30+ Blank Work Schedule Templates

Blank work schedule templates provide you with an unprecedented range of flexibility. The most important feature of these templates is…

Sep 13, 2023

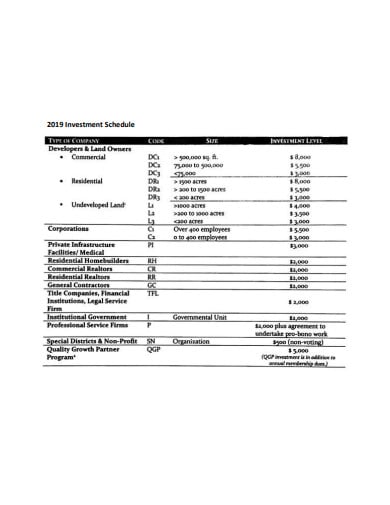

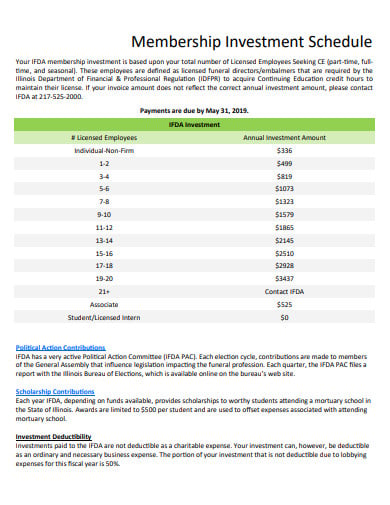

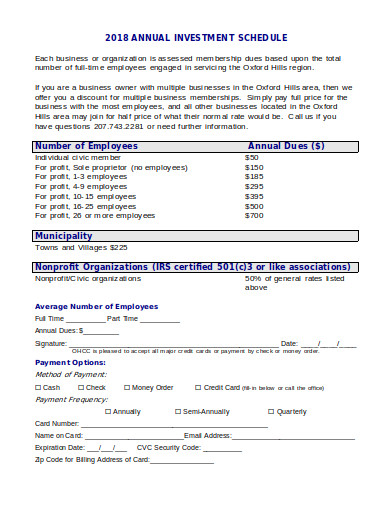

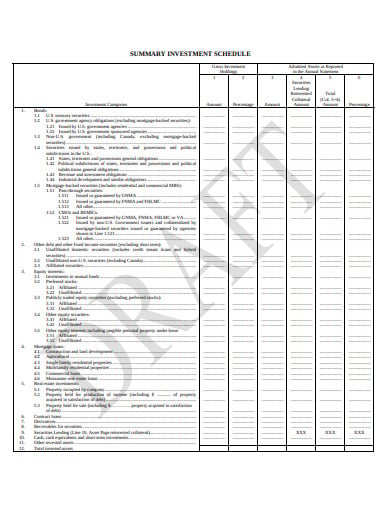

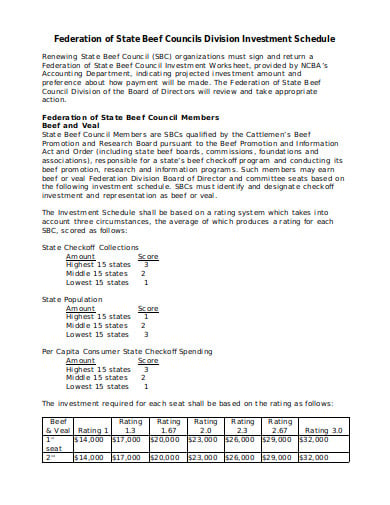

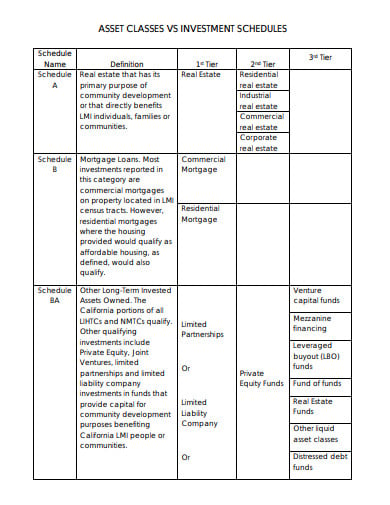

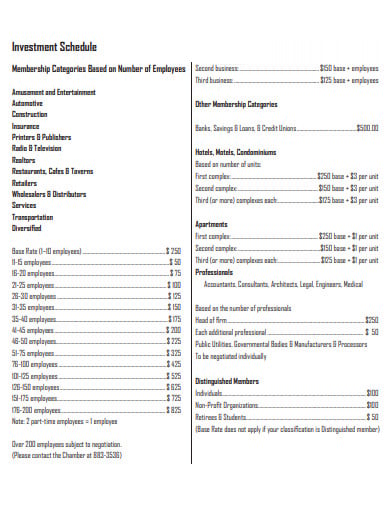

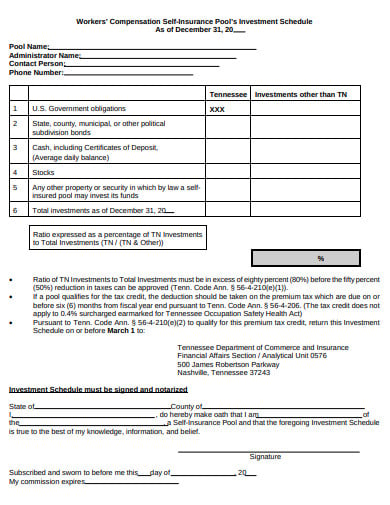

The investment schedule refers to the connection that is seen between investment and the national income level. The investment schedule comprises three elements namely autonomous investment, replacement investment, and induced investment. The investors’ conduct against new investment is formulated in the sense of the Capital Marginal Capacity or Investment-Demand Schedule plan.

