43+ Spreadsheet Examples in Microsoft Excel

Creating a worksheet, workbook, and data sheet makes it easier to do complicated to simple tasks. With our spreadsheet examples…

Dec 17, 2023

One of the company’s financial statements is an income sheet, also known as an income statement or profit and loss account. It demonstrates the profits and expenditures of the company over a period of time. It shows how revenue is converted into net income or net profit. Income sheet templates are the tool to use to make income sheets.

The time period of the income sheet is the first thing that needs to be selected. Revenue statements evaluate earnings and expenditures over a given span of time and are produced typically on a monthly, weekly, or annual basis. Choose the span you want to use to calculate your declaration of income. Publicly traded companies must produce weekly and annually earnings reports to register with the Securities and Exchange Commission. Once this is done, write the header which includes the full name of the company and the title ‘Income Sheet’.

Sales revenue involves all earnings from the purchase of products and facilities, irrespective of whether the money was received or not. You need to list income from revenues for the period you have chosen. Say, for instance, you sold 10,000 inventory units for $5 apiece. You’d report USD 50,000 in sales revenue, even if you have not been paid by all of your yet.

The gross profit you made during the time frame you chose is the total amount of money you made before your expenses. To calculate this, the first you need to do is calculate the cost of goods sold which is the immediate labor, immediate equipment, and overhead manufacturing expenses you incurred to generate the stock you sold. Write down on your spreadsheet the distinction between your sales revenue and the price of the products purchased in the next row to determine the gross profit.

Operating expenses are costs that connect straight to the administration of the company. List the number of expenses incurred during the period next to each line item. Common working costs include wages and salaries for those staff who are not immediately engaged in the production of items, lease, insurance, office equipment, skilled charges, services, travel expenditures, advertising, depreciation, and estate tax.

Both methods of depreciation and amortization serve to reduce the recorded asset costs. Depreciation is most frequently calculated using a direct row technique that gradually lowers a tangible asset’s expense over its helpful lives. For intangible assets, amortization is used and is calculated likewise to depreciation.

The earnings that are not related to any sort of business operation, sales or production are known as non-operational gains. These revenues stem from different activities such as unrelated sales or investments that are generally different or peripheral to normal operations. So in this section, you need to write down the revenues incurred for each item respectively beside the item itself.

To find out the total expenses of the income sheet, you need to find out the non-operational losses too. Find out what losses you have incurred during your chosen time period and sum them all up together. After that, you need to determine the total operating expenses. Once you have these two in place, you need to add them up together to calculate the total expenses.

The final section to be included in the income sheet is the net income. Take the gross profit that you have already calculated and added that to the non-operational gains. This will give the total amount of profit that you have incurred during the period you chose. Now, you just need to subtract the total expenses from this profit margin to get your net income.

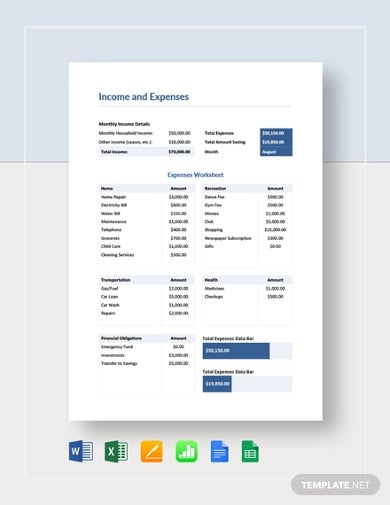

An income sheet is a very important document that should be provided to all the employees of a company so that they know about the company’s profits and losses. If you wish to make a proper working income sheet, then you need to download this sheet template in Word. This template is available to be used in other formats too such as Google Docs, Pages, Sheets, Excel, and Numbers format.

