Feb 13, 2025

During certain times within a month, employers have to make sure that their employees get the salaries they have earned. However, it’s not enough to just hand over their salaries, the employer also has to ensure that the employees get a breakdown of just how much they’re earning and why they’re earning that amount. For a wider selection of paystub sheet templates, check out more options here.

This is the reason why employers have to make sure that they learn how to make proper pay stubs or paycheck stubs. These stubs provide the employees with important information regarding their salaries. And it can also help them in the event that the employee finds any discrepancies in their pay.

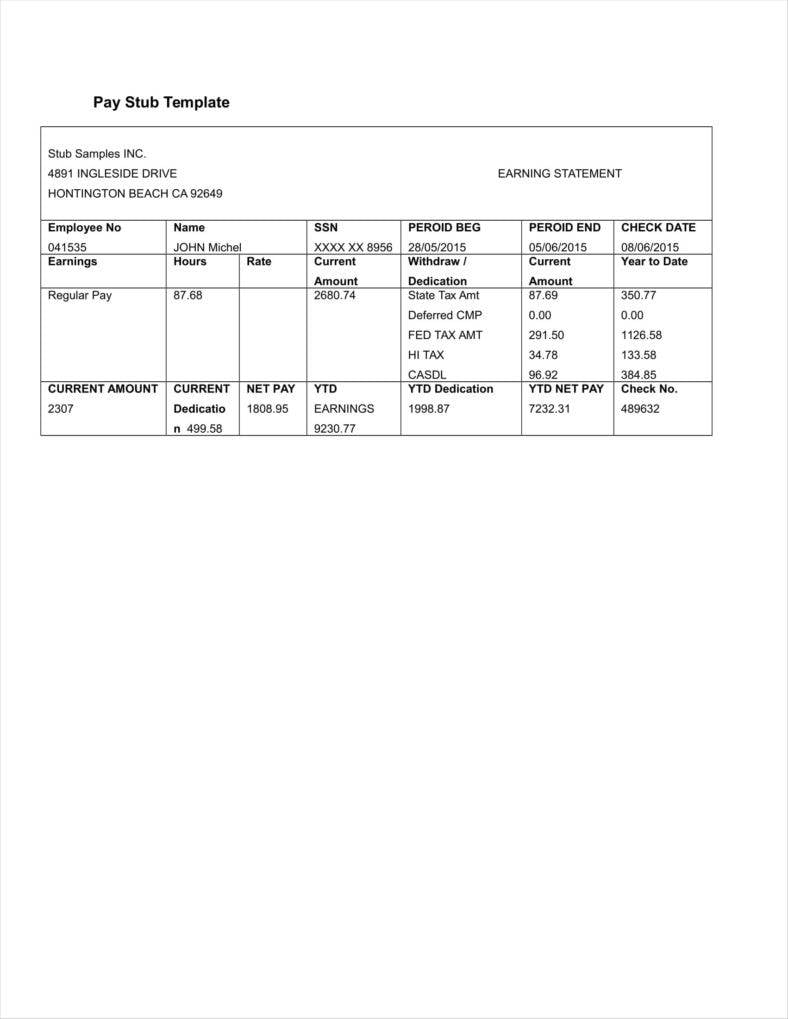

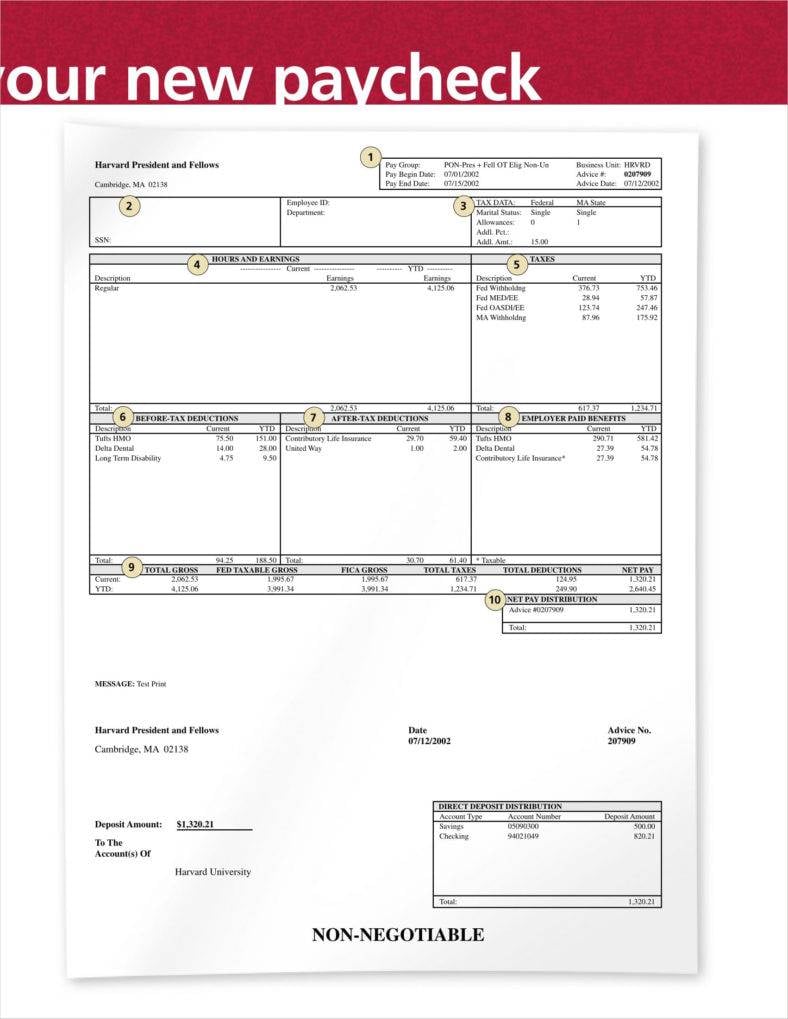

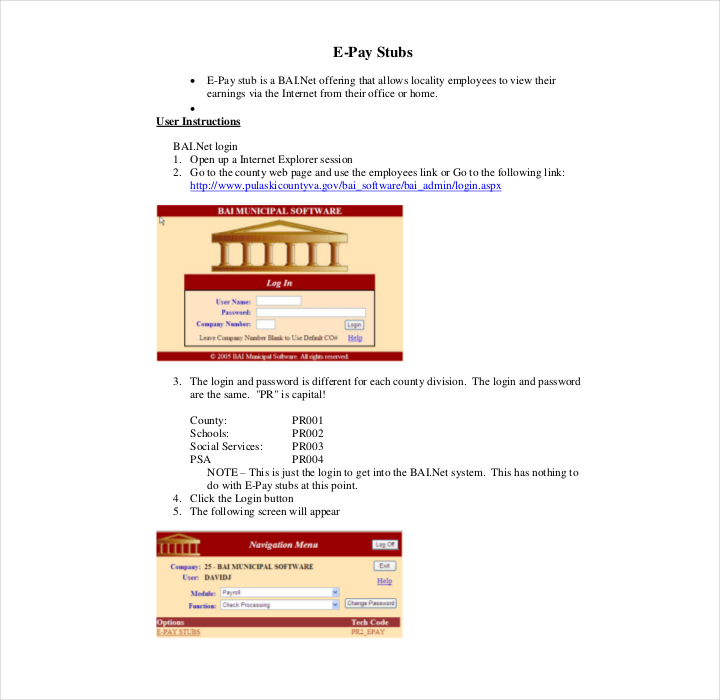

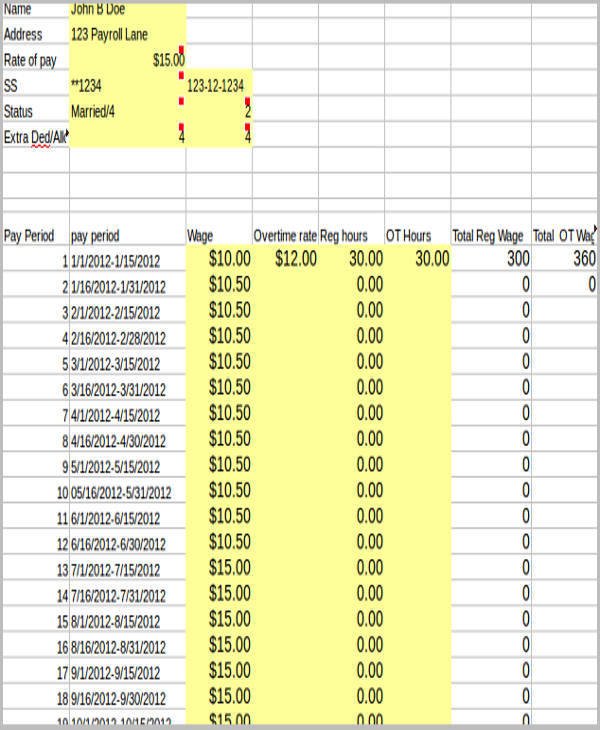

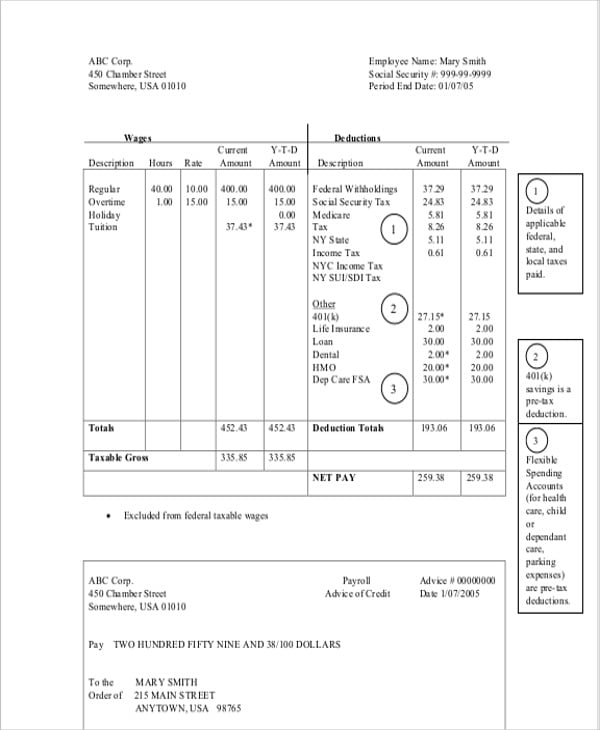

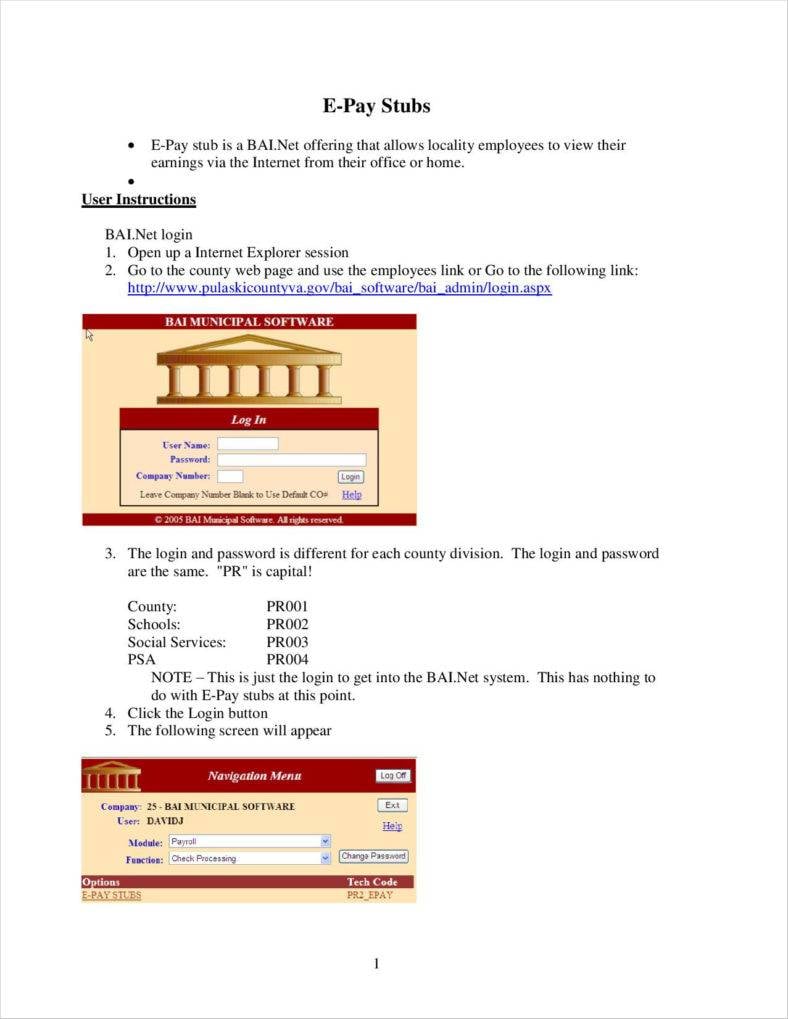

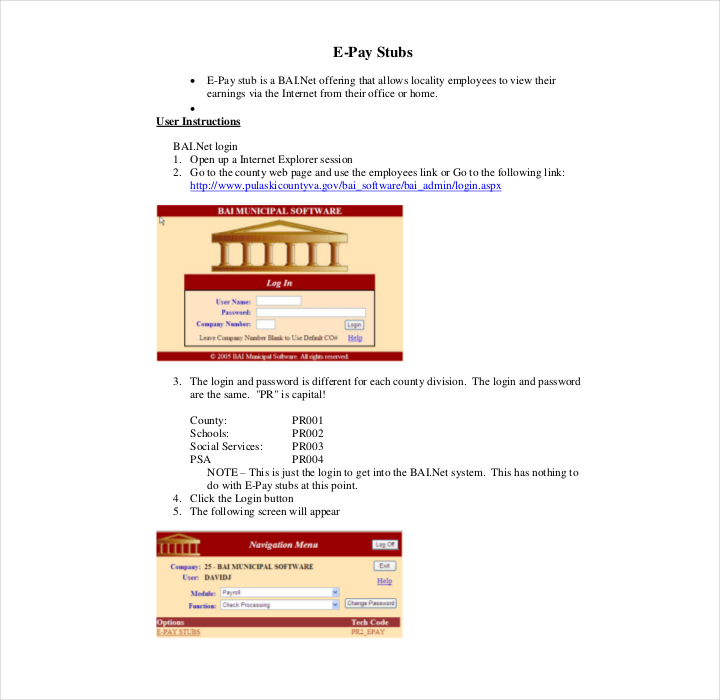

E-Pay Stub Template

pulaskicounty.org

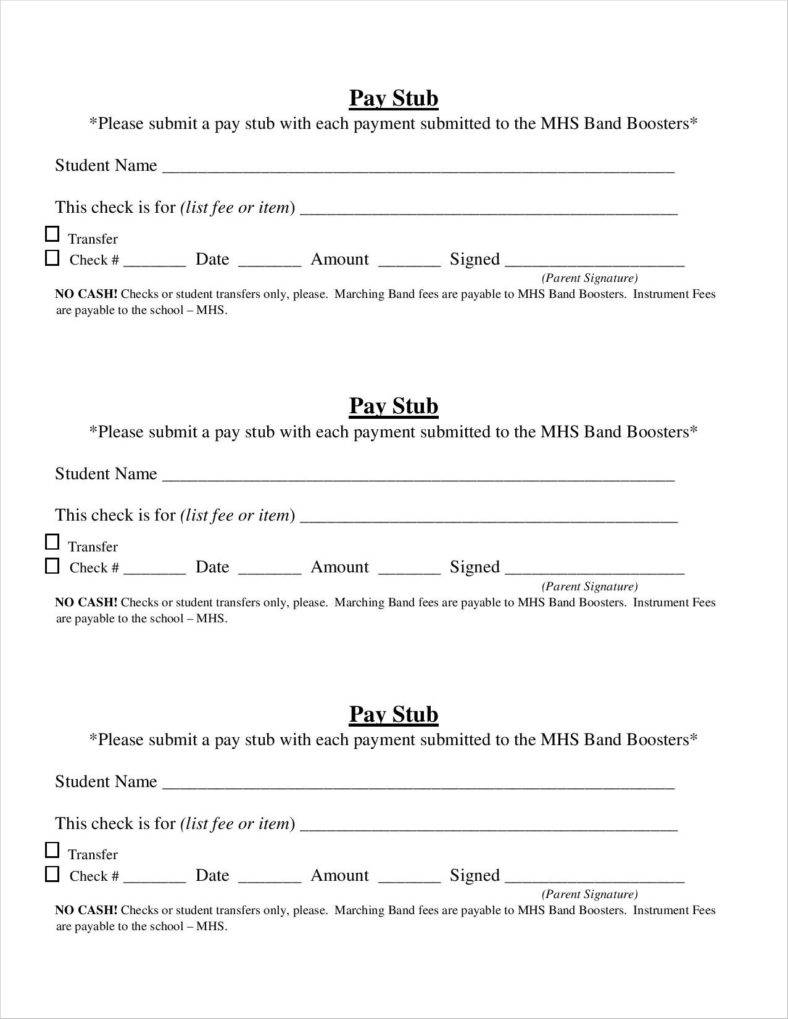

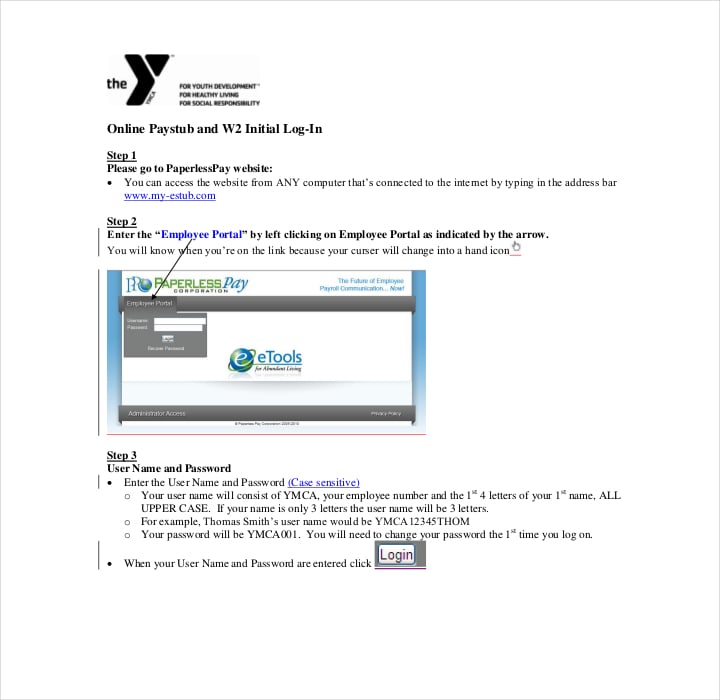

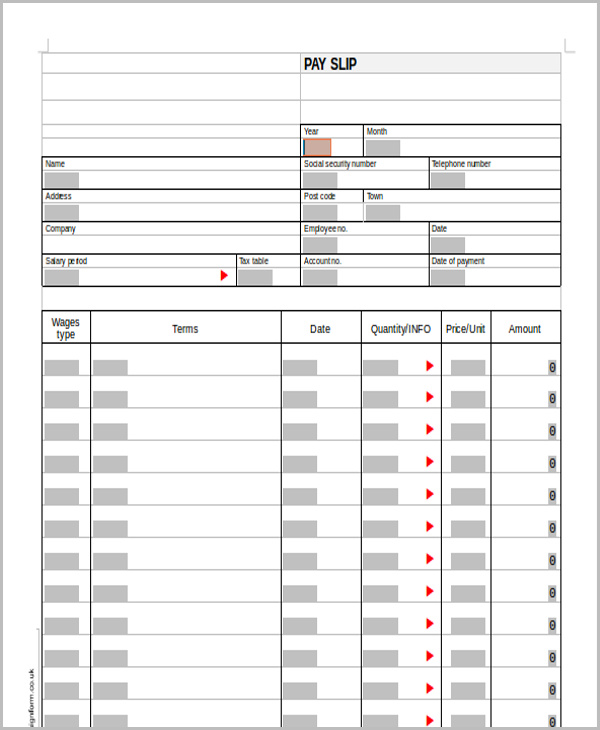

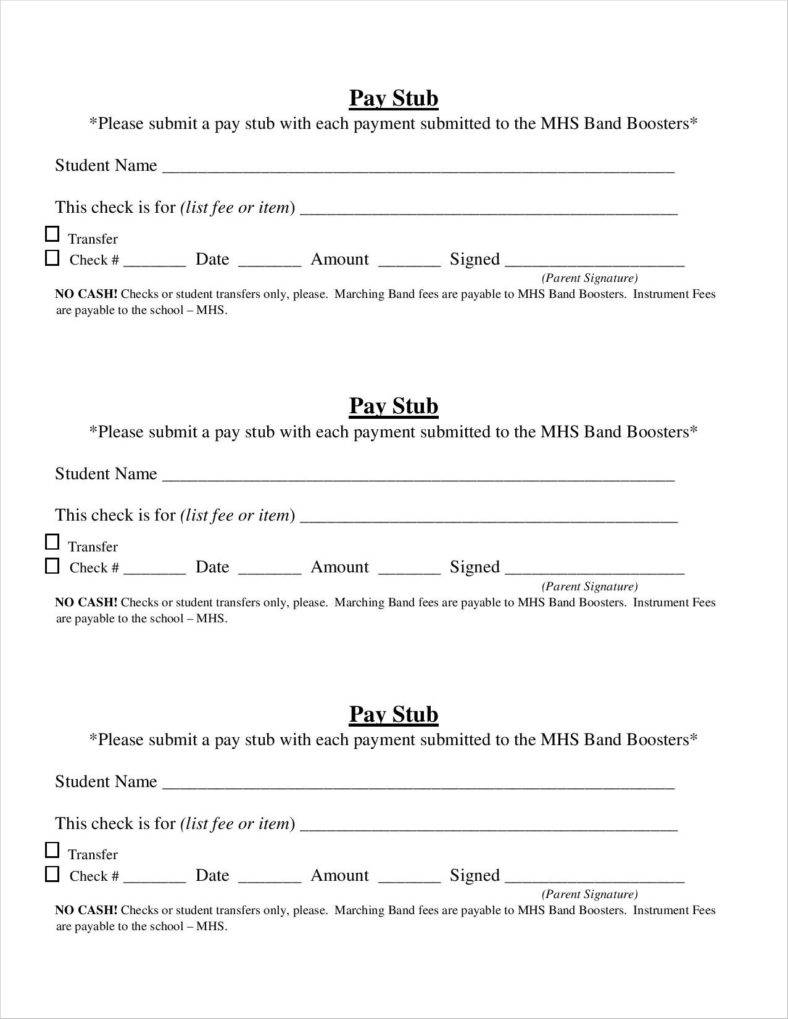

Simple Pay Stub Template

middletownband.com