westhouston.org

westhouston.org iucu.org

iucu.org cdn.ymaws.com

cdn.ymaws.com core.windows.net

core.windows.net naic.org

naic.org r-calfusa.com

r-calfusa.com insurance.ca.gov

insurance.ca.gov hancockcountyiowa.com

hancockcountyiowa.com core.windows.net

core.windows.net greaterbeloitworks.com

greaterbeloitworks.com orangetexaschamber.org

orangetexaschamber.org tn.gov

tn.govThe conduct of the investors concerning new investment is developed in the form of the Capital Marginal Efficiency Calendar or Investment schedule plan. This indicates a functional relationship between the MEC and the amount of investment in a particular type of capital asset during a given period. The MEC is the rate of discount that equates to the expense of the system the present value of a collection of cash flows obtainable from an income-earning commodity like a machine over the whole of its economic life. The MEC is the rate of return at which a project will break-even.

Investment is the independent variable that is dependent on the MEC. As more and more investment is made in a capital asset, the MEC keeps falling. This means that a rising function of the marginal productivity of capital is the demand for capital assets of any kind. Where there is increased investment in any type of capital over any period, the marginal productivity of that type of capital will decrease as the investment in it increases, partly because the prospective return will decrease as the supply of that type of capital increases; and partly because, as a rule, the demand on the production facilities of that type of capital will affect its scale. The marginal efficiencies of all forms of capital assets are organised in an ascending order that may be rendered over a given period reflect the schedule of the investment’s marginal effectiveness. When deciding the amount of profit and tasks, the location and shape of the investment-demand schedule are of major importance.

The investment plan consists of several elements:

It is the investment that is related to non-income variables such as technological change and cost-cutting which will be performed regardless of the level of income.

It is the investment that is required to maintain the existing capital stock of the economy and which appears to differ in line with changes in national income rates, as a greater amount (in absolute terms) of replacement investment is required to maintain the existing capital stock of the economy as national income and increase in output.

It is the investment that occurs when rising demand puts pressure on existing capacity and increases productivity, thereby motivating companies to invest further.

MEC and interest rate are the two main factors that affect investment volume and these two must be calculated independently of each other in advance. MEC is the product of the supply price and the prospective yield of the capital asset Interest rate is the price paid for loanable funds and dictated by the demand for and supply of loanable funds, like any other commodity. A potential investor will continue to balance the MEC against the prevailing interest rate for new investments. The investment will continue to be made as the MEC exceeds the interest rate until the MEC is equalized and the interest rate is equalized. Once the MEC equals the rate of interest, the equilibrium investment will be determined. Therefore, if the spending has to be increased, either the interest rate will be reduced or MEC will rise.

Both the MEC and the interest rate are significant determinants. However, the contribution by Keynes relates primarily to the latter. He pointed out effectively that investment demand is inelastic interest, and that the MECC affects investment much more than the interest rate. The interest rate is important for successful fiscal policy implementation (especially debt management). However, as a way of influencing private investment, if the marginal production schedule is highly elastic it could be of value (as a determinant of income and employment).

In general theory, volatility is attributed to demand changes and the resulting shifts in the MEC and not to interest rates. We were used to describing the ‘crisis’ to emphasize the increasing interest rate phenomenon under the impact of increased demand for money for both trade and investment purposes. Certainly, this aspect can sometimes play an aggravating, and perhaps sometimes an initial part. Yet it is believed that a more common and often prevailing explanation of the crisis is not simply an interest rate rise but a sudden collapse in the capital’s marginal performance.

A shift in the investment-demand schedule is triggered by a change in capital’s marginal output due to changes in complex factors such as technological advancement, market expectations, etc. Technological progress creates opportunities for investment and thus increases the timetable for investment-demand. Likewise, discovering new wealth or territorial expansion or population growth would also create new prospects for investment and move the investment-demand curve upward. In the short term, however, shifts throughout entrepreneurs’ market expectations primarily influence the role of the investment-demand schedule.

Blank work schedule templates provide you with an unprecedented range of flexibility. The most important feature of these templates is…

Timetable templates are essential tools for managing time effectively, whether for personal, educational, or professional use. These templates help organize…

Keep an eye on how you spend your hours with this hourly schedule template absolutely free. This resourceful hourly schedule…

When your organization wishes to hire new employees in the organization. The plan and the strategy are the outlines for…

The only difference between successful and the rest of the crowd is that successful people plan every single day of…

A maintenance schedule tells and records weekly, monthly, quarterly, and yearly property and facility repairs and checkups needed for your…

If you’re management personnel, a production schedule template download never goes to waste irrespective of the industry you are involved…

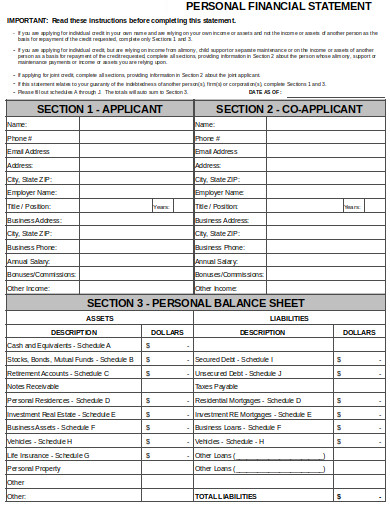

Managing the Financial Statement and payment can be nerve-wracking and complicated. If you want to create a breakdown or list…

nanny daily schedule nanny work schedule nanny weekly schedule nanny routine schedule nanny baby schedule nanny cleaning schedule Schedule Template…