43+ Spreadsheet Examples in Microsoft Excel

Creating a worksheet, workbook, and data sheet makes it easier to do complicated to simple tasks. With our spreadsheet examples…

Jun 27, 2020

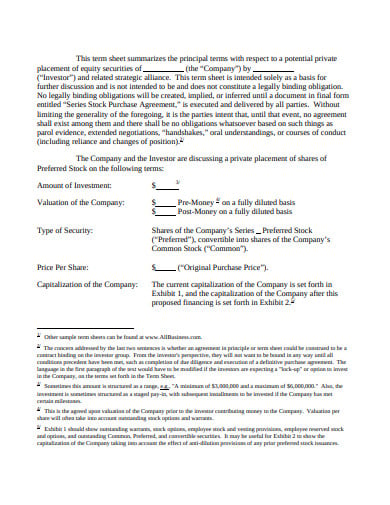

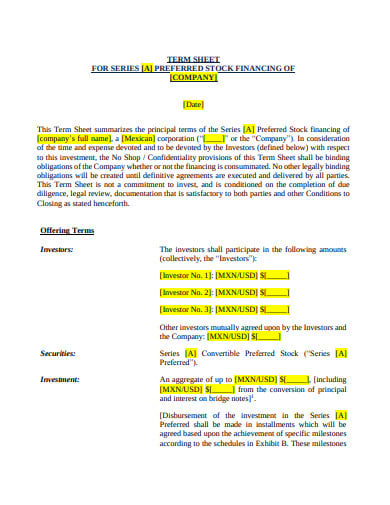

An equity investment term sheet is where the investor puts resources into an organization by buying portions of that organization in the securities exchange. These offers are ordinarily exchanged on a stock trade. It can have risks as well as have potential profits.

allbusiness.com

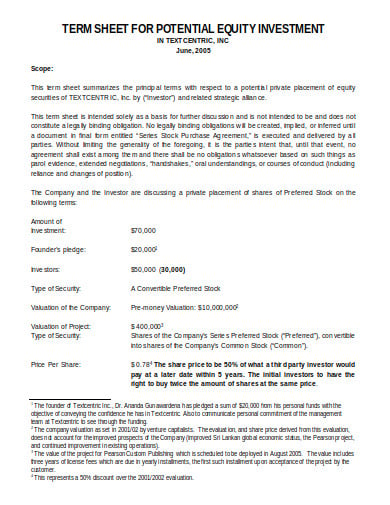

allbusiness.com cs.cmu.edu

cs.cmu.edu stanford.edu

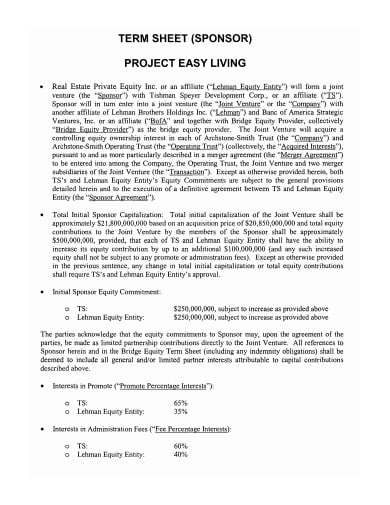

stanford.edu kyangels.net

kyangels.net casesmartimpact.com

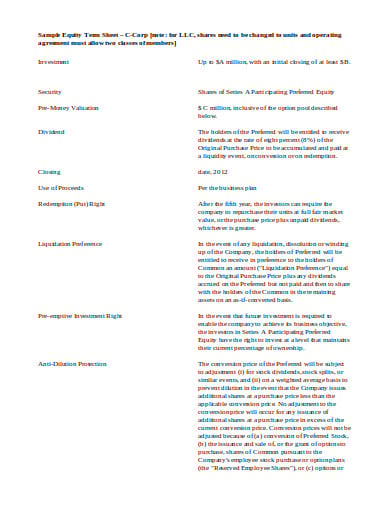

casesmartimpact.com cdn.hubspot.net

cdn.hubspot.netAn organization could be not able to compensate for its obligation.

An organization’s worth could change as a result of movements in the estimation of various universal monetary standards.

An organization could be not able to meet its transient obligation commitments.

An organization’s profits could endure given a nation’s political changes or unsteadiness.

An organization’s worth could drop since it’s excessively amassed in a solitary element, segment or nation (tying up its resources in one place). If the estimation of that factor drops, the organization will get injured lopsidedly.

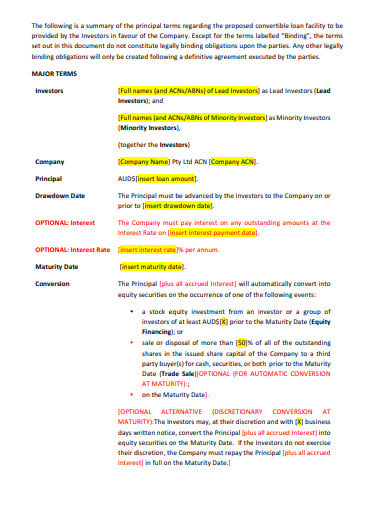

Each speculation which furnishes showcase connected returns is related to a component of loss Speculation loss essentially shows the plausibility of money related misfortune given vulnerability required because of different elements. In the accompanying segment, a portion of the key dangers identified with putting resources into values will be talked about alongside basic alleviation methodologies that common reserve organizations or potentially singular speculators will in general use.

