11+ School Counselor Lesson Plan Templates in PDF | Word

Empowering the youth to become the best can be such a fulfilling task to accomplish. But, school counselors proved that…

Apr 07, 2021

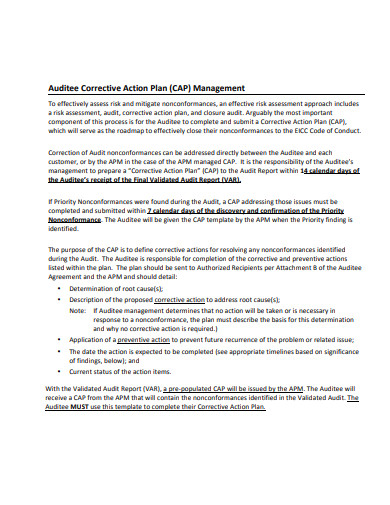

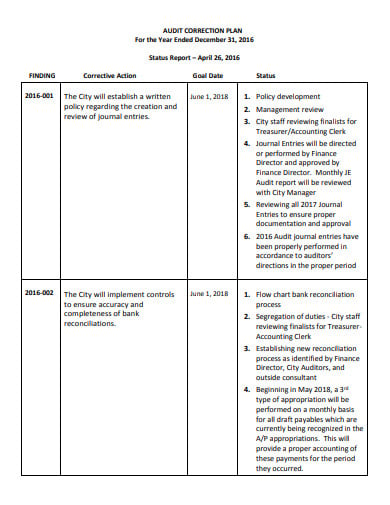

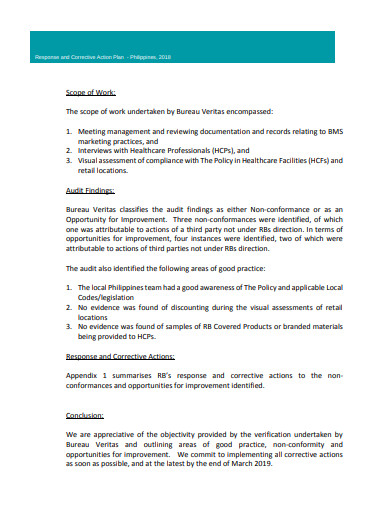

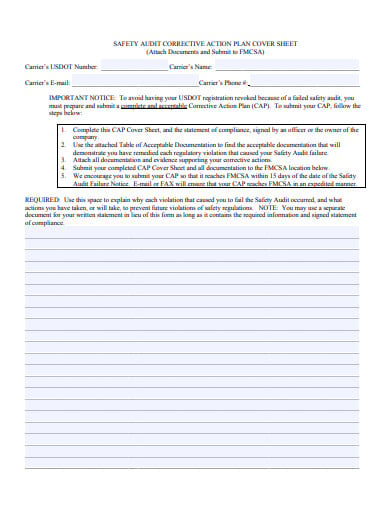

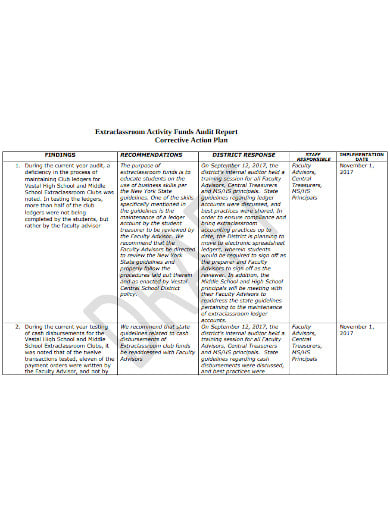

As there is a saying that ” with big positions comes the big responsibilities”. It is the huge duty to look after the financial matter of a company. And, when these responsibilities are handed over to the particular audit party to provide a corrective action plan to the client. Then, there are two types of audit people. The first one, who finds discrepancies in the inventory figures in the financial statement. The other type of auditor gives solution to the problems or issues in the critical financial situation. Hence, the second type of auditors gives corrective plans to the financial problems of the organization.

