11+ School Counselor Lesson Plan Templates in PDF | Word

Empowering the youth to become the best can be such a fulfilling task to accomplish. But, school counselors proved that…

May 24, 2021

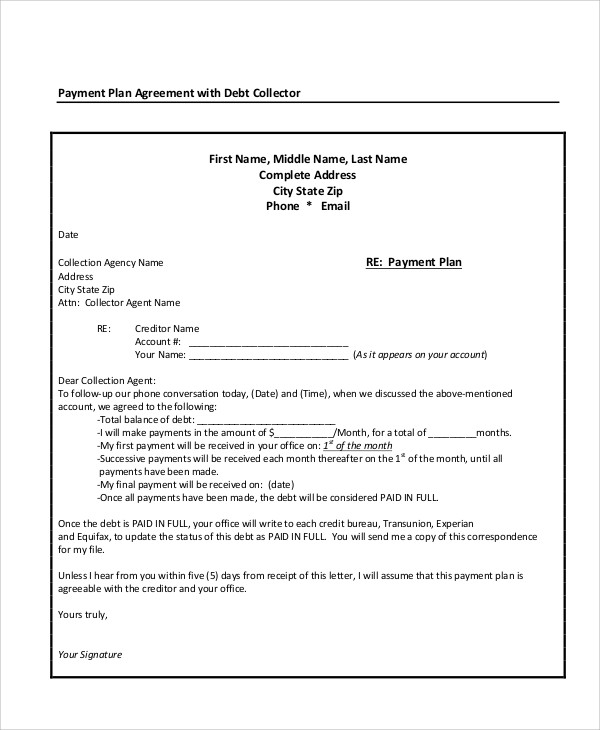

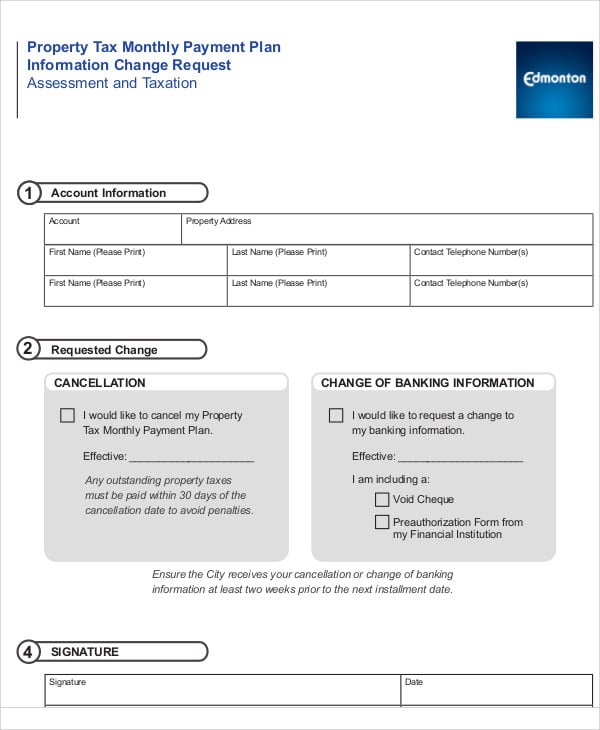

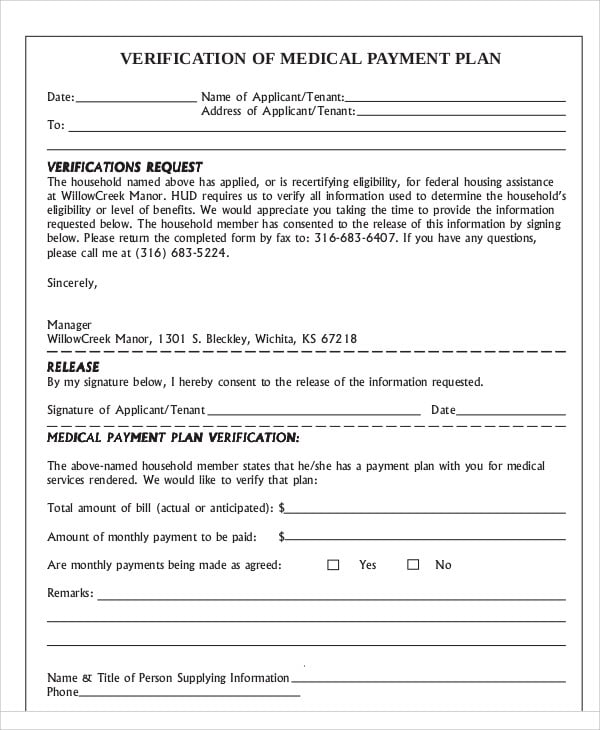

In cases that the borrower or the debtor can no longer settle his or her outstanding balance, a payment plan is created by a creditor to speed up the simple payment and settlement processes. Because there are a variety of financial transactions, the payment plan formats also vary considerably. However, these plans still possess similar characteristics with business plans and strategic plans. You may also see Plan Templates.

