19+ Restaurant Receipt Templates

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

Sep 05, 2023

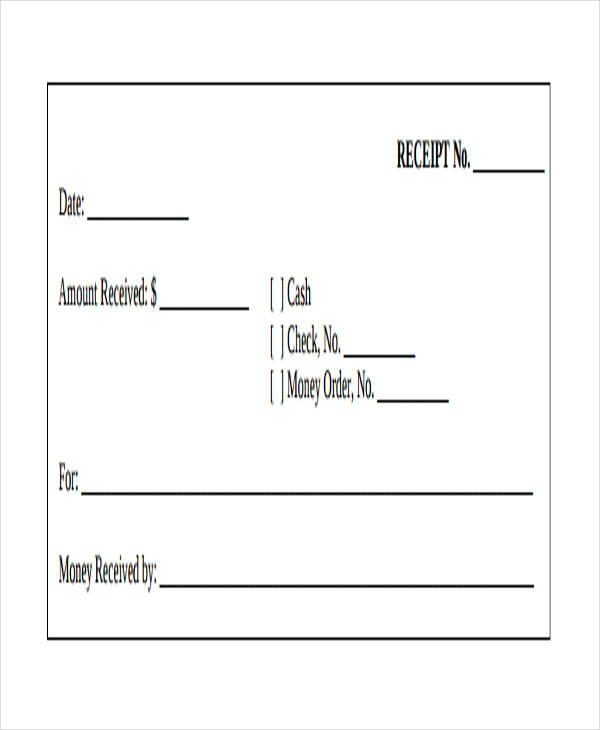

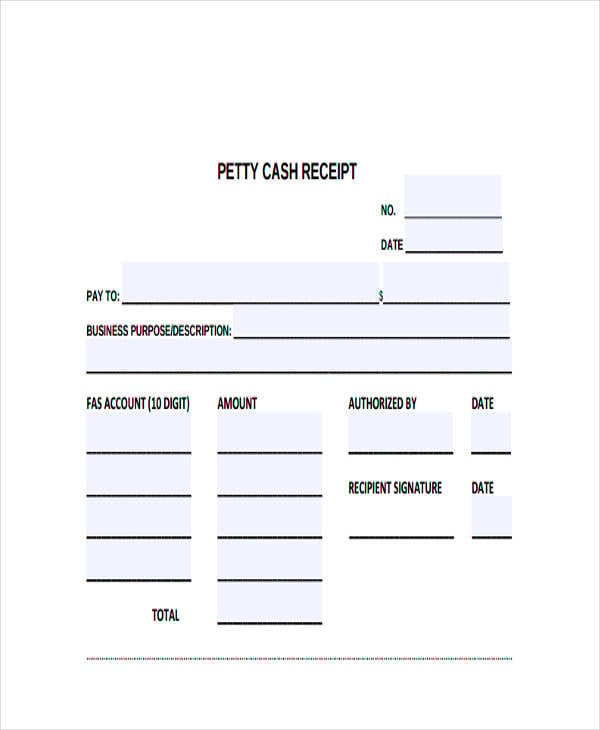

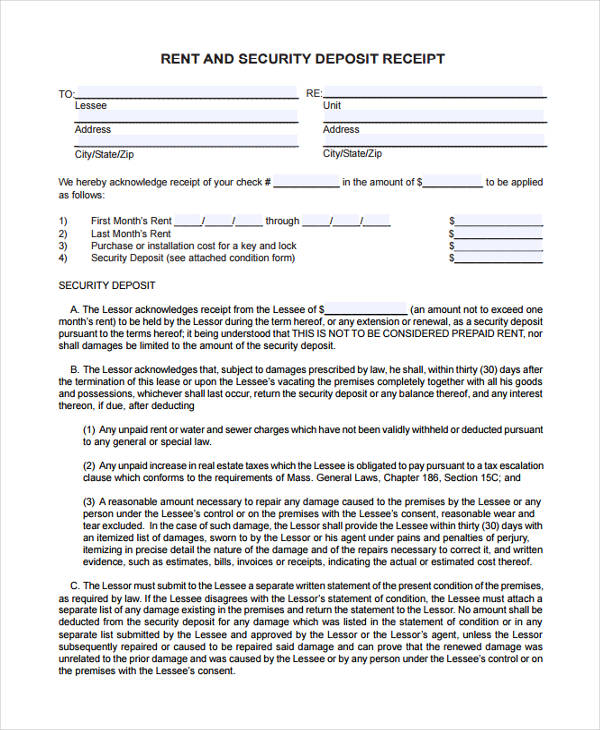

In the world of business, receipts are considered to be one of the most important documents. According to Investopedia, “a receipt is a written acknowledgement that something that holds value has been transferred from one party to another.” One of the most common forms receipts that is widely used in business transactions is the acknowledgement receipts.

