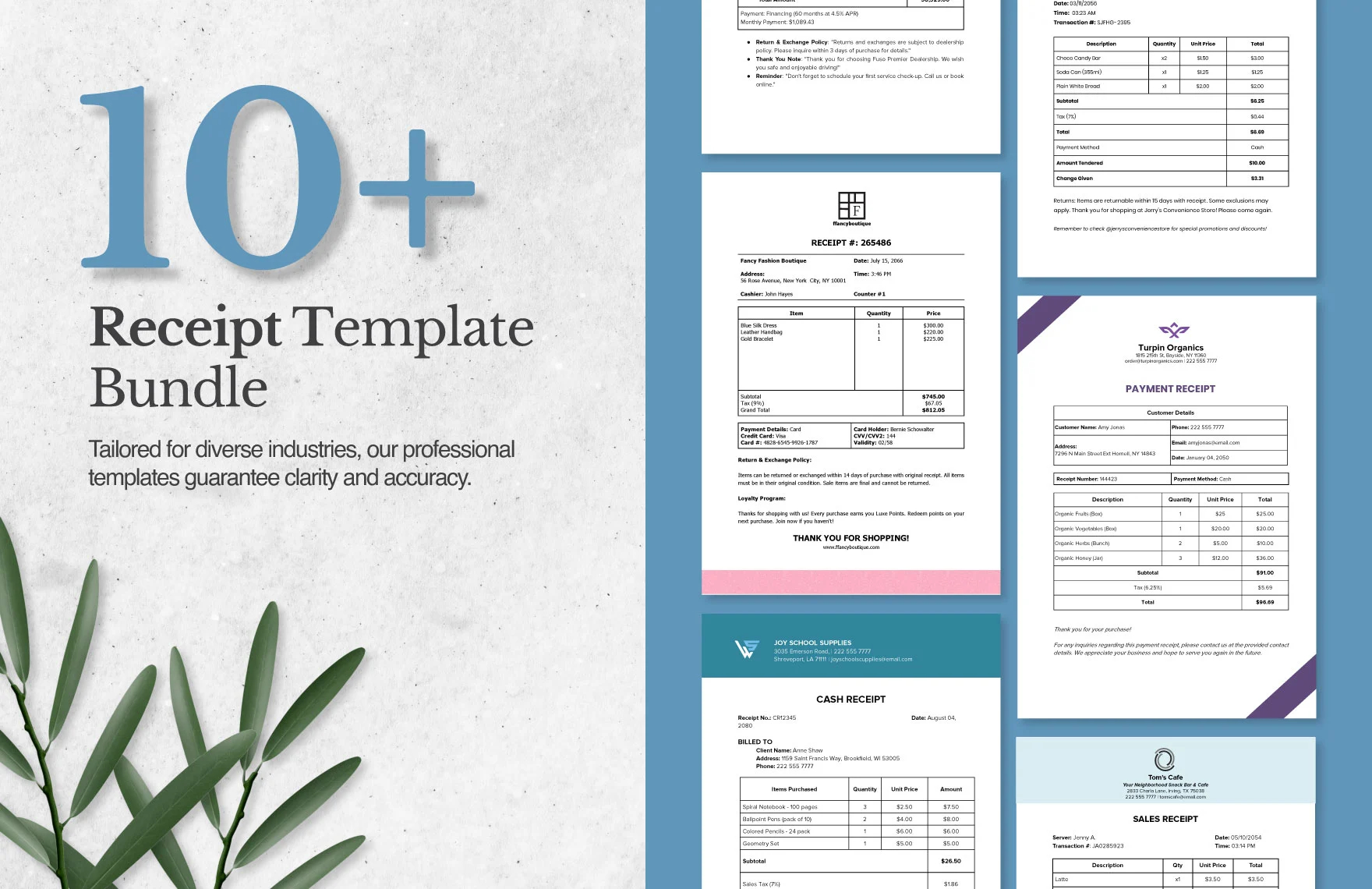

19+ Restaurant Receipt Templates

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

Mar 04, 2024

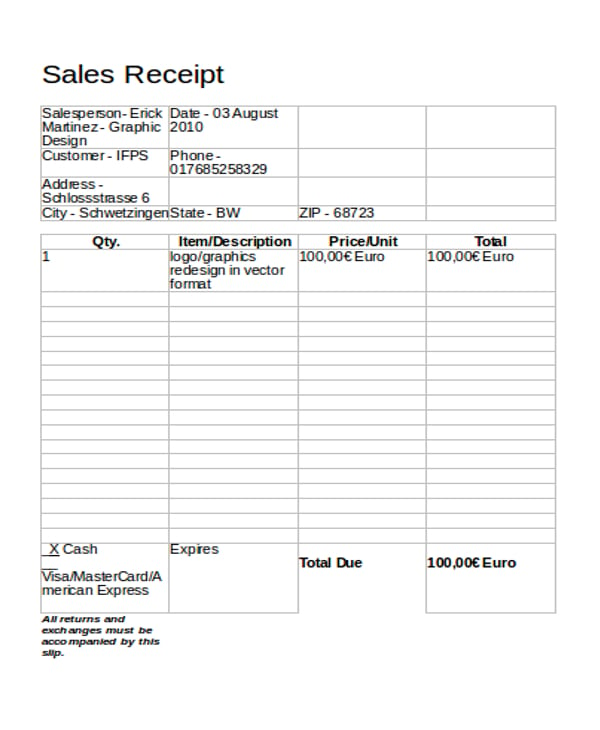

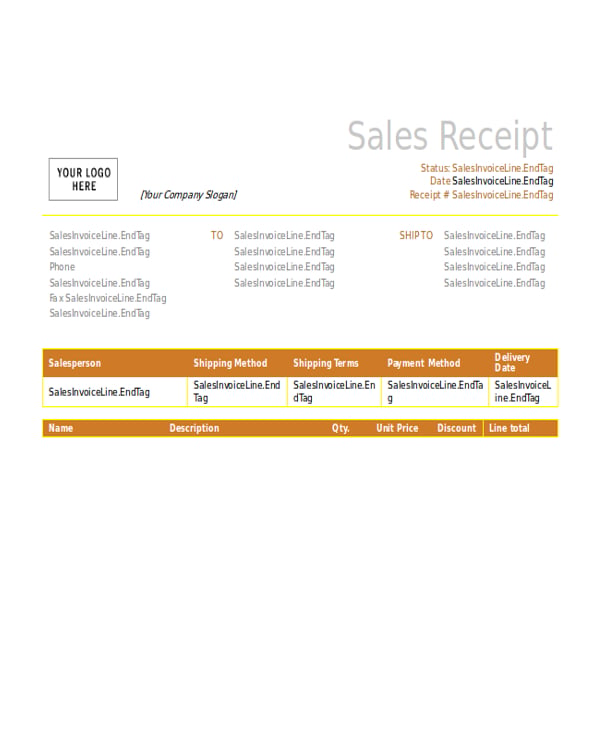

Once a customer buys an item on registered establishments such as departments stores and restaurants, a proof of purchase is given by the entity which confirms that a payment is made with definite mode of payment. Most receipt templates are given in print to customers while some receipts like a Service Receipts need not shown in actual slip possession.

A receipt format as a document confirming what transaction transpired between two parties. Transaction with the receipt requirement usually involves an exchange or a trade. These receipt formats can be used for your business’s use. They are in Word format making them easier to run and to utilize.

If you are running your own business, your customers need a receipt for their purchase from your service. A receipt contains information about your purchase details such as the name of the product you purchase, the date of purchasing the product, the statement of your purchase, payment information, etc. If you are looking for a receipt format template, you can checkout receipt formats templates available online. The purpose of giving receipts to customers is to provide a record of their purchase of the product. There are many receipt makers available online which will give you ready-made receipts for your business whenever you need them.

