24+ Research Statement Templates in PDF | DOC

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

Sep 04, 2023

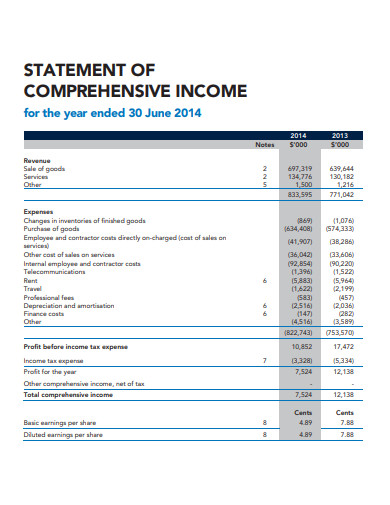

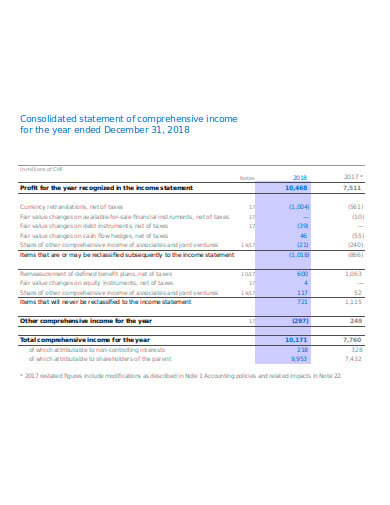

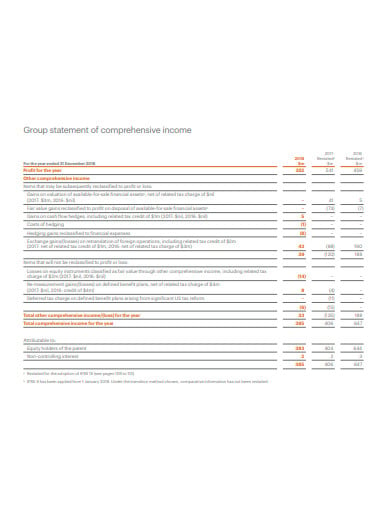

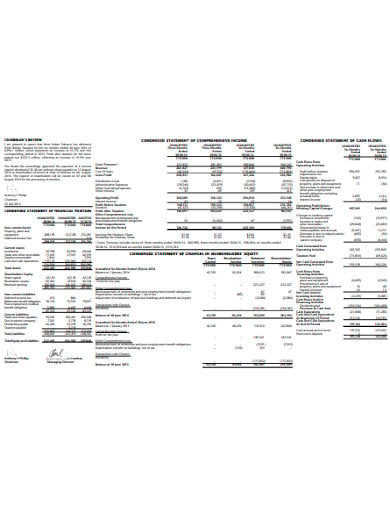

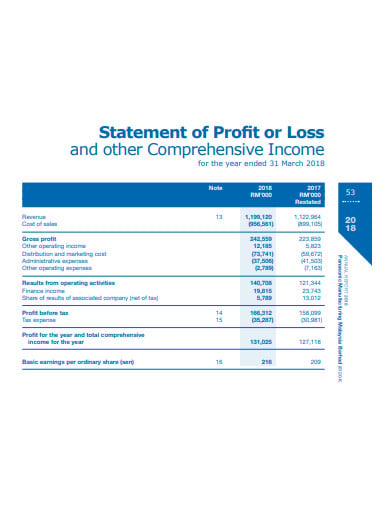

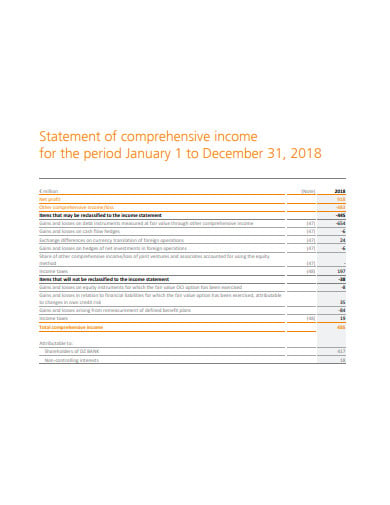

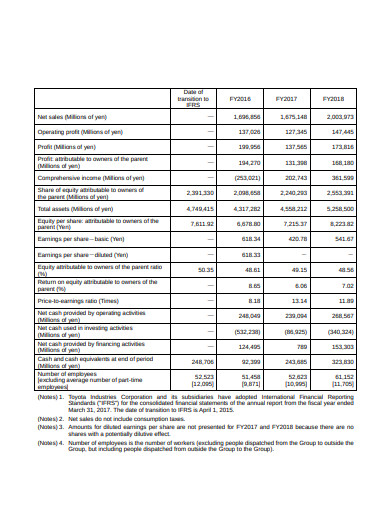

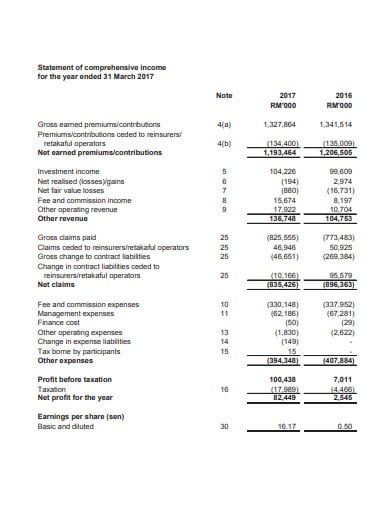

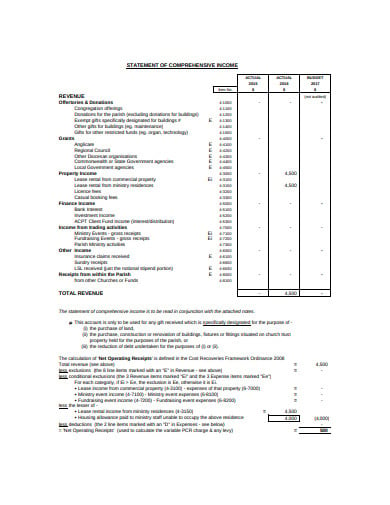

A statement of comprehensive income is known as a financial report that lays out the change in a company’s net assets during a specific time. It is rather different from the typical income statement that consists of the profits and losses but may exclude some changes in net assets due to the transfer of holdings, change of ownership or other factors. It contains two main things which include the net income and other comprehensive income.

investor.data.com

investor.data.com nestle.com

nestle.com ihgplc.com

ihgplc.com aicpa.org

aicpa.org batcaribbean.com

batcaribbean.com finance.wa.gov.au

finance.wa.gov.au dsebd.org

dsebd.org pmma.panasonic.com.my

pmma.panasonic.com.my annualreport.dzbank.com

annualreport.dzbank.com toyota-industries.com

toyota-industries.com malaysian-re.com.my

malaysian-re.com.my sds.asn.au

