11+ Remuneration Policy Templates in PDF | Ms Word

Arrangements on a remuneration policy are significant reports made by associations crosswise over different fields for giving standards to moral…

May 17, 2024

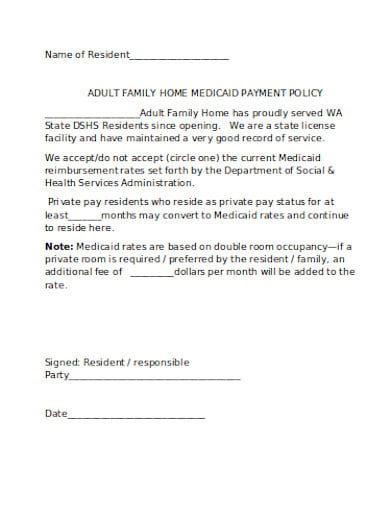

The payment policy is the set of rules or directions that guides a customer to make the bill payment templates. It is the guideline that is set so that there is no issue between the customer and the seller. The payment policy is framed so that there is complete clarity in the minds of the customer. Here are some policy templates that you can take advantage of to prepare your payment policy.

nhhealthyfamilies.com

nhhealthyfamilies.com harvardpilgrim.org

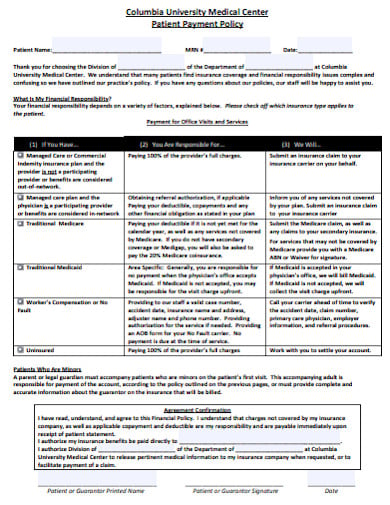

harvardpilgrim.org cumc.columbia.edu

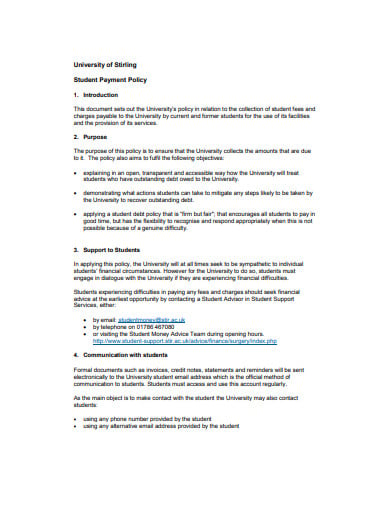

cumc.columbia.edu stir.ac.uk

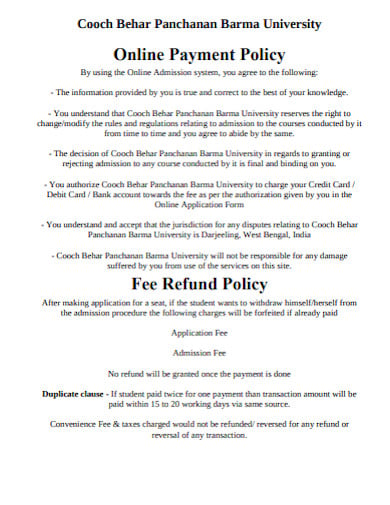

stir.ac.uk cbpbu.ac.in

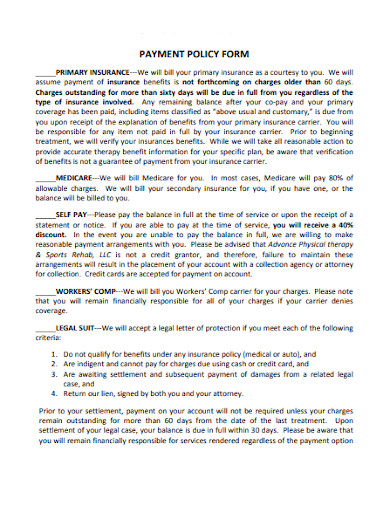

cbpbu.ac.in advanceptsports.com

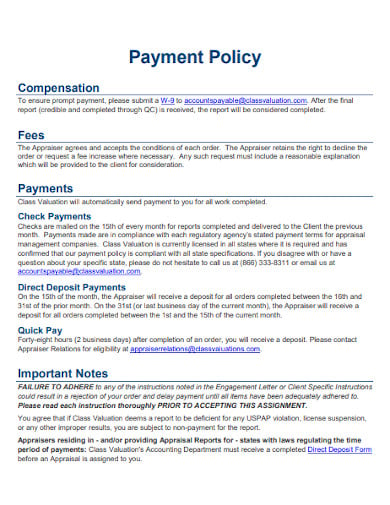

advanceptsports.com classvaluation.com

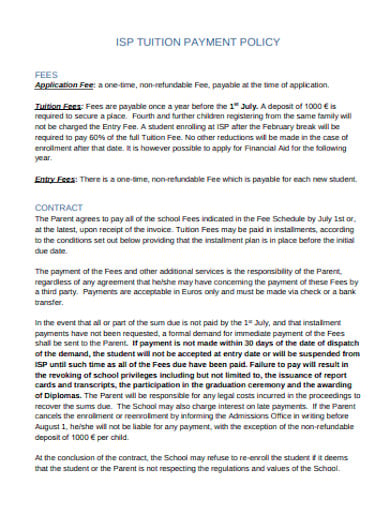

classvaluation.com isparis.edu

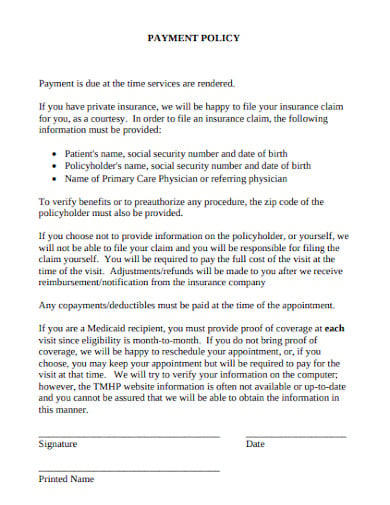

isparis.edu panhandleobgyn.com

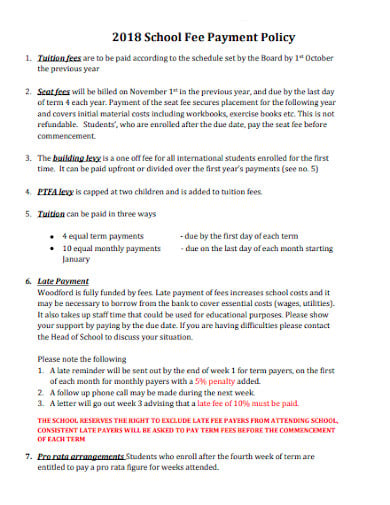

panhandleobgyn.com wis.edu.sb

wis.edu.sb afhna.wildapricot.org

afhna.wildapricot.orgUse the Google Docs or the MS Word for the preparation of the payment policy. These two computer applications are the best form of computer application that you can make use of and then prepare the required document. You can make all your required settings such as the measurement of the page, margins, font style, font size, etc. For a wider selection of policy and procedure templates, check out more options here.

A policy cannot be formulated by a single person. It requires meeting minutes and discussions to come up with the perfect policy. Therefore it is necessary that you have a meeting where you brainstorm ideas and get to a conclusion that will be your final policy.

After the discussion is over and you come up with the ultimate points that you will be registering as the final decision, prepare the policy. Give the important points that have discussed the structure of the required policy. Find more professional policy templates by visiting this link.

After you are done preparing the policy and crafting the document, check it. You need to review it to avoid any kind of mistake and error. Make sure that you have prepared the right policy, the structure is well-constructed and organized, etc.

This is the last date of making payment with the charges that will be incurred on late payments. Mentioning this will ensure that you inform the buyer that he has a deadline before which he has to make the payment templates.

This includes the list of all the payment methods that you accept and you do not accept. Different buyers use different types of methods. Therefore it is necessary to inform your buyer what payment method he can use to make the payment.