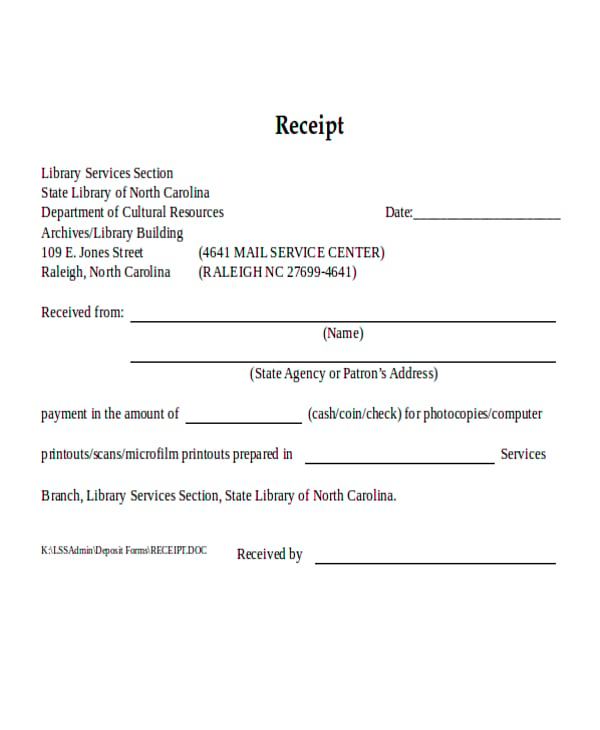

statelibrarync.pbworks.com

statelibrarync.pbworks.com mygroupbargain.com

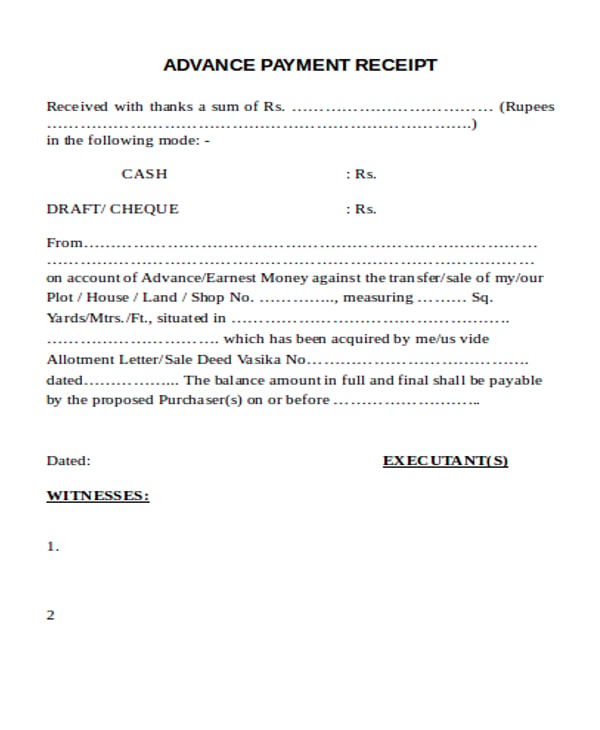

mygroupbargain.com libertygroup.in

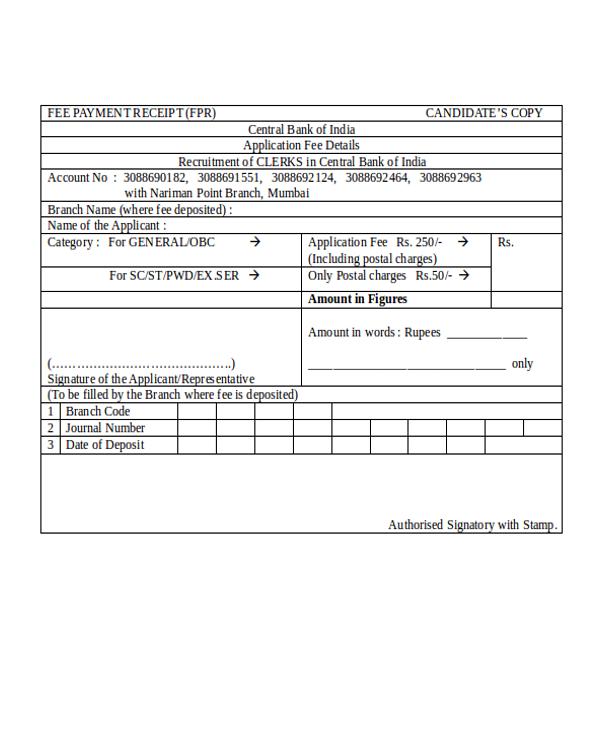

libertygroup.in hartleytaxaccounting.com

hartleytaxaccounting.com redmondtoddler.org

redmondtoddler.orgInvoice Receipts are slips an entity has the obligation to give to its customers and the right to get from its suppliers. In a business entity’s perspective, receipts have the following uses:

