![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

How To Create Meeting Minutes in Google Docs [Template + Example]

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

Mar 30, 2023

Receipts are often used in most business transactions as proof of sale between a seller and buyer. Issuing receipt documents a sale or transfer of ownership which is significant in a number of aspects given what the document stands for.

A receipt is a digital or printed document that acknowledges that something of value has been paid and is transferred from one party to another.

It provides proof that a financial transaction or an official exchange has occurred between two parties.

A receipt is an official document that is issued from one party to another during business and stock market transactions. Receipts contain valuable information in regard to the transaction that occurred and are used for tax purposes as proof of certain expenses. Buyers are required to ask for a receipt after an item has been purchased in case there is a need to exchange or return the item, or for warranty purposes.

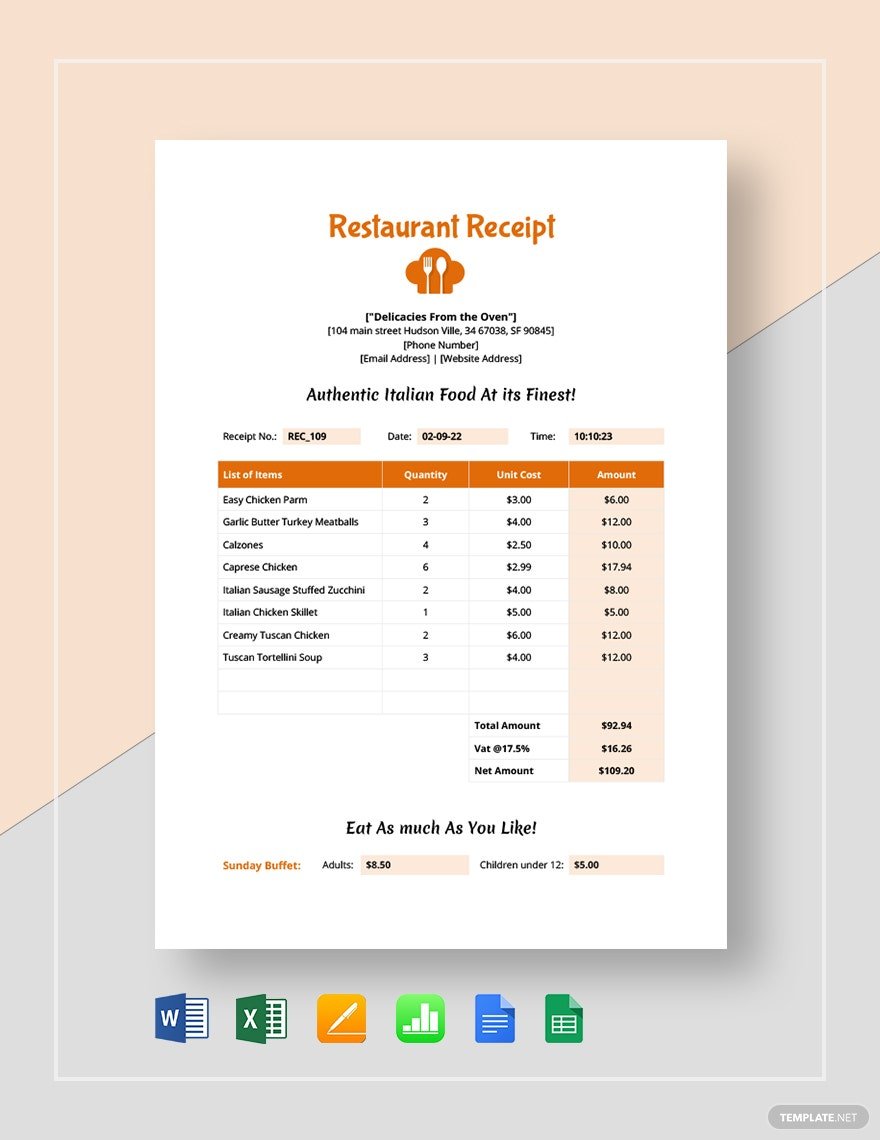

Receipts come in different sizes depending on the transaction and the details that need to be written down in the document. A bill receipt offers a more detailed and complete list of the items purchased and services rendered to the client. This receipt is designed to summarize the transaction between the buyer and the seller. And it is also applicable if you shop, buy and order online.

