Table of Contents

- What is Shared Appreciation Mortgage?

- Shared Appreciation Mortgage Pros and Cons

- 7+ Shared Appreciation Mortgage Templates in PDF | DOC

- 1. Shared Appreciation Financial Mortgages

- 2. Shared Appreciation Level Mortgage

- 3. Equity Shared Appreciation Mortgage

- 4. Shared Appreciation Mortgage Loans

- 5. Shared Appreciation Mortgage Capital

- 6. Investment Shared Appreciation Mortgage

- 7. Recapture Shared Appreciation Mortgage

- 8. Lender Shared Appreciation Mortgage

- 5 Steps to Shared Appreciation Mortgage Agreement

7+ Shared Appreciation Mortgage Templates in PDF | DOC

Living these days without debt is not an impossible thing to do. It takes a lot of smart decisions and control when it comes to spending your money. You’re lucky if you can purchase your property without loaning money. But for some, they need financial services from institutions that offer assistance related to monetary problems. There are good and bad parts of getting into debt. It depends on how you perceive and handle it. But you should take into consideration how your debt would come out in the long run. Everything goes down on how you negotiate with the lender and how you would approach these situations.

What is Shared Appreciation Mortgage?

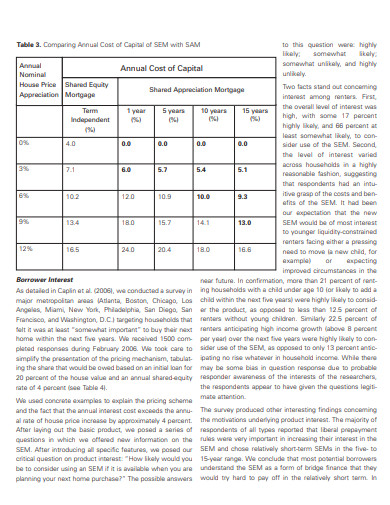

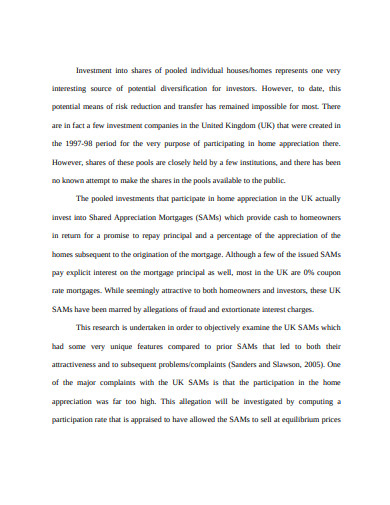

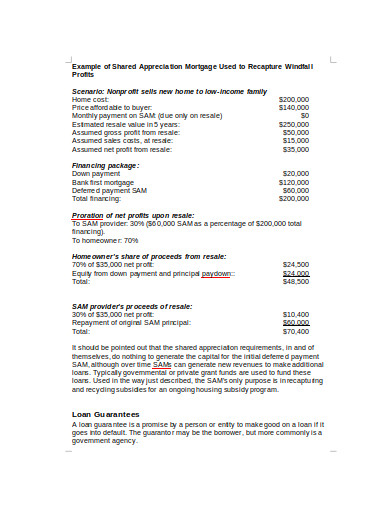

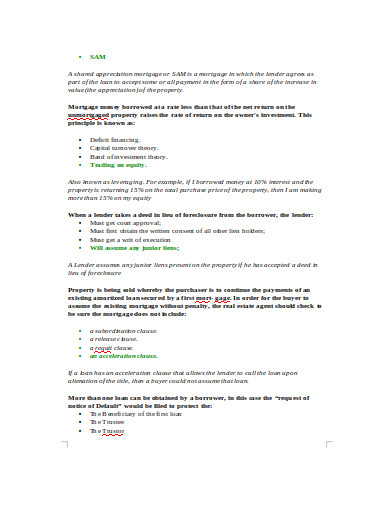

A shared appreciation mortgage (SAM) is when the borrower or buyer of home shares the percentage of the value of the property with the mortgage lender. In exchange for this additional settlement, the lender would agree to charge the interest rate below the standard market rate. Investors sometimes use shared appreciation mortgages in the real estate sector. It is different from the regular mortgage throughout the process of reselling the property.

Shared Appreciation Mortgage Pros and Cons

As a homeowner, you should consider everything before you agree to the terms of the shared appreciation mortgage (SAM) contract. You should be confident about your decisions and the consequences of the choice you made. These decisions should include how you would benefit to the said agreement. Some of these might be agreeable or not for you. Some of the pros in this agreement include; keeping hold of the property ownership which means that the lender has no residence rights to your property.

Along with is that you get exclusive benefits that a regular mortgage doesn’t have. If there are favorable parts of it, you should expect the negative to follow. Some cons include; you have to pay additional fees, your property subjected to a home appraisal, and you have to share the profits of your home with the lender.