unnati.mydrreddys.com

unnati.mydrreddys.com alamuru.weebly.com

alamuru.weebly.com stepsinnepal.files.wordpress.com

stepsinnepal.files.wordpress.com

ua.unm.edu

ua.unm.edu seedinvestafrica.com

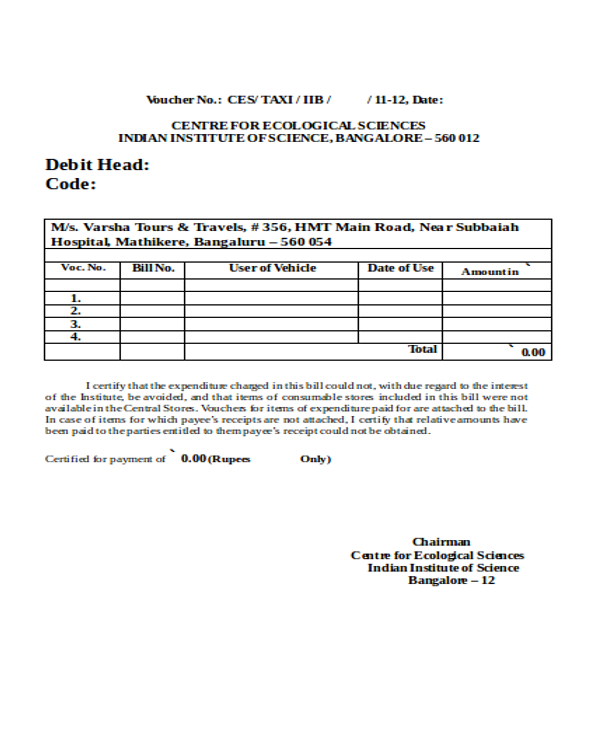

seedinvestafrica.com ces.iisc.ernet.in

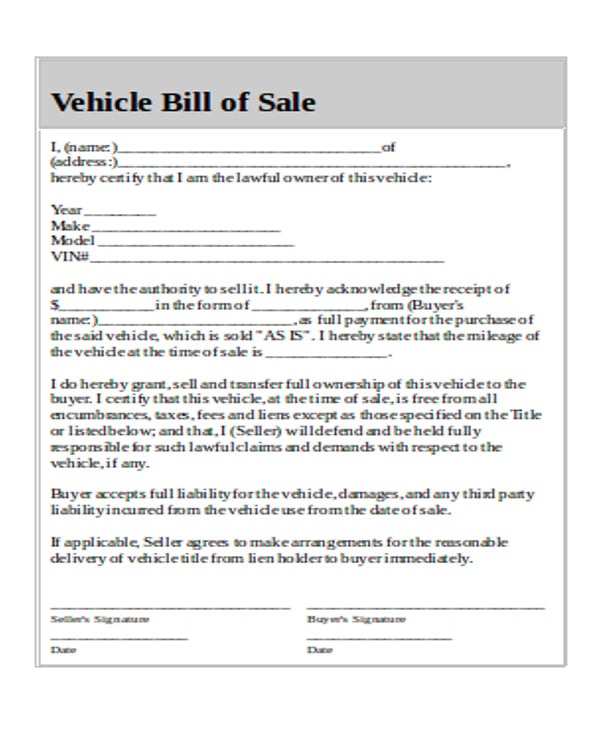

ces.iisc.ernet.inThere are various types of Business Receipts an entity issues when transacting with its customers. The following are the types of receipts issued by businesses:

The Printable Receipt Templates on this website contains the following receipt types:

setupmyhotel.com

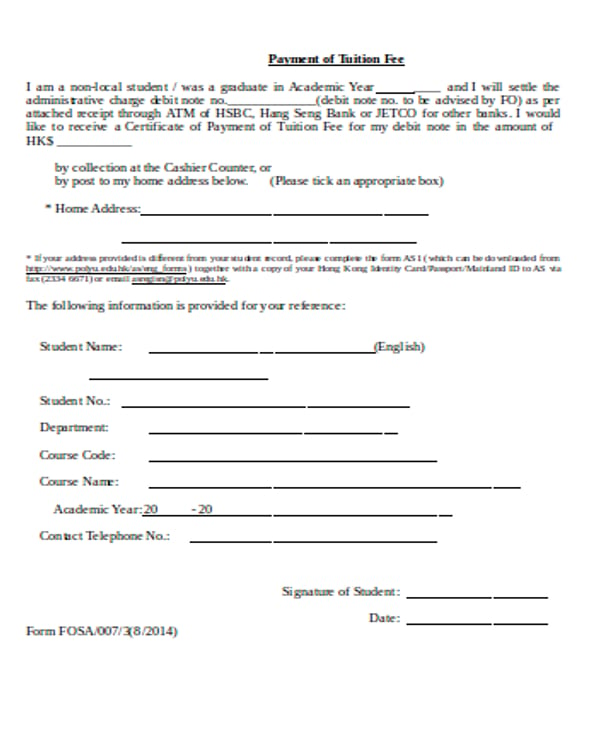

setupmyhotel.com polyu.edu.hk

polyu.edu.hk

cdn.armymwr.com

cdn.armymwr.com emsps.com

emsps.comCompletion is the key to any business document. Because documents such as receipts can have legal implications, it is important to stay on the side of safety and make sure that all details are present and that everything is in order.

After all, you do not want to lose any possible court case just because you were a few details short.

It is essential, then, to learn about the key elements of a receipt, which is listed as follows:

The issuance of a receipt is made, not only for its mandatory purposes, but also for the security features it provides to both the consumer and the business entity. Receipt Templates in google sheets and in Word formats allow you to create your own documents without much hassle. All you have to do is alter them according to your preference, and the transaction is a done deal.

Restaurants are establishments that are typically dedicated to the selling of edible food items to service customers as their main…