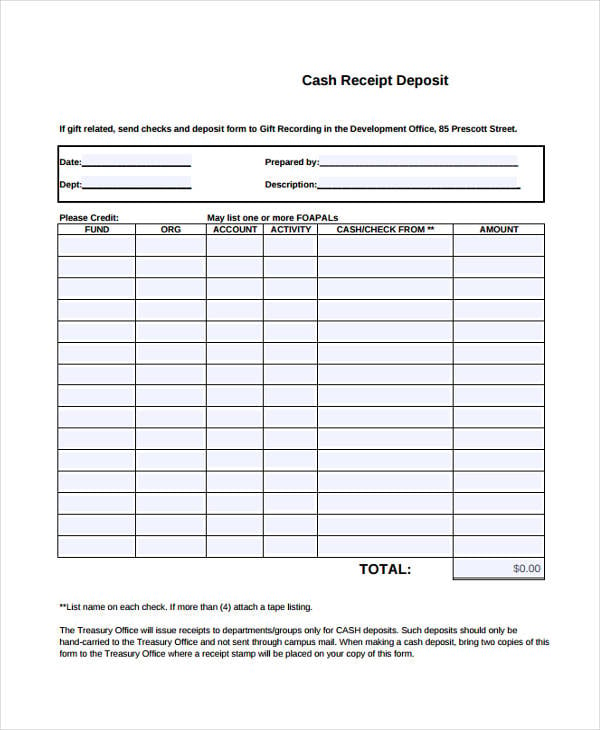

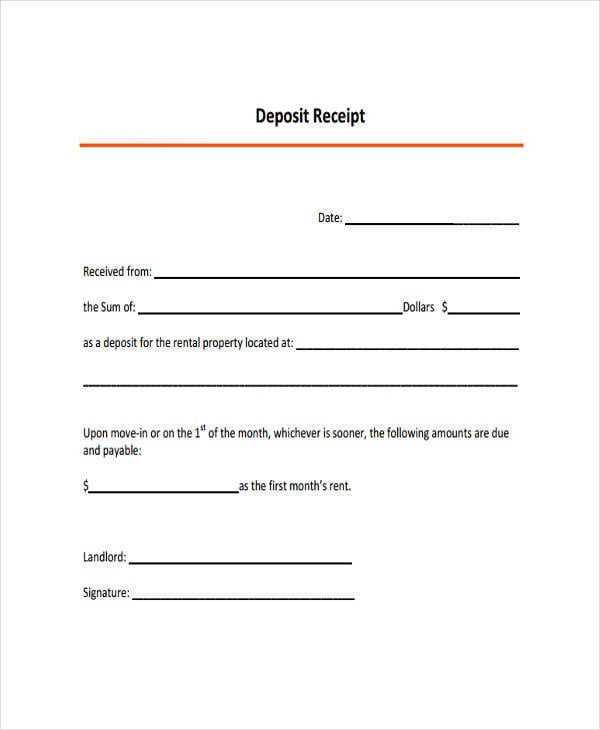

Since business transaction can be really broad, different forms of receipts are issued in different business dealings. Let us take for example, when you want to deposit money to your bank account, the bank teller will issue you a deposit receipt to acknowledge that you have completed a transaction with the bank.

hooverwebdesign.com

hooverwebdesign.com web.wpi.edu

web.wpi.edu finserv.uchicago.edu

finserv.uchicago.edu tenantsbc.ca

tenantsbc.ca fsh.stanford.edu

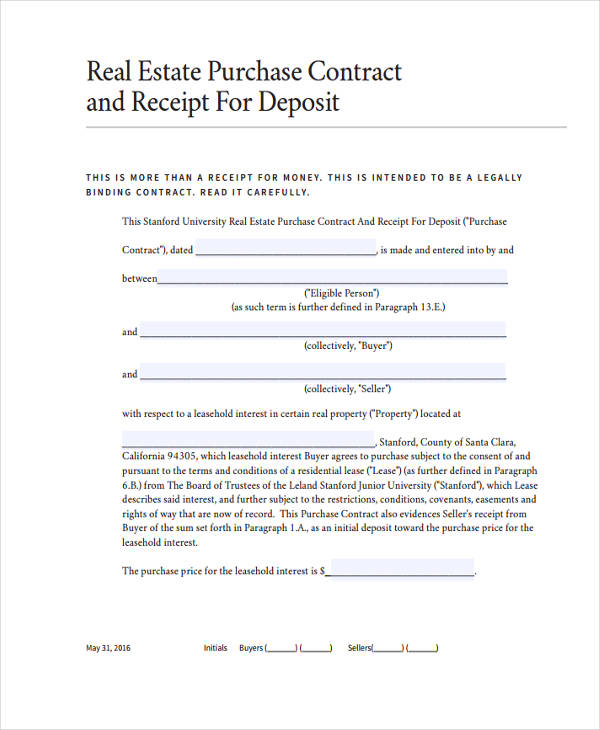

fsh.stanford.eduWhen purchasing goods and/or service, the seller and the buyer usually complete a financial transaction during business transaction. This agreement is commonly recorded via invoice or receipt. And while these two transaction documents are essential for accounting, there are some people who are not quite familiar with the difference between an invoice and a receipt and even use the two terms interchangeably.

In this section, we would learn how a receipt is different from an invoice. And since we have already discussed the definition of a receipt, let us get to know what an invoice is all about. An invoice is a document that is issued by the seller to the buyer to authorize a sale. It usually contains information (price, discount, date, and place of the delivery) of the goods and/or service purchased, as well as the names and address of both parties. Here are the other factors that set them apart from each other:

If you’re looking for a receipt to use for your business, check out the receipt templates in PDF on our website.

