40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 12, 2023

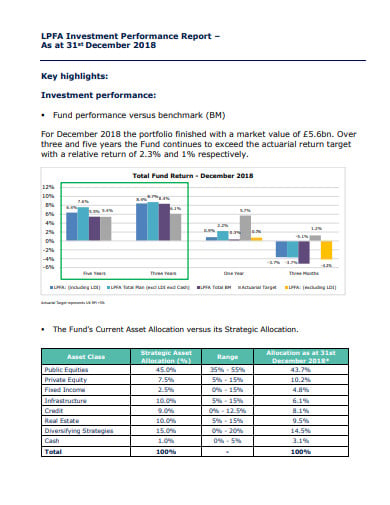

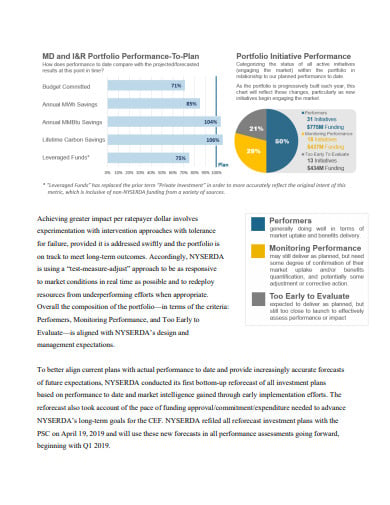

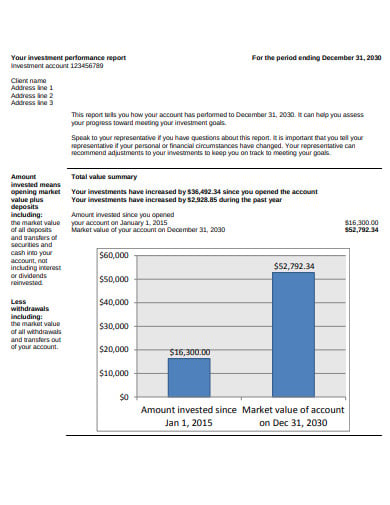

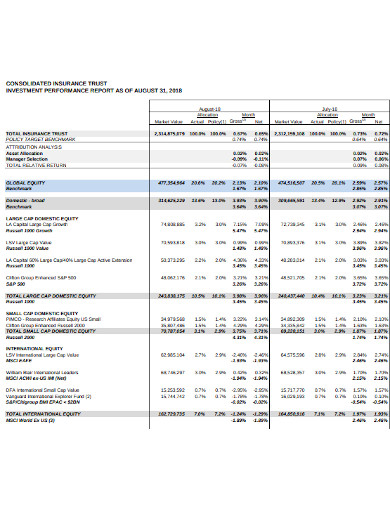

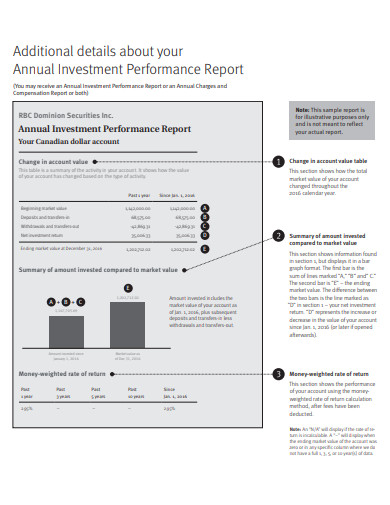

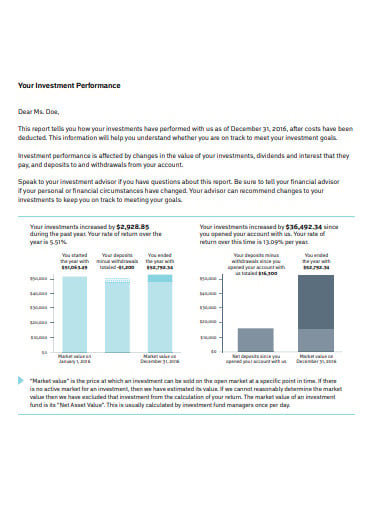

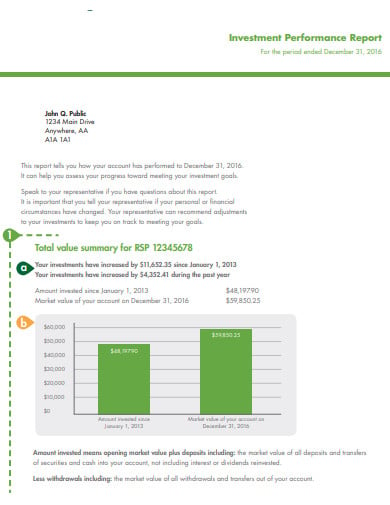

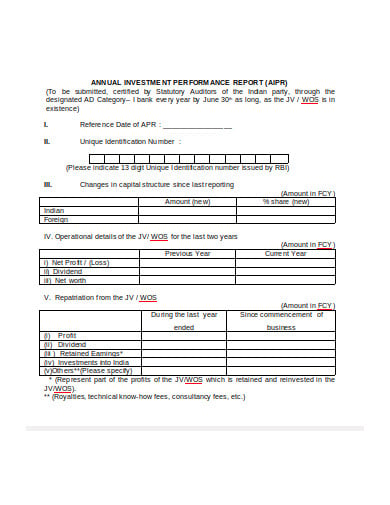

An investment performance report is a major requirement as investments need regular care and attention and creating a report about the performance of the investment helps in achieving the goals and objectives. Creating an investment performance report also assists in keeping a watchful eye on your funds and doing what you can to keep them on track. The performance