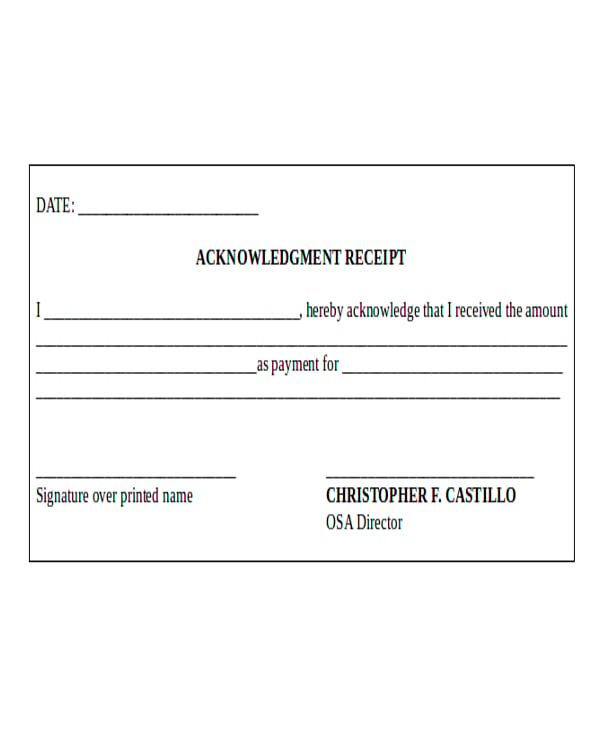

Any type of receipt serves as a receipt acknowledgment and proof that a certain product or type of service has…

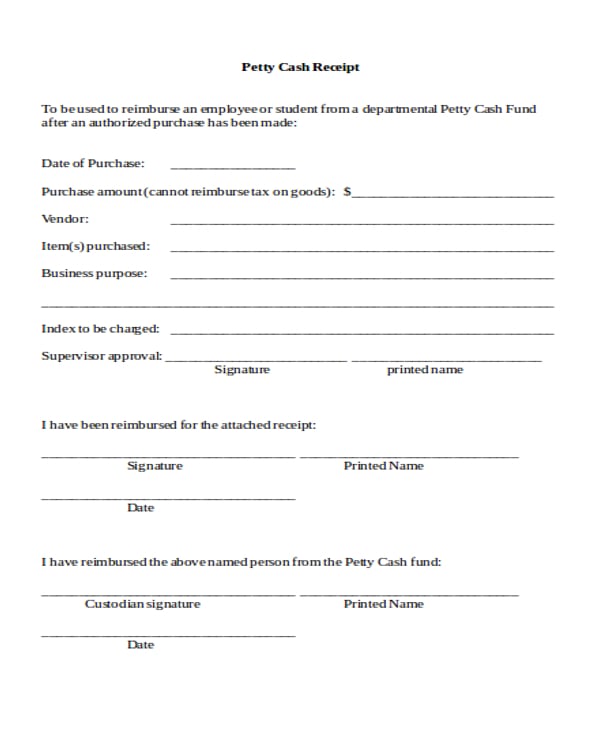

For any business that only accepts money as mode of payment from their customers, a good system for calculating the…

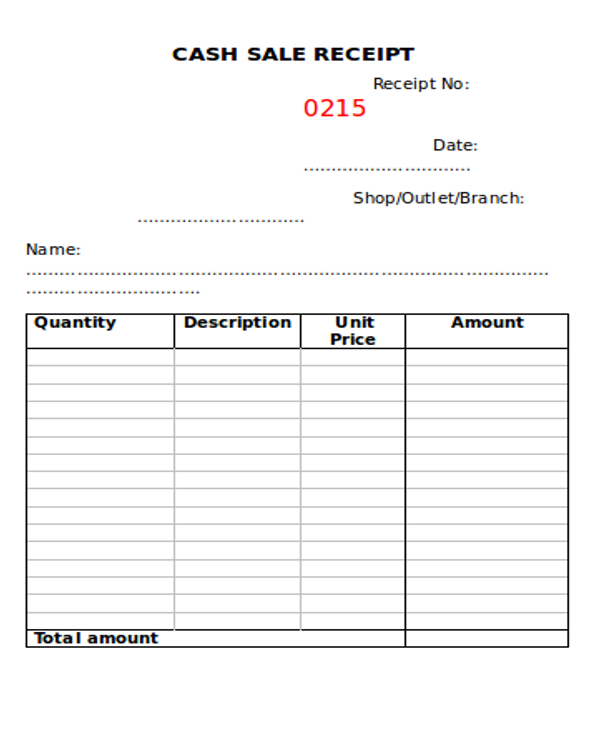

If you’re going to run a business that focuses on selling products to customers, then both you and the people…

Daycare centers take care of small kids while their parents are busy working in the office. A daycare center uses…

