40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Sep 16, 2023

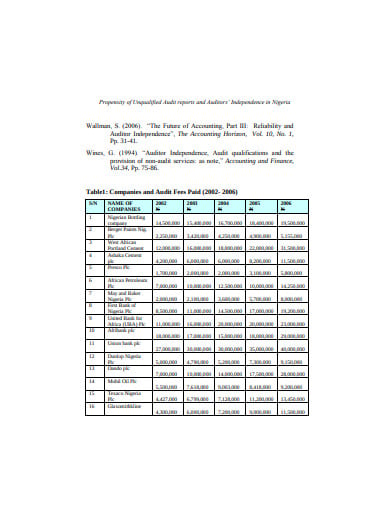

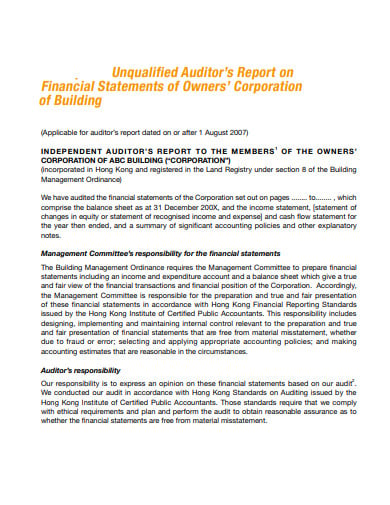

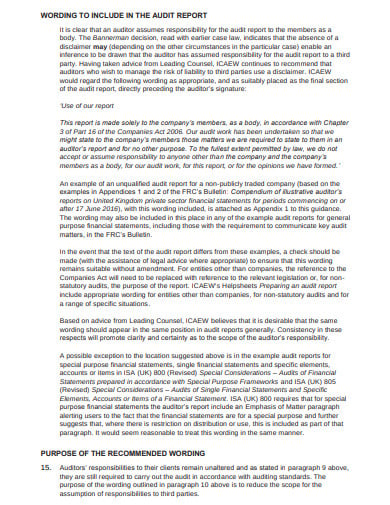

The unqualified audit report portrays the business’s financial statement that complies with the general accounting principles. It is the report that gives the opinion with the thorough research and study considering the financial documents. Any possible discrepancies with that audit rose from the information that could not be obtained by the auditor. The unqualified report analyses the internal systems of the control as well as in the organization accounting books.

ajol.info

ajol.info upenn.edu

upenn.edu icac.hk

icac.hk ecpm.info

ecpm.info utexas.edu

utexas.edu icaew.com

icaew.com edu.my

edu.my wiley.com

wiley.com isarhq.org

isarhq.org edu.my

edu.my diva-portal.org

diva-portal.org richmond.edu

richmond.eduThe audit report must have in it the reference and things about the concerned company or the organization. The references must be in the descriptive and elaborative in nature. The unqualified audit report is about the fairly and correctly conducted audit that completely complies with the in general accounting standards.

The audit report can be referred by the page number as it becomes more proper if you can explain the things by mentioning in accordance with the page numbers. The results must align with the general accounting principles and statutory requirements. You can directly mention the page numbers on which you found the main element of the report.

The unqualified audit report depends on the auditor’s opinion and the judgment regarding financial statements or accounting. The auditor describes the nature of the audit examination and writes about the findings and consequences.

The report contains everything about the material aspect of conducting the audit and form the report on the basis of the various components of the finance of the company or the organization. The financial statement of the business presents its affairs in all the material aspects.

The unqualified audit is known as the clean report. It mentions the auditor’s date and addresses in the report as the contact information if anyone needs it. The auditor’s contact detail is important to put at the beginning or at the end of the report.