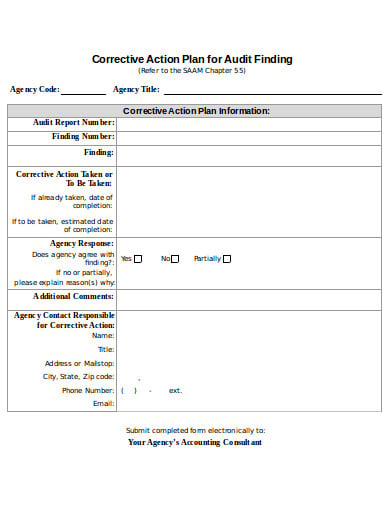

ofm.wa.gov

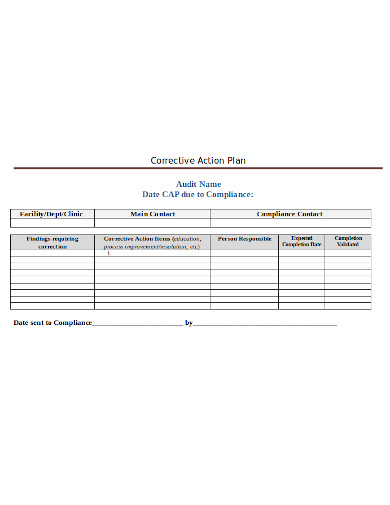

ofm.wa.gov assets.hcca-info.org

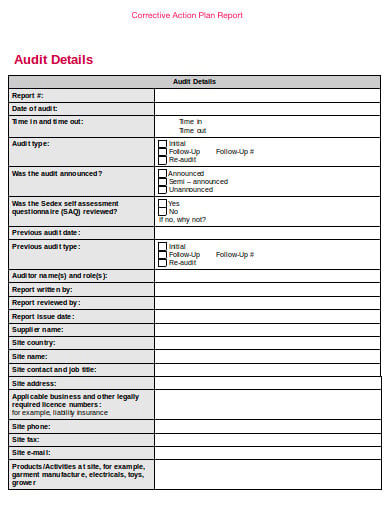

assets.hcca-info.org allyservice.com

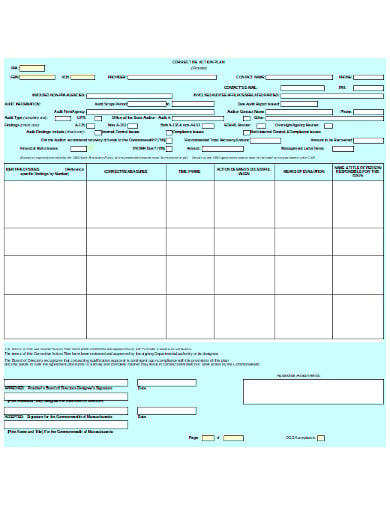

allyservice.com mass.gov

mass.gov responsiblebusiness.org

responsiblebusiness.org education.mn.gov

education.mn.gov budget.pa.gov

budget.pa.gov energy.gov

energy.gov independenceks.gov

independenceks.gov rb.com

rb.com ok.gov

ok.gov vestal.stier.org

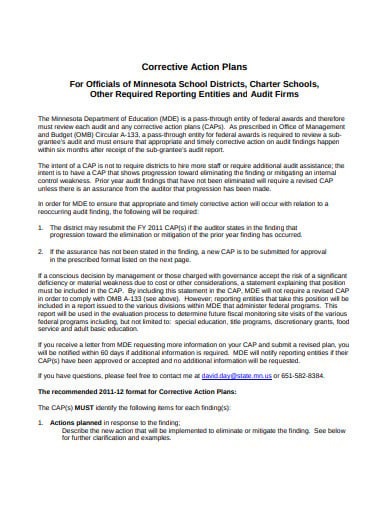

vestal.stier.orgYou must be clear about the problems and issues of the financial situation or matter. The solution must be given in a clear and transparent manner so that it can be understood by the organization and can work accordingly. That’s why it is known as the corrective action plan.

When you can mention about the problems in the financial system or the management. Then, you too can provide the organization with the desired solution to resolve it. And with the solution, the organization will recover.

You must create a simple and effective solution to the problems or the issues in the financial system. And, the management works smoothly without any obstruction or barrier in the financial matters of the organization.

You must also write about the things and processes through which the organization must get accurate and the obvious alternatives to the problems in the finance or economy. The economy is the crucial thing to take care of.

You must also set the accurate deadlines to achieve the required situation or the environment. The desired situation is to achieve a self-sufficient financial position in the organization. The deadline is the period of time to achieve the desired result.

When the business organization faces financial issues, then they approach toward good and effective action plans to eradicate it. The auditors look into the matter and give them solutions to adapt. When the company follows the given solutions to deal with the issues, then it shall overcome the problems of financial discrepancies within the short term. In order to give a corrective plan, the company and the organization hire the auditor. The internal auditors can reinforce a strong and controlled environment to study or calculate financial status.

The corrective action plans follow the step by step instructions that are introduced to achieve the desired result cost-effectively, so that deficiency is identified during the internal audit or evaluation. It is the state where you can find out the answer to the non-conformity in the financial situation. The plan is to avoid and control the situation of the recurrence. It elevates the problem from the roots and lessens the chances of its occurrence again.

When you are going to take the help of the corrective plan, it is made sure that the same situation does not occur again and again in the economic system of the organization.

The main aim and objective of the corrective action plan are to achieve complete and total success in business operations without any loss and failure. It acts as the tool or the instrument that is used to guide the organization off of the high risk. This plan strengthens the internal control over financial management and process. With the enforcement of these plans, the work of the business operations becomes smooth and strong.

There is a panel of skillful and trained people that looks after the finances of the organization and give alternatives to tackle it. The process of the audit corrective action plan is to take control of the management system. It is the auditor that looks into the company’s corrective action processes at the time of investigations. The plans are followed up in a timely fashion. The management of the monetary issues or the problems is the purpose of having the corrective action plan in the system.

The good audit corrective action plan should have the in-built audit processes to verify that it is at the optimal performance. Whereas, the data and information tracking is an important component of the management. It is an effective way through which you can confirm, monitor, measure and if required you can correct it. And the corrective action plan is the formal and evaluative process through which you get the maximum effective end result in the finances or economy. It has a descriptive solution to the issues.

Empowering the youth to become the best can be such a fulfilling task to accomplish. But, school counselors proved that…

A compensation plan is the detailed plan of an employee’s wages, salaries, benefits and the terms of payment. The plan…

As there is a saying that ” with big positions comes the big responsibilities”. It is the huge duty to…

The student recruitment plan is one of the most important and essential parts of educational institutions. The strategy interacts with…

The recruitment and retention are two different terms explaining the thing that is inter-related. Recruitment is the process of identifying,…

A College Recruitment Plan is the designed plan or a strategy that is developed to recruit the employees of a…

A Recruitment Action Plan is a strategy that is designed for putting the recruiting process into action. This is the…

A recruitment business plan is one of the necessities for a company. It does not just help you to map…

Clinical trial recruitments are considered to be very essential to the success of any clinical study and it is often…