of the investment must be checked at least once a year or it can be frequently checked as the stock market constantly changes. It is always preferable to make sure your investments are still in line with your objectives.

org.uk

org.uk ny.gov

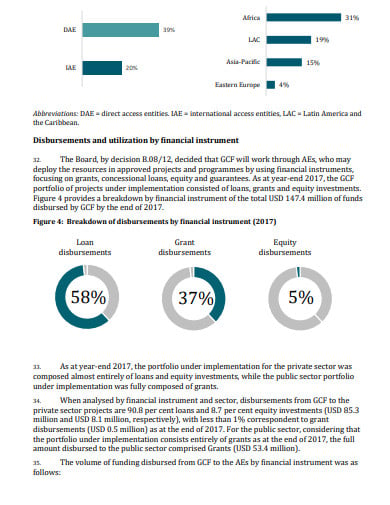

ny.gov greenclimate.fund

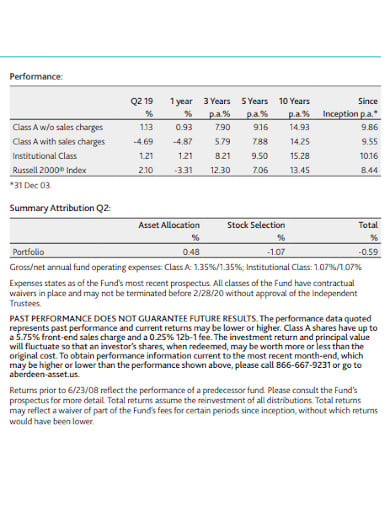

greenclimate.fund standard.com

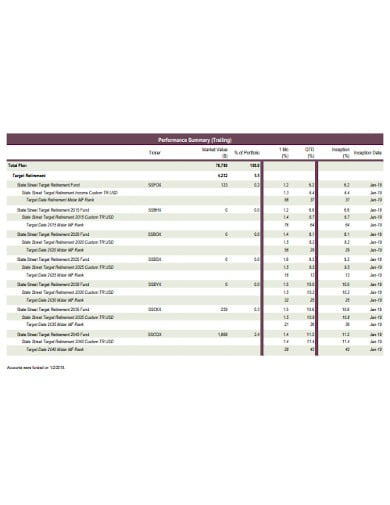

standard.com ca.gov

ca.gov on.ca

on.ca nd.gov

nd.gov management.com

management.com ific.ca

ific.ca mfda.ca

mfda.ca org.in

org.in stpi.in

stpi.inAnalyzing your investment may be a critical task for investors and that is particularly true in case you have an investment advisor manage your money and are now thinking about taking over.

