Best AI Text to Video Models & Templates

1. Google Gemini / Veo 3.1 https://images.template.net/wp-content/uploads/2025/12/Google-Gemini-Veo-3.1.mp4 This Google Gemini tool is for creating high-quality AI videos from text or…

Jul 18, 2024

You probably have a great business idea in mind and probably a foolproof strategy on how to operate it successfully, but the only problem is you are short in the financial department. This is often the most common scenario for any aspiring entrepreneur today. No matter how great your ideas are, if you do not have enough cash to start with, then your hopes of opening your very own business will remain a dream. You may also see loan templates.

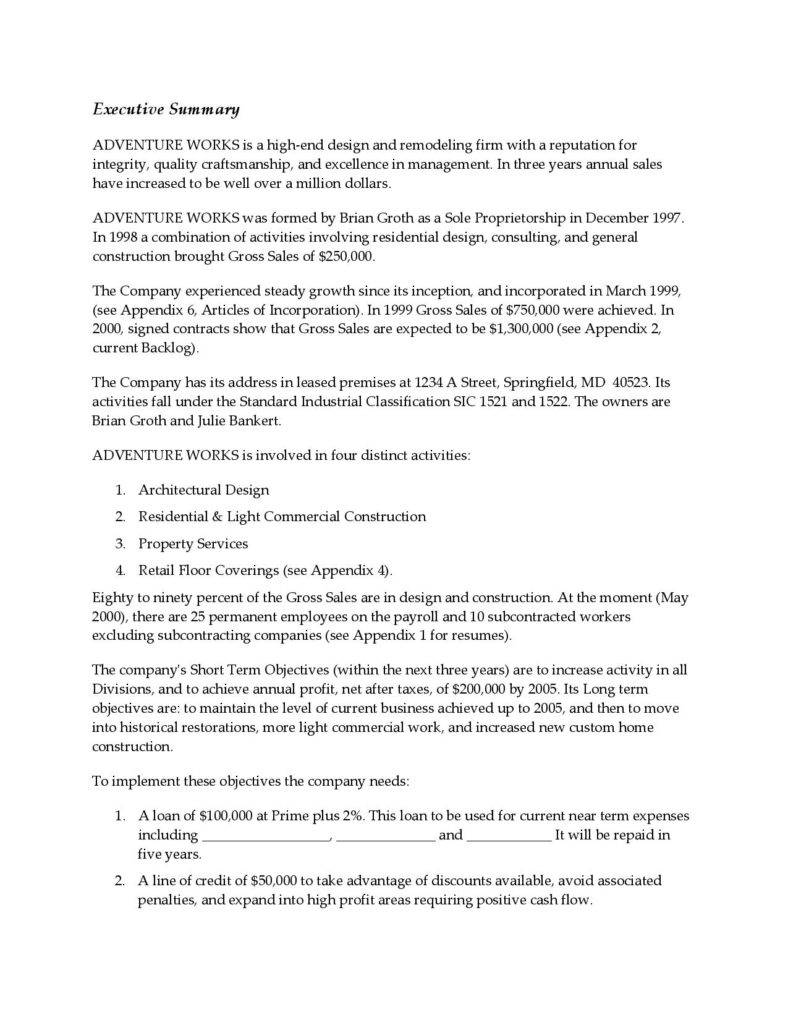

If you have the drive and motivation to really start a business, you will not be surprised to learn that there are various ways to secure sufficient financing. There are a lot of investors out there who might potentially want to put their trust and confidence on your business idea. A great way to convince them is by learning how to write a successful business plan. If you are not very well-acquainted with how your business plan should look like, you can check out the sample business plan templates below:

You may also want to download our business plan templates and use them as your reference to convince a prospective investor to bankroll a capital on your business.

Unfortunately, no matter how good your business plan is, it does not guarantee you that investors will grant you the funding you need. However, there is another way in which you can still obtain the cash you need. Securing a loan from a reputable bank or financial institutions is your next bet. Numerous small businesses found loans reliable since most investors may hesitate to bank their capital on a small startup business. All you need to do is convince the banker or the lender that he will make a profit from your business and your commitment to pay your obligations to them. For a wider selection of small business invoice templates, check out more options here.

Sounds tough, huh? Do not worry because in this section, we will give you a rundown on how you can effectively and successfully secure a loan to start your business.

Your credit history and score play a critical factor in securing a loan. Whether you are planning to open a business or requiring additional financing, your personal credit history and score are strictly evaluated before the bank or any financial institution will grant your loan. To review your credit history, make sure to request them from major credit reporting agencies. Find more business loan templates by visiting this link. You may want to check and read our article, “What Is a Credit Report and Why Is It Important?”.

Once you have made sure that your credit history and score are flawless, the next step to take is to research for banks and financial institutions with a great reputation. This is a crucial step to make because if you happen to do business with scrupulous lender, instead of your business flourishing with your loaned money, chances are they are going to suck every cent you have by imposing high interest rates and hidden charges. View a wider selection of startup business plan templates right here. The best way to avoid it is by researching on their background and knowing what their past customers have to say about their services.