consumerslaw.com

consumerslaw.comThe overall objective of a payment plan is for the debtor and the creditor to reach a compromise agreement with respect to the unpaid outstanding balance. Like any other plan templates in Word, payment plans must be expressly agreed upon by the parties.

clark.edu

clark.edu edmonton.ca

edmonton.ca cloudfront.net

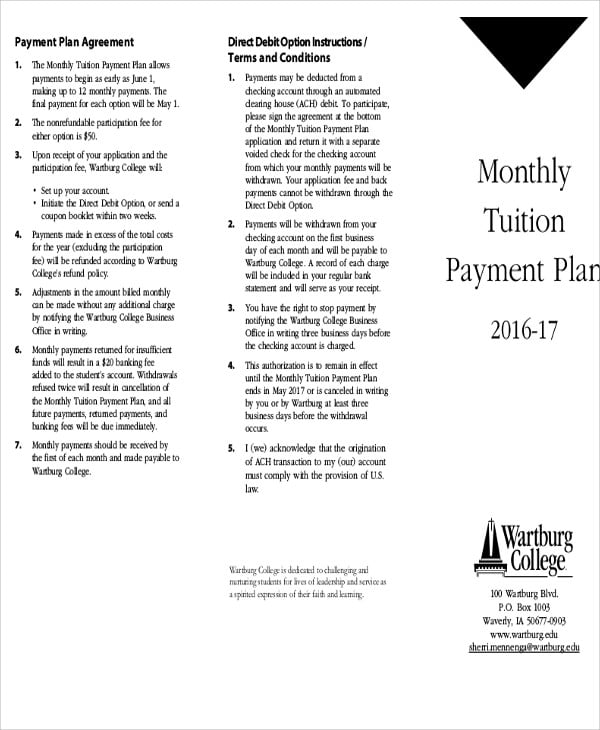

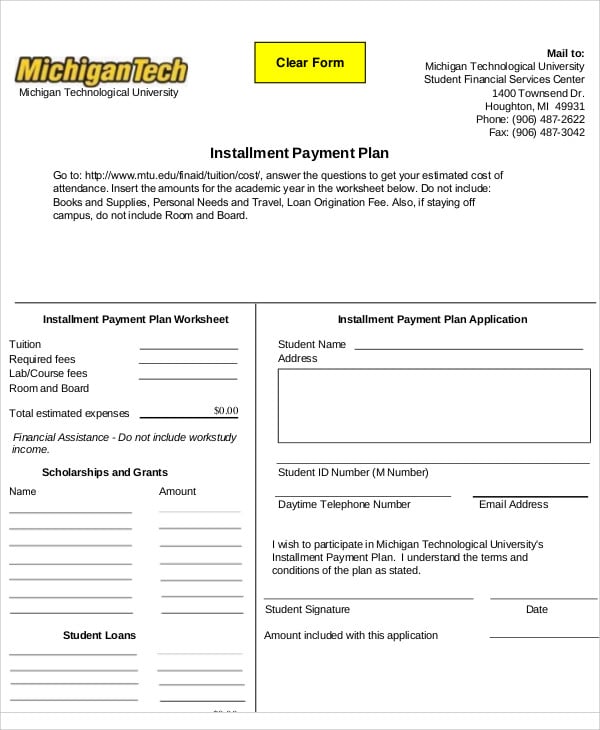

cloudfront.net mtu.edu

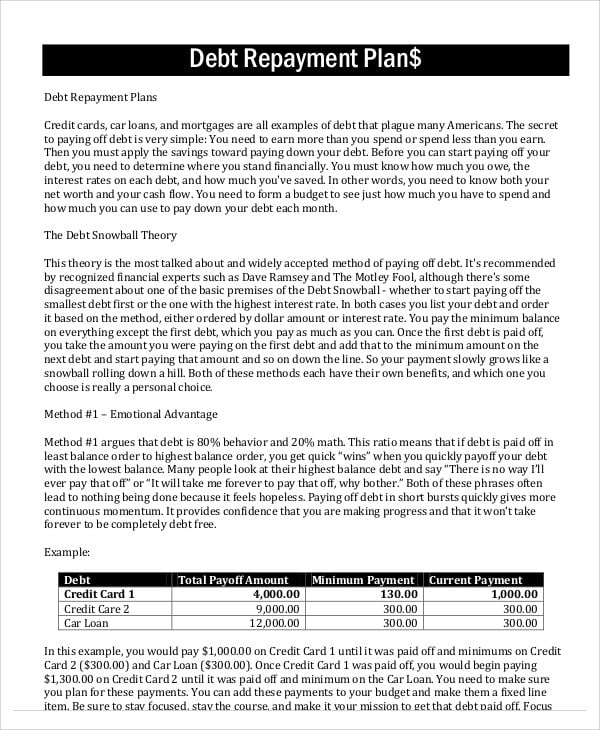

mtu.eduIf you’re looking for ways to solve your debt-related problems, you should consider making a debt payment plan. The plan can help debtors track their debts and ultimately speed up