Feb 13, 2025

Banks offer a safe place where people can store their money, so people don’t have to carry excessive amounts of cash in their pockets. They are important because they loan money, accept deposits, and attract investments. Banking plays an important role in the financial lives of individuals and businesses, and the importance of banks can be seen from the fact that they are considered as to be the lifeblood of this generation’s economy. The sector also offers debit and credit cards for their clients’ convenience in the purchase of goods and services.

The role of a banker is filled with various roles and responsibilities. Bankers come in many different types and each one is unique in their own specific way. Some of these individuals work for large corporate entities, some also work for small town financial institutions, and others work for individual people. The duties of each banker will differ among the individuals and each one has their own agenda in their role as a banker. Although no wealth is created by banks, their essential services help facilitate the process of production, exchange and distribution of income.

Feel free to look around our website for some banking resume samples and Professional Resume Examples.

Investment Banking Resume Templates

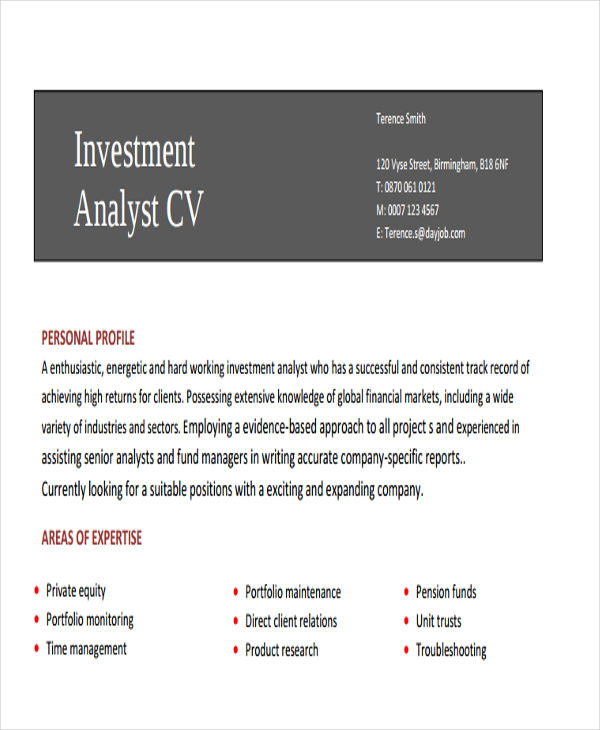

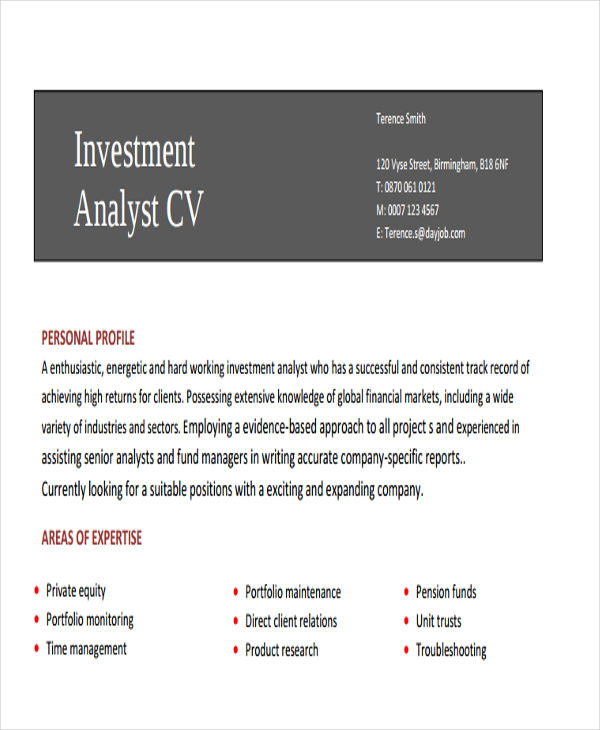

Investment Banking Analyst Resume

dayjob.com

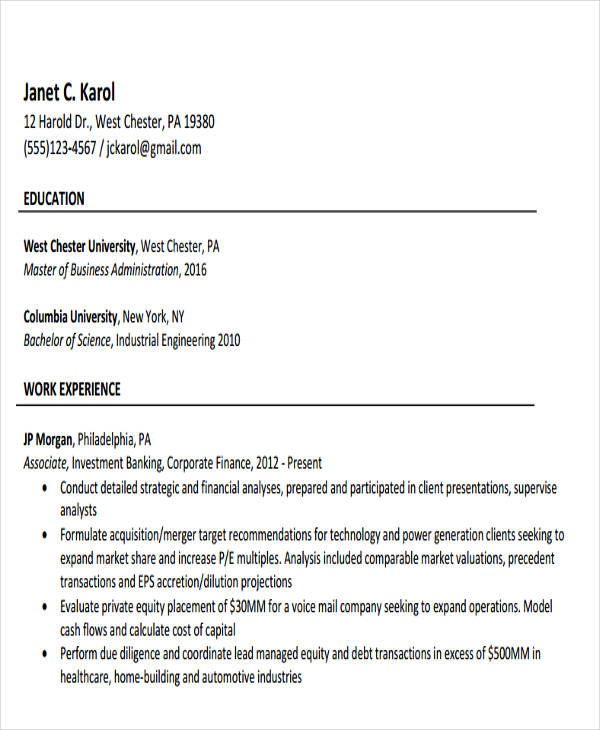

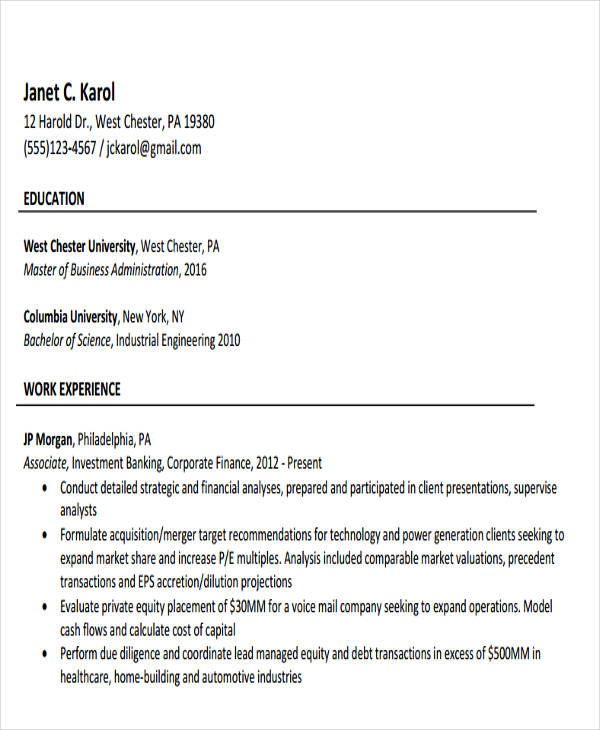

dayjob.comInvestment Banking Associate Resume

wcupa.edu

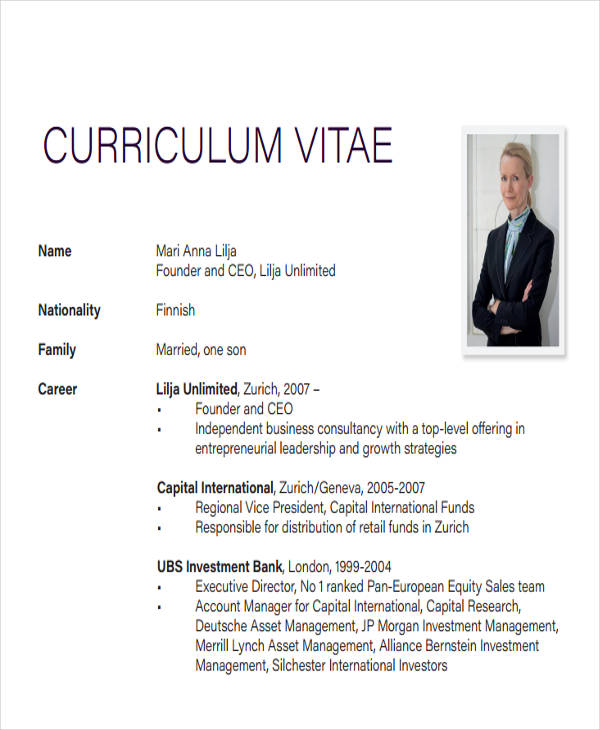

wcupa.eduInvestment Banking Sales Resume

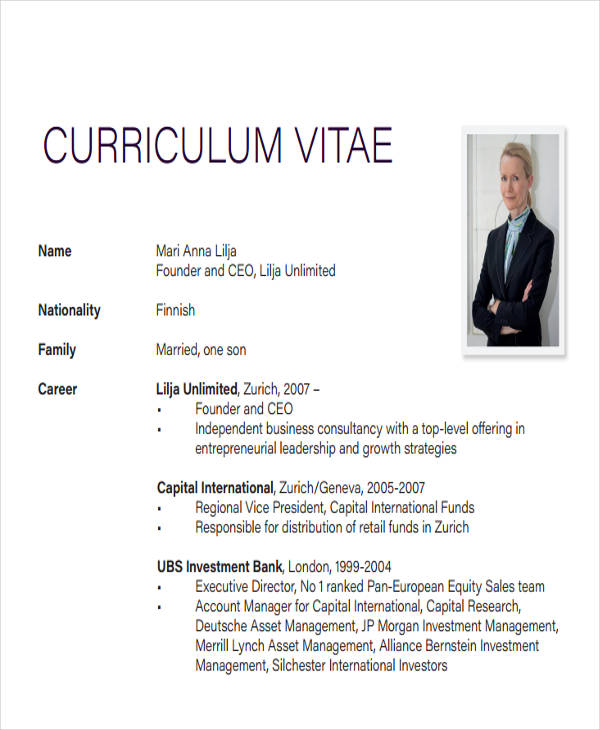

liljaunlimited.com

liljaunlimited.comRetail Banking Resume Templates

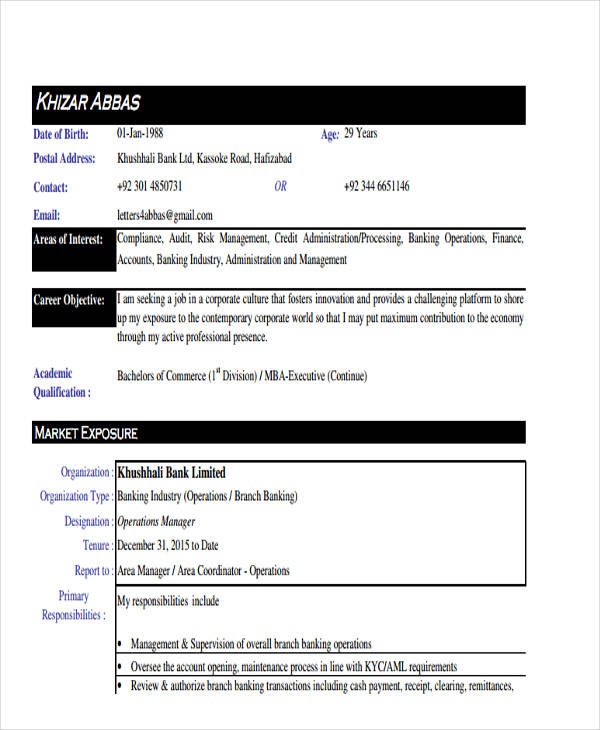

Retail Banking Operations Resume

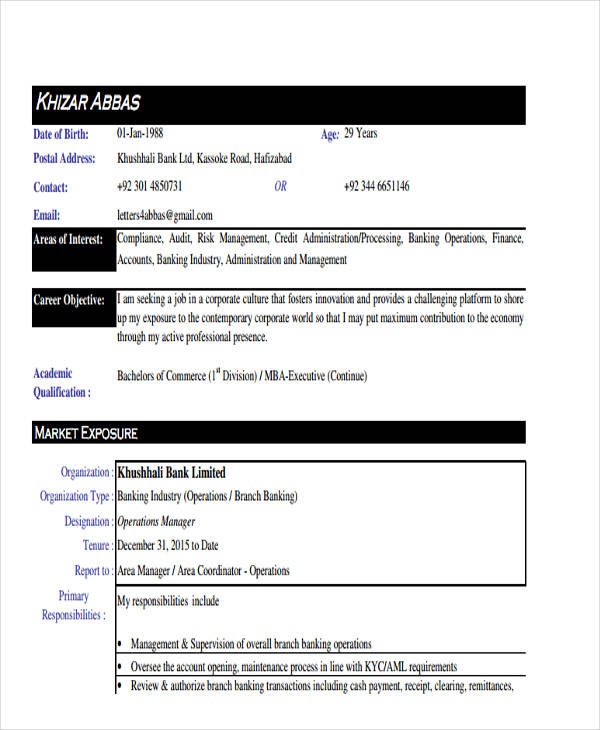

mobilinkbank.com

mobilinkbank.comRetail Banking Experience Resume

anexpertresume.com

anexpertresume.comRetail Banking Manager Resume

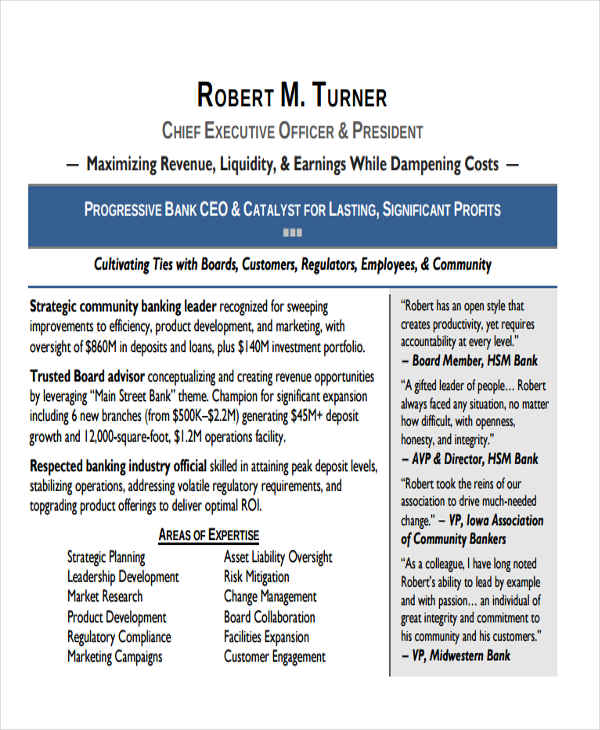

c.ymcdn.com

c.ymcdn.comRetail Banking Officer Resume

js101.org

js101.orgCommercial Banking Resume Templates

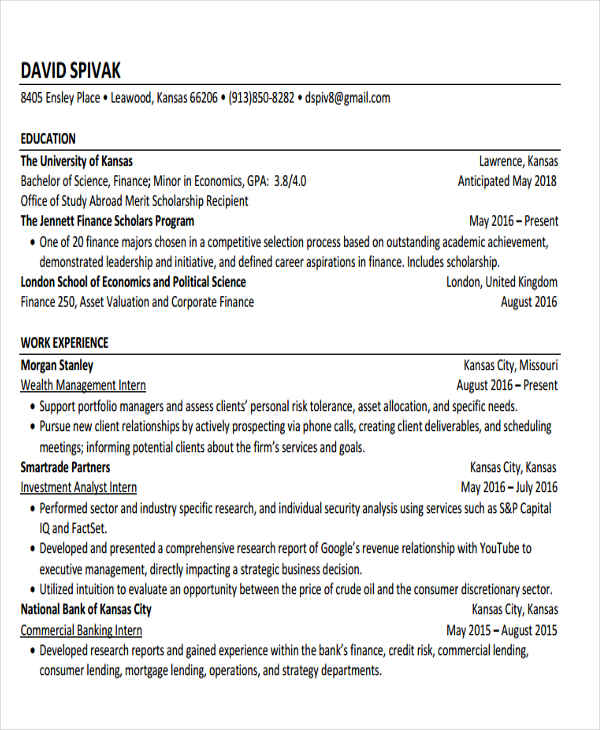