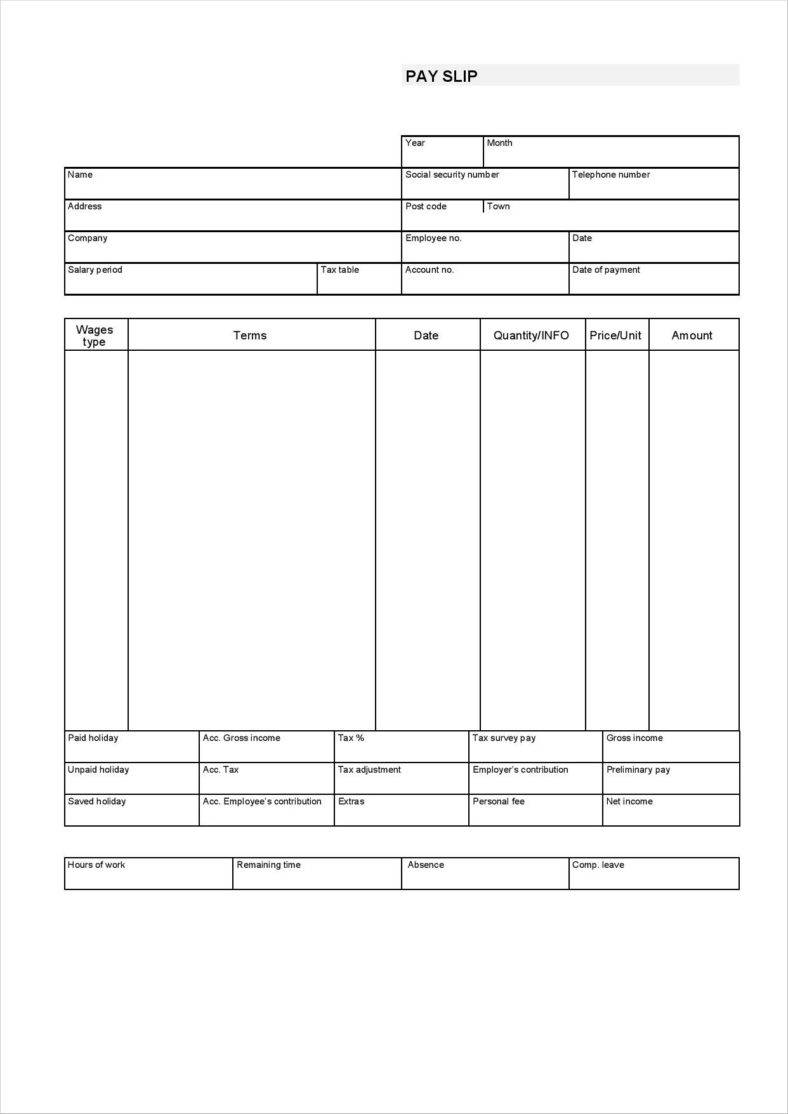

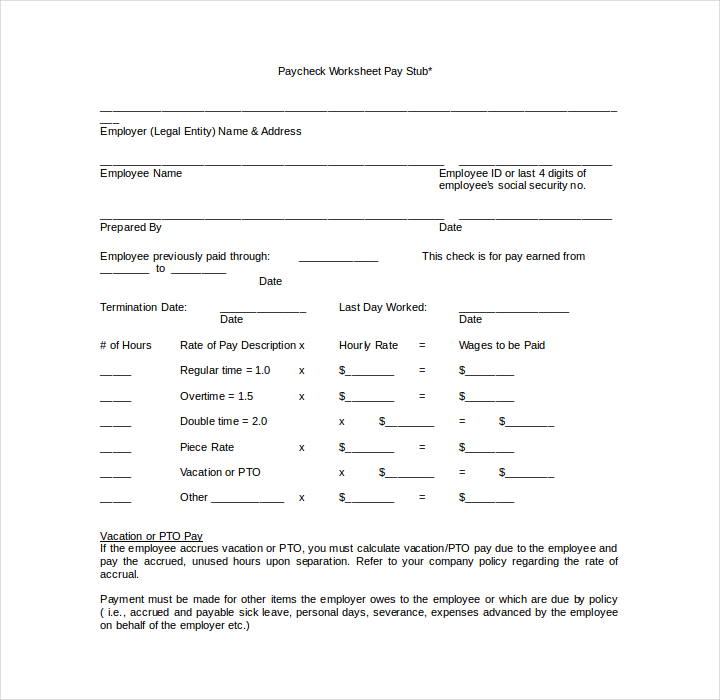

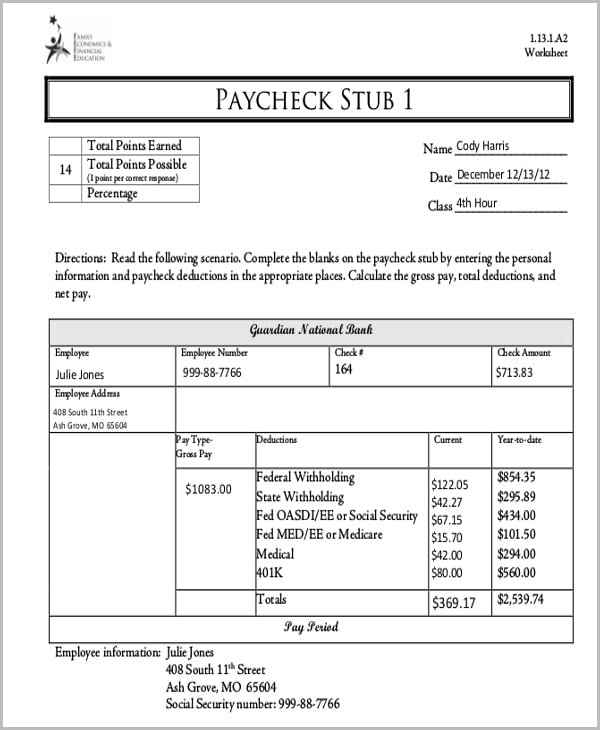

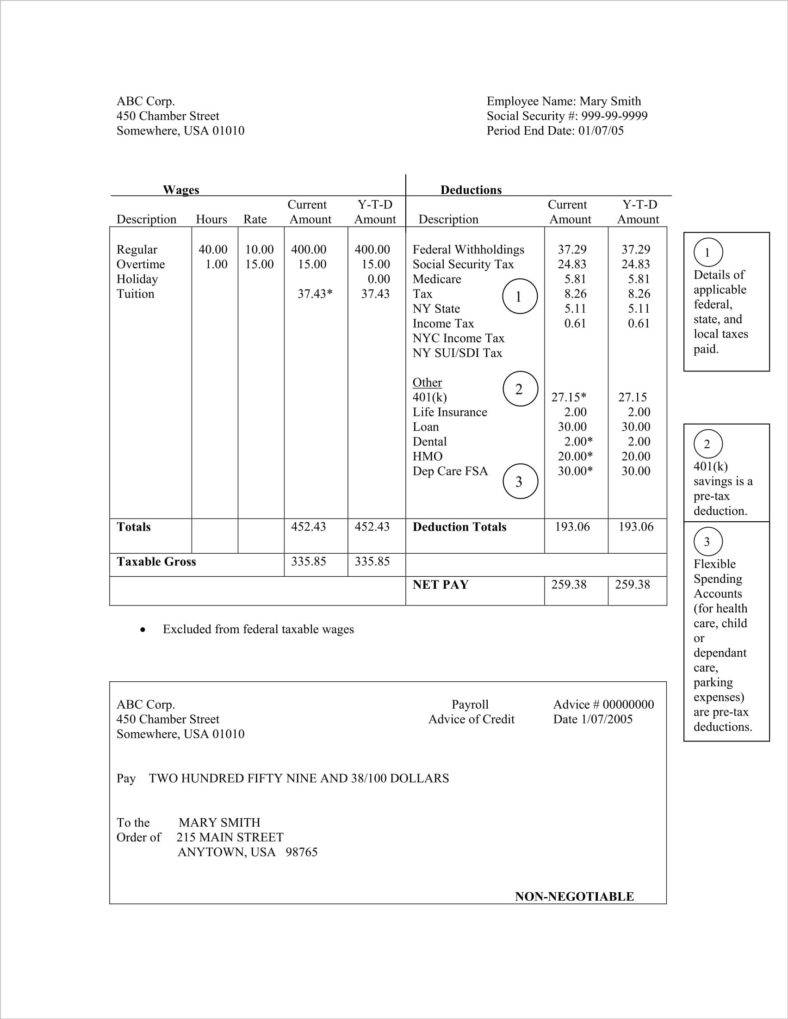

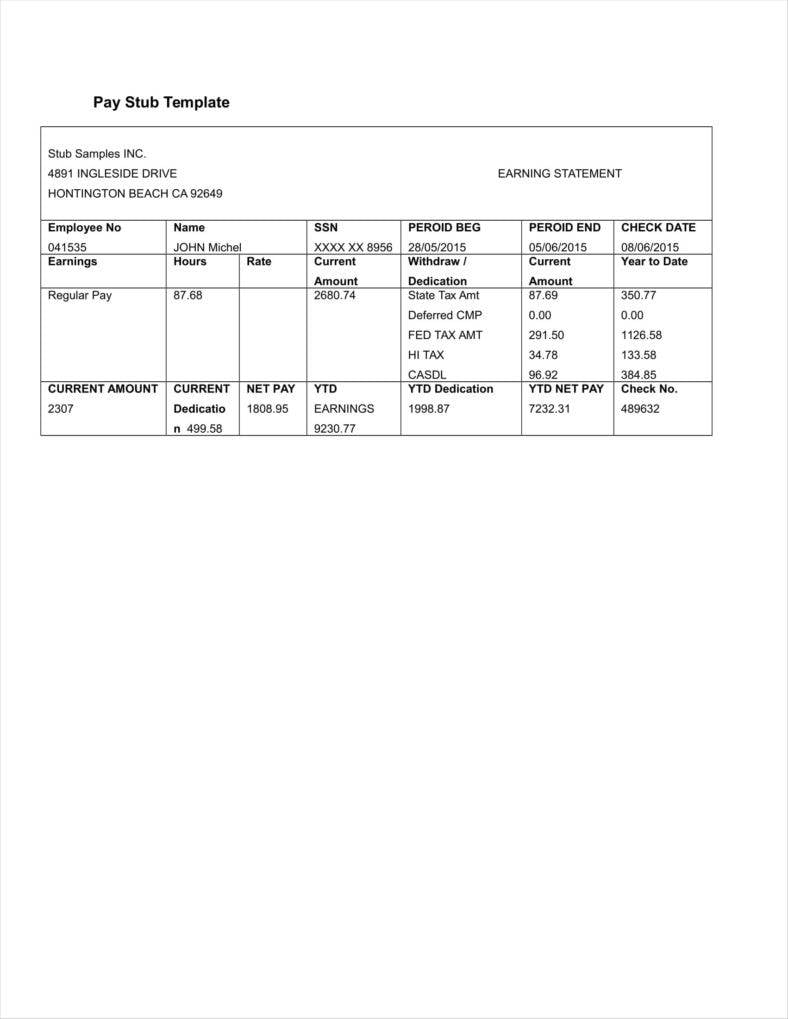

Blank USA Pay Stub Template PDF Printable Download

wikidownload.com

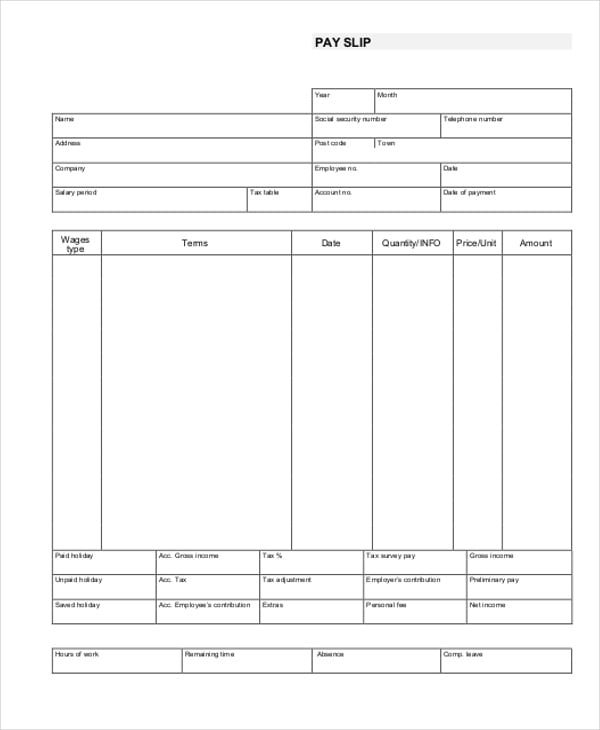

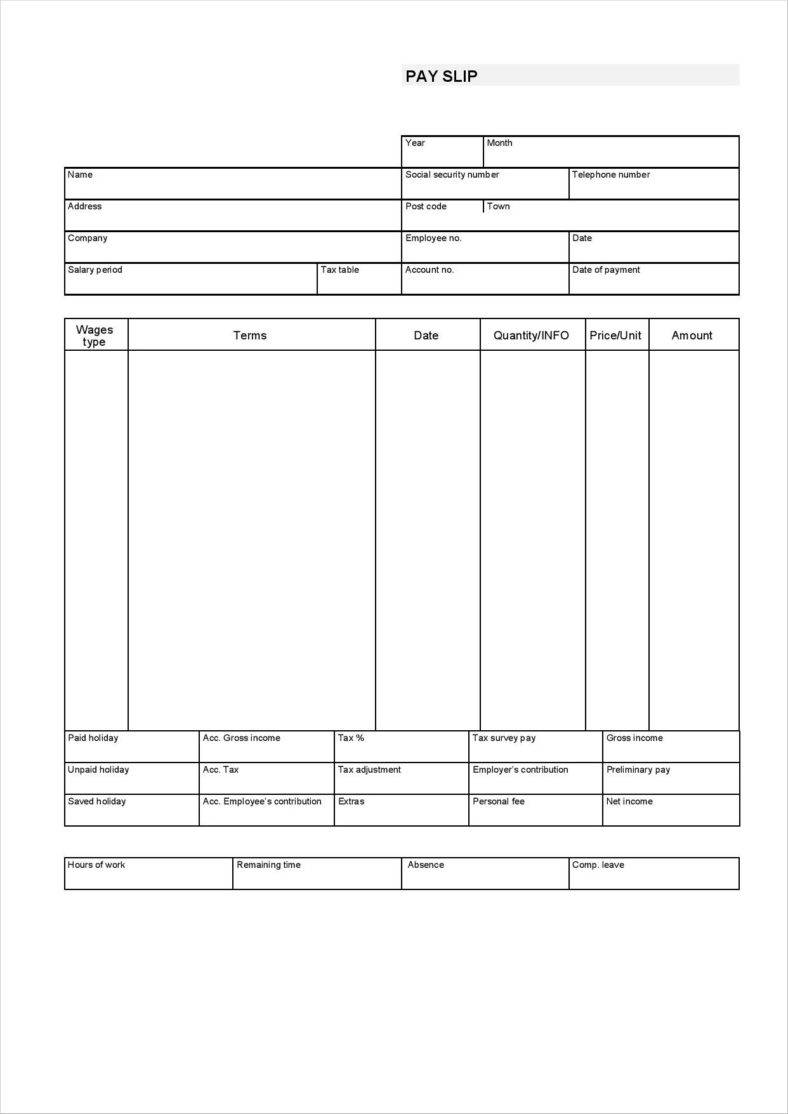

Free Download Company Pay Stub Template DOC

docspile.com

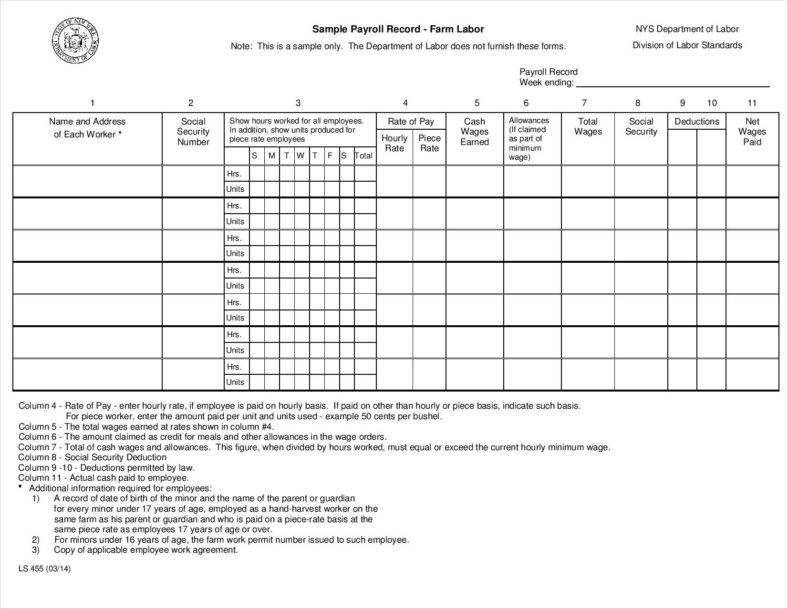

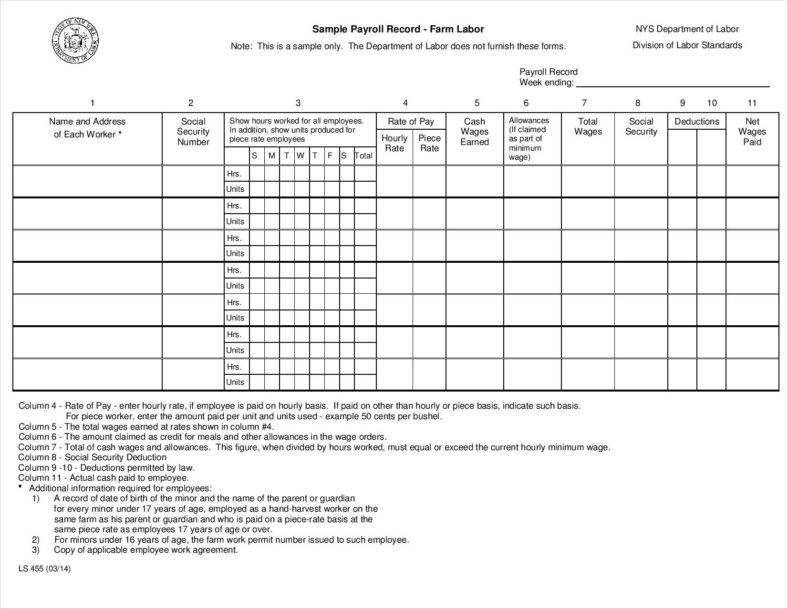

Employee Payroll Record Template

labor.ny.gov

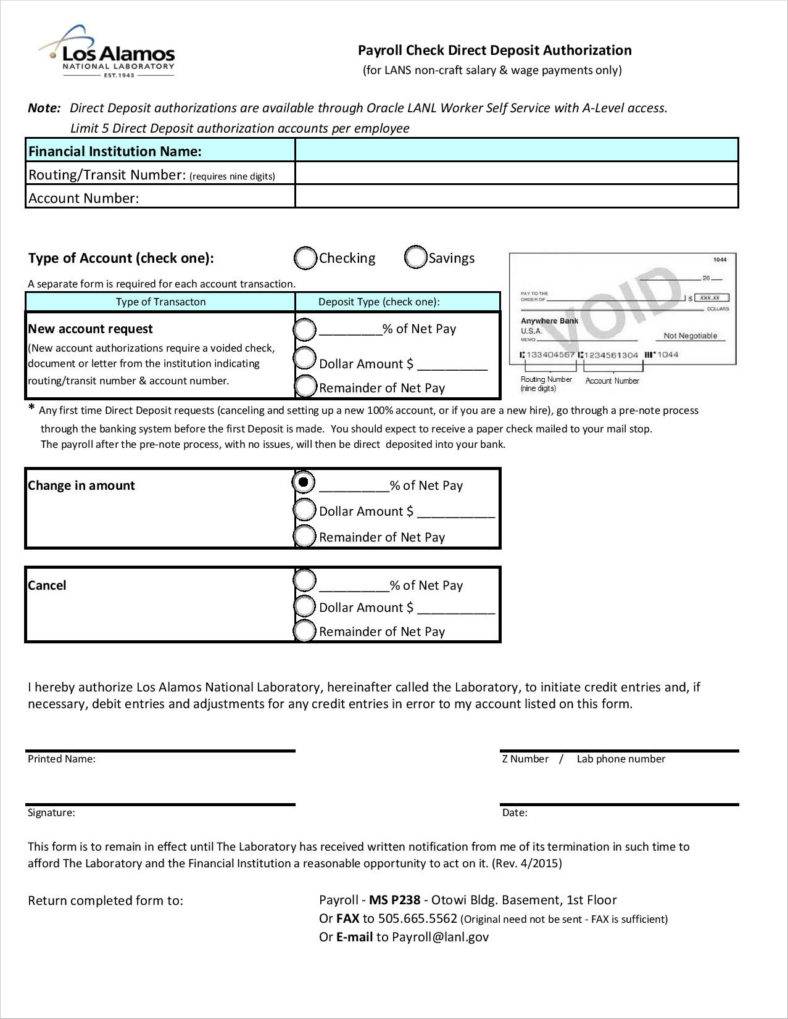

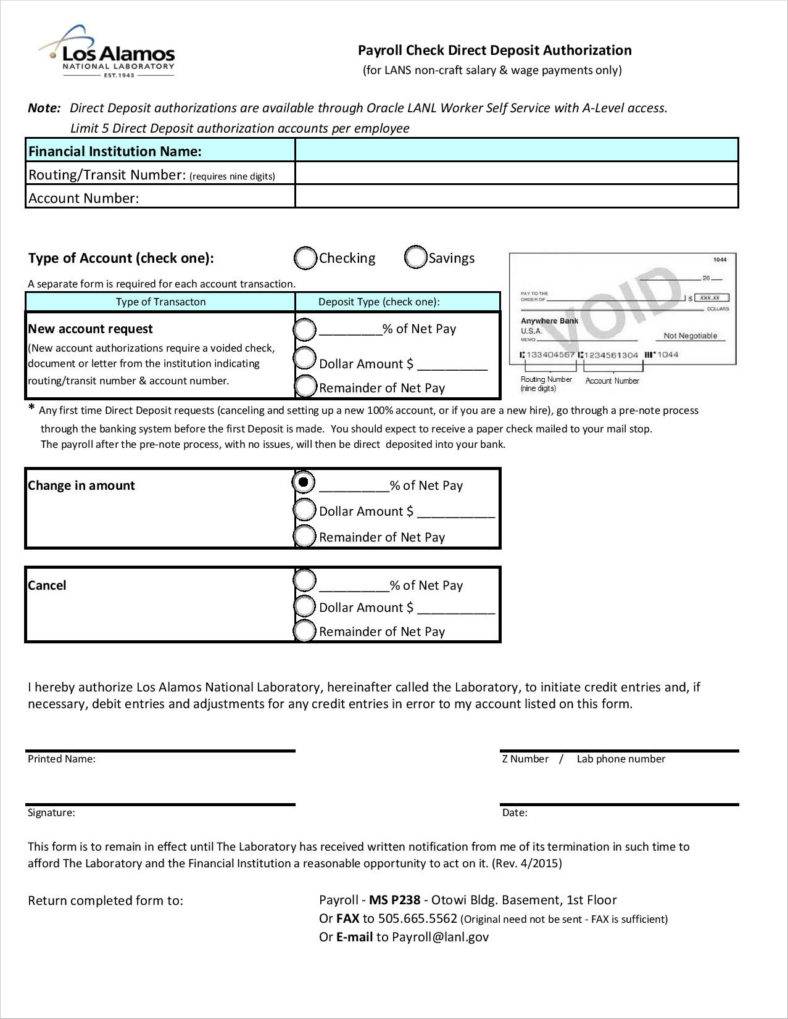

Blank Payroll Check Template