sds.asn.auA variation that occurs in a company’s net assets from non-owner sources during a specific period is known as a comprehensive income. It usually includes the net income and unrealized income such as unrealized gains or losses on the unoriginal financial instruments and foreign currency transaction gains or losses. A holistic view of a company’s income is provided by the comprehensive income that is not captured on the typical income statement. It helps in including a total of all operating and financial events that may affect the interests of the owners in a business.

A statement of comprehensive income fulfills the purpose of providing information to the users on the financial performance of a business over the accounting period. To assess the potential changes in its economic resources and its capacity to generate cash from its resources, the users need are going to need information on the entity’s financial performance. Besides, the users are also going to need the information to evaluate how effectively any additional resources might be used.

The statement of comprehensive income encircles the income statement and other comprehensive income. An income statement puts light on a company’s financial events and is used for some major purposes. Some of them are:

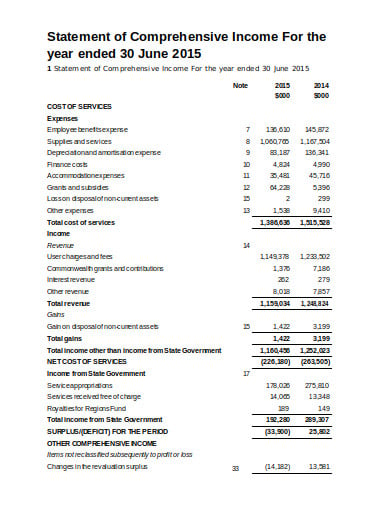

1. One of the primary purposes of a statement of comprehensive income is to provide information on how a company is raising its revenue and the costs sustained in doing so. It not only explains the cost of goods that are sold that have a relation to the operating activities but also includes other unrelated costs like taxes. The statement also helps in capturing other sources of revenue which are not associated with the main operations of a company.

