![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

How To Create Meeting Minutes in Google Docs [Template + Example]

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

Apr 21, 2023

Payrolls are essential when it comes to an employee’s salary and wages. It is crucial because a company needs to have a systematic process to also help keep track of the other employee benefits and deductions.

Payroll is defined simply as the process of paying an employee during their payday.

The process includes a detailed breakdown of not only the salary but the number of hours rendered, pay calculation, and methods of distributing payment whether in check or cash.

Payroll may be a process of handling an employee’s salary, yet is also referred to as the list of employees that are entitled to receive their weekly or monthly wages. A company’s accounting or HR department is in charge of handling and managing an employee’s payroll. While a payslip is a summary of the salary per payday, payroll is the procedure of calculating an employee’s salary benefits and deductions such as tax.

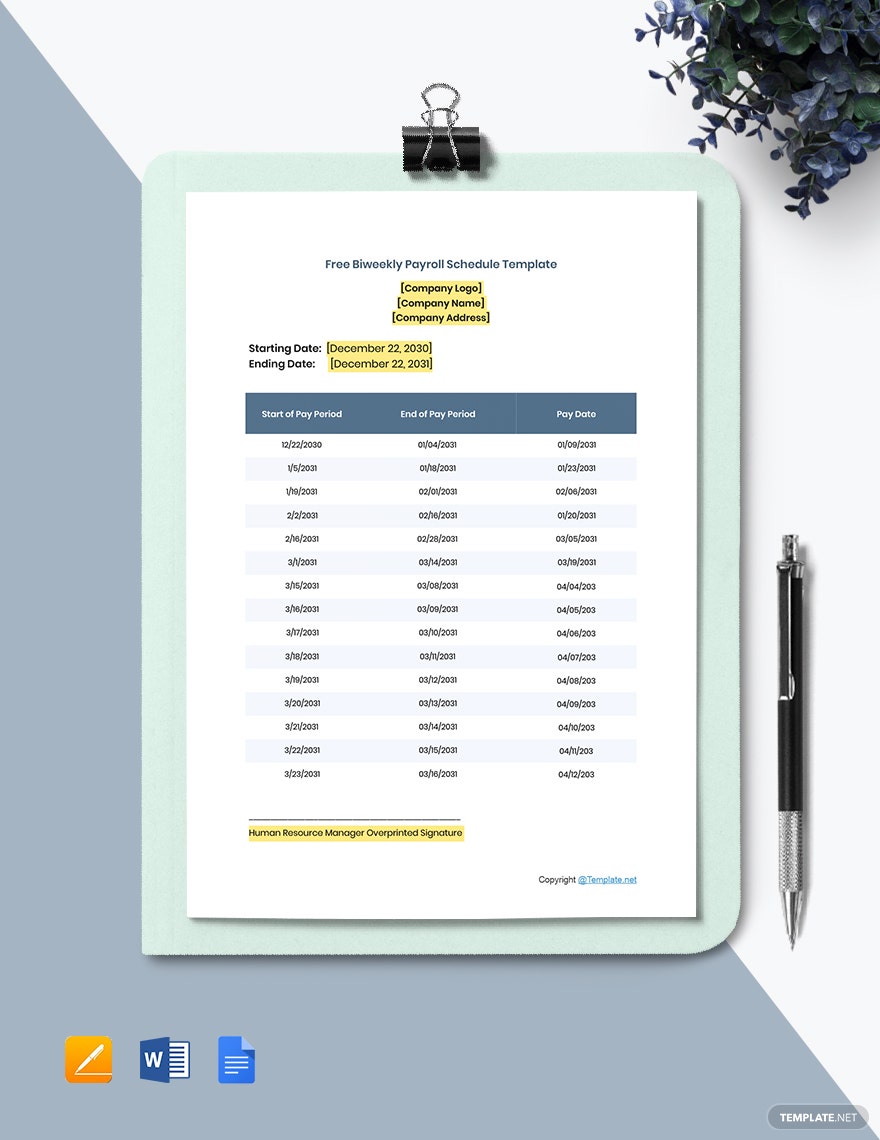

A payroll schedule differs per company, as some offices pay their employees once a month or weekly, biweekly, and semimonthly. Prevailing labor laws sometimes affect a payroll schedule so it is essential to check these before implementation. Overall choosing the right schedule to pay your employees also depends on the type of business and how an employee’s salary is calculated.