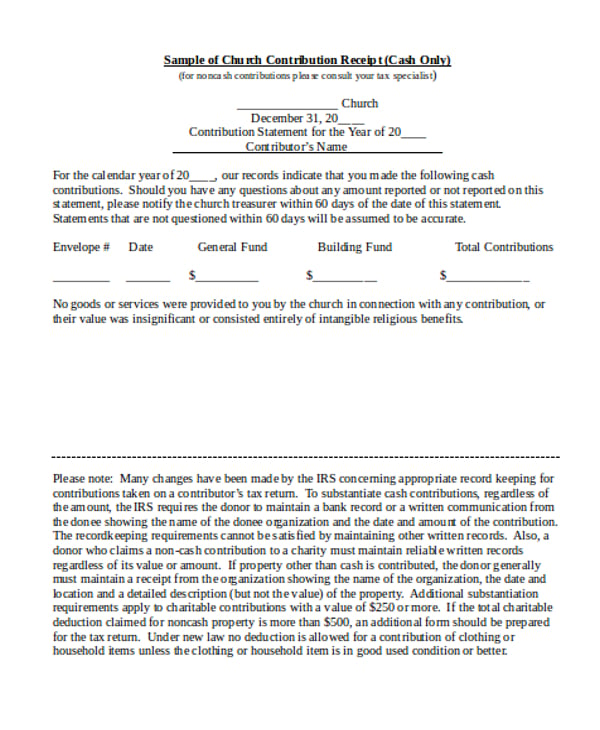

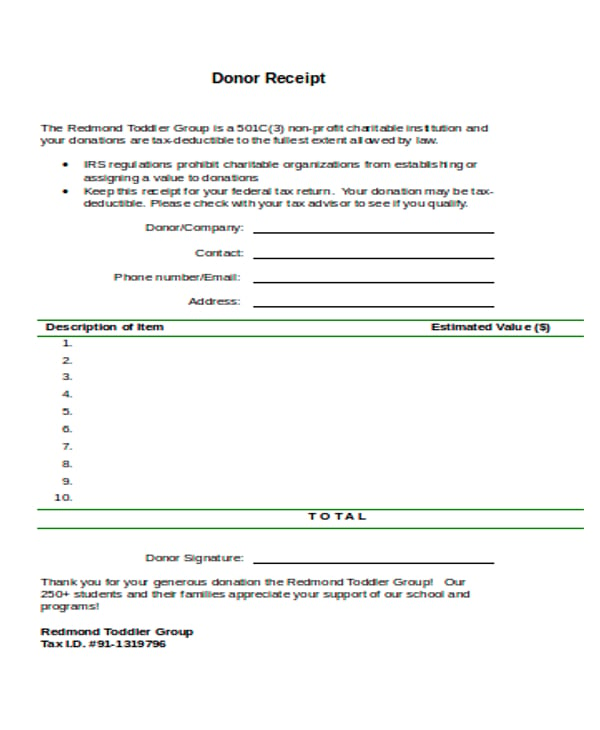

There is a need for the receipt whenever church donation is made or given. This donation receipt works as the…

An investment receipt is a record that recognizes that an individual has obtained capital or assets in compensation as a…