A cash receipt is widely used in most businesses. It is a printed acknowledgment that the customer has paid in cash or in some cases in check. A copy is then given to the customer and the other is retained by the company for accounting purposes.

Daycares are business establishments that provide professional care and support for young children, and physically or mentally disabled adults for a day. As a business entity, a daycare receipt is provided to paying customers after the service has been rendered. A breakdown of the services, rates, and other items is written down in this document.

Logistics plays a major part in a lot of businesses across the globe. It is common for shipping companies to issue a delivery receipt as proof that the parcel delivered has been sent. The receiver then, is tasked to affix their signature to the document as proof that the parcel has been received. There are several ways to use delivery receipts, through mail exchanges as well as the logging of orders sent out by a company for delivery.

A payment receipt is a type of document that is issued to a client when full or partial payment has been paid. Several details are written down in this document including the company’s business name, the amount paid, and the date of payment. For partial payment, the amount owed is written down as well.

When directly depositing cash or a check to a bank, the teller will issue a deposit receipt or a deposit slip to the recipient as an acknowledgement that the deposit has been successful. Information written down in a deposit receipt includes the date of the transaction, the amount, the depositor’s name, and account number. For online banking, a deposit receipt is available for download or is emailed right after a successful transaction.

While dining in a restaurant, right after you finish your meal, you ask for the bill. A bill is a list of food ordered with its equivalent price. Once a customer like yourself acknowledges the given bill and proceeds to make a payment, a restaurant receipt is issued.

A sales receipt is provided by a vendor or seller to their customers. It records the products and services provided and the amount that has been paid. This receipt is also used for tax and inventory management, reimbursement, and other accounting purposes.

A school receipt is issued after tuition and other school fees are paid by the parents or guardians. It usually contains the breakdown of the fees that are charged and paid. Tuition fees are usually paid in full or on a quarterly basis.

For services rendered by a professional service provider or a company, a service receipt is issued to their clients. In the document, all services rendered, including any equipment used and their cost are itemized and reflected. Its purpose and design is to offer transparency and proof of service to the client.

Issuing a receipt is a must especially when the transaction involves the exchange of money or goods. Without proper documentation, it would be hard to exchange a damaged item or maintain and balance accounting records. Hence, receipts are a major requirement for companies, freelancers, and professional service providers when running a business.

Receipts are provided to customers to acknowledge their payment whether in cash, check, or in-kind. It is common practice that whenever a business transaction and payment occurs, the receiving party is obliged to issue a receipt as confirmation. Should any businesses fail to issue any receipts to their clients may be penalized according to the law.

Receipts are used to tally, reconcile and record transactions in accounting books. It is also used to match inventory and help balance finances. Receipts contain information that validates the expenses that were made over a given time period.

Receipts can also provide evidence for expenses that are claimed on an income tax return. Businesses can claim tax deductions on expenses, but only if they have a valid proof of purchase. And this can prove it was a business expense.

It is important to keep receipts in case there is a need to exchange or refund an item. Stores usually ask for verification thus a receipt is needed in order to proceed. This will serve as proof that the item has been bought in their store and if it’s still within the warranty period.

Receipts are important for reimbursing expenses. If an employee has paid for a work-related expense and used their personal account to pay for it, then the company is obliged to reimburse the employee. To do so, receipts are needed as proof of how much was spent and what for.