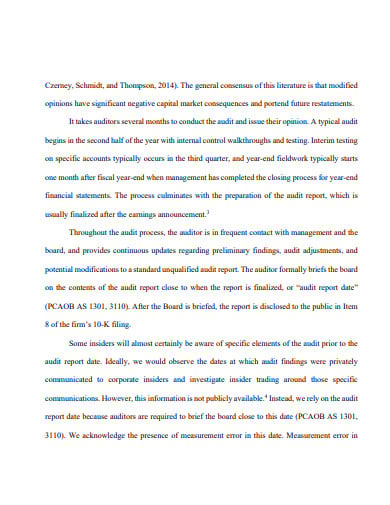

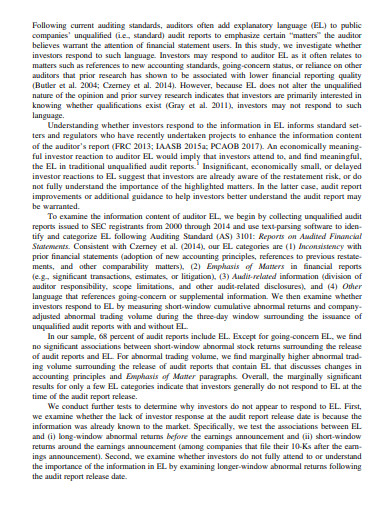

The unqualified audit has concluded most of the financial matters dealing correctly although there might be some outstanding minor issues. On the other hand, the audit report is considered a qualified report for certain reasons like the limited scope in the work of the auditor and if there are things concerning the account policies. The point of concern must have some financial significance for an auditor to qualify the report. The auditor might consider that the issue misstates the real financial condition of the firm.

Whereas the qualified report doesn’t mean that the business organization is facing a loss or in distress condition or that it is failing to disclose any kind of important information in the financial report. The only thing that portrays from the qualified report is that the auditor is unable to give a clean report. The unqualified report is considered to the clean report and it is the most common type of report. In this report, the auditor mentions that the facts and figures in the financial statement are fair and correct.

The unqualified audit states that there are no important facts that are hidden and it also complies with the accounting standards. Whereas the qualified report states that the company’s financial statements are presented fair enough from certain areas. And it meanwhile does not follow the general principle of the accounting standards. This shows that the company’s condition is eventually deteriorating and degrading, for which the financial statement is not found to be transparent.

The financial statement is the detailed information asked by the banks and the other financial institution when they come for the loans or any sort of financial assistance. The process can be very tedious and time-consuming but it is essential for the company to have them. When you’re planning for the audit then knowing about the difference between both the audit reports is important.

The qualified and unqualified audit works differently. Studying or researching about the financial statements of an organization helps to find out if the audit report will be qualified or unqualified. It qualifies that after doing the testing of the financial statement, it is found that the accounting is fairly and correctly demonstrated with compliance with the accounting standards and principles.

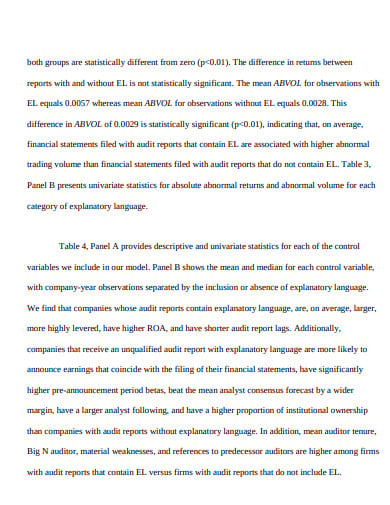

The good unqualified report is prepared by the auditor of the company that is practicing accounting for years. Every company must appoint the auditor to conduct the audit every year. The auditor would release the audit report and opinion after verifying the accounts and the financial operations of the company. The unqualified audit report is forwarded by the auditor after verifying and accepting the accounts and finances of the company.

It doesn’t raise any kind of questions or doubts in the financial statements presented by the company or the organization. It also finds that the accounts are complying with the general accounting audit principles. The auditor can easily give their opinion on the financial matter of the company and, therefore, create an unqualified audit report.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

