Elevate Your Financial Documentation with Ready-To-Use Credit Templates by Template.net

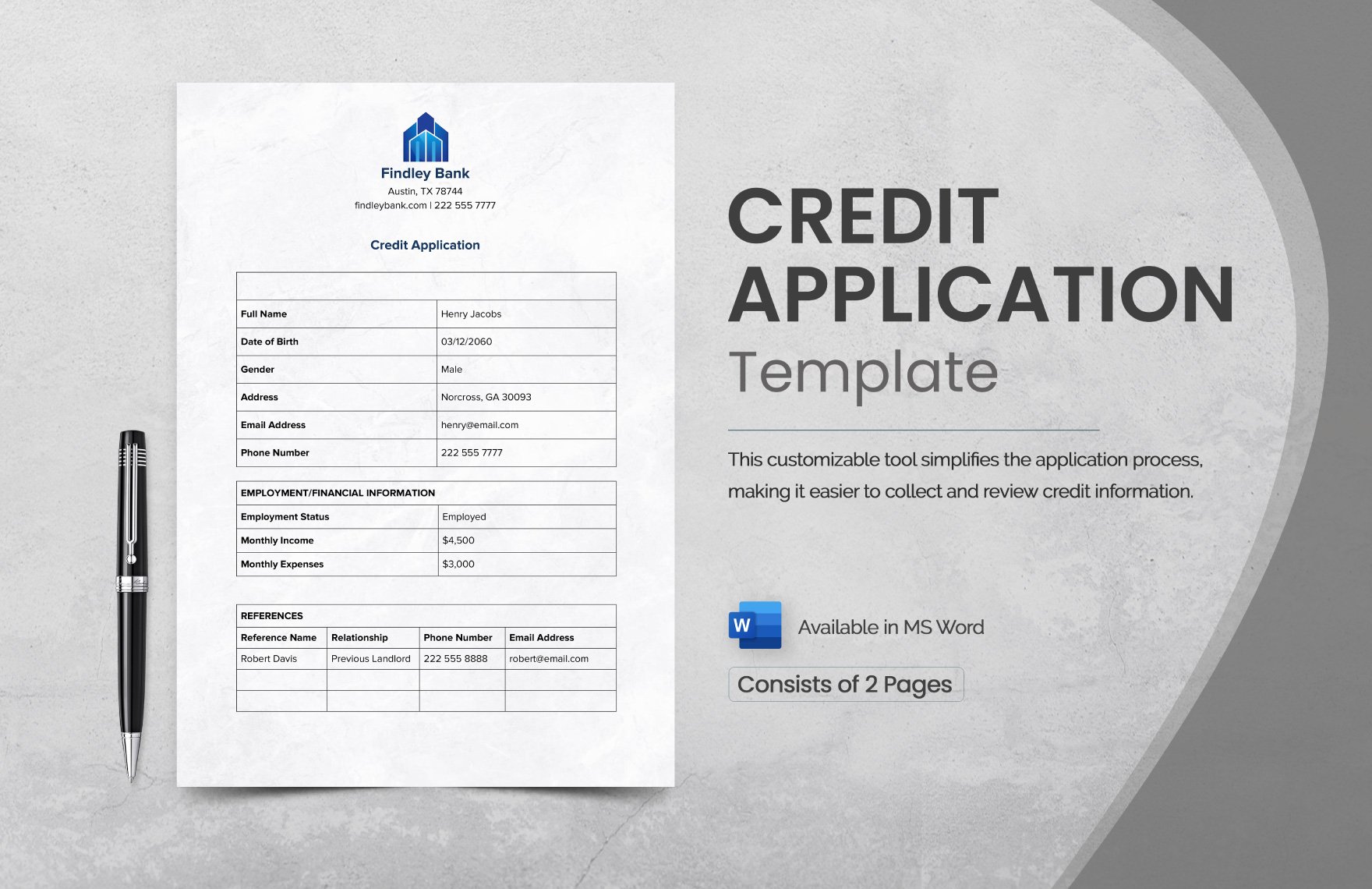

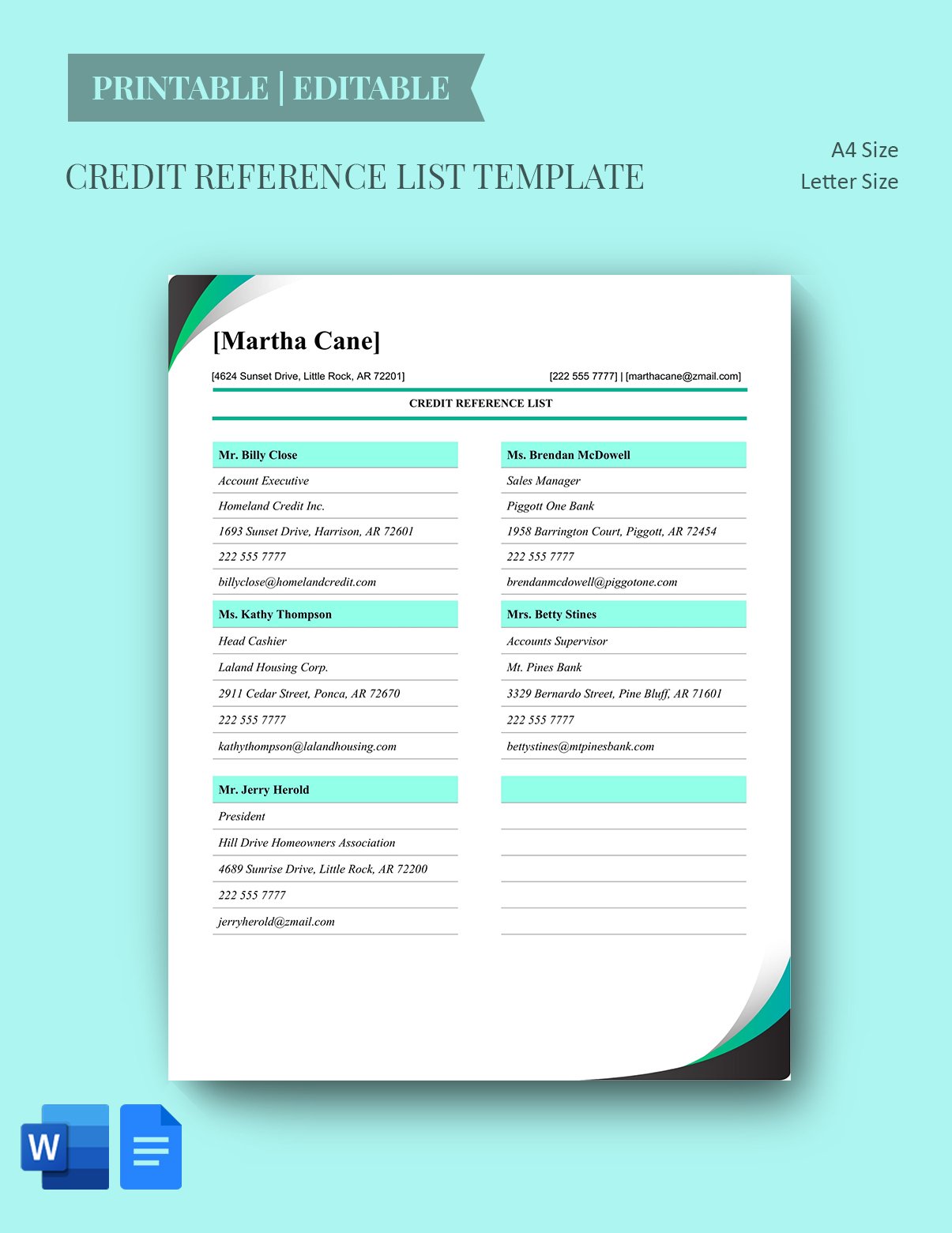

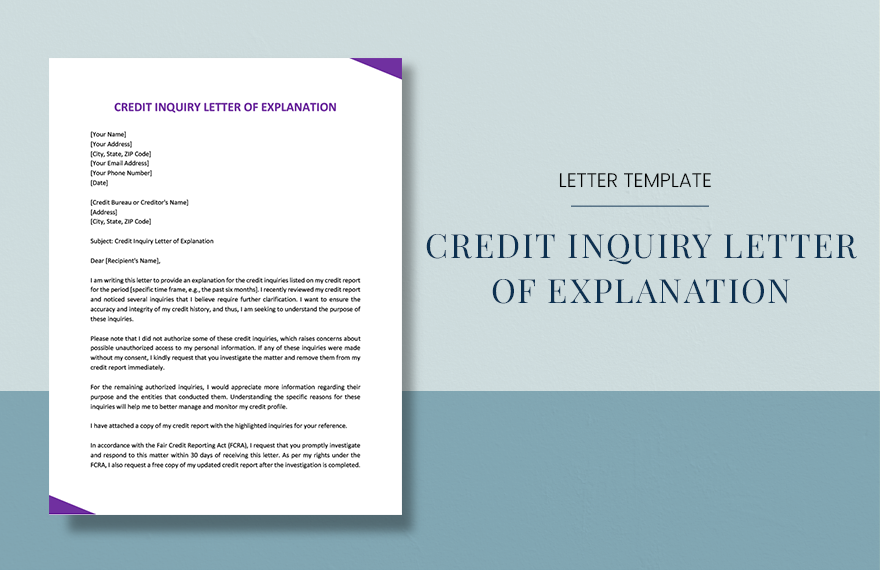