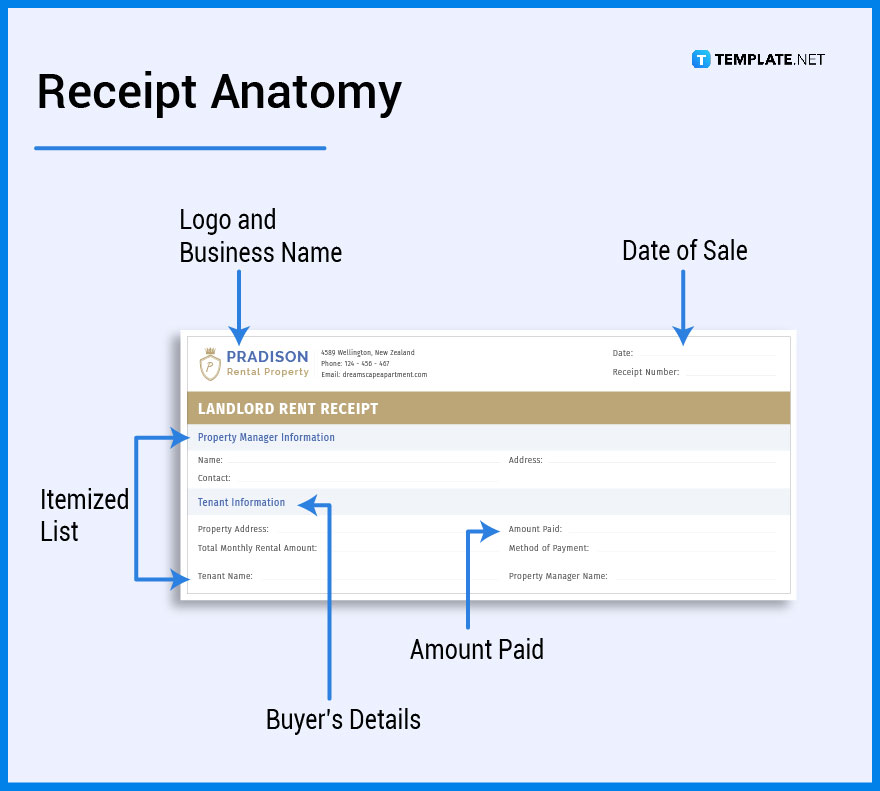

The company’s logo and business name are usually found in the uppermost portion of a receipt. Aside from that, contact information such as the email address and mobile or landline details are included as well. This applies to personalized and customized receipts. For general receipts, the seller’s business name and contact information is is manually written down.

Another important feature is the date of sale which is found in the front portion of the receipt. This detail should never be written incorrectly or forgotten since this is one of the basis sellers check when there is a need to refund or exchange an item.

Written in words and in numerical format, the amount paid is reflected on the front portion of a receipt, including any discounts, sales tax, or fees. It is also important to identify if the payment is in cash, credit card, or check. For check payment, the check’s details are written down in the receipt, and for credit card payments the credit card slip is attached.

The main section of a receipt is the itemized list of items purchased or services rendered. In most cases, the list contains a thorough breakdown meaning each item or service has its corresponding rate aside from the total amount paid. This is important because it allows the customer and seller to reference exactly what was bought and sold and correct any discrepancies.

The buyer’s name and contact details are also written down on the receipt. This is important in case there is a need to exchange or refund the item purchased.

