24+ Research Statement Templates in PDF | DOC

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

Sep 05, 2023

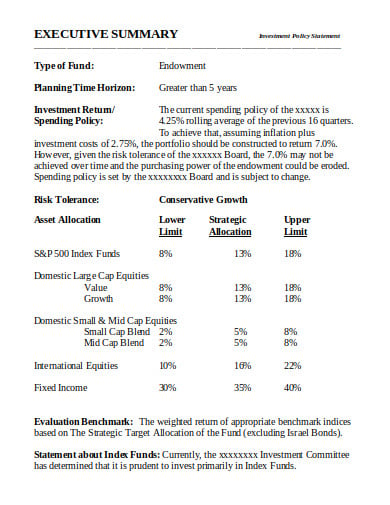

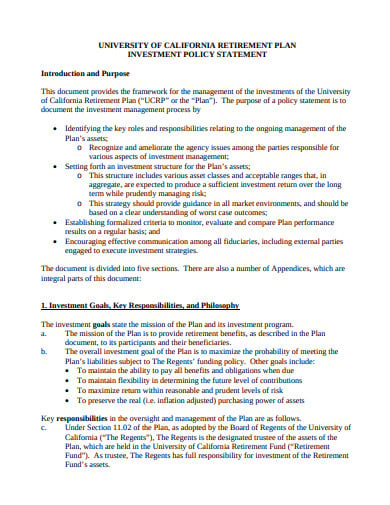

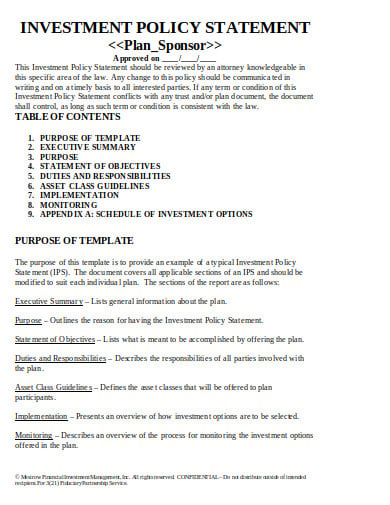

An Investment Policy Statement is a general document established between the portfolio manager and the clients that gives rules for the manager. And this statement or document provides the basic investment goals and objectives of a client and agrees with the strategies that the manager must employ to fulfill these objectives. The specific information on the significant matters like asset allocation, risk tolerance in a policy statement.

boardsource.org

boardsource.org russellinvestments.com

russellinvestments.com suntrust.com

suntrust.com fmgsuite.com

fmgsuite.com welchgroup.com

welchgroup.com welchgroup.com

welchgroup.com whzwealth.com

whzwealth.com step.org

step.org regents.universityofcalifornia.edu

regents.universityofcalifornia.edu dartmouth.edu

dartmouth.edu haverford.edu

haverford.edu ta-retirement.com

ta-retirement.comOne of the first things that you do is sit down with the representative of the firm looking after the assets and talk to them. It is important to learn if they have any kind of internal guidance to their suggested investment proper decision-making process. In these cases, the professional or expert makes transactions on your account for you in other cases, they can act as a legal authority of the account.

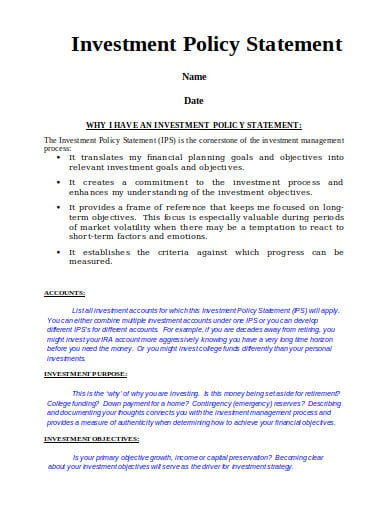

You must begin by sitting down and becoming honest with yourself about the goals and the objectives. Think about how much risk you want to take on in the investment process. Always make sure that the speculative investments have much higher returns but you are at risk level of losing the capital amount invested.

