40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 16, 2023

A return on investment report (ROI) is a financial formula that is used to measure the benefit an investor will receive in comparison to the cost of their investment. It is most commonly calculated as net revenue divided by the investment’s original cost of capital. The ROI or the return on investment tests the gain or loss that investment has produced relative to the amount of money invested. ROI is commonly expressed as a percentage and is usually used for individual financial decisions, to evaluate the productivity of a business or to compare the performance of various investments.

topmba.com

topmba.com topmba.com

topmba.com in.gov

in.gov pdfs.semanticscholar.org

pdfs.semanticscholar.org ahrq.gov

ahrq.gov ncver.edu.au

ncver.edu.au publishing.service.gov.uk

publishing.service.gov.uk tpl.org

tpl.org euro.who.int

euro.who.int nemaweb.org

nemaweb.org socialvalueuk.org

socialvalueuk.org ucop.edu

ucop.edu

ROI is one of the most used profitability ratios because of its flexibility. That being said, one of the downsides of the ROI calculation is that it can be manipulated, so results may vary between users. When using ROI to compare investments, it’s important to use the same inputs to get an accurate comparison.

Also, it’s important to note that the basic ROI calculation does not take time into consideration. Obviously, it’s more desirable to get a +15% return over one year than it is over two years.

The typical ROI calculation shows how much an investment yielded overall. However, if you’re comparing ROI from two or more investments, the amount of time it takes to make a given return matters too.

For example, let’s say an investor is comparing the ROI from two different investments. The investor bought $1,000 worth of shares in ABC Corp. and sold them for $1,400 two years later for an ROI of 40% — that’s (Net profit / Original Investment) X 100 = ($400 / $1,000) X 100 = 40%.

Then let’s say that investor bought $5,000 worth of shares in XYZ Corp. and sold them for $7,500 five years later, for an ROI of 50% — that’s ($2,500 / $5,000) X 100 = 50%.

At first glance, it seems that the XYZ Corp. investment yielded a higher ROI. But when time is considered, the results are different.

The investment in ABC Corp. returned 40% over two years, while the investment in XYZ Corp. returned 50% in five years. If we divide each of those returns by their respective duration, that means the ABC Corp. investment returned 20% on an annual basis (20% / 2 years) and the XYZ Corp. investment returned just 10% on an annual basis (50% / 10 years).

In other words, even though the investment in XYZ Corp. made more profit overall, the ABC Corp investment generated a higher annual ROI.

[Calculate your annual return on investment with the CAGR Calculator]

Yes, depending on what variables you’d like to be considered there are more precise ways to calculate return on investment. For example, if you’re looking to compare returns between investments that have been returning money for different periods of time, then ROI may be divided by the duration of the investment (see the first FAQ question) to get an annual rate of return.

For a measure that takes into account more outside variable, the Real Rate of Return measures an investment’s return after adjusting for inflation, taxes, or other external factors.

For individual investors or companies looking to project returns years into the future, the Net Present Value (NPV) finds the expected return of today’s investment based on projections of future cash inflows (adjusted for inflation). If the initial cost of the investment exceeds the amount you expect to earn from it after inflation over the next several years, the investment has a negative NPV and will not generate value.

Investors or companies looking to acquire another company may also analyze a company’s ROI using different variables that represent the investment cost.

For example, the Return on Assets (ROA) calculation shows a company’s return (profit) for every $1 of assets it owns. Meanwhile, the Return on Equity (ROE) formula shows how much a company returned (how much in profit it generates) for every $1 shareholders have in the company’s equity.

Return on investment, better known as ROI, is a key performance indicator (KPI) that’s often used by businesses to determine profitability of an expenditure. It’s exceptionally useful for measuring success over time and taking the guesswork out of making future business decisions. The ability to calculate return on investment is extremely valuable for any business, regardless of size or industry.

After all, knowing if you’re getting your money’s worth is a basic concept that both individuals and businesses need to understand in order to strengthen — rather than hinder — financial success. By calculating ROI, you can better understand how well your business is doing and which areas could use improvement to help you achieve your goals.

While there are many ways to measure investment performance, few metrics are more popular and meaningful than return on investment (ROI) and internal rate of return (IRR). Across all types of investments, ROI is more common than IRR largely because IRR is more confusing and difficult to calculate.

Firms use both metrics when budgeting for capital, and the decision on whether to undertake a new project often comes down to the projected ROI or IRR. Software makes calculating IRR much easier, so deciding which metric to use boils down to which additional costs need to be considered.

