![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

How To Create Meeting Minutes in Google Docs [Template + Example]

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

Apr 22, 2023

Term sheets are documents that provide an outline of the terms and conditions that a company and an investor have to negotiate and agreed upon before drafting a legal contract. It allows the company and the investor to exchange conditions before drafting an official document.

Term sheets are nonbinding agreements used by entrepreneurs to attract investors that outline the basic terms and conditions under which an investment will be made.

A term sheet is a document used to represent a trustful agreement between a company and an investor to process one financing transaction under major terms that the document contains.

Term sheets are documents that detail the important aspects of a deal without giving in-depth facts about minor occurrences that a binding contract covers. It ensures that the parties involved in a business transaction agree on most major aspects. A business can also use term sheets to negotiate key terms by outlining the most important elements of the transaction.

A business term sheet is provided to outline the terms and conditions of a business transaction for an official agreement. It is used when a prospective buyer proposes the basic economic terms and material conditions and provisions of acquisition to the potential seller. A business term sheet can be only one page or as long as ten pages.

Startup term sheets are the first formal but nonbinding documents between a startup founder and an investor that layouts the terms for investment. It is used to negotiate the final terms which will be written in a contract. A startup term sheet aligns the interests of the investors and founders which gives them an opportunity to have a long-lasting relationship.

A project term sheet is a bullet-point document that the parties involve exchange which contains important terms and conditions of a deal. It serves as a template for mutual understanding while creating a more detailed document that would become legally binding. It contains the description of the company, project name and purpose, investors (an angel or venture capital investor), and disbursement of investment.

Partnership term sheets contain the terms and conditions, as well as rights, responsibilities, and obligations of the parties involved. It provides information on the partnership agreement, distribution of profits, and expenses and losses the partners agreed upon. These term sheets are used as a template and starting point for more detailed legal documents that will come in the future.

Mortgage term sheets are used to outline the terms of a potential loan before writing a complete deal and issuing a commitment letter for commercial real estate lending. It is not a document to express the commitment to lend but an expression of interest in a potential transaction provided that a borrower is able to meet the terms and conditions. It also outlines additional documentation that a borrower is required to for a full analysis of the transaction.

Investor term sheets are documents that outline the terms by which an investor will make a financial investment in a company. It consists of three sections which are Funding, Corporate Governance, and Liquidation. It also provides terms and conditions for both parties to prevent future arguments over the terms and expenses required.

An equity term sheet defines all the main aspects of the equity investment. It also serves as a checklist of the terms and conditions to be agreed upon between the company and the investor. By using this term sheet, managers and investors can focus on negotiating commercial issues between them.

Investment term sheets are written documents that contain important terms and conditions of deal agreements. It contains details on the company, investors, investment amount, governing law, types of securities, types of dividends, and more. It summarizes the main points of legal agreements before their execution.

A venture-capital term sheet is a statement of proposed terms and conditions for a proposed investment. Most of its terms are non-binding except for certain confidential information and exclusive rights. It helps founders who received them to understand the management of the process from a legal perspective.

Startup investment term sheets contain the summarized information of the proposed key terms of an investment for a startup. It serves as a blueprint for the formal legal paperwork that will be drafted in layers. A term sheet startup investment includes details on company valuation, investment price, liquidation preference, board, confidentiality, and more.

Term sheets are nonbinding agreements provided by investors to show the basic terms and conditions of an investment. It helps to enable the alignment of interests of the investors and the founders. Term sheets should include detailed information about their content to ensure that the parties involved are all on the same page.

Term sheets indicate the intention of parties to agree to the funding and financial agreement. It also aims to provide understandable and detailed information that investors and founders can use to negotiate and agree upon. It contains clear and concise descriptions of deal terms and conditions that will help in avoiding future disputes.

A term sheet marks the beginning of a potentially long relationship between an investor and a company. As it provides clear details on the terms and conditions of a deal, it helps create a direct relationship between the potential investors and startups. Term sheets provide an overview of the significant terms that are included in the deal, giving both parties clear visibility of their intention.

Negotiations can be done to make changes in a term sheet before making the final agreement of a deal. It gives clarity and transparency which are important factors in developing investor relationships during the entire funding process. Some important terms to negotiate include the funding amount, valuation, preferred vs. common stock, liquidation preference, and more.