the debt repayment process. The plan format for a debt payment plan will depend on your debtor’s contextual condition which is similar to staff development plan templates which must be customized to fit the subjective capacities of an employee. You may refer to the following:

tiffin.edu

tiffin.edu sanjac.edu

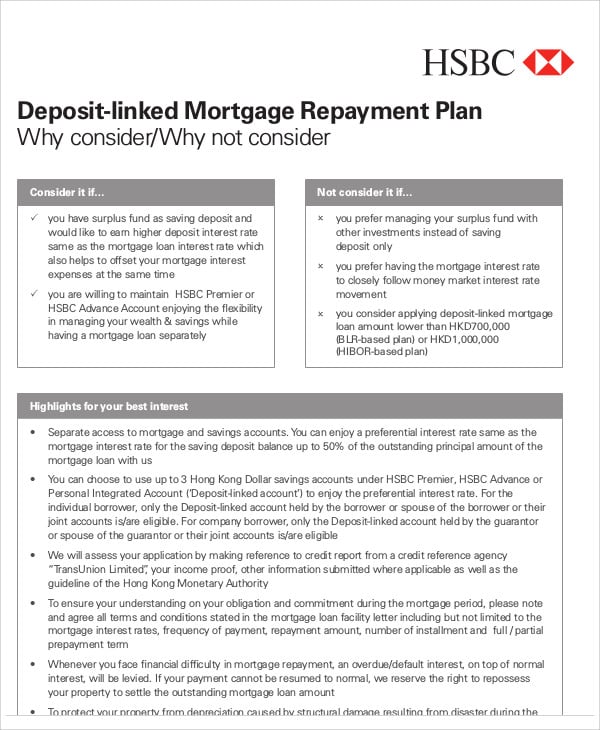

sanjac.edu personal.hsbc.com.hk

personal.hsbc.com.hk buildersinc.com

buildersinc.comPlan templates in PDF displays an array of plans that are used business and financial transactions. Simple marketing plan template, for instance, help advertisers come up with plan that will effectively sell and promote their products and services.

