40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 13, 2023

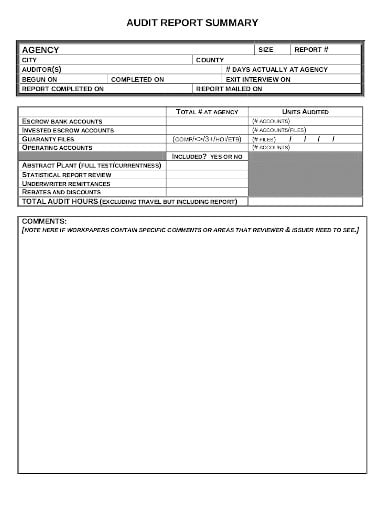

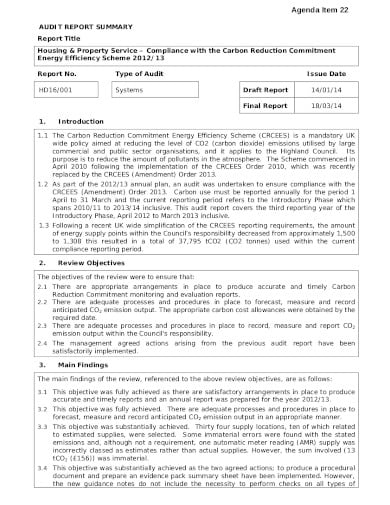

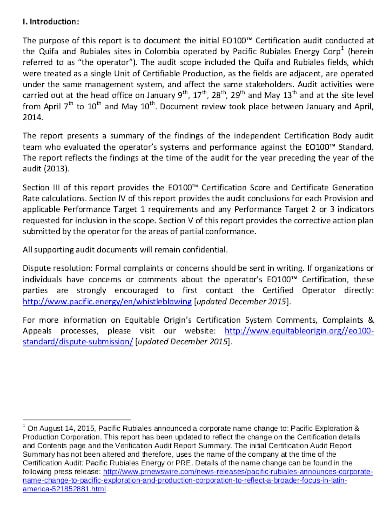

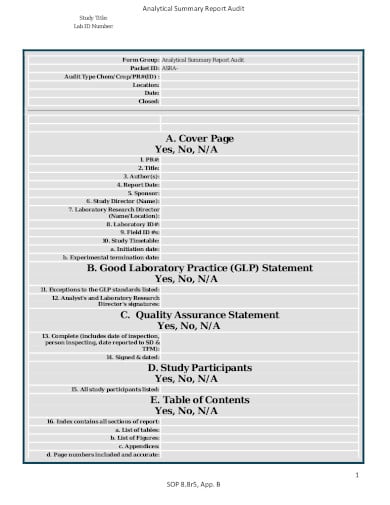

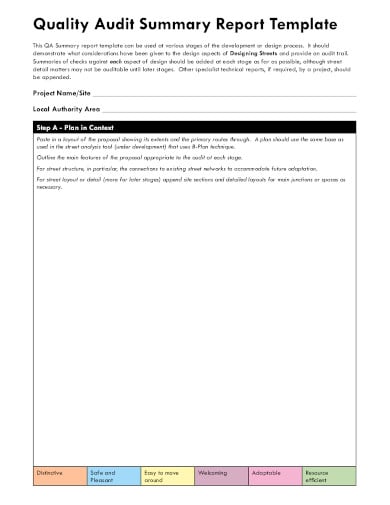

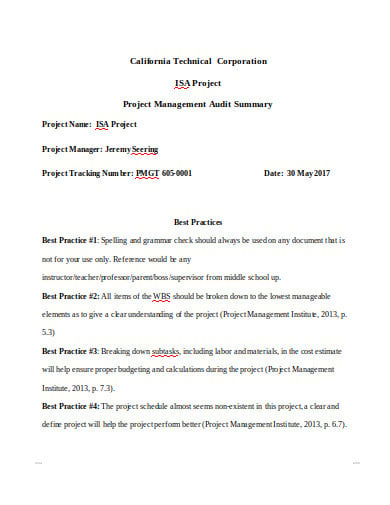

The audit summary report is a very useful and valuable piece of the record. And it is the written letter from the end of the auditor stating whether the financial statement complies with the generally accepted accounting principles. There are both internal and external audit reports. The external audit report is independent in nature and typically published with the company’s annual report. The audit summary report is important to document by the bank to know about the organization’s financial statement.