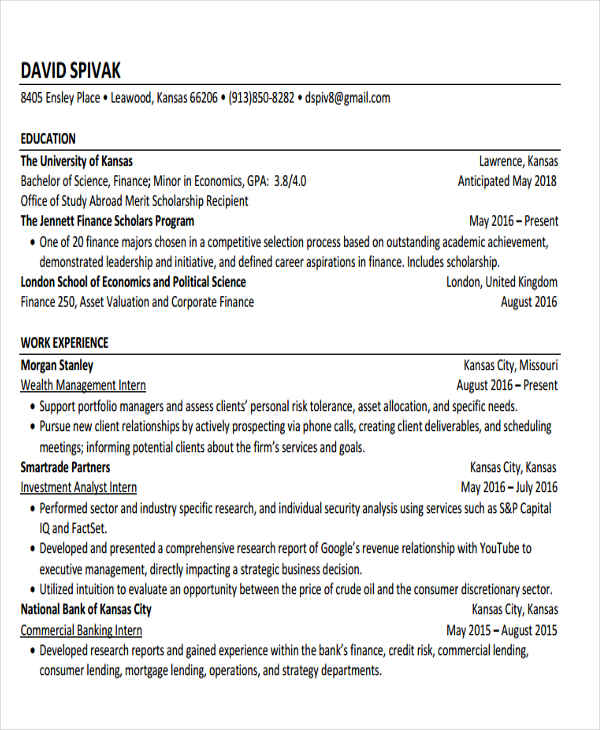

Commercial Banking Intern Resume

business.ku.edu

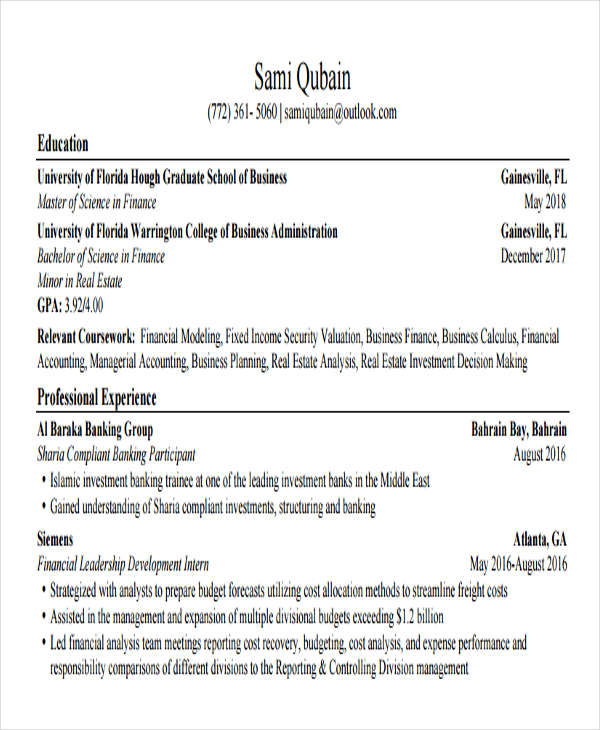

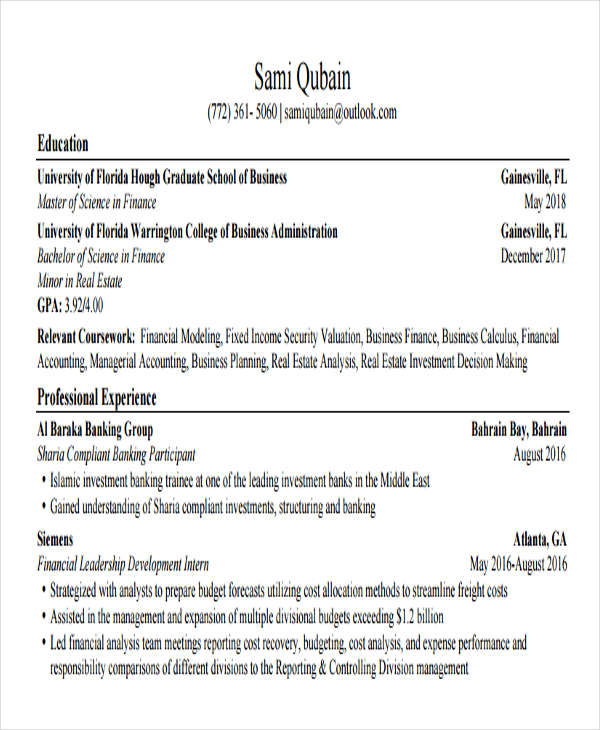

business.ku.eduCommercial Real Estate Banking Resume

warrington.ufl.edu

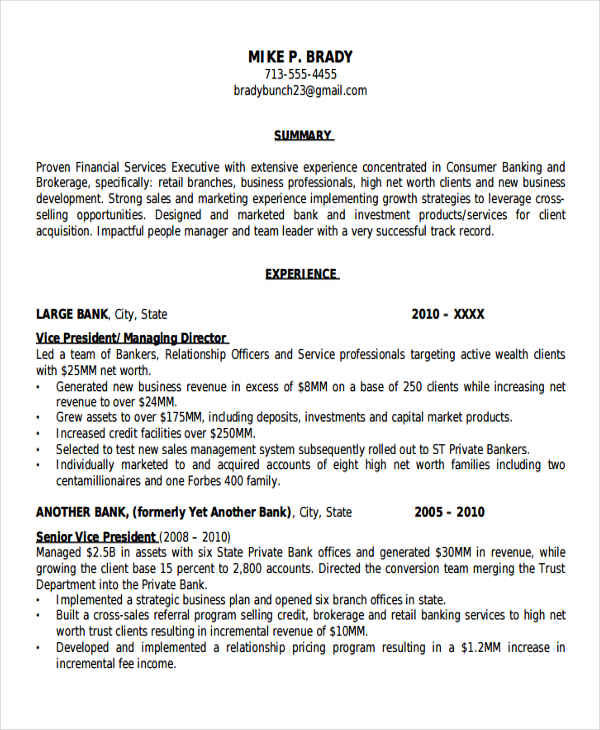

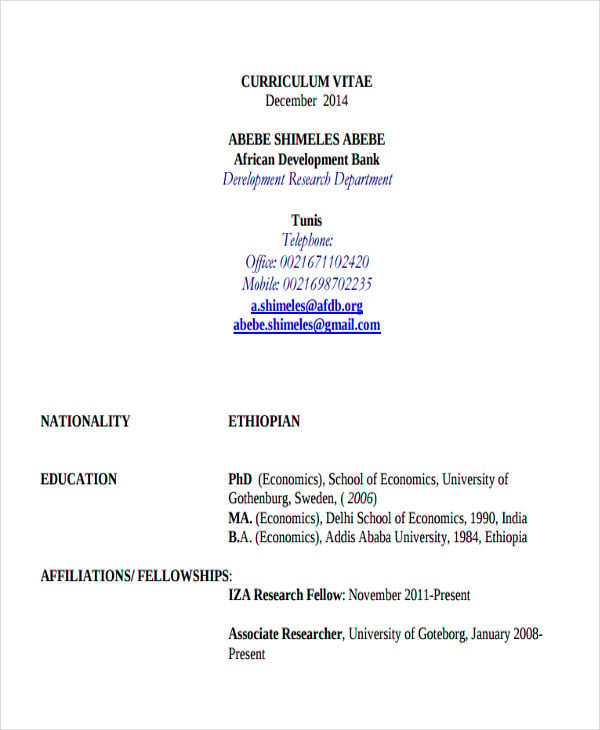

warrington.ufl.eduCommercial Banking Manager Resume

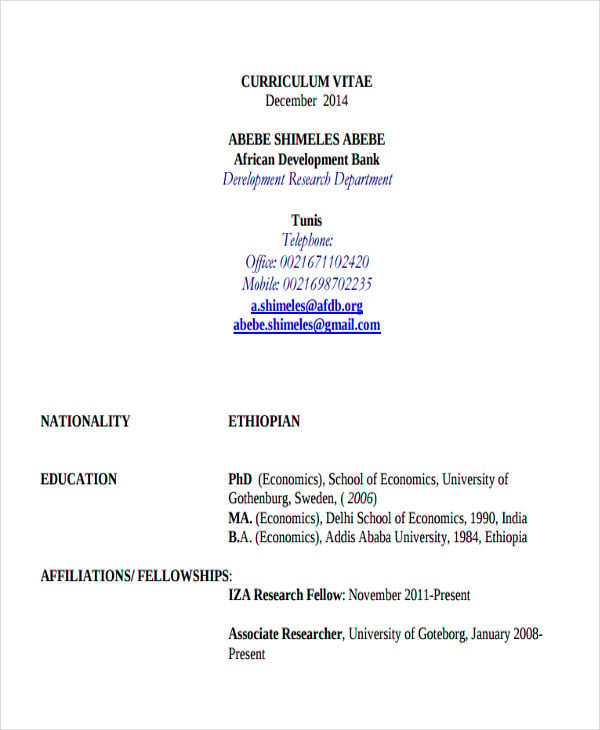

legacy.iza.org

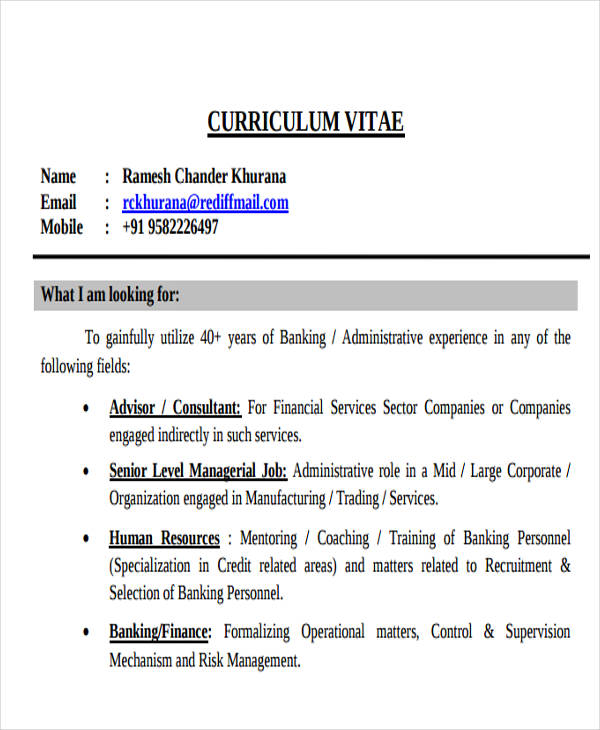

legacy.iza.orgCorporate Banking Resume Templates

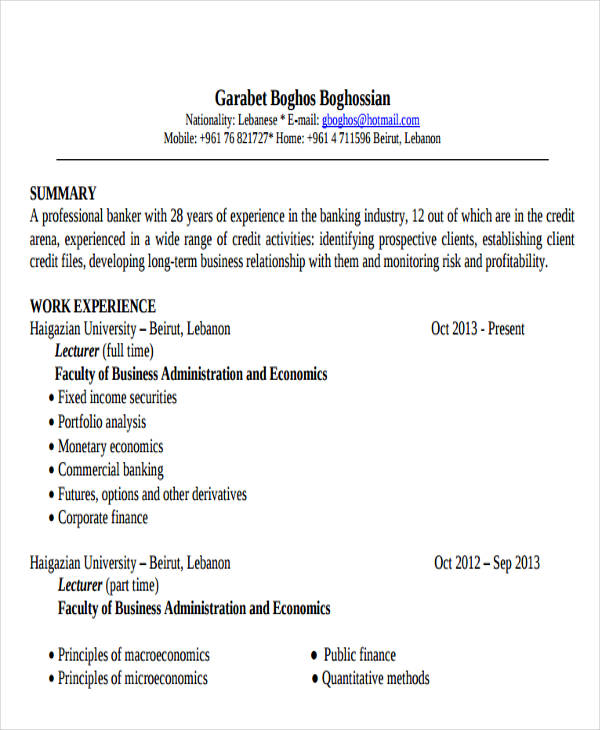

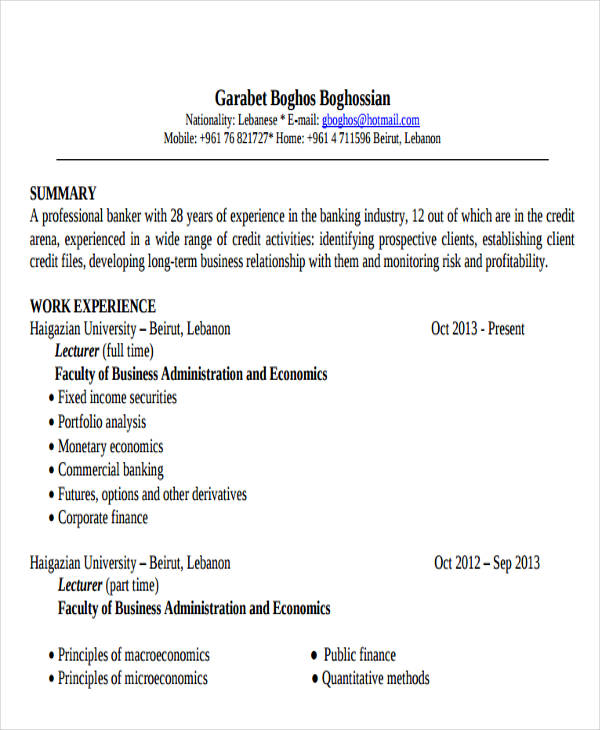

Corporate Banking Analyst Resume

haigazian.edu.lb

haigazian.edu.lbCorporate Banking Associate Resume

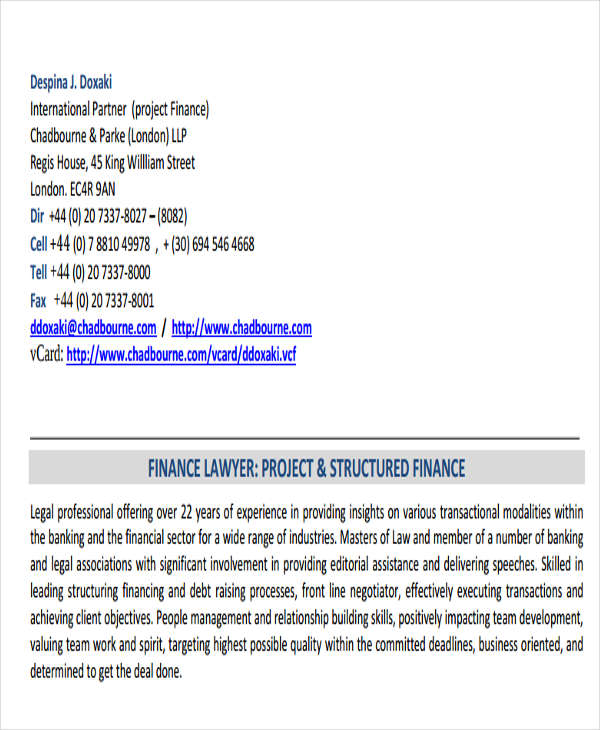

web.xrh.unipi.gr

web.xrh.unipi.grSample Corporate Banking Resume

indiansmechamber.com

indiansmechamber.comBusiness Banking Resume Templates

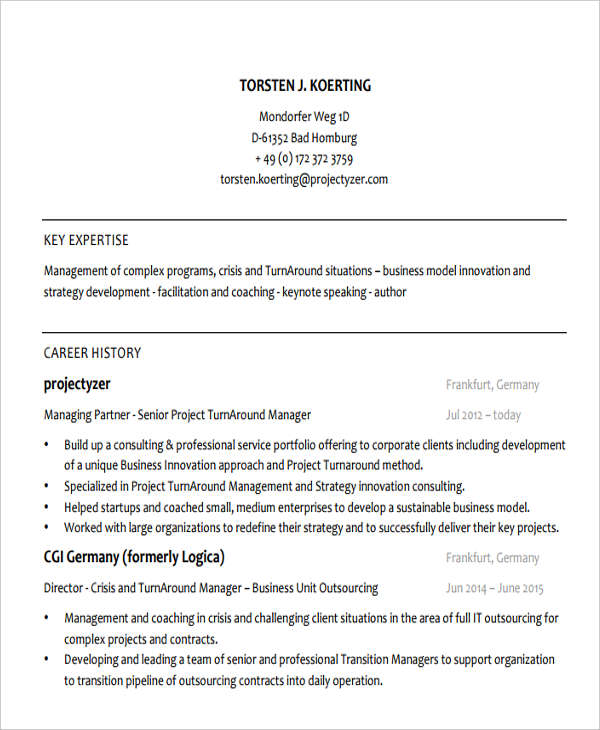

Business Analyst Banking Resume

intranet.msit.org

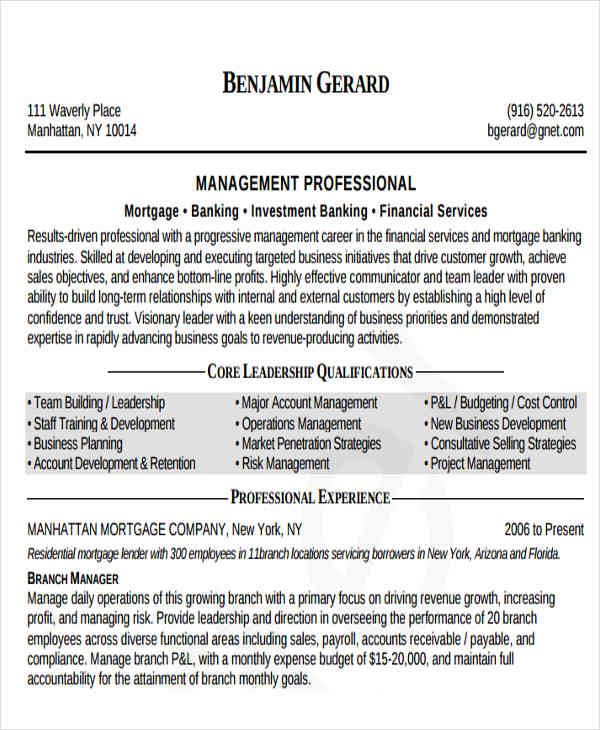

intranet.msit.orgBusiness Banking Manager Resume

resume-resource.com

resume-resource.comBusiness Banking Officer Resume

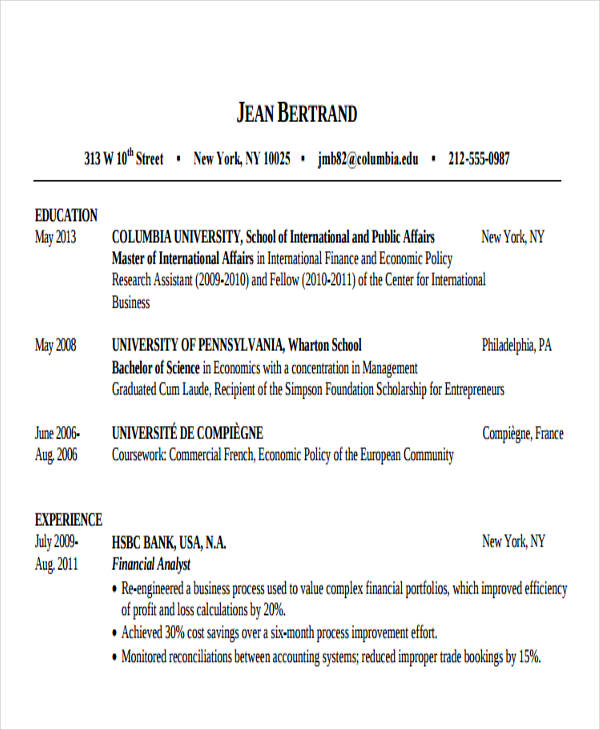

sipa.columbia.edu

sipa.columbia.edu1. What Is a Banker? (If You’re Living under a Rock)

A banker is defined as an individual that is employed by a banking institution and participates in various financial transactions, which may or may not include investments. There are actually various types of bankers: Financial analysts, financial managers, bank tellers, and loan officers.

- Financial Analysts. Financial analysts function as advisers to individual bank clients and businesses on investments. They may advise clients on stocks and bonds that they can invest in to grow their pension plans or retirement portfolios.

- Financial Managers. They are required to have at least a bachelor’s degree and must generally have a minimum of five years of experience working in other financial roles. They work to develop and review financial reports and budgets, and manage and audit a company’s profits and losses. They may also supervise accountants and financial analysts.

