40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 15, 2023

For the past decade, the government had tried to help resolve countless cases of fraud and funds misappropriation in the business sector and in the early 2000s, investor confidence in financial statements and corporations in general, was mired with the threat of public auditing and accounting scandals. It demanded stricter regulatory standards and as a response, the United States Congress passed the Sarbanes-Oxley Act of 2002 on July 30 2002 in order to protect investors from any form of fraud in accounting activities by corporations. You may also see audit report samples.

The SOX Act of 2002 which is often known as the Corporate Responsibility Act of 2002, required an overhaul for the improvement of financial disclosures from corporations, enforce auditing responsibility and prevent accounting fraud. You can also read free report templates.

ed.gov

ed.gov oc.ca.gov

oc.ca.gov opm.gov

opm.govIt’s hard to argue that if money can be gained without having to put in much of the effort and hard work that most of us put to earn our pay, we would gladly choose it and some of us would take the money without thinking twice or looking back. Especially in the most desperate times. You may also check internal audit reports.

Companies themselves are no different, and sometimes to a greater extent, producing records and manipulating sample financial statements and inflating actual figures to also inflate stock prices. Meanwhile, employees resort to funds misappropriation when the pressure to meet targets based on earnings takes it toll and you have excessive financial responsibilities such as vices on top of debts and bills. Fraud is everywhere.

And if a company doesn’t perform proper auditing procedures regularly, fraud would be a normal part of the workplace if it already isn’t in organizations with lax policies, because even with federal laws and state regulations in place for auditing, there are still companies and employees who are able to get away with “murder” in terms of company property be it financial or otherwise. You may also see sample internal audit reports.

Auditing is an important function in simple business involving the evaluation of records and evidence regarding the economic and financial activities or transaction of an organization. The greater good gained from regular auditing is the reasonable assurance of avoiding misstatement and false projections that comes with financial statements and disclosures, which is important for a business’ stakeholders since figures and documentation of company activities would be properly accounted for and backed by auditors according to compliance with auditing standards.

Auditing offers credibility to the information communicated by corporations and reduces confusion and inconsistencies that might otherwise exist between users and companies upon the issuance of financial statements. You may also see safety audit report templates.

barnet.moderngov.co.uk

barnet.moderngov.co.uk portseattle.org

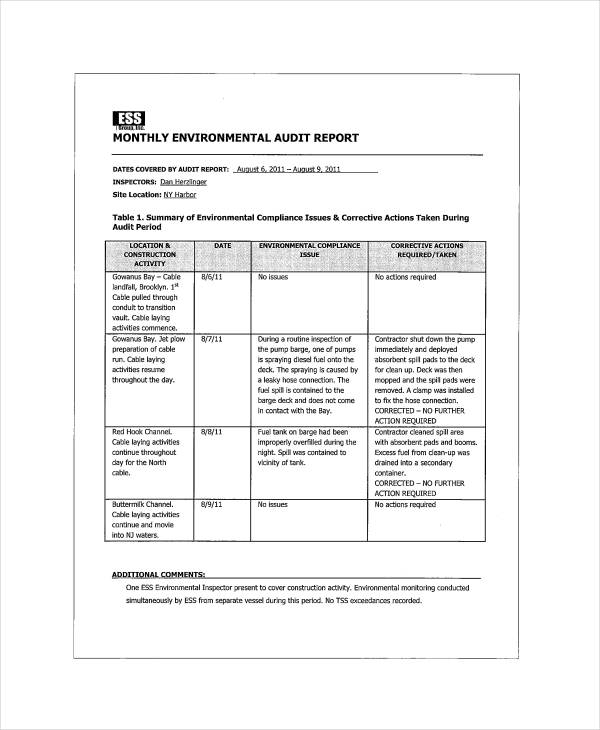

portseattle.org documents.dps.ny.gov

documents.dps.ny.gov miamitownship.com

miamitownship.com wsscwater.com

wsscwater.comAn audit report is a document created by a qualified auditor at the close of the auditing process. Through the audit report, the management would have a copy of the auditor’s professional, detailed findings after evaluation of financial records and other reasons, because there are different reasons why audits are conducted, including getting monetary capital and compliance with business or corporate standards. There are four types of audit reports that could be created: qualified, unqualified, adverse and disclaimer of opinion.

Whichever of the four you are asked to write, it should be in a business letter format. The audit report serves as a formal or professional expert opinion of audit findings in organizations with the results being used by the organization where it was conducted, to improve financial record-keeping, investing, changing operations, establishing accountability or decision-making.

Effective audit reports are important in ensuring the audit results to be credible and useful to those who are supposed to benefit from it. You may also see environmental audit reports.

An audit is seen as an official evaluation to confirm that policies and procedures are being followed and therefore can come in different forms, as previously stated:

1. Financial Audit. This is probably the most common form of audit known. Financial audit deals with the systematic review of the company’s financial reports,making sure that all figures are valid and data shown conforms to GAAP standards.

2. Operational Audit. This type of auditing refers to the review of how a company make use of resources available to them, in order to make sure that those resources are being used properly to reach the organization’s goals and mission. You may also see stock audit reports.

