11+ Remuneration Policy Templates in PDF | Ms Word

Arrangements on a remuneration policy are significant reports made by associations crosswise over different fields for giving standards to moral…

Sep 14, 2023

The dividend policy is a financial decision that indicates the balance of the firm’s wages to be paid out to the shareholders. Here, a firm settles on the portion of revenue that is to be disseminated to the shareholders as dividends or to be pushed back into the firm. Have a look at the dividend policy templates provided down below and choose the one that best fits your purpose.

yesbank.in

yesbank.in idfc.com

idfc.com shodhganga.inflibnet.ac.in

shodhganga.inflibnet.ac.in vardhman.com

vardhman.com ijasrw.com

ijasrw.com jgbm.org

jgbm.org silverchair-cdn.com

silverchair-cdn.com ripublication.com

ripublication.com res.mdpi.com

res.mdpi.com amrita.edu

amrita.edu pide.org.pk

pide.org.pk res.mdpi.com

res.mdpi.comThe dividend policy is essential because it describes the importance, purpose, type, and number of dividend disbursements. At the most crucial level of decision making, organizations have two primary options about what to do with their profits which are: retain or distribute the earnings.

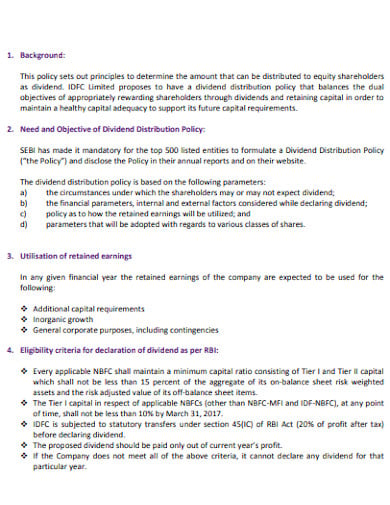

The dividend policy indicates the choice of the board about the distribution of surplus earnings to its shareholders. The main purpose of a finance manager is the maximization of the wealth of the shareholders.

The dividend decision is one of the important decisions made by the finance manager describing the payouts to the shareholders. The payout is the balance of earning per share given to the shareholders in the form of dividends.

Dividend decision attributes to the policy that the management expresses in concern to earnings for distribution as dividends among shareholders. The dividend decision, in corporate finance, is a choice made by the directors of an organization about the quantity and timing of any cash payments made to the organization’s stockholders.

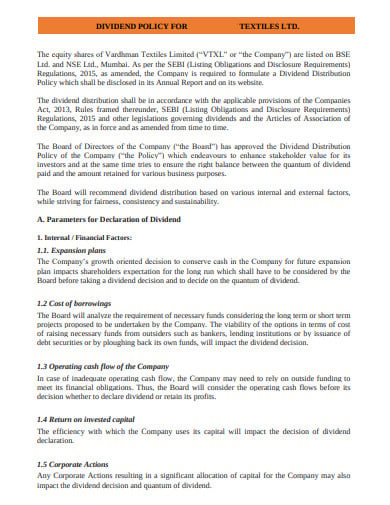

The dividend policy decides how the earnings of an organization are disseminated. Wages are either held and reinvested in the organization or are paid out to shareholders.

A stable dividend policy is also referred to as the regular policy. In this, an organization pays a dividend at a fixed rate and keeps it for a long time even the advantage varies. It pays the merest amount of dividends every year usually. A firm paying this can persuade the shareholders and can magnify the credit in the market.

Dividend decisions are significant features of corporate financial policy since they can have an impact on the availability as well as the cost of capital. The dividend decision decides the division of earnings between payments to shareholders and retained earnings.

A stock dividend is a bonus payment made in the form of supplementary shares rather than a cash payout. Organizations may choose to disseminate this type of dividend to shareholders of record if the organization’s availability of liquid cash is in low supply.

Neither any problem of bonus shares nor stocks cut to change the value of the organization. The difference between bonus shares and dividends is that the dividends are a component of the organization’s yearly profit that it disseminates to its shareholders. Bonus shares are declared from an organization’s held earnings retained back for many years.

There is an advantage of getting bonus shares because issuing bonus shares raises the issued share capital of the organization, the organization is regarded as being larger than it really is, making it more engaging to investors. In extension, raising the number of excellent shares reduces the stock price, making the stock more reasonable for retail investors.

The shares are granted to the shareholders at the reduced price to assist them to buy the rights issue. The organization saves a meaningful amount of money, such as underwriting fees, advertisement costs and so on.

Arrangements on a remuneration policy are significant reports made by associations crosswise over different fields for giving standards to moral…

Grooming policy is the rule or the protocol that an employee has to follow when he becomes the employee of…

A dress code policy is defined as a set of guidelines to make it easy for the employees to know…

A sales commission policy fulfills the policy of establishing responsibilities for setting commission rates and to define the point at…

A confidentiality policy implies individual correspondence or data identifying with an association’s business that is obscure to general society and…

The dividend policy is a financial decision that indicates the balance of the firm’s wages to be paid out to…

The payment policy is the set of rules or directions that guides a customer to make the bill payment templates.…

Bonus Policy can be referred to as the protocol formulated in an organization based on which the employees are given a…

Recruitment policy is the practice that a company exhibits while hiring employees. It a statement that outlines the rules and…