lanl.gov

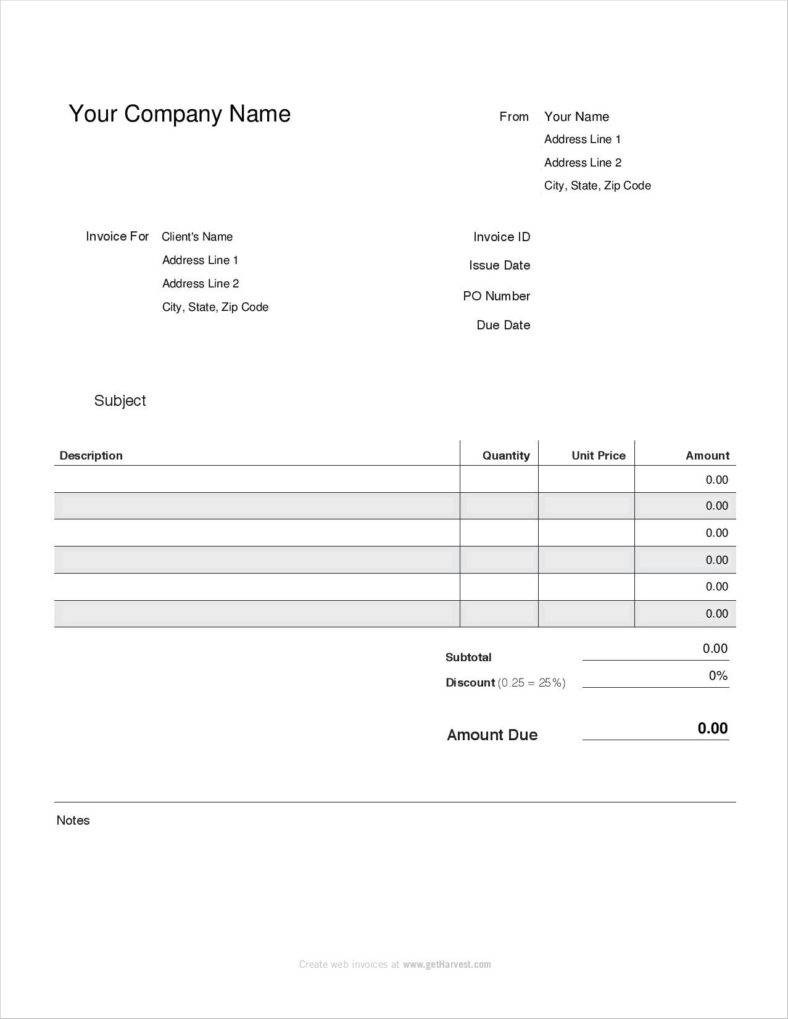

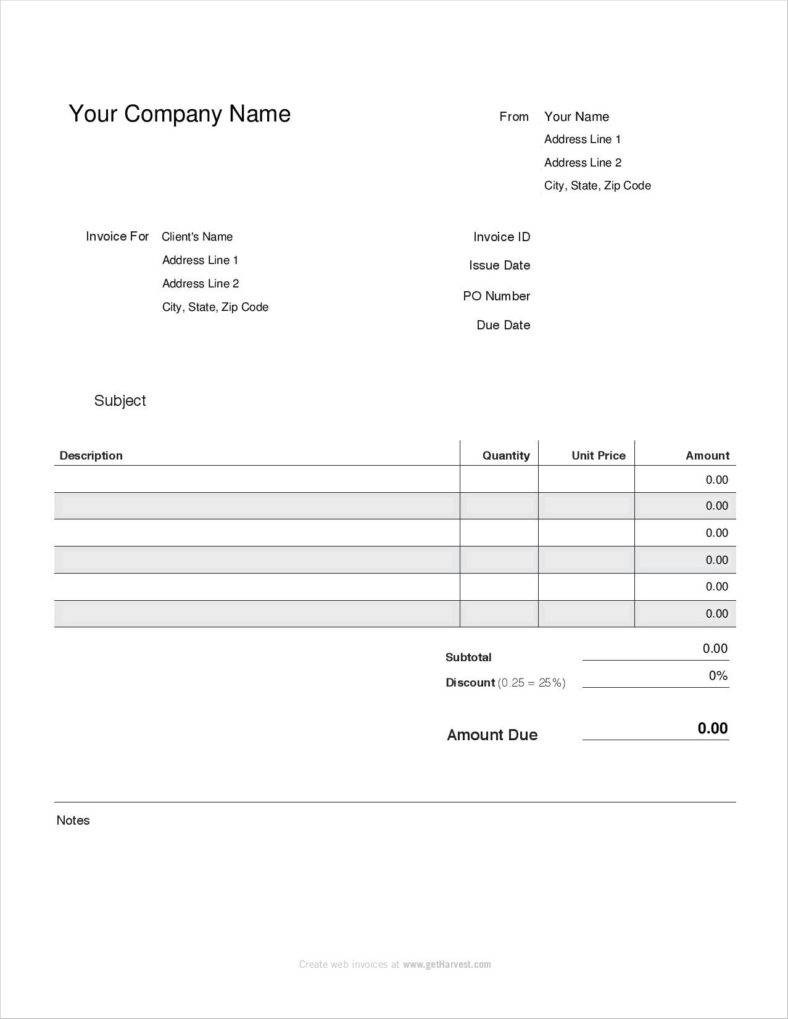

Editable Company Payroll Invoice Template PDF Download

harvestpublic.s3.amazonaws.com

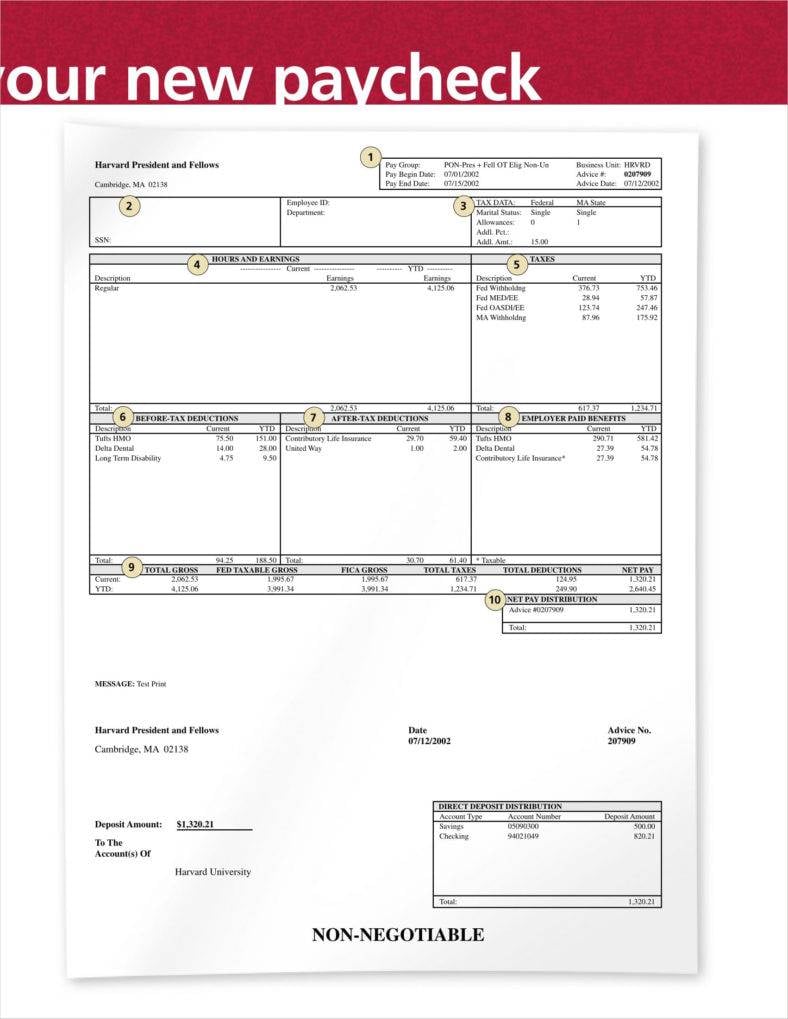

Basic Blank Pay Stub Sample

hls.harvard.edu

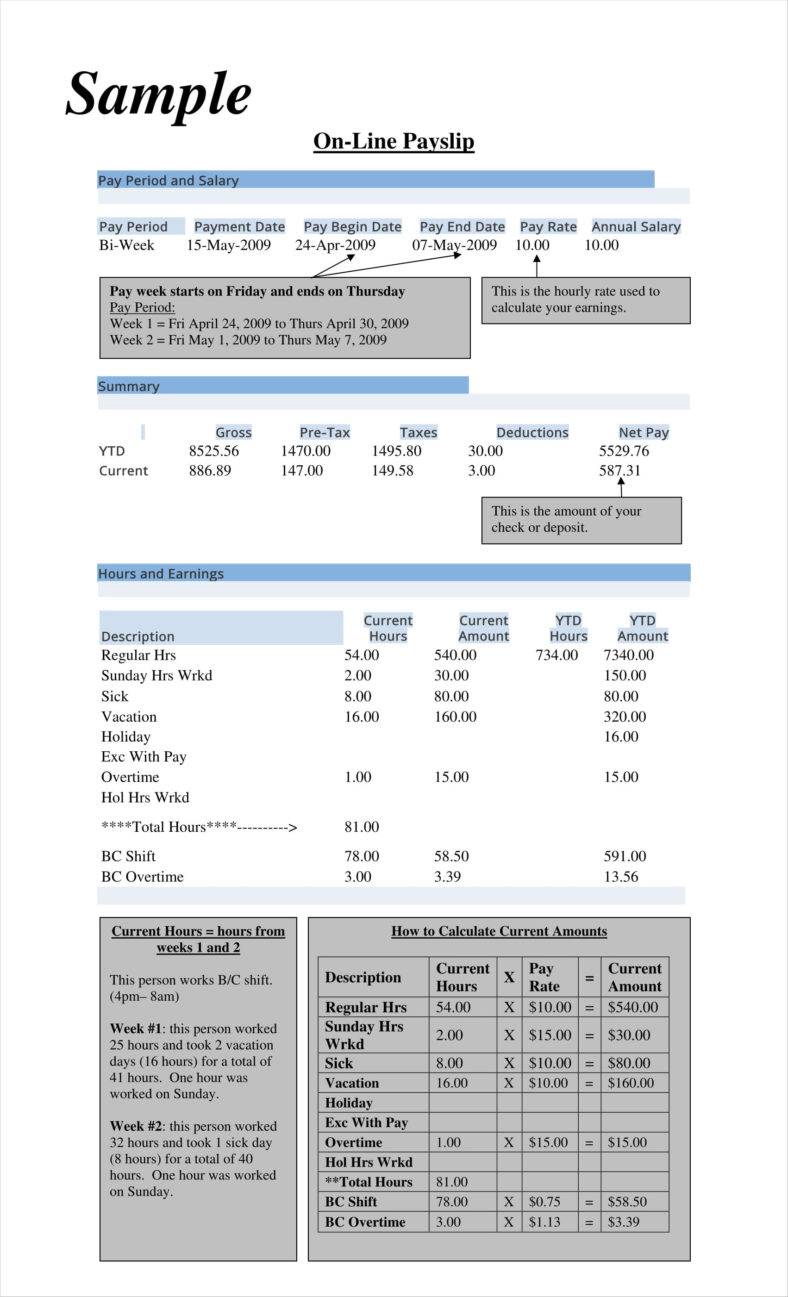

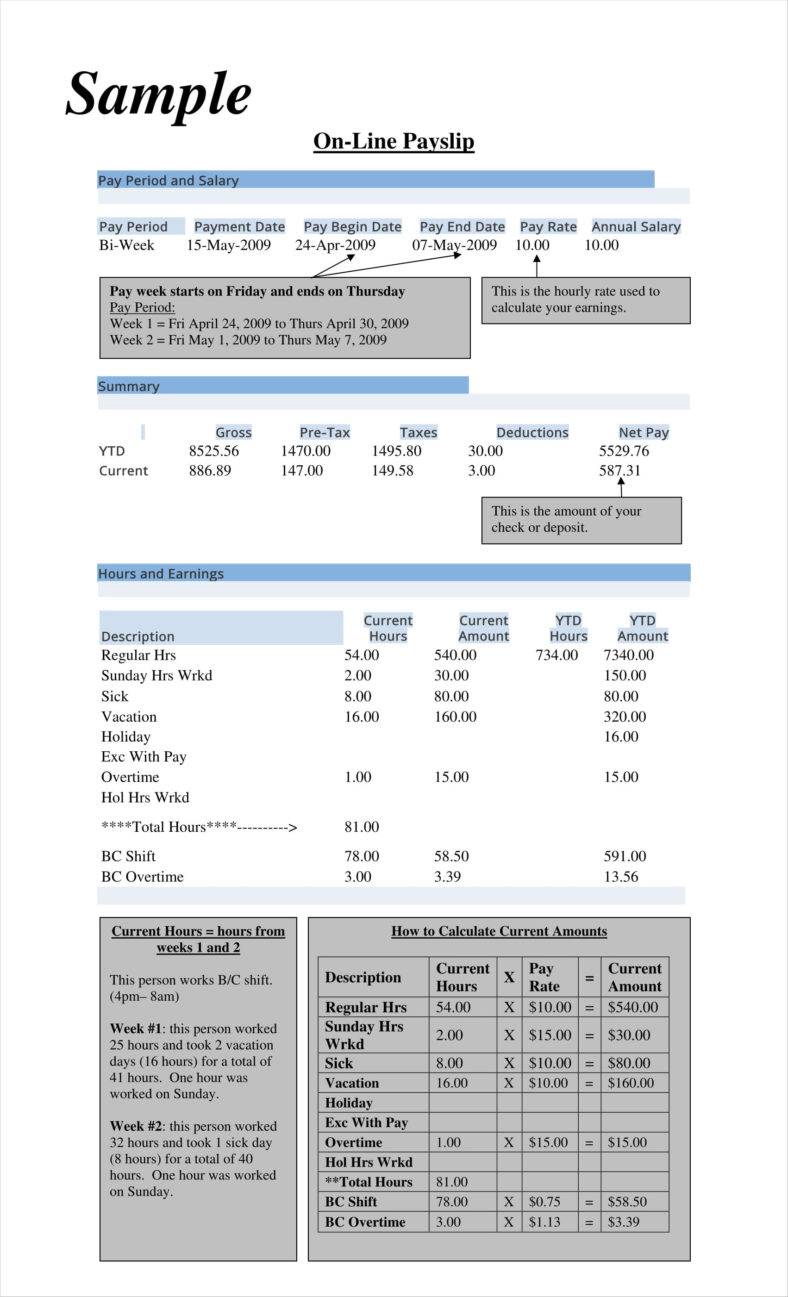

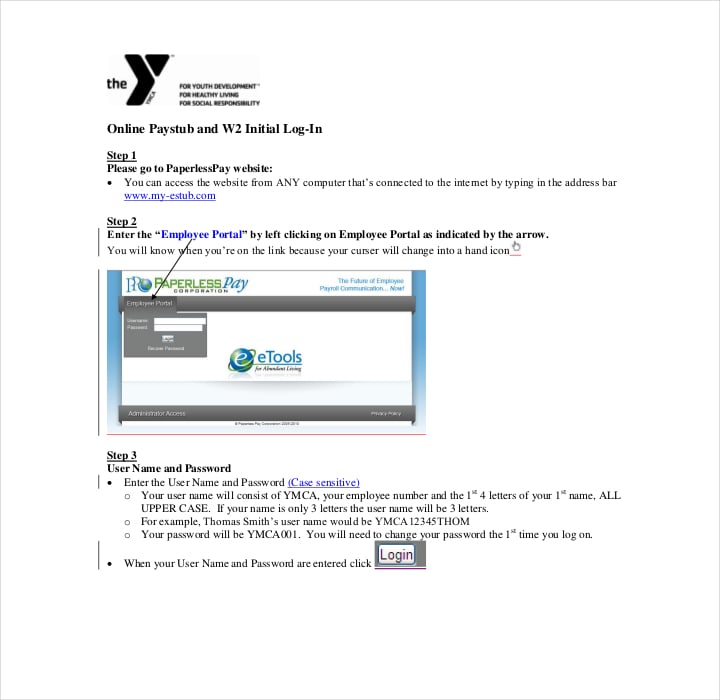

Sample Blank Online Pay Stub

rit.edu

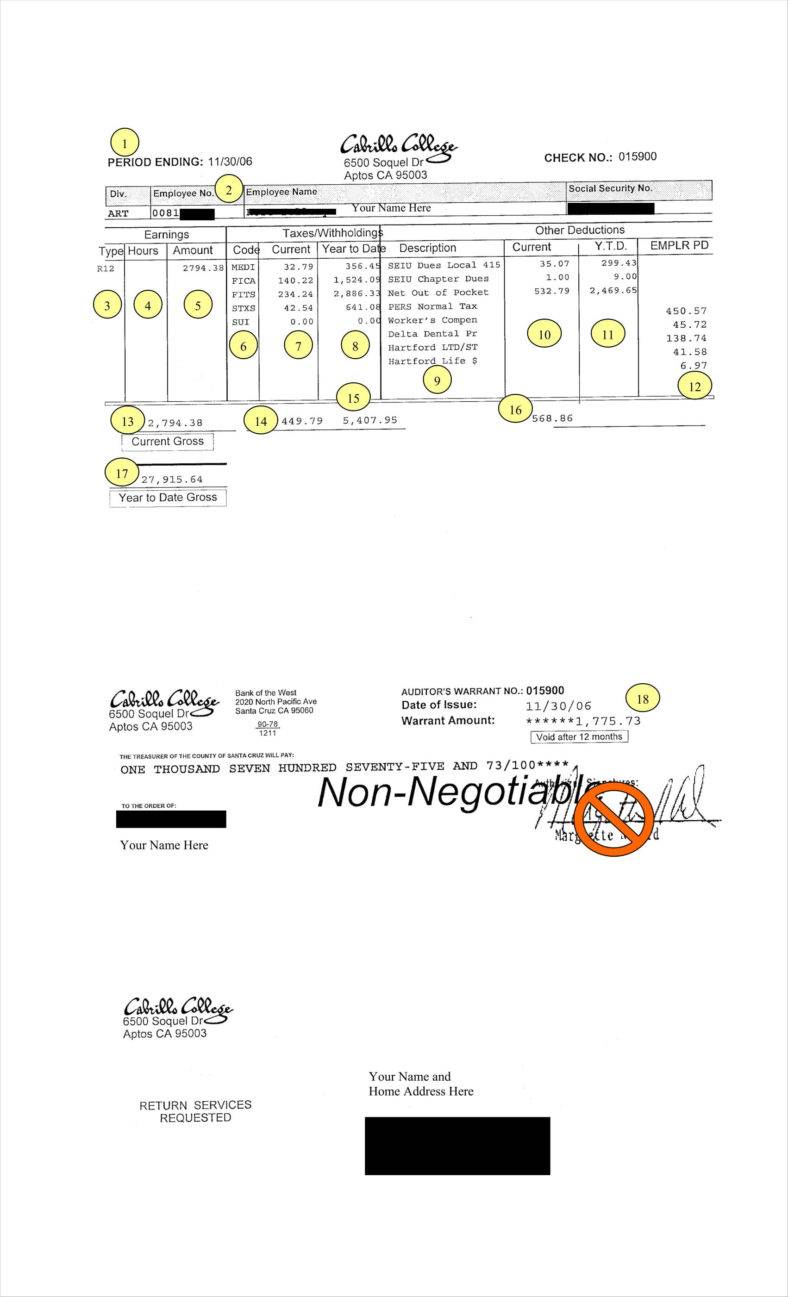

Blank Pay Stub Template

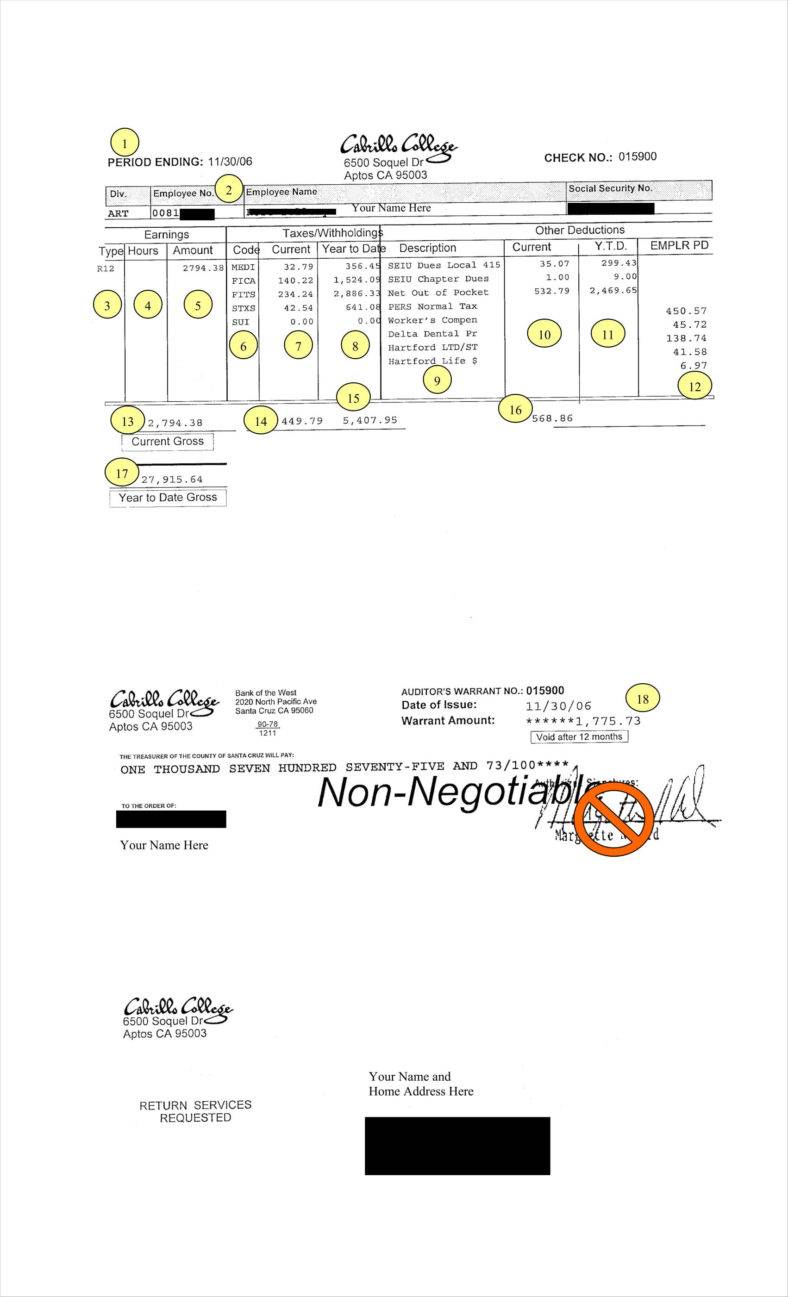

cabrillo.edu

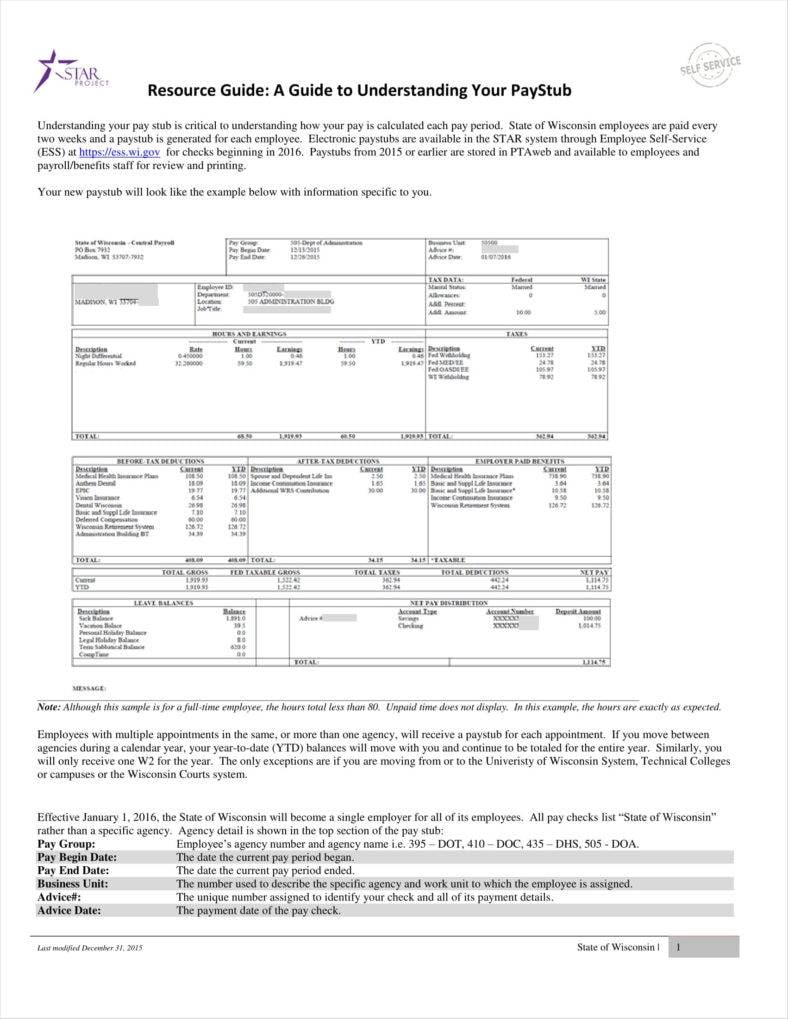

Blank Pay Stub Guide

