Legal Notice

Legal notices are formal announcements or declarations issued by entities or individuals to inform others of legal actions, obligations, or…

Sep 20, 2023

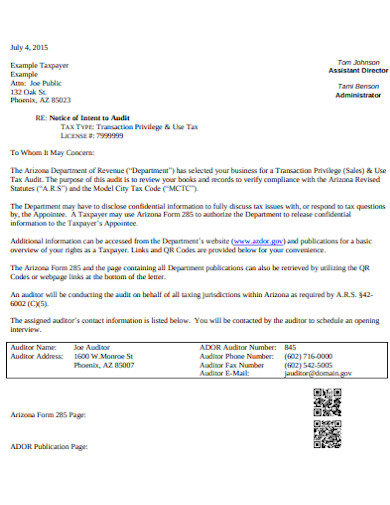

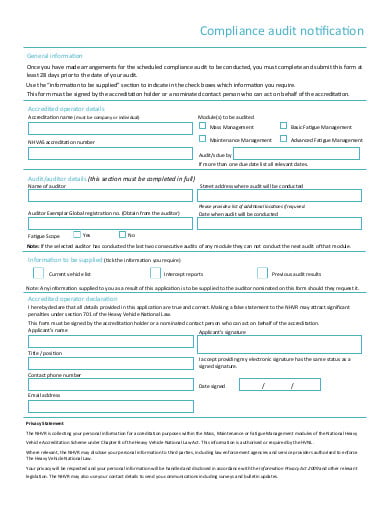

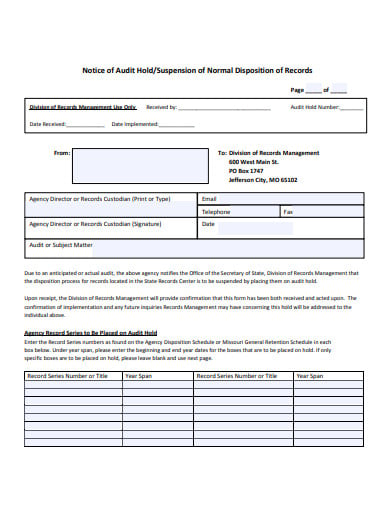

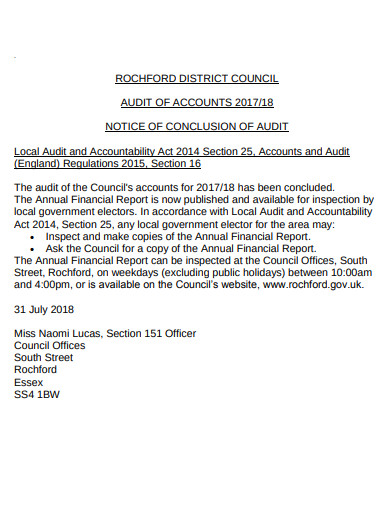

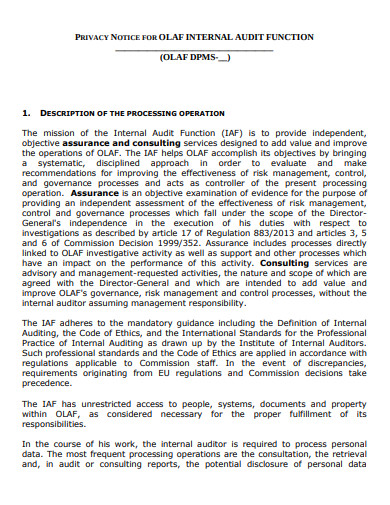

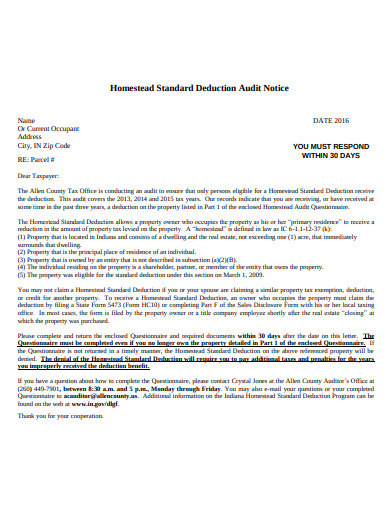

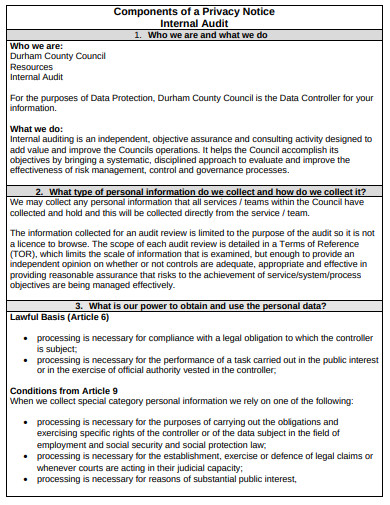

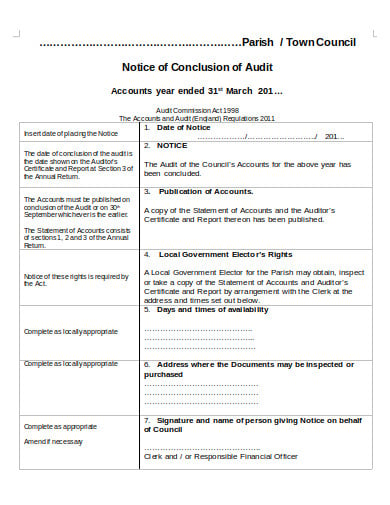

An audit notice initiates a duty review that follows a bookkeeping methodology where the IRS inspects your individual or business monetary records to guarantee you documented your government form precisely. On the off chance that you demonstrate that your underlying return was finished and right, you won’t be asked anything further, yet if the IRS discovers blunders or deliberate is-reportings, you’ll need to pay the recalculated return sum and any intrigue punishments. On the off chance that you get a review notice, here are the means you can take to rapidly resolve the circumstance.

troyohio.gov

troyohio.gov michigan.gov

michigan.gov azdor.gov

azdor.gov nhvr.gov.au

nhvr.gov.au sos.mo.gov

sos.mo.gov rochford.gov.uk

rochford.gov.uk ec.europa.eu

ec.europa.eu allencounty.us

allencounty.us durham.gov.uk

durham.gov.uk leicestershireandrutlandalc.gov.uk

leicestershireandrutlandalc.gov.uk suffolk.gov.uk

suffolk.gov.ukWhile the IRS should disclose to you why your arrival was chosen, it’s dependent upon you to inquire. Your duties can be examined for an assortment of reasons, including:

All IRS Notices or Letters contain a notification number in the upper right-hand corner. These numbers will additionally advise you about the particular issue(s) with your expense form. When you realize what you are being evaluated for, you can limit your concentration and start gathering pertinent records.

There are various kinds of assessment reviews, each with their own necessities. Knowing how you are being examined will enable you to figure out what archives you need, where to send them, and whether you need an expense legal advisor.

The IRS administration focus approaches you for more data concerning a piece of your government form. The IRS is for the most part looking for receipts, checks and comparative data.

The IRS Service Center requests that you get certain records from your neighborhood IRS office. The review is directed there.

An IRS operator goes to your place of business to lead the review face to face.

