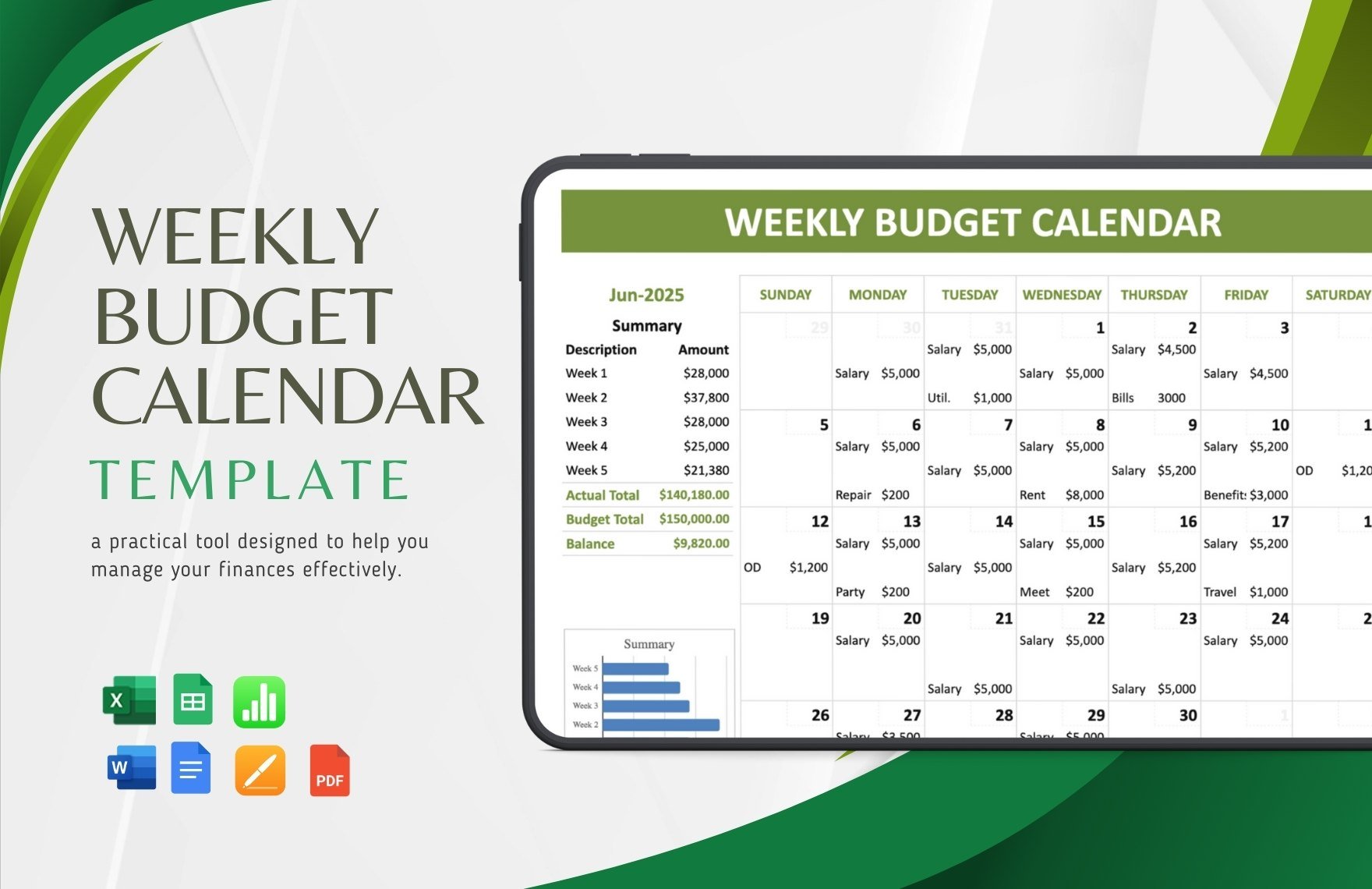

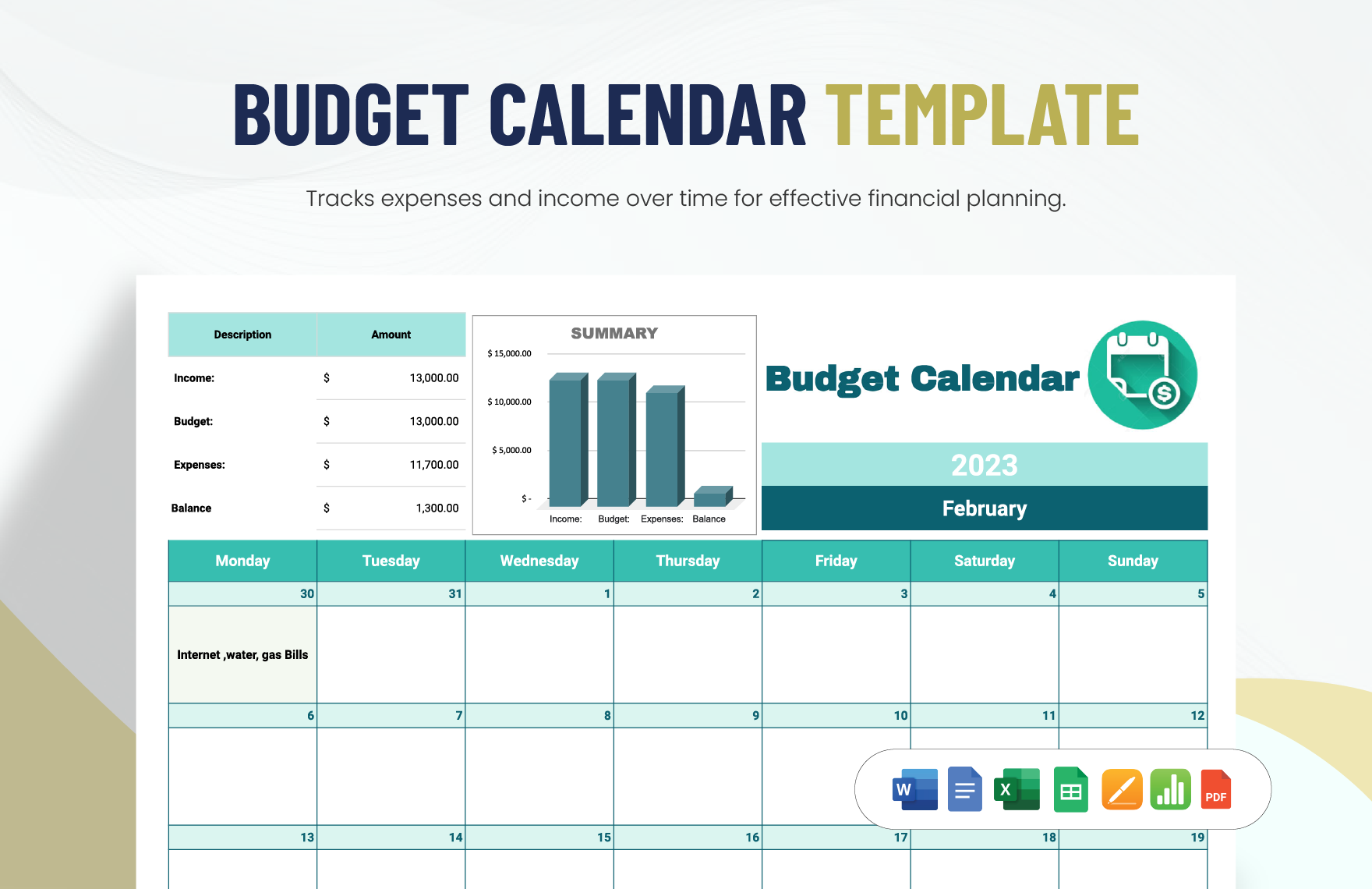

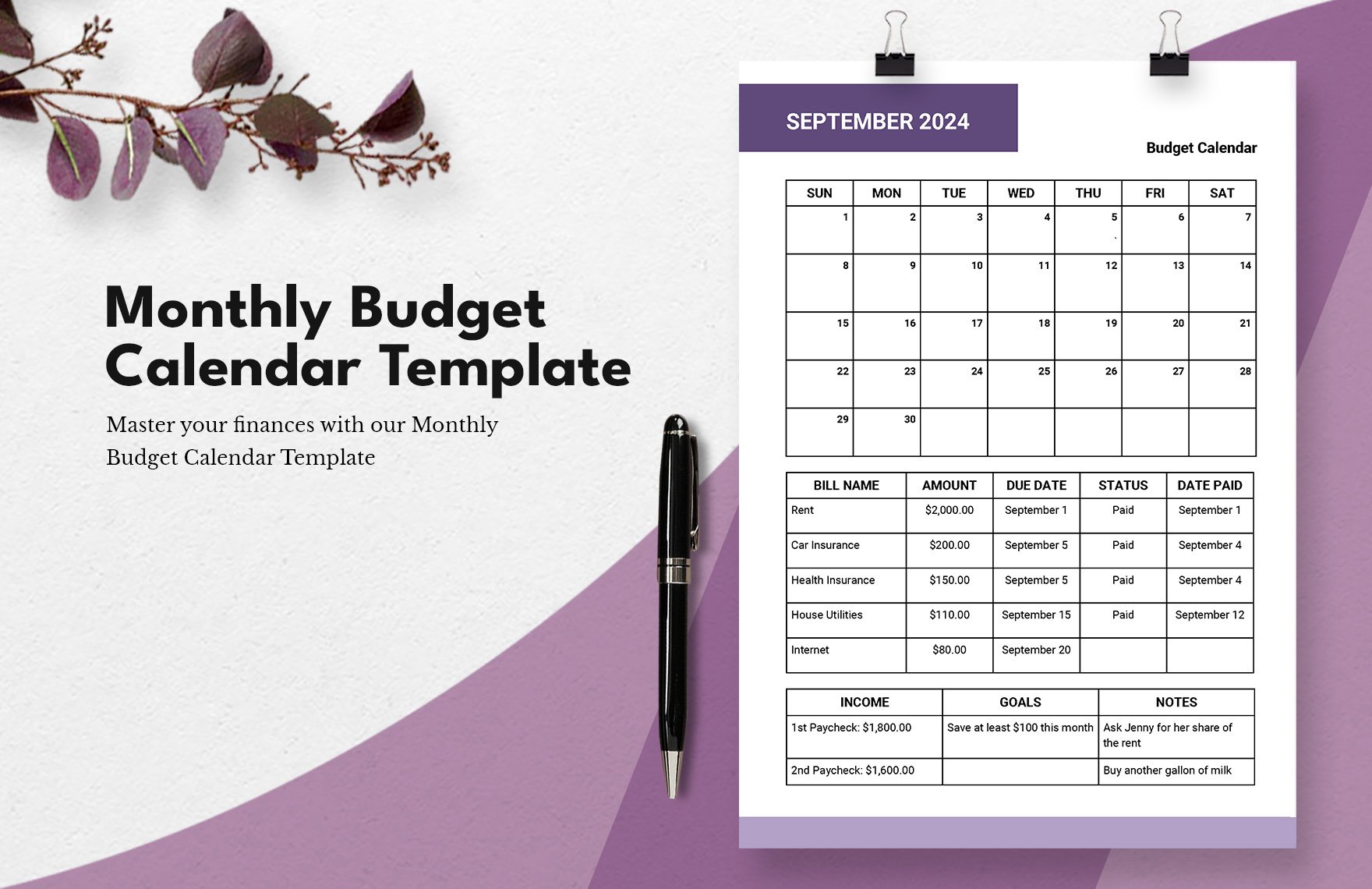

A budget calendar is a calendar that helps you track your expenses and your needs in a span of time. This is essential in estimating the money that flows in and out of your company or merely you. This is a financial tool designed to help you remember the important dates concerning your payments and savings. Creating a corporate budget calendar for your business protects the cash flow and it reminds you of your bill due dates. Regardless of what your purpose is, you must have a good grip on your budget for you to advance to a long term financial goal.

