promissory note are related to payments, interest due in case of default, lates fees, and acceleration.

The last part of an agreement is the execution of the promissory note. It is important to put as many details about the security instrument that will be attached to it. For instance, if a piano is being used as the security instrument, try to include as many details as possible about the particular asset that may include the brand name, serial number or other information related to it.

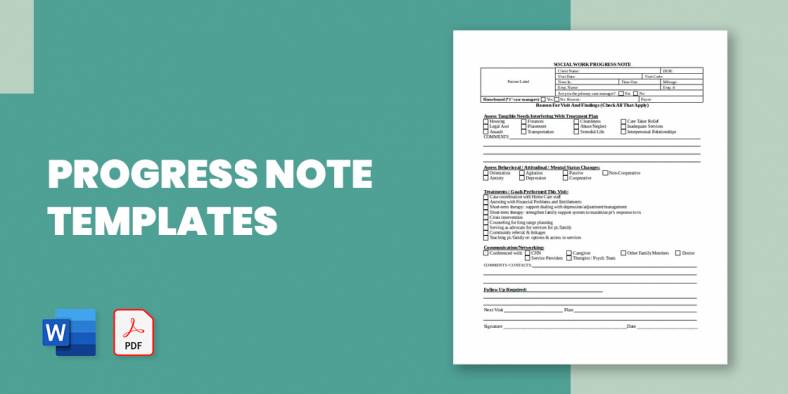

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

A printable doctor’s note is a crucial document for employees needing to verify medical absences. It serves as official proof…

A doctor attends to many patients in a day thereby making it difficult to remember the case history of each…

A doctor’s note, or commonly referred to as a medical certificate or sick note, is a verification from a doctor…

An investment promissory note can be referred to as a legal document that compels the person who signs this form…

A credit note is a statement issued and sent to the purchaser by a vendor which certifies that a credit…

A register or a set of notes that is maintained by the audit staff to record some important points observed,…

An absent note is any formally framed letter that’s self-addressed to any senior or body member for not attaining the…

In the simplest of terms, a promissory note refers to a ‘promise to pay.’ In other words, it is a…