Term sheets help in eliminating the chances of miscommunication or misconception and reduce the probability of unnecessary details. It also allows the parties involved to address any misunderstanding or issues. Using term sheets enables the parties to outline any conditions that need to be addressed before legally binding the document.

Terms sheets provide the flexibility to both parties to abandon their agreement without damaging their branding. As term sheets are nonbinding agreements, the investor or the company can drop the deal if terms and conditions were not met as promised. By doing so, both parties can avoid further damages that may occur if they proceed with executing the unbalanced agreement.

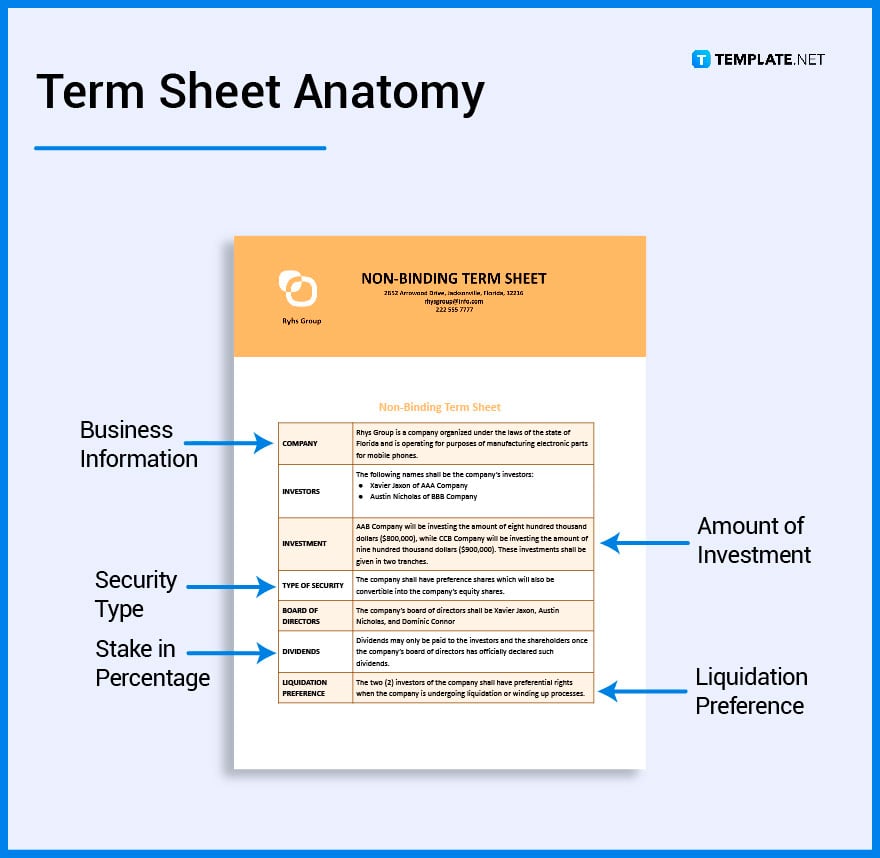

Business information contains the name of the parties involved including the name of the business seeking capital and the potential investor.

Valuations contain the price per share for the target company and provide information on the pre-money (which is based on the number of outstanding shares before the financing is done) and the post-money (which is done based on the number of shares outstanding post-financing).

This part identifies the type of security offered and its price per share which includes types of assets like equity, preference shares, warrants, and more.

This part of the term sheet should contain a clear and specified amount of the investments to avoid confusion in the future.

The liquidation preference is proportional to the amount invested which means that it can be equal to or a multiple of the amount invested.

A stake in percentage is the part of a term sheet that identifies what investors own in return for their investment.

Voting rights enable investors to know the extent to which they can participate in the decision-making process of a company, making them more confident in helping the company to raise funds and capital.

This part includes the investor commitment, founder’s obligation, time frame, non-disclosure requirements, and the closing date.

