![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

How To Create Meeting Minutes in Google Docs [Template + Example]

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

Apr 21, 2023

Deposit slips are important tools in finance, banking, the business sector and personal affairs. Financial institutions and depositors would require deposit slips to ensure a successful transaction between both parties.

Deposit slips are financial forms financial institutions, like banks, present to depositors to fill up.

Depositors are required to provide all the necessary information written in this document before they can proceed with the transaction.

One of the main requirements when depositing cash or a check is to fill up a deposit slip form. Deposit slips are proof that a deposit transaction has been made between a bank and a depositor. Deposit slips contain several categories that are to be completed by a depositor such as a date, the name of the depositor or the account name of another party, the account number, and the amounts being deposited.

Cash deposit slips are one of the most commonly used forms since most depositors use the money to replenish or add funds into bank accounts. This serves as a record between the bank and the depositor. Cash deposits go into checking or saving accounts or money market.

Companies and those in the business industry often open their own corporate accounts to secure their business funds. Therefore, a business deposit slip is a form used by those who would transfer funds into companies or if they need to pay for an item purchased or a service. Just like any other deposit slip, a depositor must fill up all the necessary details to complete the transaction.

A generic deposit slip is a common or general form one can use when transacting in financial institutions. It has the basic format or a simpler layout considering deposit transactions of this kind are uncomplicated. It is considered a universal form of deposit slip.

For those who need to pay for goods or products that are being exported or a bill of lading document, then you may use an export deposit slip. The categories written in this form may be different than other deposit slips, as there is a need to provide extra information for the transaction between a carrier, freight forwarder, and the sender. Certain details included should be relevant to the shipment for the bank and the exporter or carrier to reconcile with their files.

For those who need to deposit a cheque on their account or perhaps to another company, then a cheque deposit slip is used for this transaction. The difference between this type of deposit slip and a cash deposit slip is that you will need to write down specific information in regard to the cheque deposit on the form. This would be the cheque number, the name of the bank in which the cheque was issued, and the currency amount.

Another specific kind of deposit slip is a savings deposit slip which is common in banking transactions. Saving accounts allow the account holder to deposit money and earn a modest amount of interest. It is one of the best ways to secure your funds in the bank and is withdrawable anytime via over-the-counter or an automated teller machine or ATM.

Another way of transferring funds or payments nowadays is by doing it online. A direct deposit transaction requires the use of an electronic or online network to complete a transaction. Completing all the details in a direct deposit slip will accomplish the transaction.

Common in financial institutions such as banks is a bank deposit slip. One cannot complete their deposit without completing this form. If the transaction goes through a bank teller validates the deposit slip.

Whenever a company requires a client to pay for an item or service, this could be accomplished by filling out a sales deposit slip. This would help establishments and management determine and organize their sales for the day. They are able to balance better their daily sales transactions through reconciliation by using this deposit slip form.

A blank deposit slip is one where you need to fill up all its categories manually. In order to finalize the transaction, a blank deposit slip will also have the same necessary categories that a depositor must complete. To add you may be required to indicate if what you need to deposit is cash or cheque, and the specific currency.

Deposit slips play a pivotal role in financial transactions. These forms are one of the many forms that banks and other institutions use to support and complete a transaction. This help ensures that the deposited amount is accurately registered and completed.

A deposit slip is a form that a depositor dutifully fills out and the information provided will be checked by a bank teller. With that, details of which bank account number to which the funds should be credited are written in the form. The form itself serves as proof of the transaction between both parties and should there be discrepancies, the form would be a reference.

During the verification process, the teller will check, log and register the details between what is on file and what is written on the deposit slip. Once verified in their software, it is part of the bank’s services to process the slip along with the items in the deposit. The deposit slip itself is validated or a separate receipt is given to the depositor.

As mentioned, deposit slips serve as a reference for a deposit transaction. Banks would use this form to record in their worksheets and ledger books. This is to make sure that no deposits are missed out within a given day.

Banks are not the only establishments that need deposit slips for reference. Companies often use deposit slips to reconcile their sales and the funds in their bank accounts. This helps balance their finances and make sure nothing is missed out.