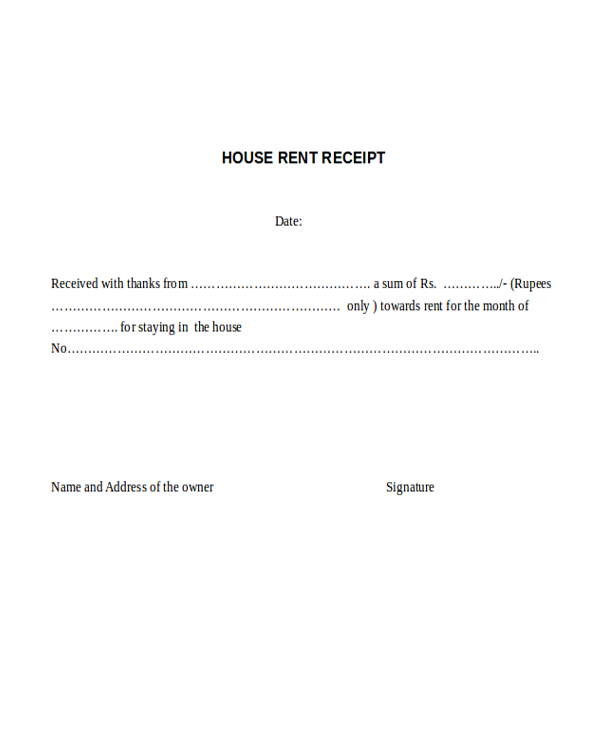

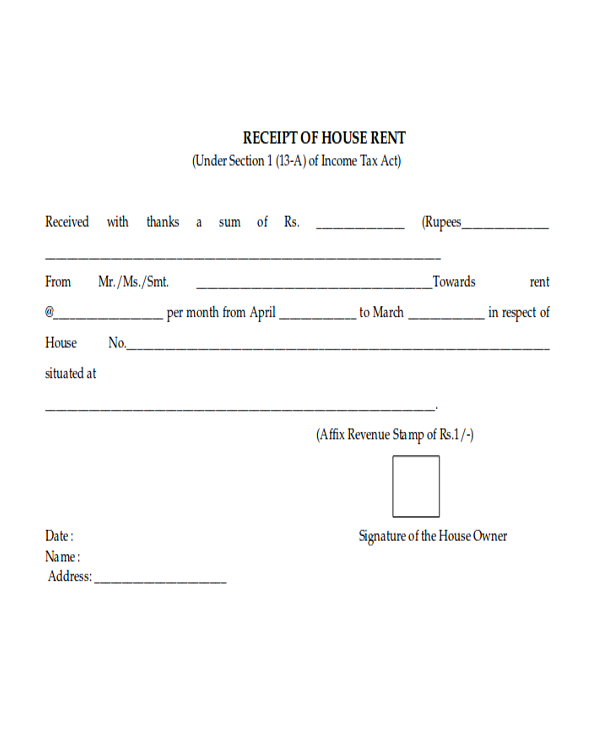

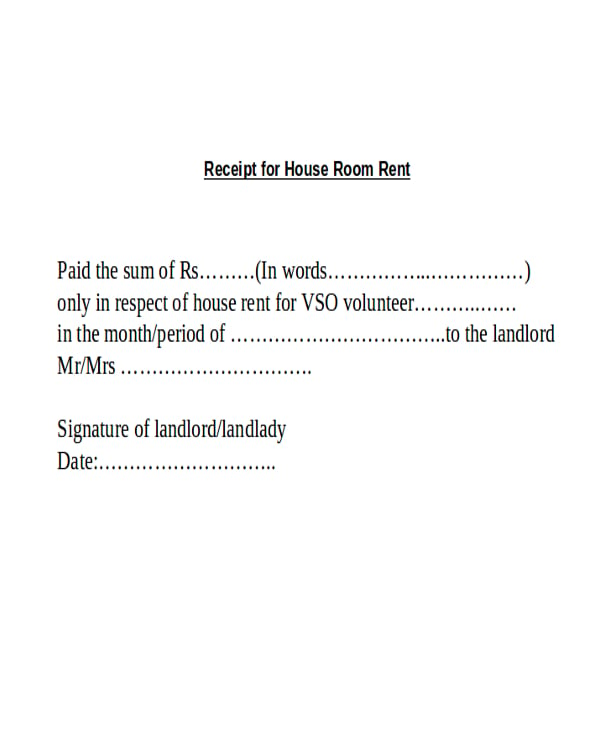

Running a rental business entails writing necessary documents for formality’s sake and legal purposes. If you are an owner of…

Once a customer buys an item on registered establishments such as departments stores and restaurants, a proof of purchase is…