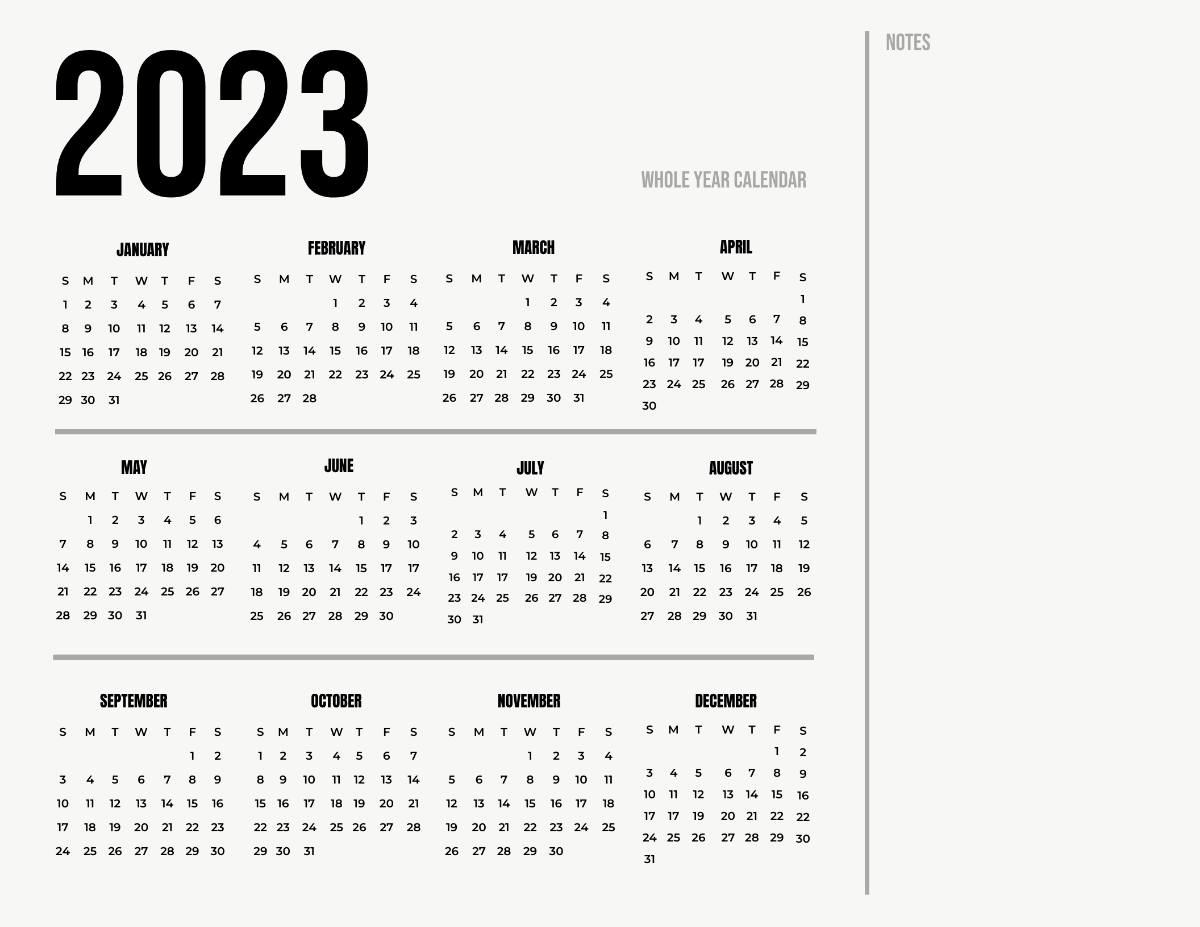

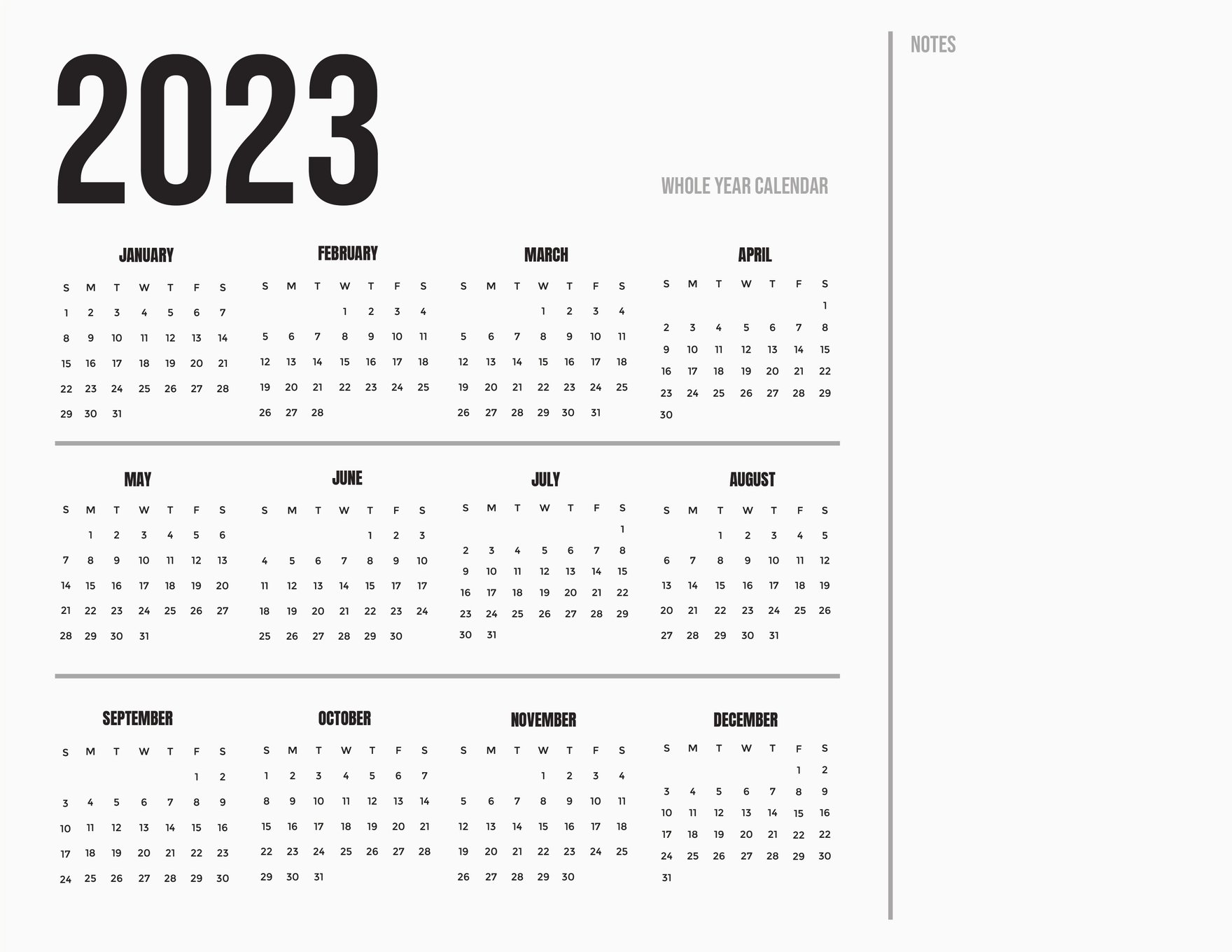

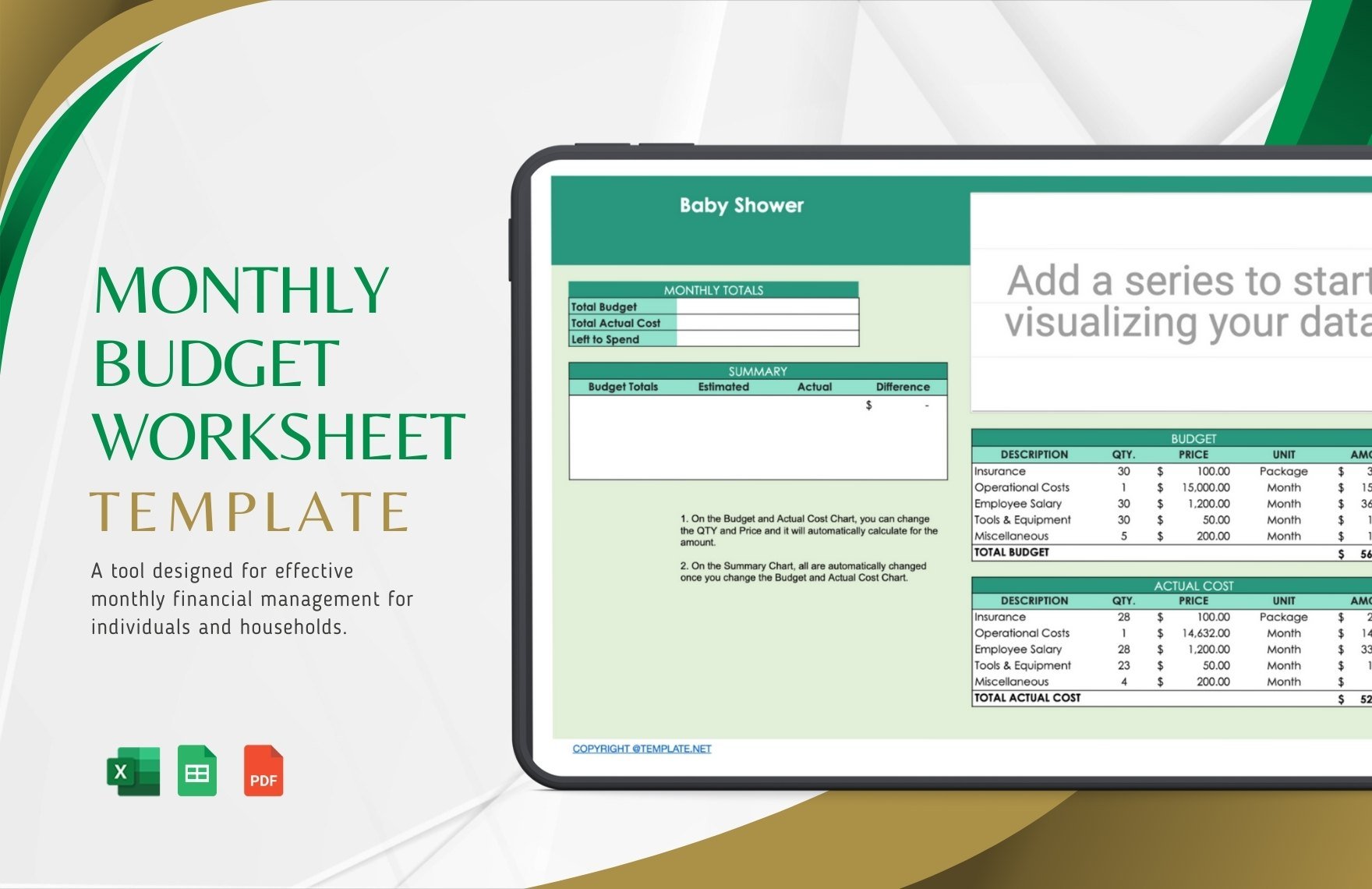

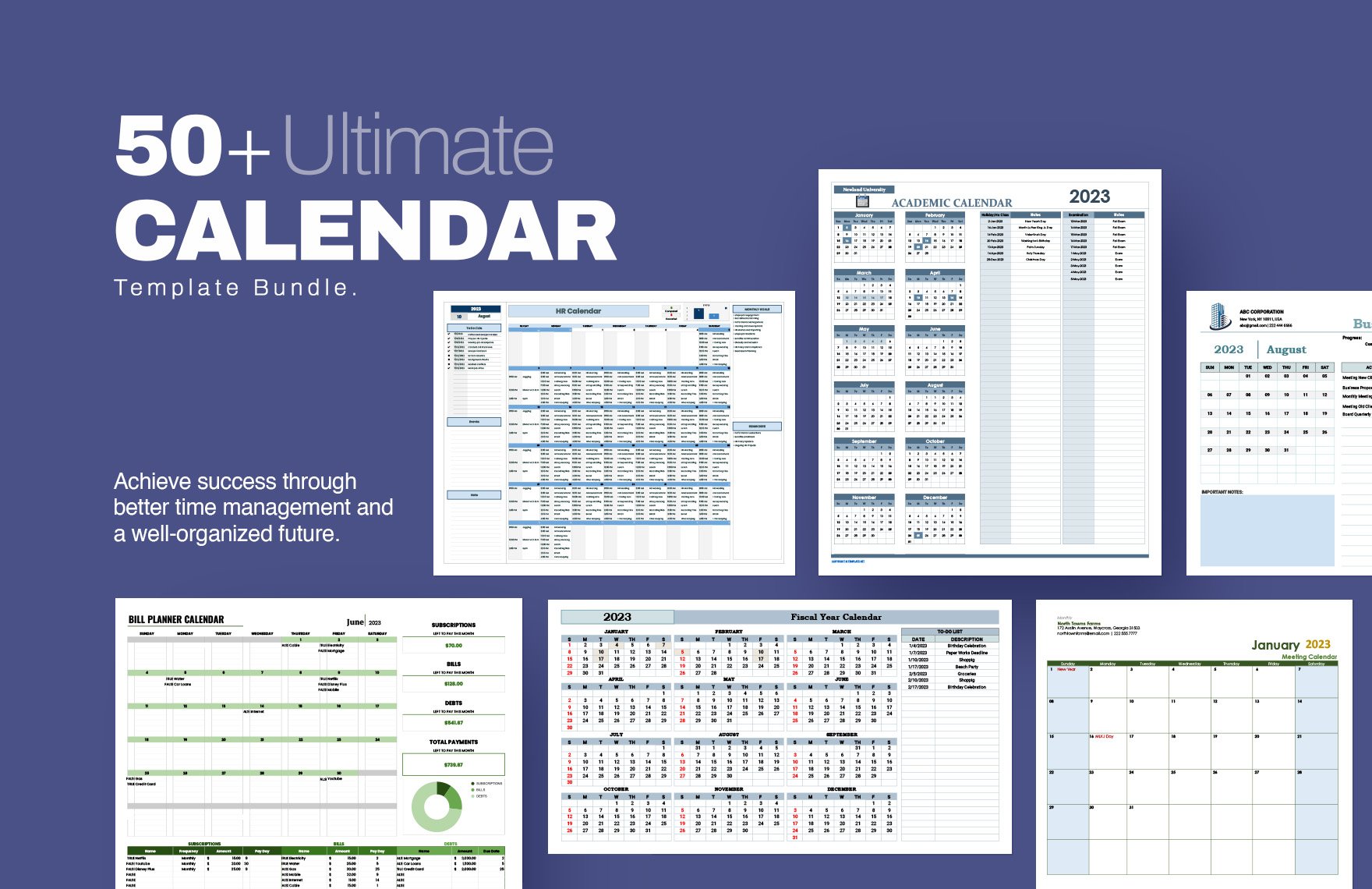

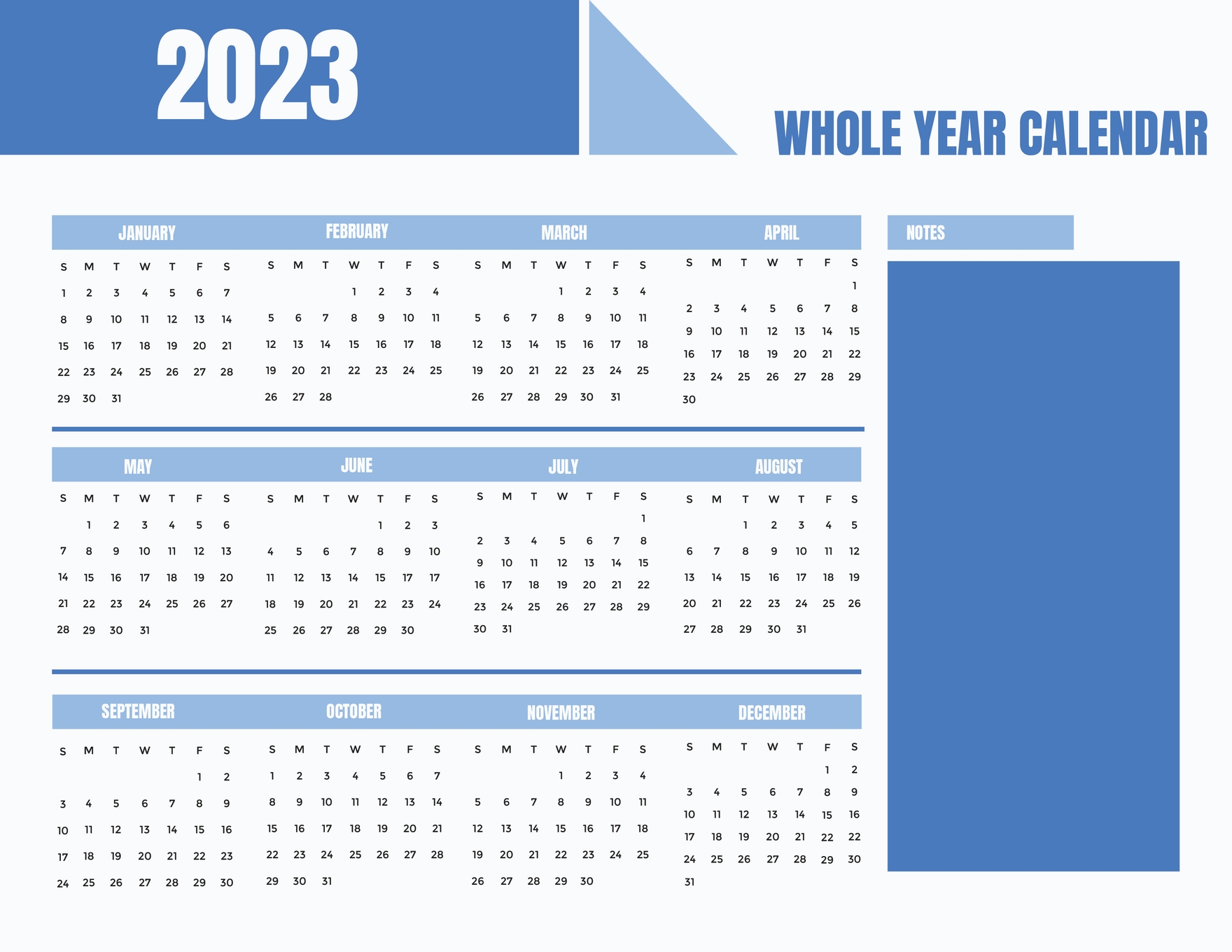

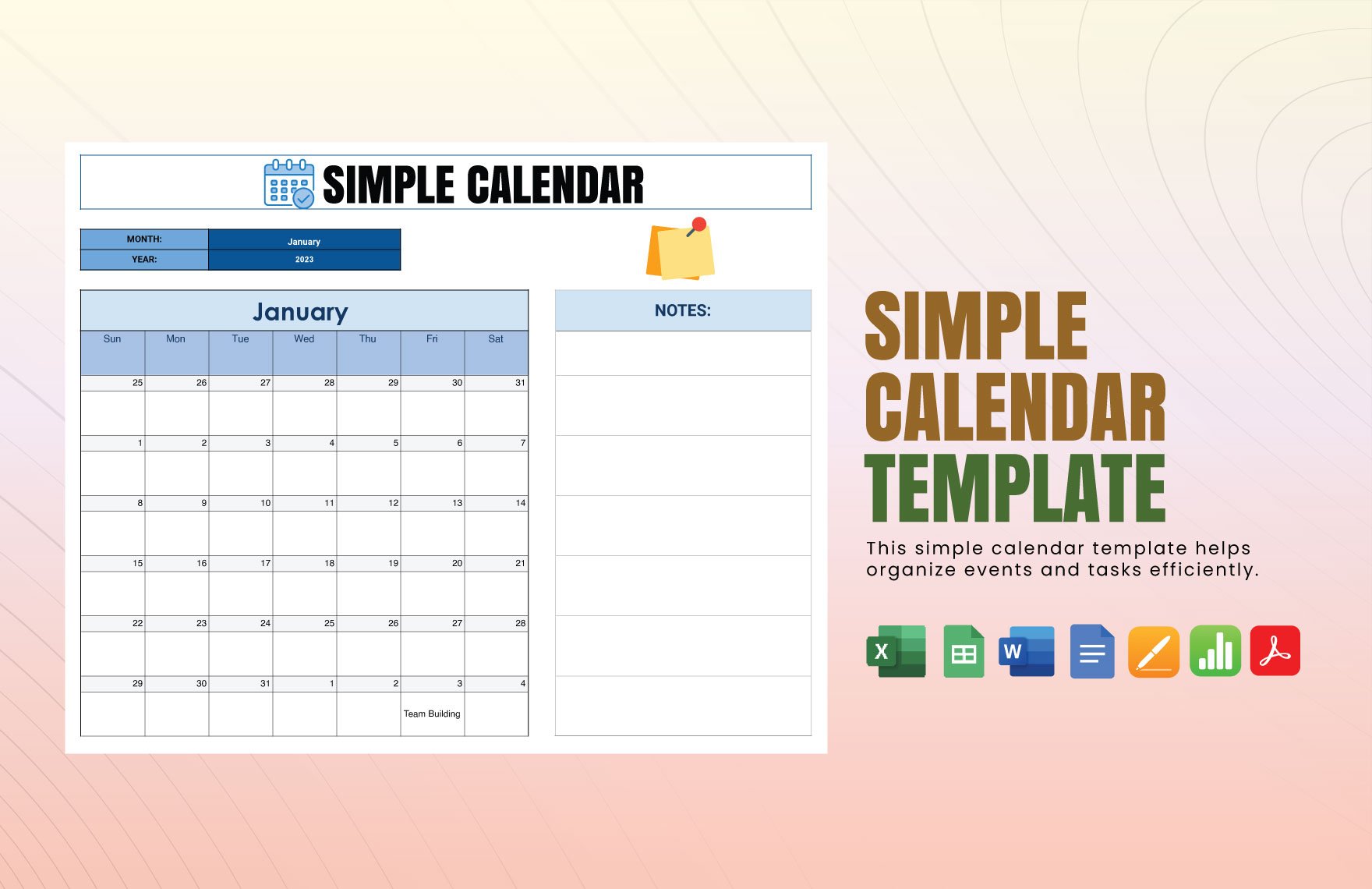

When you create a budget calendar, you have a lot of options on how you can make it. You can have it weekly, monthly, even yearly. Also, you can make it on your own or for your business. There are numerous ways, however, this denominates one purpose: to control the cash flow. You can make a monthly budget calendar, online budget calendar, budget planner calendar, and yearly budget calendar not that hard, but the real challenge is on how far can you persist. We listed a few tips for you to consider in maintaining your budget calendar.

