24+ Research Statement Templates in PDF | DOC

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

Sep 05, 2023

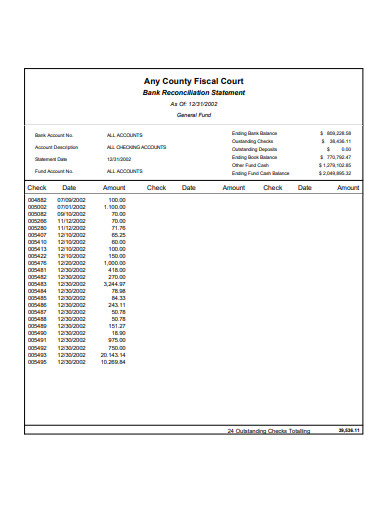

A report from PaymentsJournal says that each individual in the United States has an average of 5.3 bank accounts. And they’re not just from one bank; they’re from multiple banking insitutions. Because that’s the case, mismatches between a person’s bank account records and book balance could be imminent. They happen because keeping tabs of several bank accounts isn’t easy. Of course, fixing those mismatches is necessary to avoid further financial discrepancies and disputes. How to fix them, you ask? You can fix them through a reconciliation statement. So, here, we’ll introduce you to 22 reconciliation statement templates and samples that you can use. And, we’ll discuss the nature of a reconciliation statement.