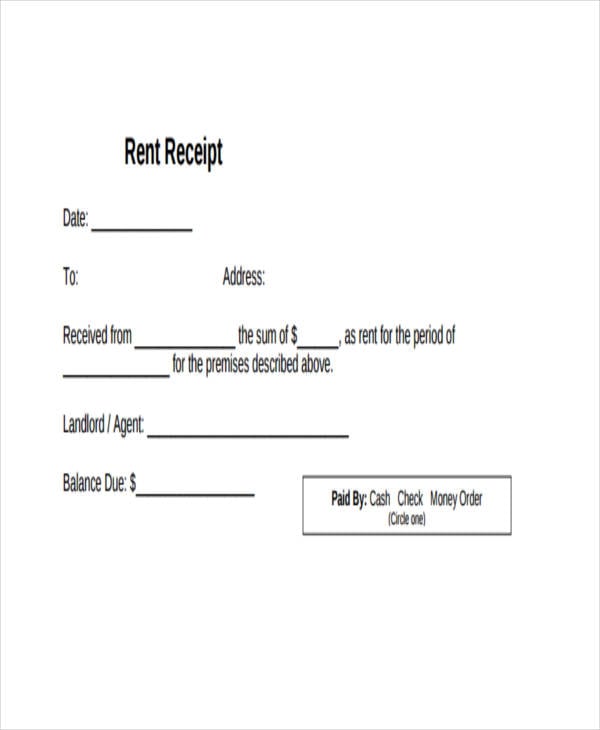

It isn’t a secret that receipts are the core of retail. Whenever you purchase something from the store, the retailer always offer you a copy of the receipt. Although there are some buyers who just throw away their receipt in the trash bin, but have you ever wondered about the other main uses of a receipt?

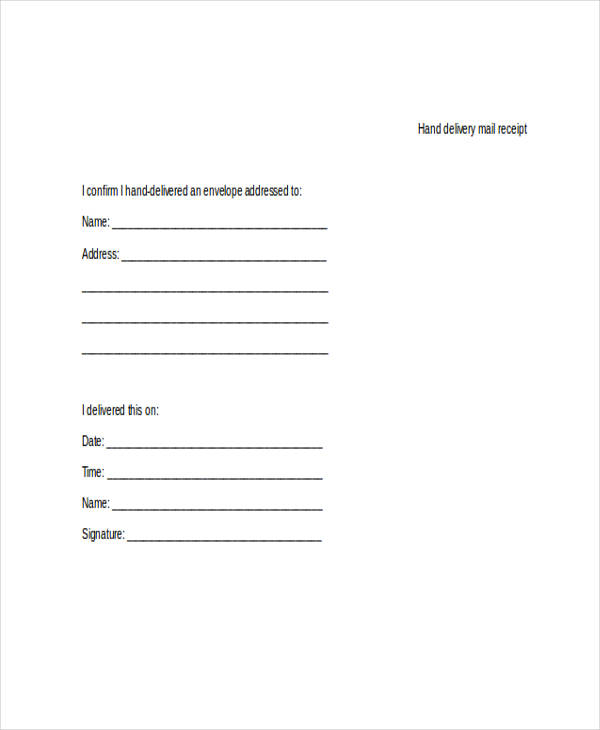

Our website also offers a collection of different delivery receipts. They can be downloaded for free and are highly editable.

aus.ac.in

aus.ac.in kenmoreproperties.com

kenmoreproperties.com thelpa.com

thelpa.com template.net

template.net transport.and.nic.in

transport.and.nic.in dcu.org

dcu.org landlordspecialists.com.au

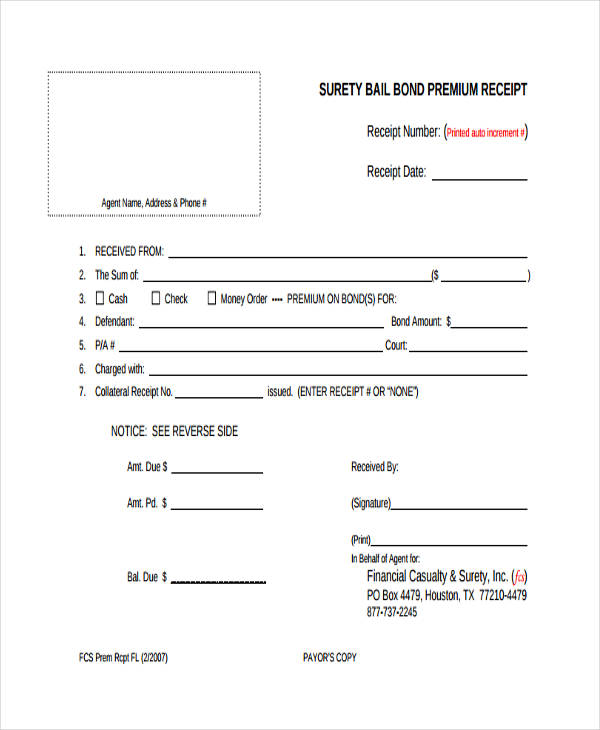

landlordspecialists.com.au fcsurety.com

fcsurety.comNon-business people are often too quick to say no whenever they are asked if they want a copy of the receipt for their purchased item. However, this is not the case for business people because receipts are highly valuable documents, especially when filing for a tax return. And since you may have hundreds, if not thousands of customers purchasing goods and/or services from your business establishment, keeping and organizing all the receipts can be a bit of headache. So, in this section, we will discuss the some basic yet effective steps on organizing your receipts.