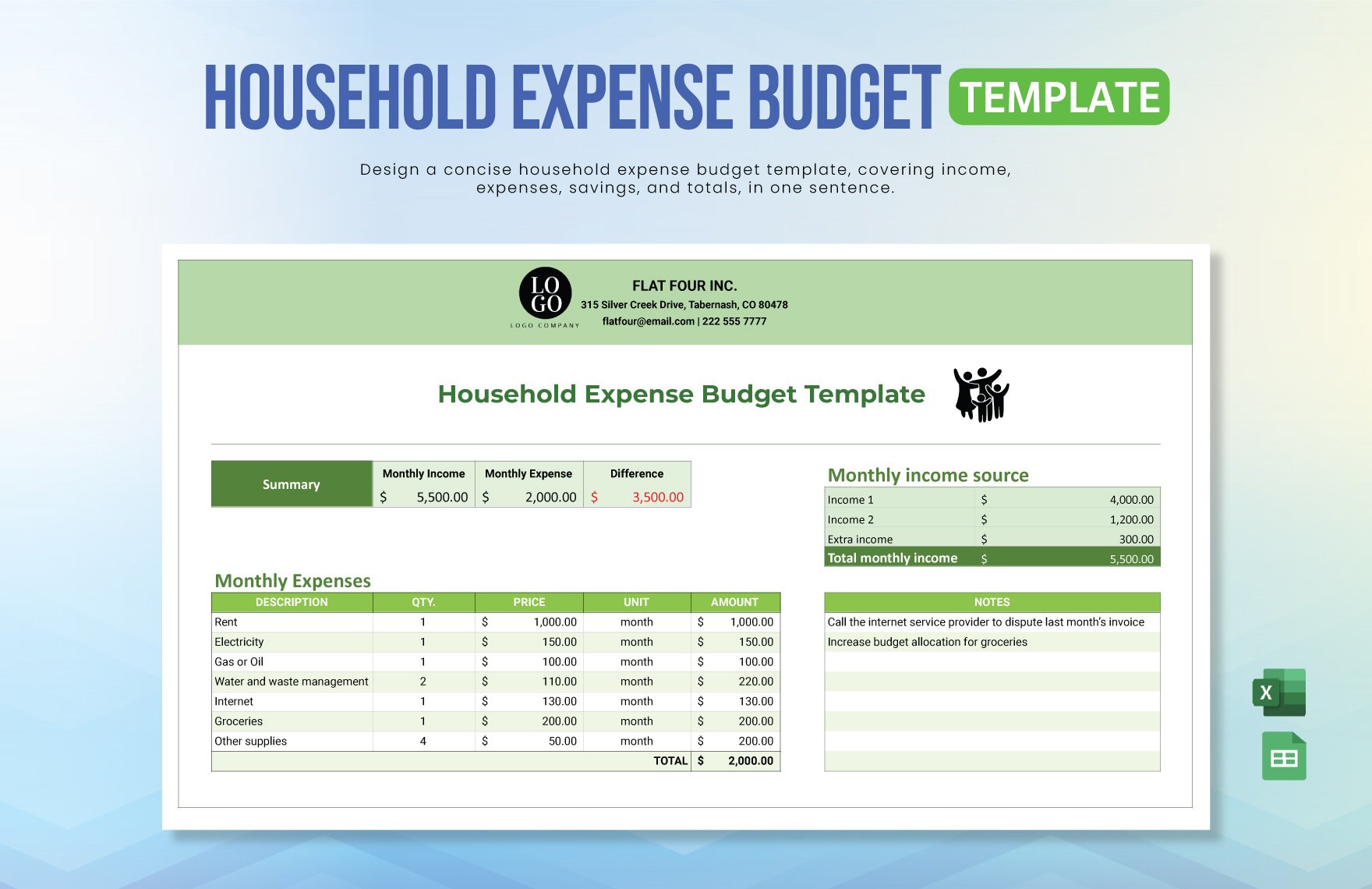

1. Determine the Financial Responsibilities

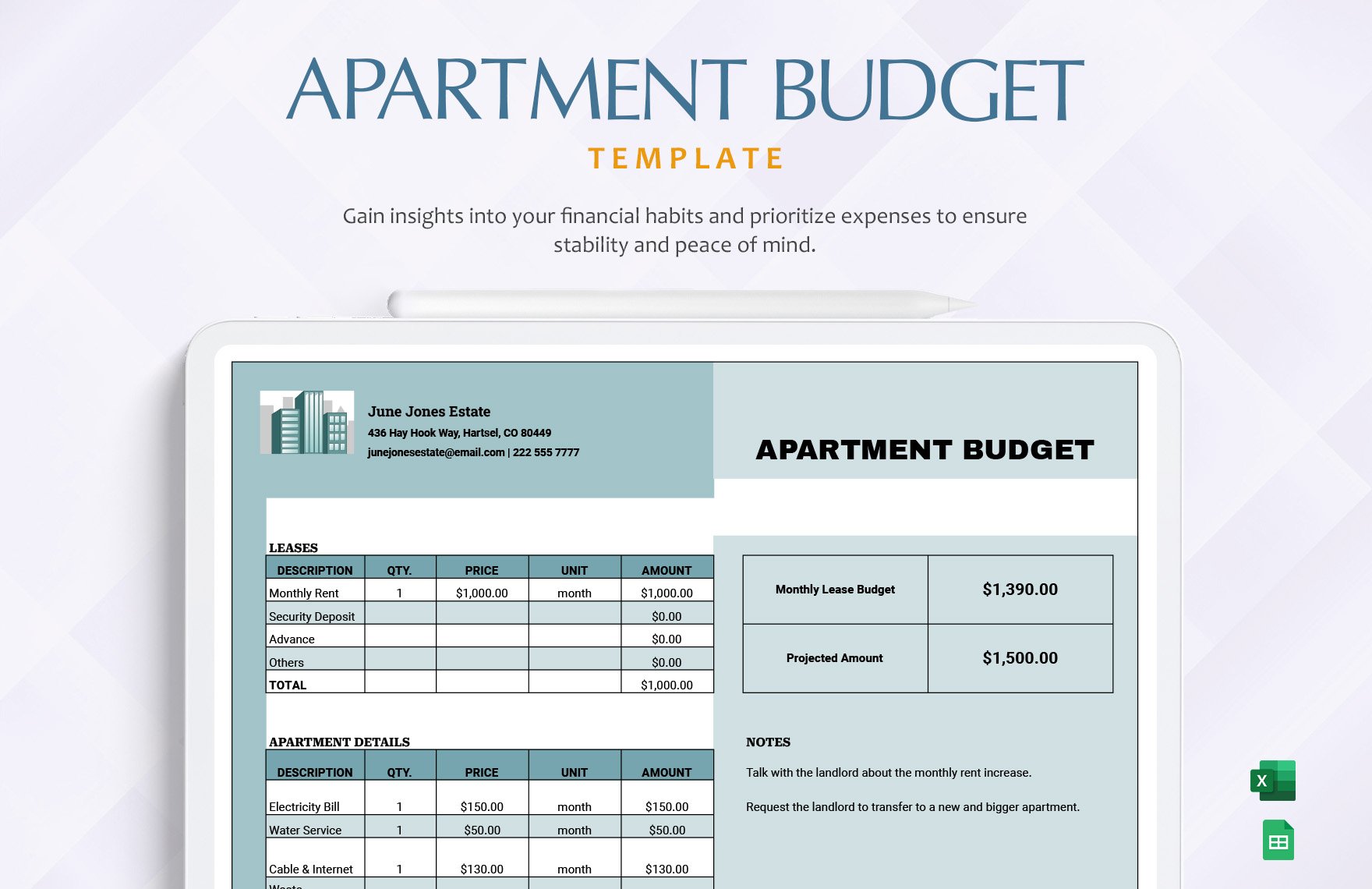

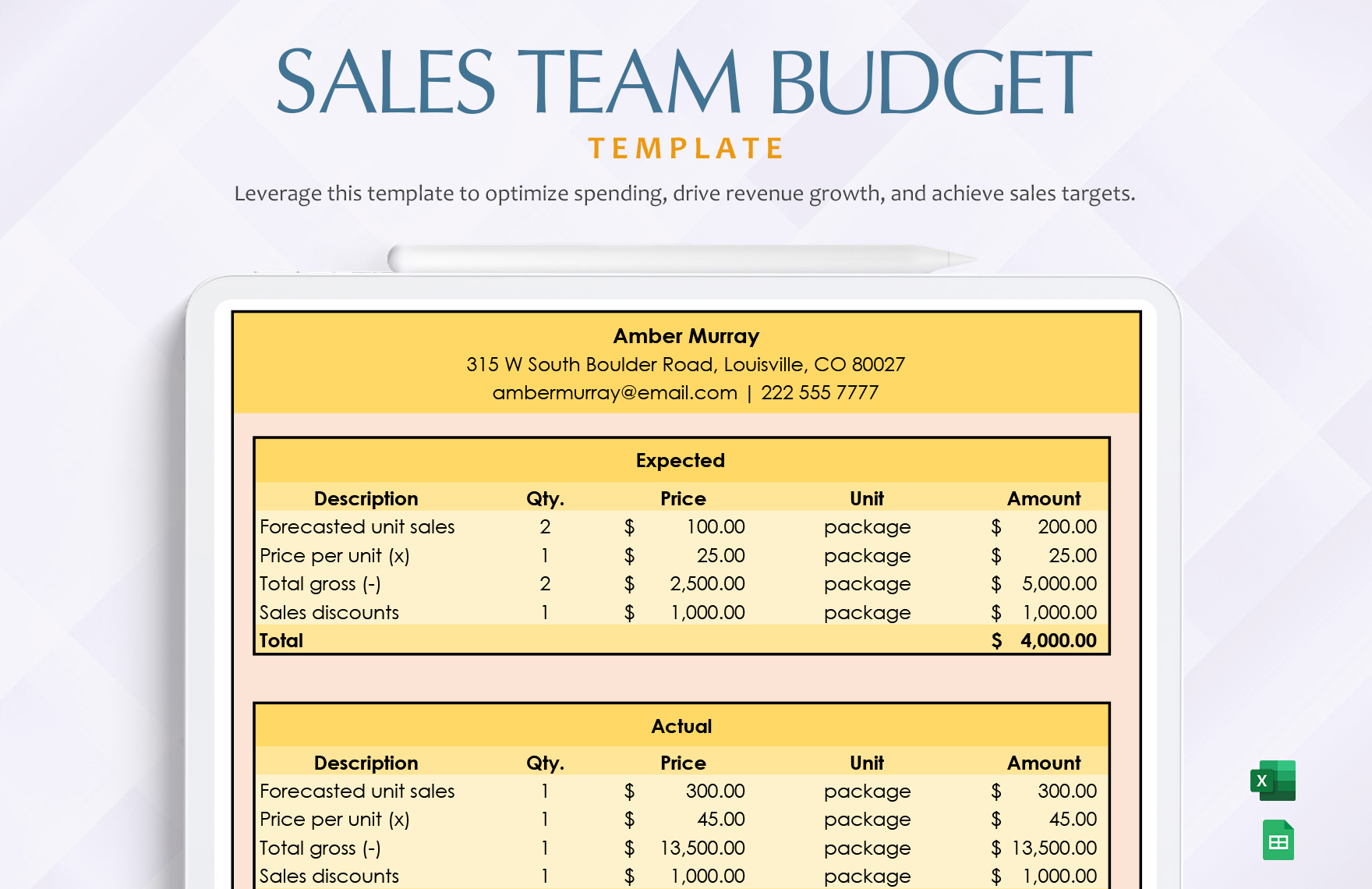

If this is a personal budget, then list down your financial responsibilities. If you have bills to pay, list all of these, and know its corresponding deadlines. After you jot down all your financial responsibilities, start to categorize it according to its time-frame. Being attentive to monetary expenses will also help you save money.