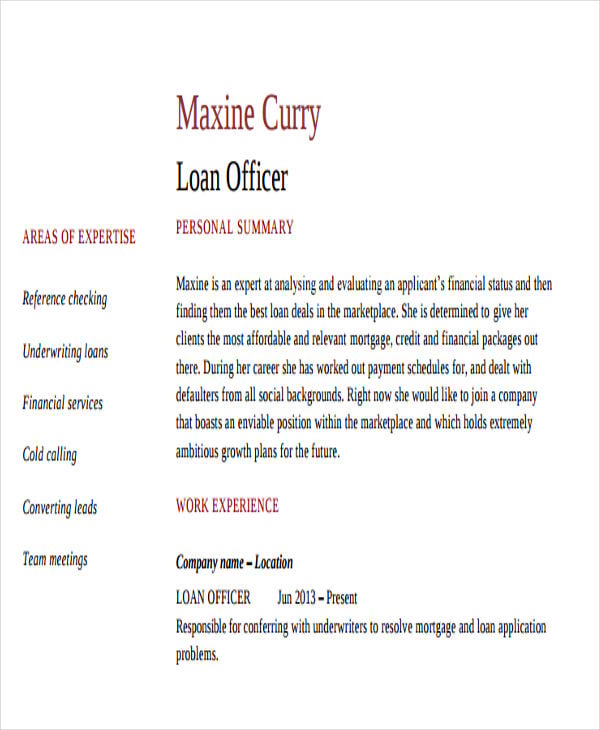

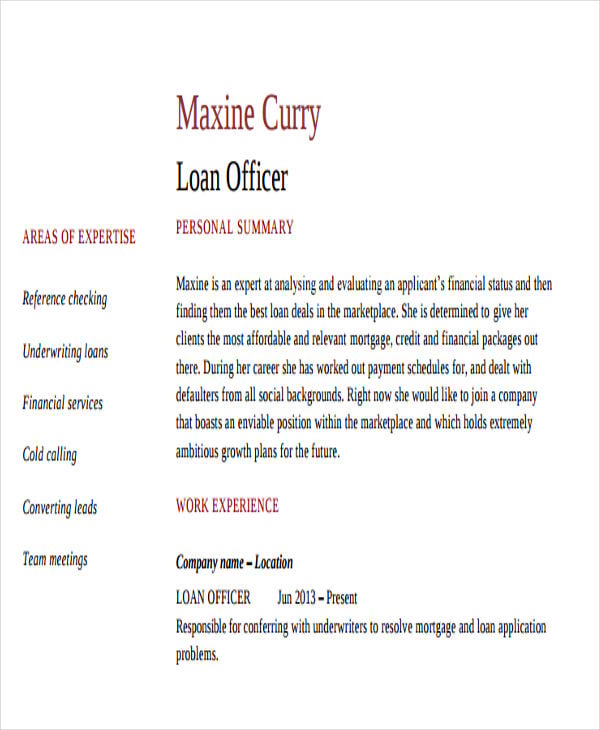

- Loan Officers. Loan officers who work with businesses or commercial clients are required to have a bachelor’s degree, but if they are working for individual clients, a high school diploma is sufficient.

- Bank Tellers. They should at least have a high school diploma to be able to work as a bank teller. They are among the first people whom customers come in contact with when they enter a bank. Aside from processing customer transactions, bank tellers also answer questions, including explaining bank services such as loans and certificates of deposit to customers. Excellent customer service skills are necessary to be a successful bank teller.

2. What Are the Responsibilities of a Banker?

A banker has numerous general responsibilities that go along with their day-to-day tasks.

- A banker is responsible for assessing clients with their financial standing and offering bank programs in accordance with their standing.

- A banker will review the finances of a client, and introduce financial programs which they may need to be able to answer to their queries.

- A banker is responsible for the smooth-sailing daily operation of the financial institution.

- A banker ensures that they comply with the institution’s rules and regulations as well as relevant laws surrounding them.

For more resume templates, you may check out our collection of Sample Job Resume Examples, Sample High School Resume Templates, and Financial Manager Resume Templates.

