11+ Logistics Note Templates in PDF | MS Word

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

Sep 22, 2023

In the simplest of terms, a promissory note refers to a ‘promise to pay.’ In other words, it is a legal document signed by two parties, a lender and the payer. The payer establishes his or her promise to pay for something that he or she borrowed or received with the help of this promissory note. In real estate, a promissory note ensures the fact that if the buyer of the property defaults on loan, he or she would have an obligation to pay it back. Real Estate Promissory Note Templates help to make such notes.

The most important thing to remember about the promissory note is to make sure that it is enforceable. For this to happen, there are a few required elements that the note must include. This includes the loan amount that has been borrowed and is owed, the date when the loan has to be repaid, the interest rate and the amount when the interest is applied, the details of the collateral held, and the terms of default. All these pieces of information are mandatory to be included in the promissory note.

The terms of the promissory note are like the clauses that are included in a contract or an agreement. They define the whole agreement. Just like the clauses, the terms of the promissory note can be negotiated upon by the two parties that are involved. These terms generally include the agreed-upon facts regarding the elements that have been talked about in the previous step. For example, regarding the payment to be made, if there are any sort of monthly or weekly payments, then the same should be mentioned in this section.

There are two types of promissory notes that can be used for real estate. The first is a secured promissory note where it is stated that the borrower will provide some sort of collateral for the amount that has been loaned. The second is an unsecured promissory note that states that no sort of collateral will be required for the loan. If the collateral is being provided, then it needs to be mentioned in the note what sort of collateral will be given such as goods, property, etc. Keep in mind that the value of the collateral needs to be either equal to or more than the loan amount.

This step is to be followed only if the promissory note is a secured one. If both the parties have agreed on a secured promissory note, then it implies that the borrower has given the right to the collateral to the lender in the case that the borrower defaults. To perfect or specify the security means that the lender will be granted full rights to the collateral property of the borrower in case of default. If required, the lender can also file a financing statement.

Among the other clauses that are included in the note, two very important ones need to be included. The first is the right to transfer clause. This clause states that the lender has full authority to transfer the note to a third party. In other words, the borrower would have to pay the debt to that third party. The second clause is the right to cancel. This clause is for the borrower and it states that the borrower has up to three days to cancel the note. Both parties must be aware of these two rights.

If the borrower fails to pay the loan amount back within the stipulated specifications, then there are bound to be consequences. The promissory note also needs to include the details of these consequences. If the loan is repaid in proper time, a release of the promissory note is issued. If the amount is not repaid, generally, consequences include harsh legal action. It must also be specified that the collateral if the note is a secured one, will be seized.

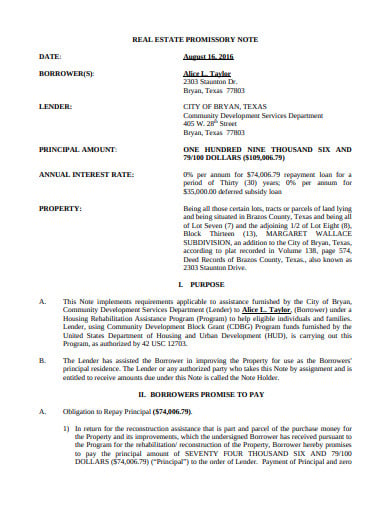

granicus.com

granicus.comA real estate promissory note is a legal document that states that a borrower has taken a mortgage loan from a mortgage lender. It mainly highlights the details of this loan and the consequences of not being able to pay it back. If you want to make such a promissory note for you and your client’s needs, then you need to download this professional note template.

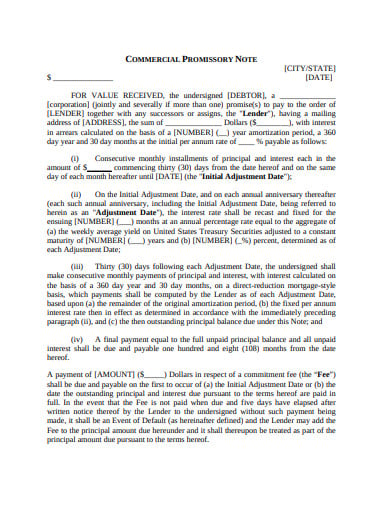

leaplaw.com

leaplaw.comReal estate is generally of two types: commercial and business. Accordingly, the promissory note form for each is different from the other. Do you want to make a promissory note for the loan regarding a commercial estate? Then this Commercial Promissory Note Template is the perfect thing for you. This template is available to be downloaded in PDF format.

iraservices.com

iraservices.comA typical promissory note must include the details of the lender, the borrower, the loan specifications, and the consequences if the loan defaults. But why would you go through all this hassle to make a promissory note when you can get a ready-made one at your disposal? Yes, that is true. And to get access to that file, all you need to do is download our basic note template.