Also, a validated deposit slip provided by a customer would serve as an acknowledgment or confirmation of payment. In this day and age of online transactions, validated deposit slips are easily sent via the internet instead of printing this document. It makes it easier for establishments to guarantee that payment has been finalized.

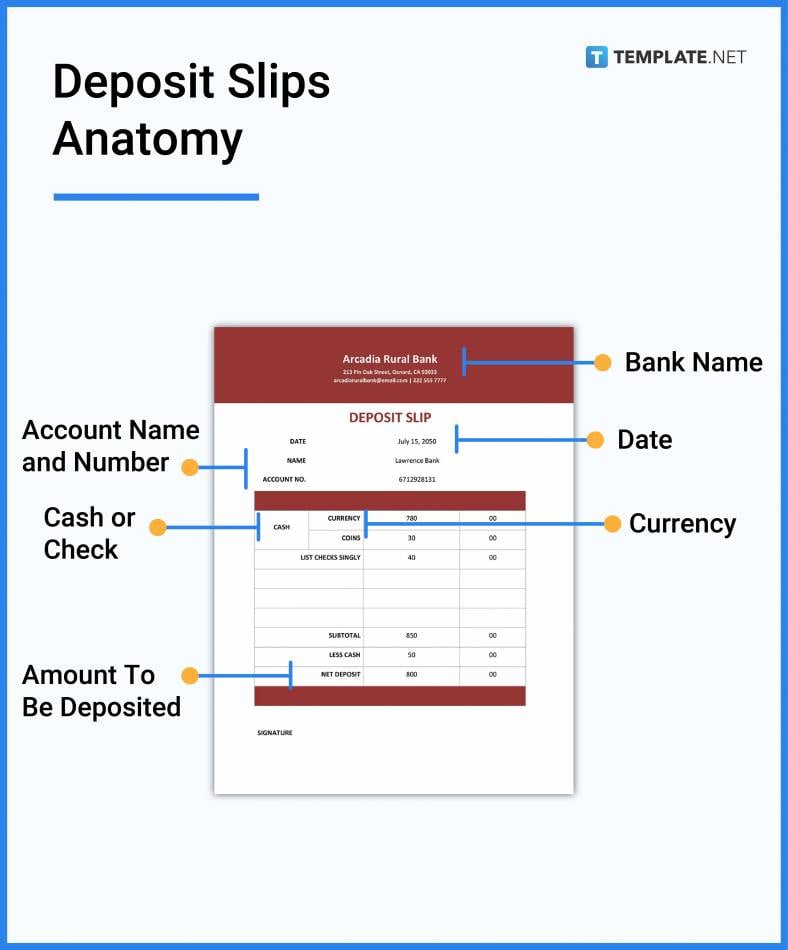

On the upper portion of a deposit slip is an area where a depositor must write down the date of the transaction. This detail should never be written incorrectly.

Another important feature of a deposit slip is the account name which may be the name of the depositor itself or company or another depositor’s name. Also, the account number should be written down in this form.

A checkbox or a space is provided to write down or check what type of currency will be deposited. This is important to avoid discrepancies during the transaction.

Another category that is important in any deposit is the section where a depositor must indicate whether the amount to be deposited is in cash or check. Cash transactions, in some cases, would need a breakdown of the amount or denomination while for checks, one must provide the check details in the deposit slip.

There is a section in the deposit slip form where the depositor is required to write the amount to be deposited. This too should not be written incorrectly so the right amount is credited.

If depositing in a certain bank or financial institution you are expected to find their bank name and logo. This is to ensure that the depositor is accurately depositing the cash or check on the right bank with which the account is affiliated.