1. The investors are interested in evaluating the statement of comprehensive income as well as an income statement as they work as financial reports before they decide to invest in a company. This statement helps in showing the earnings per share or the net profit and how all this is distributed across the outstanding shares.

1. If you want to assess the financial health of a company, the statement of comprehensive income is a go-to document, but it may fall short in some aspects. This statement encompasses both the current revenues that come as a result of the sales and the accounts receivables, which the firm is yet to be paid. It also highlights both the present and the accumulated expenses that the company is yet to pay. Therefore, this means that the statement of comprehensive income does not completely depict the true status of a business.

1. Another section where the statement of comprehensive income falls short is the fact that it does not provide much information about the future success of the firm. It is just great for establishing the earnings per share and other past financial records. However, it does not helps in revealing the future trends that the different items may take. It also fails to explain the exact sources of income of the company.

It is important to understand the difference between the types of comprehensive income statements. They may sound similar but have different meanings altogether.

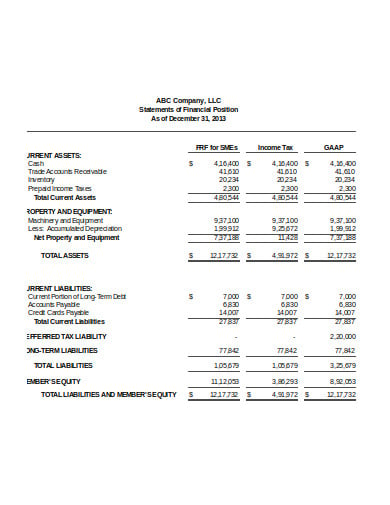

It is a typical financial statement that includes both standard income and other comprehensive income. You can start with a standard income statement followed by a section for other comprehensive income and then show the total of both. You must carry down the total standard net income, show if there are any gains or losses from other comprehensive income and end with a sum of the standard net income as well as the total number of other comprehensive income.

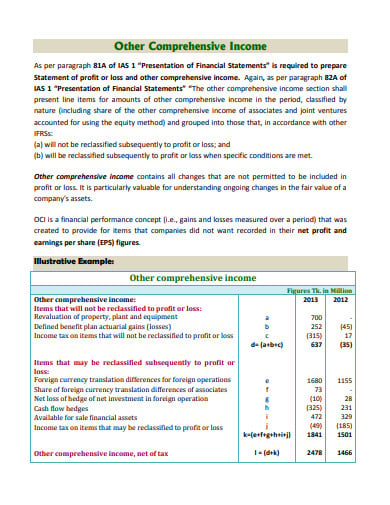

Other Comprehensive Income means the income from a change in values of certain assets that are not reflected in the standard income statement. It refers to all types of income that are not exactly the part of the standard income statement as they have not been realized. It generally consists of gains or losses in the value of assets that are being held by the company. The fluctuations that may affect the value of both the company and the owner’s interest in the company, are not considered to be part of the income and expenses from daily operations.

In a statement of purpose for research, you would like to try an in-depth analysis of knowledge and stats. You…

A suitable statement for employment outlines any supporting explanation of your skills, proving that you are ideal for the employment…

The written statement is a legal statement that the people have to go through when they face some legal ups…

A disclosure statement is the synopsis of the terms, conditions, risks, and rules that are involved in any financial transactions…

A salary statement is a form that provides different components of an employee’s salary and the cost incurred payments. It…

A document that explains the significance of the research work you did is known as an impact statement. It is…

Statement of Expenditure is a multi-column self-balancing monthly statement of expenditures of an operative level workplace. It is created to…

When you write a sworn statement or testimony, you’re testifying beneath oath, and your words can become a part of…

A purpose statement announces the aim, scope, and direction of the paper. It tells the reader what to expect in…