![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

How To Create Meeting Minutes in Google Docs [Template + Example]

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

Apr 04, 2023

Reconciliation is a business and finance document for many businesses and organizations that support the reconciliation process for many financial matters to validate and check business transactions. The reconciliation document guarantees no complications arise from basic contracts from suppliers or clients for goods or materials for inventory.

Reconciliation or account reconciliation is a financial document that contains a company’s account balance record, similar to a balance sheet.

The reconciliation document provides a process for verification of the reconciliation process between two versions of a business accounting system.

Reconciliation is a business document in the form of an Excel spreadsheet centering on business finances focusing on a company’s record of account balances and computes for the reconciling items. After the adjustments, it must match the computation for the same account through a third-party financial service provider like a standard bank, certified creditors, and other financial institutions. Reconciliation statements are valuable tools for internal and external auditors in reconciling invalid items or those that require adjustments to determine the components for following financial statement formats.

Bank reconciliation statements ensure the deposit of payment processing and cash collections into the bank as a summary of banking and business activity detailing a bank account. The reconciliation statement aids in identifying discrepancies between the bank and book balances to process corrections affecting a bank or checking account for a specific period. An accountant generally processes these bank reconciliation statements monthly, reflecting accounts payable, and is a valuable financial internal control tool to prevent fraudulent activities.

Payroll reconciliation is a financial process for comparing the payroll register with the amount an organization plans to pay their employees, confirming if those numbers align with one another. A payroll reconciliation document contains relevant information when computing employee salary, including gross pay, taxes, withholdings, and net pay. Handling payrolls tells individuals about the financial integrity of an organization, and a poorly managed payroll system will damage the company’s reputation.

A rent reconciliation is a document that details and compares the previous year’s monthly rent payments with the current year’s monthly payable rent. A rent reconciliation comes from a summary of multiple reports from rental payments by a tenant or renter, including monthly rental payable report, monthly rental payout report, success report, previous year’s rental payout report, and the remarks master. The information helps a landlord sort out any increase or decrease in rent payments, providing clarification for their tenants.

Loan reconciliation documents are valuable reports on an Excel sheet commonly used by accountants to guarantee the accomplishment of loan-related financial records and reports. Loan reconciliation statements enable accountants to verify the loan product data for an organization or individual, including total files, unreceived and received files, file status, etc. The information in a loan reconciliation document comprises a loan summary report for a company or an individual when applying for each loan product type they have in their accounts.

An invoice reconciliation is a financial statement that includes bank statements from outgoing and incoming invoices from a company or an individual. The purpose of constructing an invoice reconciliation is to guarantee that all bank and financial accounts are clean and a company’s book entries match these records. These two sets of records must be in unison with one another through the help of an impartial third-party accountant or service to ensure that all checkbook balances are up to date.

Health care reconciliation documents contain data about cash and bank balances for a medical institution coming into the bank through a hospital or clinic’s payment software or system. The figures are then transferred to the institution’s general ledger, separating nonpatient deposits from the hospital’s, including Medicare interests, parking fees, gift shops, pharmacies, and other transactions. As such, medical institutions organize the reconciliation process every month to guarantee that there are no inaccuracies in hospital accounts and records.

Creditors’ reconciliation statements are financial documents that have information about a creditor’s account or transactions in a system, comparing them to existing records and accounts receivable from another creditor. An independent third-party creditor or accountant compares the two documents and verifies if there are any inconsistencies in financial accounts and statements. The process of reconciling creditors’ accounts and reports happens every month to compare the creditor’s ledger account and the creditor’s monthly statements.

An intercompany reconciliation involves two different companies that are currently under a similar parent organization, focusing on the transactions with one another. Many large companies consist of multiple divisions and subsidiaries acting independently of each other, and they can be internationally-based companies or domestic organizations functioning in small-scale transactions. As such, any transactions within these companies must have records and statements when exchanging financial values and information that requires accounting and reconciliation.