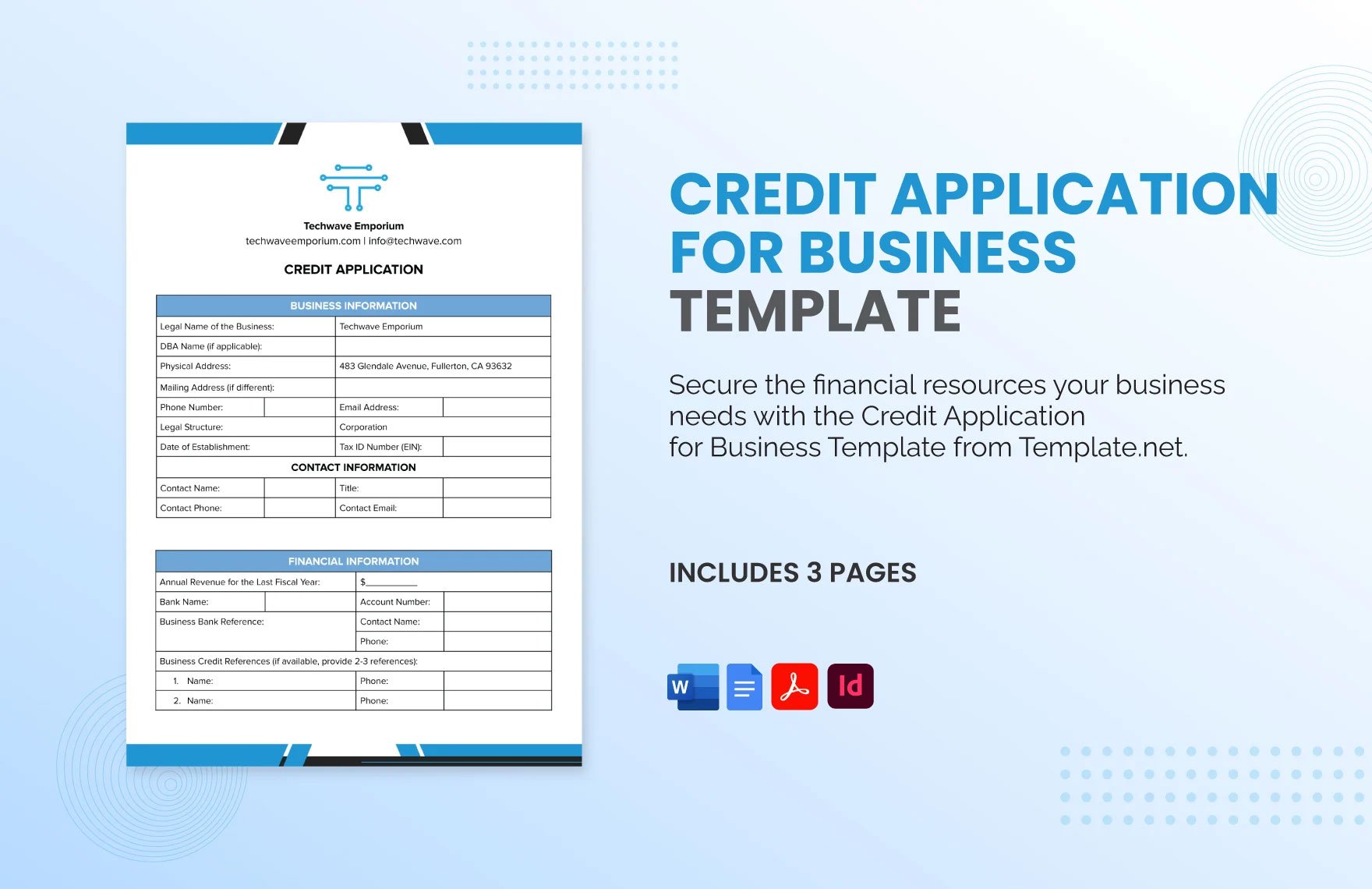

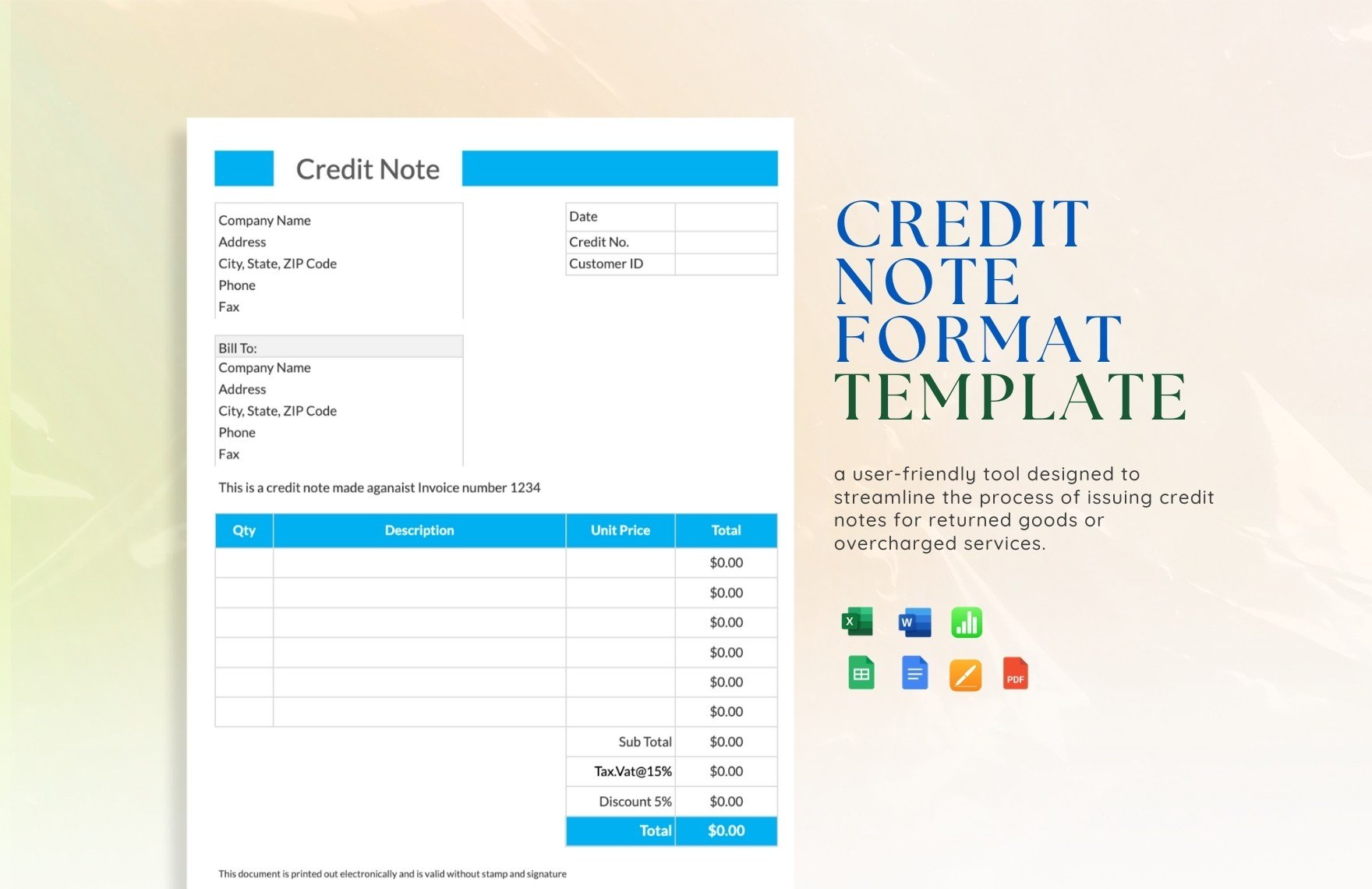

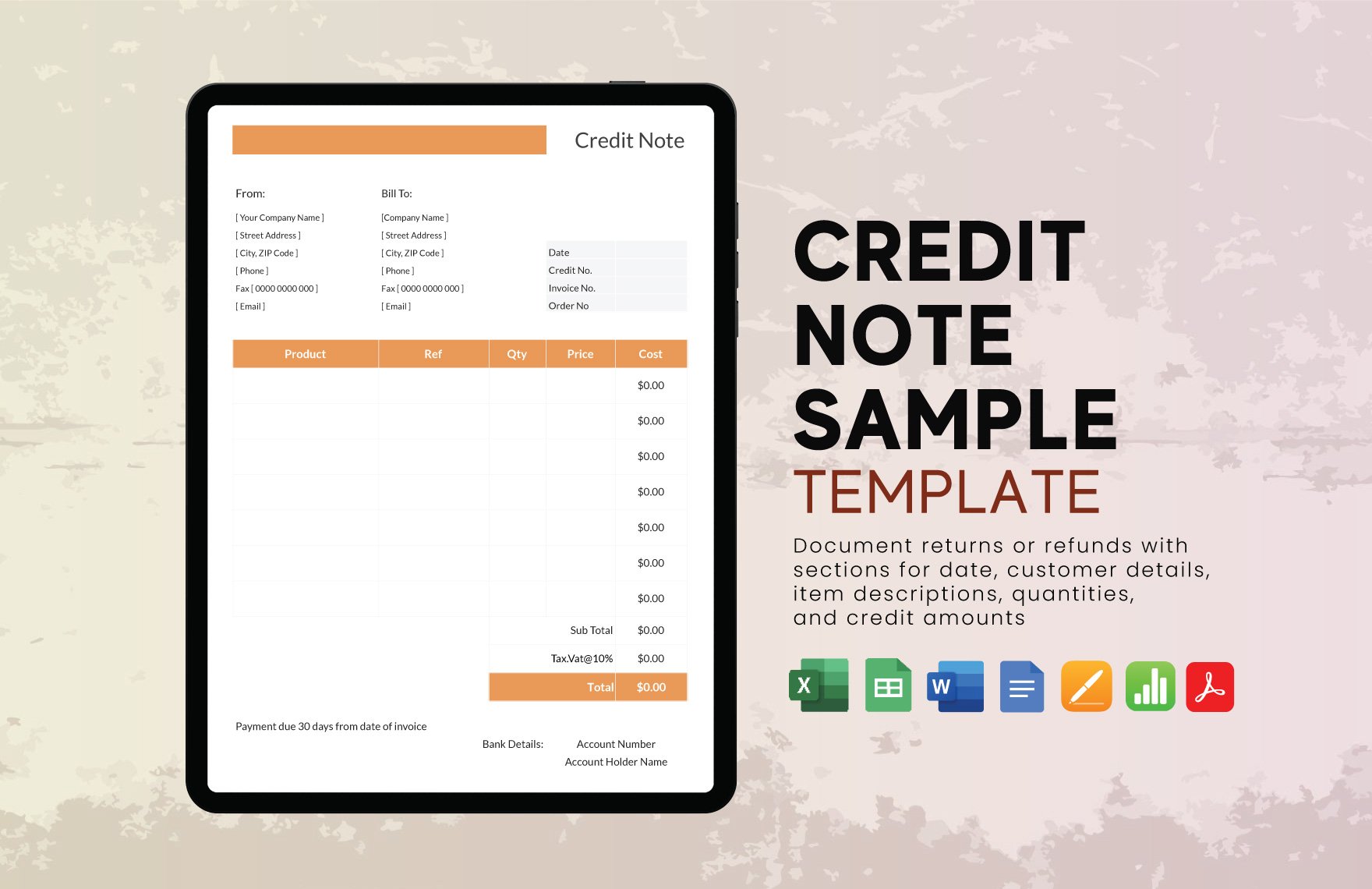

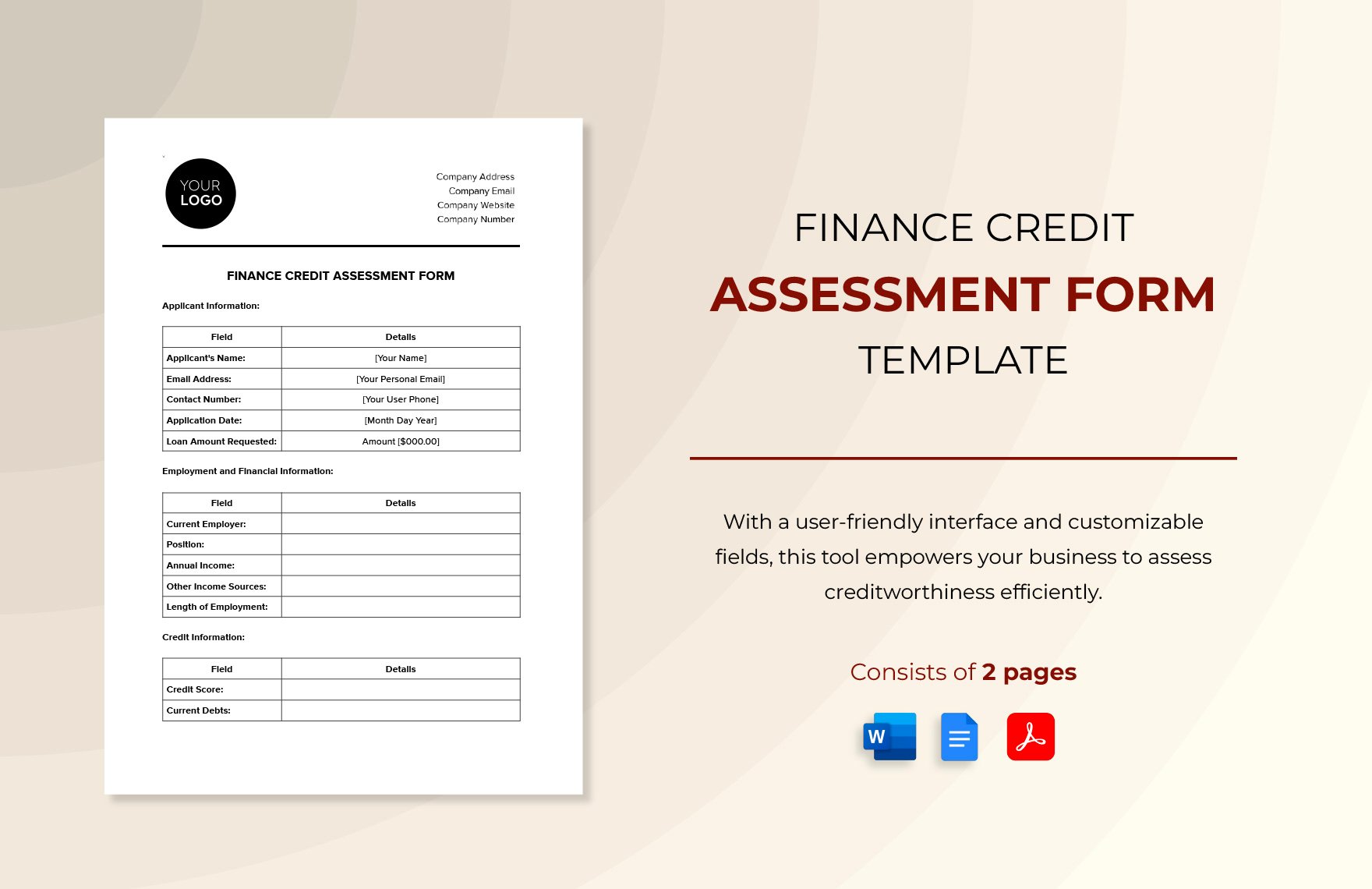

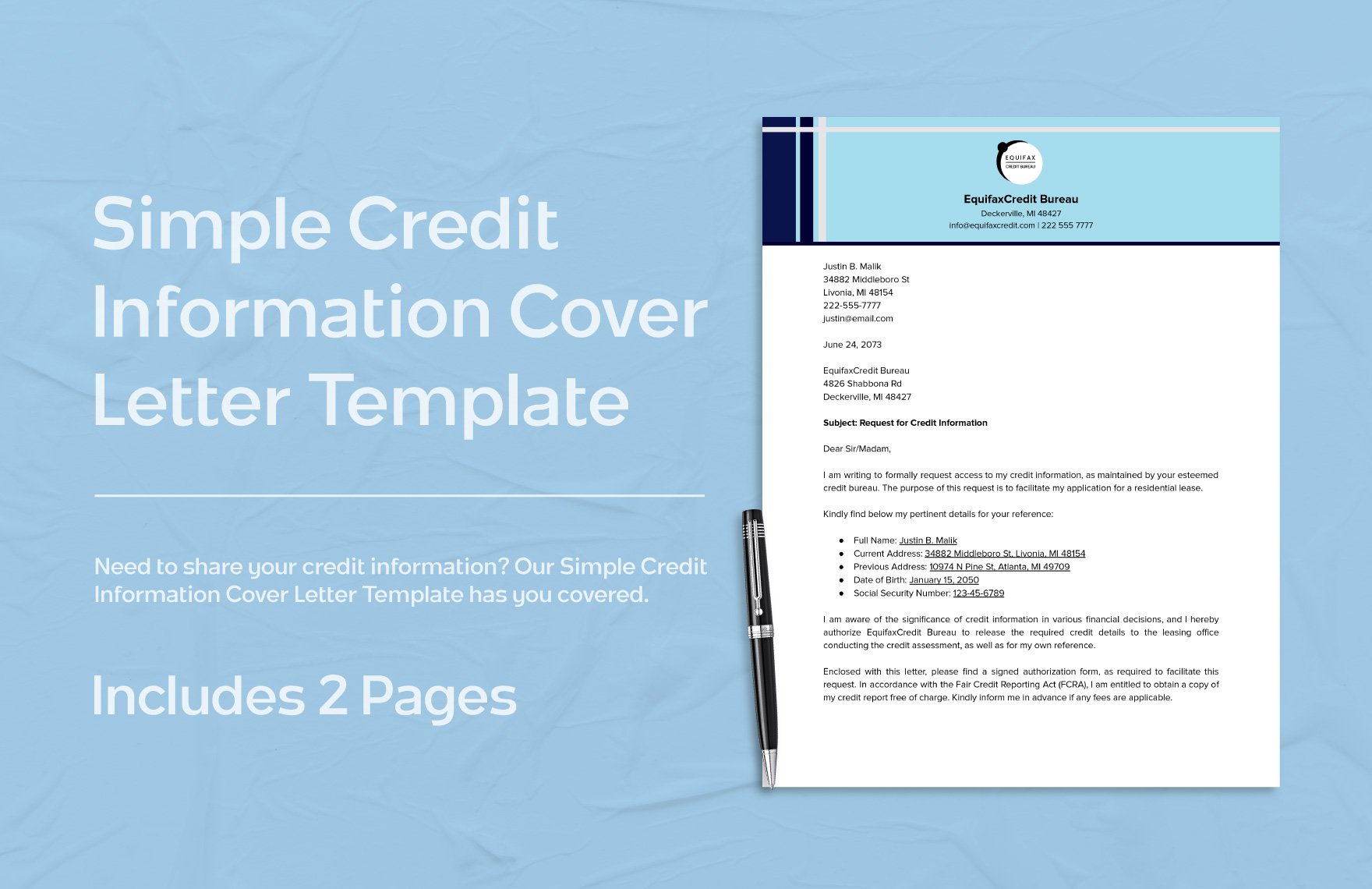