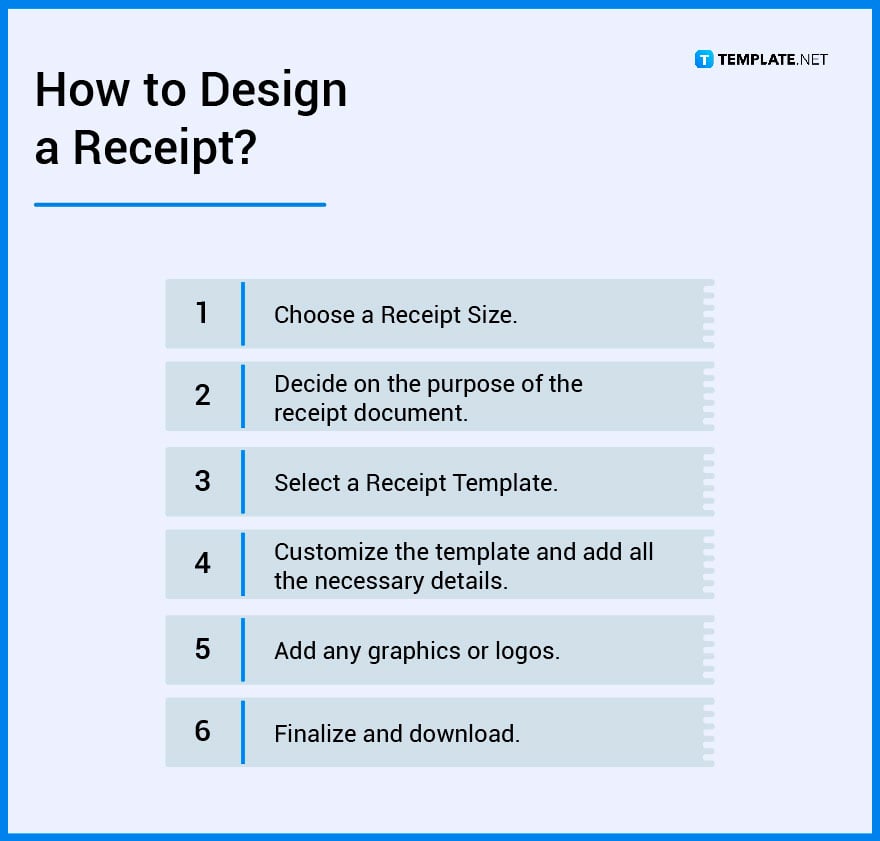

1. Choose a Receipt Size.

2. Decide on the purpose of the receipt document.

3. Select a Receipt Template.

4. Customize the template and add all the necessary details.

5. Add any graphics or logos.

6. Finalize and download.

You can check out this reference for more information if you need to create a receipt using a different application.

A receipt is issued and then provided to a customer after payment in cash, check or credit card has been made and verified.

An invoice on the other hand is a written document that is issued before payment and records the transaction between a customer and a vendor. It also outlines the payment terms such as the deadline and the payment method.

A receipt is a legal document that provides proof of payment and purchase.

A voucher is a document that is redeemable, is worth a certain amount, and could be claimed or exchanged for a product or service.

A bill is provided to a customer before payment is made, and it includes the items and the amount owed.