Handling payroll can be hard work especially if you have a lot of employees. It is important that the personnel assigned for this task is capable of handling not just employees but their salaries as well. A payroll manager resume is a document that can help companies find the right employee to sign up for the job. This is also used of course for those who want to apply for such a position.

An HR payroll and scheduling is a document designed to help the department keep track of an employee’s work schedule and the equivalent salary. A worksheet is used to align the schedule in a company’s calendar. And the payout schedule will depend on the company whether they choose to pay their employees on a monthly, semi-monthly or bi-monthly schedule.

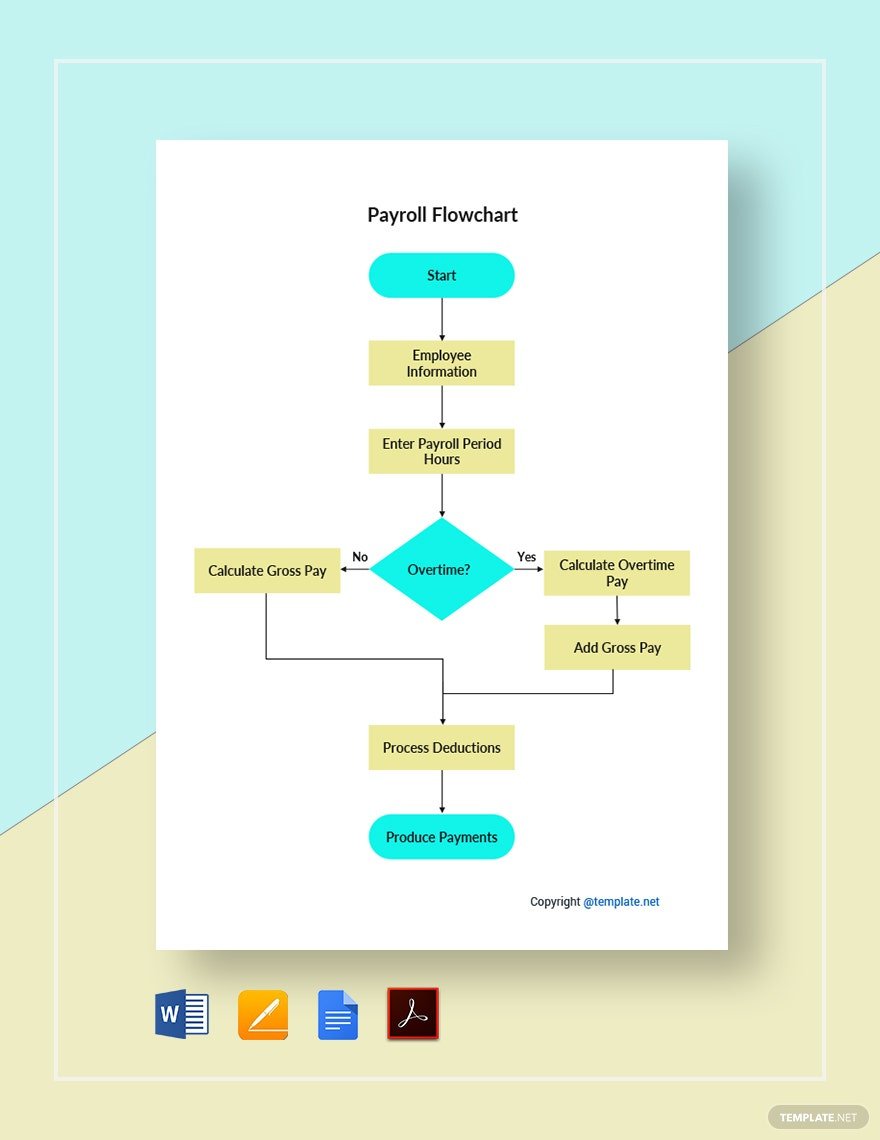

A payroll flowchart is a visualization of the payroll process, a sequence of actions to help make something simpler to understand. The HR department uses a flowchart to serve as a guide in running the payroll process, withholding deductions and distributing payments. This particular flowchart contains short and summarized words or statements, simple images, icons and clipart that are easy to understand and work through.