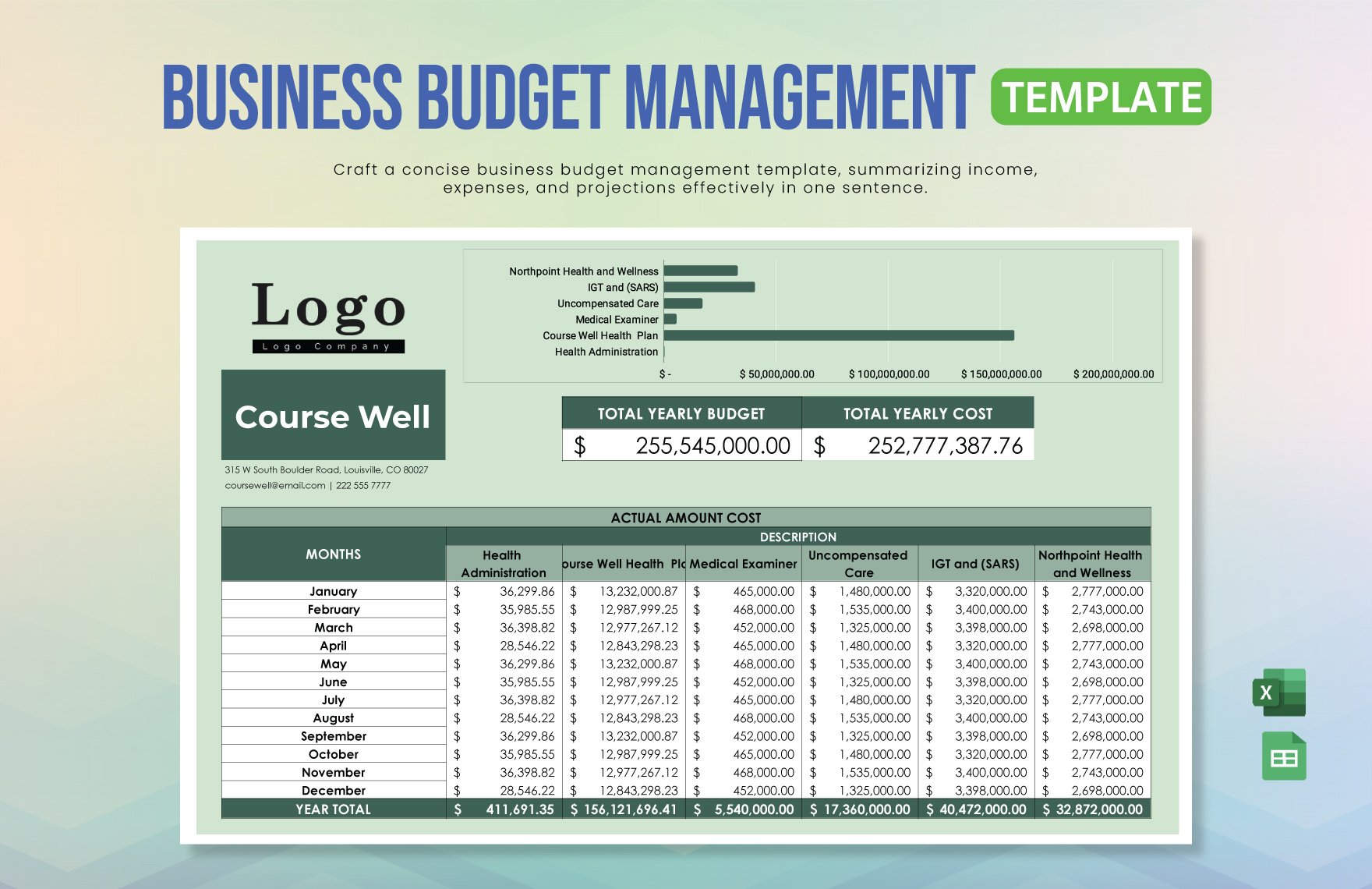

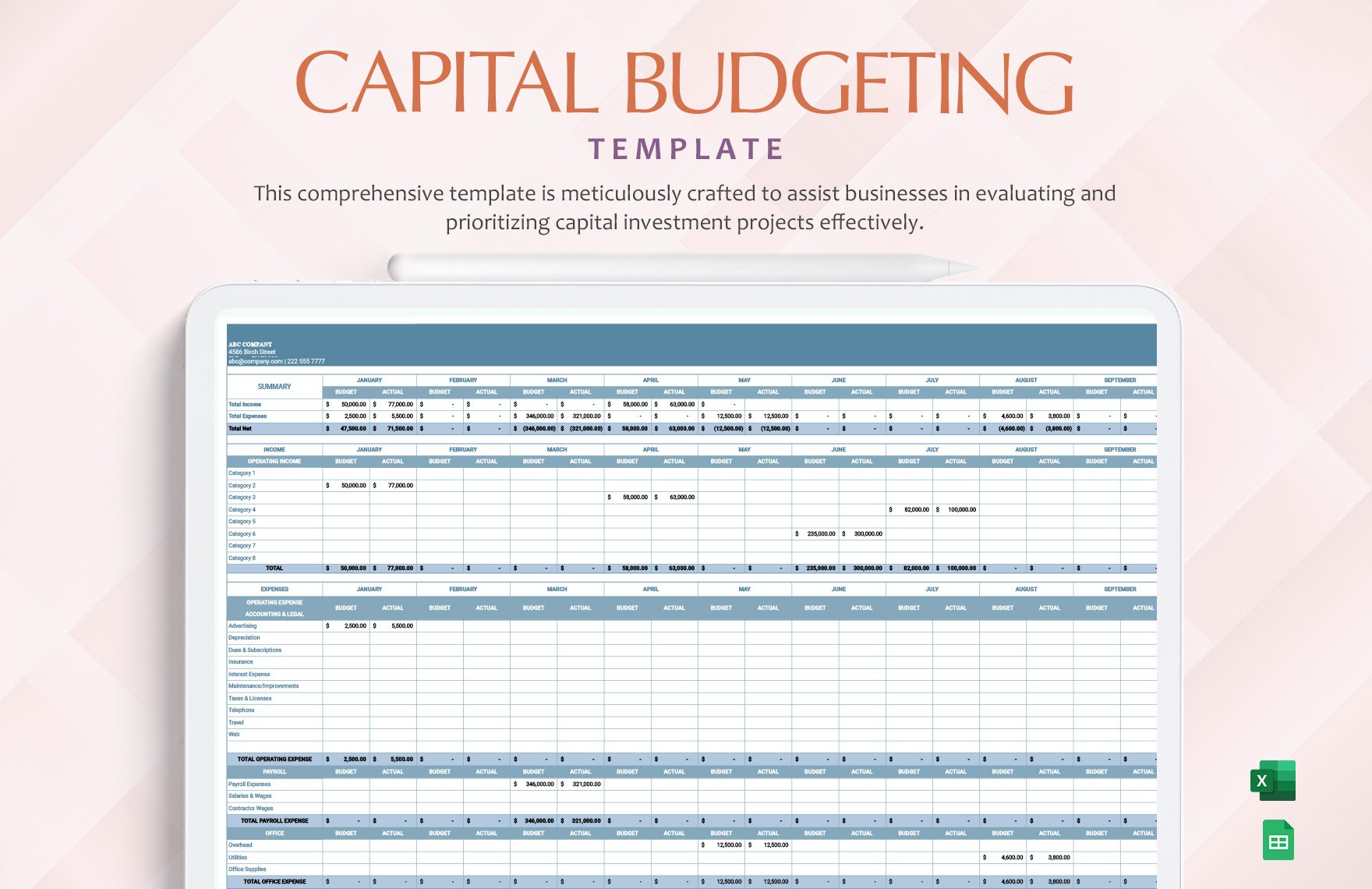

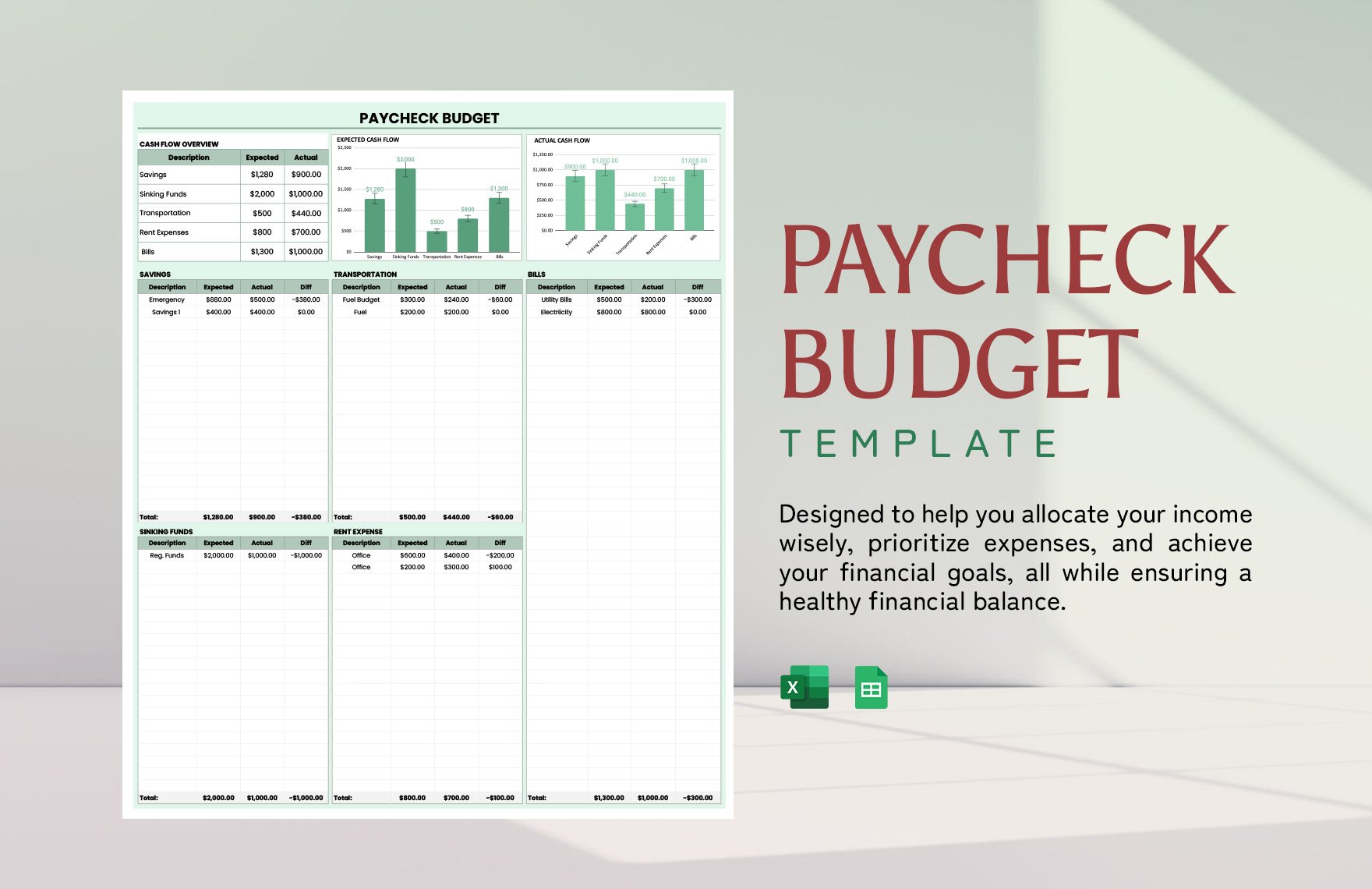

2. Create a Budget Beforehand

Before you create your budget calendar, plan your initial budget. Then review it and check if it fits your list of bills. If there is no problem with your estimated amount, then create your budget calendar. If you do not plan ahead, you will be caught off guard by some expenses. It is always better if you are ready before you start budgeting.

