10+ Types of Check Stub Templates

Employees go to work every single day, conducting different tasks and upholding responsibilities that their employers require them to do.…

Jun 19, 2020

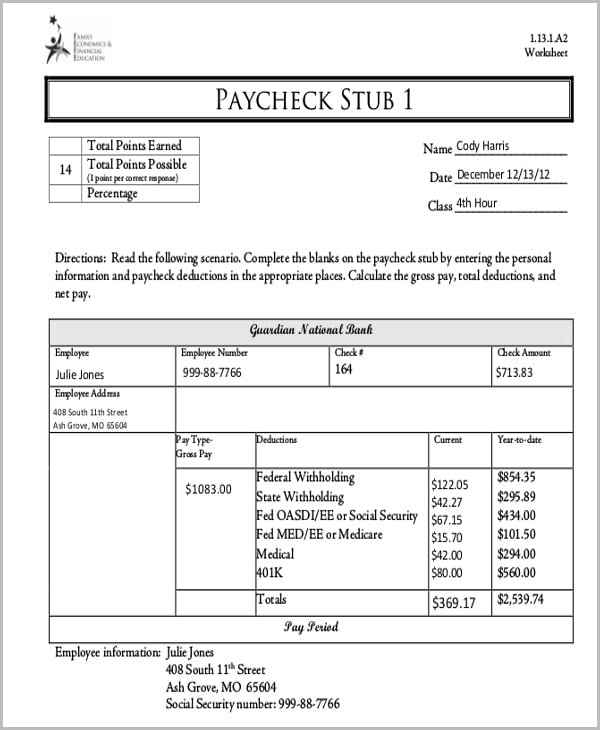

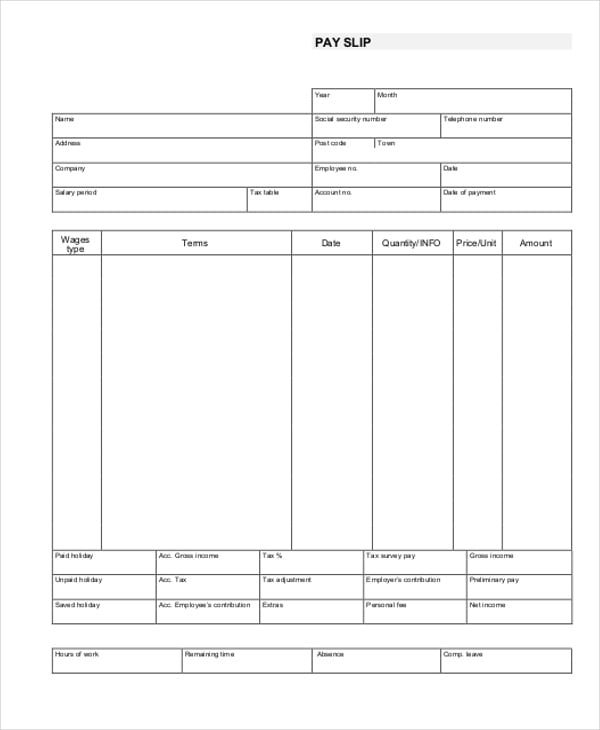

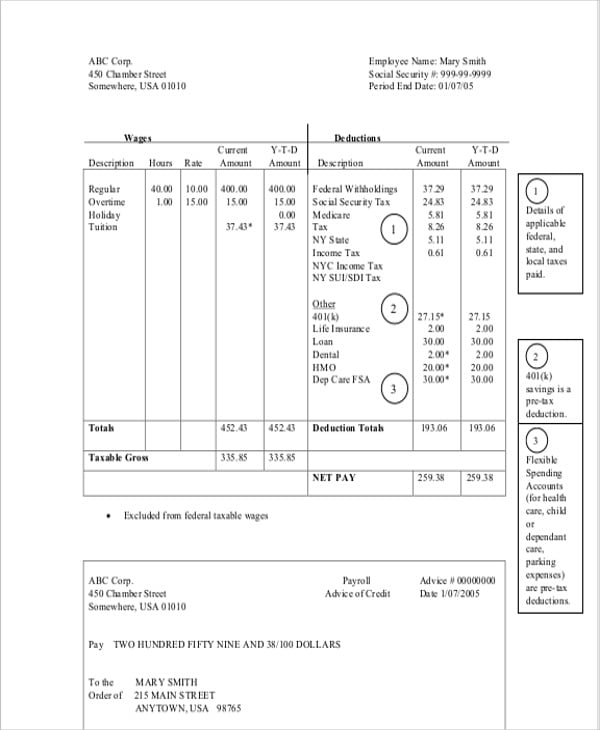

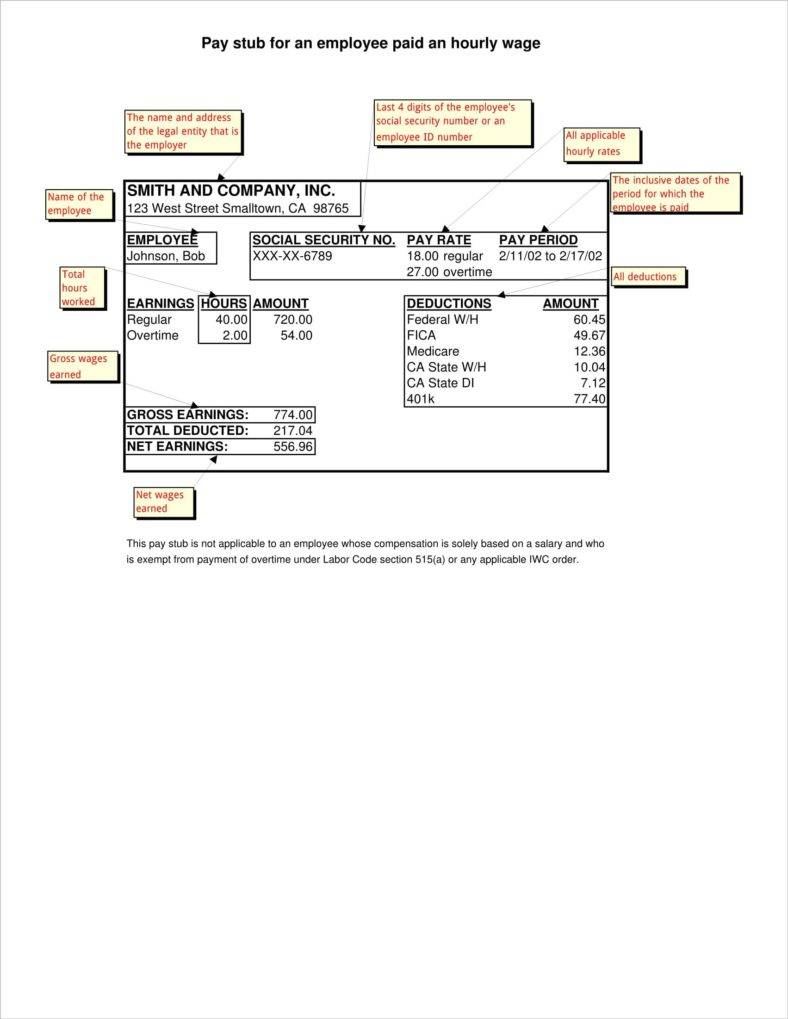

Employees go to work every single day, conducting different tasks and upholding responsibilities that their employers require them to do. So naturally, once payday arrives, employees expect to be compensated for the amount of work that they have produced. However, employees have a right to know how much they’re making and why they’re making the amount they have received.