Paying employees is considered an expense which is why it is essential that salary, wages and benefits should be included in the business budget. To help manage finances, a payroll budget is set to forecast salary and other related expenses for the upcoming year. A well-crafted payroll budget will keep the company’s bookkeeping and finances afloat and will help set priorities.

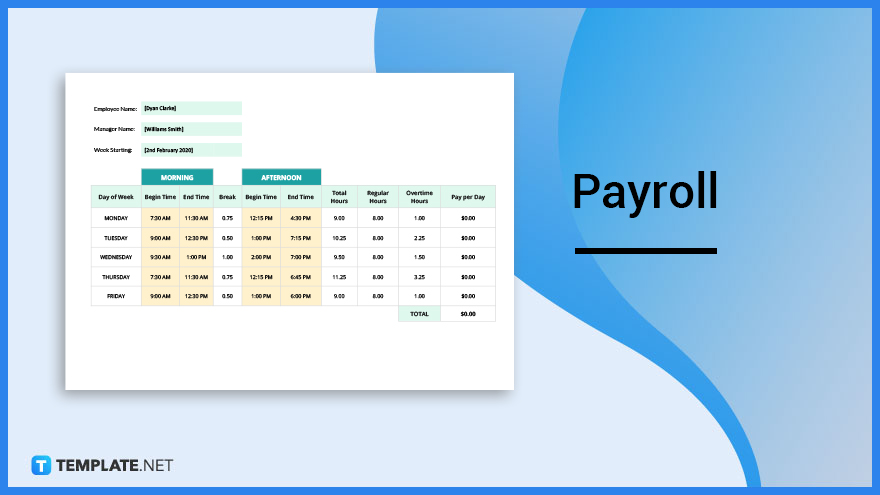

A payroll worksheet works well for those who need to prepare the payroll. It keeps things organized and manageable helping the company keep track of their employee’s salaries and other expenses. This should be able to record the employee’s names, designation, daily wage, benefits, attendance and other relevant details.

An employee payroll form is a document that records information of a particular employee such as their basic information, tax id number, designation and status in the company, benefits and as well as deductions. This form is important because this will serve as a guide to ensure that the employee is properly compensated. It is also vital that the form should be amended in case there are changes in the employee’s status.

A payroll spreadsheet is a useful tool that can help organize your company’s payroll and other employee-related expenses. This document is easy to create as you can use well-known software apps like Microsoft excel. What is great about a spreadsheet is that you are able to keep track and manage the whole payroll process properly.

Restaurants like any other business establishment need to prepare their budget for the upcoming year. Manpower plays a significant role in any company’s budget which is one of its biggest expenses. That being said, a restaurant payroll budget can aid management in planning and calculating the right budget for their staff. You can incorporate all vital information, graphs, calculations, and wages in this document.

A sheet is a collection of charts and worksheets. Using a payroll sheet is another way of managing and organizing an employee’s payroll which will keep you updated around the clock. Just open up MS Excel on your computer screen and you can start designing a payroll sheet in a way that fits your standards by using gridlines or cells, or by using a chart.

Following the right payroll process is important in any company. It involves a number of steps that ensures that pay is properly calculated and tracked and that the correct amounts for tax, company benefits and other deductions are withheld. That being said, not only is it able to seamlessly manage an employee’s salary and benefits, but this helps in complying with labor laws and regulations.

Managing employees is a complicated task, from the onboarding process to their time in the company until they resign. During their stay in the company, the payroll process plays a major role in employee management. Paying employees must follow an organized system that the company should be able to follow in order they are able to manage the salary and compensation of their employees properly.