Don’t forget to browse through our collections of printable receipt templates and invoice receipts.

derby.gov.uk

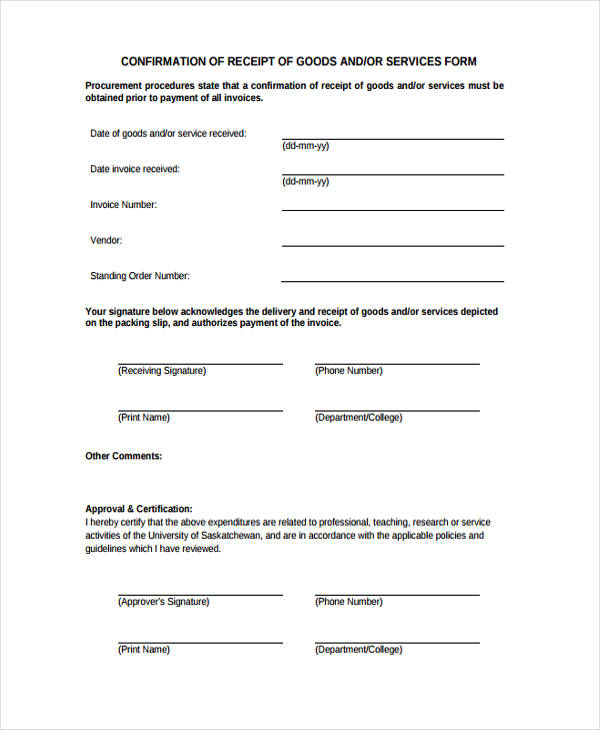

derby.gov.uk usask.ca

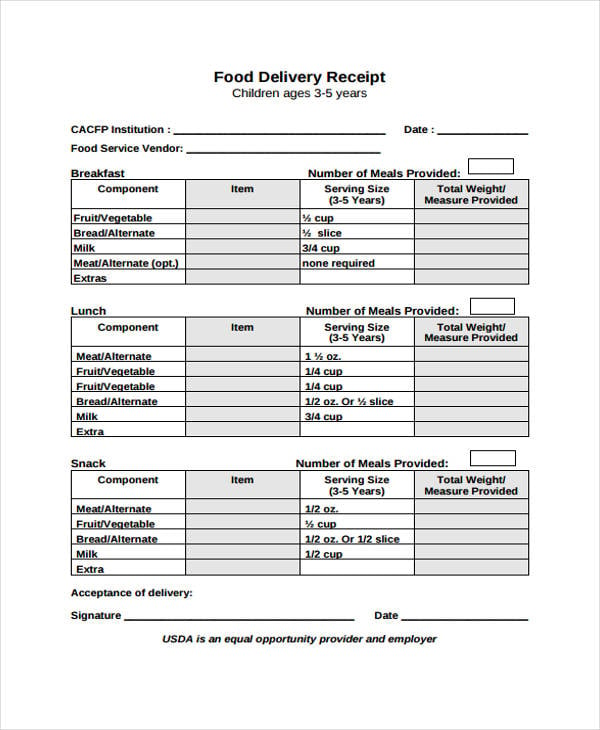

usask.ca dphhs.mt.gov

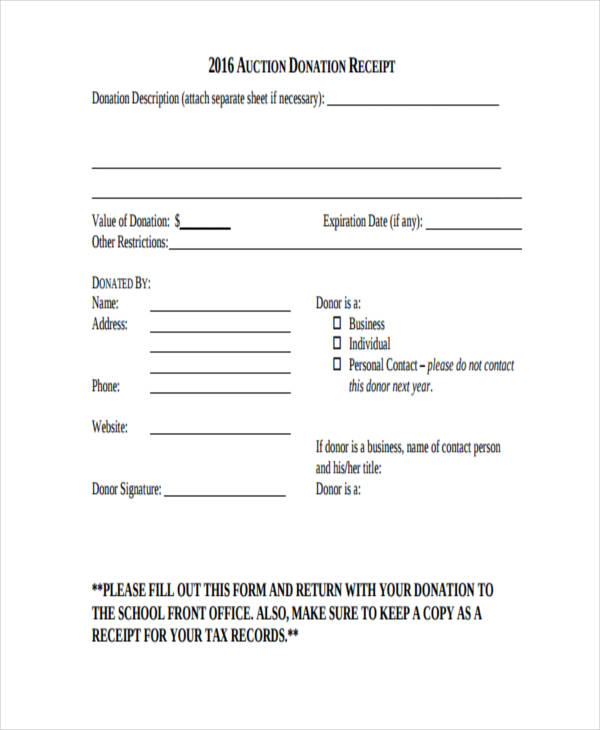

dphhs.mt.gov flagstaffacademypto.org

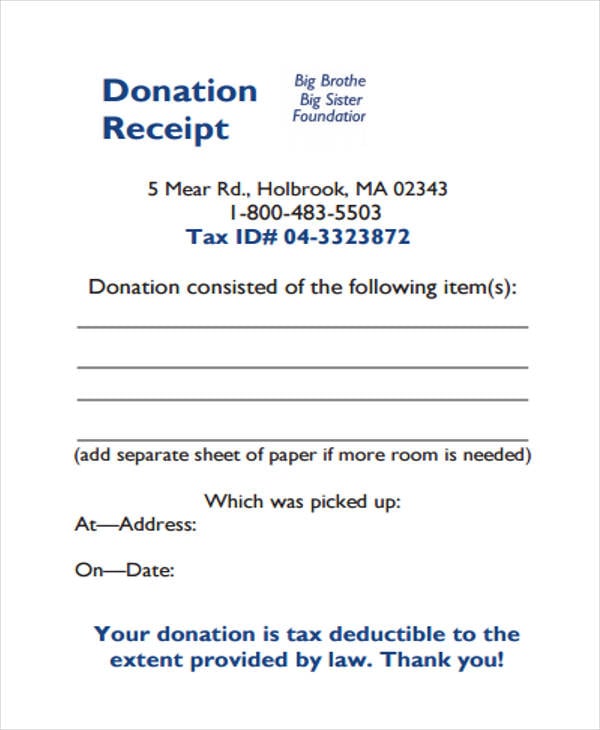

flagstaffacademypto.org bbbsfoundation.org

bbbsfoundation.orgSometimes, seeing stacks of receipts in your offices or file cabinets can be painful to look at. Yes, we all know how important they are, but how long should you keep them?