The first move is to enter your portfolio into a platform for the investment review. Personal capital is one popular option. We offer a free financial dashboard capable of importing all of your investment accounts (retirement and non-retirement) and then provide a comprehensive portfolio analysis. The research is part of an investment checkup for personal assets. There are many facets to the checkup, including an overview of the asset allocation for your portfolio.

The most important investment decision that you are going to make is how much money you are going to commit to stocks and how much to bonds. A portfolio heavily weighted to stocks is suitable for those with a decade or more before retirement, say 70 to 90 percent. Yes, these investments can go down significantly in a bear market, but an investor has time to ride out the poor market with a decade or more before retirement. It is important to recognize the relationship between that allocation and your withdrawal rate when determining the stock/bond allocation for those in or near retirement the percentage of your nest egg you invest each year. While a withdrawal rate of 4 percent is a general rule of thumb, it does not guarantee that you will never run out of money.

You would want a good mix of stocks and there can be several ways to attain this outcome. It is very important to evaluate the stock allocation as it will determine many important things. You will get to know whether your international exposure is limited to almost exclusively some countries or this may not be obvious at first. Or you will also get to determine why such a heavy emphasis is given on small and mid-cap companies?

The bonds are structured to provide a portfolio with stability. The trick will be a quick allocation to a Vanguard total bond fund, or even a fund limited to U.S. government bonds. High yield funds also are known as junk bonds invest in corporate bonds provided by companies whose credit rating has slipped below investment grade. In some cases, those funds can be a perfectly fine investment.

Now we are turning to the special funds. We’re checking at two things here. First, are the funds properly managed or are the funds indexed? We want to understand the purpose of selecting such a fund over an index fund for the actively managed funding. Secondly, we are checking into the prices. Certain questions may arise like why do you have 14 funds along with 3 individual stocks? Or three to six funds could be more than enough. You must keep in mind that the objectives or goals are an assortment necessarily.

The investment performance is the return on a portfolio of investments. The portfolio of investments can contain one asset or multiple assets. The output of the investment is calculated over a given period and in a particular currency. Investors must make a distinction between different types of returns. One is the difference between total return and price return, where the former takes income including interest and dividends into account, whereas the latter only takes capital appreciation into account.

Another difference lies between gross and net returns. The investor’s pure net return is the return encompassing of all fees, expenses, and taxes, while the pure gross return is the return before all fees, expenses, and taxes. Consequently, gross returns are higher than net returns. For instance, if one wants to calculate an investment manager’s ability to add value, then the net return of transaction expenses, but the total of all other fees, expenditures, and taxes is a better metric to look at as fees, expenses, and taxes other than transaction expenditures are often outside the investment manager’s control.

Another major difference is between the cash-weighted return and the time-weighted return. The former is suitable if the manager determines the timing of portfolio intakes or outflows. The last one is appropriate where the manager is not accountable for the timing of cash inflows from the portfolio and cash outflows

Trustworthy investment reporting remains the most valuable tool for transmitting the details on investment. Whether you are using this information as an investor or as a financial professional, that can be the most damaging thing you do not know. In today’s dynamic investment environment, a set of guidelines is required to accelerate the next phase of investment reporting.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