It’s a given that the main purpose of payroll is that it is the procedure that accounting or the HR team follows in order to pay employees their salary. A payroll must not only be systematic and organized, but it should also be able to calculate the right deductions which include taxes and other liabilities. Not to mention the payment distribution should be done correctly, whether in check or in cash.

There are certain rules that protect employees from employer malpractices such as discrimination and false salary and tax calculations. With a proper payroll in place, it helps manage and streamline payroll-related rules, regulations, and services. Also, it saves a business from paying fines and fees.

When a company manages a large number of employees, it is important for them to install a payroll system that will help organize salaries. Although doing things manually is always an option, if a company invests in a software or payroll application this helps lessen the workload and avoid miscalculations and other issues. Not to mention, companies are able to save better with a proper payroll system in place since you are able to prevent issues from reoccurring,

Late salary payout can be a major problem since this will reflect poorly on the company and increase disgruntled employees. Payroll ensures that salaries are calculated properly and given on time. With a set payroll schedule, the HR team is able to follow a timeline that gives them ample time to track and calculate the salaries and deductions.

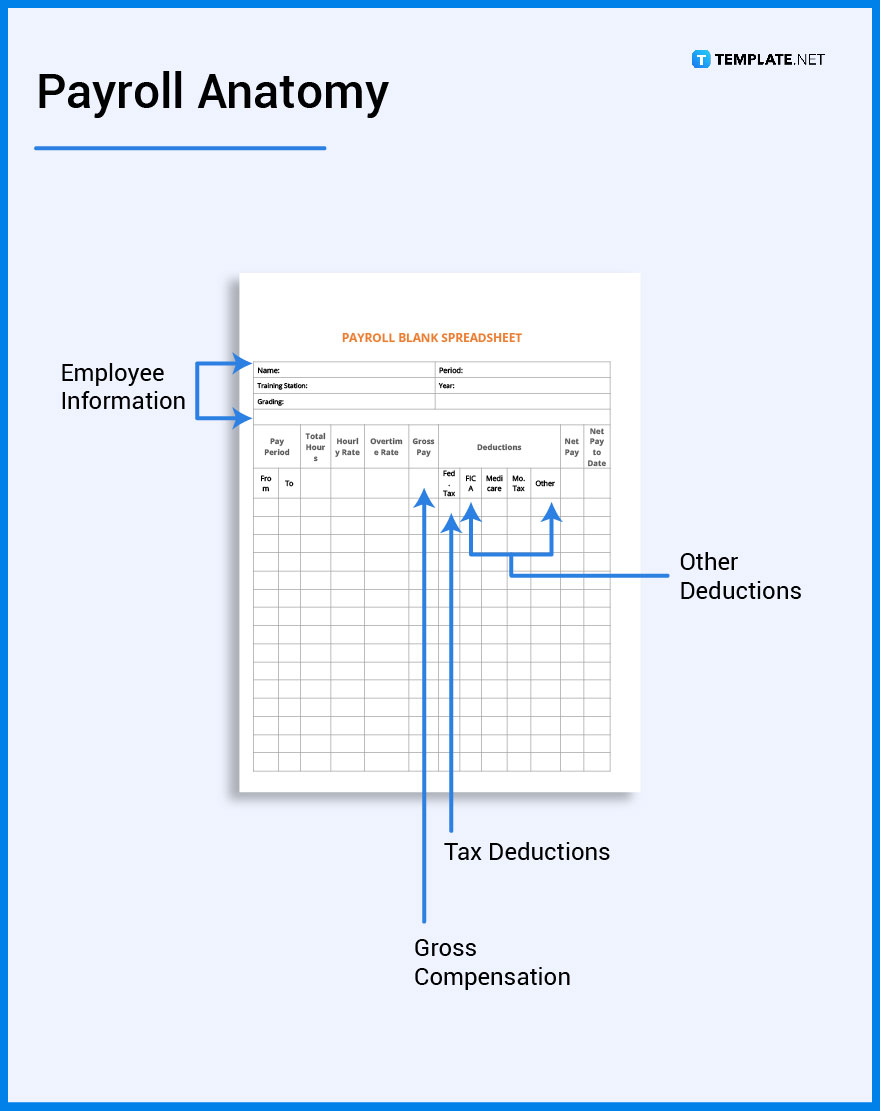

A payroll should include employees’ basic information which consists of their name, designation, the date they were hired, residential address, social security number, and much more.

