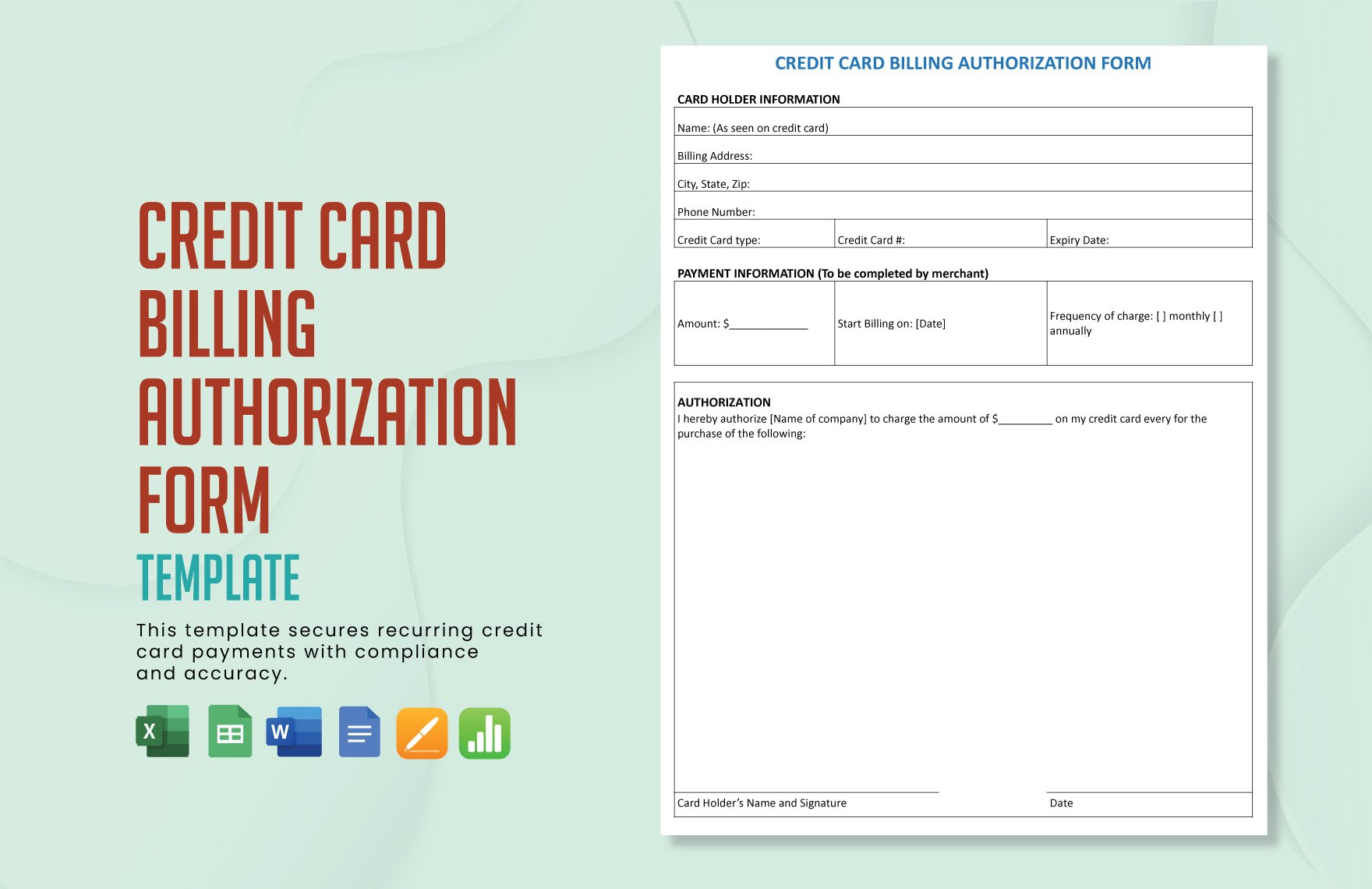

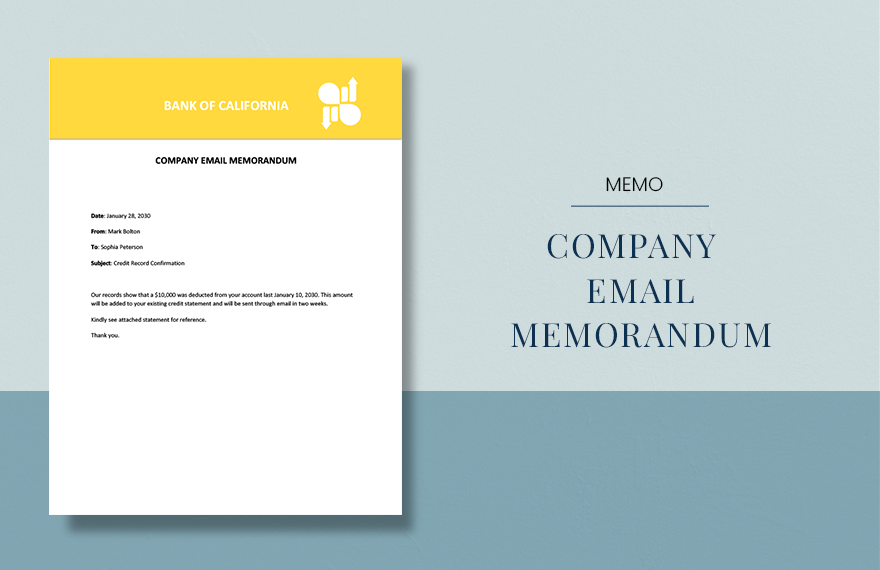

There are times wherein an individual will need to coordinate with a bank to settle financial matters with a seller or a business. To guarantee the seller of the payment, a credit letter or memo is usually sent by the guaranteeing bank. By subscribing to Template.net Pro, you'll get access to a collection of easily editable and fully printable templates to help you in creating well-written credit documents. Our templates can be downloaded anytime and anywhere, and they are fully supported by any version of Apple Pages. What more do you need? Subscribe to our premium credit templates now.

What Is a Credit Document?