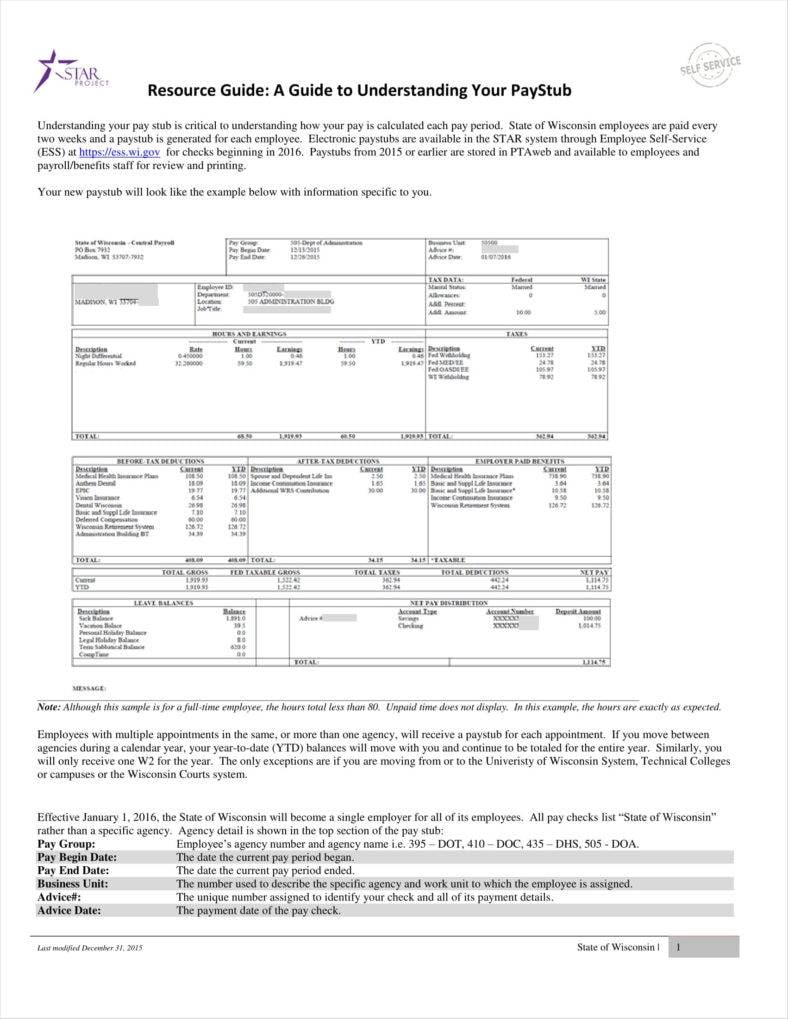

dma.wi.gov

The purpose of pay stubs

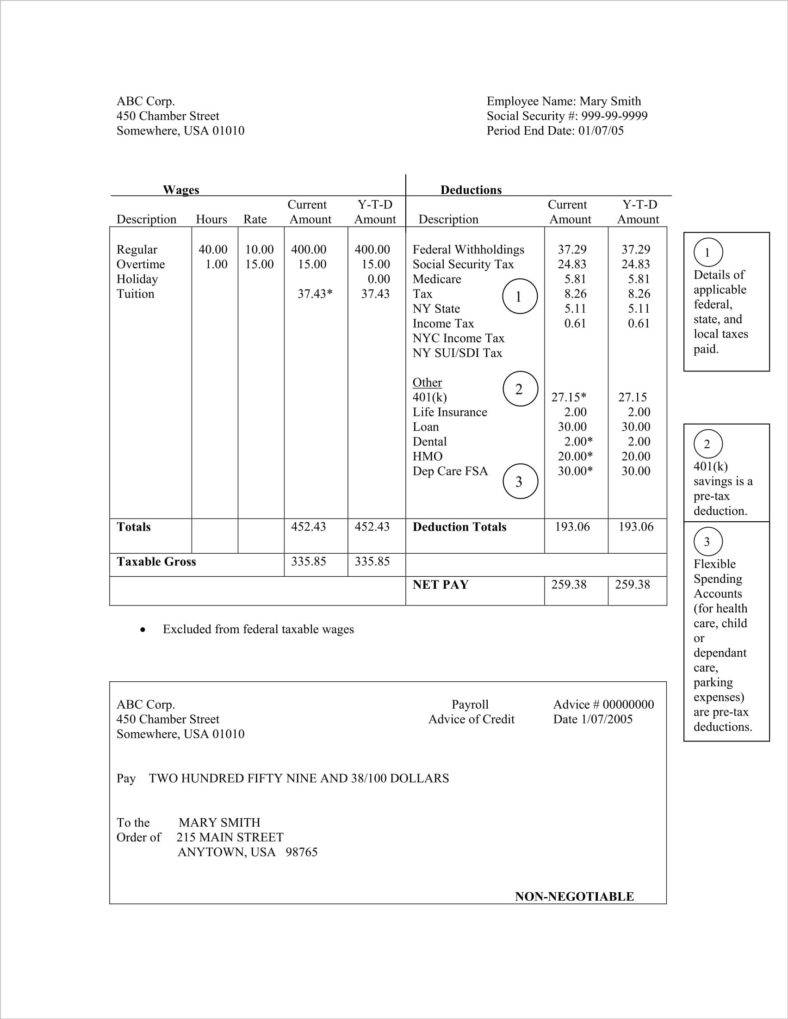

A pay stub contains information that can be used by both the employee and the employer. For an employee, the pay stub can be used to see records regarding their pay. Browse through more payment notice templates here. The pay stub allows the employee to see whether or not they are paid correctly—that means checking out their total salary and their deductions and seeing if everything adds up. So when an employee wants to see information regarding the number of hours he or she has worked, and check if the amount that the employer paid him or her matches, then all one has to do is go through the pay stub.

The employer can use the pay stub in the event there are any discrepancies in the employee’s payroll. Let’s say that an employee’s social security number is incorrect. This means the taxes the employer filed with the federal and state authorities will also be wrong, and it’s possible that the employee’s withholding amount may get applied to someone else’s account. This could cause some serious problems if left unchecked. So if an employee has questions regarding his or her pay, all the employer has to do is go through the payroll stubs.