This consists of the employee’s basic compensation package which is the salary, overtime, and leaves if applicable in that given payroll schedule.

Payroll taxes are the most common form of deductions applicable in salary processing. Take note that each country has its own rules when it comes to taxes and the way it is calculated.

Other deductions, whichever applies consist of health insurance, retirement plans, loans, and other expenses.

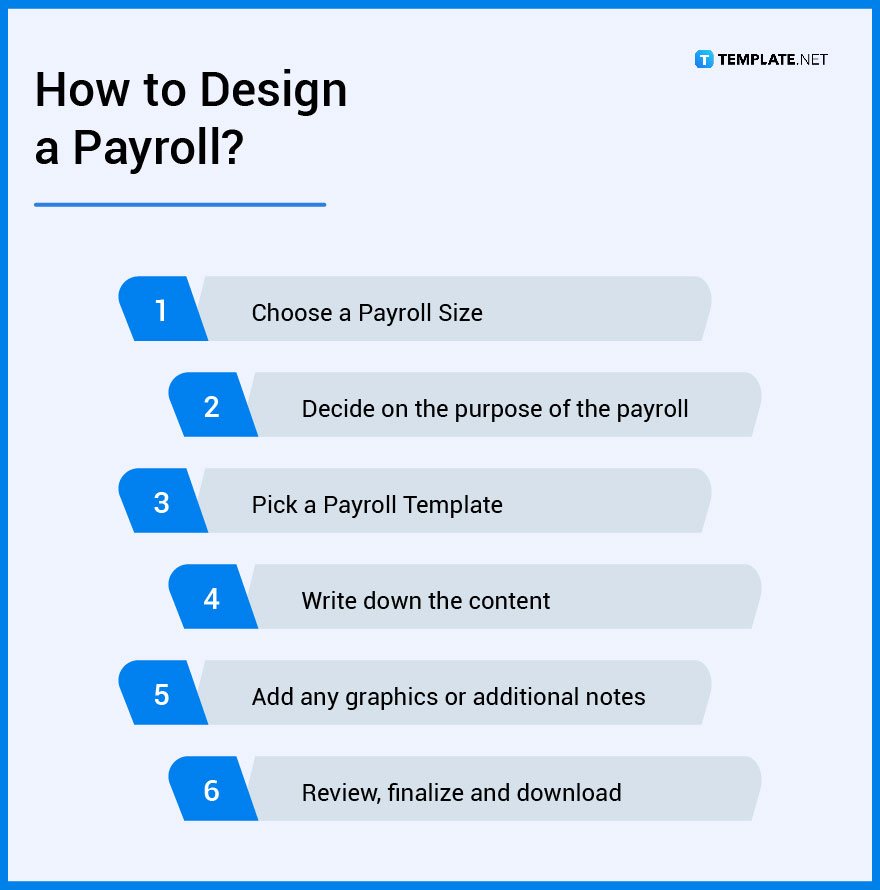

1. Choose a Payroll Size

2. Decide on the purpose of the payroll

3. Pick a Payroll Template

4. Write down the content

5. Add any graphics or additional notes

6. Review, finalize and download

Payroll is the process of managing and organizing an employee’s salary.

A salary on other hand is the amount to be paid to the employee or what an employee has earned during a given period.

A payroll involves the payment of salary, compensation, and bonuses and it also processes deductions.

Tax is a deduction where a percentage of an employee’s salary is withheld and paid to the government.

Compensation are benefits due to an employee which is paid in cash money, bonuses, profit-sharing, compensated vacation and sick leaves.