tdi.texas.gov

tdi.texas.gov highland.gov.uk

highland.gov.uk pronto-core-cdn.prontomarketing.com

pronto-core-cdn.prontomarketing.com iscc-system.org

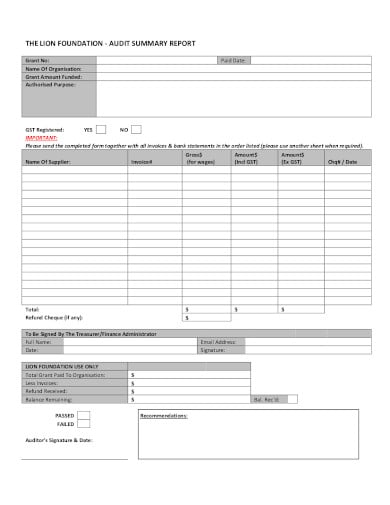

iscc-system.org lionfoundation.org.nz

lionfoundation.org.nz africanriskcapacity.org

africanriskcapacity.org parkinsons.org.uk

parkinsons.org.uk ir4project.org

ir4project.org chichester.moderngov.co.uk

chichester.moderngov.co.uk scotsnet.org.uk

scotsnet.org.uk fusiondm.hosted.nfoservers.com

fusiondm.hosted.nfoservers.comIt is important that the company’s financial records are correct and comply with the guidelines set out by the accounting standards. Most of the audit summary ends up in a clean and unqualified kind of opinion.

The auditor must also give qualified opinions even if the company did not follow the accounting guidelines but it did not break either. They must be clear with the opinions in the report so that the readers might understand it.

When the auditor makes an adverse report, it means that not only the organizations broke the accounting guidelines but also there are errors and discrepancies in the financial matter. The auditor becomes suspicious and considers it to an adverse report.

You must add the disclaimer if you did not complete the audit, or could not create an opinion regarding the report. Then, the portion of the disclaimer will tell the readers the rest of the reasons for not concluding the report.

In the end, you must evaluate the report to avoid grammatical and other errors in the report of the audit. It is good to recheck the document to avoid the unnecessary use of sentences and punctuation.

While you create the audit summary report, it is important to keep in mind that the report is not to evaluate whether the company is good for investment or not. And, it is not even the analysis of the organization’s performance for that period of the time. Rather it is the tool that measures the reliability of the financial statement. It is the opinion put forward by the auditor whether the organization’s accounting standard complies with the general principle.

The audit report is important for any business organization as the bank, regulator, and creditor ask for the financial statements at the end of the year. There are two sets of reports such as the one that is clean and as per the accounting standards and the other that is filled with errors and mistakes. These are the unqualified type of the accounts and inventory of the financial statement.

There are rules and regulations that must be followed by the organization while making the report. An adverse report meant the financial statement is filled with discrepancies, inappropriate or not as per the accounting standards. When the auditor writes the letter, it follows certain standards. The letter must be divided into different paragraphs to make the work easier. Eventually, it is divided into three paragraphs and parts. It must not look like an unqualified audit, which is thoroughly researched and improvised with time.

Therefore, with the creation of the audit report, it is important that you keep regular track of the financial status of your organization. You must keep a check on the minor and major expenditure made on it.

The audit summary report is the written record that is forwarded by the auditor of the organization or the company. And the report is in a brief manner and it contains the elements related to the finance or the account status of the company. The audit must be conducted within a period of one year as it is through these statements that the bank can calculate your taxes. With the wrong information in the statement, you cannot get definite results. So, you must be careful when you are putting the facts and figures in reports.

The banks and the creditors need the audit report as a briefing to know about the financial status of your organization in summary. And, when you keep the records of the transactions of your organization, it should always include the different deductions you made. With the complete information about the finances, you shall be able to calculate the taxes. It is the work of the auditors to study the financial state of the company or organization. The banks ask for the report to evaluate the financial and accounting statement of the organization.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…