Since receipts are essential documents used in tax returns, experts recommend keeping them for three years. But in some instance, the IRS performs an audit up 6 years, especially if they suspect a serious mistakes on the taxes filed. To save you from headache, just keep them for 6 years if you do not want to jeopardize your tax return. Feel free to download our receipt templates on our website, too.

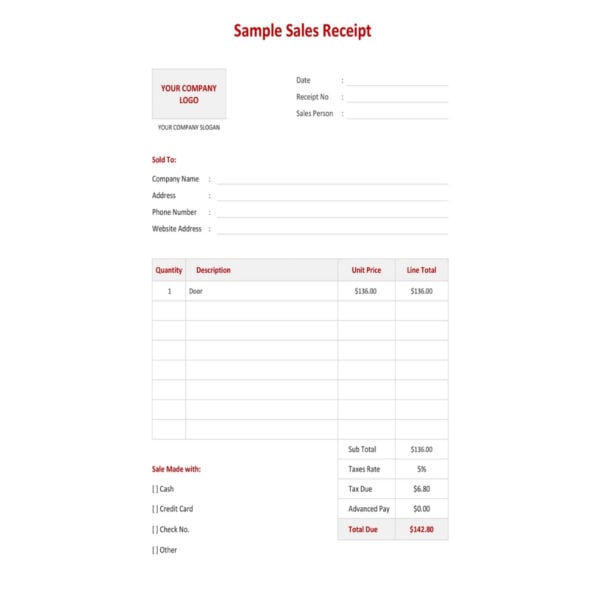

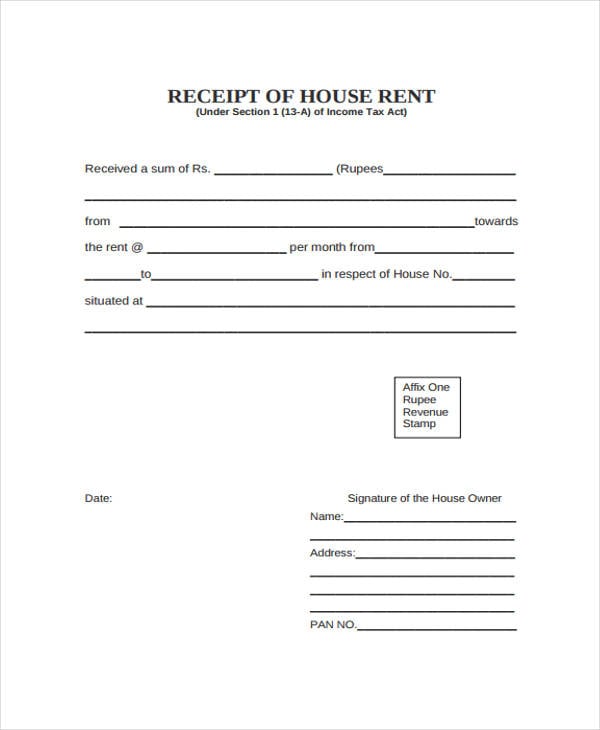

Since receipt is commonly used to keep track of your business profit and revenue and for filing of tax return, it is extremely important to write down accurate information on a receipt.