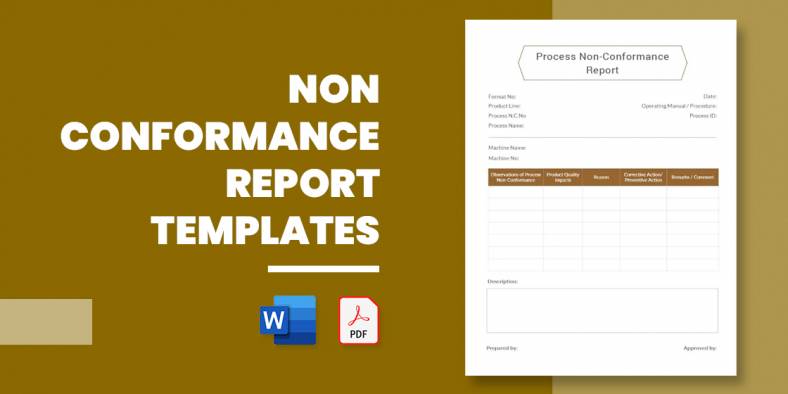

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

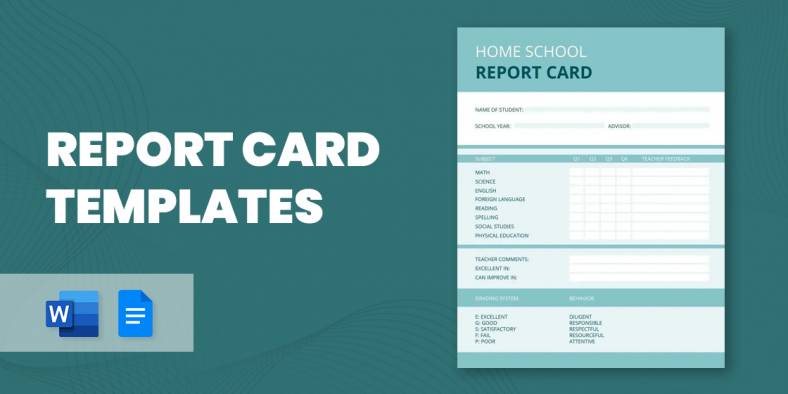

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

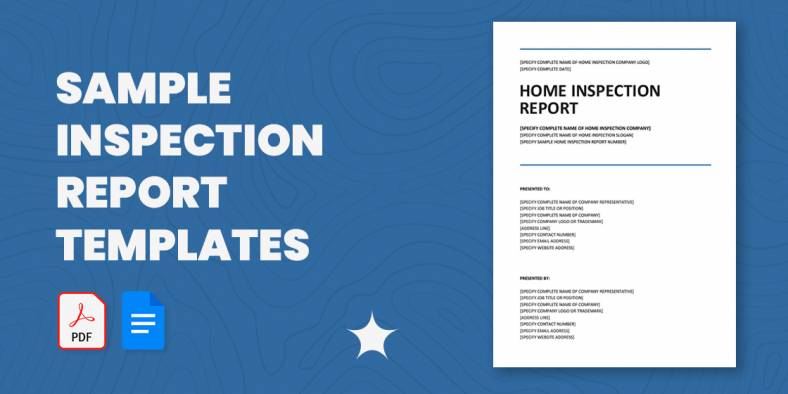

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

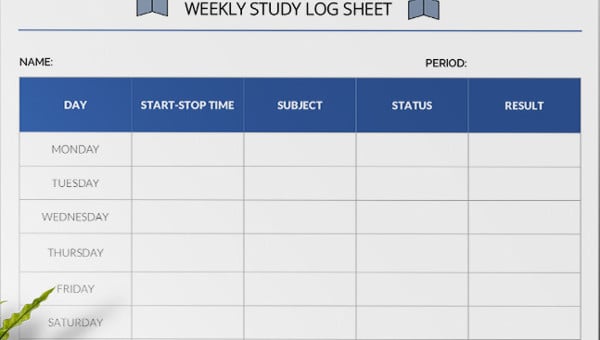

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

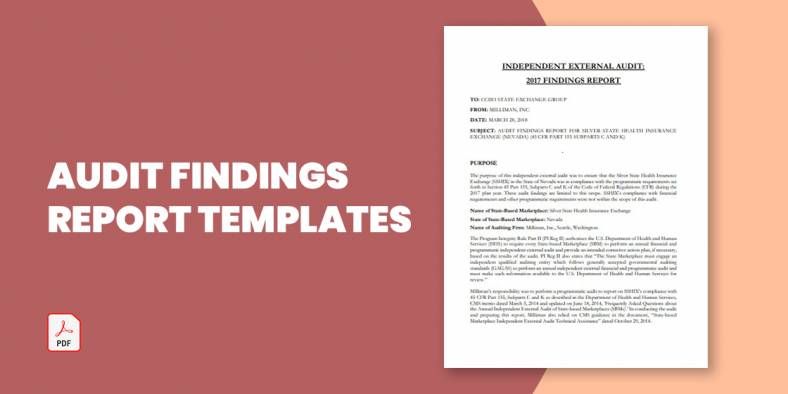

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…