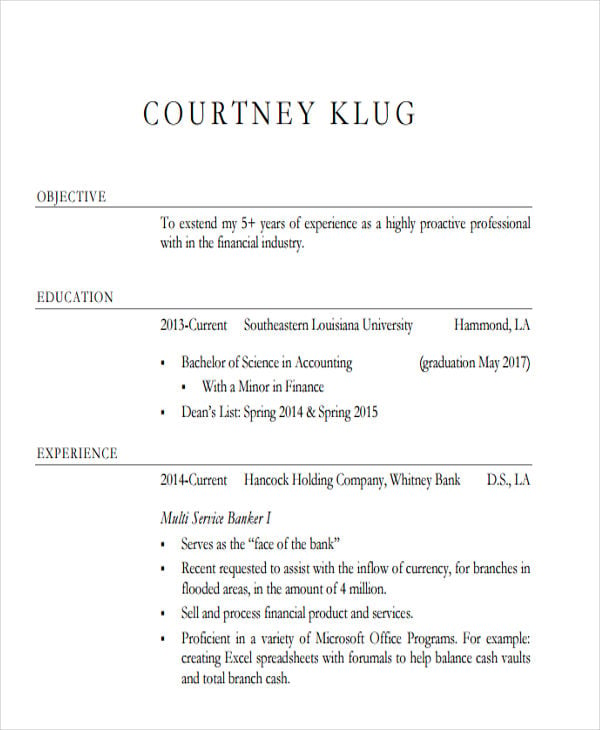

Banking Sales Resume Templates

Banking Sales Manager Resume

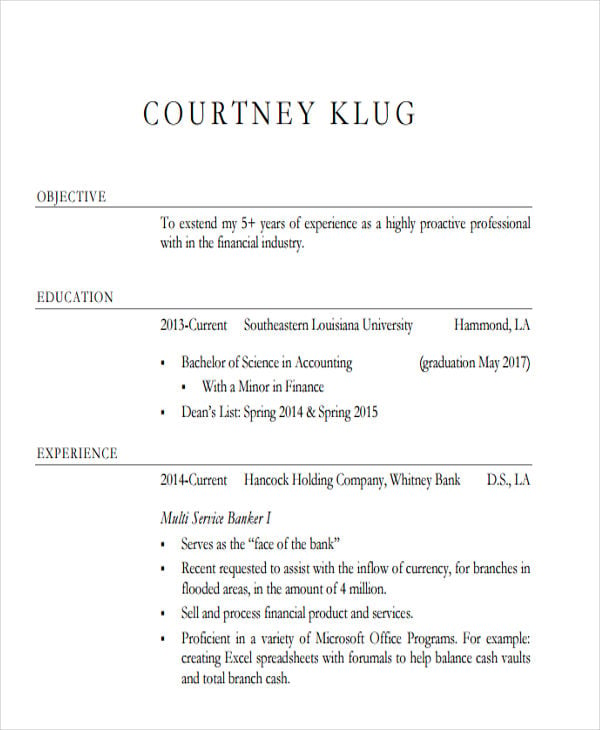

southeastern.edu

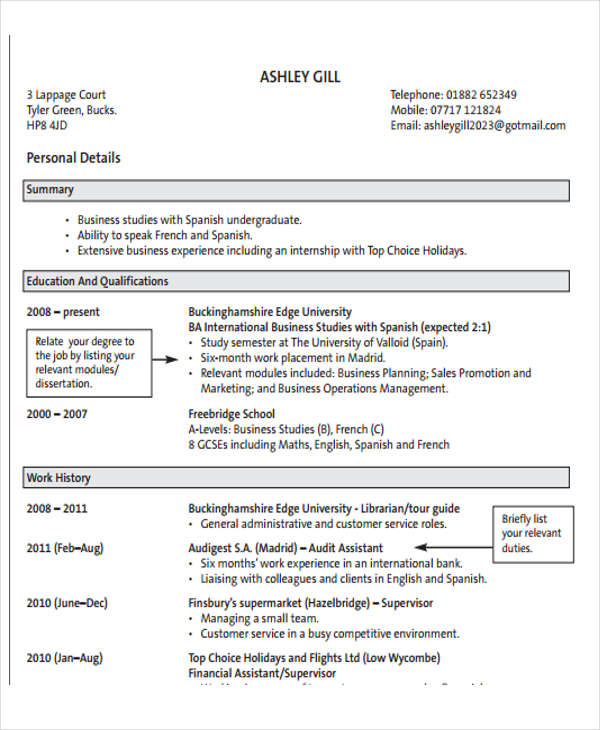

southeastern.eduBanking Sales Experience Resume

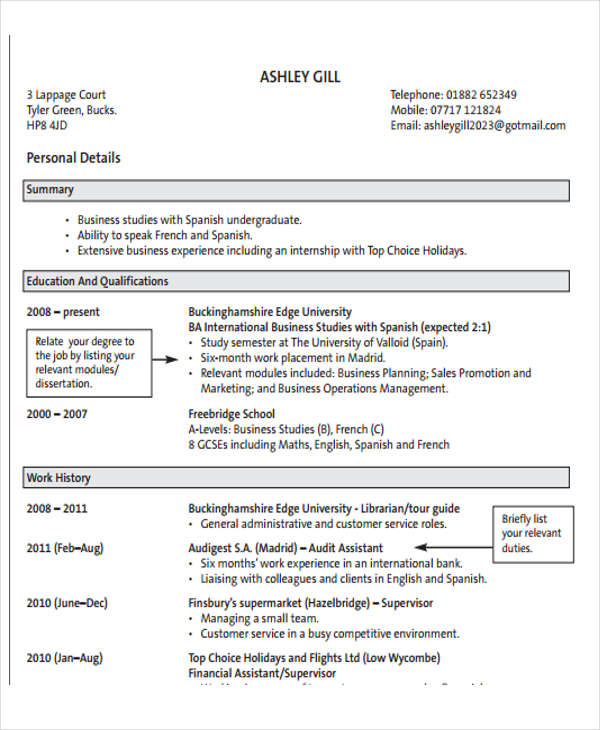

surrey.ac.uk

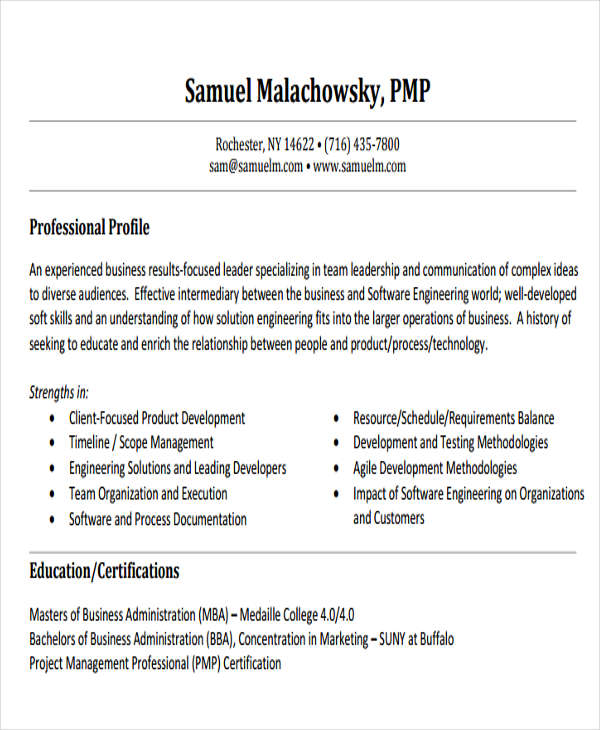

surrey.ac.ukRetail Banking Sales Resume

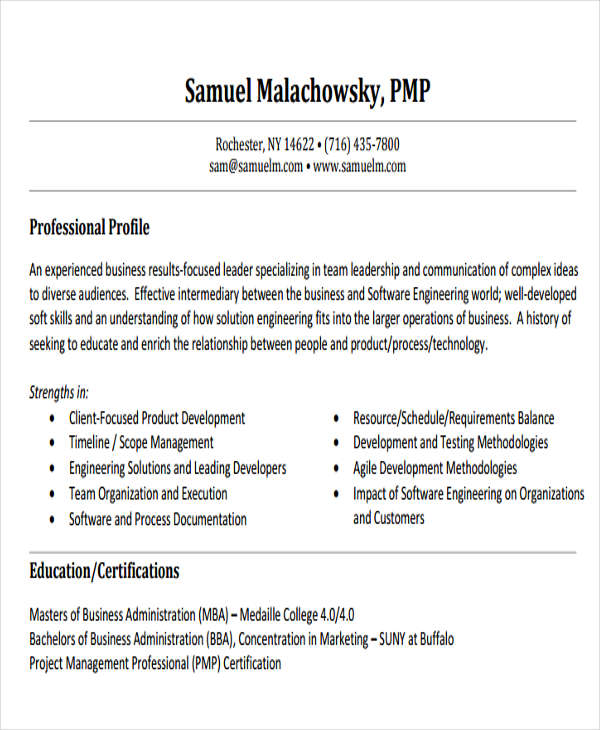

samuelm.com

samuelm.comBanking Operations Resume Templates

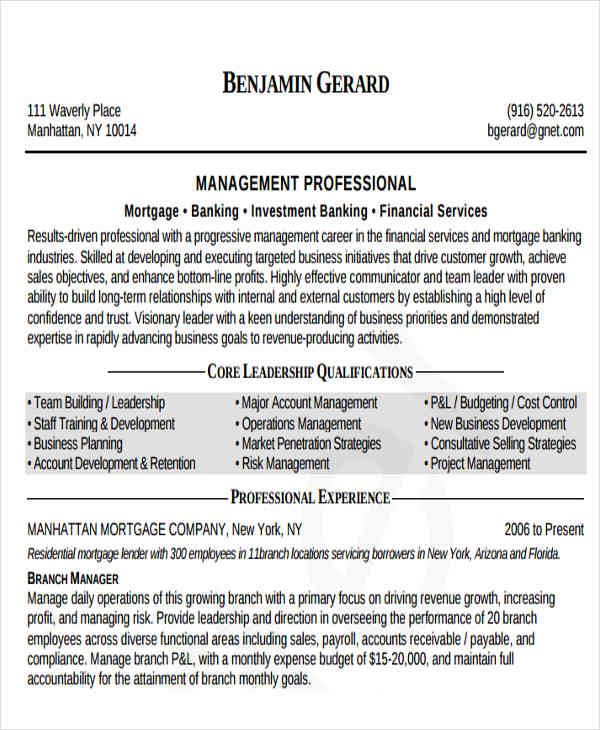

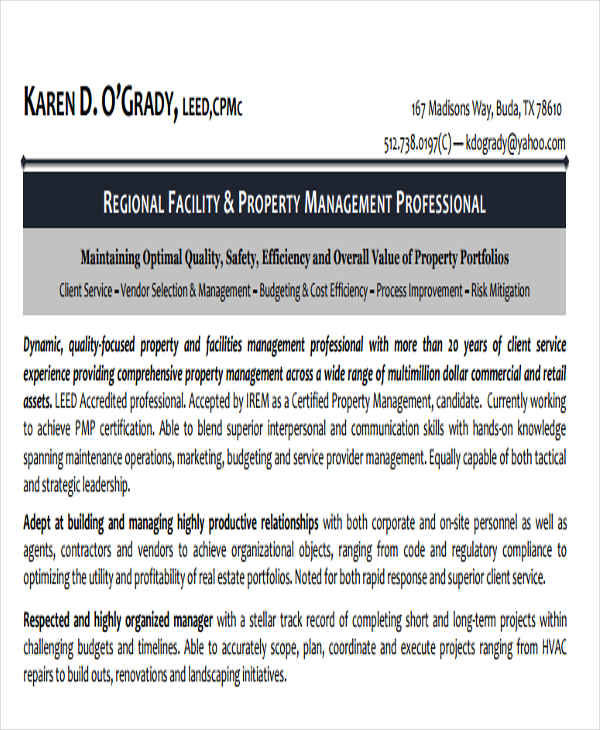

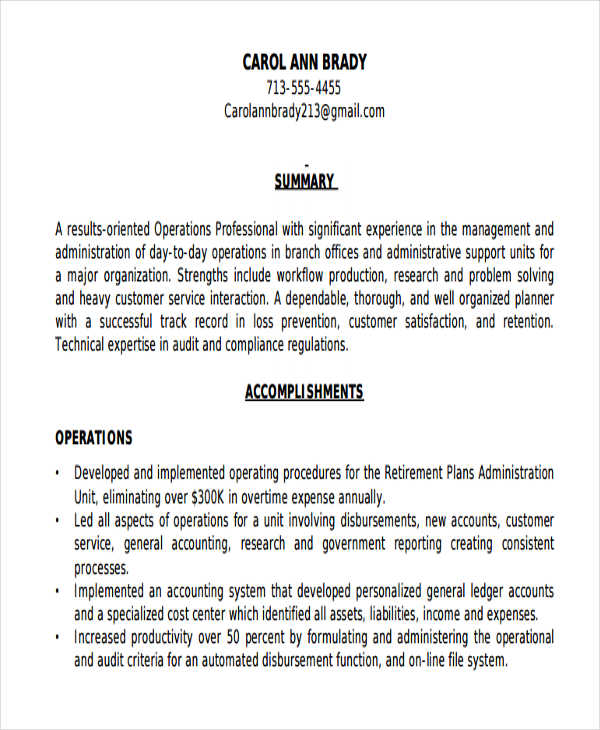

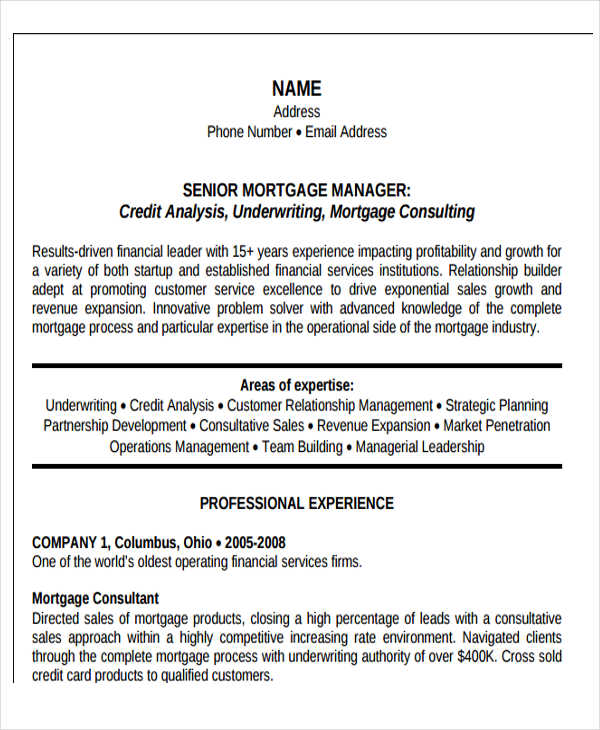

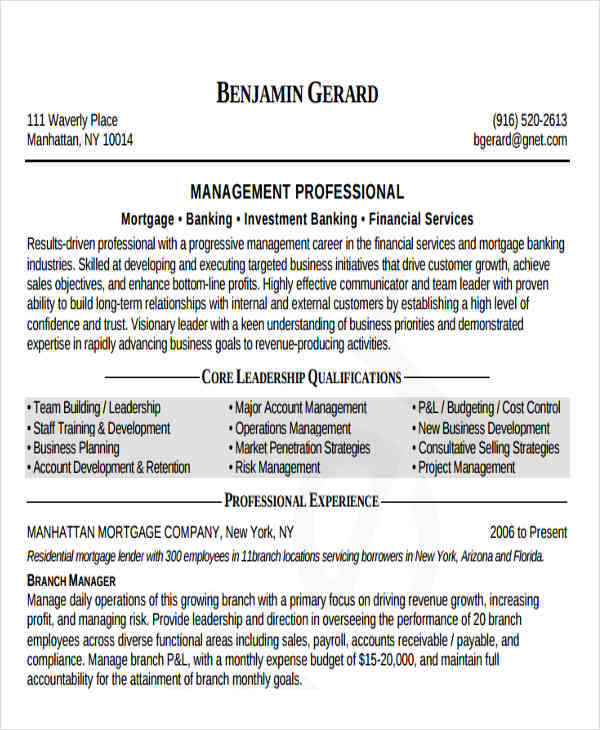

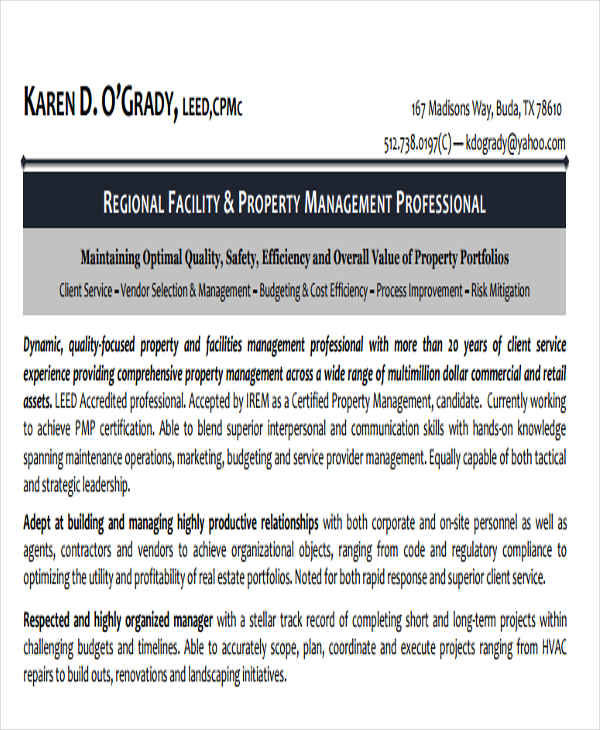

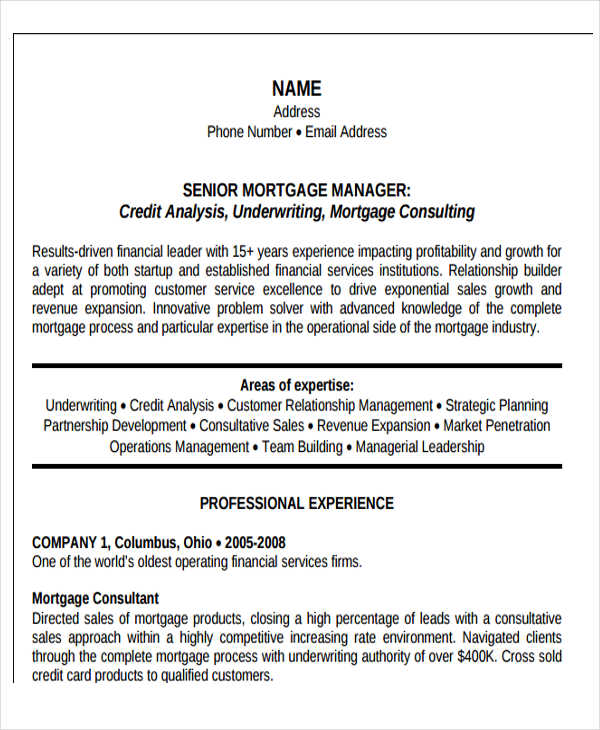

Banking Operations Manager Resume

resume-resource.com

resume-resource.comInvestment Banking Operations Resume

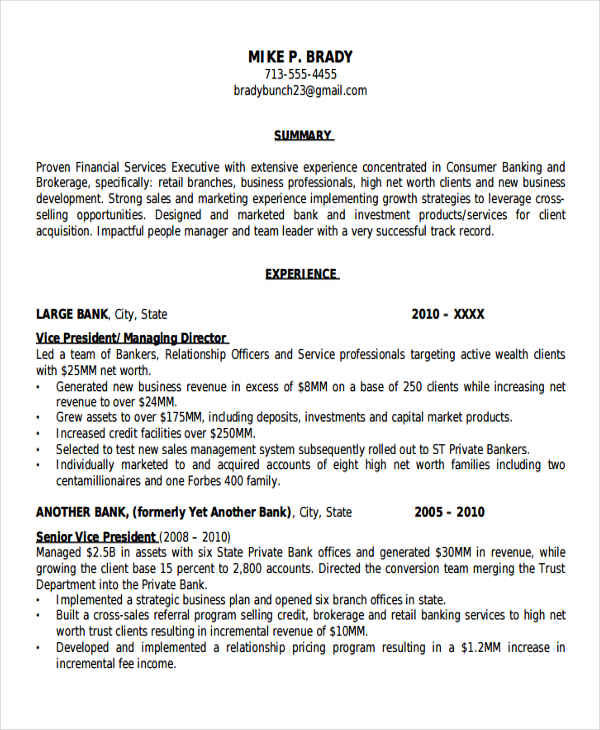

distinctiveweb.com

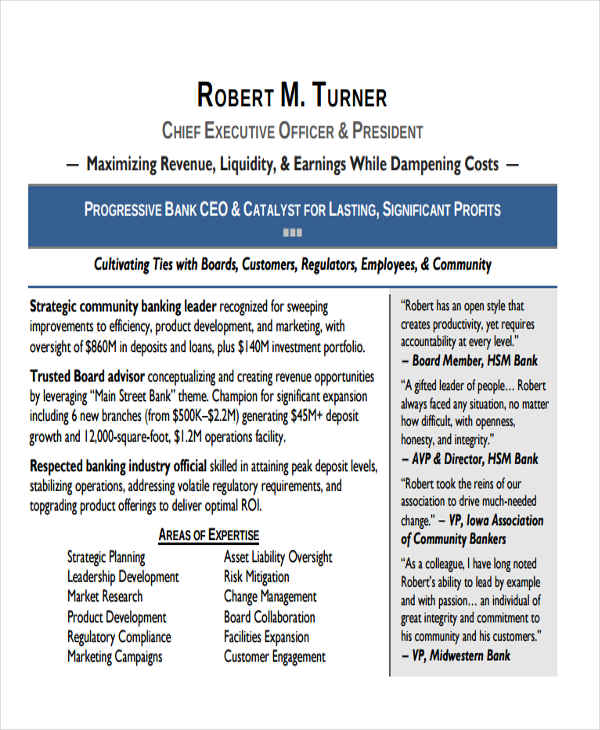

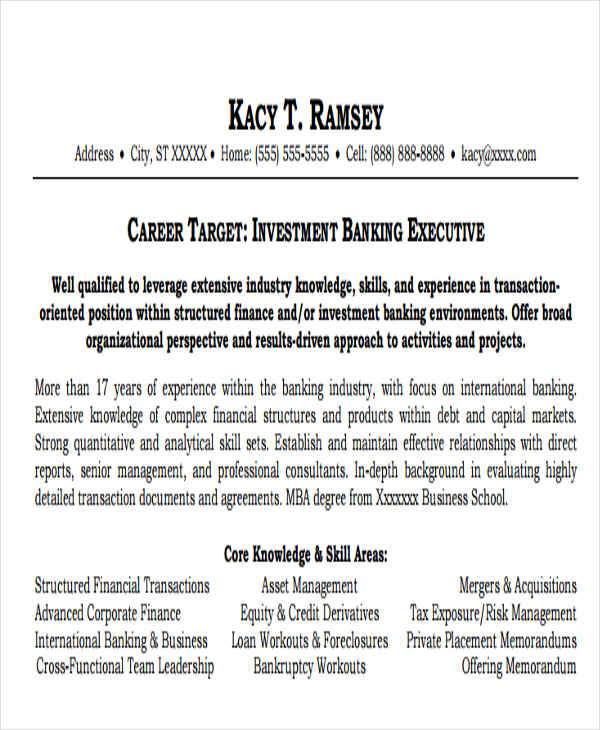

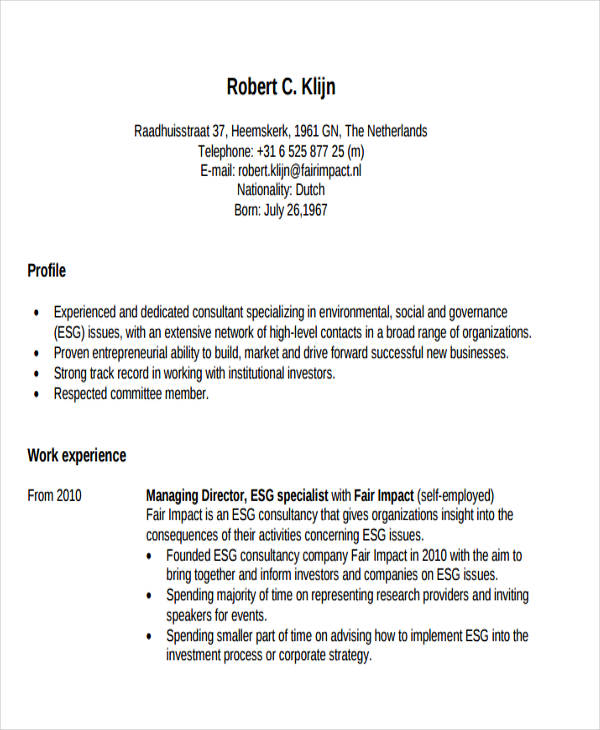

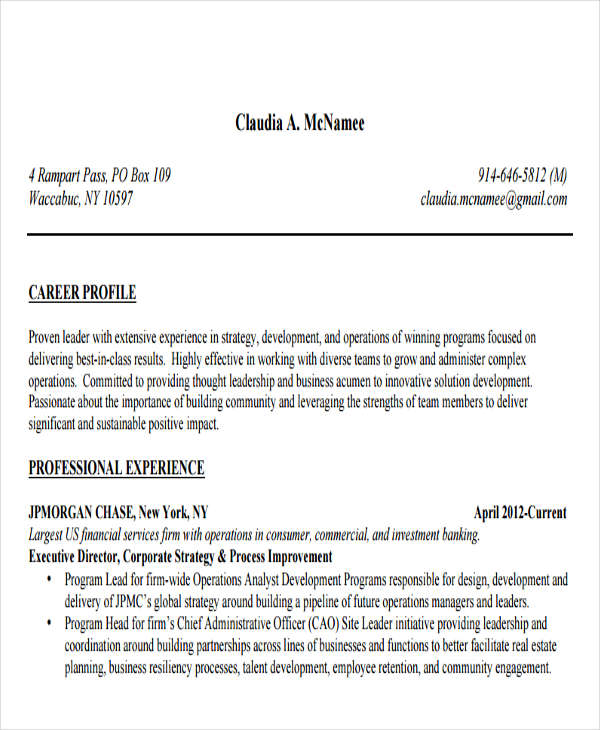

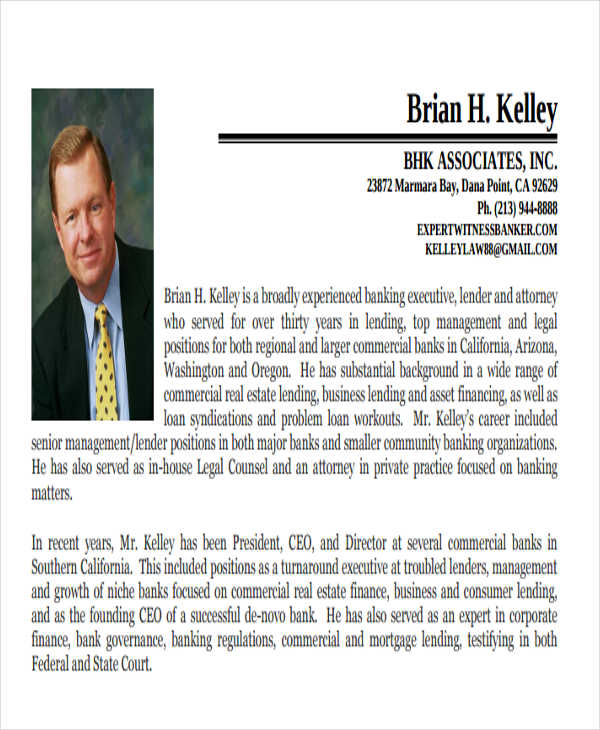

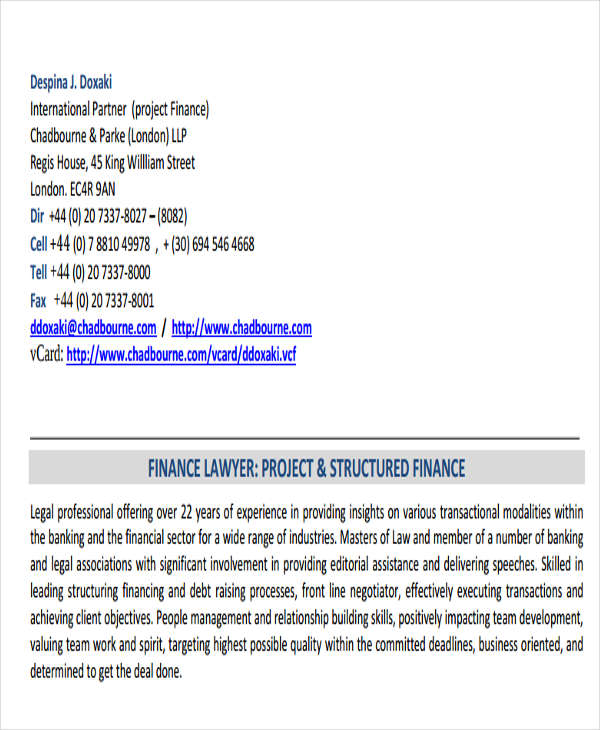

distinctiveweb.comBanking Executive Resume Templates

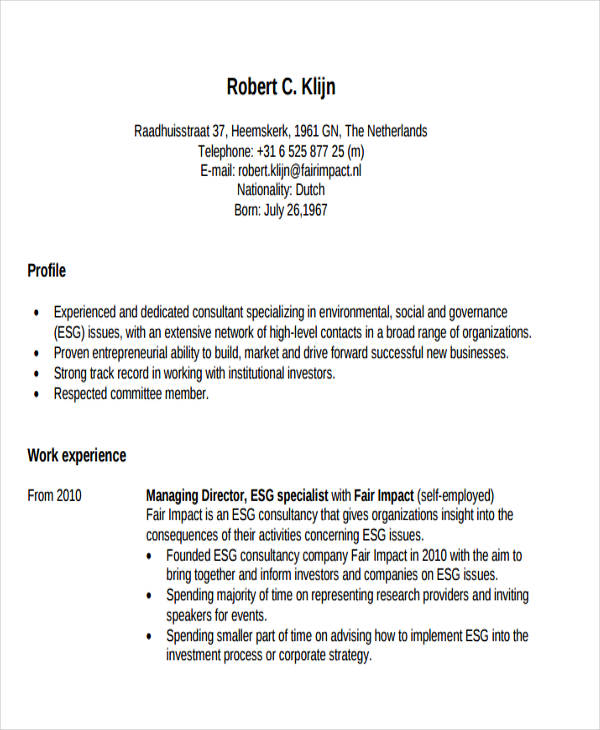

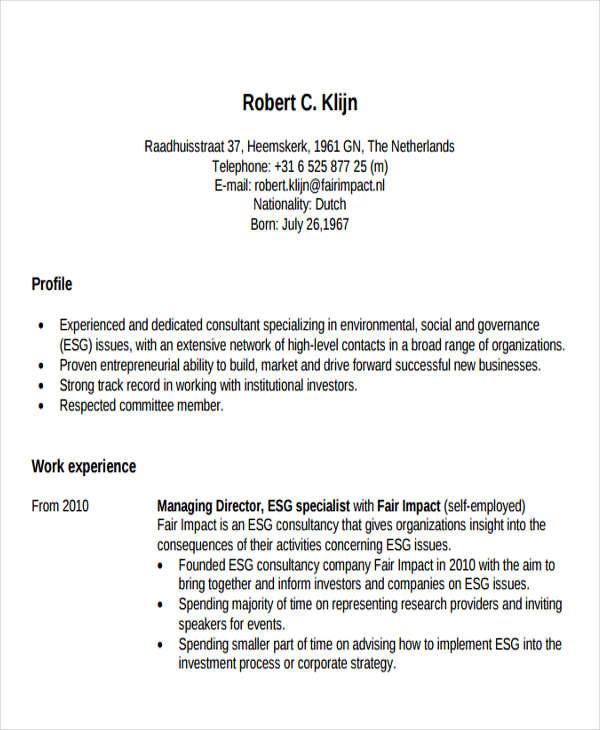