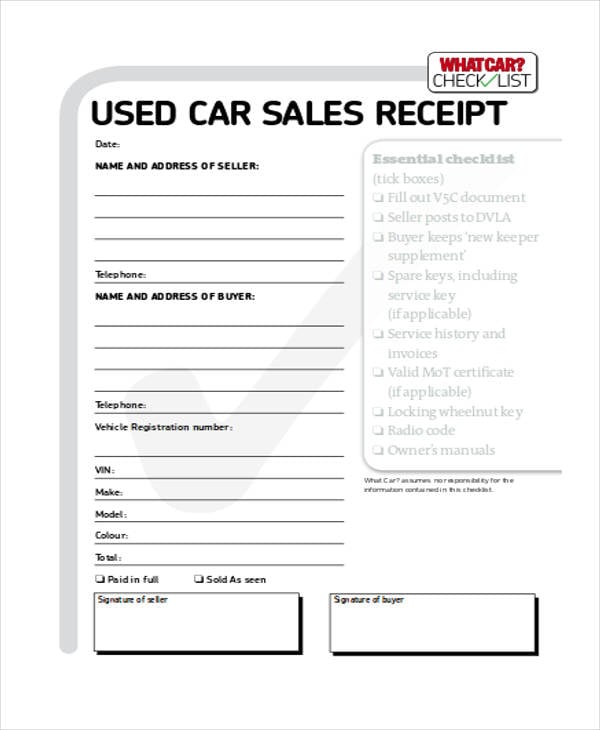

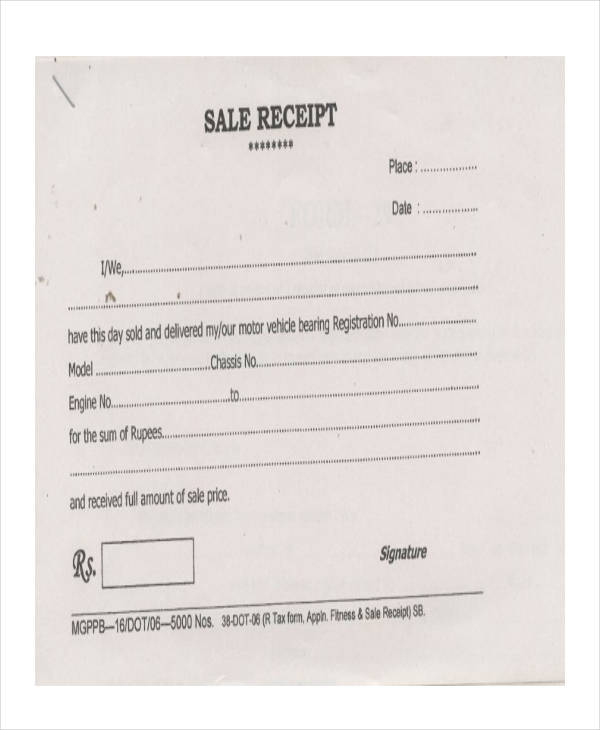

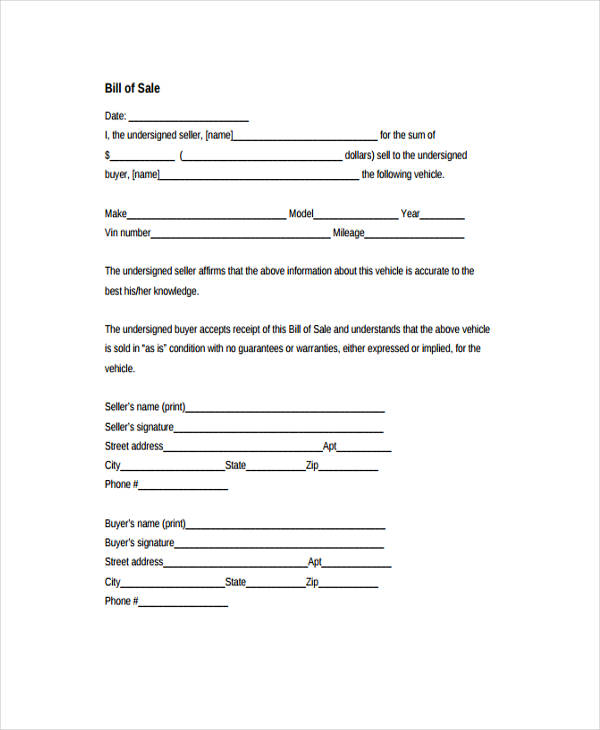

Make sure to also check out our car sales receipts and download them for free at our website.