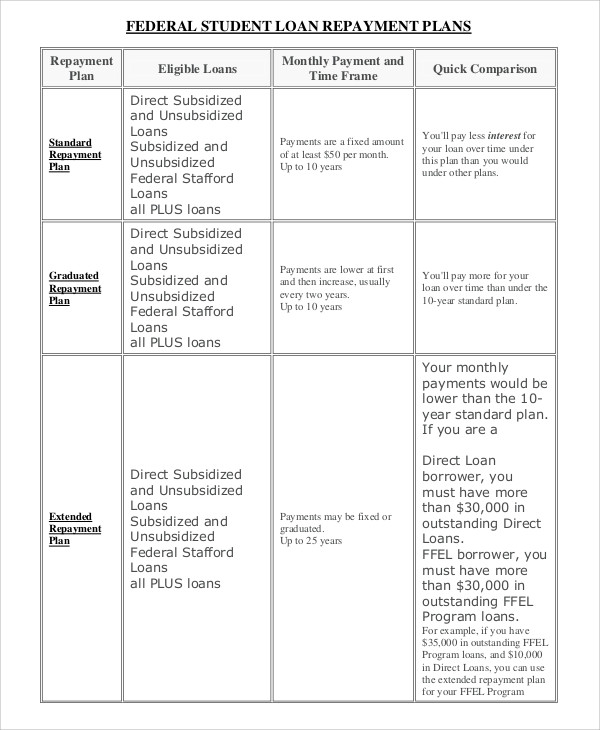

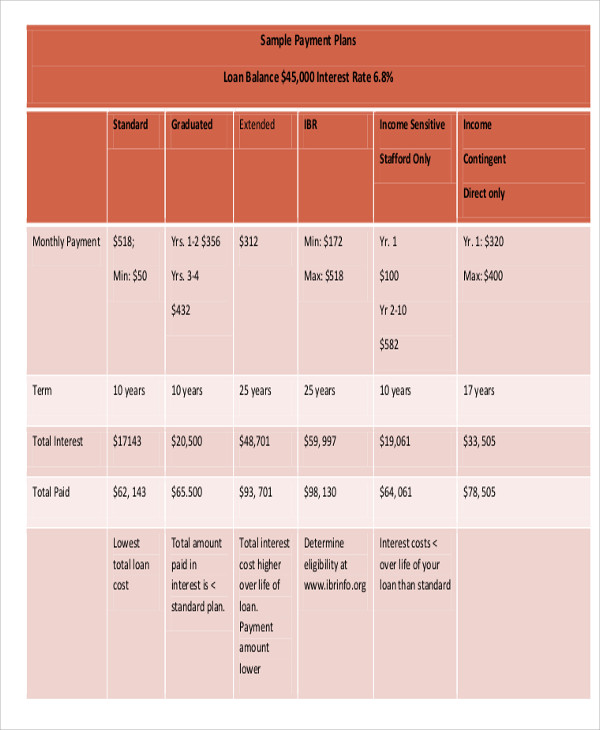

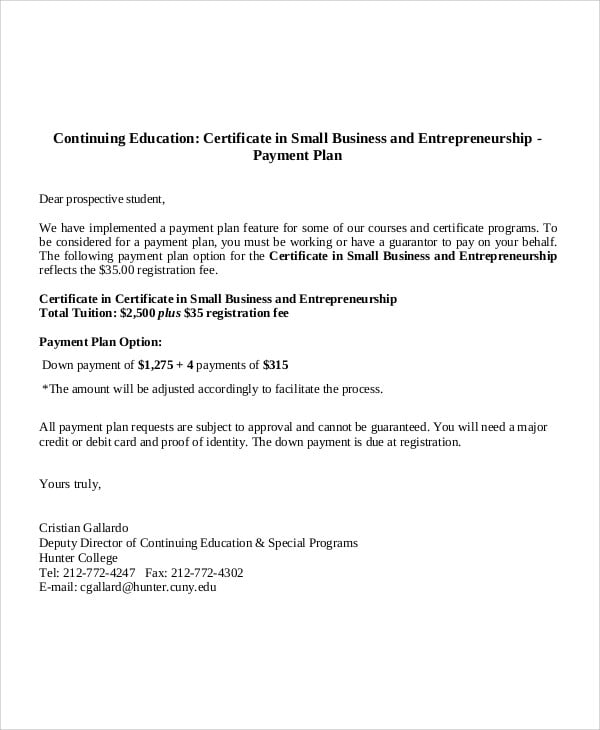

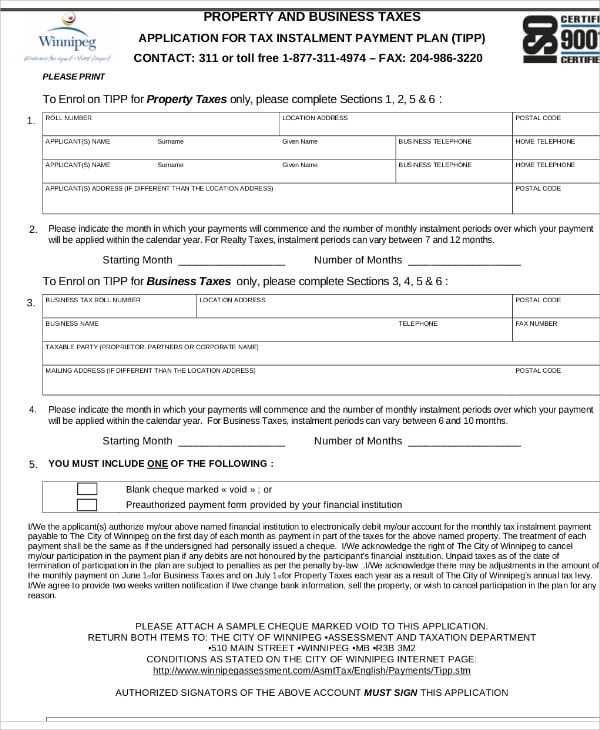

Other than a debt payment plan, there are still a variety of plan templates in PDF that showcase financial strategies. Consider the following:

It is worth noting that within the payment plan, the debtor willingly agrees to pay a certain amount of money under a payment frequency. Furthermore, there are also terms and conditions that both parties must adhere to in pursuance to agreed payment plan. Thus, payment plans are not just mere documentations. They are considered as financial documents that help debtors manage and settle their financial obligations.

hunter.cuny.edu

hunter.cuny.edu winnipegassessment.com

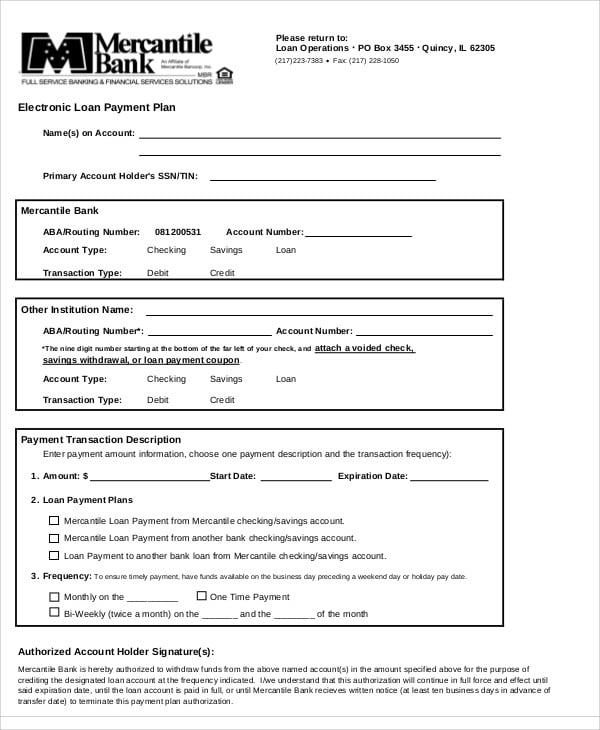

winnipegassessment.com mercantilebk.com

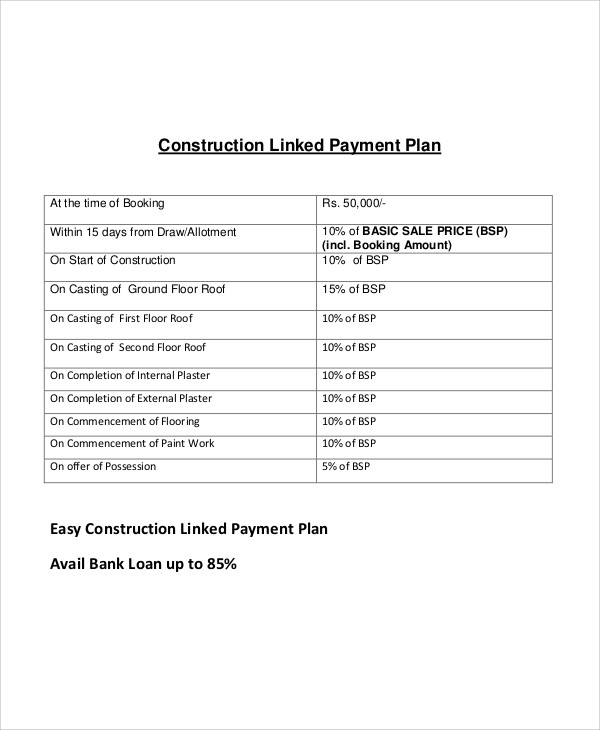

mercantilebk.com 99acres.com

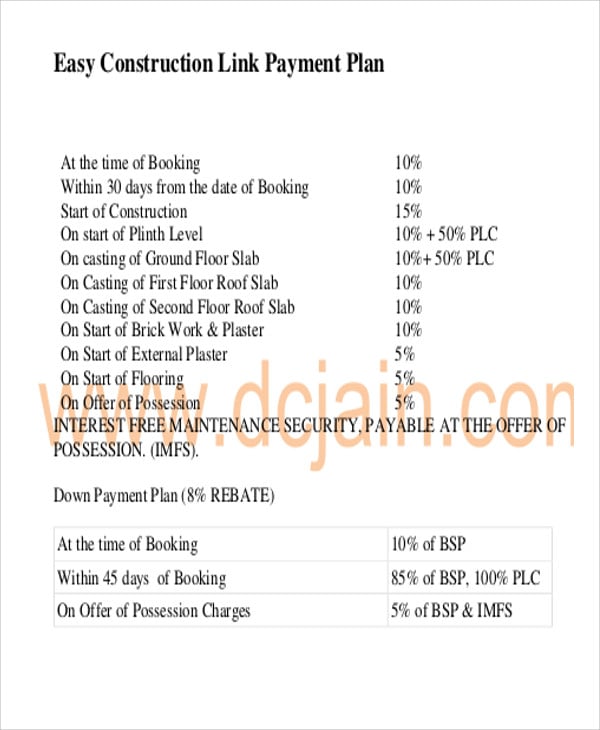

99acres.com dcjain.com

dcjain.comOther than the free plan templates provided, we’ve also consolidated a list of tips and writing techniques that you may consider in dealing with payment plans.