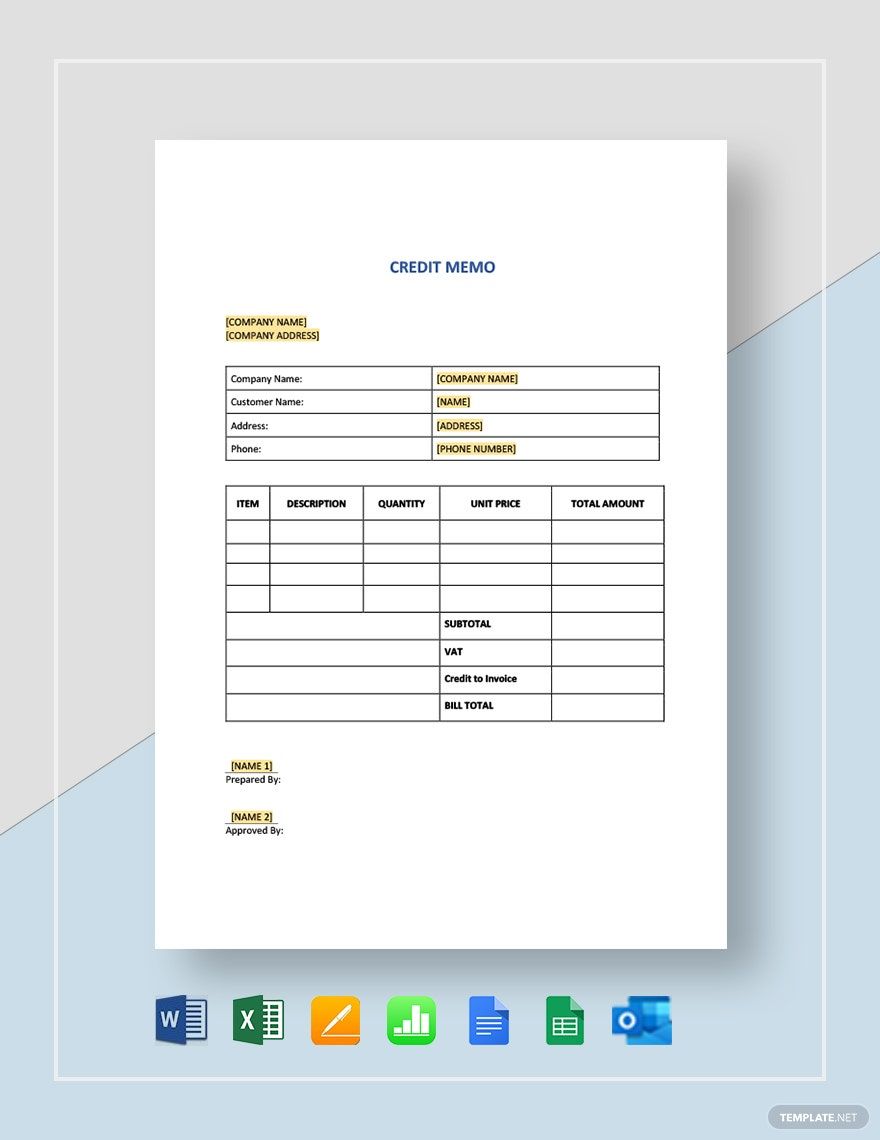

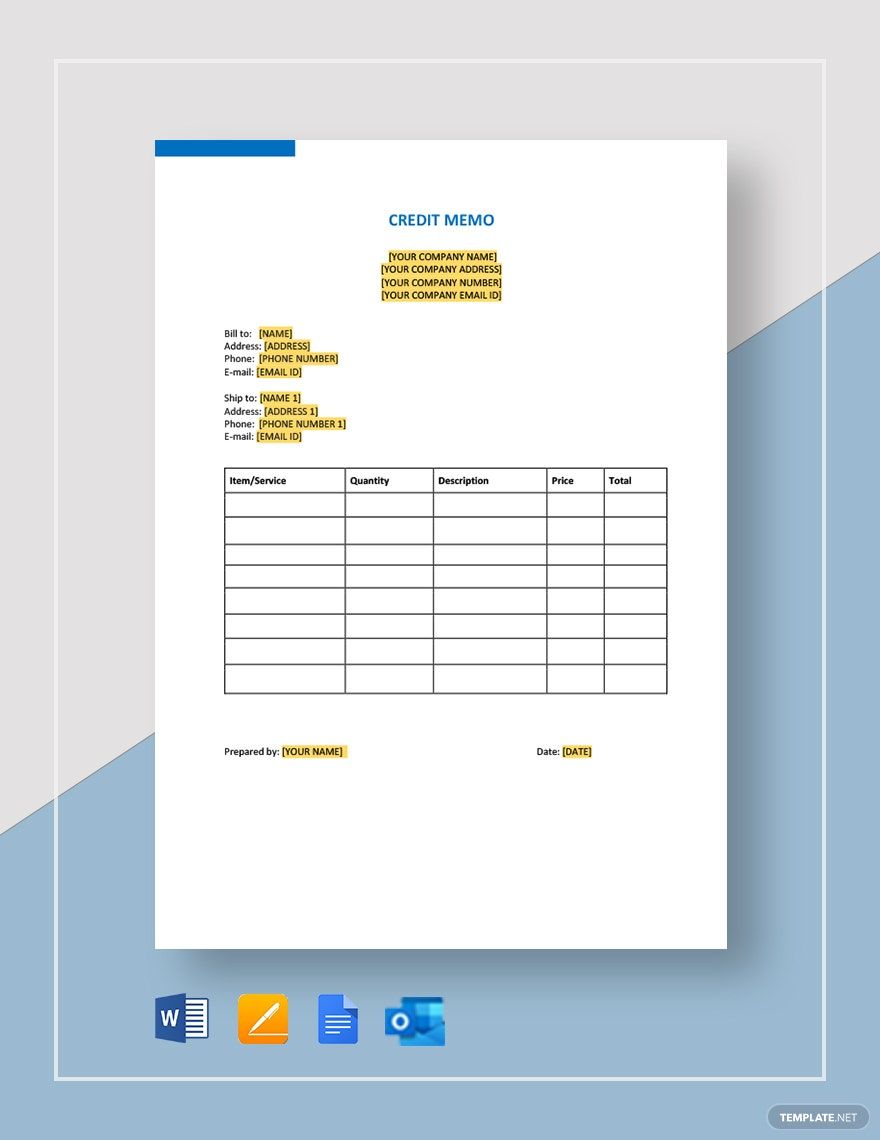

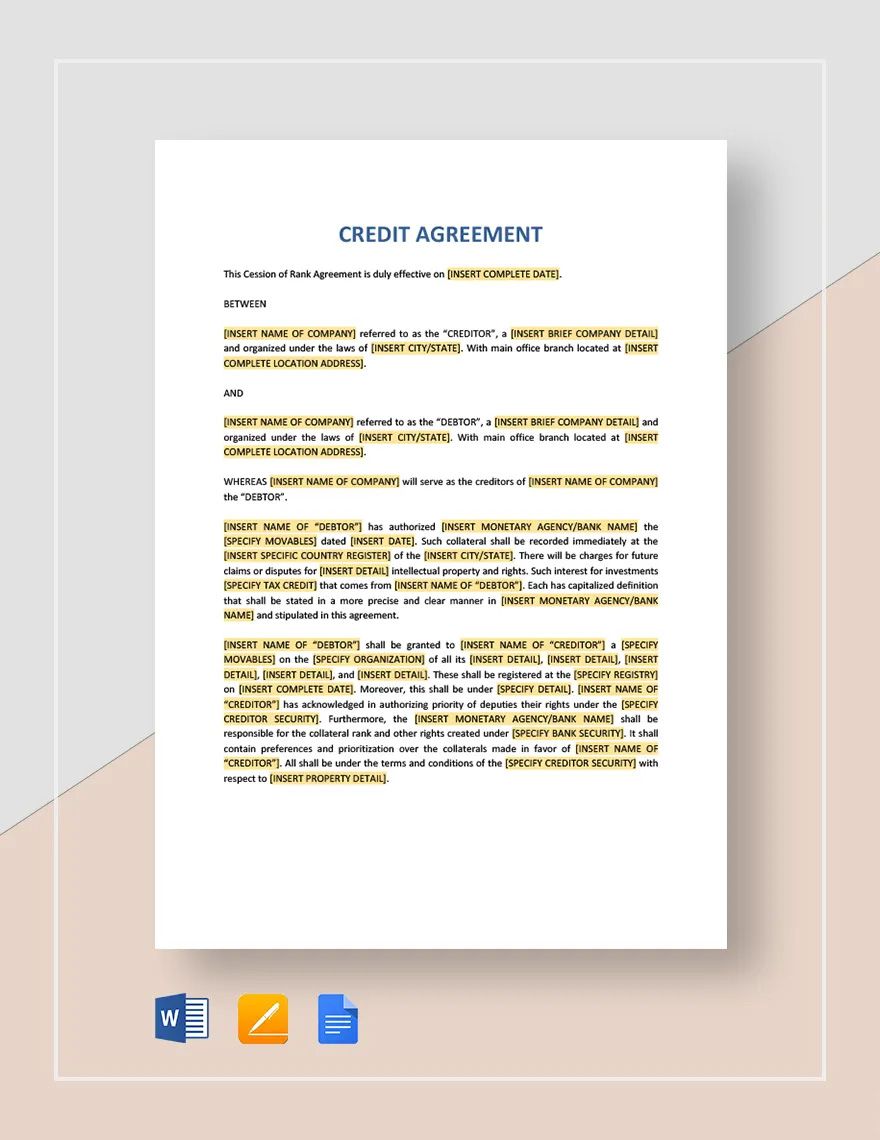

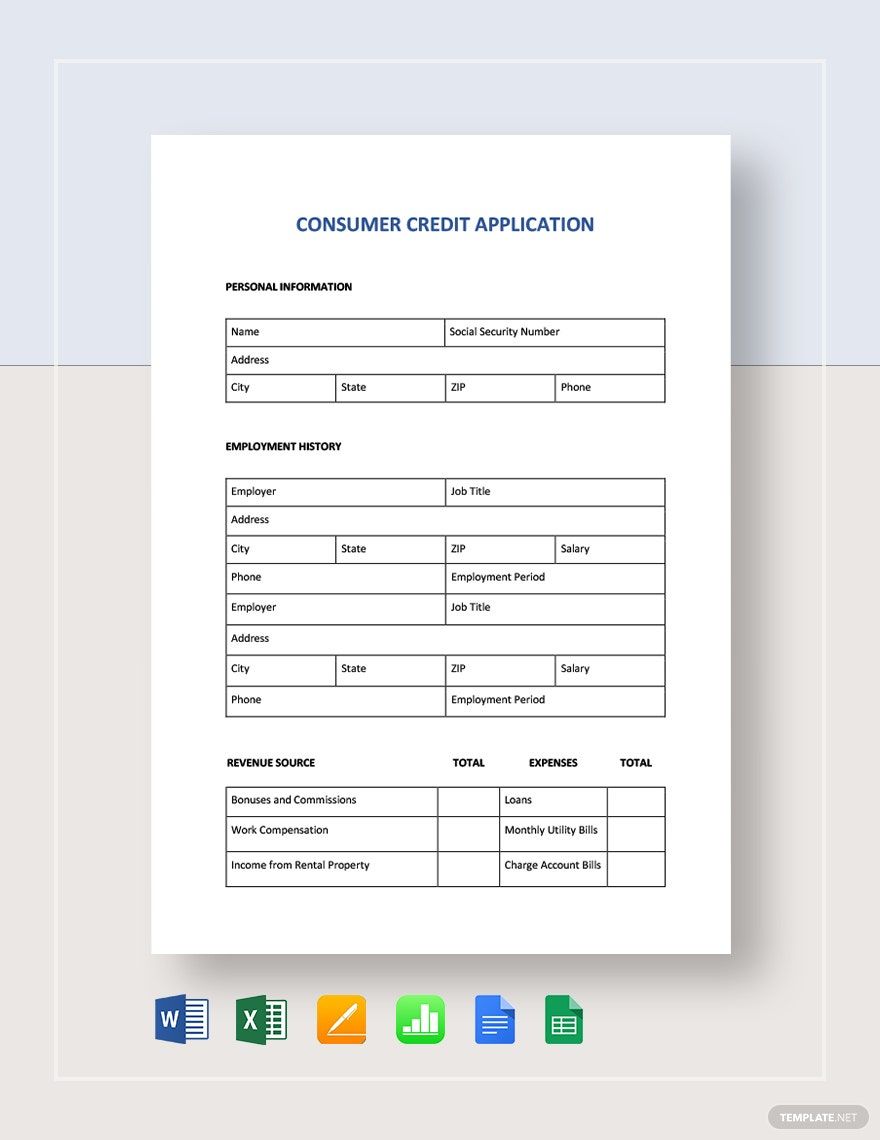

