40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 19, 2023

An investment report refers to a report setting forth some of the applicable eligible investments of each additional borrower. This report sets forth the fair market value of each eligible investment for the avoidance of doubt. It is usually provided to the investment committee or board of the fund on a quarterly basis. The investment report will also mention the investment performance fo the fund’s primary and secondary investment performance objectives. These objectives are detained by the investment manager prior to and after the investment manager’s compensation.

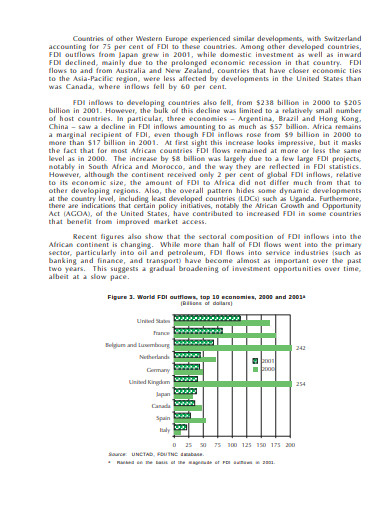

unctad.org

unctad.org asean.org

asean.org wto.org

wto.org eib.org

eib.org afdb.org

afdb.org aal-europe.eu

aal-europe.eu iberglobal.com

iberglobal.com ey.com

ey.com semanticscholar.org

semanticscholar.org schroders.com

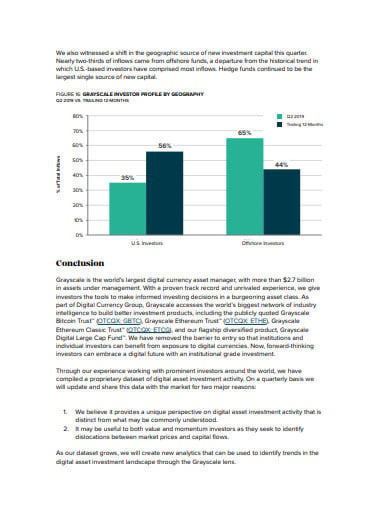

schroders.com grayscale.co

grayscale.co fund.org

fund.orgWhen some firms report investment information to their existing clients, currently, there no general or globally accepted industry practices that address the lack of transparency and clarity. A well-established Global Investment Performance Standards tackle a variety of transparency issues but primarily performance assessment and presentation for prospective customers. Current customers across the finance sector — not only those coping with investment management firms are in a similar situation to prospective customers before developing the performance analysis standards that culminate in GIPS standards.

Unvalued holdings or other holdings are valued based on hard prices that have not disclosed. There are some inappropriate pricing and the use of some prices that are based on some in-house assumptions that are not properly disclosed or visible. Other examples may include a lack of adequate disclosure of risks and no presentation of the true exposure of purchased instruments. Some unclear assumptions, calculations, and some underlying data that are used in the construction of the information users are also some examples.

Client perspective examples include presenting time-weighted returns that reflect on the asset manager’s performance but not granting the money-weighted return that may show some impact of client-driven capital flow decisions. Other examples may include providing only gross-of-fees return which may include the manager’s performance but also ignores the management fees that might be paid or have been paid by the asset owner. This will lower the return of the asset obtained by the owner.

Wherever a fee applies or could be imposed which is under the jurisdiction of the reporting financial body, the report must be clear. There is various information that needs to be clear like which fees are being applied and for what purposes along with the calculation that is used to set the fee. It also includes the amount that has been charged and the impact of the fee on the investment portfolio.

There are generally five principles that must be followed for reporting on investment and also reporting aspects that are recommended to be followed.

Communication exists between both the adviser and the user as to the intent and the need for investment reporting. Communication between the adviser and the intended user is a key component that leads to the development of a report that fulfills the objectives of the principle. Periodic communication is required so that changes in the recipient’s needs and the capabilities of the provider can be incorporated into the production of a report. This communication is expected to introduce the practices to the user as well as the principles of investment reporting. The components that are indicated by the principles must be discussed with the intended use so that the user can decide the information that he/she wishes to have in the report.

The principles mostly require that the procedures, policies, and control processes that generally support the report preparation and error correction, are documented, and are also available in case it requested by a report user. By doing this, the investment report will turn out to be timely and accurate and it complies with all the applicable laws and regulations. Data quality is defined properly and is also managed according to transparent criteria, and control processes are also defined, documented and are made available on request.

Client preferences are reflected in the documentation of the investment report The conclusion of the communication between the adviser and the user on the preferences of the user must be documented and made available for regular maintenance to the report. Monitoring the report must be checked and revised regularly to ensure that it represents improvements in the needs of the customer or the skills of the consultant including the need to include feedback on the principles.

Reporting on investment is much more than producing results on the investment. The risk inherent in the investments must be made known to the investor and any changes to the risks and risk level should be disclosed; risk exists in most investments and is associated with generating a return. The document will reveal major risks associated with specific assets, significant risks resulting from strategic factors and the overall level of risk in the assets listed.

The report must include all fees charged by the adviser to the customer or under the jurisdiction of the adviser or financial entity on whose behalf the preparer is operating. Fees are considered to be a crucial component of the outcome of the investment and the consumer has to be able to see and understand the impact of fees. Comprehensive disclosure of fees includes fees to be paid, an indication of fees to be incurred upon achievement of targets, and the current position of the applicable assets concerning those goals.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

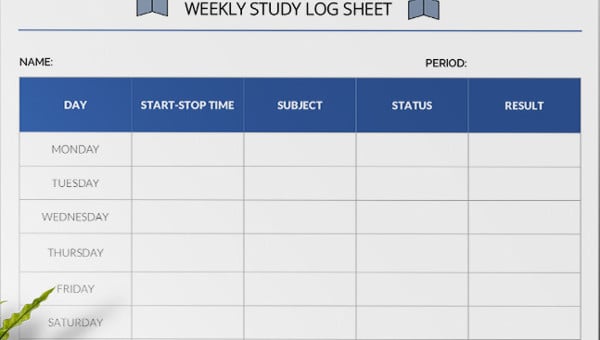

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…