Banking Sales Executive Resume

fairimpact.nl

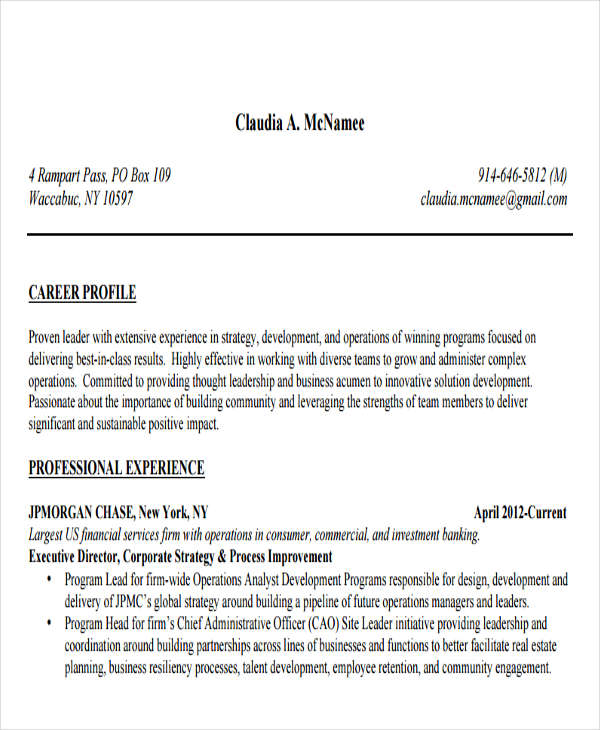

fairimpact.nlBanking Operations Executive Resume

michiganross.umich.edu

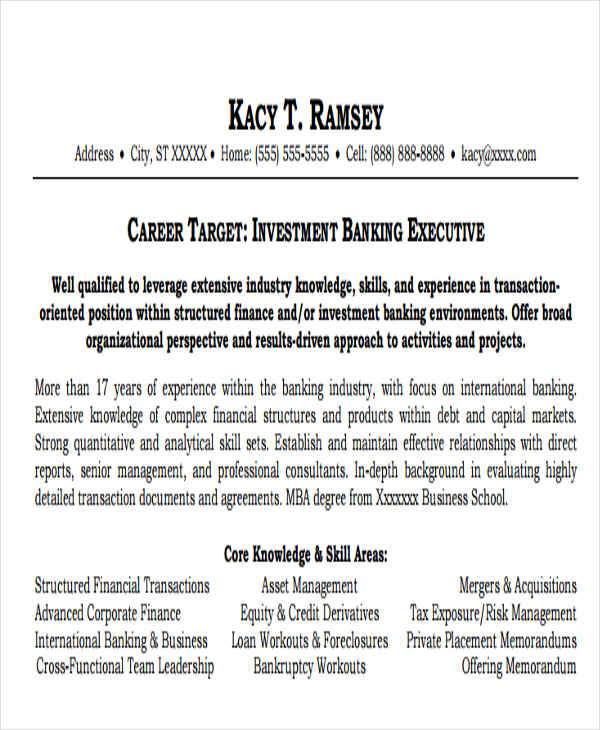

michiganross.umich.eduInvestment Banking Executive Resume

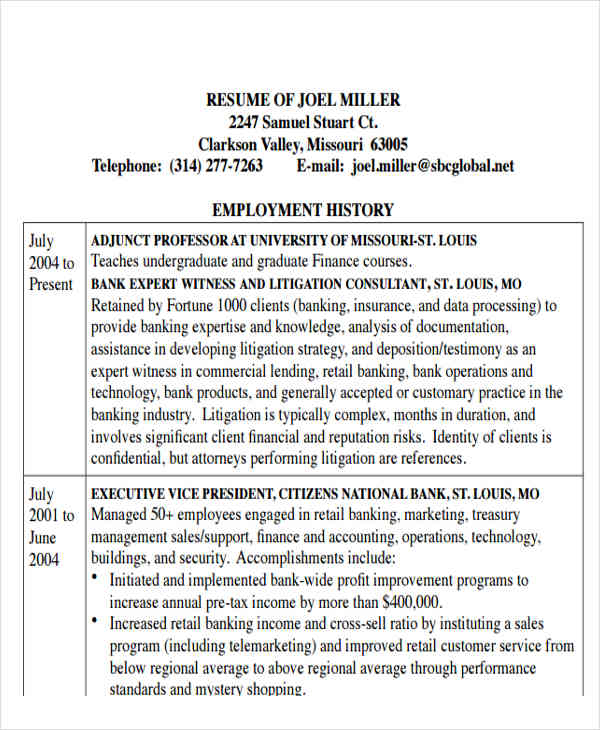

bmcc.cuny.edu

bmcc.cuny.eduRetail Banking Executive Resume

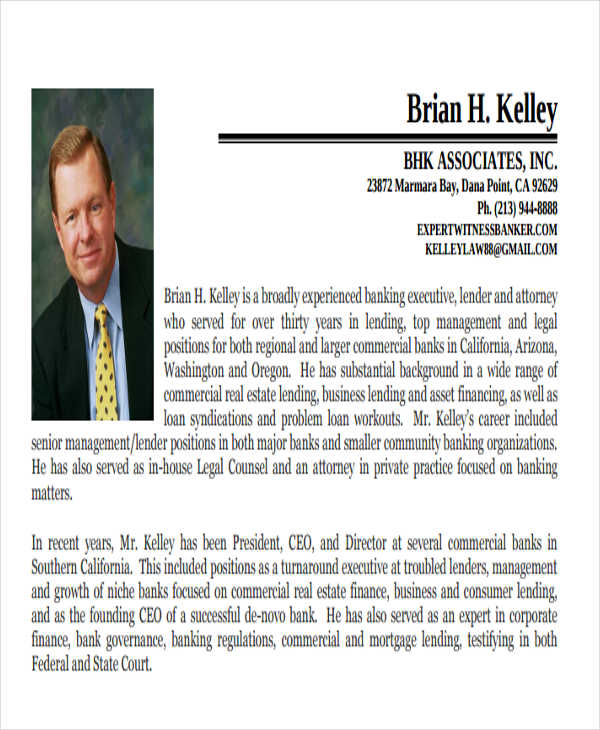

experts.com

experts.comBanking Service Resume Templates

Banking Client Service Resume

c.ymcdn.com

c.ymcdn.comBanking Service Manager Resume

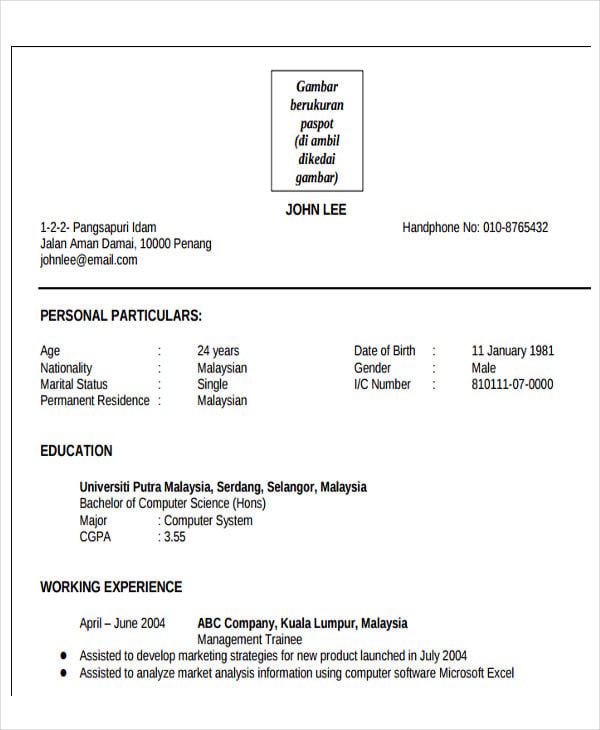

fsktm.upm.edu.my

fsktm.upm.edu.myBanking Service Officer Resume

js101.in

js101.inBanking Officer Resume Templates

Banking Loan Officer Resume

dayjob.com

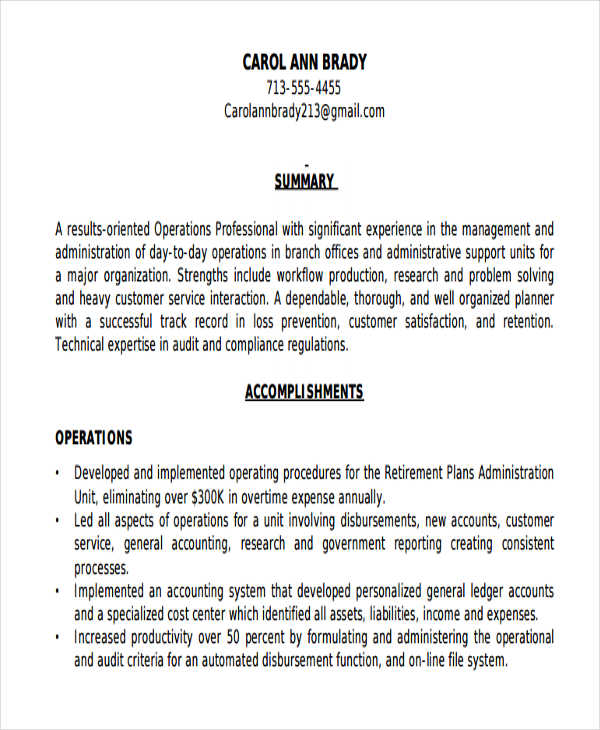

dayjob.comBanking Operations Officer Resume

chameleonresumes.com

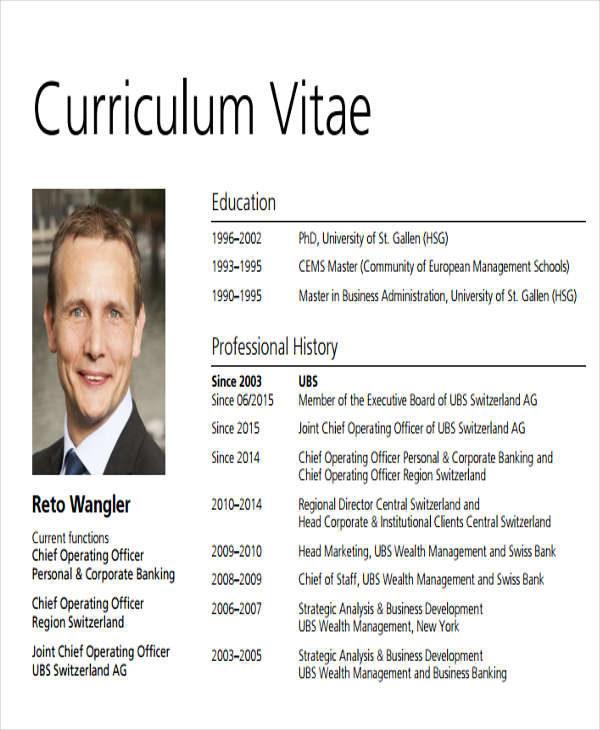

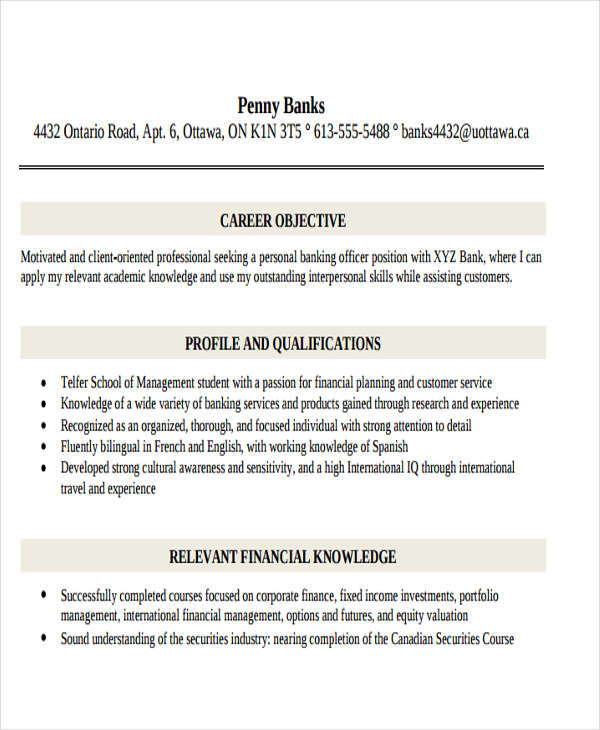

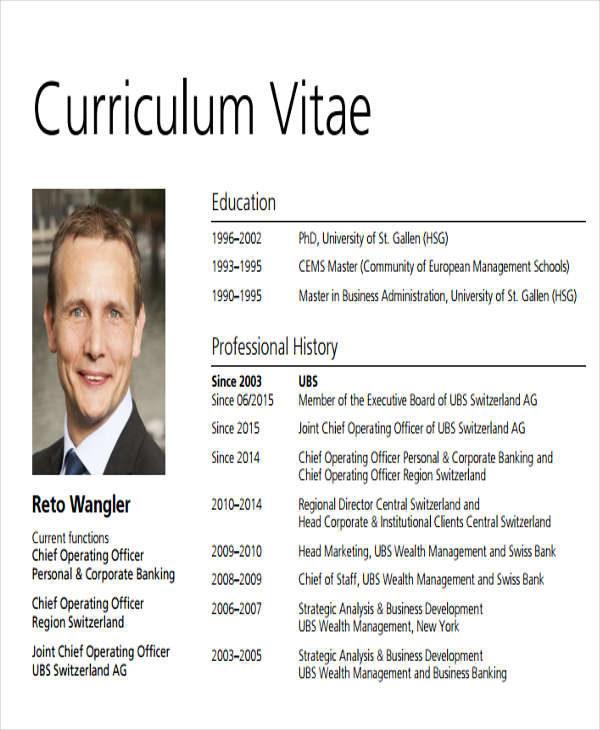

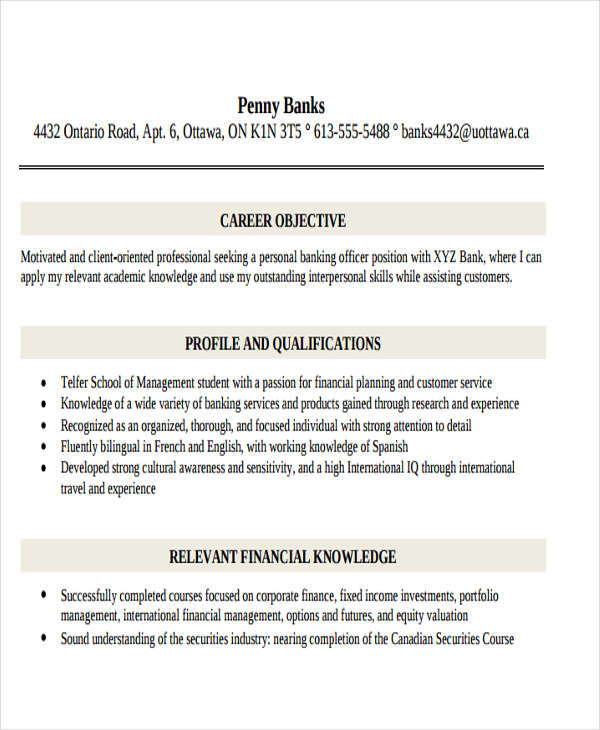

chameleonresumes.comPersonal Banking Officer Resume

ubs.com

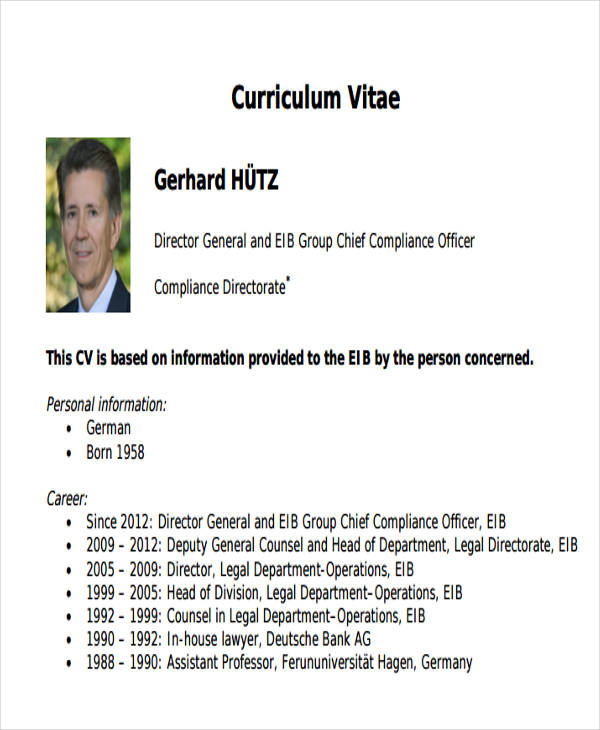

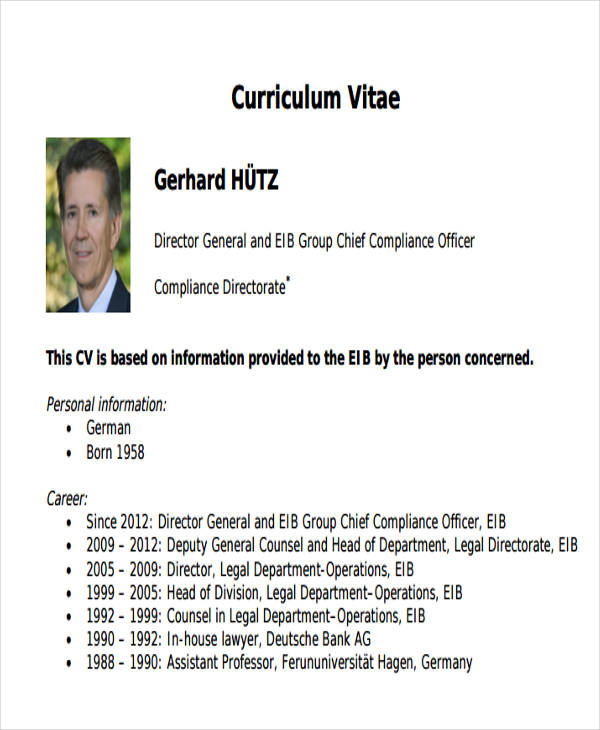

ubs.comBanking Compliance Officer Resume

eib.europa.eu

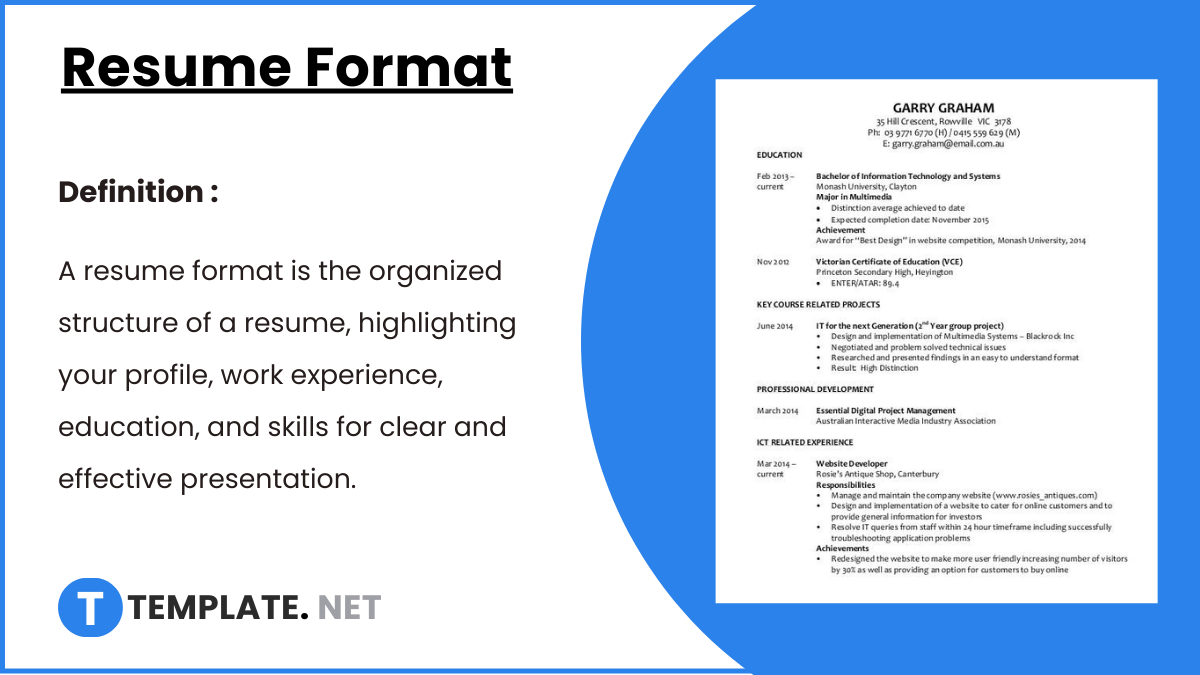

eib.europa.eu3. What Are the Types of Resumes?