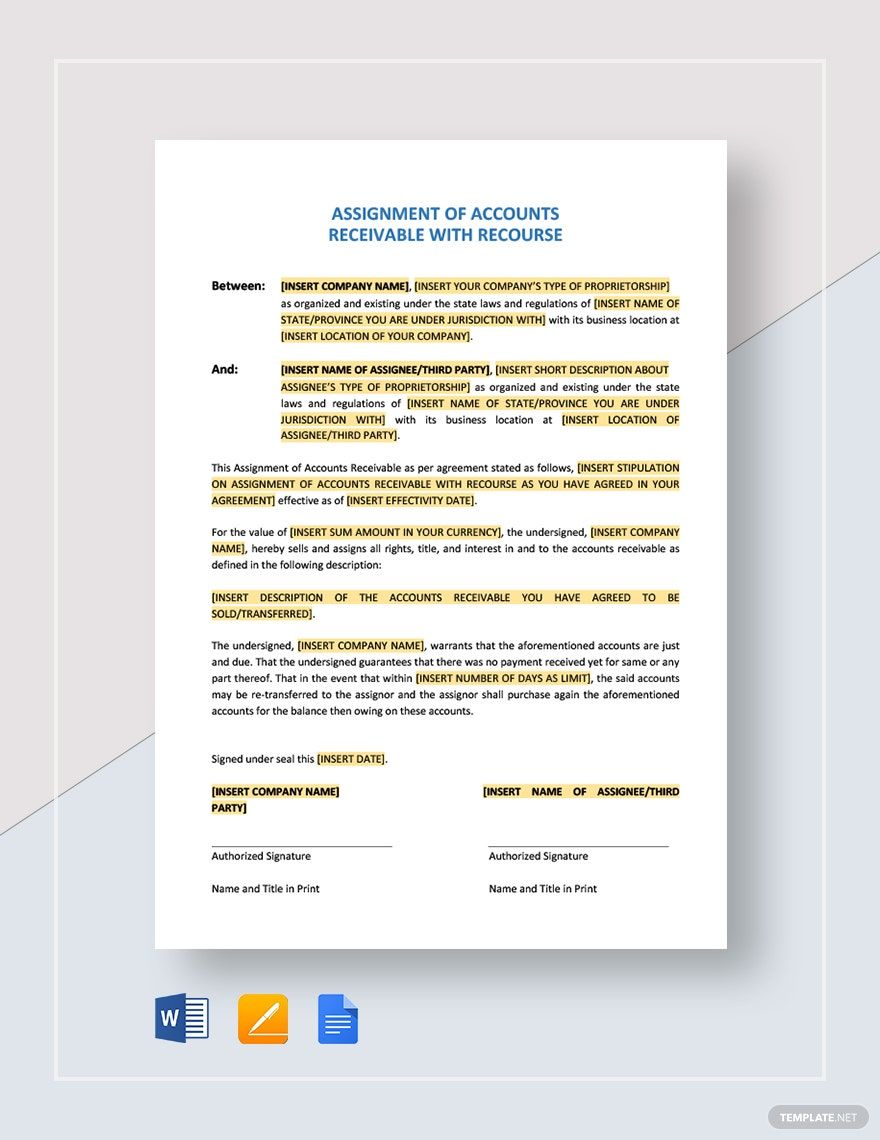

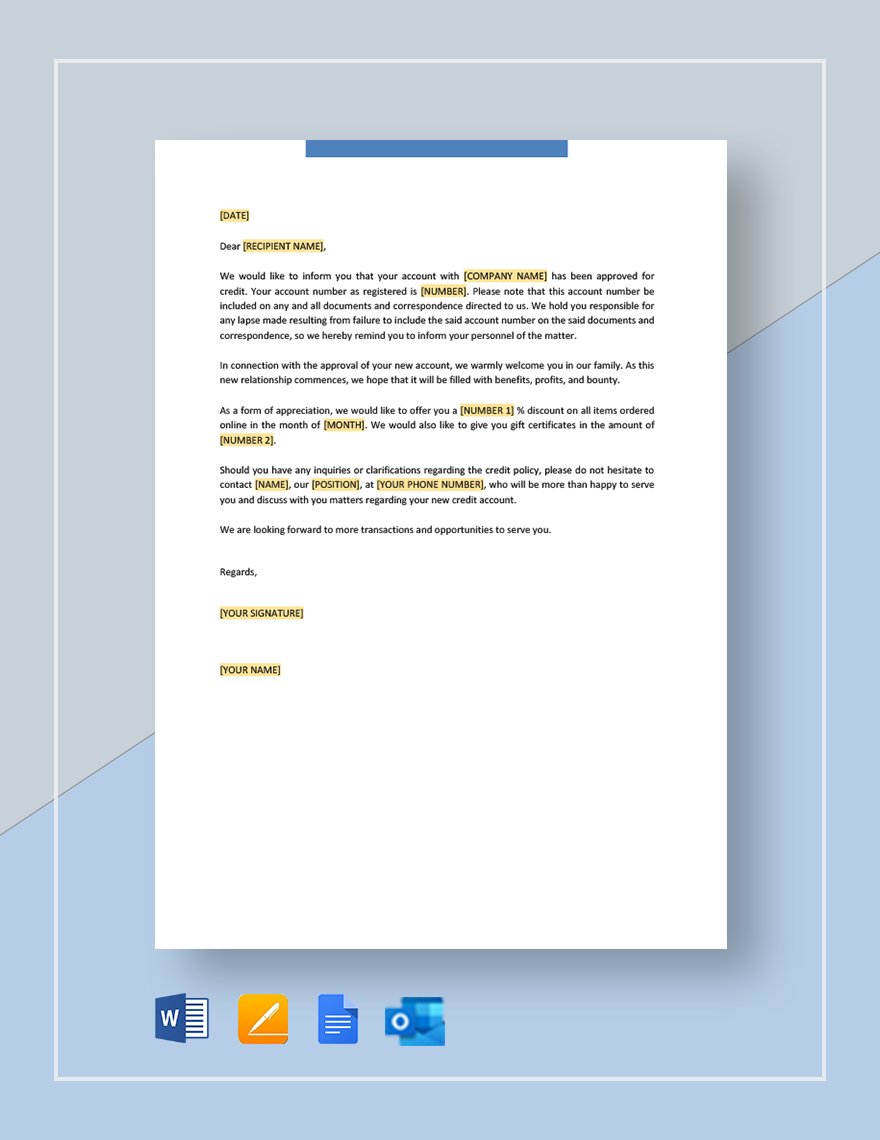

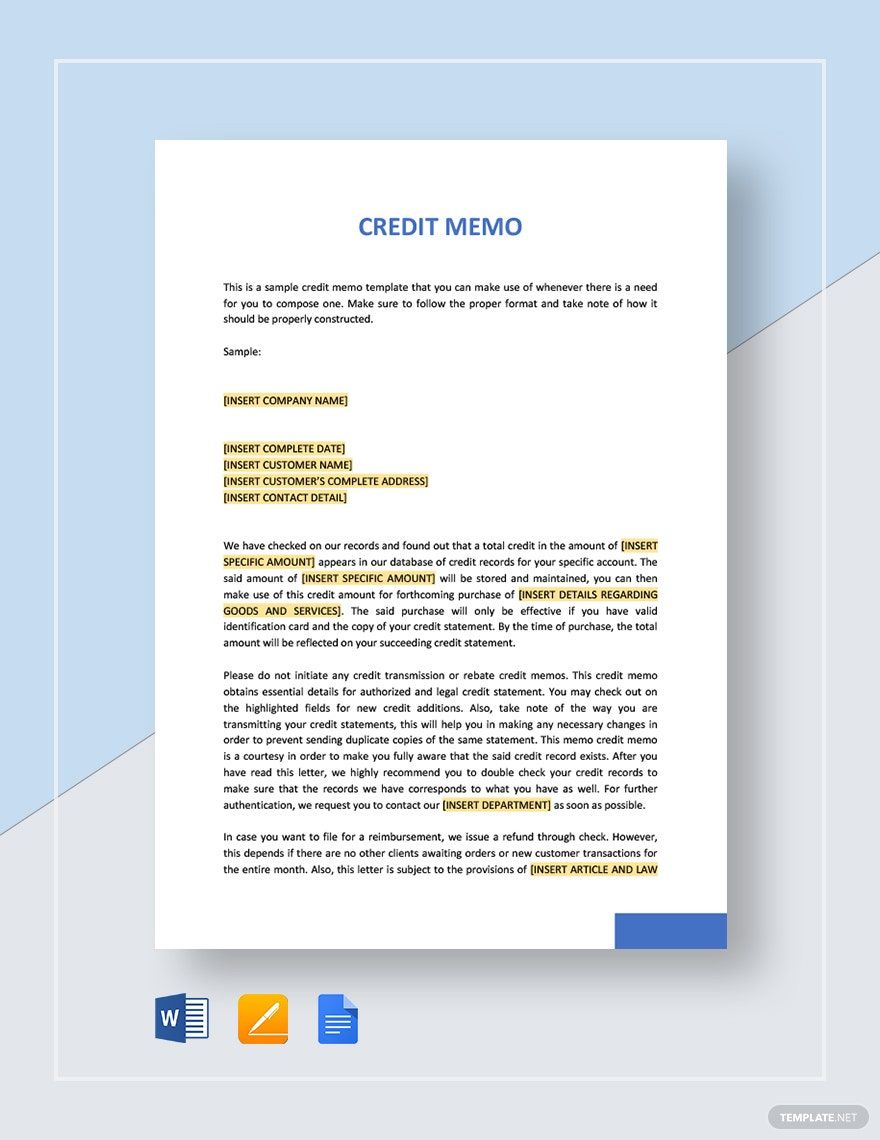

