24+ Research Statement Templates in PDF | DOC

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

Sep 04, 2023

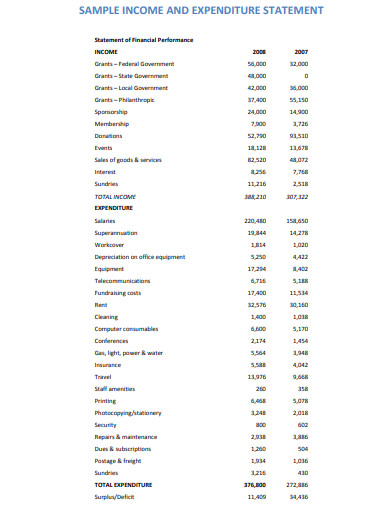

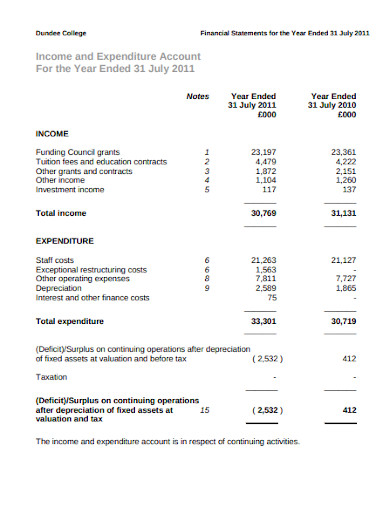

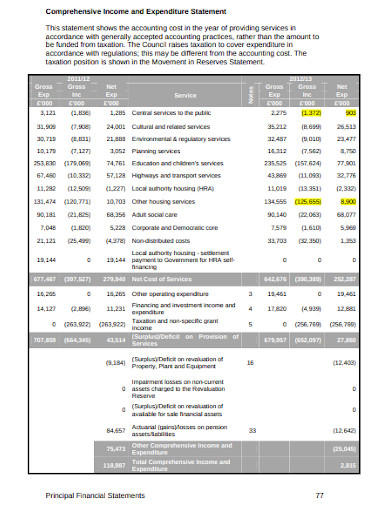

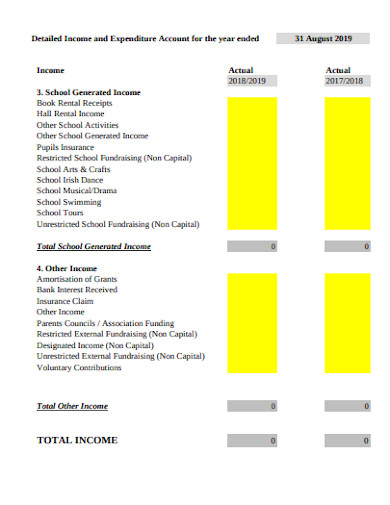

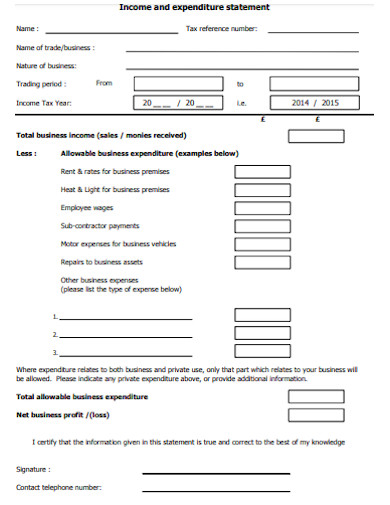

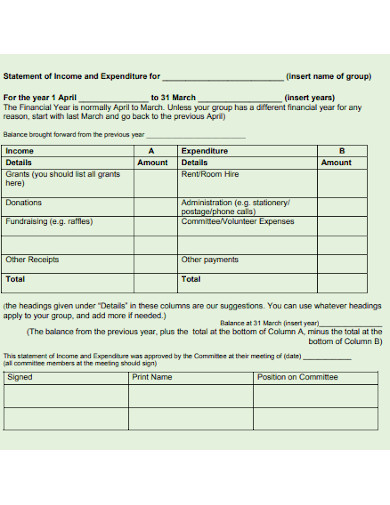

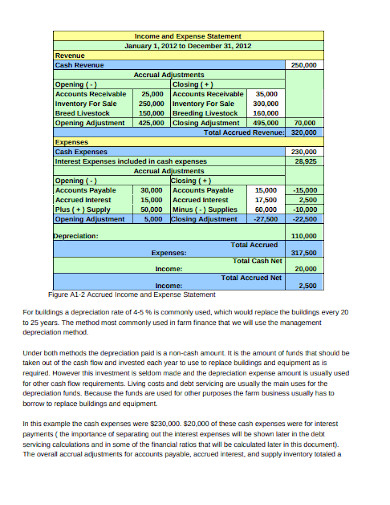

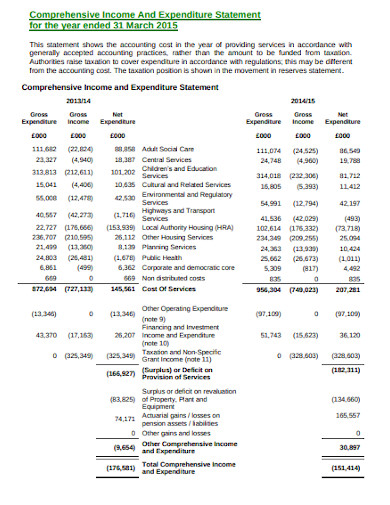

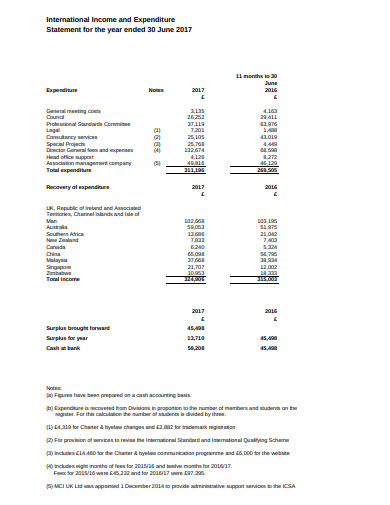

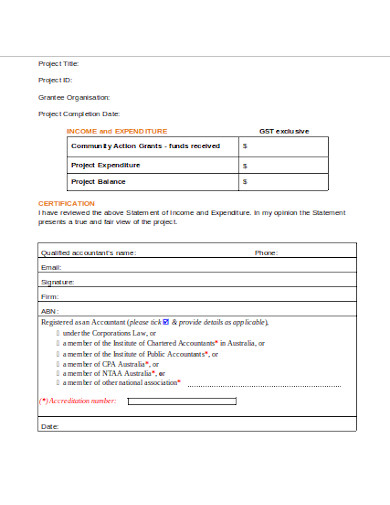

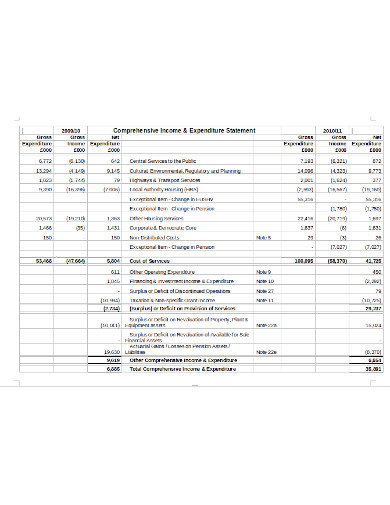

The Income and Expenditure Statement is a summary of all items of income and expenses which relate to the ongoing accounting year. It is ready with the target of sorting out the excess or deficit arising out of current incomes over current expenses. Have a look at the income and expenditure statement templates provided and choose the one that suits your purpose.

ourcommunity.com.au

ourcommunity.com.au dundeeandangus.ac.uk

dundeeandangus.ac.uk democracy.medway.gov.uk

democracy.medway.gov.uk fssu.ie

fssu.ie gov.im

gov.im hullcvs.org.uk

hullcvs.org.uk agric.gov.ab.ca

agric.gov.ab.ca cipfa.org

cipfa.org icsaglobal.org

icsaglobal.org nrm.gov.au

nrm.gov.au tamworth.gov.uk

tamworth.gov.ukThe income statement displays the revenues, expenses, and resulting profit or loss of business. To make an income simple statement, observe these steps:

Go to the accounting code and print the “trial balance” customary report. This is a summary report that contains the ending balance of every account in the general ledger.

Aggregate all of the revenue items on the balance and insert the result into the revenue line item within the earnings layout report.

Subtract the value of products oversubscribed from the revenue figure to gain the profit margin. This is the gross amount earned on the sale of products and services. You can also see more on Statement Formats.

Multiply the applicable tax rate by the pre-tax income number to arrive at the income tax expense. Enter this quantity below the pre-tax financial gain variety, and also record it in the accounting records with a journal entry. You can also see more on Income Sheet Templates.

Subtract the income tax from the pre-tax income figure, and enter this amount on the last and final line of the income statement, as the net income figure. You can also see more on Income Templates.