- Chronological. This type of chronological resume focuses on the previous work experience and lists them chronologically from the more recent to the first one.

- Reverse Chronological. Similar to the chronological type but instead of listing the employment history with the most recent first, the first one on the list is the applicant’s first ever work experience.

- Functional. This type of functional resume focuses more on the applicant’s skills and abilities rather than the work experience. This resume is good for first-time applicants with no previous work experience.

- Combination. This particular kind of resume uses the strengths of the chronological and functional resume. Combination resumes give focus on both the work experiences and skills of an applicant. This is usable for work candidates who have a great employment record and is also backed-up with technical skills and other abilities relevant to the job post that he/she is applying for.

- Targeted. A more complex type of resume which is more personalized to suit the company’s requirements. This targeted resume may be time-consuming to make and is not advisable when submitting to multiple employers but this type of resume will usually stand out from among the rest.

4. How to Write a Resume for a Banking Job?

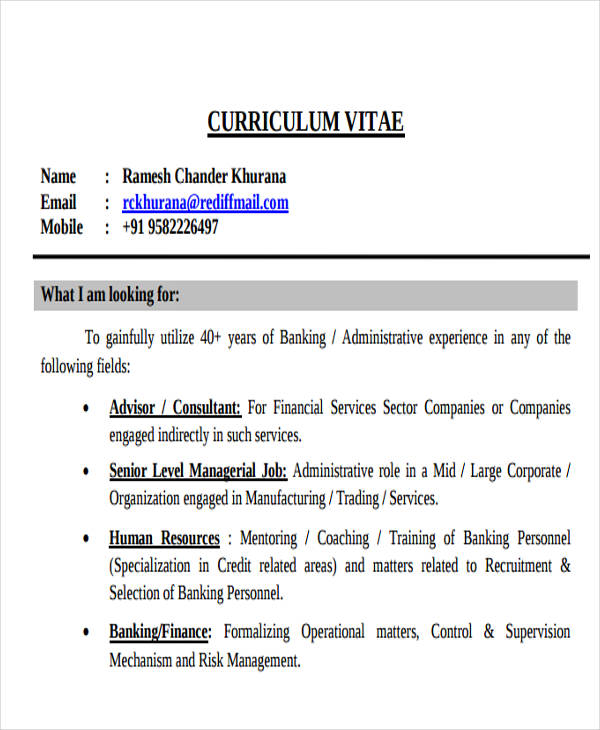

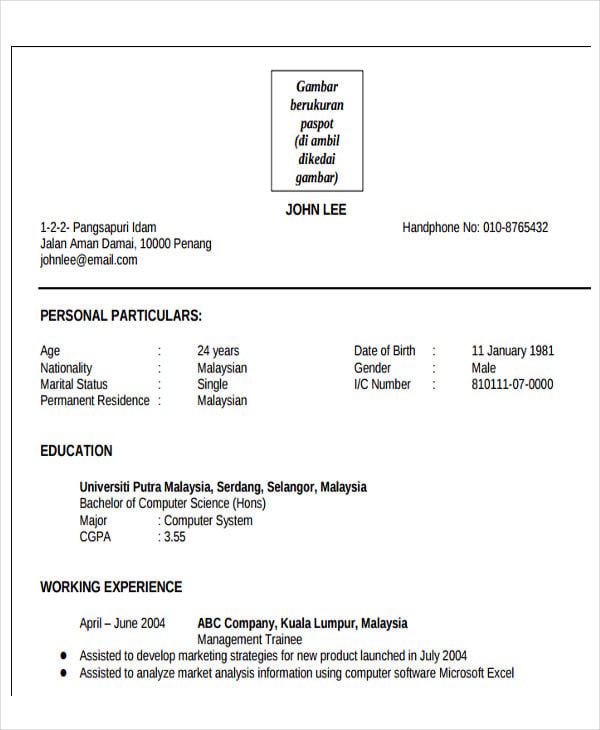

- Write your Full Name and Basic Contact Details. Depending on the format that you would like to use, your full name and contact details may be on the right, left, or center part of your document’s upper portion. Your name should have the biggest font for memory retention. Included in this area of your banking resume is your e-mail and mailing address, your mobile number and any other platforms where you may be reached by your prospective employer. You may also see Printable Executive Resume Templates.

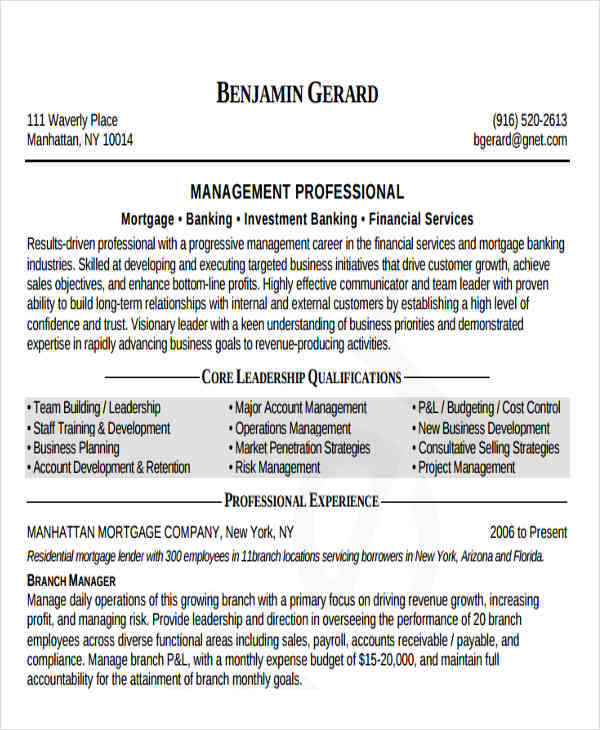

- Write an Executive Summary. An executive summary is a four to six sentence statement at the top of your resume. It summarizes your relevant experience and the skills that you can bring to the position.

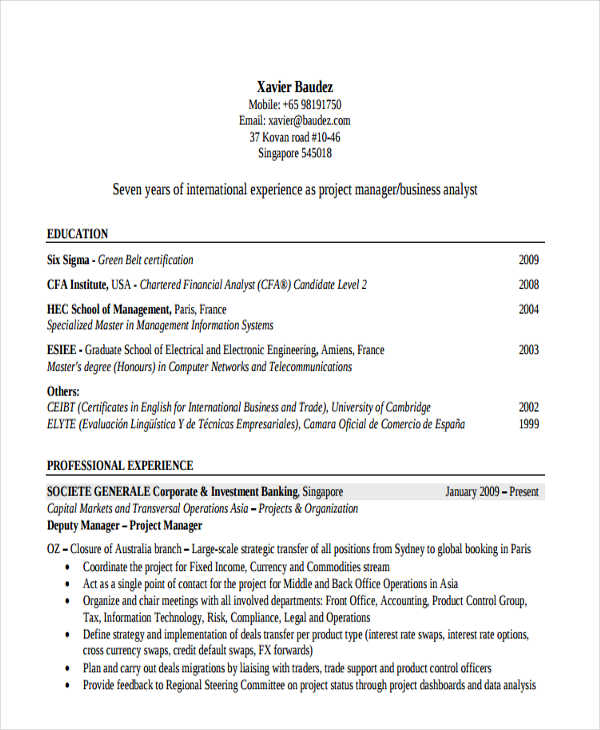

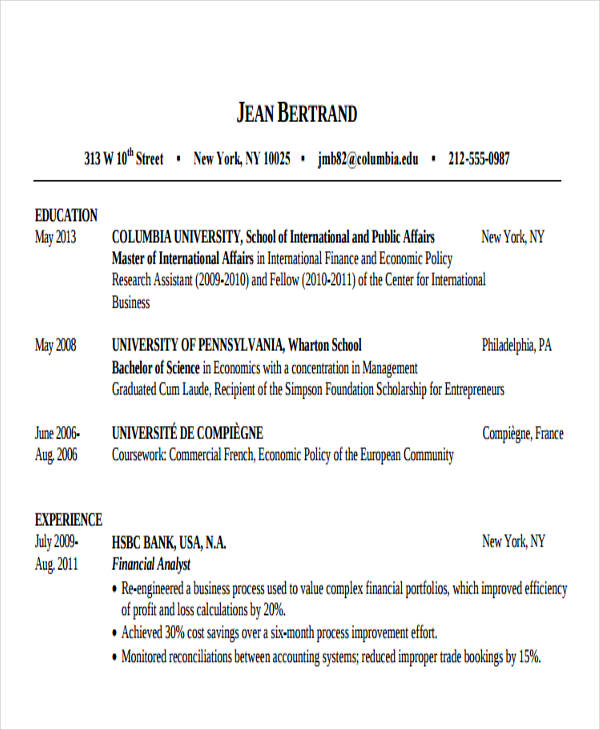

- State you Educational Background. This section should list the schools you attended, the degrees you received, your grade point average, and any awards you won. It is not necessary to include high school education unless you are just beginning your career or it was the only degree you received.

- Indicate your Work and Leadership Experience. Here you should list relevant work experiences that you have held along with internships or other volunteer work. You do not need to include every job you have ever performed, focus on the most relevant experiences. Include the name of your employer, the inclusive dates you worked for them and the location of the job. After providing this information, describe your experience in bullet points. When doing so, focus on particular accomplishments that demonstrate your ability to meet the qualifications of the job you are applying for. You may also see Creative Resume Templates.

- List Down your Skills. This can include a combination of advanced skills like specific techniques and computer programming abilities as well as simple skills, which typically refer to your ability to deal with people. Include explanations that demonstrate that you have been able to exercise these skills in the past.

- Stick to Standard Formatting. Although it might be tempting to decrease the font size or page margins to fit more onto your resume, you should avoid giving in to this temptation. Never reduce the margins below .5 inches and stick to the standard 1-inch margins, if possible. Try to use size 11 font, but between the two, it is better to reduce the font size than the margins.

- Proofread. Because banking is a detail-oriented occupation, analysts will quickly recognize formatting or typing errors and judge you for them. After completing your resume, you should take some time before returning to edit it with less-stressed eyes. Print it out and find a trusted person to review it and look for errors in grammar and spelling.

For even more resume templates, you may also check out our collection of Hostess Resume Templates, Sample Sales Manager Resume Templates, and Pharmacist Resume Templates.