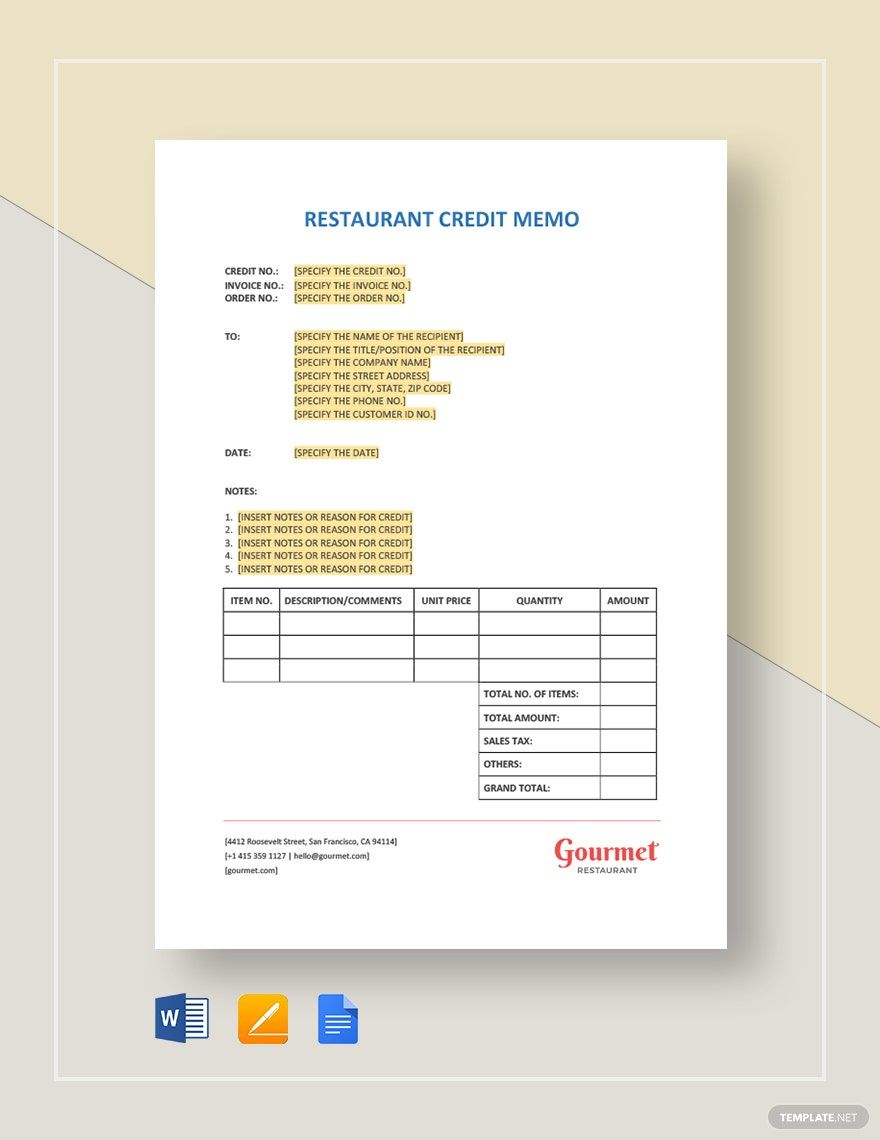

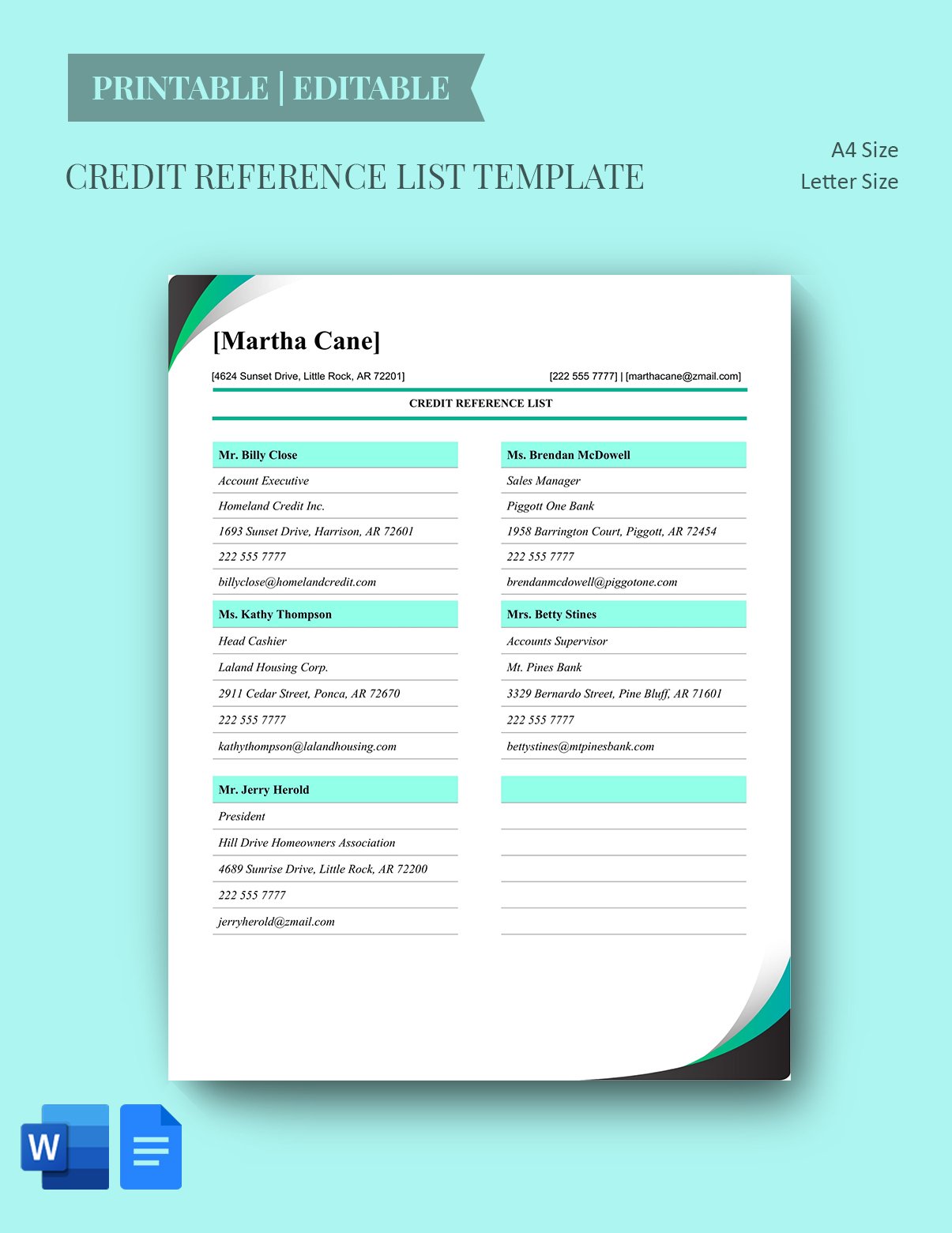

A credit document, also known as a credit letter or credit memo, is a written commitment that is submitted by a financing entity (usually a bank) to a seller to assure them that a buyer will make full payment on time.