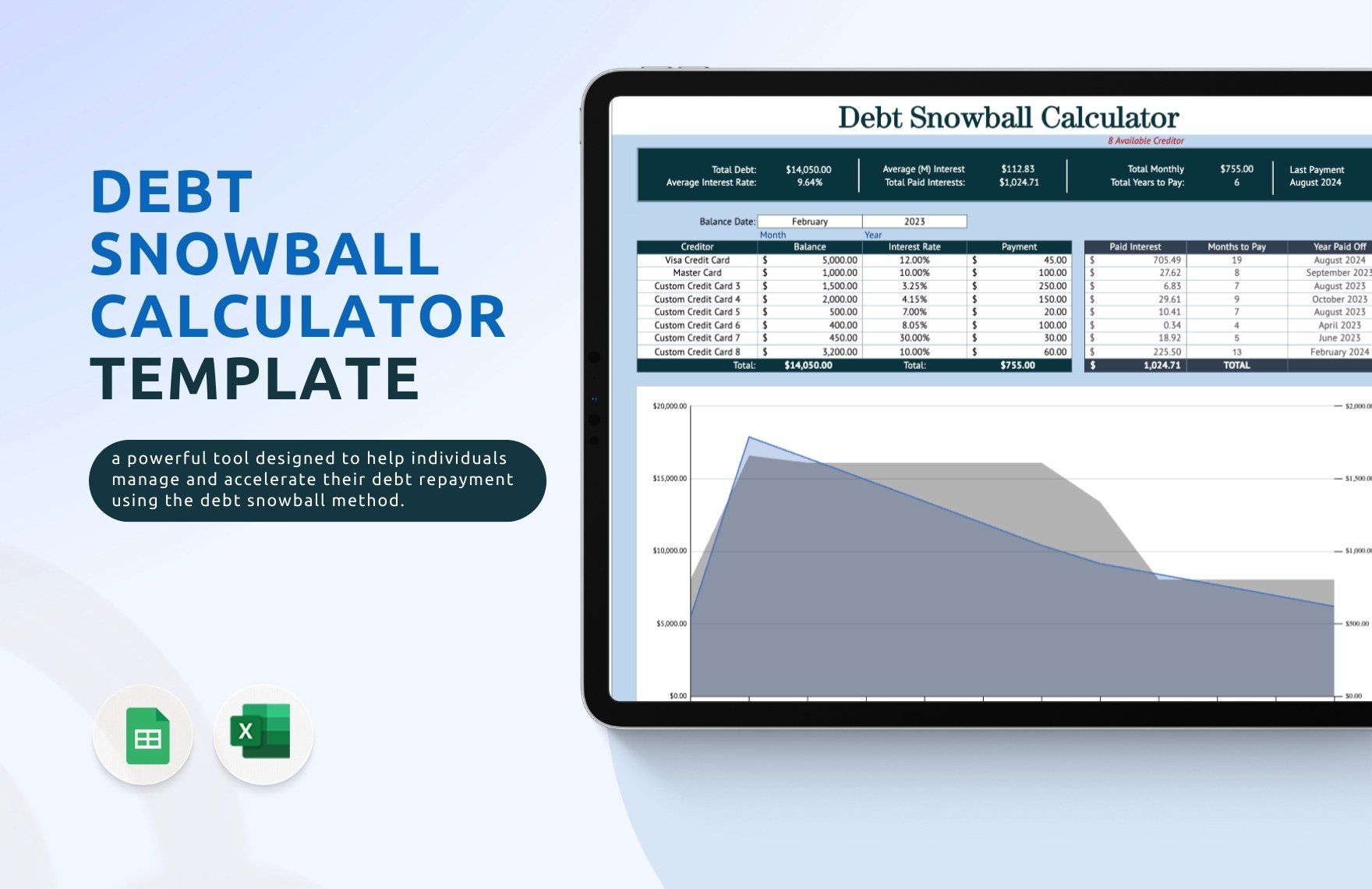

3. Set an Allowance for Unexpected Event

Part of the financial responsibilities is your other expenses. This is an allocated amount for your future hurdles. You have to set this allowance so that the remaining responsibilities or expenses will stay at it is even though unexpected changes in your printable budget calendar occur. Unexpected expenses are inevitable. Do not panic instead seek solutions for it.