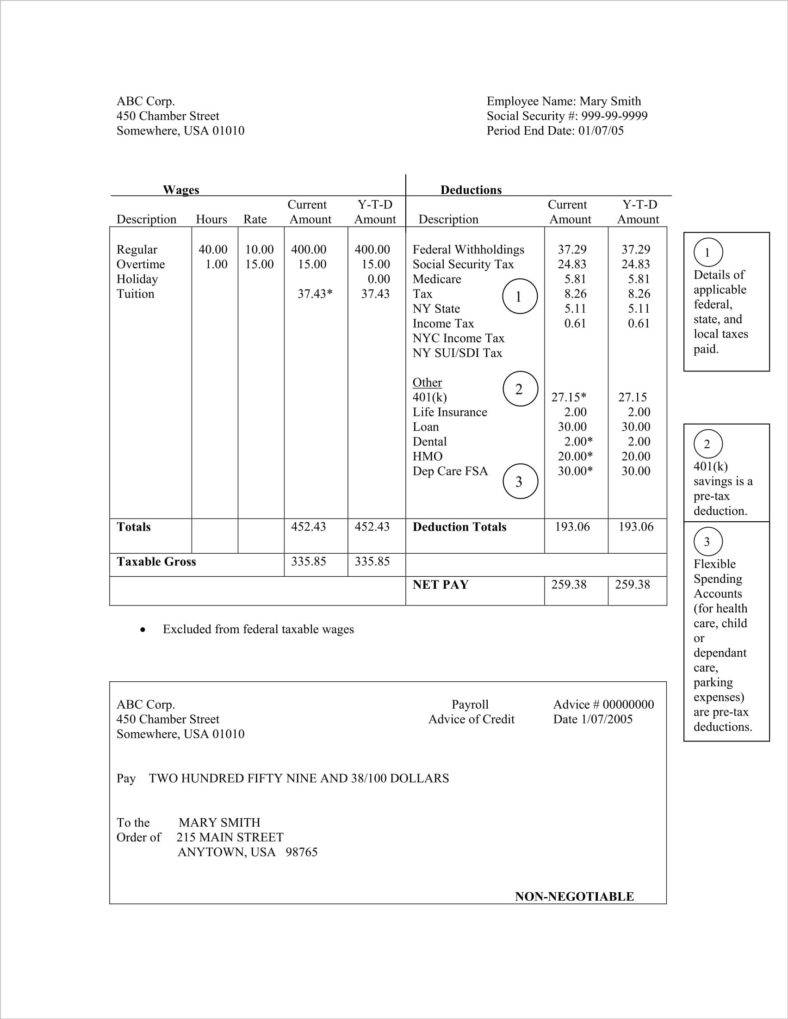

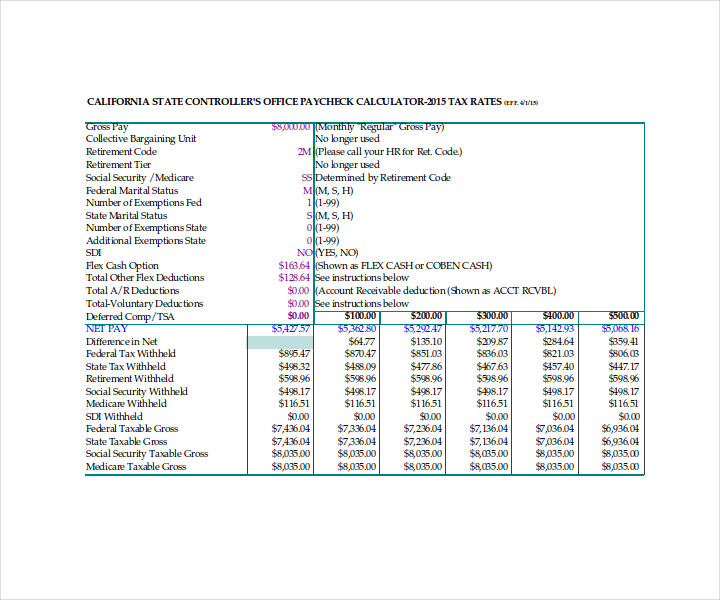

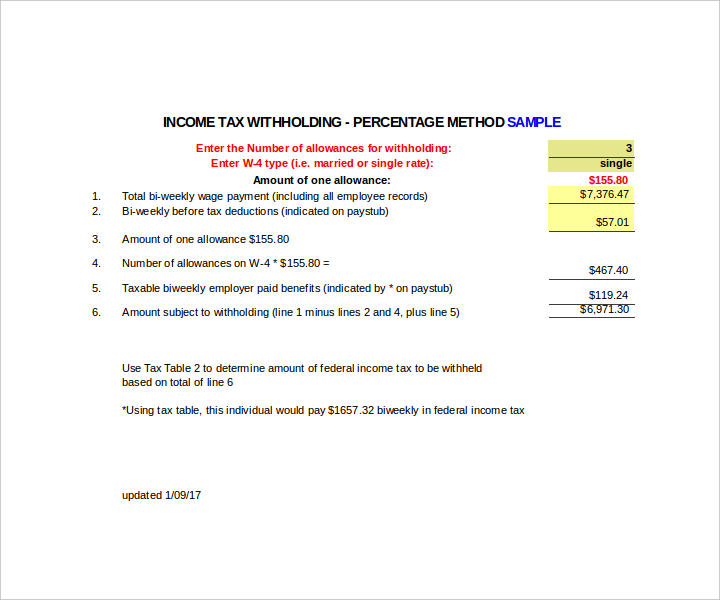

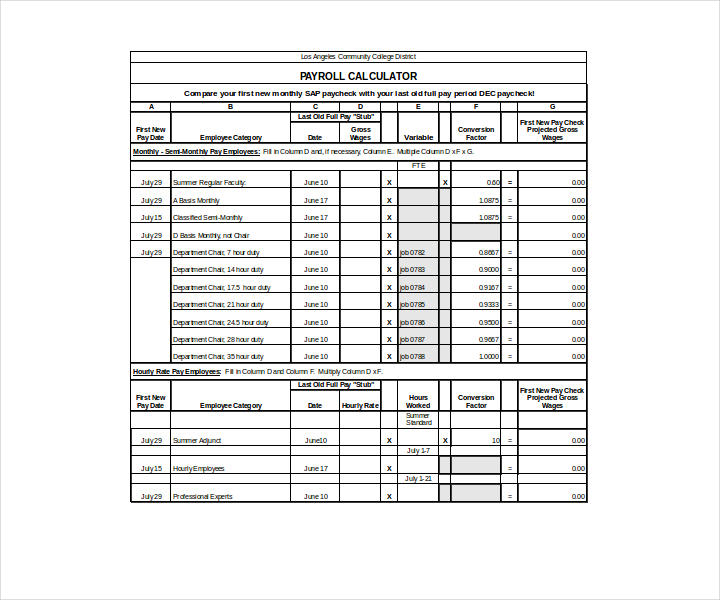

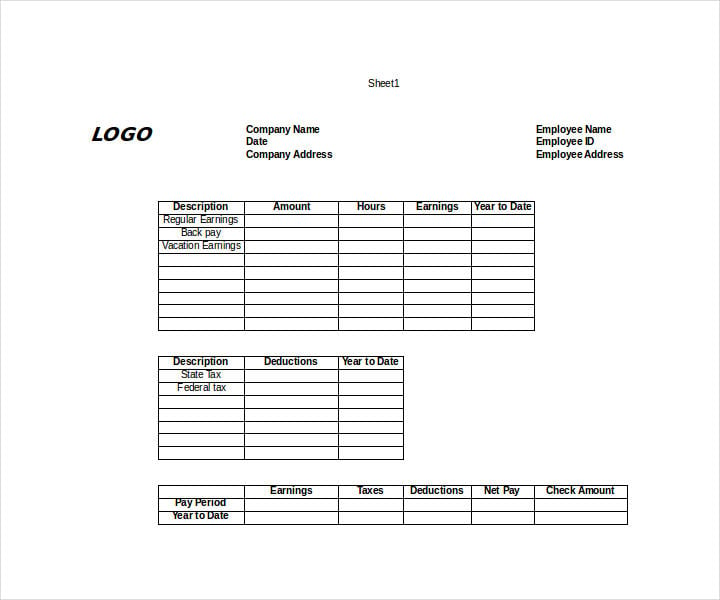

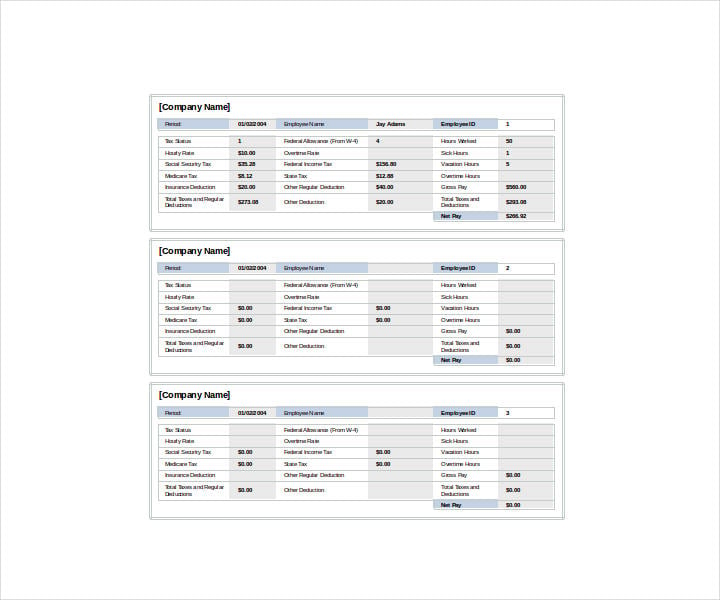

This is the reason why employers have to make check stubs. With check stubs, employers can give these employees all of the important details regarding how much they earn and other things that affect their pay. So this article will focus on how to make check stub templates and how you can read them.

d3aencwbm6zmht.cloudfront.net

wikidownload.com

pdfimages.wondershare.com

dir.ca.gov

thirteen.org

With the help of a check stub, also known as a pay stub, employees will be able to keep track of all the taxes that were taken out of their paycheck, the amount of the taxes, the hours that they have worked, and information regarding their year-to-date payment amount. Employees are also going to need these check stubs in the event that they’re going to apply for a loan, refinance their home, or for when they have to fill their children’s financial aid forms. So if you’re going to make a pay stub, here are the steps that you need to take:

sco.ca.gov

medinfo.ufl.edu

laccd.edu

freetemplatedownloads.net

While every company makes and prints their own unique check stubs, there are some details that employers must include in the stubs as mandated by law. Some of these stubs can be extremely detailed and some will only have the required information. The following items will appear on every pay/check stub that an employee receives:

As mentioned before, employees have the right to know about the amount of money that they’re making, as well as the reason why they’re making the amount that they’re receiving. They need this valuable information as it will help them plan out how to properly manage their personal finances. Plus, if an employee doesn’t hand these out, then it could lead to some serious legal issues that can only lead to more problems for the company.

So if you would like to know more about pay/check stubs, then you may go through any of our available templates that will provide you with more ways on how to make these stubs, as well as help you learn more about their purpose and why employees benefit from them.

Employees go to work every single day, conducting different tasks and upholding responsibilities that their employers require them to do.…

Are you working as an accountant or in HR? Ensure every employed independent contractor, colleague, and other employees know the…

![How To Make/Create a Pay Stub in Microsoft Excel [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2017/09/How-To-Make_Create-a-Pay-Stub-in-Microsoft-Excel-788x443.jpg)

Pay stubs are business documents organizations and companies use for employees that management and employers issue to portray gross earnings,…

During certain times within a month, employers have to make sure that their employees get the salaries they have earned.…

Looking for well-researched, professionally made permission slip templates? You’ve come to the right page. We offer you a variety of…