How to Create a Credit Document

Learn how to write an effective credit letter or memo by referring to our step-by-step instructions below. Indeed, these instructions are straightforward and will guarantee you a well-written settlement document.

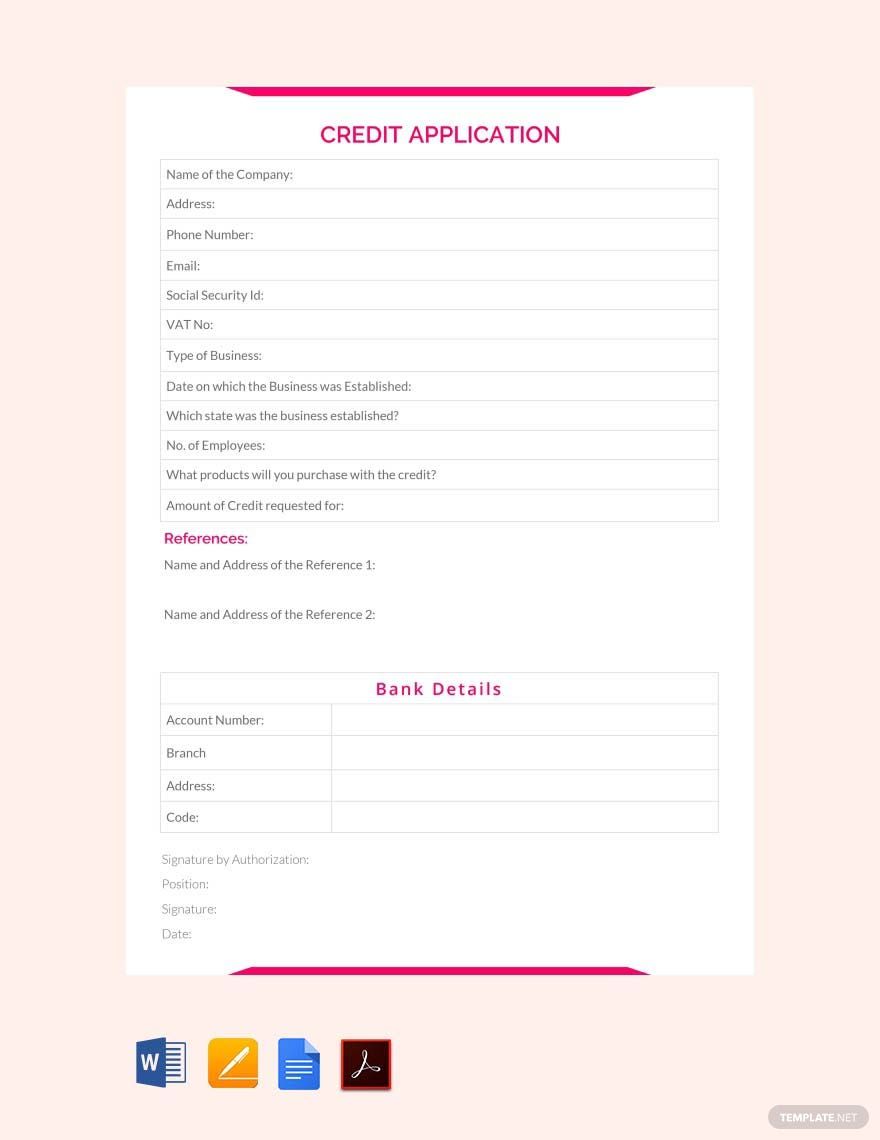

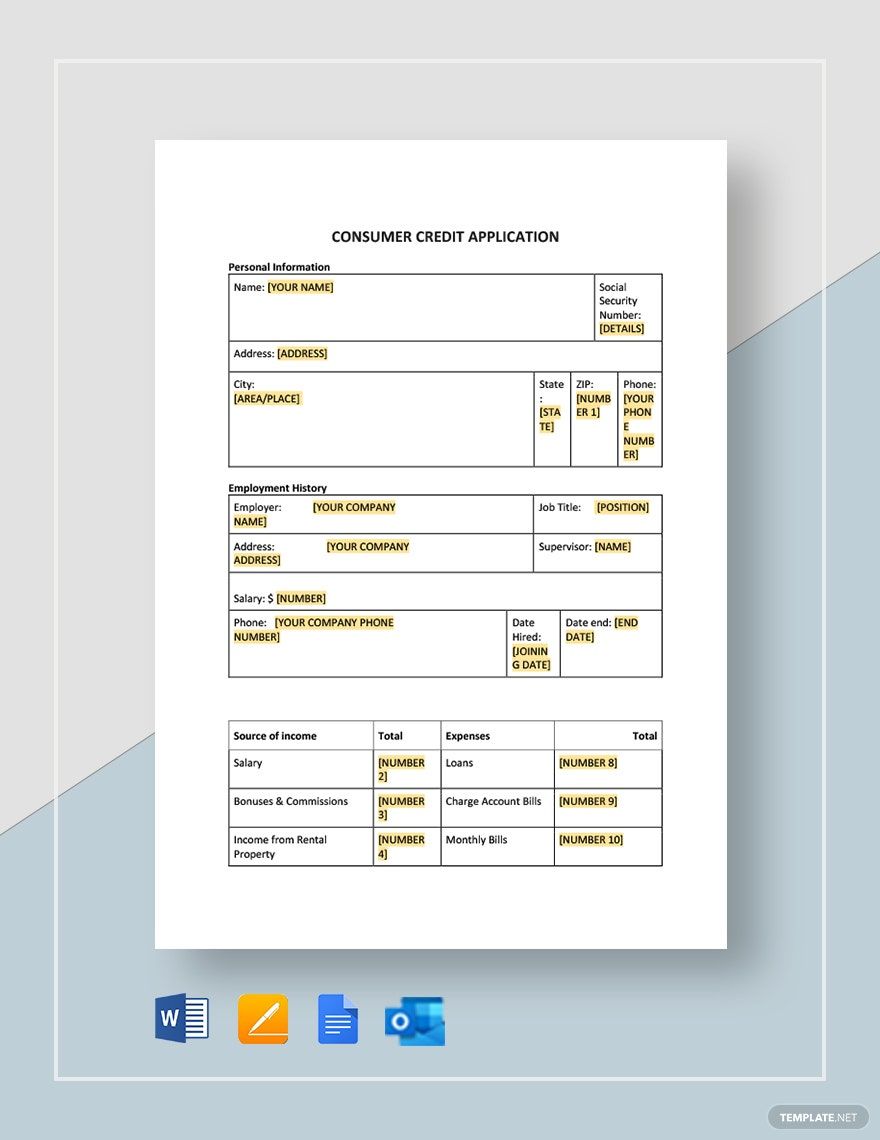

1. Identify your purpose for creating a credit letter

Why do you need to create a credit document? Do you even know what a credit document is for? To create an effective and relevant credit document, it is essential that you know why it's needed and who's going to read it. However, you also need to make sure that a creditor is indeed able to fulfill the transaction since failure in their compliance will be the liability of the guaranteeing entity.