In the header of the document, classify it as an income statement, enter the name of the business, and the date range included by the income statement.

a. Provides complete data on revenues: The income statement provides complete data on revenues. Besides the common costs such as the cost of goods sold (COGS), employee expenses, operational expenses, it also accounts for extra costs like taxes applicable. Thus, on the revenue front, it accounts not just for revenues attained from sales however conjointly factors certain revenues obtained from non-operational parts like interest collected by completely different investments. Therefore, the income statement is an absolute source for complete revenue information. You can also see more on Mission Statement Templates.

c. Other benefits: The income statement shows the profitability of the organization over a point of time. The organization can decide the major revenues it has earned. Secondly, it is important because it is based on the matching principle and shows the expense acquired by an organization to earn the revenues. From an investment prospect, shareholders of an organization are interested in the net income because the dividends are paid out of the total income. Furthermore, the income statement also benefits the groups to analyze their expenses and take into account the major streams of working revenues of the organization. You can also see more on Problem Statement Templates.

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

A suitable statement for employment outlines any supporting explanation of your skills, proving that you are ideal for the employment…

The written statement is a legal statement that the people have to go through when they face some legal ups…

A disclosure statement is the synopsis of the terms, conditions, risks, and rules that are involved in any financial transactions…

A salary statement is a form that provides different components of an employee’s salary and the cost incurred payments. It…

A document that explains the significance of the research work you did is known as an impact statement. It is…

Statement of Expenditure is a multi-column self-balancing monthly statement of expenditures of an operative level workplace. It is created to…

When you write a sworn statement or testimony, you’re testifying beneath oath, and your words can become a part of…

A purpose statement announces the aim, scope, and direction of the paper. It tells the reader what to expect in…