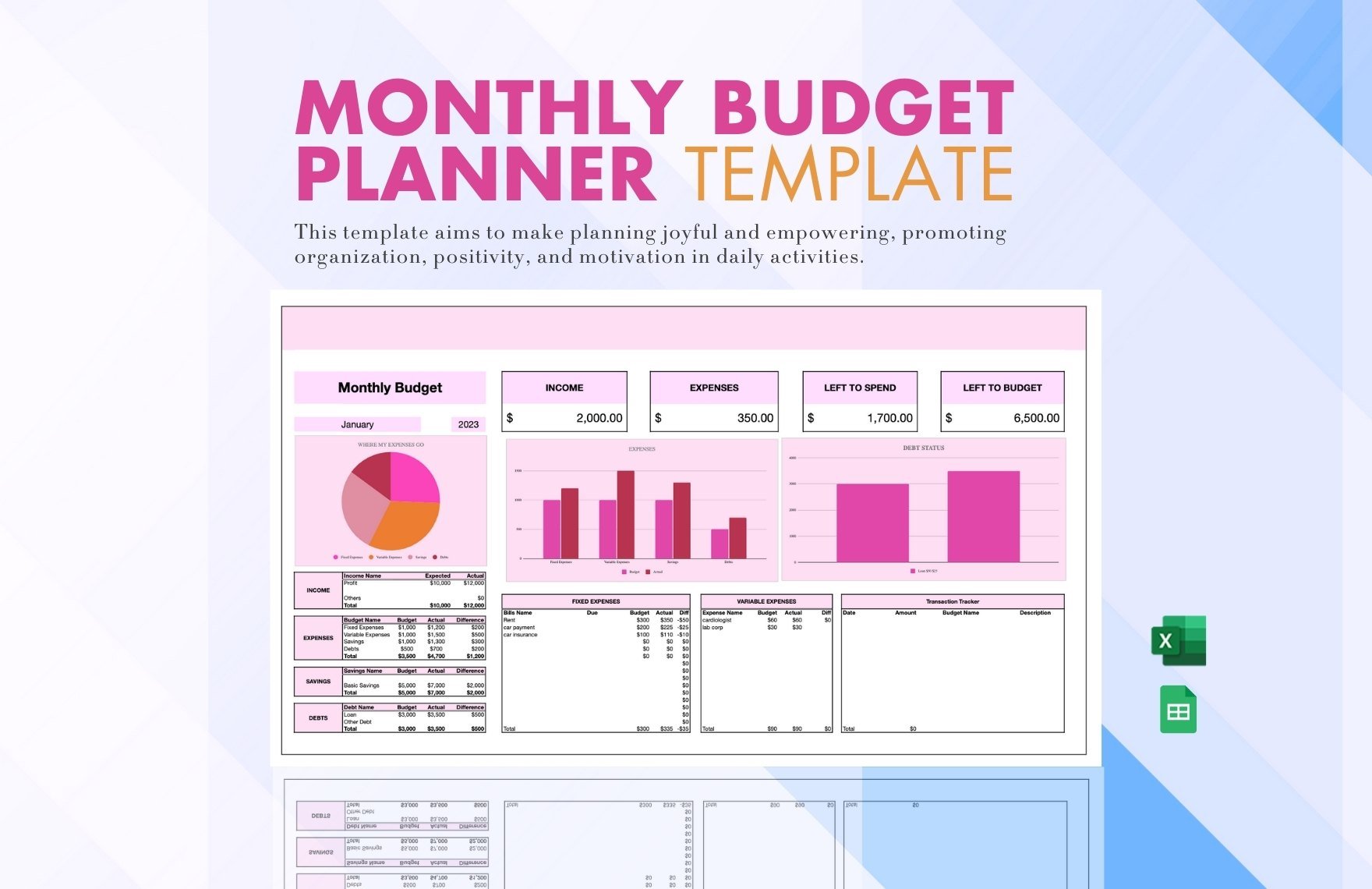

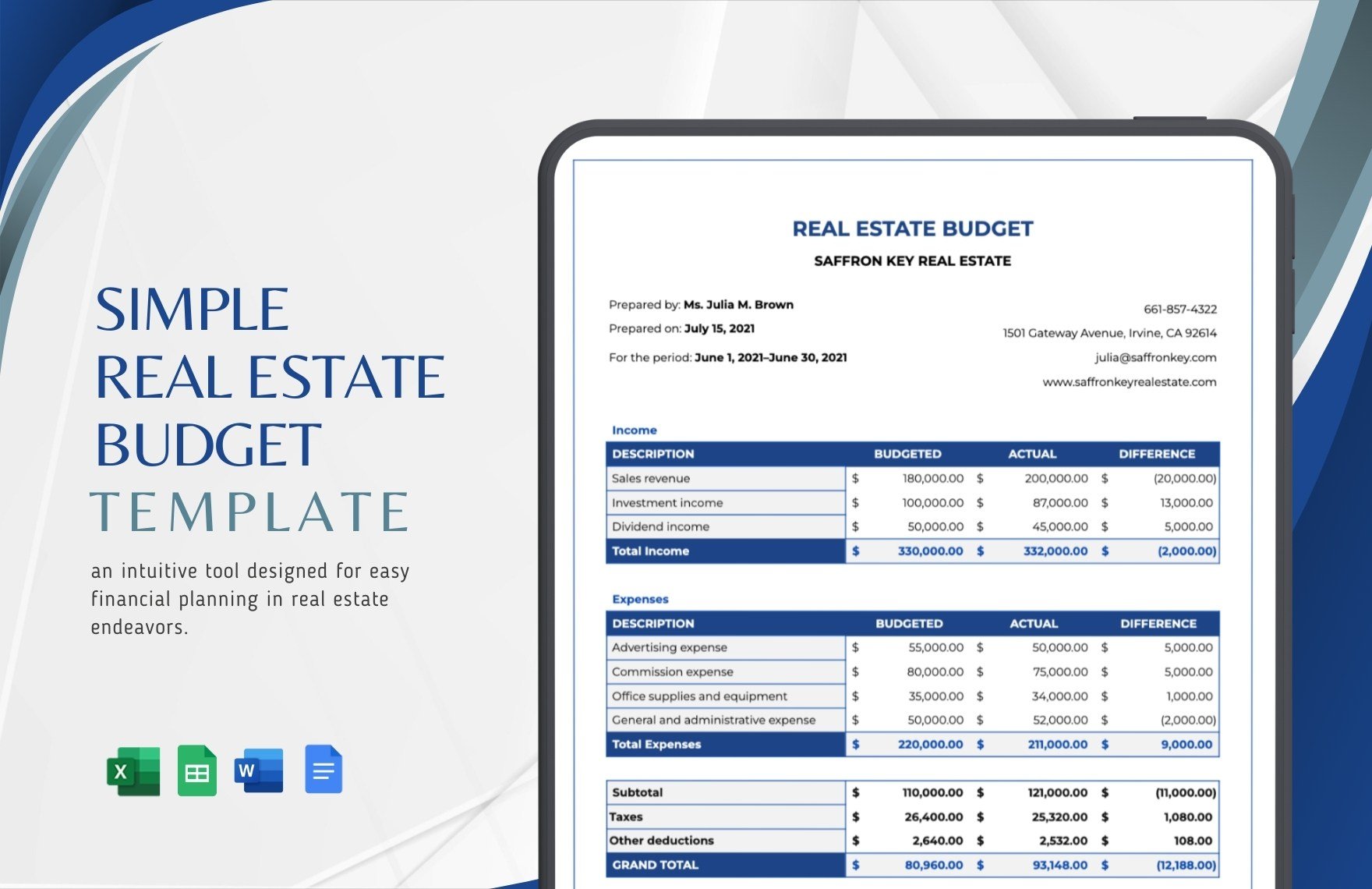

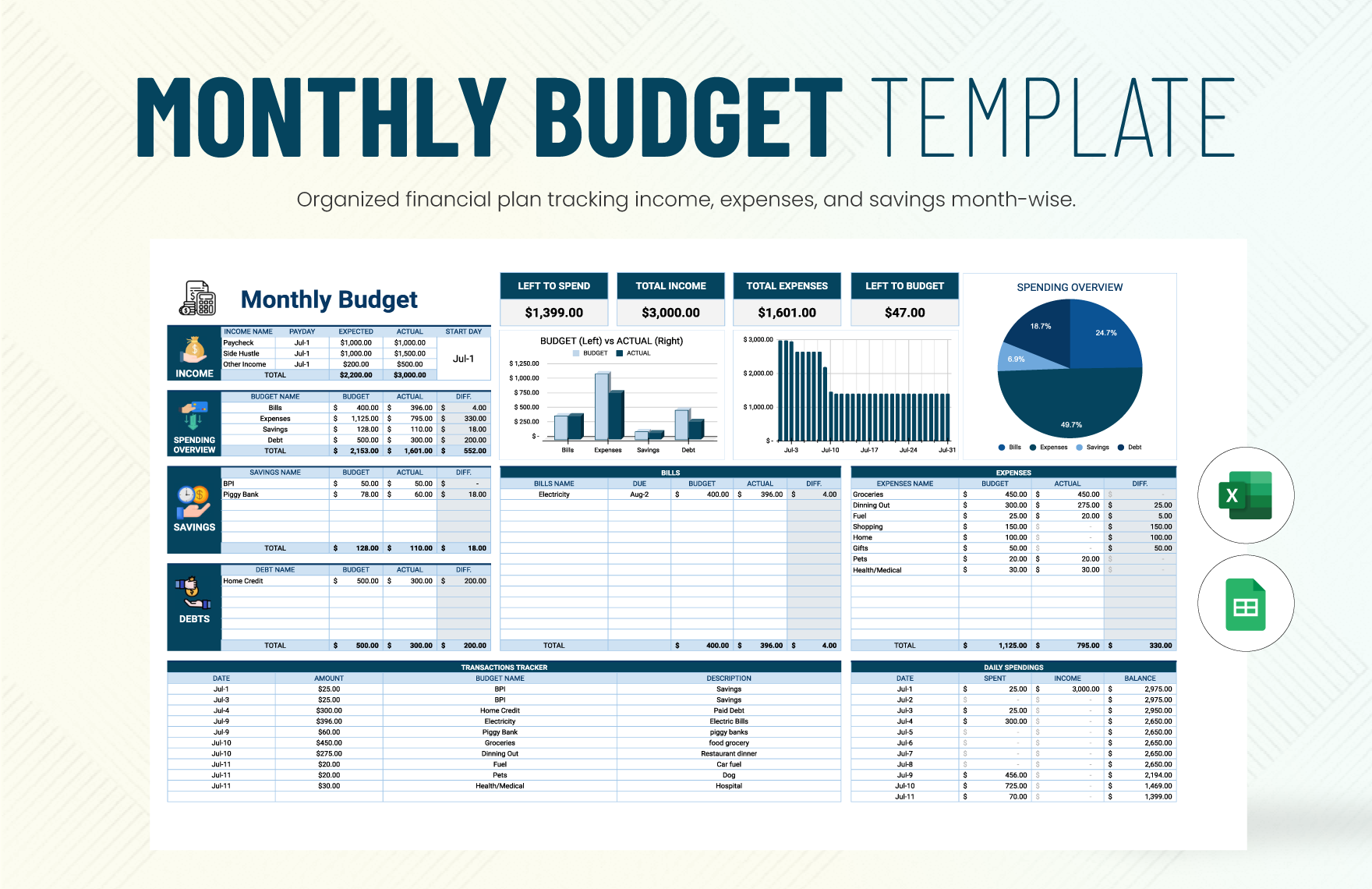

4. Recheck your List Every Time

One good way to be informed on the cash flow is to do rechecking. If you create a monthly budget calendar, then you can check your expenses weekly or even twice a week. This is to check if your expenses do not overboard your budget. Be hands-on in your budgeting.

5. Take Note

Take note of your business budgeting seriously because once one bill disrupted, it will automatically affect the remaining budget. Take note of the changes that occur in your entire budgeting. List down the things that you successfully achieved and to those which have not yet finished. Taking notes is a good way of reassessing your productivity.