Grant reconciliation documents verify general ledger accounts that include information about financial transactions with source documents to validate discrepancies. Grants are prevalent in various institutions like colleges and universities through a reconciliation process consisting of a grant manager and principal investigator working together to confirm accurate details about the statements. These individuals are responsible for verifying that all statements match certain grant beneficiaries and that financial assistance is accurate with the general ledger.

Supplier reconciliation is a statement that contains information about accounts payable in a general ledger, guaranteeing that its contents are accurate and clear. The reconciliation process is necessary for large or small organizations as different volumes of documents come in and out daily, monthly, and annually. Supplier reconciliation statements must be available to guarantee that records and statements undergo proactive verification and assure that suppliers get their payments on time.

Reconciliations are necessary documents in the form of spreadsheets for many businesses and individual accounts, especially when tracking assets, liabilities, and expenses for a specific period. It guarantees that bank accounts and bank statements have accurate information.

For many organizations, fulfilling orders or completing projects is a part of daily business operations that makes up annual business functions and activities for clients and consumers. Businesses must also acknowledge that payments are available in various types, including cash and credit that are now processed in the bank that a business engages in to acquire its sales. Reconciliations guarantee that the information is available through a monthly or annual record to analyze discrepancies or inconsistencies in the archives.

As companies grow, they slowly acclimate to using accrual accounting methods, recording revenues and expenses when there are relevant transactions or activities instead of relying on cash flows. Accountants use accrual accounting methods to provide the most accurate and realistic accounting picture of the organization’s financial situation that the IRS (Internal Revenue Service) requires for their records and requirements. Companies that use cash accounting still demand reconciliation statements to guarantee that there are no mismatching records or accounts for company cash books and bank accounts.

Reconciliations help companies and organizations recognize inaccuracies and errors that are possible in the accounting records for internal staff on the company’s general ledger of accounts. Although errors are preventable and not always common in accounting for bank records, they still happen, and it is advisable to make sure that all records are accurate and precise when third-party service providers check all financial documents. When it comes to checking the general ledgers, there are more possibilities of accounting errors when it comes to organizations because it requires manual business accounting methods and procedures for handling monthly bank reports.

Companies that consider and take accounting matters seriously through a disciplined approach for handling reconciliations with a set schedule often pinpoint cashflow problems early on. Through having the advantage of earlier recognition of the issues, companies can take preventive measures to minimize disruptions and problems beforehand for business activities and operations. Accountants can easily make the necessary adjustments and corrections to the account to make precise and accurate changes as soon as possible.

For an organization or an individual to compute or generate correct tax returns for monthly bank accounts and transactions, accurate representations of the reconciliation document must be available. Computation for various taxes includes GST (goods and services tax) and income taxes for the organization and its staff and employees. Accurate tax representations are necessary to reconcile bank accounts, records, and statements.