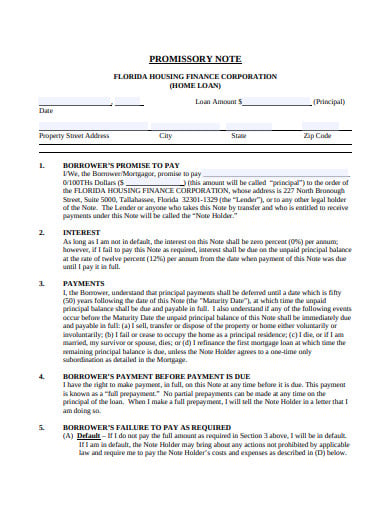

floridahousing.org

floridahousing.orgThe main job of a promissory note is to mention the details of consequences if the loan defaults. For this, there are two types of promissory notes: secured and unsecured. However, with our editable note template, you can make any kind promissory note you want. This template comes with a sample home loan promissory note that you can use as a guide to making one for your needs.

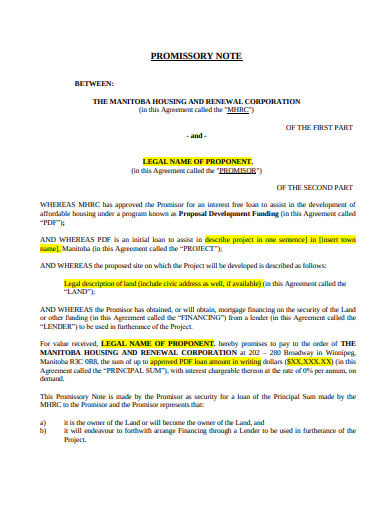

gov.mb.ca

gov.mb.caA real estate promissory note is an important legal document. Hence, the most important thing to remember about it is to make it as simple as possible. Are you having trouble doing this? Then what are you waiting for? Download our Simple Real Estate Promissory Note Template now! This template has been specially built to help you make such promissory notes.

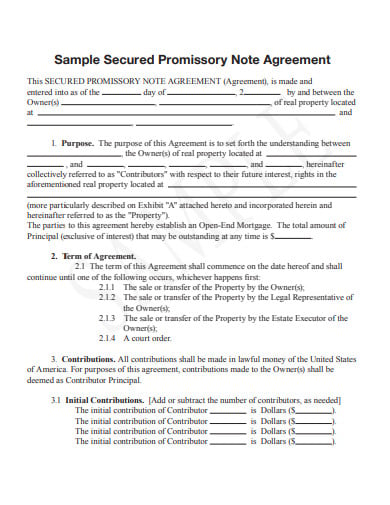

canhr.org

canhr.orgThere are two kinds of promissory that one can use for real estate purposes. This includes a secured promissory note and an unsecured promissory note. If you and your client’s need is to make a secured promissory note, then this free note sample template is just the thing for you. With this template, you can get access to a sample such note that will assist you in making yours in no time.

Taking down notes is a common practice on businesses, and it becomes familiar for every worker since note-taking happens even…

A printable doctor’s note is a crucial document for employees needing to verify medical absences. It serves as official proof…

A doctor attends to many patients in a day thereby making it difficult to remember the case history of each…

A doctor’s note, or commonly referred to as a medical certificate or sick note, is a verification from a doctor…

An investment promissory note can be referred to as a legal document that compels the person who signs this form…

A credit note is a statement issued and sent to the purchaser by a vendor which certifies that a credit…

A register or a set of notes that is maintained by the audit staff to record some important points observed,…

An absent note is any formally framed letter that’s self-addressed to any senior or body member for not attaining the…

In the simplest of terms, a promissory note refers to a ‘promise to pay.’ In other words, it is a…