40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 12, 2023

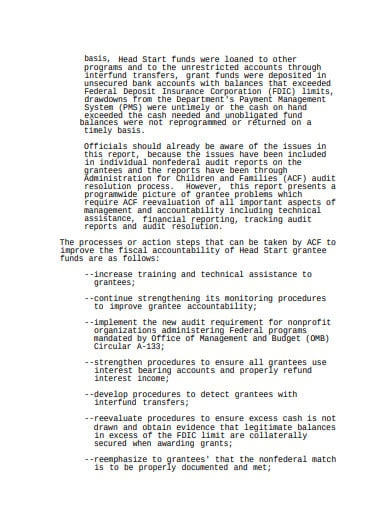

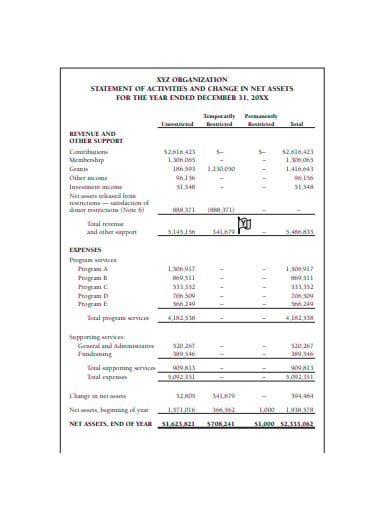

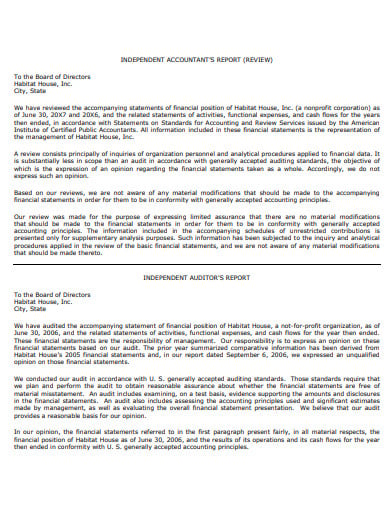

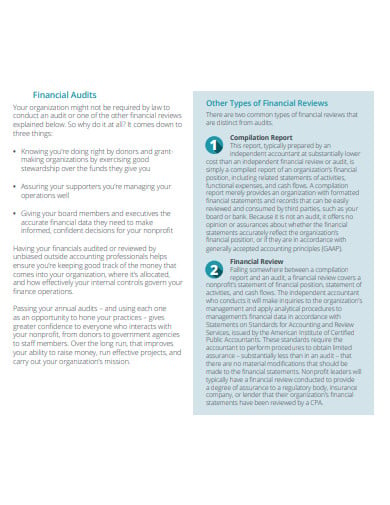

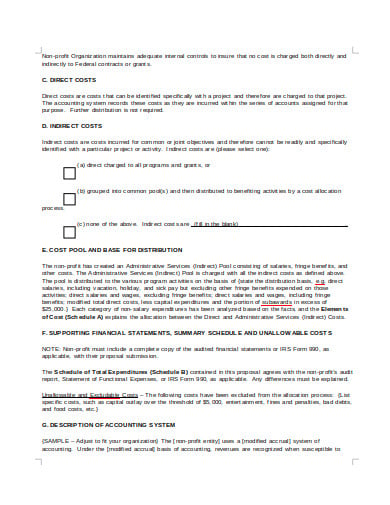

The non-profit audit report is the assessment or evaluation of the statements regarding the financial positioning of the nonprofit organization. The audit report comprises of the statement of the activities, the functional expenses, and cash flow for the years that ended. It contains the related notes to the financial statements. Before preparing the audit report, the management takes care of the financial statement. It is the management that is responsible for the fair presentation of the financial statements. The auditor assessing the finances directly reports to the governing body.

nj.gov

nj.gov josephshouse.org

josephshouse.org capkids.org

capkids.org hhs.gov

hhs.gov profittoolbox.com

profittoolbox.com aicpa.org

aicpa.org ercpa.com

ercpa.com ftmllc.com

ftmllc.com doi.gov

doi.govThe non-profit audit report gives on the information about the different factors affecting the financial position of the organization. And, the financial position gives the organization the strength to make a decision. The reports give descriptive detailed information on the revenues and expenses of the organization.

The report or the summary has in it the activities that mostly affects the financial status of the organization. And with this information, it is helpful to the institution to be prepared for future prospects. So, the report tells about the activities affecting this.