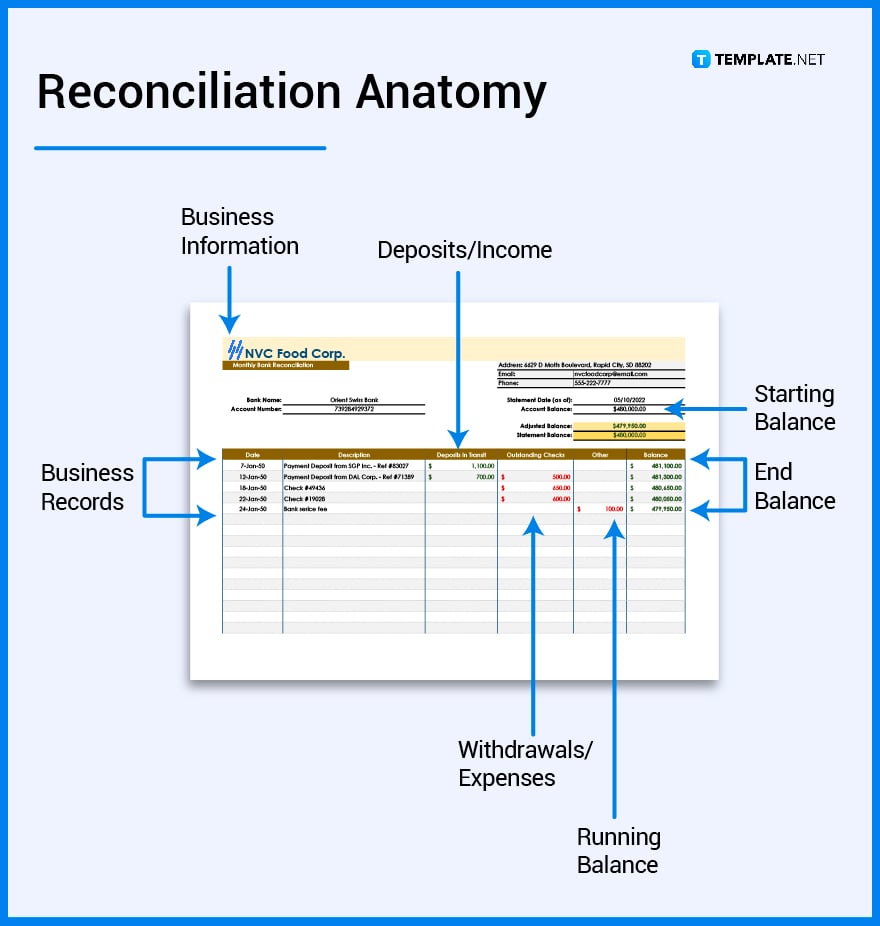

The reconciliation document contains information about the organization, including its name, address, and company logo to clarify which company owns the statement.

The business records include printable ledgers of incoming and outgoing money matters through a logbook or spreadsheet using bills and receipts from different business transactions.

The initial part of one of the tables in the reconciliation must showcase the final balance from the previous month or year, depending on the statement that the business requires for a specific transaction.

Highlight the amounts and dates of the deposits in the business account, indicating if it is a sale, interest, refund, or other deposit classification.

Any withdrawal that the business engages in during the month or year must be visible in the reconciliation statement to track any possible withdrawal transactions from the business’s bank account.

The running balance for the reconciliation depicts the various additions and subtractions from business transactions, including incomes and expenses that the business encounters during a specific period.

The end balance in the reconciliation must be the final amount after collating all the information from income and expenses for a duration.

