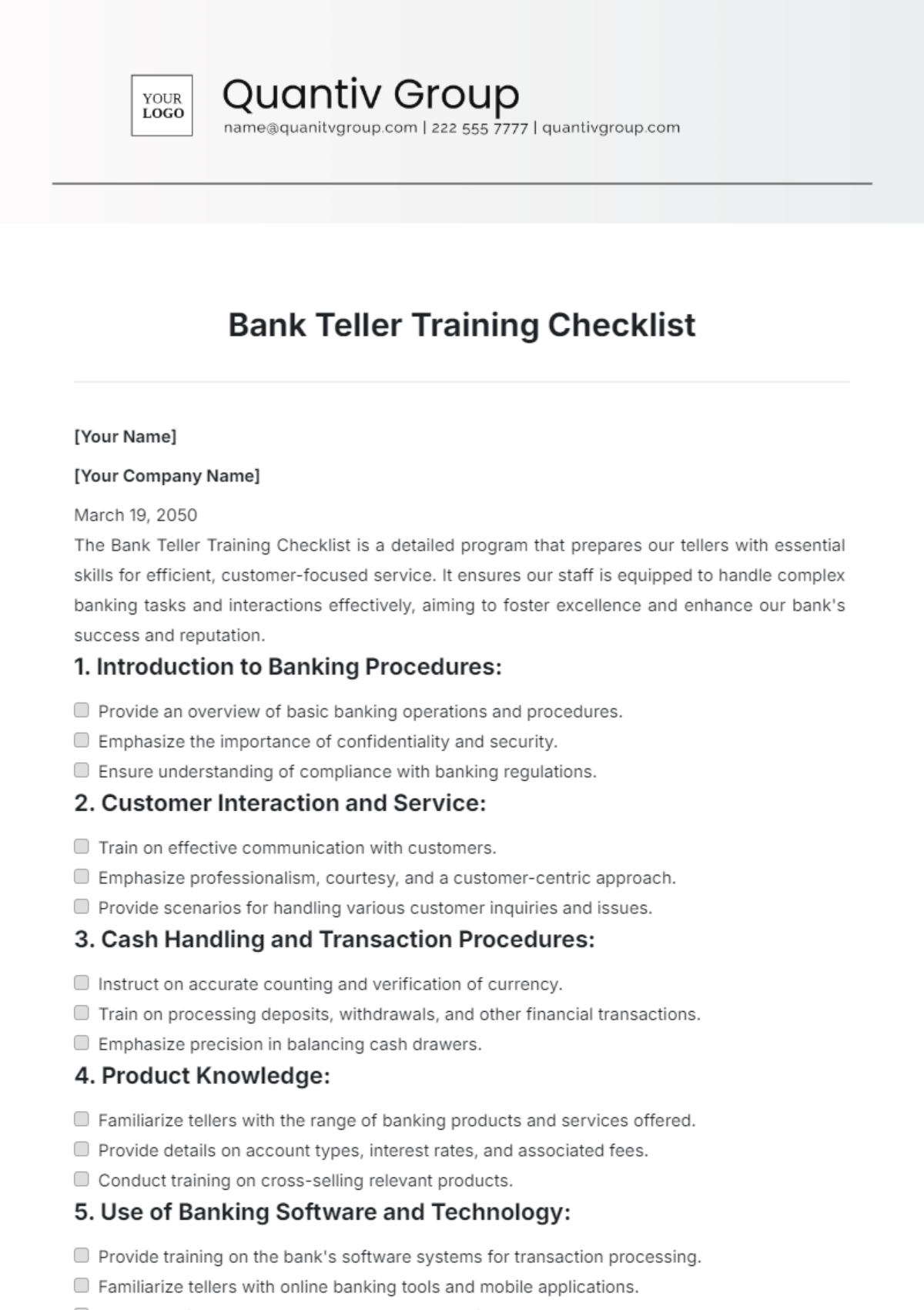

Free Bank Teller Training Checklist

[Your Name]

[Your Company Name]

March 19, 2050

The Bank Teller Training Checklist is a detailed program that prepares our tellers with essential skills for efficient, customer-focused service. It ensures our staff is equipped to handle complex banking tasks and interactions effectively, aiming to foster excellence and enhance our bank's success and reputation.

1. Introduction to Banking Procedures:

Provide an overview of basic banking operations and procedures.

Emphasize the importance of confidentiality and security.

Ensure understanding of compliance with banking regulations.

2. Customer Interaction and Service:

Train on effective communication with customers.

Emphasize professionalism, courtesy, and a customer-centric approach.

Provide scenarios for handling various customer inquiries and issues.

3. Cash Handling and Transaction Procedures:

Instruct on accurate counting and verification of currency.

Train on processing deposits, withdrawals, and other financial transactions.

Emphasize precision in balancing cash drawers.

4. Product Knowledge:

Familiarize tellers with the range of banking products and services offered.

Provide details on account types, interest rates, and associated fees.

Conduct training on cross-selling relevant products.

5. Use of Banking Software and Technology:

Provide training on the bank's software systems for transaction processing.

Familiarize tellers with online banking tools and mobile applications.

Ensure proficiency in using ATMs and other self-service options.

6. Fraud Prevention and Security Measures:

Educate on recognizing and preventing fraudulent activities.

Train on identity verification procedures.

Emphasize the importance of adhering to security protocols.

7. Regulatory Compliance:

Review regulatory requirements and compliance expectations.

Conduct training on Anti-Money Laundering (AML) procedures.

Ensure tellers understand and adhere to Know Your Customer (KYC) guidelines.