Market hazard includes the plausibility of venture bringing about misfortunes because of market factors. If the money related market isn’t doing admirably because of elements, for example, financial lull or other such factors which may affect the general wellbeing of the business sectors contrarily. Market chance is otherwise called foundational chance as it is extensively reliant on large scale factors and in this manner, not restricted to a specific industry or organization. Be that as it may, various segments may get influenced to various extent relying upon the kind of market loss. Since showcase chance influences all ventures, it must be figured out how partially with an expansion of the portfolio.

Value common assets put resources into singular stocks and these stocks might perform as indicated by desires. This is the embodiment of execution and it influences both individual stocks just as whole segments now and then. The execution might cause a loss that will in general influence sectoral or topical assets to the most noteworthy degree as they highlight portfolios that emphasize on a particular industry or enterprises identified with a foreordained topic (utilization, social insurance, vitality, mining, and so forth.).

The key methodology that common finances utilize to moderate execution chance is broadening in a perfect world across enterprises, subjects, and market capitalizations.

Liquidity is the capacity of particular speculation to be sold at a reasonable cost and inadequate amounts as and when required by the speculator. Value speculations which can be sold as and when wanted, face the issue of liquidity chance. For the most part, stocks which are exchanged low volumes on stock trades are progressively inclined to liquidity chance.

Social, Political and Legislative changes can prompt changes in the exhibition of a business. For instance, if a nation advances its homegrown industry by expanding passage obstructions to remote organizations, those neighborhood enterprises will undoubtedly perform better till the time these section boundaries are evacuated.

Consequent to the evacuation of protectionism, this preferred position might be lost by the secured organizations which may bring about a descending development of their offer cost. This kind of hazard exists in the event of numerous organizations and the main methodology at present actualized as for dealing with this sort of hazard includes broadening over various businesses just as across national outskirts.

Money chance which is additionally alluded to as conversion scale chance emerges because of swapping scale developments between monetary forms. Speculators having investment venture presentations to remote value markets are inclined to confront cash dangers. Aside from that, such organizations that determine a significant piece of their income from worldwide activities likewise face a swapping scale loss. For instance, organizations having a place with pharma, IT or other fare arranged segments are probably going to confront conversion scale causes loss because of their high presentation to outside business sectors.

One regular technique to alleviate this hazard is the upkeep of money save or holding exceptionally fluid resources whose allotment can be expanded or diminished to counterbalance swapping scale changes or other cash related dangers looked by value/value common reserve conspire, financial specialist. Such loss needs moderation, rehearses are otherwise called supporting procedures.

The main trademark that a value speculator must-have is a capacity and ability to face a challenge. Market-connected Investment instruments are not fit people who can’t risk the potential loss. The achievement of your value speculation relies upon the financial specialist’s information and aptitudes. Be that as it may, financial specialists who are obliged because of the confinement of time and additionally sufficient information can gain savvy returns at a moderate loss by putting resources into value common assets.

Creating a worksheet, workbook, and data sheet makes it easier to do complicated to simple tasks. With our spreadsheet examples…

A Job sheet can be defined as a document or a page that contains instructions to help an employee do…

We start working to earn a living and to secure the future of our family but there will come a…

A timesheet is used to record the time that an employee spends within the workplace. Timesheets use a digital or…

A blank spreadsheet template is a document for indicating income and expenditures. It can be used by individuals or groups…

Answer sheets are digitized sample forms that are used during examinations for candidates to put their answers in. There are…

Research information sheet is also known as participant information sheet. This sheet and consent forms are both important aspects of…

Using a run sheet to manage your event can save you a lot of time. The template gives you a…

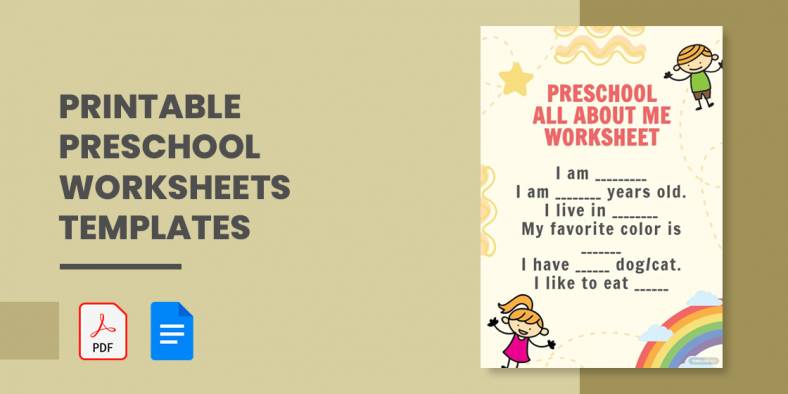

Storytime, music, dance, and art are fun and recreational play group activities for preschoolers that develop their overall brain development.…