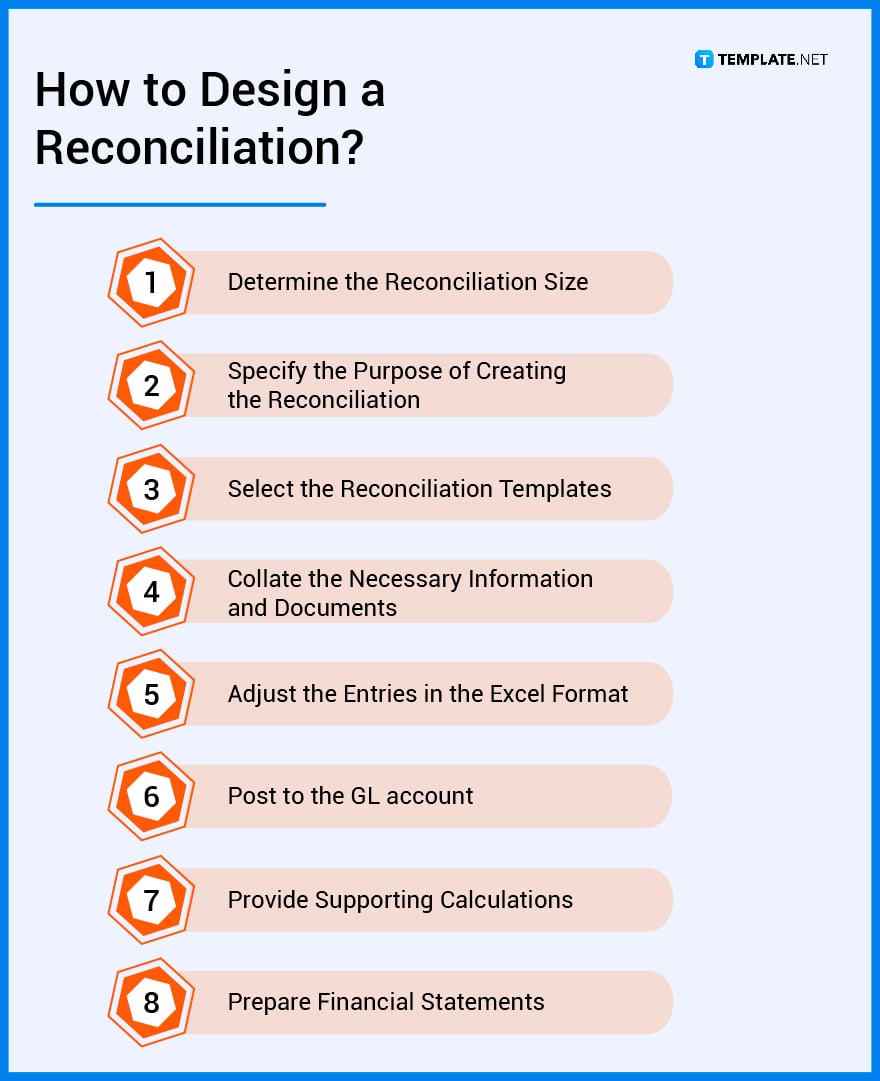

1. Determine the Reconciliation Size

2. Specify the Purpose of Creating the Reconciliation

3. Select the Reconciliation Templates

4. Collate the Necessary Information and Documents

5. Adjust the Entries in the Excel Format

6. Post to the GL account

7. Provide Supporting Calculations

8. Prepare Financial Statements

Reconciliation is a process in accounting comparing two financial statement examples like an Excel template or worksheet template to validate and check if the items or information are similar and accurate.

Conciliation is a method of intervention focusing on the process of settling industrial disputes wherein an impartial third-party aims to help solve and mediate conflicts and problems between entities.

Reconciliation is a business document that contains necessary information about a business and its finances and account records, similar to Excel bank statements and balance sheets.

Bank statements are printed documents that contain sample bank account balances and the amounts that industries, companies, and individuals deposit or withdraw from them annually.

Mediation, also known as arbitration, is a process or method of settling disputes or problems through an impartial mediator using specialized communication and mediation techniques.

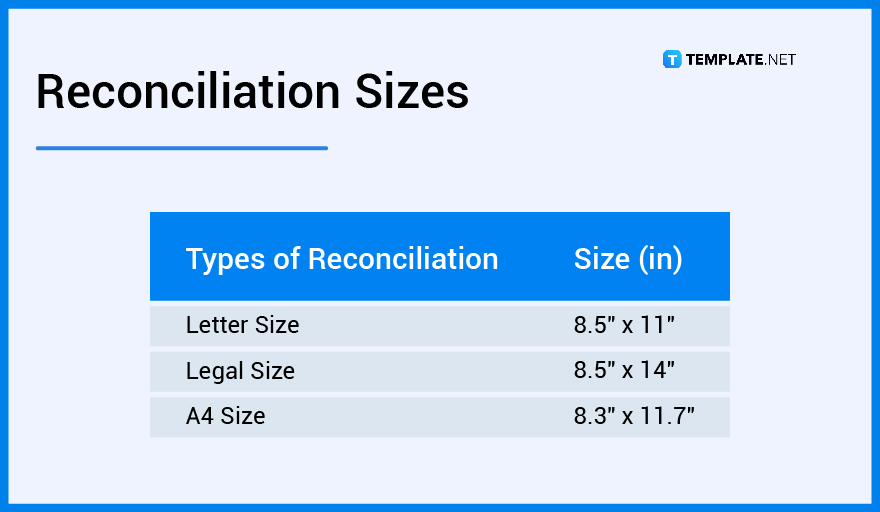

Reconciliation documents are financial documents that represent a company’s value, detailing their account balance record for prepaid accounts and petty cash deals using a simple bank form printable in standard reconciliation sizes. These tables appear on paper of different sizes, including the US letter, legal, and A4, frequently used in business transactions.