3. Compliance Audit. A compliance audit is conducted to check if a company or program is operating in accordance with laws, government regulations, industry standards and procedures.

4. Investigative Audit. Most of the time, this type of audit is performed when the company finds out about a possible violation of rules, policies, laws or procedures and may take a combination of all types of auditing previously mentioned. You may also like forensic audit reports.

torontohousing.ca

torontohousing.ca ca-nvmoose.org

ca-nvmoose.orgBefore going right down to the specifics of writing an organized audit report, it is very important to have a broad perspective of the main purpose and goals of all audit reports. Knowing these goals as you go through the technicalities of coming up with a report will ensure that your report serves it purpose. You may also see clinical audit reports.

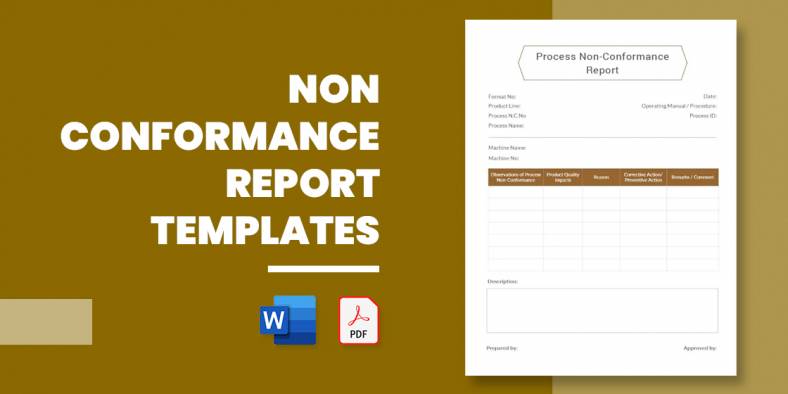

Exposing which area a company fails to conform with any standard, rule, policy or procedure or regulation that it is supposed to be conforming o complying with, is the goal of every audit report. It s therefore vital to clearly identify the non-compliance or the standard it didn’t conform to and describe which evidence was used to verify the non-conformity. The goal should be this-that each non-conformity will have enough details to offer for the receivers of the audit report to alter or change it.

An audit report should not completely be about negatives, especially when it comes to doing a compliance audit report and operational audits. Outlining positives allows a company to set its focus on areas that are working and apply the results to other areas that needs it more. For example, if you are performing a compliance audit to make sure that a business complies with certification or training requirements, you may state in your report “The audit shows the training program in place exceeds the requirements and that it is both within the time frame and simple budget set.

You don’t just state the parts where the company sin’t conforming to or complying with requirements, it is also crucial to include high-risk areas or areas that may be conforming for now but shows risks of not being able to comply in the future, or whether or not, it can still be improved. You may also learn more about how to create an effective action plan.

Audit reports are generally formal since they are an official document. However, there are also certain style guidelines you have to follow for writing any audit report. This means you have to make sure you’r’e familiar with the principles of audit reporting before beginning to write even an outline of one. You may also see brand audit reports.

Here are some of the things you can do:

1. Offer professional point of view to the reader with the intention of fair balance between the positive and negative results of the audit. You may also see laboratory audit reports.

2. Be precise, concise, simple and formal. Avoid using redundant phrases and misuse of technical terms. For clarity, choose shorter sentences over longer ones. You can have a limit of 5 to 18 words as recommended in business documents. You also need to avoid terms such as “clearly,” “special,” “key” and “reasonable” as these terms are short on precision. You may also see management audit report templates.

3. Use the active voice. Passive voice have a way of confusing a reader and tend to be difficult to read. For example, instead of stating “No evidence of irregularity over operation was exposed” you can say “The auditing staff found no evidence of irregularity”. You may also see quality audit reports.

4. Avoid verbal deadwood. Why will you say “for the reason that” when you can just say “because”?

erawa.com.au

erawa.com.au usda.gov

usda.govOne of the main functions of the auditing process is to anticipate and reduce the risk of information, risk in the sense that the management would use information inaccurately in order to mislead stakeholders, especially if it’s data that directly affects investment, lending and other big decisions relevant users of financial statements have to make. You may also see internal audit reports.