This includes the details of the place or the site or the option where the customer can make a payment. Here you can also mention your contact details. Mention this enables the customer to know where the final payment is going.

You might or make use of some kinds of discounts that will fasten the payment process. You may give incentives to the customers who will pay before a certain date. The process of early payment will ensure that you receive all your demand payments on time or even early.

Late payments can make the process of the payment slow. Therefore contributing to the low cashflow template. Therefore it is necessary to have certain charges that will make your customer avoid the late payment. You may add some amount of interest to the payable amount to compensate for the late payment and the loss in your business.

This is the set condition under which the seller is bound to complete the all over the sales process. Under this condition, the buyer is obliged to make the payment. The terms and conditions might include the amount due, the demand for the cash in advance, cash on delivery, etc.

These are very important conditions that are to be mentioned in the policy memo. It is extremely essential that every payment policy should have the payment terms so that there is clarity between the buyer and the seller.

This article not only provides you a generous amount of information about payment policy but also gives you valid examples from which you can learn. The simple free templates are the most valuable entity present here that will give you the complete image of the payment policy. You will be able to learn many things if you download these templates of payment policy. Explore additional payment policy templates on our website, template.net, to find a variety of options that suit your needs.

Arrangements on a remuneration policy are significant reports made by associations crosswise over different fields for giving standards to moral…

Grooming policy is the rule or the protocol that an employee has to follow when he becomes the employee of…

A dress code policy is defined as a set of guidelines to make it easy for the employees to know…

A sales commission policy fulfills the policy of establishing responsibilities for setting commission rates and to define the point at…

A confidentiality policy implies individual correspondence or data identifying with an association’s business that is obscure to general society and…

The dividend policy is a financial decision that indicates the balance of the firm’s wages to be paid out to…

The payment policy is the set of rules or directions that guides a customer to make the bill payment templates.…

Bonus Policy can be referred to as the protocol formulated in an organization based on which the employees are given a…

Recruitment policy is the practice that a company exhibits while hiring employees. It a statement that outlines the rules and…