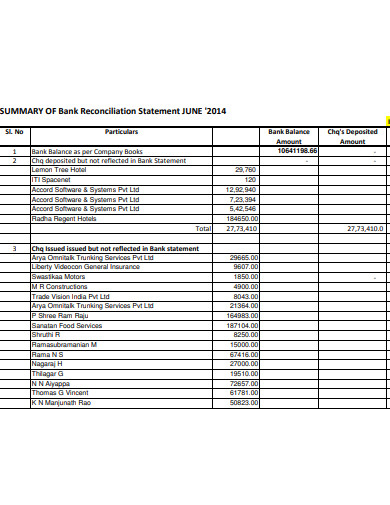

org.in

org.in booksshop.co.uk

booksshop.co.uk brisbanenorthphn.org.au

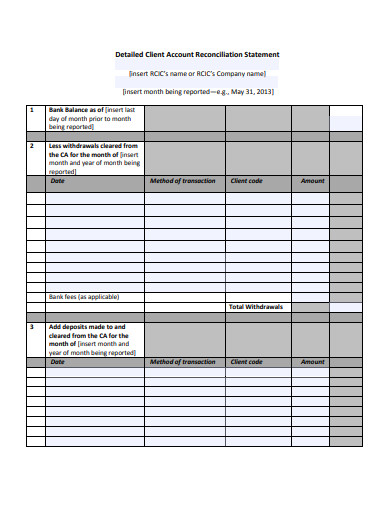

brisbanenorthphn.org.au iccrc-crcic.ca

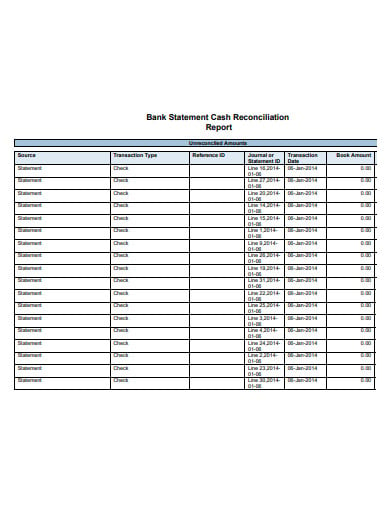

iccrc-crcic.ca oracle.com

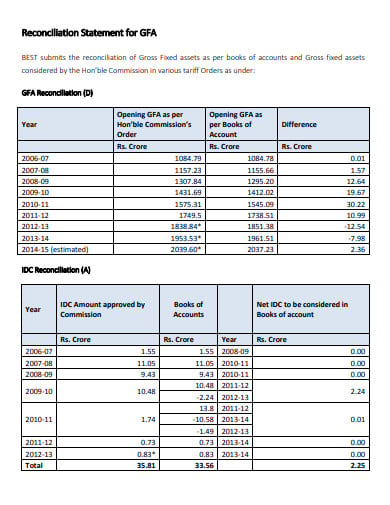

oracle.com bestundertaking.com

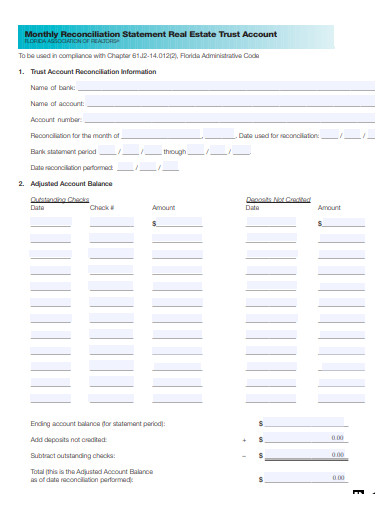

bestundertaking.com unlimitedmls.com

unlimitedmls.com igcseaccounts.com

igcseaccounts.com elcita.in

elcita.in une.edu.au

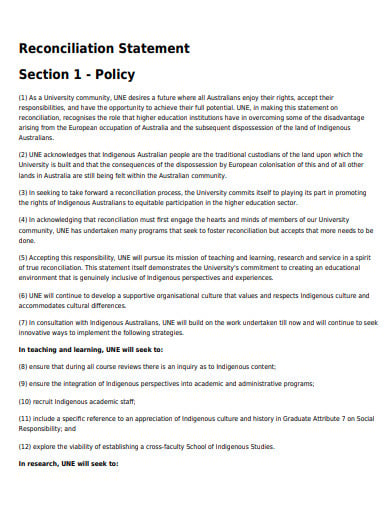

une.edu.au vertafore.com

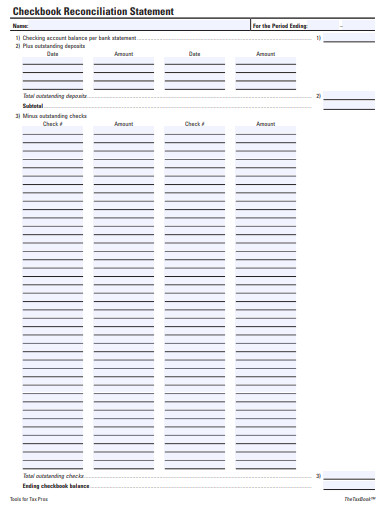

vertafore.com thetaxbook.com

thetaxbook.com fiscalsoft.com

fiscalsoft.com mhc.wa.gov.au

mhc.wa.gov.au images.iskysoft.com

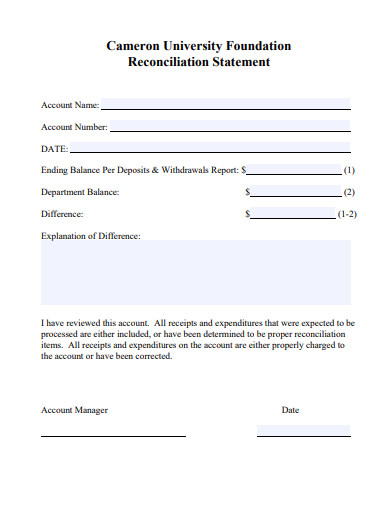

images.iskysoft.com cameron.edu

cameron.edu cilex.org.uk

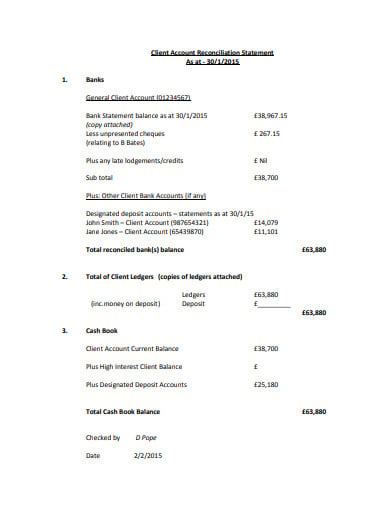

cilex.org.uk frpbc.ca

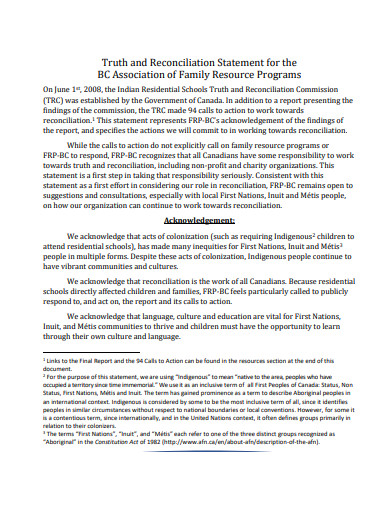

frpbc.ca steel.gov.in

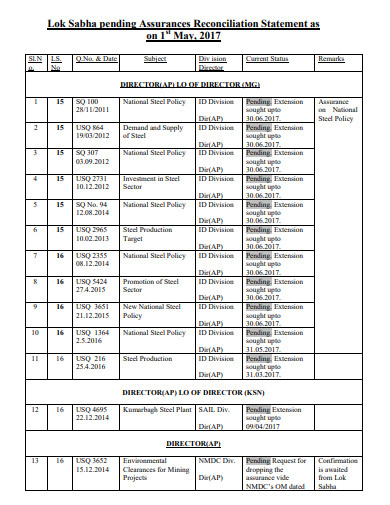

steel.gov.in dineshbakshi.com

dineshbakshi.com dineshbakshi.com

dineshbakshi.com dineshbakshi.com

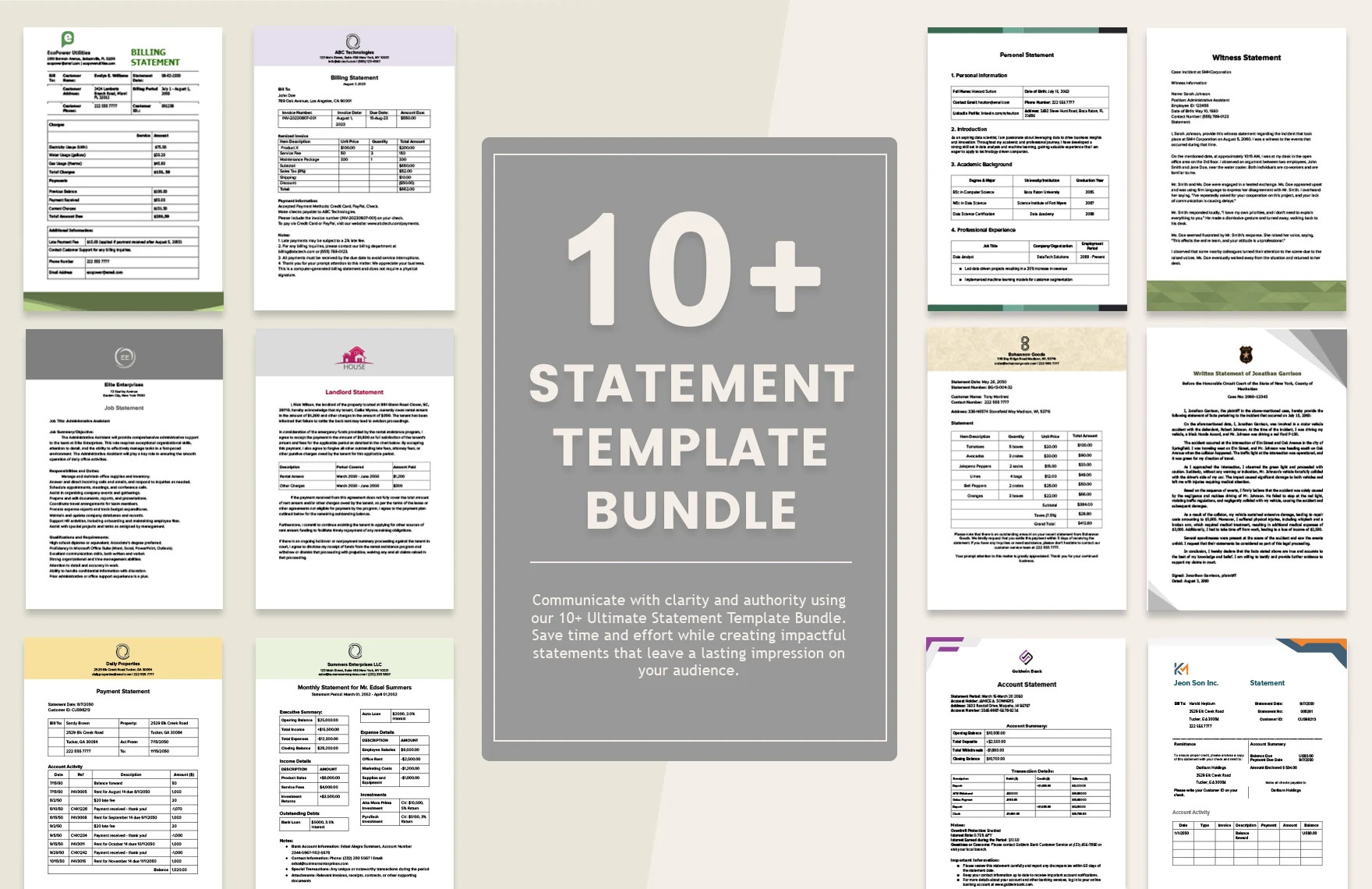

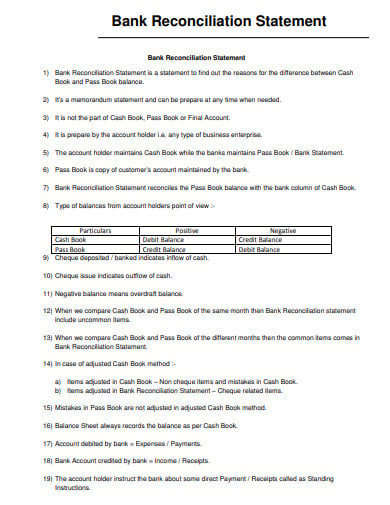

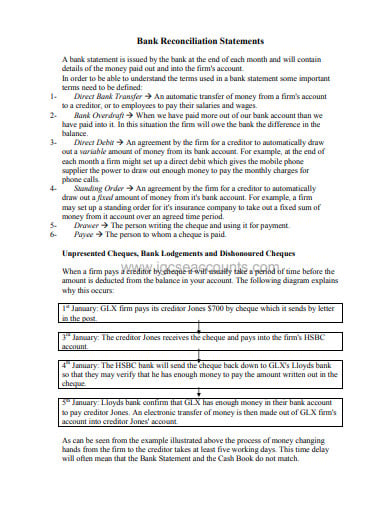

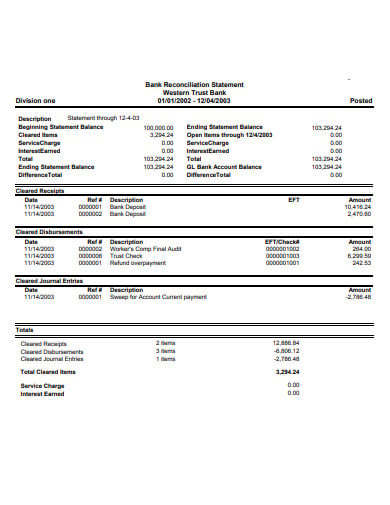

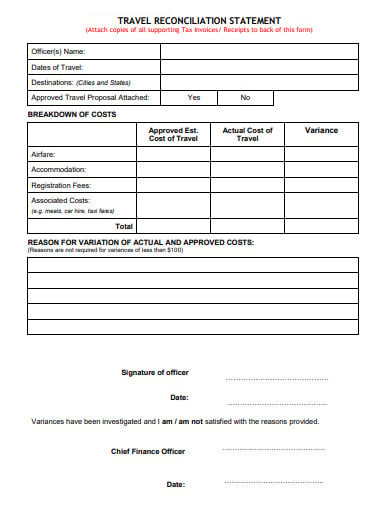

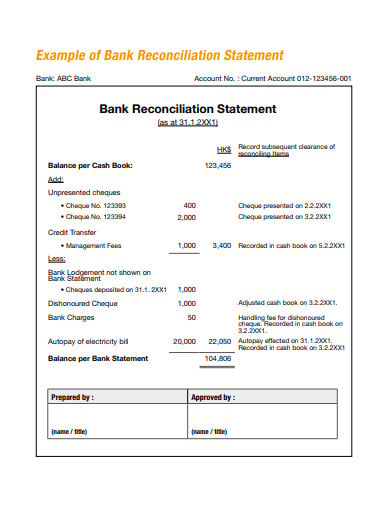

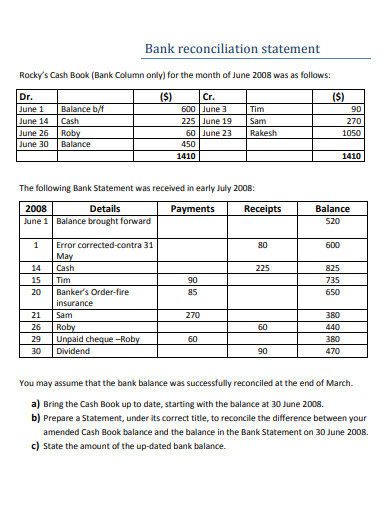

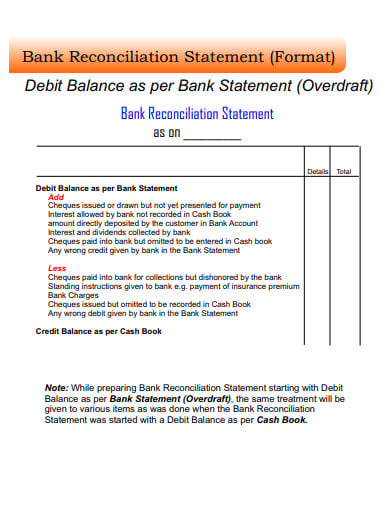

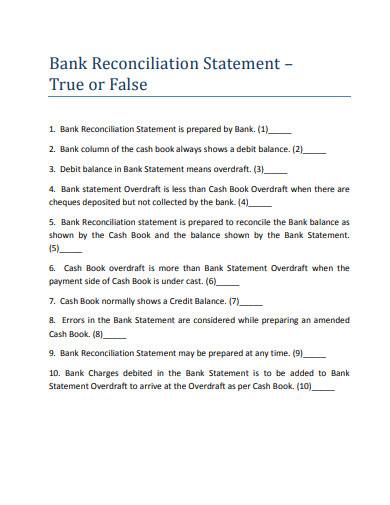