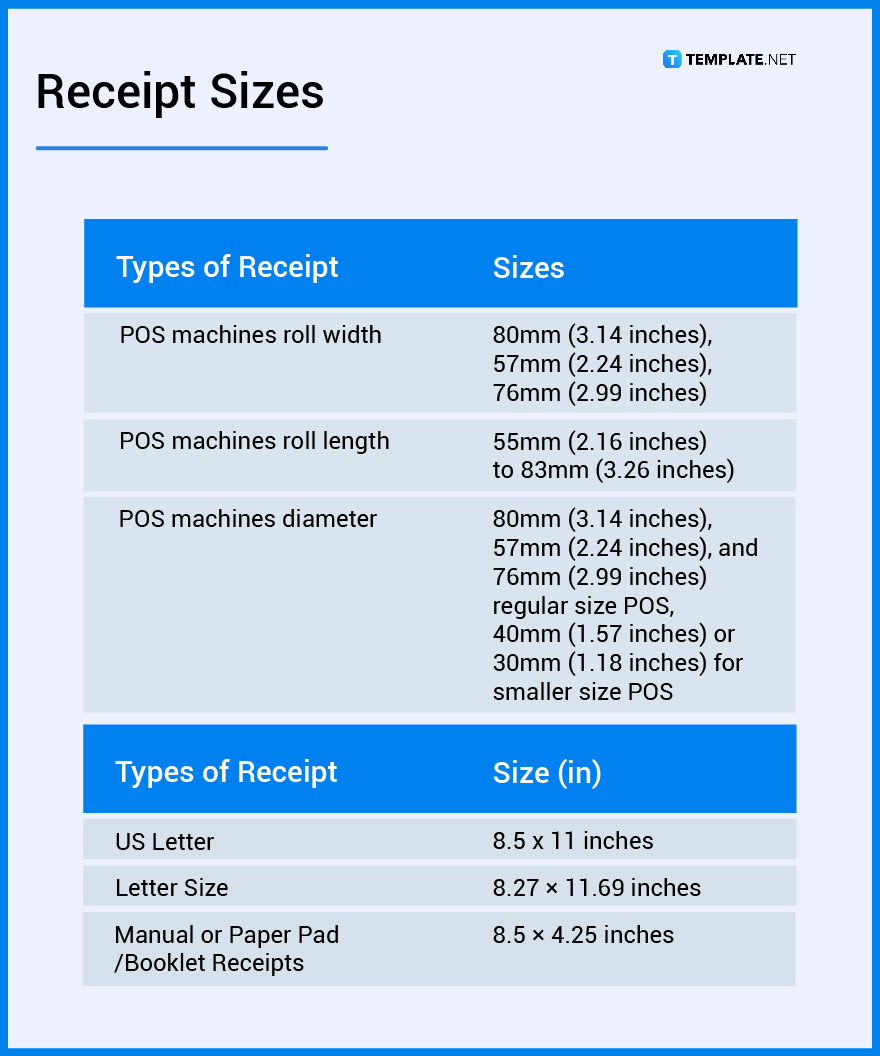

Receipts come in all shapes and paper sizes. To help you determine the right dimensions for your receipt, here are the standard receipt sizes you can choose to work on.

Receipts are designed to be simple, useful, and practical. Various businesses use receipts for different purposes thus we have a list of receipt ideas and examples you can choose from to help you design and prepare one.

The main components of a receipt are its business name, date issued, amount paid, and the list of items/services purchased.

A gross receipt is the total amount of all combined receipts in cash or property without including deductions, discounts, and other expenses.

A receipt note is a voucher that is used to record and validate the goods received while a delivery note is a document that accompanies a goods shipment and it explains the contents of the parcel.

A merchant copy receipt is a printed or electronic copy kept by the vendor when a customer uses their credit card to pay for a transaction, it contains specific information not found on the cardholder receipt.

Receipts are important documents that are used for tax purposes, proof of transaction, and creating liabilities or reducing financial assets.

When transferring funds from one bank to another, a receipt is issued to indicate a successful fund transfer.

This is a page in an app called Verizon where documents and receipts are stored.

It is important to ask for an official receipt because you may need it in the future in case there is a need to refund or exchange your item, for reimbursement and tax purposes.

A receipt is legal proof of payment because it contains valuable details including a unique receipt number pertaining to the transaction that transpired between a customer and the vendor.

Expense receipts are purchases carried out by the company or its contractor which are officially work-related.

![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

![How To Make/Create a Manual in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Google-Docs-788x443.png)

Manuals are essential instructional and reference guides. They help direct and inform an individual’s actions and also explain how to…

![How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Microsoft-Word-788x443.png)

Creating a manual can be a time-consuming and tedious task. However, manuals and other reference guides are necessary for organizations…

![How To Create a Legal Document in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Legal-Document-in-Google-Docs-Template-Example-2023-788x443.png)

When creating a legal document, there are a lot of things a person has to consider, and one of which is the…

![How To Make/Create a Contract in Microsoft Word [Template + Example] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Microsoft-Word-Template-Example-2023-1-788x443.png)

Contracts can come in different forms and for different reasons but the most common thing is that when a company does business with…

![How To Create a Contract in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Google-Docs-Template-Example-2023-Step-788x443.png)

Contracts are an important part of any company or business, especially those that work with different companies or businesses. Companies…

![How To Make/Create a Report in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Create-a-Report-in-Microsoft-Word-788x443.png)

A report is a comprehensive document that covers a wide array of topics from finance, research, incidents, feasibility studies, and…

![How To Make/Create a Report in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Report-in-Microsoft-Word-Templates-Examples-20232-788x443.png)

A report is a document that contains information, data, analysis, finding, and other relevant information based on a specific topic.…

![How to Make/Create a Notebook in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-to-Make_Create-a-Notebook-in-Google-Docs-Templates-Examples-2023-788x443.png)

Notebooks always come in handy in writing important information or expressing our thoughts through written words. When we need a…