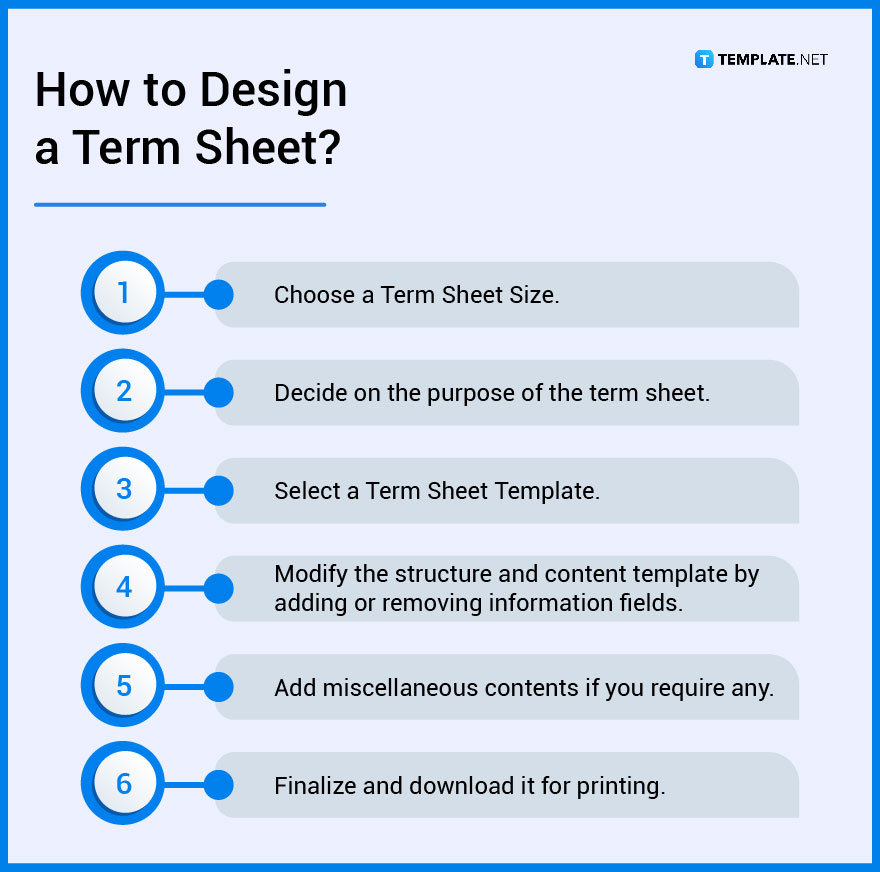

1. Choose a Term Sheet Size.

2. Decide on the purpose of the term sheet.

3. Select a Term Sheet Template.

4. Modify the structure and content template by adding or removing information fields.

5. Add miscellaneous contents if you require any.

6. Finalize and download it for printing.

Term sheets are written memorandum and nonbinding agreement that defines the basic terms and conditions of an investment deal that will become a legally binding document once the parties involved agree to its content.

Job descriptions are plain-language tools that define the tasks, duties, functions, and responsibilities of a position, as well as the details on who performs a specific type of work, how it should be done, and the purpose of the work.

Term sheets are used by startups as well as entrepreneurs to attract investors which contain the terms and conditions under which an investment will be made.

Functions in investment refer to the concept or strategy within economics that helps in identifying the connection between shifts in the national income and investment patterns.

Duties in investment refer to the fiduciary duties which exist to ensure that those who manage other people’s money act in their beneficiaries’ interests and not in their own.