dineshbakshi.comA reconciliation statement is a document that helps in determining the mismatches between the records of a book balance and bank account. It showcases a detailed analysis of which transactions caused discrepancies. These transactions could be payment situations, money withdrawals, money transfers, and many more. Another culprit behind discrepancies is an improper cash handling procedure. It’s called a reconciliation statement because it reconciles the differences between bank and book records. In other words, it harmonizes them. Bank and book records need to match to avoid fraud and to fix accounting errors promptly.

The person responsible for preparing reconciliation statements is usually accountants. So, if you’re an accountant, you already how this reconciliation works and how to do it. After all, reconciliation is also an accounting process. But, if you’re not an accountant, you should at least familiarize yourself with it. We never know. You might face financial disputes concerning your bank accounts and book balance. It’s important to be aware of your finances and be involved in fixing them when needed.

Regardless if you’re an accountant or not, here are four basic steps in formulating a reconciliation statement.

First of all, you must collect all the financial documents. That includes receipts, invoices, previous balance sheet docs, ledger sheets, and cheques. Without them, it’ll be impossible to trace the root cause of the errors. Those documents are proof that a certain transaction took place. Simply put, you can’t start reconciling the financial records if they’re not present for reference.

Reconciling records without referring to relevant financial documents is a fraudulent act. If you’re an accountant, for sure, you’re aware of that. Your accounting license is at stake if you do it. With those in mind, keeping past financial documents and records is an important practice.