Reconciliation statements in finance are valuable documents that represent vital information about a business’s financial status and transactions in various fields and industries as essential reports. There are different reconciliation ideas that companies can take advantage of for sample forms and report templates for their documents.

When writing reconciliation statements, compare the deposits, bank statements, cash accounts, and balance sheets a verify the contents through an impartial third-party service.

Many companies reconcile their benefits using Excel spreadsheets, print-outs, and rulers, highlighting inconsistencies in the business’s account and financial statements.

Prepare for CAM (Common Area Maintenance) reconciliation or operating expense reconciliation by preparing a summation of operating expenses throughout the year against the estimated CAM charges from tenants.

The month-end reconciliation statement refers to a process of accounting techniques in reviewing, recording, and reconciling inconsistencies in accounts.

When creating a payroll reconciliation for small businesses, the first step is to list the payroll balance sheet accounts, set up monthly reconciliation sheets, gather all reports from payroll software and general ledgers, and finally, review transactions and reconcile differences to fix the reconciliation items.

To establish a bank reconciliation, gather the business and bank records, specify the starting balance for the organization, check through deposits and income then withdrawals and expenses, and compute the end balance.

To develop a monthly balance sheet reconciliation, there must be a closing balance for assets and liabilities for a specific period, identify the net balance for these, and match the net balance for assets and liabilities to determine any inconsistencies.

A petty cash reconciliation form contains information about petty cash transactions and balances to guarantee that the records are accurate and up-to-date.

A good account reconciliation must be complete, accurate, and timely, support account principles, and review processes of reconciliation procedures.

To reconcile investments for accounts, the first thing to do is to conform opening balances and amounts with investments from previous statements and years, then reconcile these figures to the investment account for the current year.

When creating an account reconciliation, start by inputting the ending balance per bank statement into the spreadsheet, subtracting uncleared outstanding checks, adding the undeposited credit, summarizing unrecorded bank fees and transactions, and indicating the ending cash balance to the general ledger.

![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

![How To Make/Create a Manual in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Google-Docs-788x443.png)

Manuals are essential instructional and reference guides. They help direct and inform an individual’s actions and also explain how to…

![How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Microsoft-Word-788x443.png)

Creating a manual can be a time-consuming and tedious task. However, manuals and other reference guides are necessary for organizations…

![How To Create a Legal Document in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Legal-Document-in-Google-Docs-Template-Example-2023-788x443.png)

When creating a legal document, there are a lot of things a person has to consider, and one of which is the…

![How To Make/Create a Contract in Microsoft Word [Template + Example] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Microsoft-Word-Template-Example-2023-1-788x443.png)

Contracts can come in different forms and for different reasons but the most common thing is that when a company does business with…

![How To Create a Contract in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Google-Docs-Template-Example-2023-Step-788x443.png)

Contracts are an important part of any company or business, especially those that work with different companies or businesses. Companies…

![How To Make/Create a Report in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Create-a-Report-in-Microsoft-Word-788x443.png)

A report is a comprehensive document that covers a wide array of topics from finance, research, incidents, feasibility studies, and…

![How To Make/Create a Report in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Report-in-Microsoft-Word-Templates-Examples-20232-788x443.png)

A report is a document that contains information, data, analysis, finding, and other relevant information based on a specific topic.…

![How to Make/Create a Notebook in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-to-Make_Create-a-Notebook-in-Google-Docs-Templates-Examples-2023-788x443.png)

Notebooks always come in handy in writing important information or expressing our thoughts through written words. When we need a…