In this step after considering what good rates of returns is for each and every different asset class, you must set p the asset allocation in such a way that permits you to meet your objectives and goal over the specified period of the time period. The cash equivalents are the kings of domestic as well as international trade that create the backbone of the global markets.

You have to make sure of how frequently you will assess your portfolio to make sure you are within your pre-planned limits and hitting your compounding fence posts. It is good to plan of how often you will rebalance your holdings, or if you would rebalance at all. Establish the measurement term you would utilize to plan if your strategy is on track and running smoothly.

And lastly, make sure that you write, sign, and mention date in your investment policy statement to make it accountable. When you say you aren’t going to allow a single stock or bond to exceed your determined percentage of your portfolio, stick to your policies.

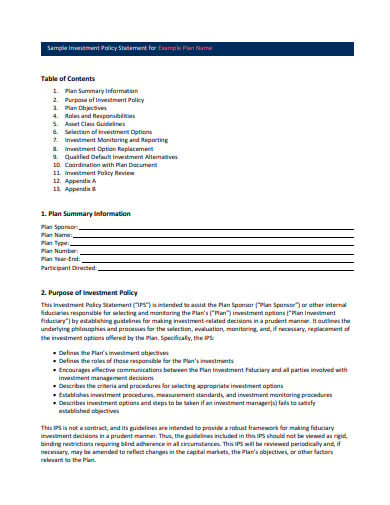

The Investment policy is needed under virtually all investors, with the exception of individual investors. The presence of a policy statement assists in efficiently communicates to all the relevant Advisorant parties, the process, investment philosophy, guidelines, and constraint to stick by the other parties. It is seen as a thing from the client to the investment manager about how money is managed.

But the investment policy statements must provide guidance for all the investment decisions and responsibility of each party. It is a policy document other than an implementation directive, and statements provide guidance for how investment decisions are made and therefore should not be a list of the certain securities to be utilized.

And the presence of the Investment statements assists in creating an environment of clarity and transparency in the relationship among the client and the advisor. The statements offer the client a better understanding of what you can expect from the advisor. And that clarity usually helps to establish a much higher position of the trusts and respect as it helps assure the investments manager is familiar with the expectation of the client.

And utilize the Investment Policy Statement with each and every investment client is now considered a best practice for investment and financial experts should be expected by clients hiring a professional manager. And the well-written investment policy statement might be critical in minimizing the legal liability in a trusted entity such as plan trustees, endowments and foundations or charitable trusts.

Introducing a solid investment policy statement is not a typical workout for more investors. And these require plenty of thought. It also needs an understanding of how the market gradually works as well as accustomed to investment principles and practices. The importance of an investment policy statement is mainly to formulate the process that is to be used by the financial advisor.

The financial advisor and professional follow the terms and conditions of the investment policy statement as a part of effectively reviewing, monitoring and evaluating the investment objectives of clients. This complies with the prudence, due diligence, diversification, or other applicable trusted norms imposed by law.

A well-drafted Investment Policy Statement builds a systemized review procedure that helps the investor to remain focussed on the long-term objectives, even the economy or market changes in the short term. It contains all the current account details, current allocation, and how much has been collected and how much is presently being invested in different accounts.

Investment Policy Statements writes down the investor’s investment objectives, along with the time horizon. Much attention and focus are on describing the investor’s risk/return profile, involving naming value classes that would be avoided as well as naming preferred the asset divisions.

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

A suitable statement for employment outlines any supporting explanation of your skills, proving that you are ideal for the employment…

The written statement is a legal statement that the people have to go through when they face some legal ups…

A disclosure statement is the synopsis of the terms, conditions, risks, and rules that are involved in any financial transactions…

A salary statement is a form that provides different components of an employee’s salary and the cost incurred payments. It…

A document that explains the significance of the research work you did is known as an impact statement. It is…

Statement of Expenditure is a multi-column self-balancing monthly statement of expenditures of an operative level workplace. It is created to…

When you write a sworn statement or testimony, you’re testifying beneath oath, and your words can become a part of…

A purpose statement announces the aim, scope, and direction of the paper. It tells the reader what to expect in…