7+ Shared Appreciation Mortgage Templates in PDF | DOC

1. Shared Appreciation Financial Mortgages

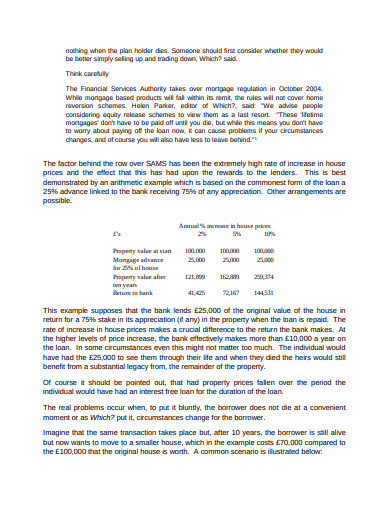

parliament.uk

parliament.uk2. Shared Appreciation Level Mortgage

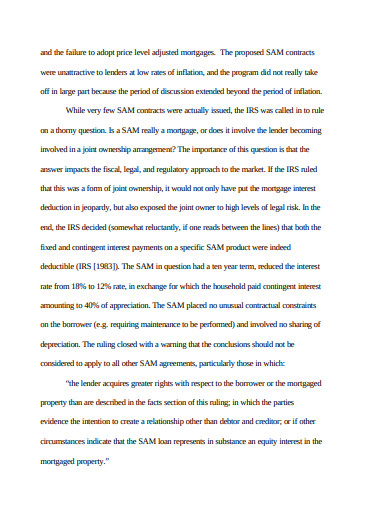

nyu.edu

nyu.edu3. Equity Shared Appreciation Mortgage

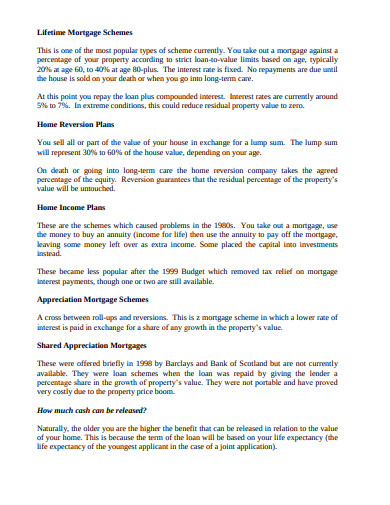

miltonpj.net

miltonpj.net4. Shared Appreciation Mortgage Loans

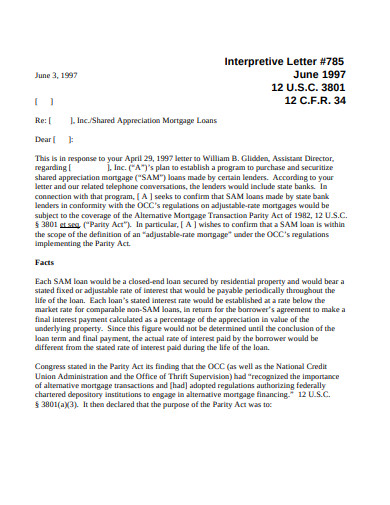

occ.gov

occ.gov5. Shared Appreciation Mortgage Capital

psu.edu

psu.edu6. Investment Shared Appreciation Mortgage

efmaefm.org

efmaefm.org7. Recapture Shared Appreciation Mortgage

community.org

community.org8. Lender Shared Appreciation Mortgage

francisha.com

francisha.com5 Steps to Shared Appreciation Mortgage Agreement

Having a better understanding of the shared appreciation mortgage and its terms is the first step to get the house or property of your dream. Even though it can give you relief from stressful financial dilemmas, you still need to be acquainted with how the settlement usually works. Some can be amended depending on the negotiation between the debtor and the lender. Here are some useful guides when making a SAM agreement.

Step 1: Discuss Negotiation Matters

Before you draft your contract agreement, talk with the person you’re going to make a transaction with, both parties must agree to the terms of the contract, as well as the payment schedule and interest rate. Settling everything down in one sitting can help you save the time and effort in making a legal agreement and the materials used for it.

Step 2: Make an Outline

Before going down on it and start scripting everything, make a simple outline from your notes. It is to make everything organized in terms of classifications in a relevant manner. With this, it helps you remember to put every vital detail that should be in a legal agreement. These details include; the nature of the settlement, the payment terms, and importantly the interest rate of the loan.

Step 3: Be straightforward

When writing a contract agreement, be concise with every sentence that you want to state. Avoid unnecessary words or phrases that are not relevant to the contract. It does not only make it look formal, but it helps save the reader the time to read words that are not useful for the whole process.

Step 4: State Laws Governing the Contract

It is as essential as any other details in the agreement, for it can specify which law is applicable when a legal dispute would happen in the future. If the other party lives in a different state, don’t forget to include it, for you need a new legal document if that happens. Avoid this hassle legal inception to ensure the smooth process.

Step 5: Establish Confidentiality

Every contract that involves different parties needs to agree to the terms of confidentiality to ensure that there is no exposing of business practices and trades of a company or an institution. It is to help maintain the standard integrity of everyone involved. And to avoid sharing of information that others may use for appalling reasons.

Most people are very cautious about where they spend their money, and luckily, there are options that you can take to help lessen the chance of getting scammed. Even if a mortgage involves owing money from others, it does not mean that this would not be a good investment for you. Just learn how to negotiate with the right people to ensure that wherever your money and effort go, it doesn’t go to waste.