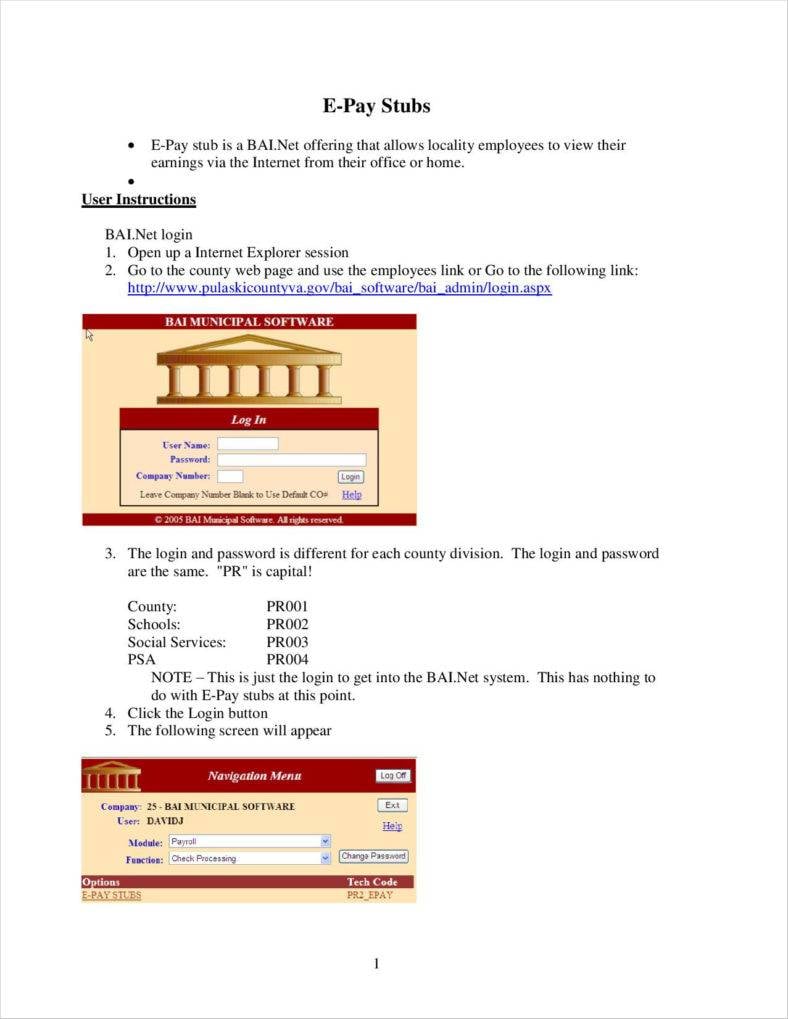

E-Pay Stub Template

pulaskicounty.org

Simple Online Pay Stub

ymcaboston.org

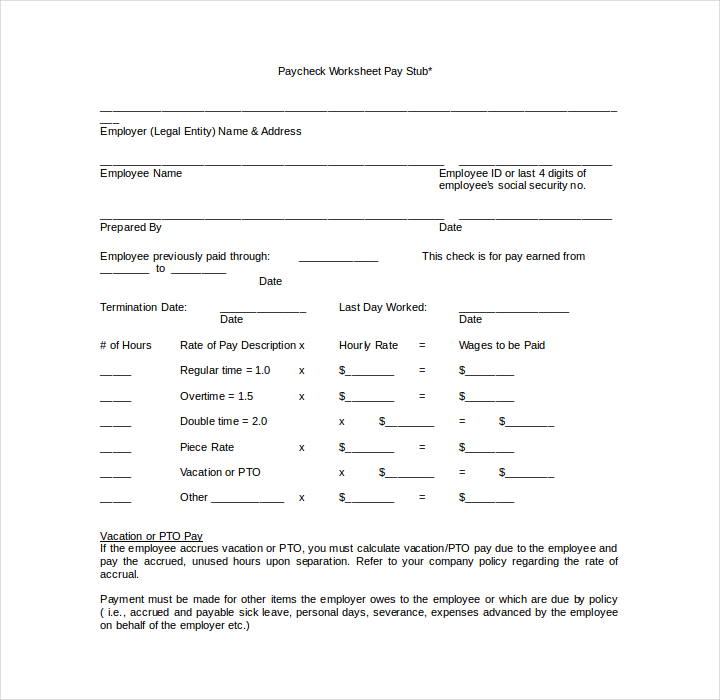

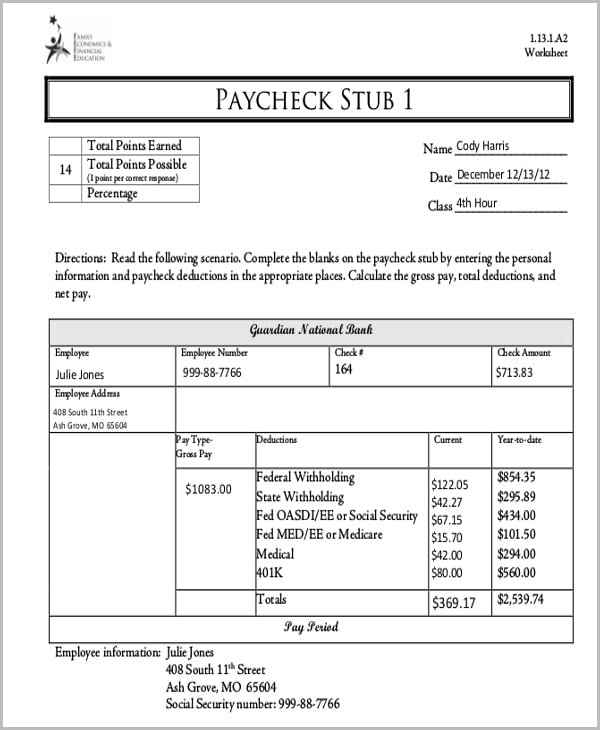

Paycheck Worksheet Pay Stub Template

silvershr.com

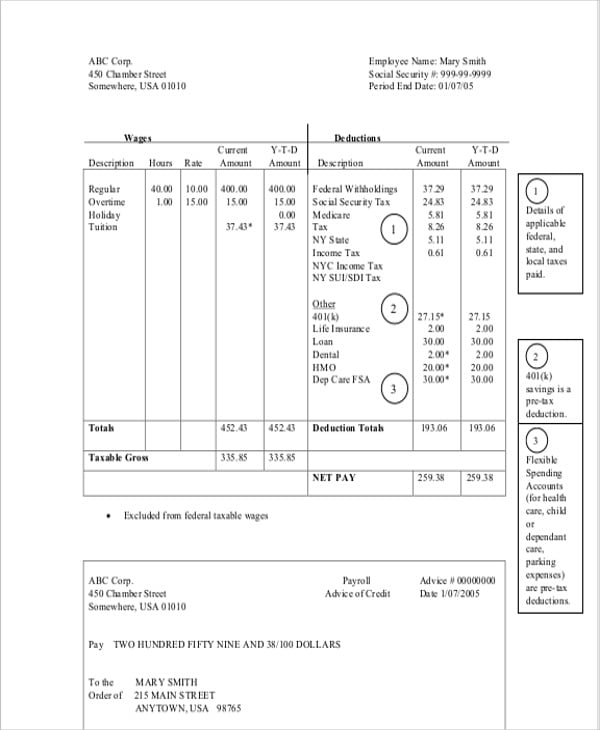

Pay Stub Example Template

thirteen.org

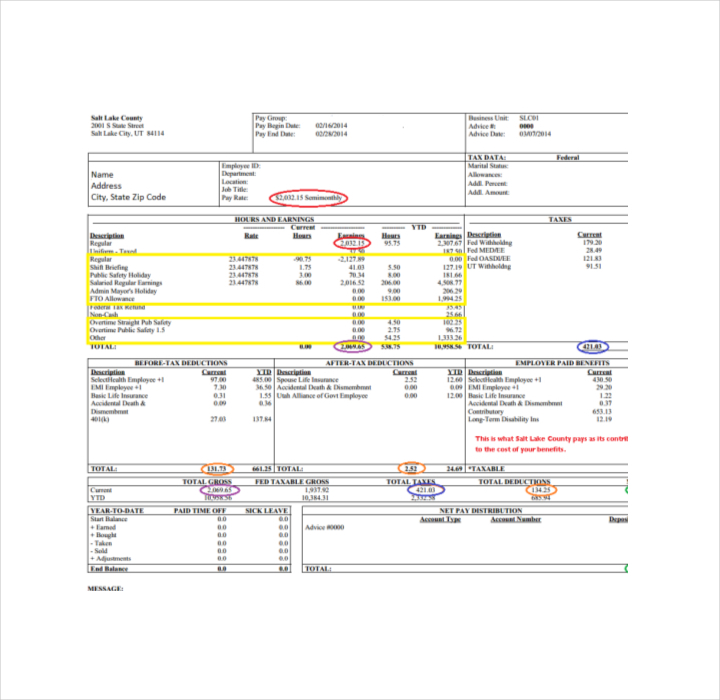

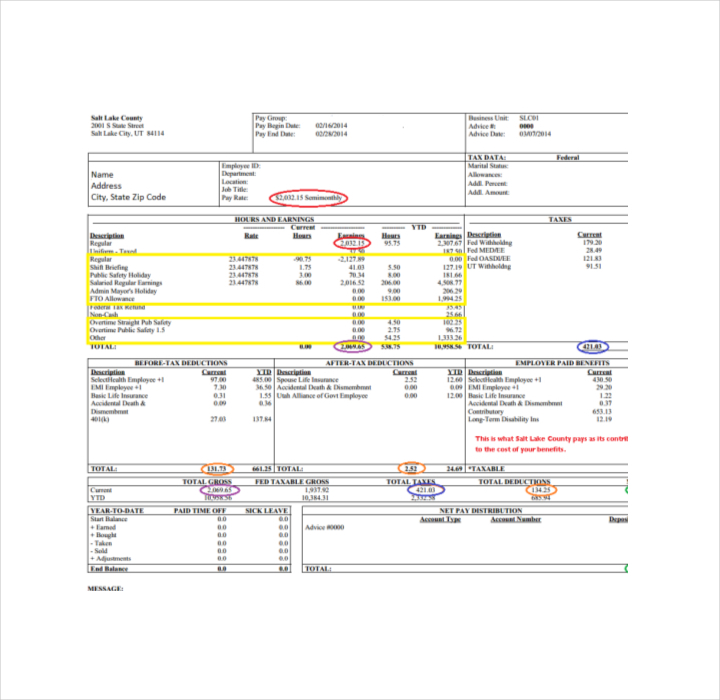

Salary Pay Stub Template

slco.org

The rules of giving employees their pay stubs

- Federal law overview. The Fair Labor Standards Act (FLSA) regulates issues such as employee payroll record-keeping for employers and it doesn’t exactly require the employers to provide the employees with pay stubs. Employers don’t have to provide the employees with a paper record, but federal law has very strict requirements when it comes to record-keeping. Basically, it’s a number of things that must be contained in the employee records such as the name of the employee, sex, regular hourly pay rate, total wages paid each pay period, hours worked each day, and much more.

- State law overview. In spite of the fact that pay stubs or pay statements are not exactly required under federal law, most states have passed state laws wherein employers are required to provide their employees with statements regarding their pay and withholdings on a regular basis. So when making these statements, information such as an employee’s name, social security number, pay rate, pay period, and deductions must be available. Looking for more insights? Dive into our blog post about payment receipt templates.

Make sure to comply with the rules with regard to giving employees their pay stubs. Because if you don’t, then it can lead to some serious legal issues that can only end badly for the business.

Most people think that their paychecks just mean that they finally have money in their bank accounts. However, if you want to improve your money management skills, then you’re going to have to learn how to read your pay stub. By educating yourself and understanding the information that your pay stub contains, then you’ll find that the pay stub plays a vital role in helping you become more effective in terms of money management and proper budgeting. You’ll know where your money is going and you can make sure that you stay on top of things. Although different companies print out their paychecks in their own ways, there are some aspects of an employee paycheck that employers must include by law. The following items will appear on the pay check stub: For a wider selection of payment voucher templates, check out more options here.

- Gross pay. This is the total amount you have earned in a particular pay period. The pay period is determined by your employer, but this is usually bi-weekly or monthly. Also it’s important to take note that this is the amount of pay that you get before any taxes or withholdings are deducted from it.

- Net pay. This is the actual amount that you take home with you at the end of the day. So this is basically the result after your gross pay has been reduced by the necessary deductions. So this is the amount of money that goes straight to the bank and into your finances.

- Federal tax amount. When you were first hired by your employer, he or she required you to fill out a W-4 form. What this form does is cover any tax that you may owe to the federal government once tax time comes. It is deducted incrementally after every paycheck, and it can also vary depending on the exemptions that you chose to claim.

- State tax. Depending on where you live, you may or may not have to pay a state tax. However, for those that do have to pay it, then it’s best to know that this amount is deducted from your paycheck in order to cover the amount of what you owe the state when your tax return is filed. Find more payment agreement templates by visiting this link.

- Local tax. Although this is rare, local tax is sometimes applied to the salaries of employees that live in certain cities, counties, or school districts. These taxes are generally for public projects. Basically it can be anything from health care related projects or even infrastructure ones. Explore a variety of payment schedule templates here.

- Social security. The federal government requires that just about every employee has to have a certain percentage of their paycheck withheld for social security purposes. This will entitle them to monthly social security payments upon their retirement. Basically, no matter where you work, your employer has to make sure that he or she deducts a portion of your salary to pay for your social security. Otherwise, it could lead to some serious problems in the future. Check out more payment to creditor templates available here.

- Medicare. Much like social security withholdings, medicare payments are mandatory. Every employee has to pay 1.45% of their paycheck towards medicare, and employers contribute another 1.5% on behalf of the employee. So once an employee is eligible for social security, an employee is entitled to coverage for a majority of the medical expenses. This is certainly a great thing to have in the event that one requires serious treatment.

- Year-to-date (for both pay and deductions). The year-to-date field that’s in your pay stub shows just how much you have paid for a particular withholding at any point within the calendar year. This can be really useful for you in the event that you’re trying to budget your monthly expenses or if you are planning on achieving any long-term goals.