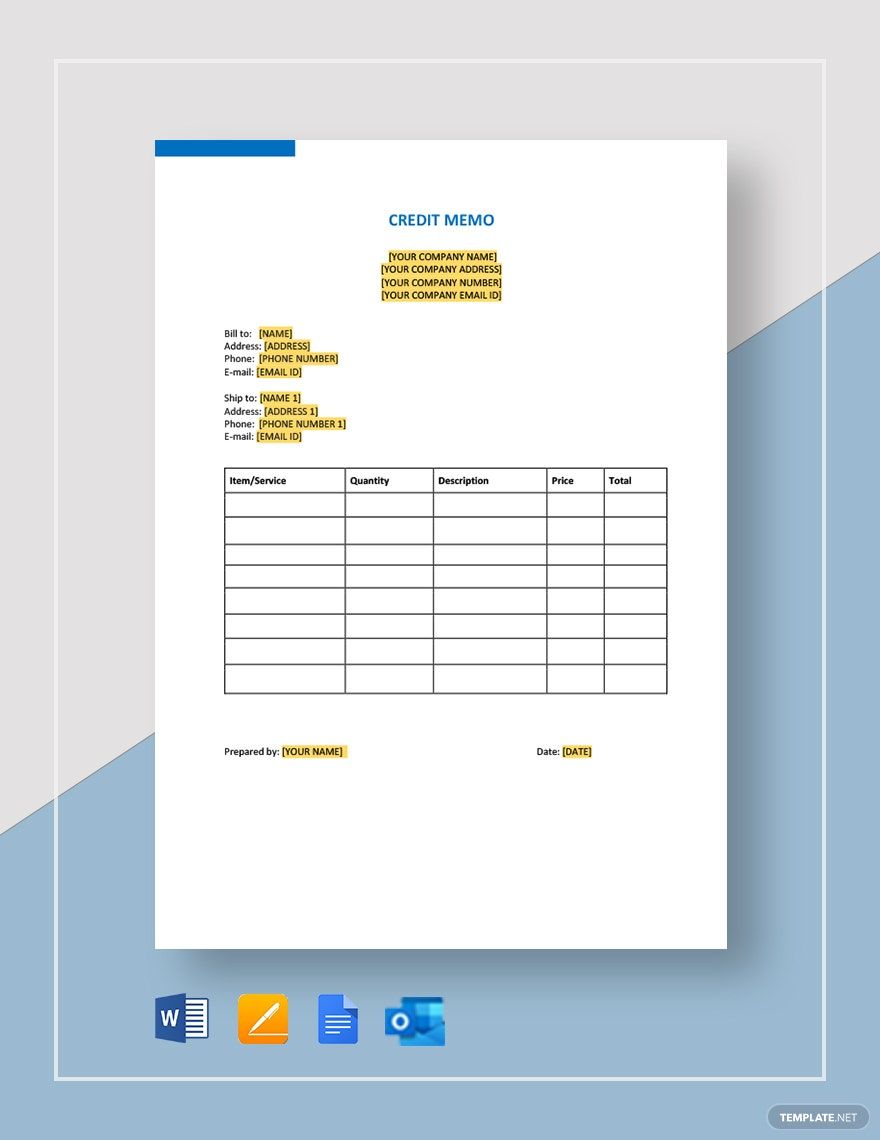

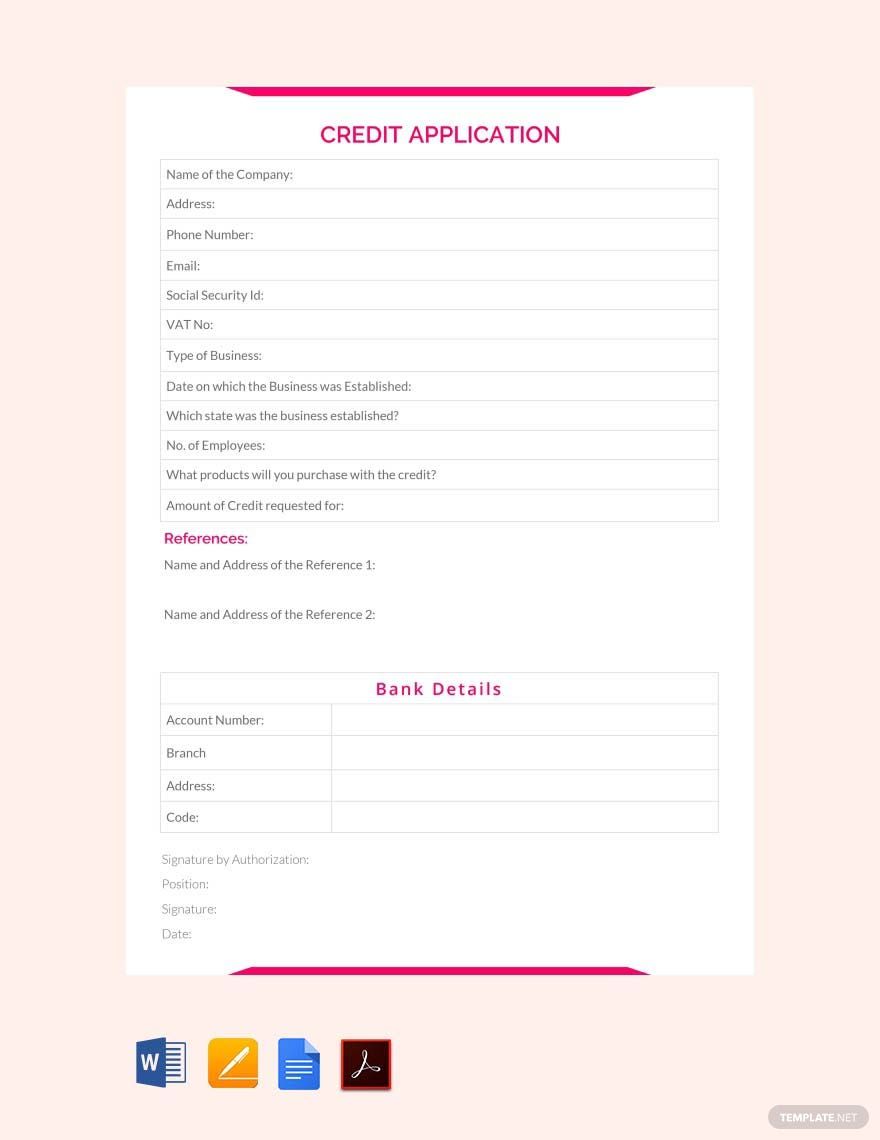

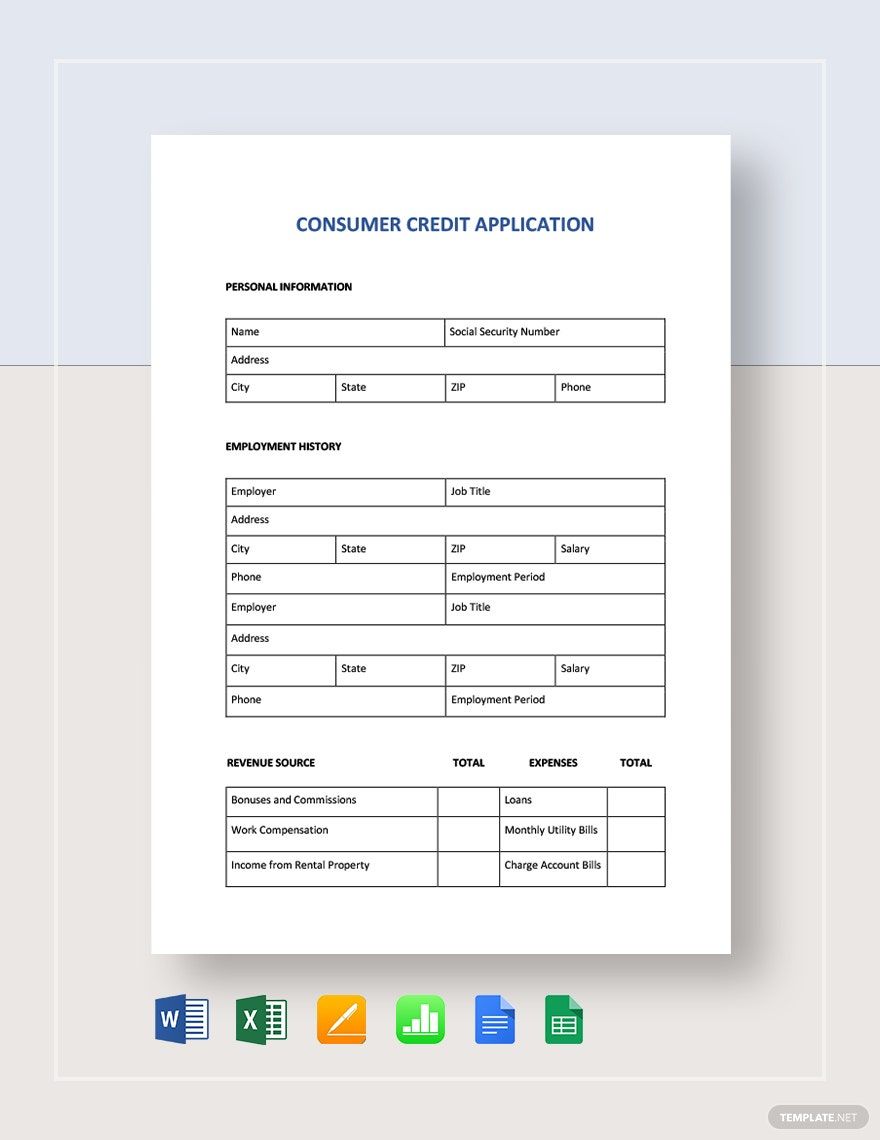

Transform your financial record-keeping effortlessly with free pre-designed Credit Templates in Microsoft Word by Template.net. Tailored for both financial professionals and small business owners, these templates empower you to create precise and neat credit documents in minutes, even if you lack design experience. Whether you are looking to effortlessly document a customer's credit agreement or streamline your internal credit control processes, these tools are invaluable. With an array of free pre-designed templates that are readily downloadable and printable in Microsoft Word, you'll have everything you need at your fingertips. The user-friendly layout ensures that no design skills are necessary, offering beautiful pre-designed templates that save valuable time and resources. Additionally, customizable layouts support print and digital distribution, perfectly suiting both traditional and modern communication methods.