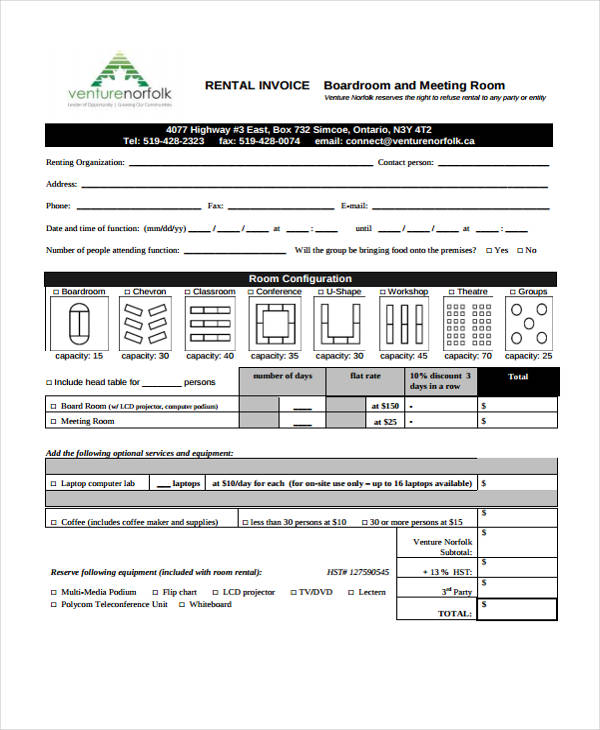

venturenorfolk.ca

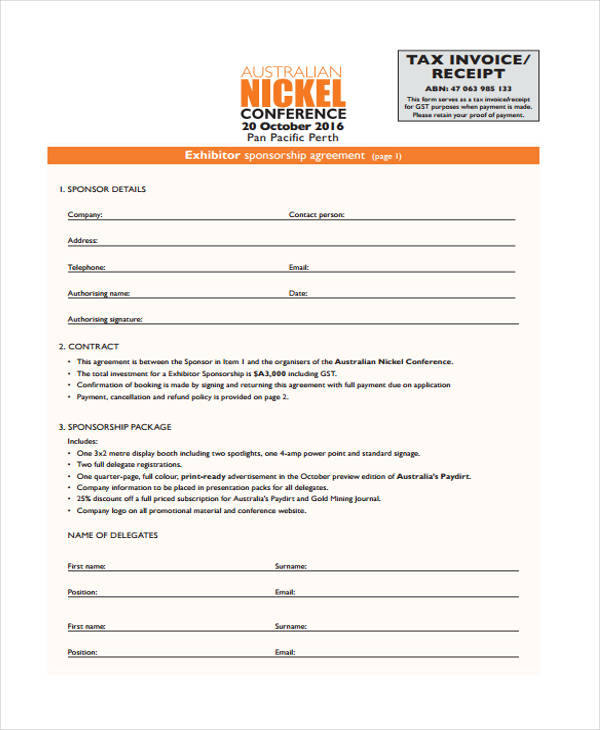

venturenorfolk.ca australiannickelconference.com

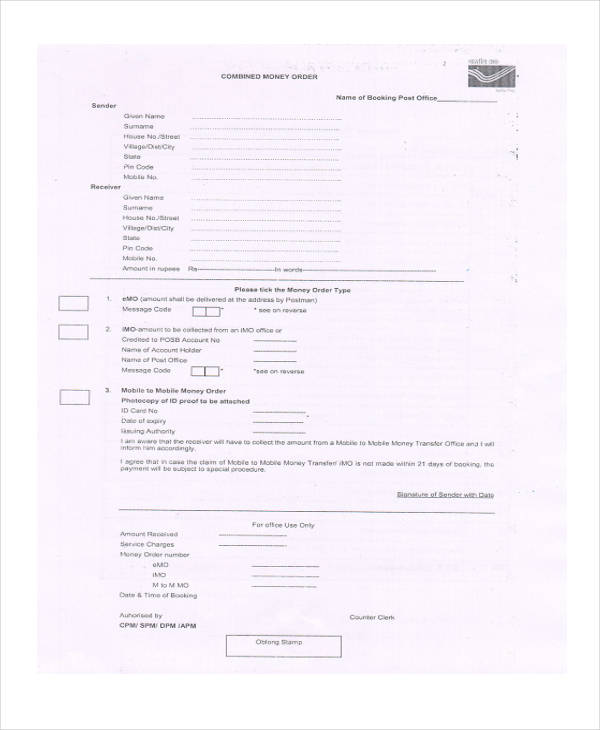

australiannickelconference.com indiapost.gov.in

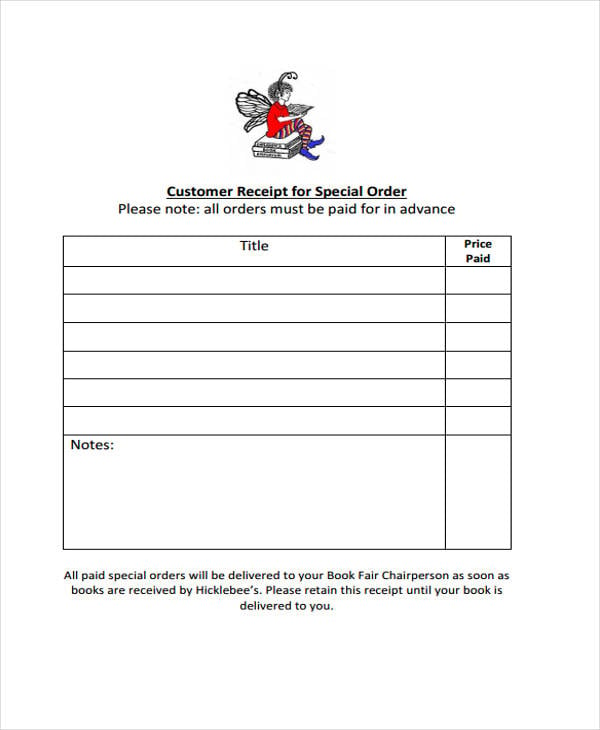

indiapost.gov.in hicklebees.com

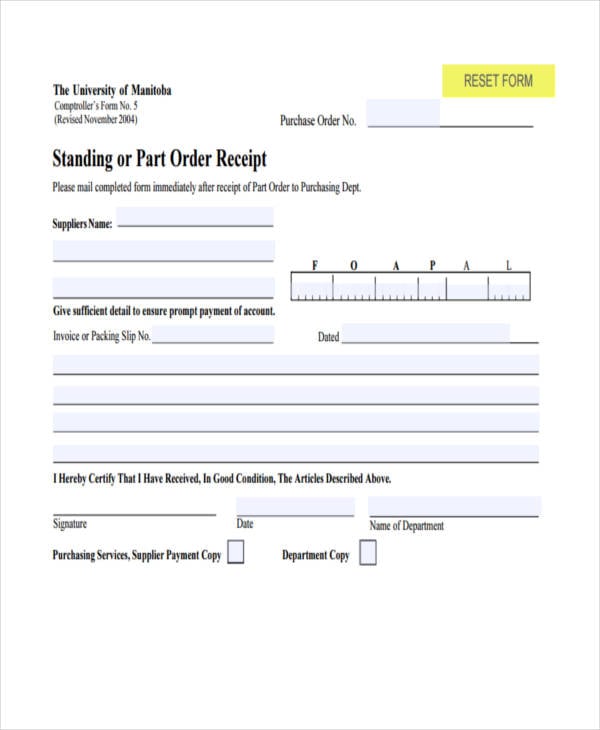

hicklebees.com umanitoba.ca

umanitoba.ca wp.stolaf.edu

wp.stolaf.eduKnow that you have learned the importance of receipts for your business, we would like to recommend you to check out the receipt format in Word, as well as the blank receipts, at Template.net.