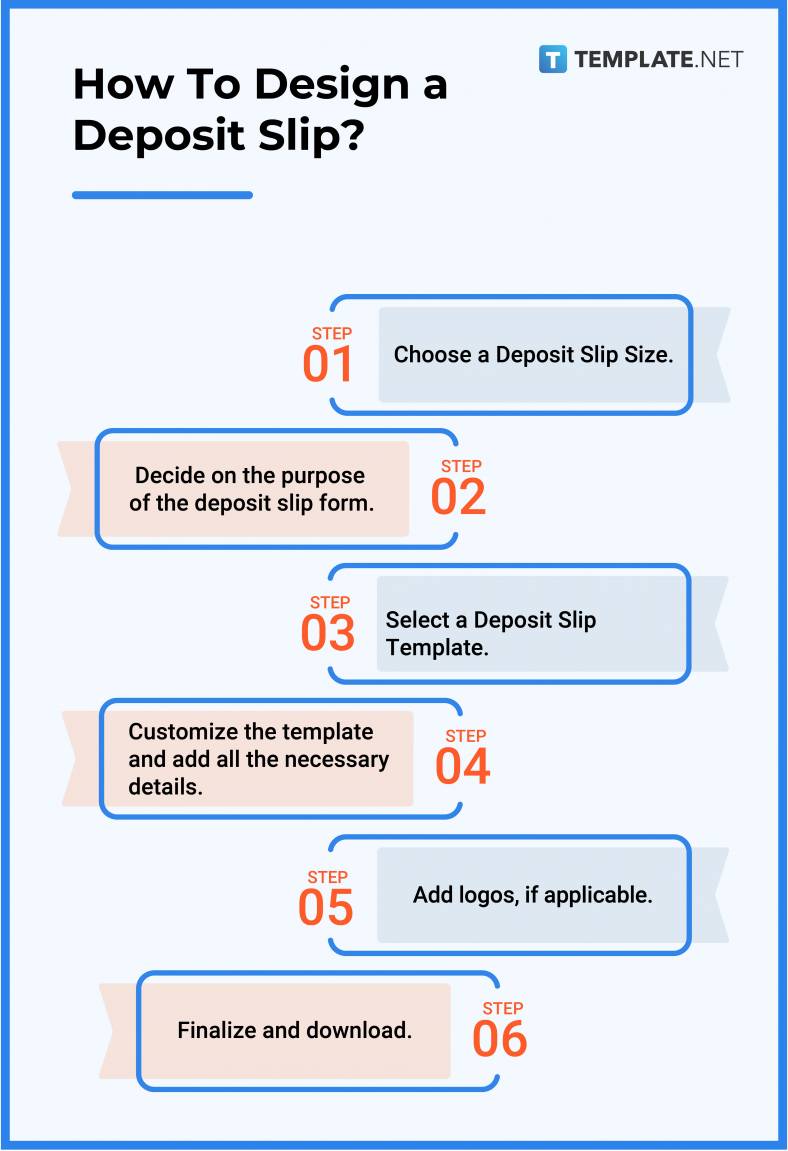

1. Choose a deposit slip size.

2. Decide on the purpose of the deposit slip form.

3. Select a deposit slip template.

4. Customize the template and add all the necessary details.

5. Add logos, if applicable.

6. Finalize and download.

A deposit slip is a form where a depositor is required to fill up all necessary details to complete the transaction and for the bank, this form also serves as validation that the transaction has been completed.

A receipt on the other hand is a document provided to a customer whenever they purchase an item or avail of a service.

A deposit slip is a form, usually in printed format that has to be filled up by the depositor or customer in order to complete a deposit transaction.

A withdrawal slip, on the other hand, is also a form provided by a bank where an account holder fills out a written request to withdraw a certain amount from a specific account number.

A cheque or check is a piece of paper that directs the bank to pay a specific amount from a person’s account to the person in whose name the cheque has been issued.