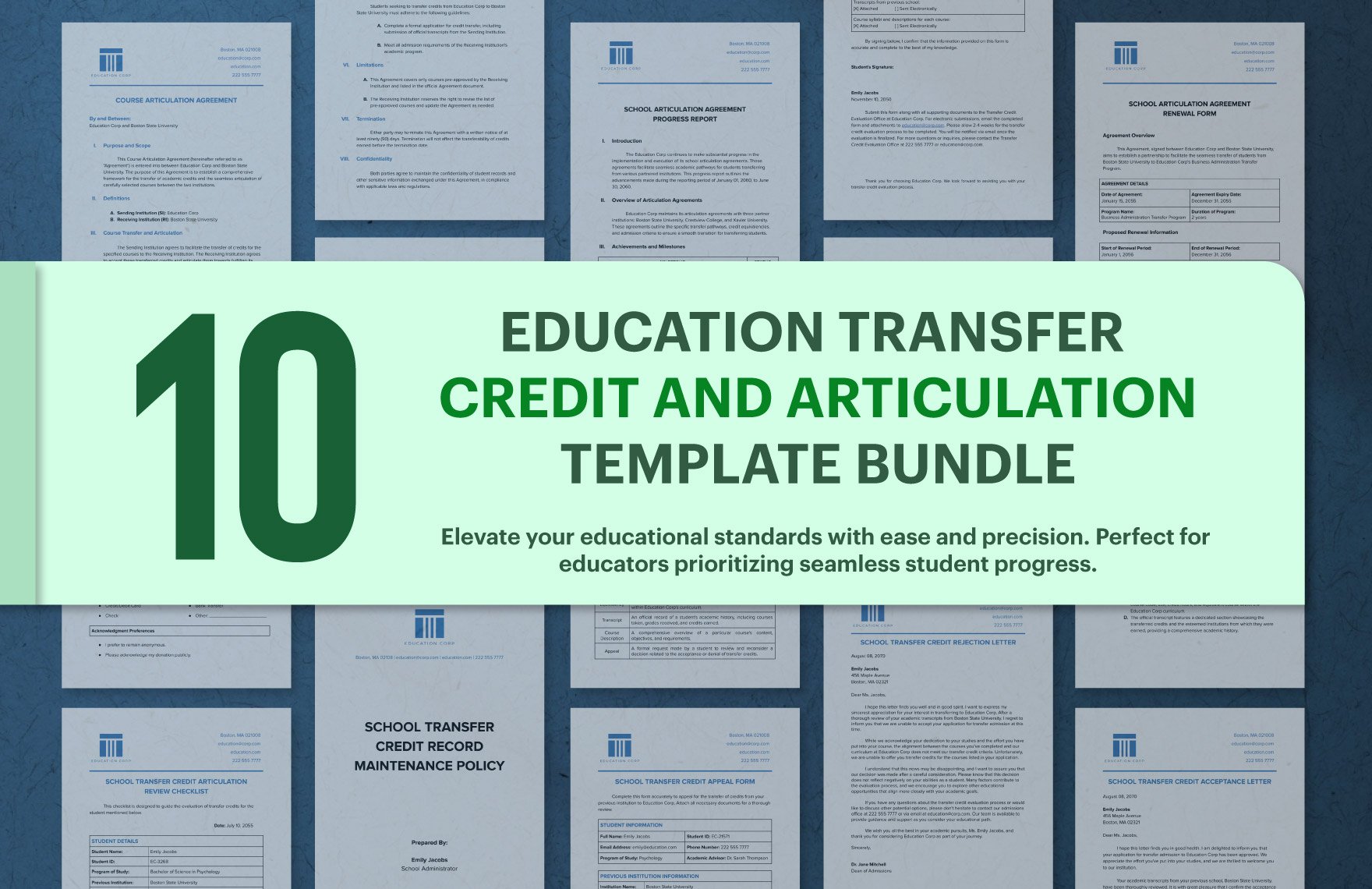

Discover a diverse range of Credit Templates, each one crafted to meet specific financial needs. Explore more beautiful premium pre-designed templates in Microsoft Word, which are updated regularly to reflect the latest design trends and functionality improvements. Whether you need to download or share your documents via link, print, or email, these templates maximize your reach and effectiveness. For optimum flexibility, consider utilizing a mix of both free and premium offerings. By integrating different templates into your workflow, you can ensure comprehensive and versatile documentation that enhances your financial management capabilities.