Another important difference between IRR and ROI is that ROI indicates total growth, start to finish, of the investment. IRR identifies the annual growth rate. The two numbers should normally be the same over the course of one year (with some exceptions), but they will not be the same for longer periods.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

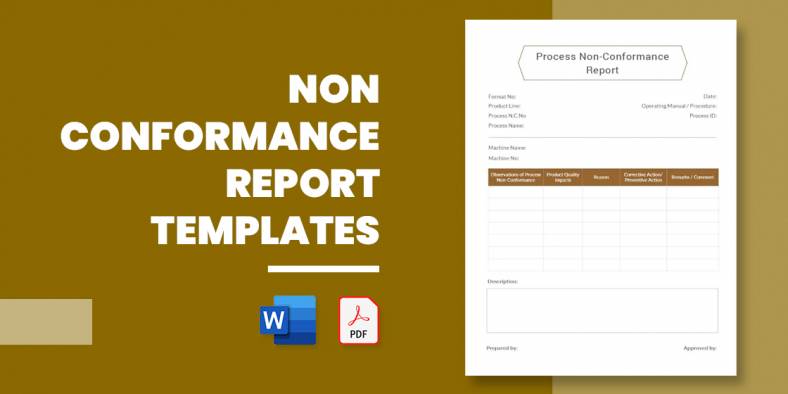

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

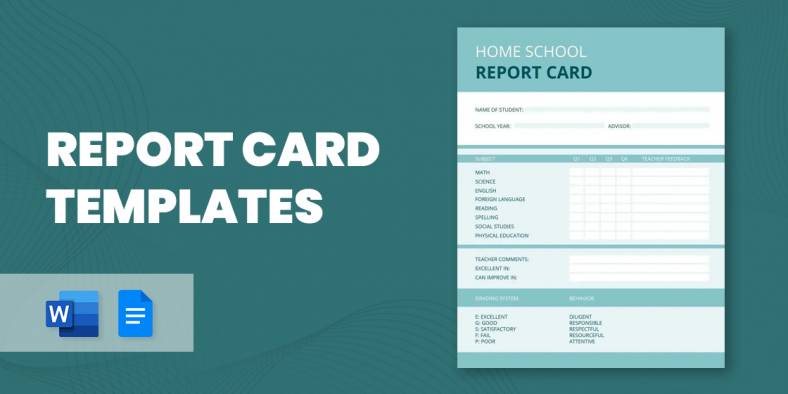

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

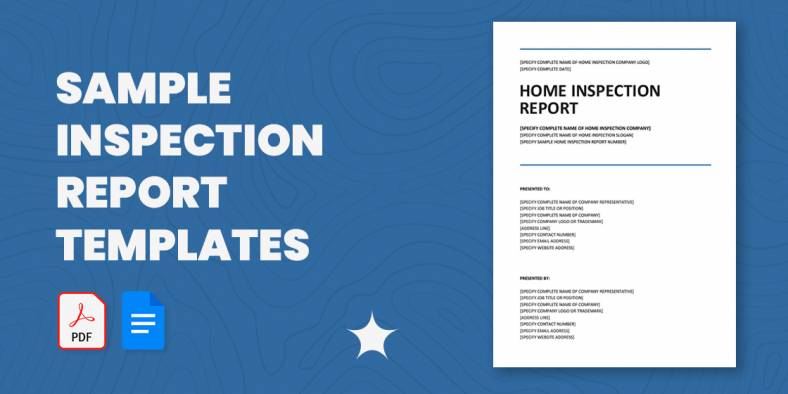

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

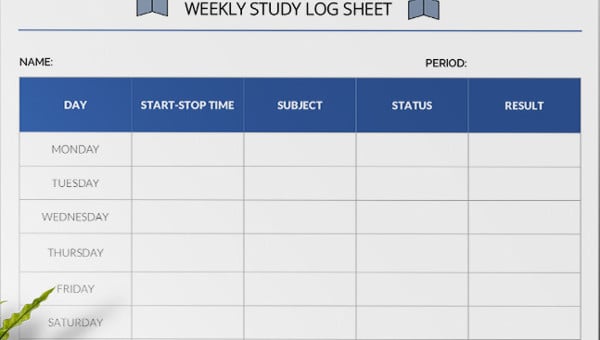

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

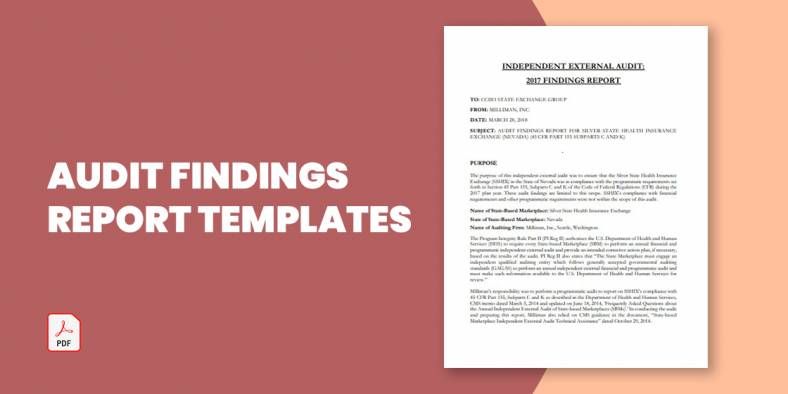

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…