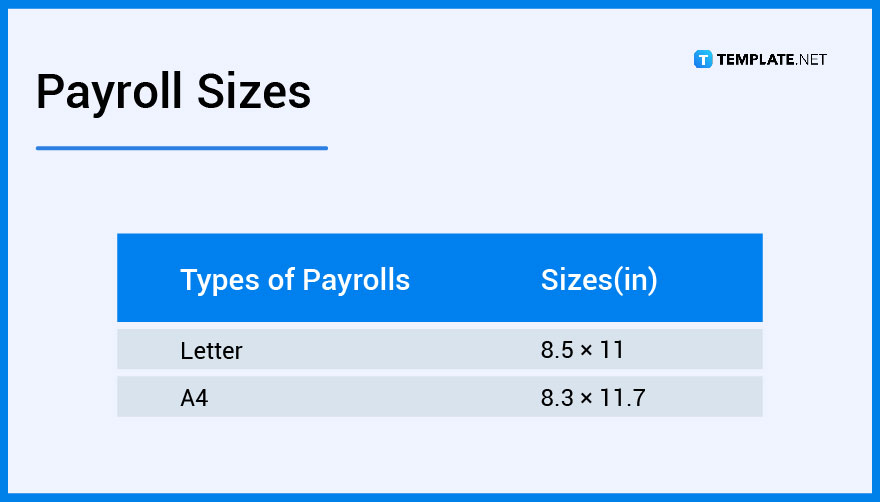

A payroll document is widely used by the accounting and HR departments, that being said these are the most commonly used payroll sizes.

Payrolls are used by a majority of businesses across the globe. To help you choose what best works for your business, we’ve got a list of payroll ideas and examples so you can begin working on this document.

You need to know the exact salary the employee should be receiving, their social security number, and determine if there are other factors to be considered so you are able to properly compute the salary and deductions.

Deductions are important because for instance tax deductions are required by law and if the employee has loans and other liabilities then it is important to include these in your payroll calculation.

To create a payroll you need the employee’s information, their salary and status in the company, determine if they have any liabilities, then compute the salary and taxes to be deducted.

This includes government taxes, wages, and benefits.

Payroll tax is needed because this helps fund government projects and programs that can be beneficial to the public.

These costs consists of employee compensation and the payroll taxes paid by an employer.

The basic components of payroll are gross compensation, recurring items, ad hoc items, and government deductions.

A payroll system is important to ensure a seamless workflow process that can be managed online which meas no more manual use of a calculator, or you can also opt to outsource payroll services from another partner company.

When paying contractors they may be exempted from a payroll tax or in some cases they are liable to pay depending on the circumstances and the jurisdiction.

To adjust, login to the portal or application you are using, then debit the payroll liability account for the amount of the adjustment, credit the payroll expense account that you are adjusting, or for reduction credit the payroll liability account for the amount of the reduction, then process the entry.

![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

![How To Make/Create a Manual in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Google-Docs-788x443.png)

Manuals are essential instructional and reference guides. They help direct and inform an individual’s actions and also explain how to…

![How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Microsoft-Word-788x443.png)

Creating a manual can be a time-consuming and tedious task. However, manuals and other reference guides are necessary for organizations…

![How To Create a Legal Document in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Legal-Document-in-Google-Docs-Template-Example-2023-788x443.png)

When creating a legal document, there are a lot of things a person has to consider, and one of which is the…

![How To Make/Create a Contract in Microsoft Word [Template + Example] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Microsoft-Word-Template-Example-2023-1-788x443.png)

Contracts can come in different forms and for different reasons but the most common thing is that when a company does business with…

![How To Create a Contract in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Google-Docs-Template-Example-2023-Step-788x443.png)

Contracts are an important part of any company or business, especially those that work with different companies or businesses. Companies…

![How To Make/Create a Report in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Create-a-Report-in-Microsoft-Word-788x443.png)

A report is a comprehensive document that covers a wide array of topics from finance, research, incidents, feasibility studies, and…

![How To Make/Create a Report in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Report-in-Microsoft-Word-Templates-Examples-20232-788x443.png)

A report is a document that contains information, data, analysis, finding, and other relevant information based on a specific topic.…

![How to Make/Create a Notebook in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-to-Make_Create-a-Notebook-in-Google-Docs-Templates-Examples-2023-788x443.png)

Notebooks always come in handy in writing important information or expressing our thoughts through written words. When we need a…