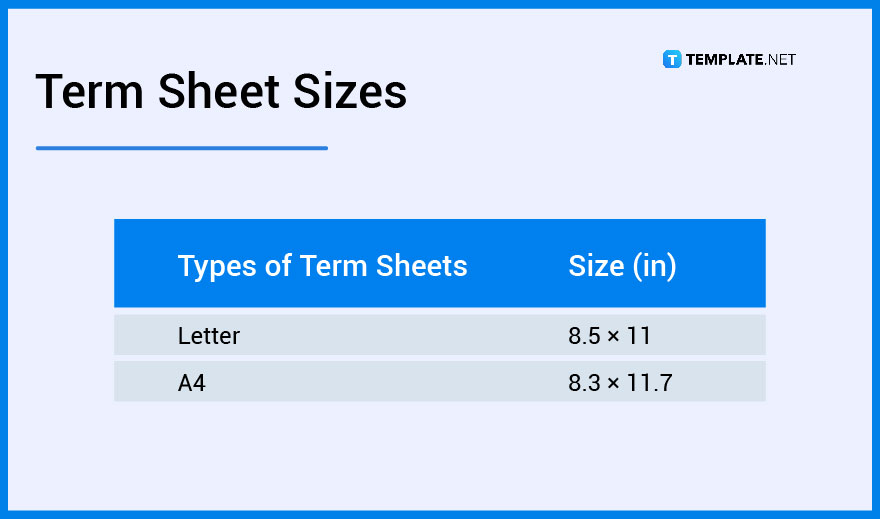

Printing terms sheets must be done using the correct paper size. The most common term sheet sizes include the US Letter (8.5″ × 11″) and A4 (8.3″ × 11.7″) sizes.

Term sheet ideas are presented using clear and concise information about a proposed investment deal with the help of properly organized term sheet templates.

A term sheet must include important details on the terms and conditions of an investment deal as well as a summary of the main points of the deal agreements.

Term sheets should contain the estimate of the company’s worth or valuation, securities being offered, voting rights, amount of investment, liquidation preference, stake in percentage, and miscellaneous provisions.

A signed term sheet is evidence of serious intent while not legally binding which sets out certain terms of a transaction agreed upon between parties.

A good term sheet identifies its purpose, summarizes the terms and conditions, includes the offering terms, dividends, liquidation provisions, the participation rights, and ends with the voting agreement.

Yes, term sheets have expiration dates which indicate the date it will automatically terminate when a company does not sign an agreement.

Term sheets are usually issued by angel investors, venture capital companies, and financial institutions which vary in terms of size and risk they can take.

You should look for the valuation, type of stock, option pool, liquidation preference, participation rights, pro-rata rights, tag-along and drag-along rights, and anti-dilution provision.

A term sheet for series A is an agreement that provides an outline of all the terms and conditions of the investment which focuses on the control of company shares and how financials will be divided if an exit occurs.

A nonbinding term sheet refers to an agreement in which parties are not legally bound or obligated to carry out terms.

Term sheets serve as blueprints for an investment that establishes the specific conditions and agreements of venture investments between an early-stage company and venture company.

![How To Create Meeting Minutes in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-Meeting-Minutes-in-Google-Docs-Template-Example-788x443.png)

Meeting minutes Play a vital role in the recording of meeting information and details. In any kind of meeting, there is always…

![How To Make/Create a Manual in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Google-Docs-788x443.png)

Manuals are essential instructional and reference guides. They help direct and inform an individual’s actions and also explain how to…

![How To Make/Create a Manual in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make-Create-a-Manual-in-Microsoft-Word-788x443.png)

Creating a manual can be a time-consuming and tedious task. However, manuals and other reference guides are necessary for organizations…

![How To Create a Legal Document in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Legal-Document-in-Google-Docs-Template-Example-2023-788x443.png)

When creating a legal document, there are a lot of things a person has to consider, and one of which is the…

![How To Make/Create a Contract in Microsoft Word [Template + Example] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Microsoft-Word-Template-Example-2023-1-788x443.png)

Contracts can come in different forms and for different reasons but the most common thing is that when a company does business with…

![How To Create a Contract in Google Docs [Template + Example]](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Contract-in-Google-Docs-Template-Example-2023-Step-788x443.png)

Contracts are an important part of any company or business, especially those that work with different companies or businesses. Companies…

![How To Make/Create a Report in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Create-a-Report-in-Microsoft-Word-788x443.png)

A report is a comprehensive document that covers a wide array of topics from finance, research, incidents, feasibility studies, and…

![How To Make/Create a Report in Microsoft Word [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-To-Make_Create-a-Report-in-Microsoft-Word-Templates-Examples-20232-788x443.png)

A report is a document that contains information, data, analysis, finding, and other relevant information based on a specific topic.…

![How to Make/Create a Notebook in Google Docs [Templates + Examples] 2023](https://images.template.net/wp-content/uploads/2023/07/How-to-Make_Create-a-Notebook-in-Google-Docs-Templates-Examples-2023-788x443.png)

Notebooks always come in handy in writing important information or expressing our thoughts through written words. When we need a…