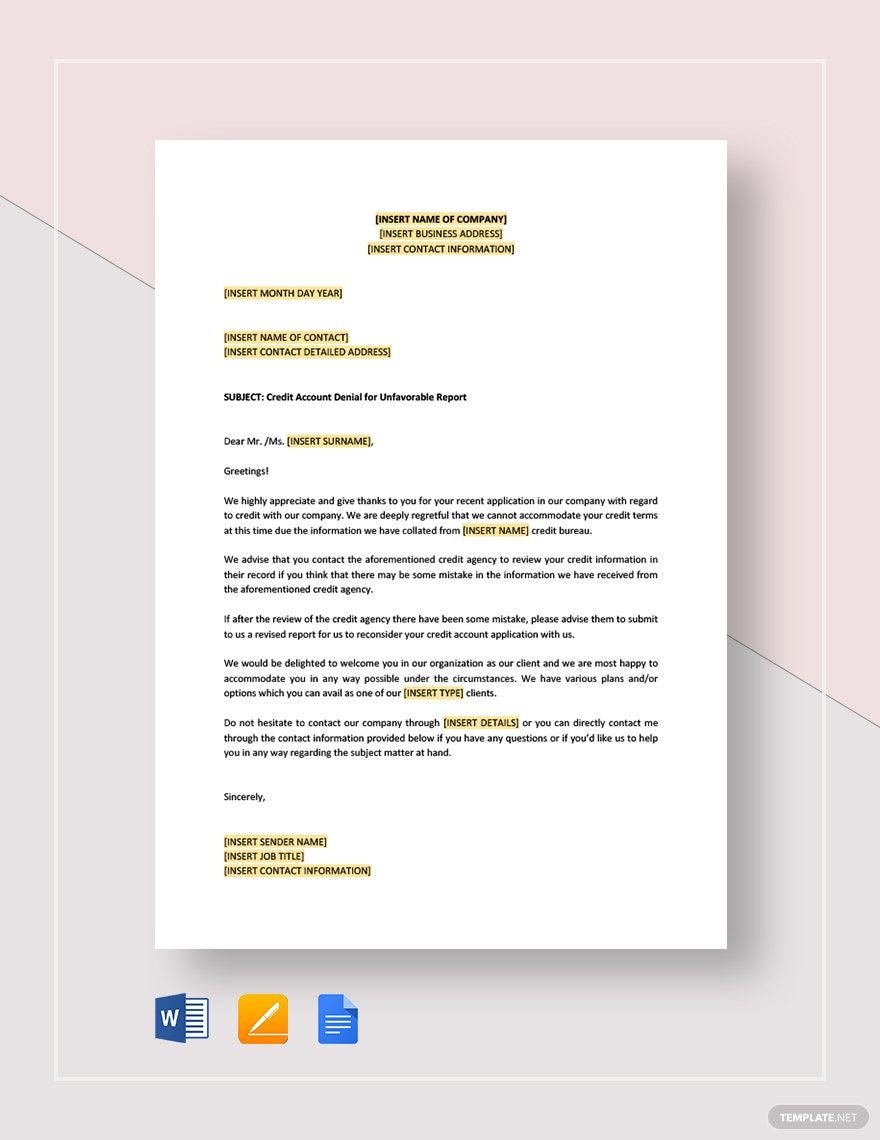

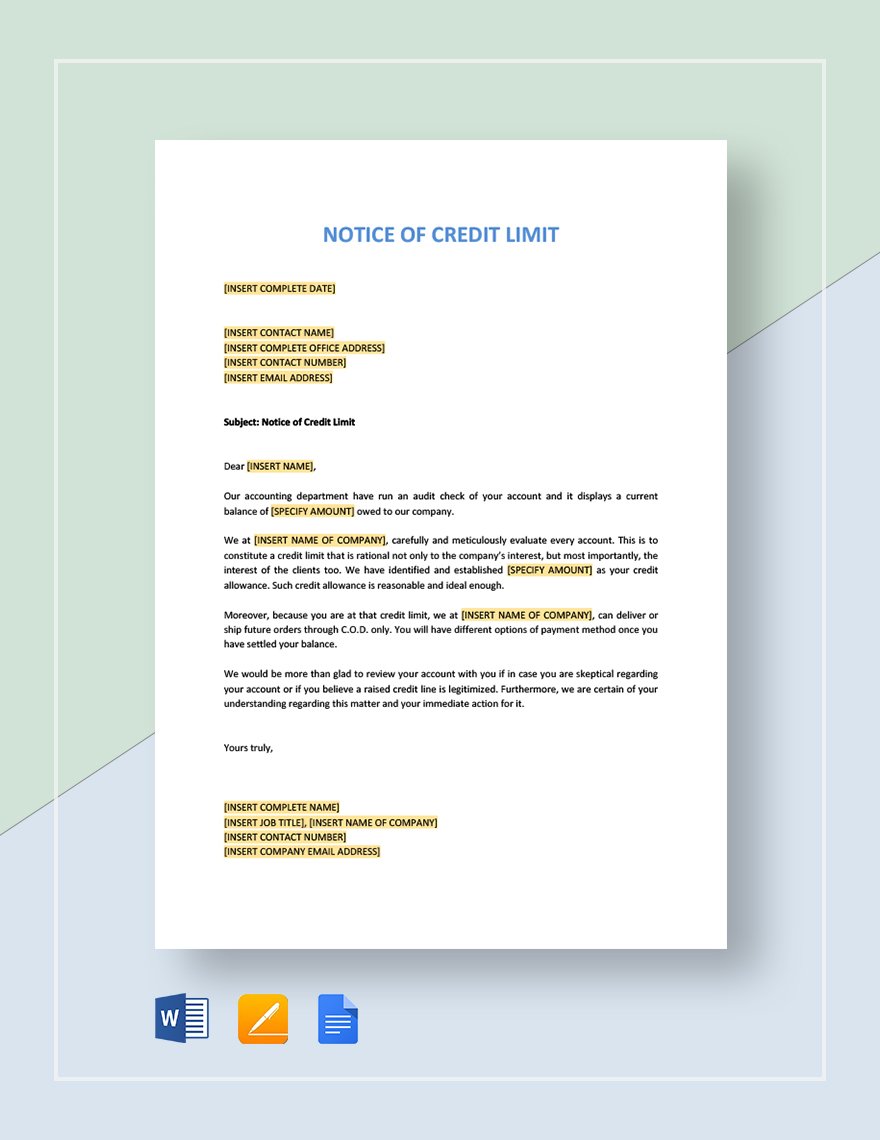

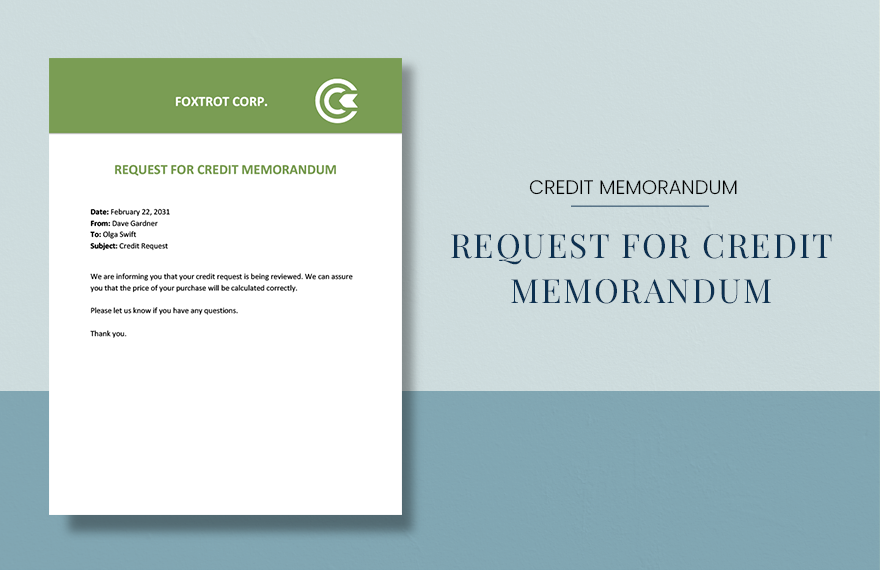

2. Determine whether you can approve or need to deny credit request

As mentioned in the previous step, it becomes your liability if the client is unable to settle their debt with the seller. This is why you have all the right to deny or discontinue a person's credit. If you are indeed denying the person credit, always maintain a professional tone and explain clearly the reasons for the decision made. In addition, be sure to leave the door open if the same party wishes to make future requests.

3. Make a draft of the document

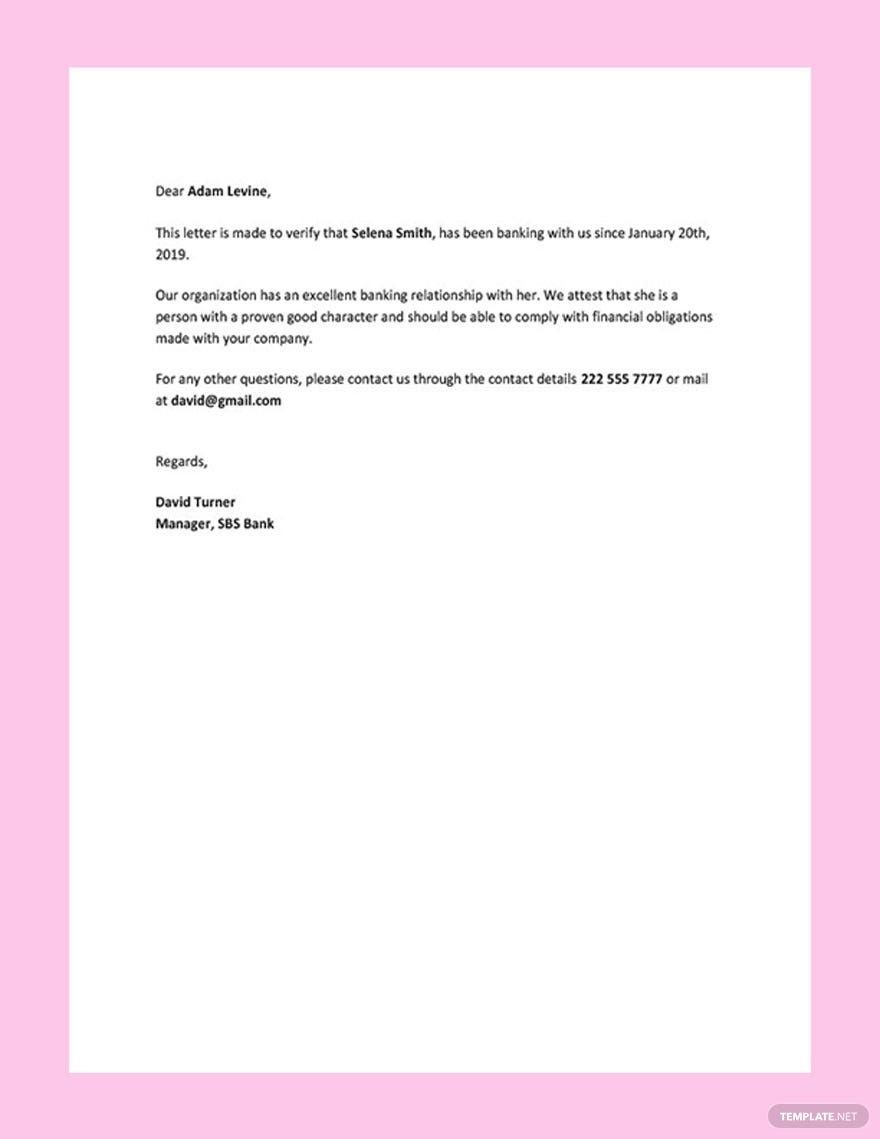

A simple yet effective method to ensure that a credit letter is written well is to start with a draft or an initial version of it. Here, you can focus on relevant keywords that you want to use to make your letter worth reading. Also, maintain a courteous tone, be clear and thorough with your information, and tailor your letter specifically to your audience. Lastly, be assertive and assure your reader that everything will be kept confidential.

4. Open Apple Pages and start writing your credit letter

After preparing everything you need for your credit document, you can finally start encoding your credit document using Apple Pages. Simply launch the word processor, open a new document, and then start encoding. Of course, refer to the draft that you have prepared in the previous step to save you time. And since this is a legal document, always follow the appropriate format and a professional tone of voice.

5. Review your work

Don't forget to review your work after writing it, this will help ensure that errors are seen and can be corrected. Go through the entire content and see if there are any errors to the grammar and spelling, and then make the necessary corrections if there are. Also, review the content if there are any redundancies or sentences that might create confusion. Be sure that your content is indeed well-written and can be easily understood.

6. Submit your credit document

If you want, you may present a soft copy of the letter to the creditor to see if all the details are correct. This will enable them to give suggestions if they wish to change something in the letter. On the other hand, you can also have full control over the document by converting it in PDF, printing it, and then submitting it to the entity who is expecting to get paid.