This is the broadest kind of review, where all aspects of your assessment form must be proved by reports, including birth and marriage endorsements. The main role of this review is to refresh the information used to compose the PC scoring program.

For both field reviews and TCMP reviews, it’s enthusiastically prescribed that you have a legal advisor present while the review is led.

When you comprehend what is anticipated from you, you can begin experiencing your records to locate the applicable receipts and archives. Never send in your unique reports or your lone duplicate, and never send in more than is mentioned. In the event that you can’t discover significant documentation, quickly demand copies, since the inspectors won’t acknowledge the reason that records are absent or lost.

When you have every one of your duplicates and firsts, get them composed, particularly on the off chance that you are confronting an in-person review—great association shows the specialist that you are a mindful citizen, and may bring about the operator constraining the extent of their examination.

When you get warning of an IRS charge review, contact the duty consultant who arranged your arrival. The person in question can clarify the review procedure and help you get ready. On the off chance that you are as yet anxious about the review, or have a field reviewer going to your work environment, it’s a smart thought to enlist an expert assessment legal counselor.

Legal notices are formal announcements or declarations issued by entities or individuals to inform others of legal actions, obligations, or…

Being a landlord, sometimes certain conditions arise when you have to send an eviction notice to your tenants. Whatever may…

Before any meeting is conducted, preparations are made by the participants with the use of the information written on a…

It is normal to have circumstances where you find it difficult to pay for properties. However, there are also a…

An eviction notice template is issued by a landlord to a tenant asking the tenant to evict from the place…

An audit notice initiates a duty review that follows a bookkeeping methodology where the IRS inspects your individual or business…

A termination notice is drafted to inform the required person about the end of a particular contract. Such type of…

A maintenance notice is an announcement or reminder for the designated recipient about the maintenance work. It can be the…

Let’s say that there is a particular client that has yet to pay you for services that you have already…