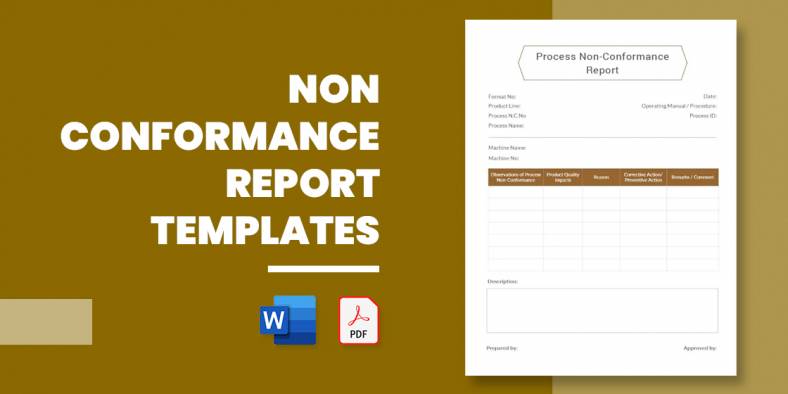

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

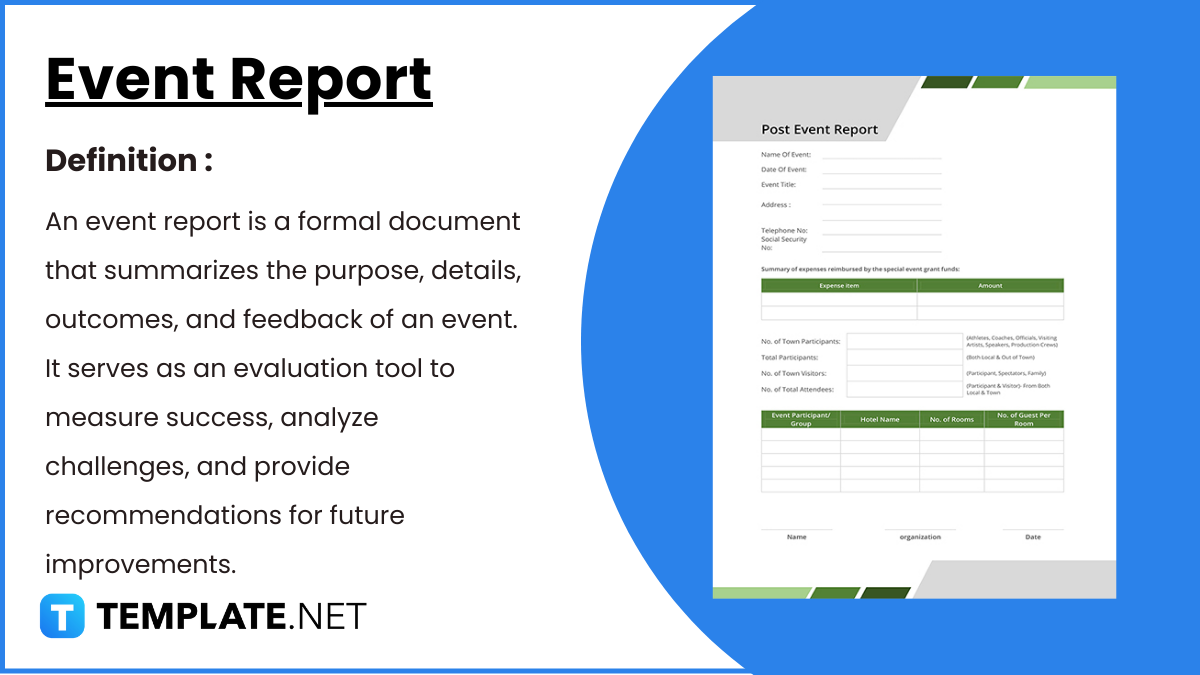

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

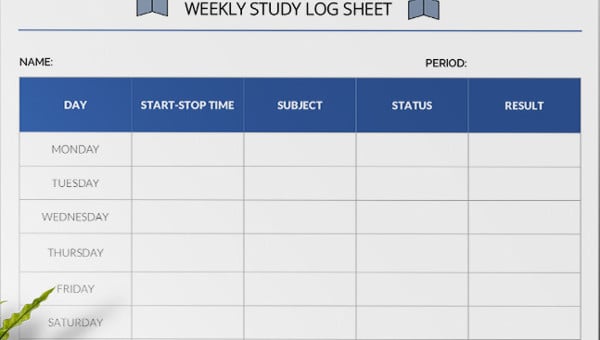

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…