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

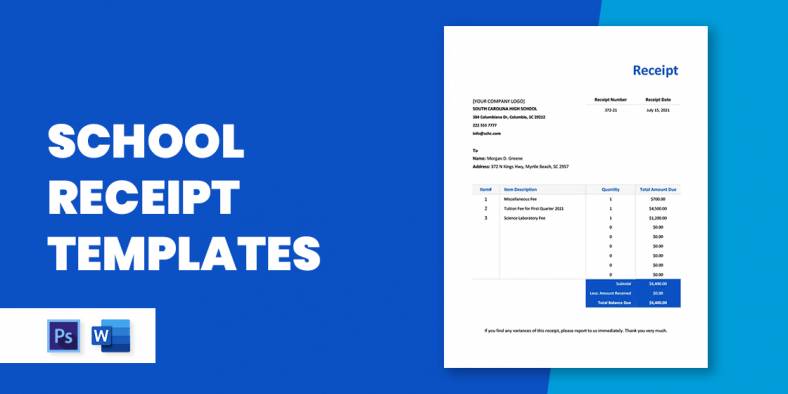

Any type of receipt serves as a receipt acknowledgment and proof that a certain product or type of service has…

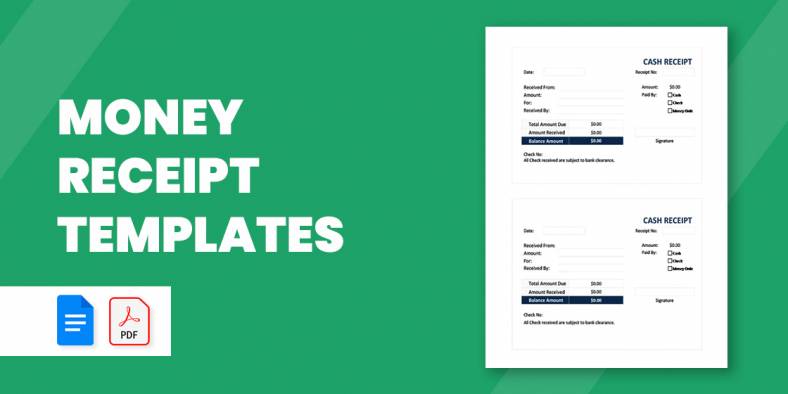

For any business that only accepts money as mode of payment from their customers, a good system for calculating the…

If you’re going to run a business that focuses on selling products to customers, then both you and the people…

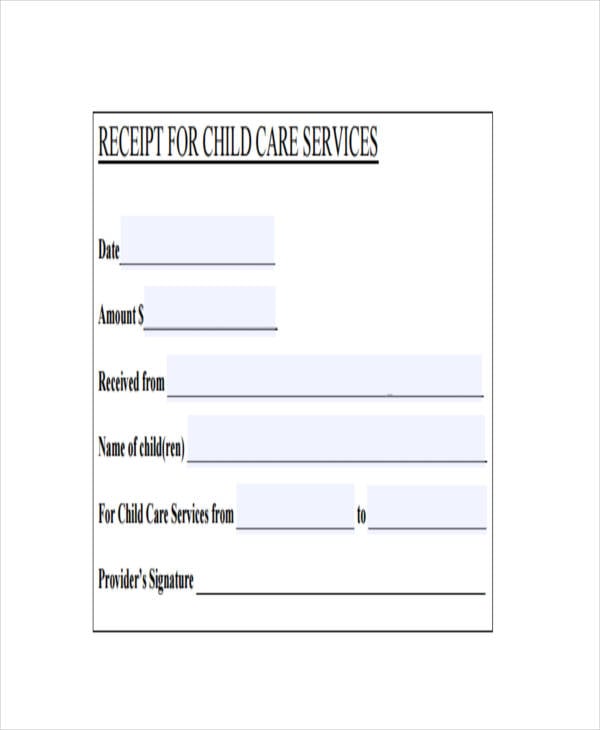

Daycare centers take care of small kids while their parents are busy working in the office. A daycare center uses…

There is a need for the receipt whenever church donation is made or given. This donation receipt works as the…

An investment receipt is a record that recognizes that an individual has obtained capital or assets in compensation as a…

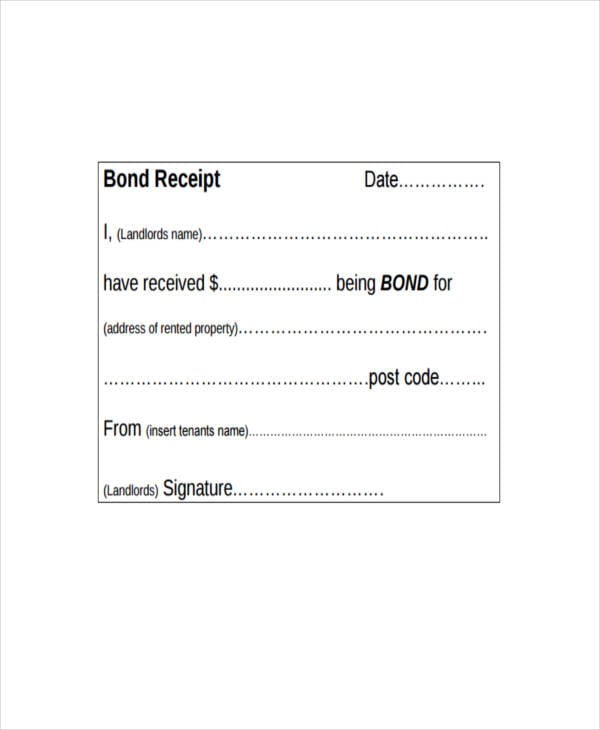

Running a rental business entails writing necessary documents for formality’s sake and legal purposes. If you are an owner of…

Once a customer buys an item on registered establishments such as departments stores and restaurants, a proof of purchase is…