Banking Representative Resume Templates

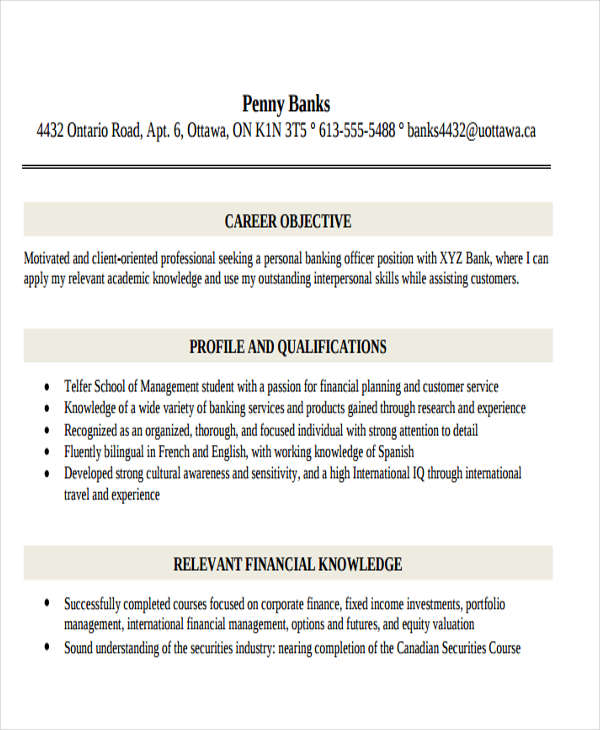

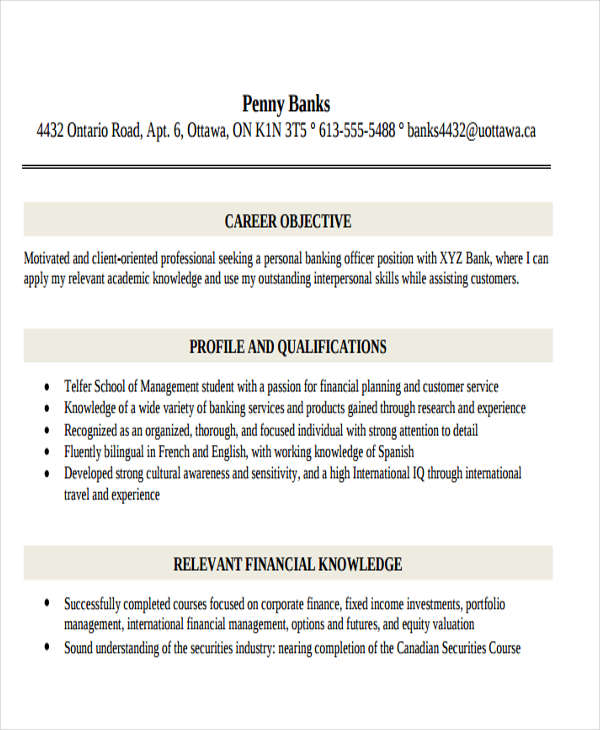

Banking Customer Service Representative Resume

telfer.uottawa.ca

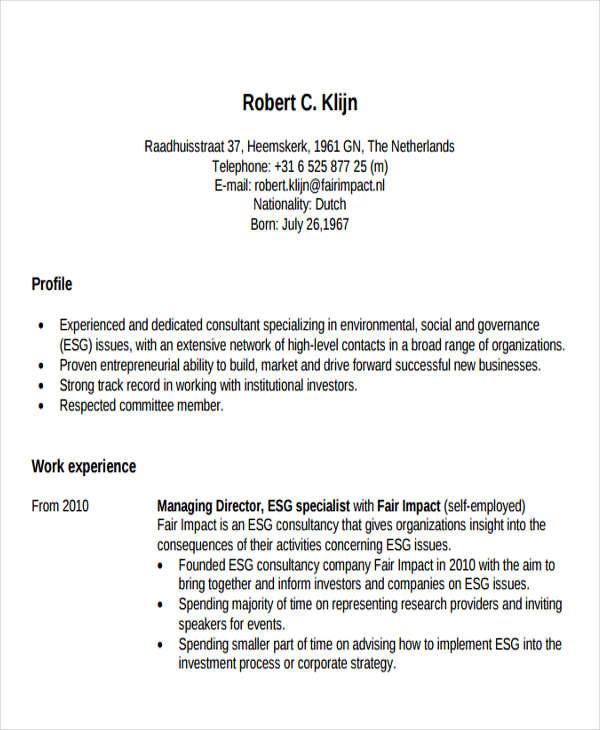

telfer.uottawa.caBanking Sales Representative Resume

fairimpact.nl

fairimpact.nlPersonal Banking Representative Resume

telfer.uottawa.ca

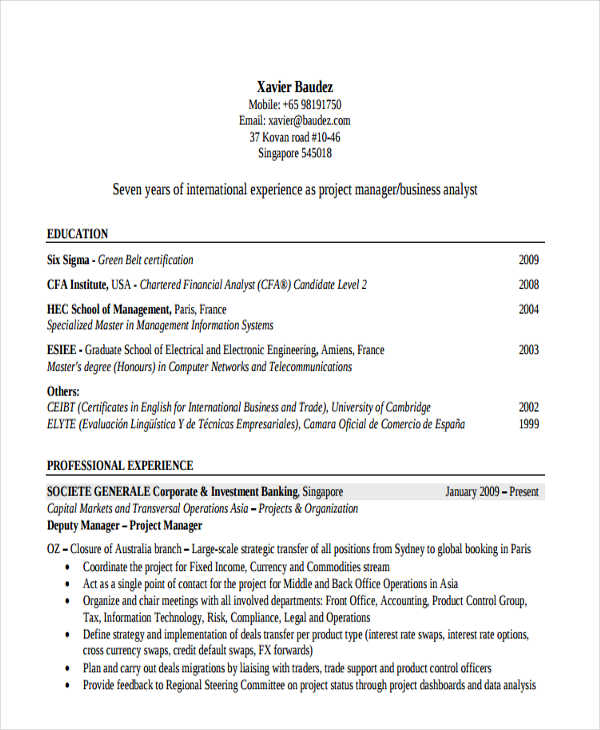

telfer.uottawa.caBanking Analyst Resume Templates

Banking Credit Analyst Resume

getinterviews.com

getinterviews.comBanking Operations Analyst Resume

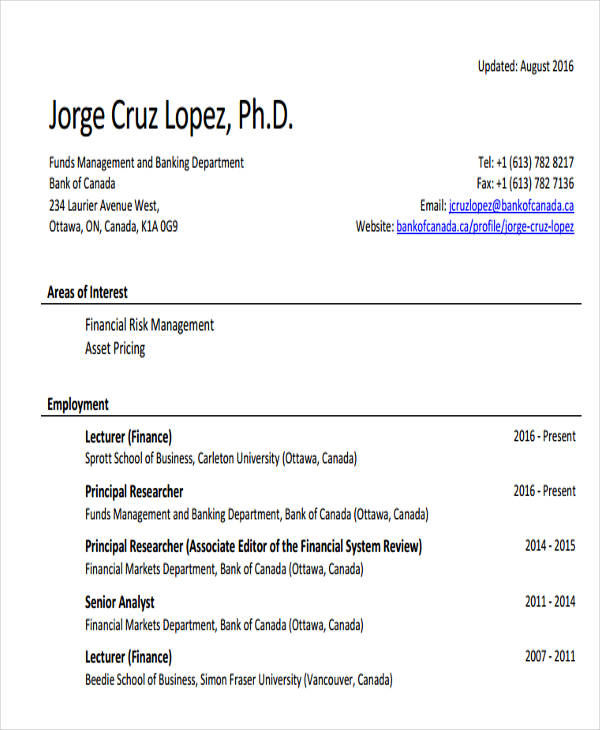

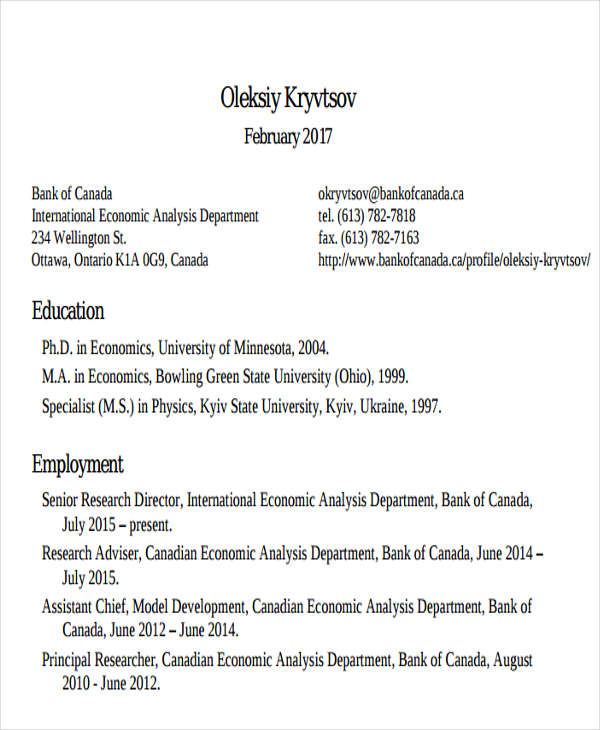

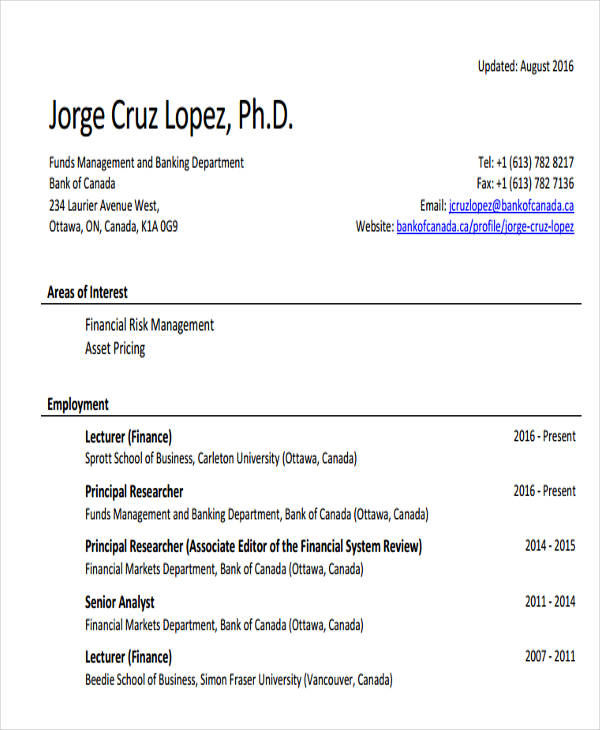

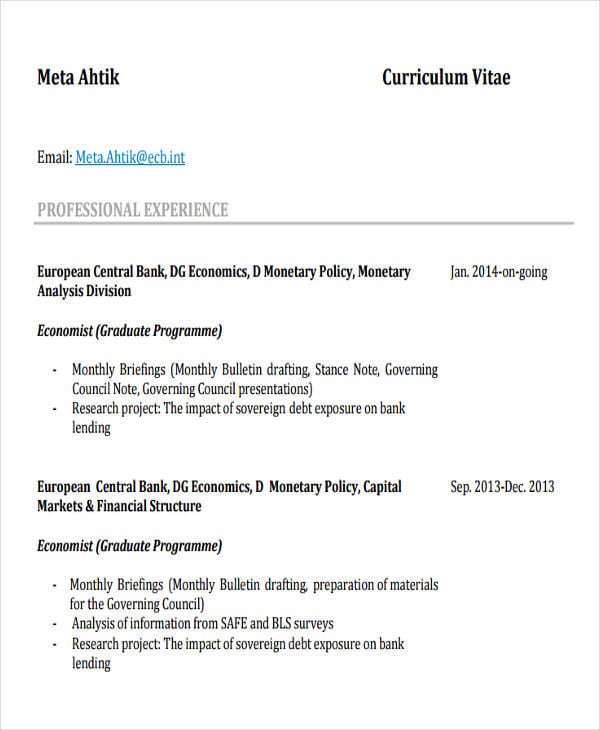

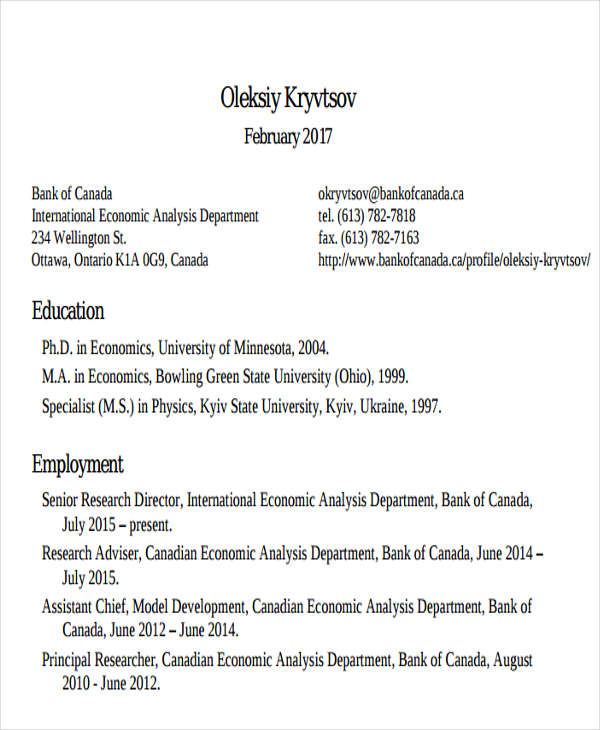

bankofcanada.ca

bankofcanada.caBanking Data Analyst Resume

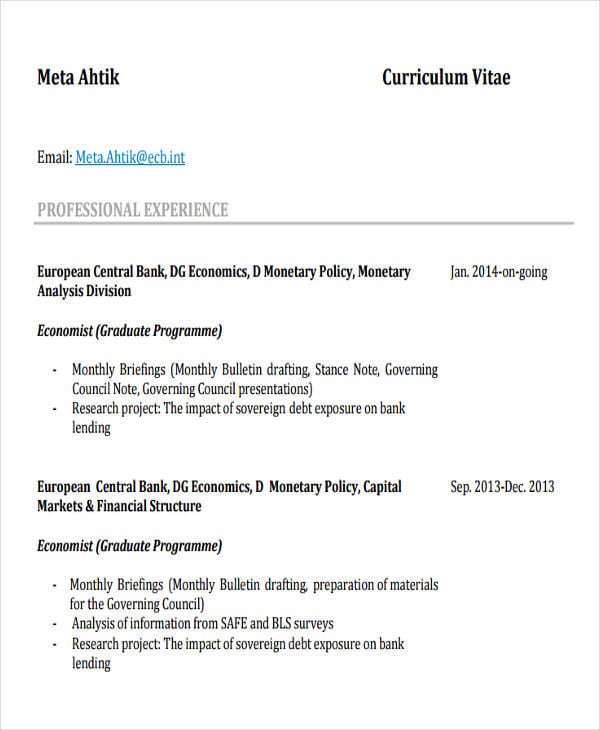

pf.uni-lj.si

pf.uni-lj.siBanking Research Analyst Resume

bankofcanada.ca

bankofcanada.caBanking Assistant Resume Templates

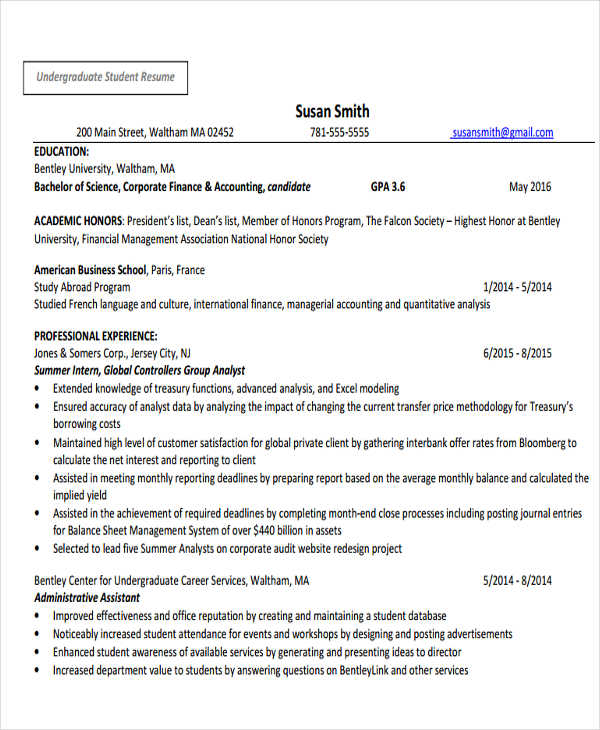

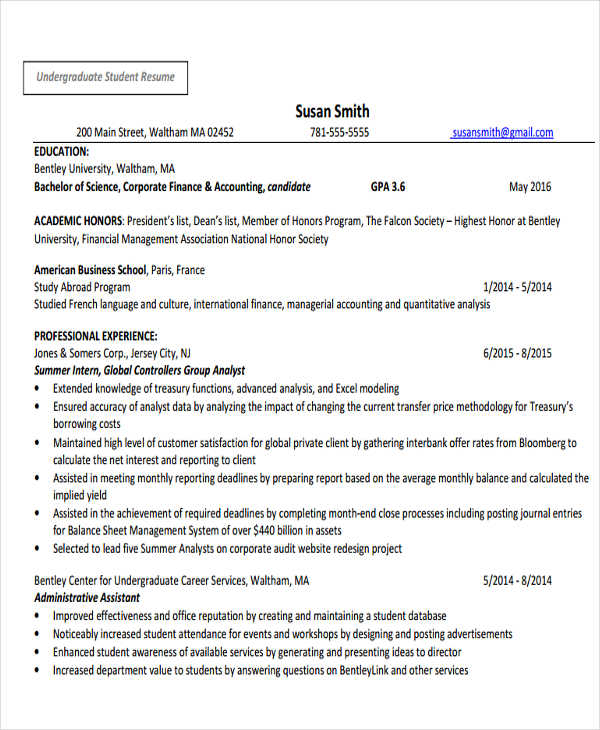

Banking Administrative Assistant Resume

bentley.edu

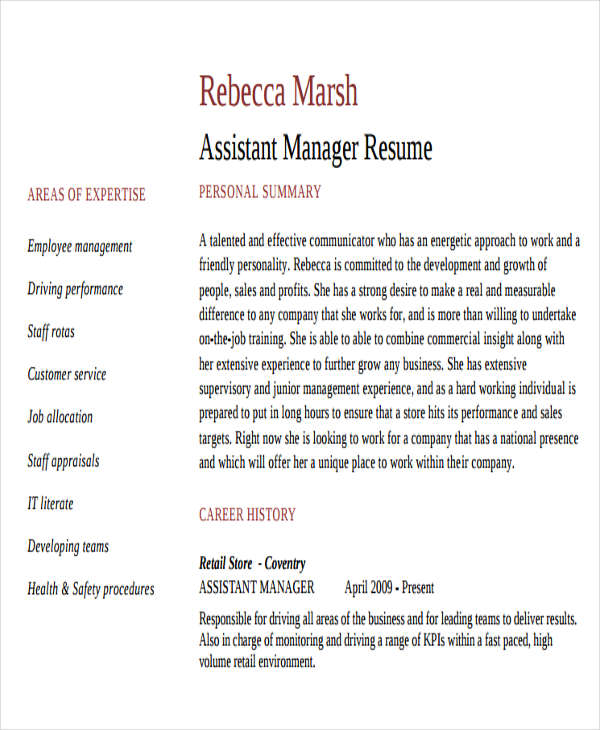

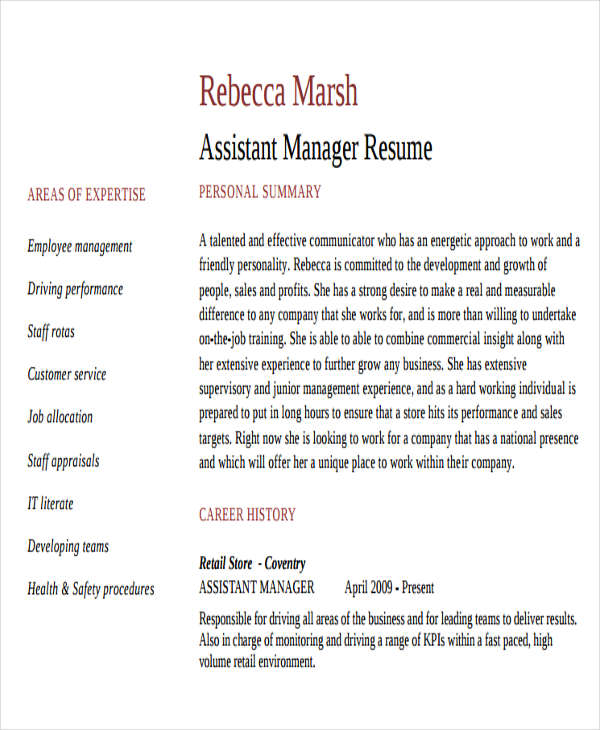

bentley.eduBanking Assistant Manager Resume

dayjob.com

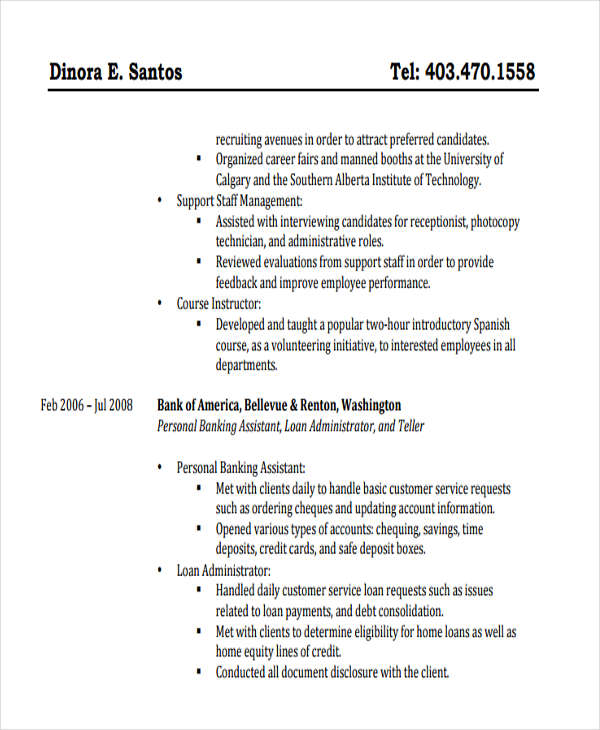

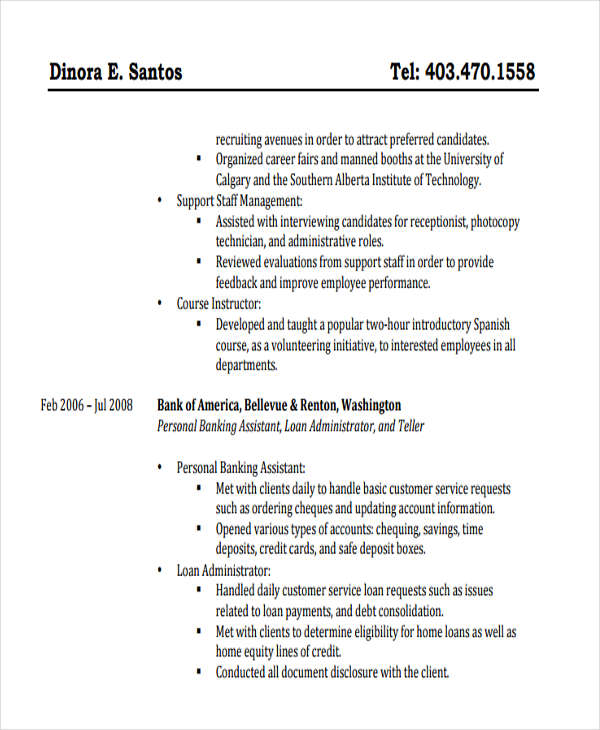

dayjob.comPersonal Banking Assistant Resume

landman.ca

landman.caBanking Consultant Resume Templates

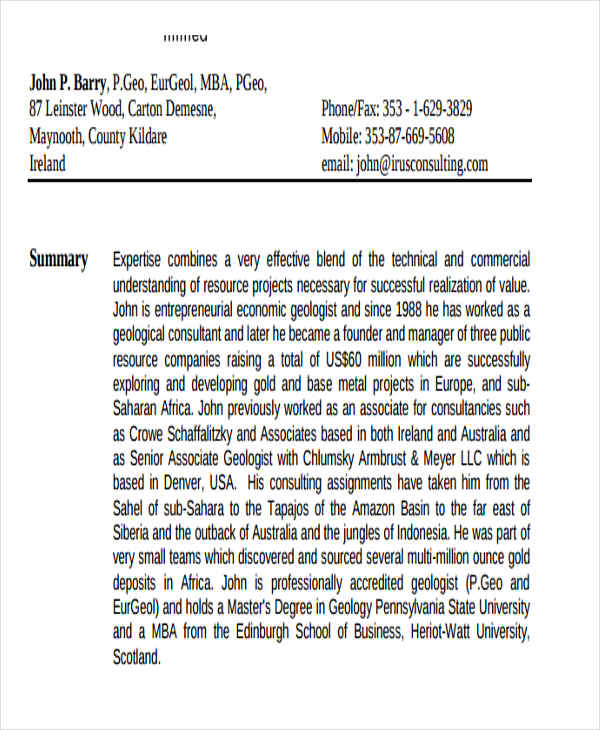

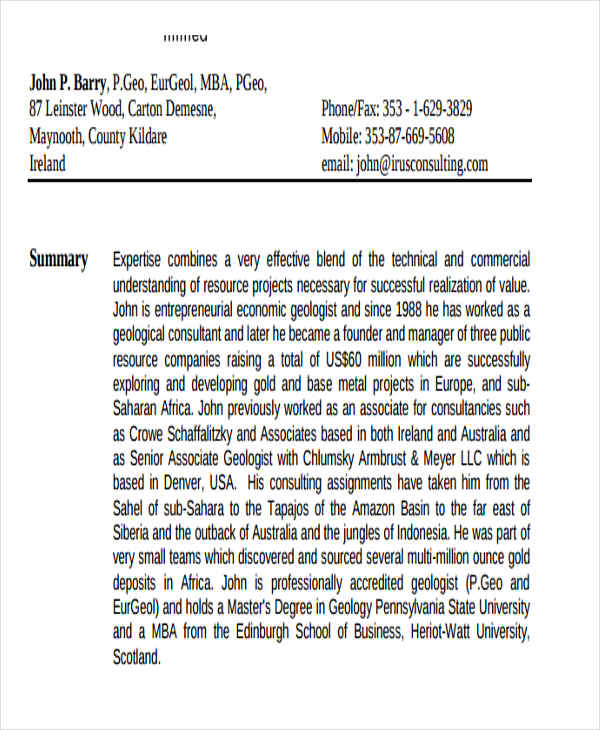

Retail Banking Consultant Resume

irusconsulting.com

irusconsulting.comBanking Sales Consultant Resume

ceibs.ch

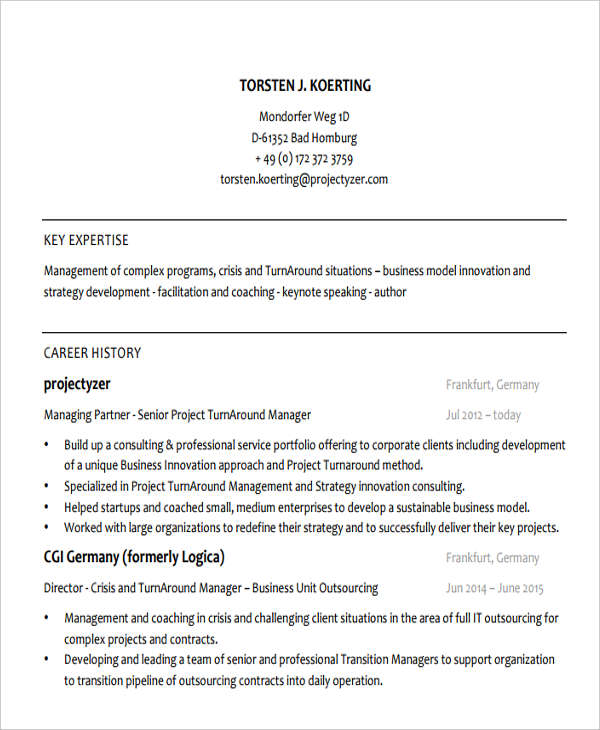

ceibs.chSample Banking Consultant Resume

vault.com

vault.comBanking Customer Service Resume Templates

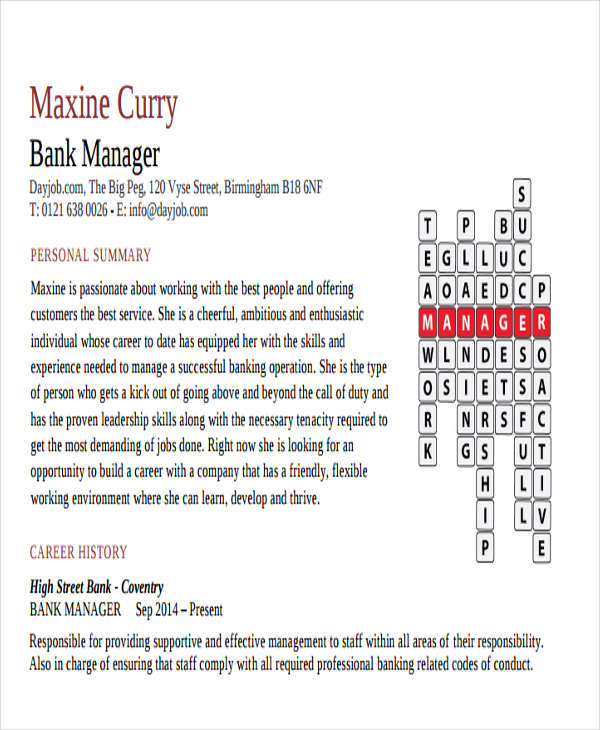

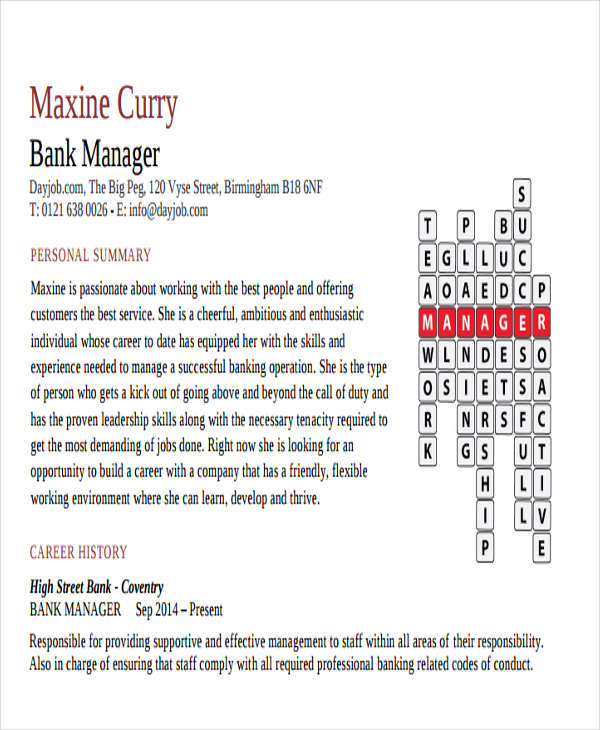

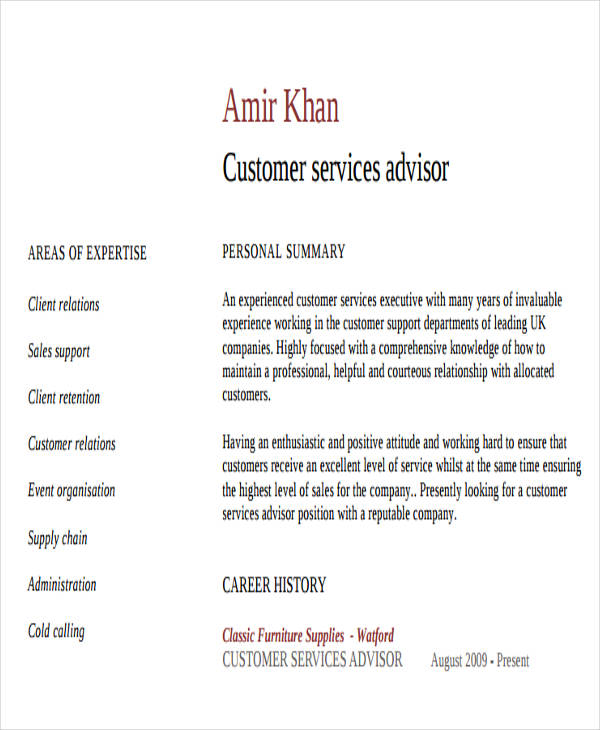

Banking Customer Service Manager Resume

dayjob.com

dayjob.comBanking Customer Service Adviser Resume

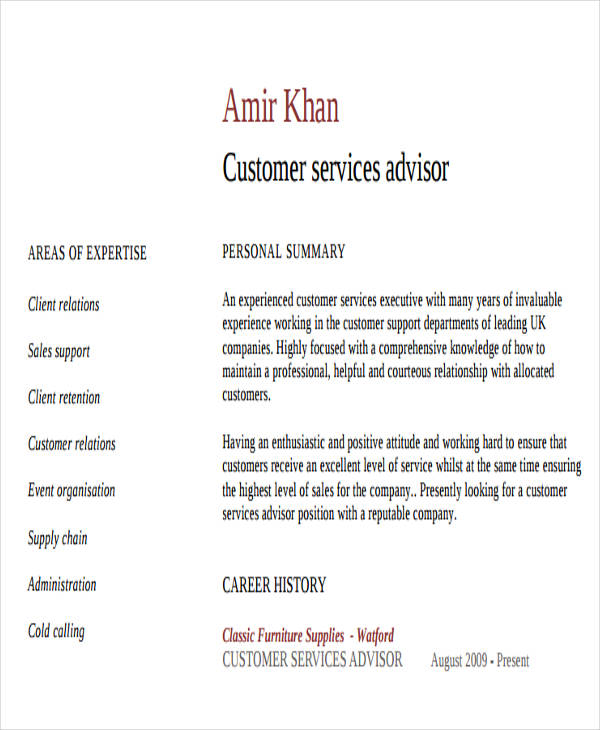

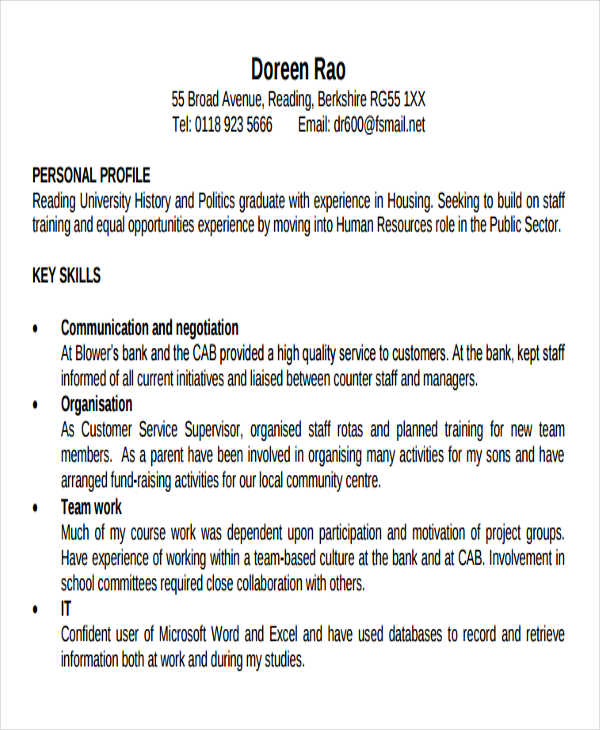

dayjob.com

dayjob.comBanking Customer Service Officer Resume

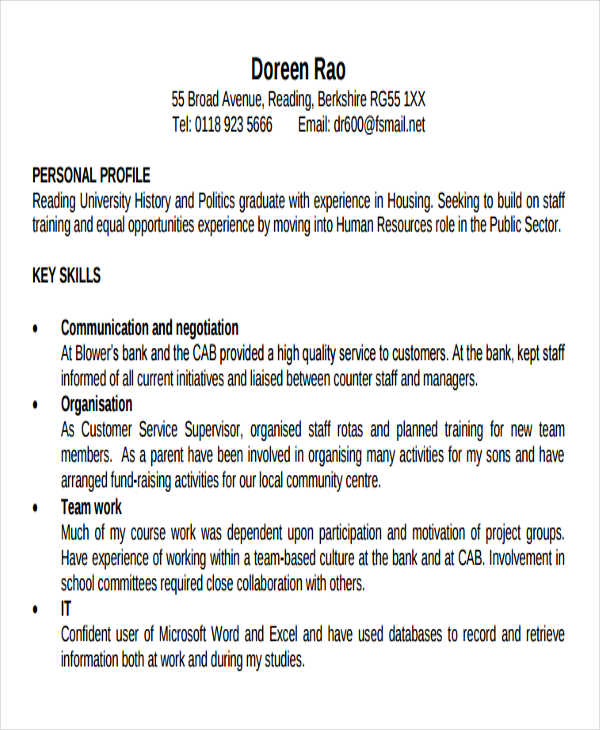

reading.ac.uk

reading.ac.ukRetail Banking Customer Service Resume

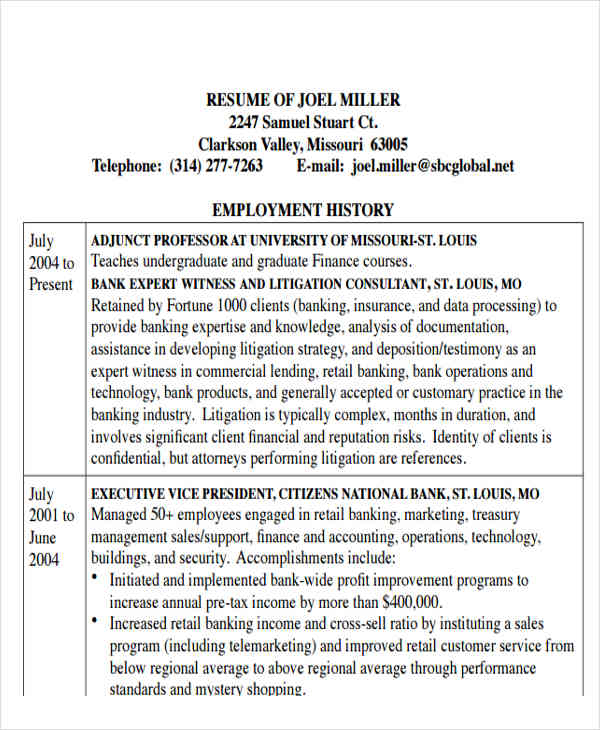

business.umsl.edu

business.umsl.edu5. How Can You Become a Banker?

- If you have finished high school, you can either be a loan officer or a bank teller. But if you have a degree in finance, accounting, or something related, then you can be a financial manager or analyst.

- Get an internship to provide you with the needed experience in the field and give you an understanding of banking policies and regulations.

- Enroll in an investment banking program to learn about the strategies involved in making investments and working with clients.

- Decide what type of position matches your current skill set and education.

- Though not really required, you may want to get certified to make yourself more appealing to employers.

- You may consider getting a Master’s Degree in Business Administration to prepare you to work in higher level banking positions.