Before writing a loan application, it is crucial to determine the amount of money to loan and make a plan on how you will use it. To make sure that you are able to address this issue, you will need to draft a budget plan that is well-supported with a realistic financial projection. Feel free to download our financial projection templates and make them your guide.

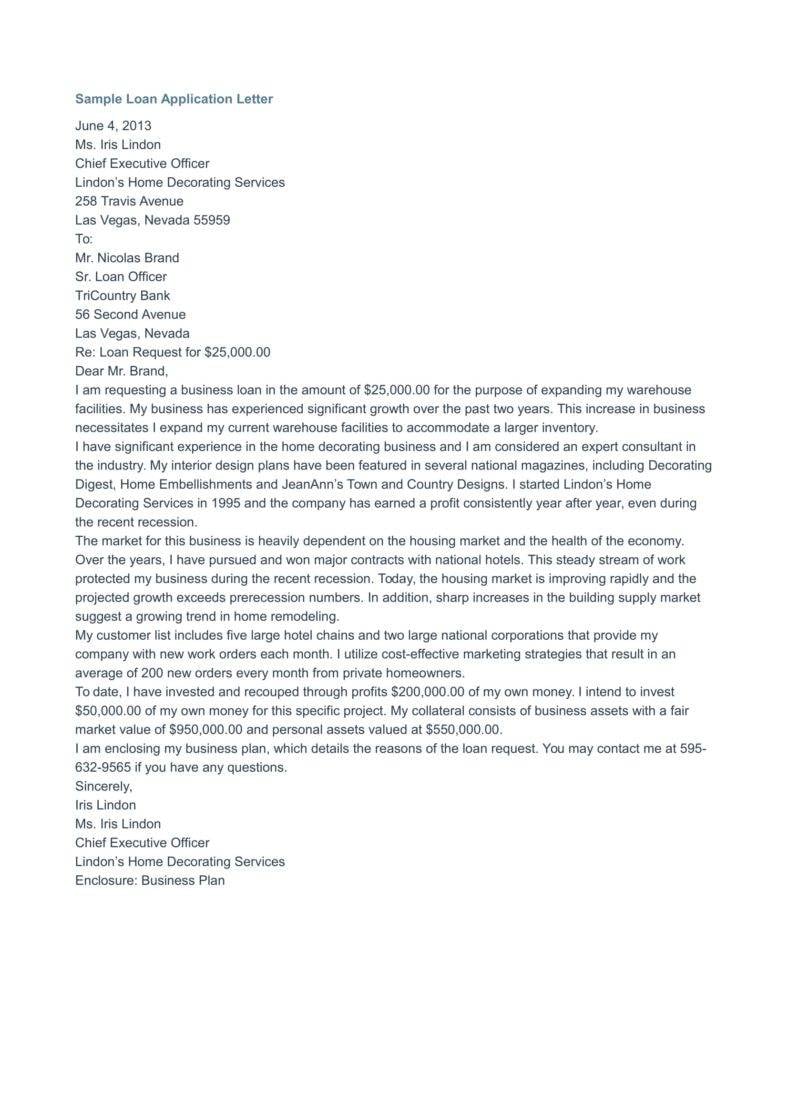

A loan application letter is prerequisite document that is submitted to a loan officer by someone who is hoping to secure a loan. In order to increase your chances for loan approval, you will need to make your letter compelling. However, you will also need to submit a business plan, showing an overview on how you plan to develop and grow your business successfully.

If you need a professional reference materials on how to write a convincing and compelling loan application letter, do not hesitate to download our sample loan application letters or check out the samples that are found below:

Now that we have reached the end of this article, we have hopes that we are able to provide you with useful tips and ideas on how to secure a loan essential for starting up a business venture. While the whole process of acquiring a loan can be a meticulous process, use our loan application letter templates as your reference. Just be yourself and have confidence that you will not only secure a loan but also make your business a huge success.

1. Google Gemini / Veo 3.1 https://images.template.net/wp-content/uploads/2025/12/Google-Gemini-Veo-3.1.mp4 This Google Gemini tool is for creating high-quality AI videos from text or…

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

Hospitality Induction Templates are structured guides created specifically for the hospitality industry to facilitate the onboarding process for new employees.…

Whether you are a business or an organization, it is important for you to keep track of your business bank…

A Company Description provides meaningful and useful information about itself. The high-level review covers various elements of your small business…

A smartly designed restaurant menu can be a massive leverage to any food business.

Whether you need to keep neat records of received payments, or are looking for a template that helps you look…

The most widely recognized use for a sample letter of planning is the understudy who, after finishing secondary school, wishes…

The term “quotation” can refer to several things. While to some it may refer to a quote, which is proverbial.…