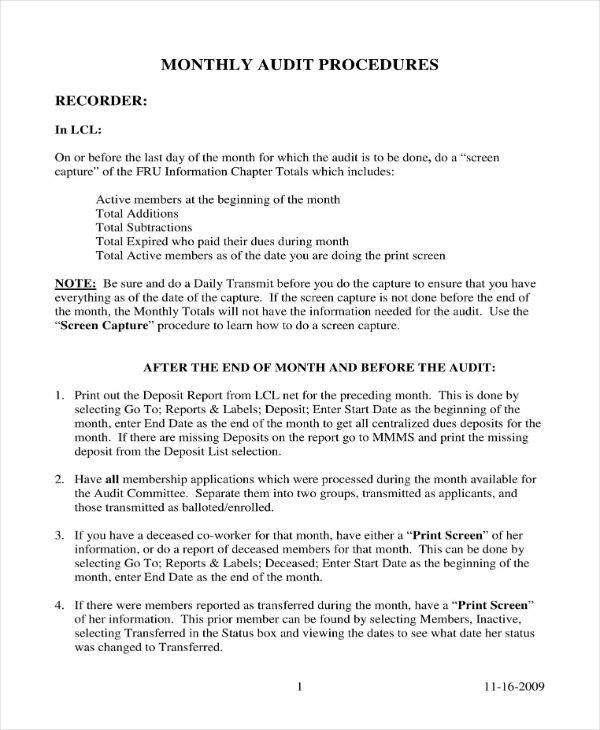

For accountants and auditors, the end of the month is a dreaded period because of the work and time it takes to close statements and finalize records. Government organizations are no different. The board as well as the public depends on reliable financial records on monthly basis. Accountants need to stay organized and follow a strong process to make sure that important entries are completed to also make way for robust monthly audit reports. You may also see engineering audit reports.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

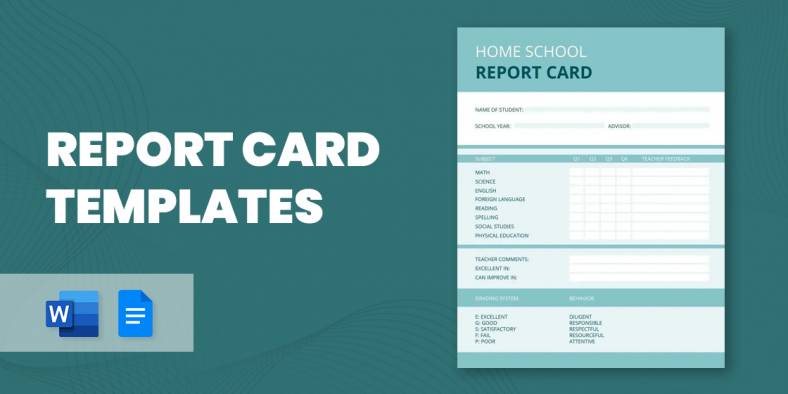

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

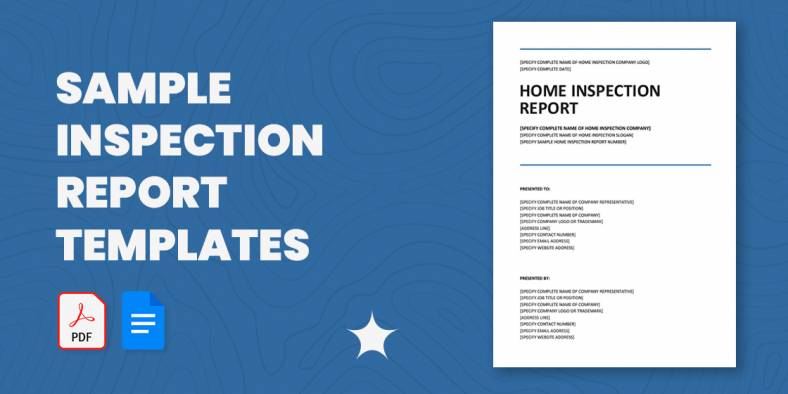

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

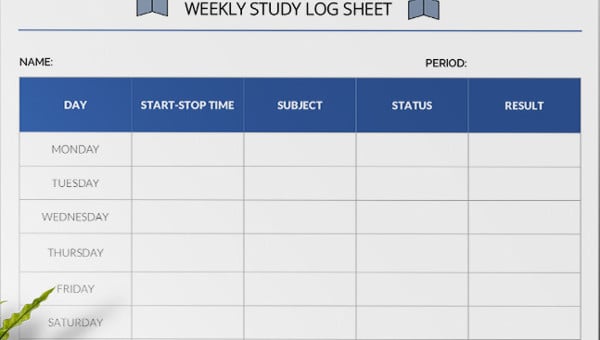

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

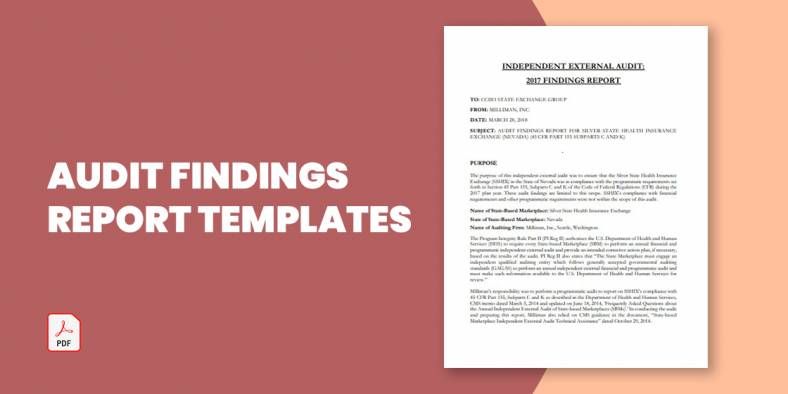

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…