The overlooked transaction between a debtor and creditor are the primary culprits most likely. That said, you must check both the debit and credit sides of the records. Compare the two of them to see if they connect accurately. If not, then there’s a problem. In that case, you have to backtrack and refer to the gathered documents.

If you didn’t detect any anomalies at first glance, that’s good. But for assurance, make sure to doublecheck.

Once you’ve found the cause of the mismatches, make the necessary correction directly. In this step, you can use a separate worksheet for a better view of the process. The separate worksheet can function as your draft. When don, you can integrate it into the reconciliation statement doc itself later on. And yes, you must also do a doublecheck as much as the previous step.

After you’ve made corrections, that’s the time to calculate the total balance of the bank account and the book. If they match, that means everything is fine. But in reconciliation, you can never be too sure. So, again, you need to doublecheck. On the contrary, if the total balance of the two didn’t match, you missed something. So you have to review the whole process again. When everything is final and polished, present the reconciliation statement to both parties.

There’s no standard or exact format to follow in creating a reconciliation statement. As long as it clearly outlines a solution to the discrepancy, it’s acceptable.

The following are the specific types of reconciliation statements:

These are the most common reasons why accountants prepare reconciliation statements:

If it’s the bank requesting a reconciliation statement, they don’t need to pay for it. They have their own accountants. But, if it’s the bank account holder who’ll be requesting, he or she might have to pay for an accountant.

Reconciliation statements are vital in the financial world. They’re the best solution to clear up questionable records. You need to acquaint yourself with them to keep your accounts clean and precise. So if you haven’t yet, don’t forget to check out the templates and samples we displayed here.

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

A suitable statement for employment outlines any supporting explanation of your skills, proving that you are ideal for the employment…

The written statement is a legal statement that the people have to go through when they face some legal ups…

A disclosure statement is the synopsis of the terms, conditions, risks, and rules that are involved in any financial transactions…

A salary statement is a form that provides different components of an employee’s salary and the cost incurred payments. It…

A document that explains the significance of the research work you did is known as an impact statement. It is…

Statement of Expenditure is a multi-column self-balancing monthly statement of expenditures of an operative level workplace. It is created to…

When you write a sworn statement or testimony, you’re testifying beneath oath, and your words can become a part of…

A purpose statement announces the aim, scope, and direction of the paper. It tells the reader what to expect in…