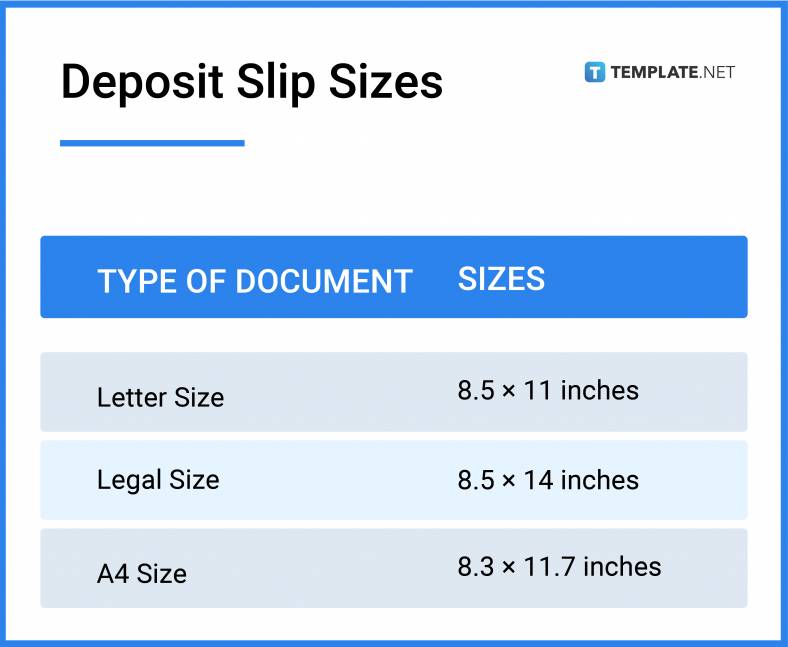

If you need to create a deposit slip using MS Excel or print one for a bank office, then here are the standard deposit slip sizes you can choose to work on.

Deposit slips come in a variety of layouts and features, all of which are designed to be useful and practical to depositors and financial institutions. That said, there are a number of deposit slip ideas and examples that can help you understand the different features of this form and inspire you to create one.

Depositors should include the account name, number, date, type of currency, amount to be deposited, and if it is in cash or check.

Yes, you can print out your own deposit slip, just ensure you’ve got the right format and paper size.

To fill up a deposit slip, you need to ensure you’ve got all the necessary and correct information to complete the form.

Whatever is written in the back portion of a deposit slip depends on the requirement of the bank, as this could be the amount to be deposited, a validation that the transaction has pushed through or other relevant details.

To get a cashback you need to indicate the amount of cashback you want to receive in the ‘Less Cash Received’ section of the deposit slip form.

A subtotal is where a depositor writes down the combined cash and check amount.

Deposit slips are usually issued by banks.

There is a portion or a section in a deposit slip form where the depositor must provide accurate information that cash is to be deposited into the account.

Usually, you may find a check box of a local currency, or it is common as well that US Dollar is included in a deposit slip being one of the widely used international currencies.

Cash is a common option of what can be deposited into an account, thus making it part of the form.

![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

![How To Make/Create a Manual in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Google-Docs-788x443.png)

Manuals are essential instructional and reference guides. They help direct and inform an individual’s actions and also explain how to…

![How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Microsoft-Word-788x443.png)

Creating a manual can be a time-consuming and tedious task. However, manuals and other reference guides are necessary for organizations…

![How To Create a Legal Document in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Legal-Document-in-Google-Docs-Template-Example-2023-788x443.png)

When creating a legal document, there are a lot of things a person has to consider, and one of which is the…

![How To Make/Create a Contract in Microsoft Word [Template + Example] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Microsoft-Word-Template-Example-2023-1-788x443.png)

Contracts can come in different forms and for different reasons but the most common thing is that when a company does business with…

![How To Create a Contract in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Google-Docs-Template-Example-2023-Step-788x443.png)

Contracts are an important part of any company or business, especially those that work with different companies or businesses. Companies…

![How To Make/Create a Report in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Create-a-Report-in-Microsoft-Word-788x443.png)

A report is a comprehensive document that covers a wide array of topics from finance, research, incidents, feasibility studies, and…

![How To Make/Create a Report in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Report-in-Microsoft-Word-Templates-Examples-20232-788x443.png)

A report is a document that contains information, data, analysis, finding, and other relevant information based on a specific topic.…

![How to Make/Create a Notebook in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-to-Make_Create-a-Notebook-in-Google-Docs-Templates-Examples-2023-788x443.png)

Notebooks always come in handy in writing important information or expressing our thoughts through written words. When we need a…