While these aren’t required, the following may appear on your pay check stub and are useful for money management and knowing your employment status:

- Insurance deductions. These are monthly payments that include types such as insurance for health (medical and dental) and life insurance.

- Leave time. This includes both vacation hours and sick hours. A majority of employers will place this in detail as to how many hours have been used up to date, and how many hours there are remaining for the following year.

- Childcare assistance. If your employer offers childcare assistance, then you will find that this amount may appear on your paycheck as a pre-tax benefit.

- Importance notices. There are those employers who make use of a portion of the pay stub to communicate important pieces of information to the employee. The information that are in these notices are usually about tax filings or even wage increases. So make sure that if you see an important notice, you go through it carefully so you can keep up to date with your company. You can take a look at these payment waiver templates provided here.

Sometimes employers, or the people they hire, make paychecks that have abbreviations in them. This is because it saves both time and space, allowing employers to have pay stubs easily made as well as making it more neat and presentable. So here are a couple of abbreviations you need to know:

- YTD: Year to date

- MWT or Med: Medicare tax withheld

- FT or FWT: Federal tax or tax withheld

- SS or SSWT: Social security or security tax withheld

- ST or SWT: State tax or state tax witheld

Since you understand just how important it is to provide and offer pay stubs to employees and staff members, the main question that needs to be answered now is how to make one. You can take the option to make handwritten ones, but no business owner wants to burden himself with that amount of work, especially if there are a lot of employees that need to be taken into account. Another perfectly good reason why you shouldn’t make your pay stubs by hand is because there are a lot of banks and companies that will not accept handwritten pay stubs. So if you’re trying to affiliate with them, then you’re going to have to make sure that your stubs are made professionally. Browse through more demand payment templates here.

- To help you make proper pay stubs, there are a lot of accounting software and programs that are available to just about every business owner. A good example would be Microsoft Excel wherein you can download the pay stub template that you need, and all you have to do is choose and customize it until it meets your requirements. Finding free or low-priced pay stub templates online should not be difficult as there are a ton of them available. However, it’s critical that you have to make sure that the software works with the application that you’re using so that you’ll be able to provide the information to your employees and staff at the beginning of every pay period. Looking for more insights? Dive into our blog post about late payment templates.

- There are also a great number of websites that you can go to that can provide every business owner all the templates needed in order to make pay stubs for the employees. There are websites that allow business owners to choose from a variety of templates that will best suit his or her needs. After deciding which template is best, you can look forward to making the pay stub by accurately filling out the information of your staff and for the pay period that’s desired.

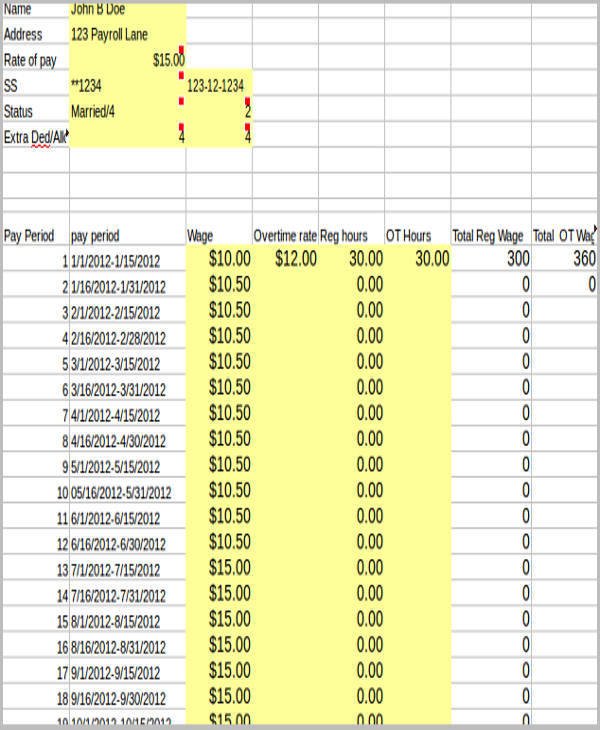

Pay Roll Paycheck Stub Template

templates.openoffice.org

Sample Paycheck Stub Template

wikidownload.com

Free Paycheck Stub Template

d3aencwbm6zmht.cloudfront.net

Blank Paycheck Stub Template

wikidownload.com

Printable Paycheck Stub Template

pdfimages.wondershare.com

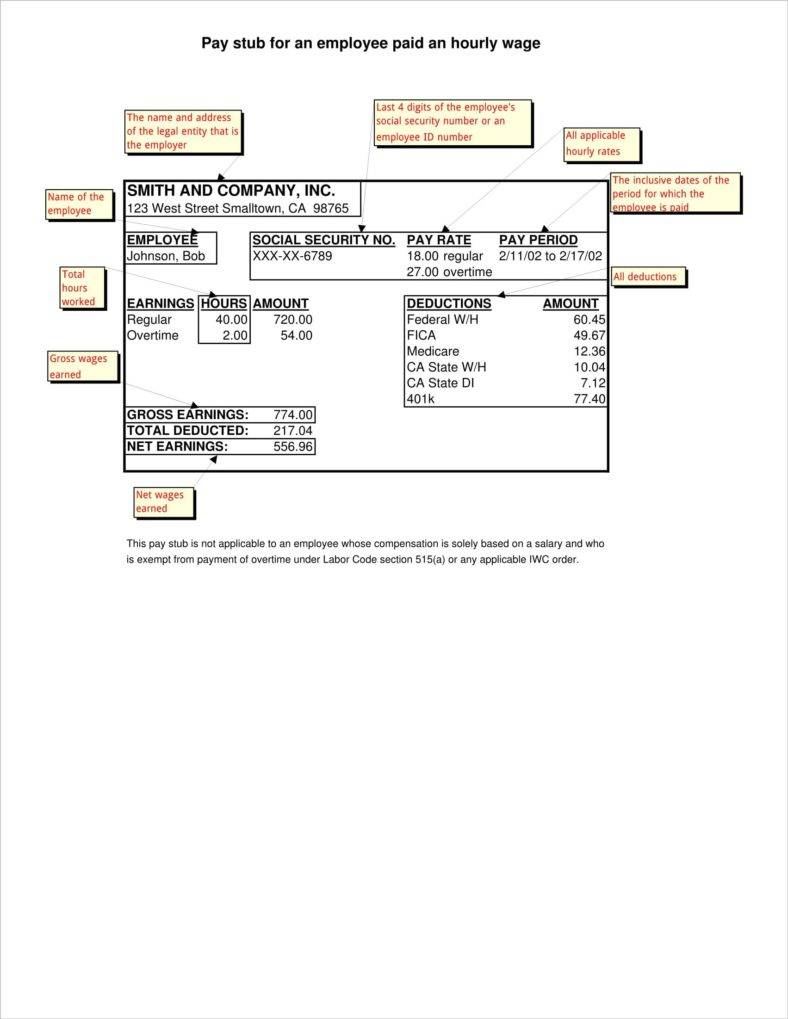

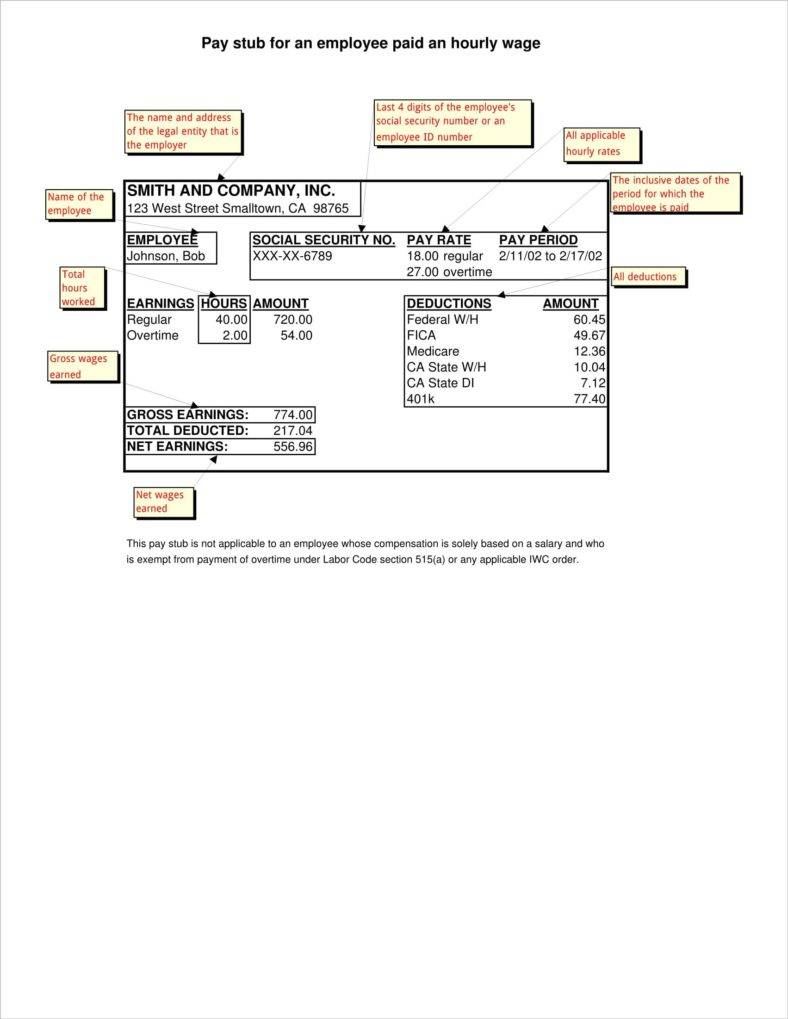

Pay Stub for Hourly Wage Employee

dir.ca.gov

Pay Stub Example

thirteen.org

How to read your paycheck

When you are receiving your pay stub, you’re going to want to understand just how much you’re earning and just how much is deducted from it. Knowing how much you’re going to earn will help you keep better track of your income. So here are the steps that will help you understand your earnings.

For understanding your earnings:

- The first thing you need to look at is the top of your pay stub. What you’ll see on the top of your paycheck stub would be your basic employee information such as your name and the date of when the issue was paid. You can also find the check number at the top part of the pay check stub. This is useful for your financial report so that you’ll be able to track your sources of income. And in the event that something is wrong with your paycheck, you can check with human resources to resolve the issue.

- Find the area in your pay stub that’s labeled as “gross pay”. As mentioned before, gross pay is the total amount you earn before any withholdings have been deducted from your pay. The gross pay will usually be over a certain period of time, which is known as the pay period. A period will may vary in length and will ultimately depend on your employer. The pay periods commonly cover a weekly, bi-weekly, or monthly period. While other periods are possible, they’re not as common. Find more final payment templates by visiting this link.

- Find the area in your pay stub that’s labelled as “net pay” to let you know just how much money you’re going to be taking home with you. Any amount that’s next to the net pay will already have had withholdings and taxes removed from it. So basically, it’s the result of your gross pay that has already been deducted and what you get to keep with you at the end of the day.

Learning what taxes and withholdings were taken:

- Look for the words “Federal Tax Amount” on your pay stub. This will tell you the amount the federal government has taken from your paycheck in order to pay for the taxes that are due. The amount will vary depending on the number of exemptions you have claimed in your W-4 form. If you want to change the amount of exemptions, then all you have to do is fill up a new W-4 form. If you want help, then you can always contact your human resource department to tell you how to best make changes to it.

- Look for the item that’s labeled as “Social Security” so you can know just how much of your paycheck is going into your social security account. This is important because when the day comes that you’ll need to retire, you’re going to want to access your social security funds. So you need to know just how much your company is paying to your social security account and if the company is paying it at all. You should be contributing at least 6.2% of your income to social security payments. Your employer will also contribute 6.2% of his or her income into social security income. This way, you can be rest assured that you’ll be given monthly payments from the government once you’ve retired. For a wider selection of construction payment templates, check out more options here.

- Find the area that’s listed as “Medicare”. The medicare program is what will help with medical payments and billing once you’re eligible for social security. So in the event that you’re ever in an emergency situation where you’ll need to be treated, your medicare insurance will cover the bill. Payment into the medicare program is mandatory for both you and your employer. Medicare payments are set to 1.5% of your total pay. Your employer will also be required to contribute at least 1.5% of his or her total pay to Medicare. You may find that your medicare may be part of another item that’s labeled as FICA. FICA usually includes both medicare and social security together, making things much easier.

Finding additional items and summaries:

- Look for the item in your pay stub that’s labelled as “year to date”. This entry is really useful in your pay stub as it will show you exactly just how much you have earned, and how much has gone into taxes and withholding, up until the current date that’s placed on the pay stub. You can use the year-to-date area of your pay stub to keep yourself up-to-date on your financial records as well as making sure that everything is accurate. Explore additional paystub paycheck templates on our website, template.net, to find a variety of options that suit your needs.

- Look for any additions that may appear on your pay stub. Although we’ve already covered this before, it is really important that you know about the additional items that you should look out for. So that’s everything from insurance reductions, retirement plans, time off, and additional notices.

Learning how to read one’s pay stub is very important, but it’s also important that employers know how to make these pay stubs. So in the event that you would like to learn more about pay stubs or paycheck stubs, then you can go through any of our available pay stub templates so that you can learn more about how they’re used and why it’s important that one learns how to both read and make them.

![How To Make/Create a Pay Stub in Microsoft Excel [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2017/09/How-To-Make_Create-a-Pay-Stub-in-Microsoft-Excel-788x443.jpg)