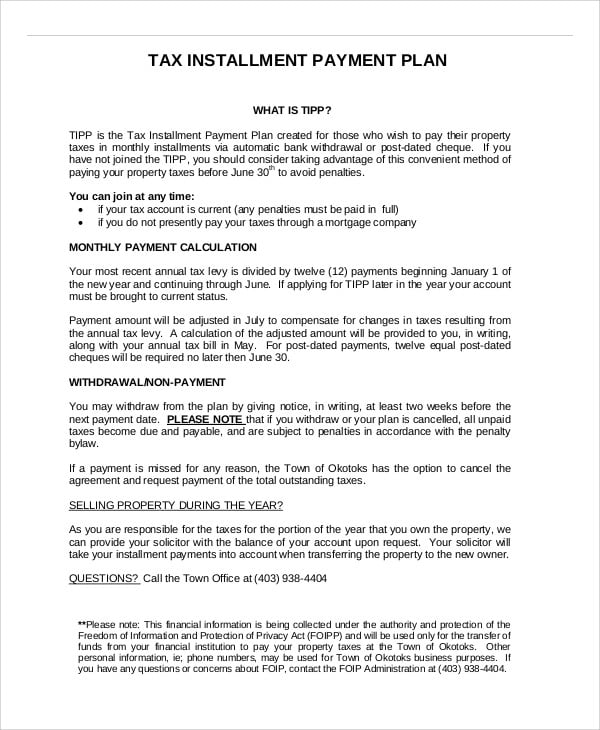

okotoks.ca

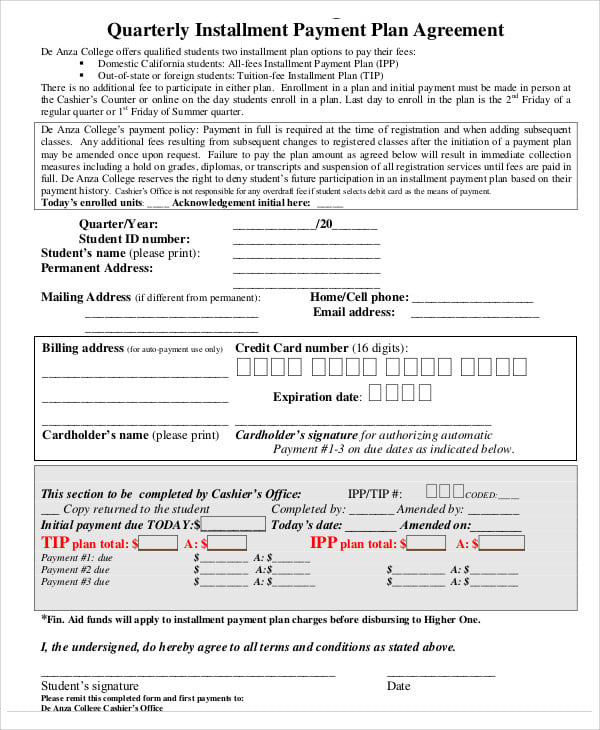

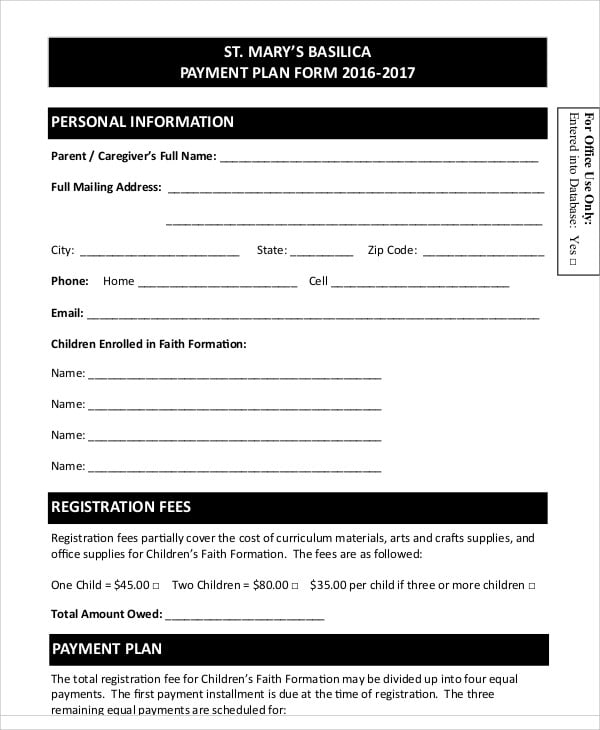

okotoks.ca deanza.edu

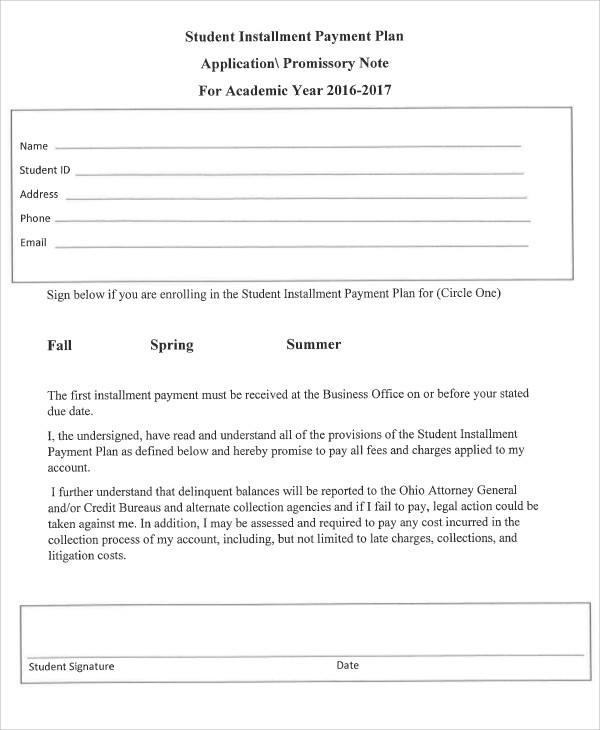

deanza.edu rio.edu

rio.edu revenue.state.il.us

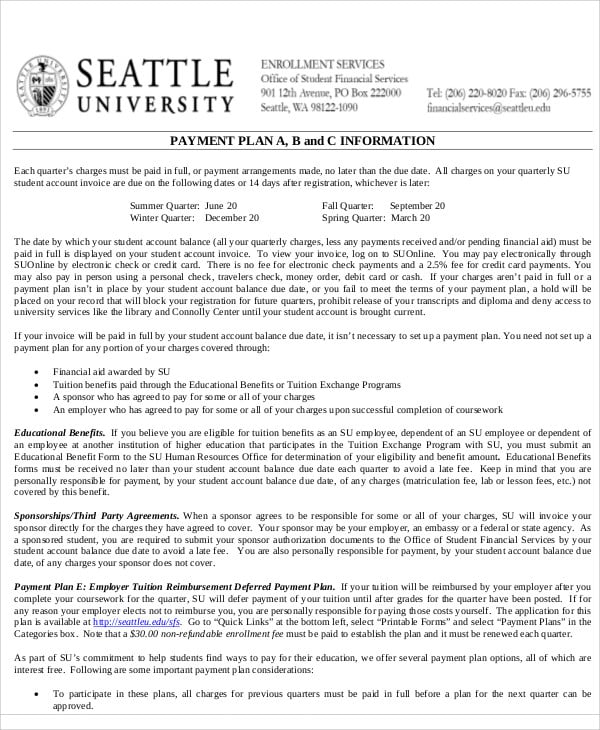

revenue.state.il.us seattleu.edu

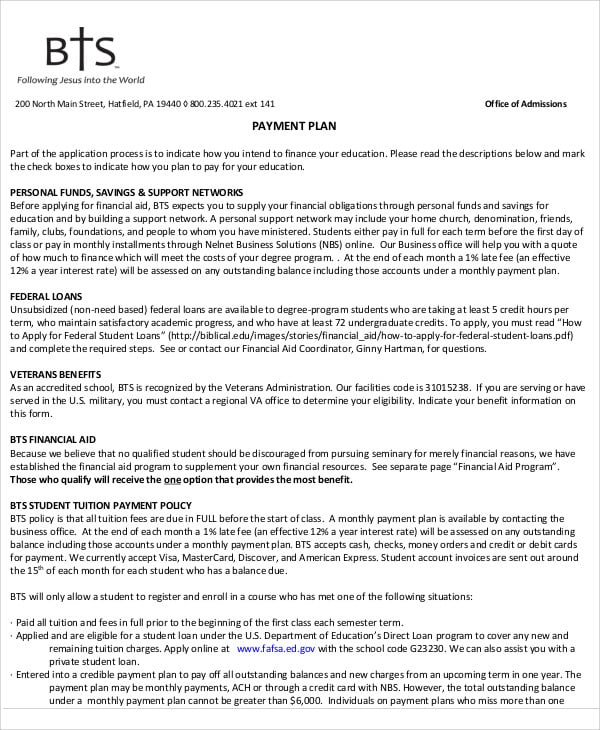

seattleu.edu biblical.edu

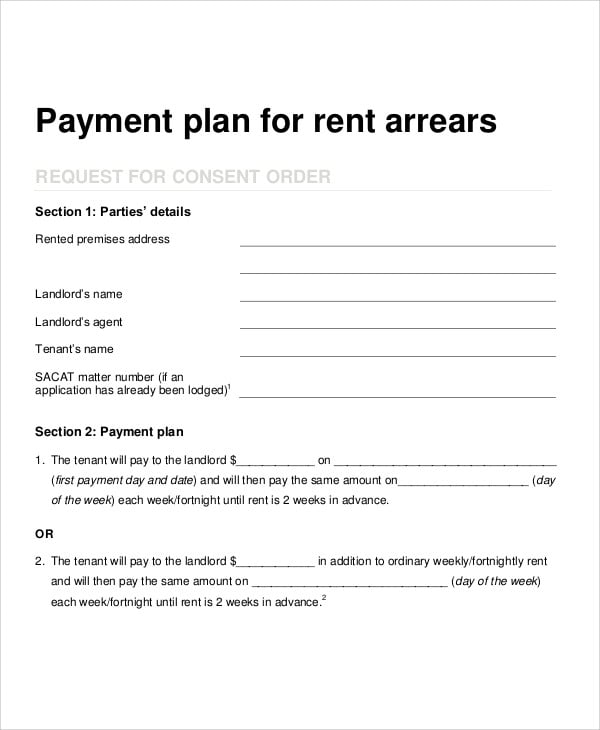

biblical.edu sacat.sa.gov.au

sacat.sa.gov.auPayment agreements have similar characteristics with payment plans. Most of the time, payment plans and payment agreements work hand in hand. To help you know the basics of writing one, you can refer to the following templates:

Empowering the youth to become the best can be such a fulfilling task to accomplish. But, school counselors proved that…

A compensation plan is the detailed plan of an employee’s wages, salaries, benefits and the terms of payment. The plan…

As there is a saying that ” with big positions comes the big responsibilities”. It is the huge duty to…

The student recruitment plan is one of the most important and essential parts of educational institutions. The strategy interacts with…

The recruitment and retention are two different terms explaining the thing that is inter-related. Recruitment is the process of identifying,…

A College Recruitment Plan is the designed plan or a strategy that is developed to recruit the employees of a…

A Recruitment Action Plan is a strategy that is designed for putting the recruiting process into action. This is the…

A recruitment business plan is one of the necessities for a company. It does not just help you to map…

Clinical trial recruitments are considered to be very essential to the success of any clinical study and it is often…