Functional expenses play an important role in the annual audit report. So, the auditor put the functional expenses into the report sheet of the non-profit organization. The auditor keeps a keen eye on the functioning expenditure of that organization.

When you talk about the cash flow within the organization mean that the sources of the income and the revenue through which you earn the profit and growth. The statement or the document that mentions the cash inflow from different sources.

The auditor writes down a brief explanation about the areas where you spent and from where you expect revenue or income. The financial statement is the reflection of the areas where the organization earns the revenue and made expenses.

The non-profit organization needs to send their financial statements including the salaries and information on the deduction to the auditing team. The annual audit report is the financial overview of that non-organization or charitable trust. It is the breakdown of the various revenue collected and the expenditure made. It also shows the transformation or changes from the past year. It tells about the investments in infrastructure or the sale of the assets.

Every organization that earns an annual income of maximum limit must file for the audit or inspections. It abides by the rule and guidelines set by the state or federal government. The financial audit of the non-profit organization is the tool or medium through which you get to know about the present cash situation. The audit and inspection is an important phase for the organization and its development.

The auditor studies the income and other financial statements and creates the report including the footnote to assist the reader in interpreting the balance sheet and other cash flow statements. The organization’s account goes through a different transition because of the factors such as the in-kind donations, the relative liquidity of assets, etc. This situation means that if an organization has a sum of a certain amount and it uses the maximum percent of that fund, then that money cannot support the organization’s infrastructure.

And, with the use of the audit report the organization gets an overview of the current financial condition. The further plans also depend on the available funds and amount left with the charity or the organization. Everything lies on the stake of the organization’s finance quotient.

The audit report speaks plenty about the financial condition of the organization through the assessment and evaluation process. Procedures and processes take place before planning of conducting the audit in a particular organization. The organization that will conduct the audit receives a letter from the regulatory body informing the staff members to arrange and assemble the important documents needing for the evaluation.

The non-profit entity issues a different form of the financial statement than the statement issued by a profit-making agency. The organization wants to know about their financial position by giving a brief detail on its annual revenue and expenses. With the information regarding the cash flow, the organization knows what are the sources of their income.

The formation of the non-profit report is made with keeping certain things in the mind of the auditor. It is short and brief in nature. It contains the important and essential information that the auditor finds after completing the evaluation and assessment process. The reports give complete financial information by breaking up each and every detail into a separate entity so that the reader understands the thing.

The non-profit audit report is somewhat different from the for-profit sector report as it shows every detail in a more elaborative manner.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

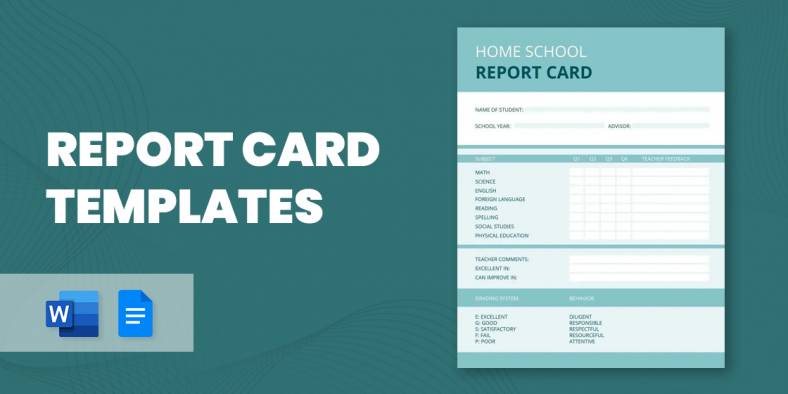

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

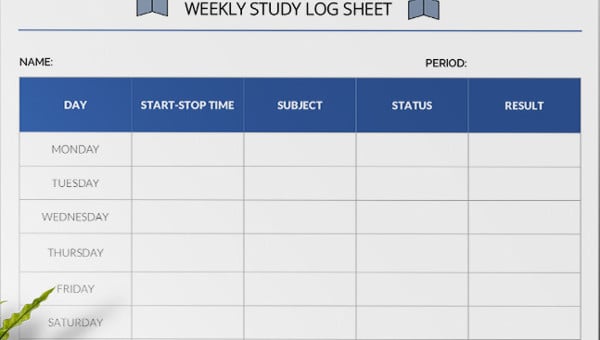

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…