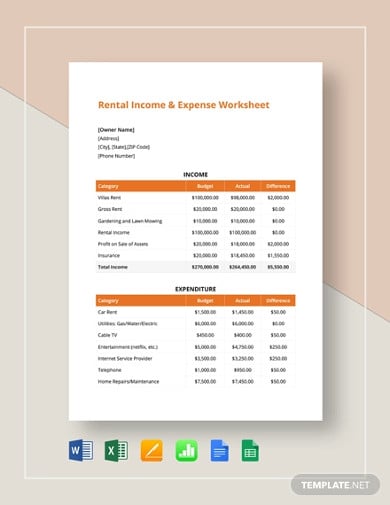

If you are providing your asset or property on rent, then it is crucial that you have a rental income and expense worksheet. Make such a sheet with the help of our sheet template in Google Docs and ensure that you know where your money is going, how and to whom. The template can be downloaded in sizes A4 and US letter sizes.

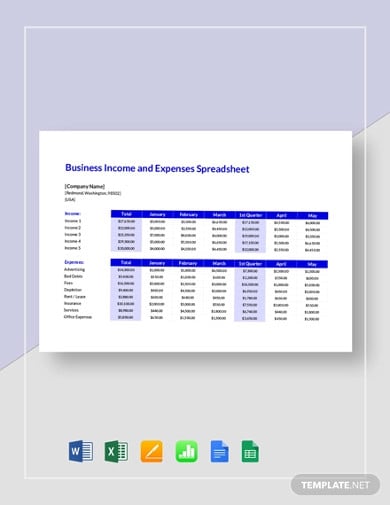

It is tougher for a small business to make a daily income sheet as larger corporations already have theirs made from before. That is why we are offering you this sheet template that has been specifically designed to help make income sheets for small businesses. Just download this customizable template available in multiple file formats and you’re good to go.

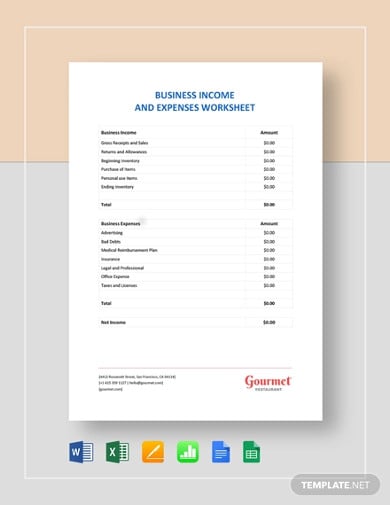

This income sheet template in Pages format provides you with a ready-made business income and expenses worksheet that can be easily used to make one for your needs. The template provides original headings and content including separate sections for listing the income and the expenses in the worksheet. So what are you waiting for? Download the template now!

Are you looking for a tool to help you make your income sheet more easily? Well, you need not look any further than this sheet template in Numbers! This template offers you a free and editable blank spreadsheet that just requires the proper information to be filled in. The template can also make a payroll sheet. The template is also fully printable and can be downloaded on any OS.

One of the most important financial documents of any company is the price sheet. This sheet tells the readers all about the company’s profits as well as losses over a definite time. Need to make such a document? Then make use of this Free Income Expense Sheet Template. With this template, you will be able to make the income sheet of your company easily and efficiently. You can also edit the file to make an evaluation sheet.

Creating a worksheet, workbook, and data sheet makes it easier to do complicated to simple tasks. With our spreadsheet examples…

A Job sheet can be defined as a document or a page that contains instructions to help an employee do…

We start working to earn a living and to secure the future of our family but there will come a…

A timesheet is used to record the time that an employee spends within the workplace. Timesheets use a digital or…

A blank spreadsheet template is a document for indicating income and expenditures. It can be used by individuals or groups…

Answer sheets are digitized sample forms that are used during examinations for candidates to put their answers in. There are…

Research information sheet is also known as participant information sheet. This sheet and consent forms are both important aspects of…

Using a run sheet to manage your event can save you a lot of time. The template gives you a…

Storytime, music, dance, and art are fun and recreational play group activities for preschoolers that develop their overall brain development.…