18+ Recruitment Strategy Templates in Docs | PDF | MS Word | Pages

A recruiting strategy is a plan used to recognize, attract, and hire the best, uniquely talented to fill any open…

Jun 17, 2020

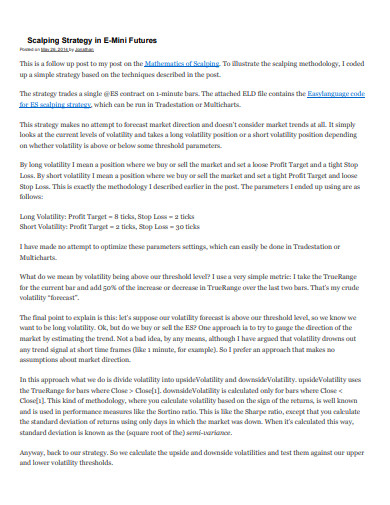

Getting the whole pig from a simple deal does not necessarily mean buying the entire animal at once. When the situation is not favorable for a significant purchase, however, with careful analysis, if getting limb by limb is profitable, then why not go for it? You can still get everything if you know your way through in getting the small pieces surely. Such is the same for trade in the stock market. Huge instant profit is always together with huge risks, and if you want to play it safe and right, then a business strategy such as scalping will be a great help. There is nothing like steady and sure gains even when it is minute. Anyways, accumulating small profits will undoubtedly lead to amassing big numbers.

The scalping strategy is a trade tactic in getting sure small gains from little price exchanges until you can get big ones when the profitable times come or via accumulation of the benefits. The strategy aims at not going for risky ventures but sure small ones to gain more in later phases. Thus, this strategy is not a one-time big win, but effective use of the snowball effect.

Small yet magnificent. A miniature yet old. Imagine an old tree in a small pot. These descriptions are the wonder of the bonsai plant. Pruning the plant as it grows, takes a lot of time. Thus, tending the plant slowly, but with care from time to time creates small results. And if you are the artist, you must have patience before you can see its true beauty. Bring the principle to the stock market, and you can see the similarity with scalping. You have fluctuating chart figures, and you wish to get the big tree. However, you can always play it right in a controlled manner. Getting small gains each time a deal appears, as long as you tend your wealth daily, quietly it grows old and sturdy. Less will eventually become more as they pile up. Grains of sands will subsequently carry on its shoulders a camel and a wanderer. So craft your strategies well, that every small gain will become significant later on. And that every little unfolding of the parts will lead to an age-old tree.

cryptotradercentral.com

cryptotradercentral.com smallake.kr

smallake.kr aboutcurrency.com

aboutcurrency.com tradeguider.com

tradeguider.com stagirit.org

stagirit.org forexwikitrading.com

forexwikitrading.com jonathankinlay.com

jonathankinlay.com infinityfutures.com

infinityfutures.com ifcmarkets.com

ifcmarkets.com ritalasker.com

ritalasker.com forexfactory.com

forexfactory.comEarning big-time from trade does not necessarily mean gaining vast sums of money in a single transaction. So, a keen eye on the trading system and alertness for every window of opportunity are the principal attitudes to consider. Your scalping strategies will always come in handy when the situation calls for it. And it is even wise to gather strategy templates while you are it. Thus, follow the simple list below to get your heels up for some planning.

Gathering critical stock market status reports is essential, as getting a comprehensive overview means you have the supporting facts. That is why keep yourself updated through the news, magazines, and journals because venturing blindly into the stock trade is a brewing catastrophe.

When you have all the data, you need a working interpretation that can guide you in making crucial decisions. Get the assistance of the best people in your workforce to come up with their comprehensive analysis document. Knowing the figures is not enough, as the numbers are rapidly changing in quick successions. Thus, understanding the trends and getting a hold on the behavior are essential pieces in making an effective strategy.

What are strategies without goals? The desired result will always be the motivation of any planning committee. Thus, strategic plans are the result of expectations. And since you are planning to execute scalping strategies, then keeping in mind that continually getting small gains is the direction to go.

Having an action plan requires a detailed and comprehensive outline. Do remember that your strategies are the means in achieving your goals, and it is vital to list down those ways as a guide. Treat the procedures are your manual to follow when the need arises to execute it. Make sure also that it is easy to understand because a set of complicated procedures will undoubtedly jeopardize your plans.

Plan A always need a plan B, C, etc. Always be on high alert that not everything will go out as planned; thus, having back up is not only being cautious but also prudent. Expect the worse as this often happens in a strongly competitive environment with a lot of surprising factors. So, remember to keep more aces up on your sleeve.

According to Confucius: “The man who moves a mountain begins by carrying away small stones.” Plus, a gardener who attends well the plant can see results. So, strategize carefully in dealing with the stock market. Remember, constant small wins will end up making a big score.

A recruiting strategy is a plan used to recognize, attract, and hire the best, uniquely talented to fill any open…

Talent Aquisition strategy is the plan that is developed to acquire or hire skilled human labor for the organization to…

Getting the whole pig from a simple deal does not necessarily mean buying the entire animal at once. When the…

It is basic for realtors to figure successful procedures to improve their deals and increment benefits. Such systems are answerable…

Every strategic mind to enter the workforce has internalized the principle of planning from start to finish. It’s not enough…

Planning and strategizing is one of the significant aspects of any activity. Particularly, when it comes to a typical business…

In your place of work, or anywhere else, you will be asked to come up with strategies that can be…

After making sure of the proposed sample business plan, HR strategy templates are used by the HR professionals to assess…

Training strategy template is no theoretical treaties. Instead it contains a highly practical, functional and user friendly tool that efficiently…