- Get yourself an employer.

6. How to Write a Resume 101

- Make your resume as honest, convincing, and realistic as possible, and refrain from making it into something that will let the employers believe that you are someone who is too good to be true.

- Draw the employer’s attention to the information and details on your resume by being creative.

- When mentioning your skills and qualifications, show them what you have accomplished instead of just stating what you can possibly do for the company.

- Invest in good quality, white paper with matching envelopes if you choose to send your application documents personally or through the mail.

- Sell yourself by not just telling the employer what you did in your previous company, let them know the details of your previous work and how you were able to contribute to your previous company

- Avoid from submitting generic resumes to different job positions. Making an individual resume for each job position shows the employer that you have made an effort to making your resume.

7. Why Download our Templates?

- These templates were selected from among the best ones on the internet and were written by knowledgeable professionals who wish to provide you with as much assistance as you need in writing resumes.

- These templates come in PDF format and can be downloaded easily and for free.

- You are assured of clear and legible printouts with our high-resolution templates.

- These templates are fully editable as long as you have the licensed version of Adobe Acrobat or Foxit Reader.

Before you leave, don’t forget to check out our collection of Sample Executive Resumes, HR Resume Templates, and Sample Photographer Resumes.

dayjob.com

dayjob.com wcupa.edu

wcupa.edu liljaunlimited.com

liljaunlimited.com mobilinkbank.com

mobilinkbank.com anexpertresume.com

anexpertresume.com c.ymcdn.com

c.ymcdn.com js101.org

js101.org business.ku.edu

business.ku.edu warrington.ufl.edu

warrington.ufl.edu legacy.iza.org

legacy.iza.org haigazian.edu.lb

haigazian.edu.lb web.xrh.unipi.gr

web.xrh.unipi.gr indiansmechamber.com

indiansmechamber.com intranet.msit.org

intranet.msit.org resume-resource.com

resume-resource.com sipa.columbia.edu

sipa.columbia.edu southeastern.edu

southeastern.edu surrey.ac.uk

surrey.ac.uk samuelm.com

samuelm.com resume-resource.com

resume-resource.com distinctiveweb.com

distinctiveweb.com fairimpact.nl

fairimpact.nl michiganross.umich.edu

michiganross.umich.edu bmcc.cuny.edu

bmcc.cuny.edu experts.com

experts.com c.ymcdn.com

c.ymcdn.com fsktm.upm.edu.my

fsktm.upm.edu.my js101.in

js101.in dayjob.com

dayjob.com chameleonresumes.com

chameleonresumes.com ubs.com

ubs.com eib.europa.eu

eib.europa.eu telfer.uottawa.ca

telfer.uottawa.ca fairimpact.nl

fairimpact.nl telfer.uottawa.ca

telfer.uottawa.ca getinterviews.com

getinterviews.com bankofcanada.ca

bankofcanada.ca pf.uni-lj.si

pf.uni-lj.si bankofcanada.ca

bankofcanada.ca bentley.edu

bentley.edu dayjob.com

dayjob.com landman.ca

landman.ca irusconsulting.com

irusconsulting.com ceibs.ch

ceibs.ch vault.com

vault.com dayjob.com

dayjob.com dayjob.com

dayjob.com reading.ac.uk

reading.ac.uk business.umsl.edu

business.umsl.edu