This checklist ensures our tellers are well-prepared to provide excellent customer service, maintain accuracy in financial transactions, and uphold the integrity and security of our banking operations.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize the training process for your bank tellers with the Bank Teller Training Checklist Template from Template.net. This customizable and downloadable template ensures a comprehensive training program for bank teller staff. Personalize the checklist effortlessly using AI Editor Tool to suit your specific needs. Download now to streamline training, enhance teller skills, and ensure consistent service quality in your bank.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

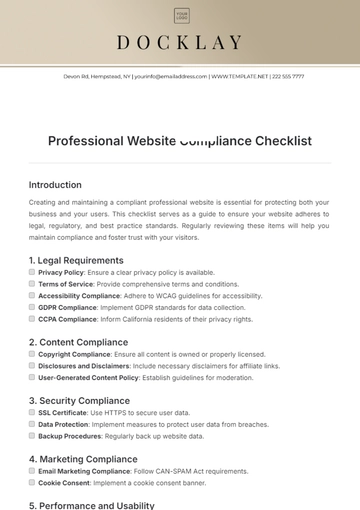

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

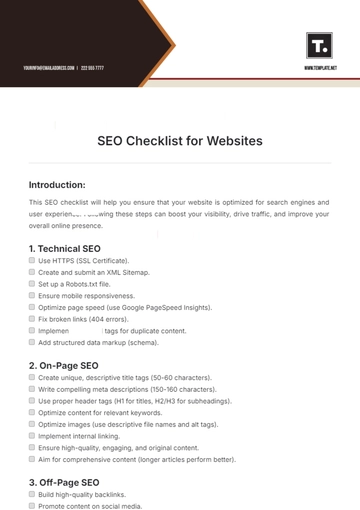

- SEO Checklist

- Assessment Checklist

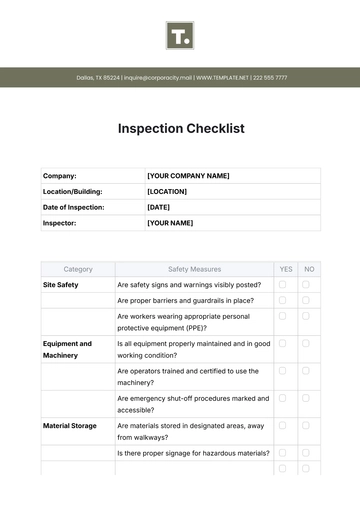

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

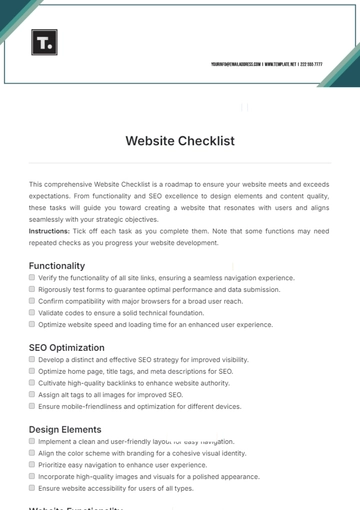

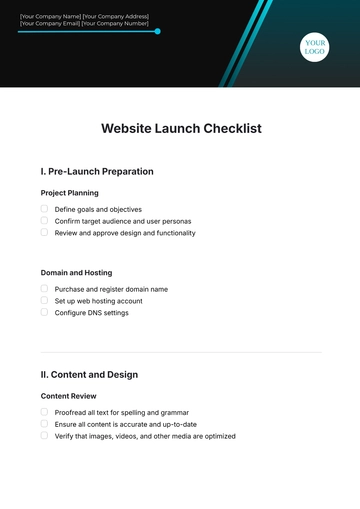

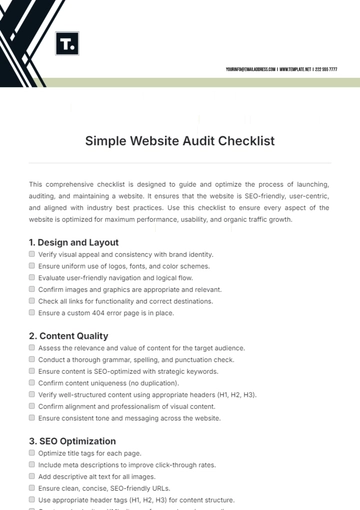

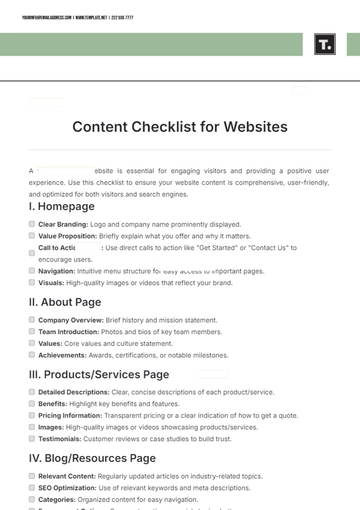

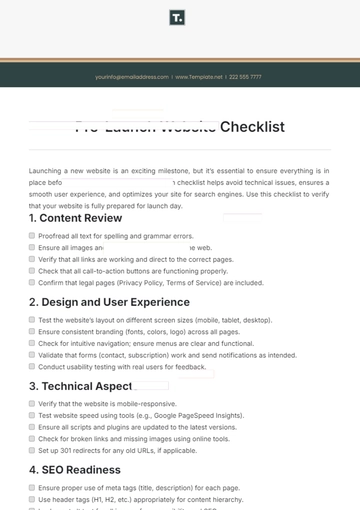

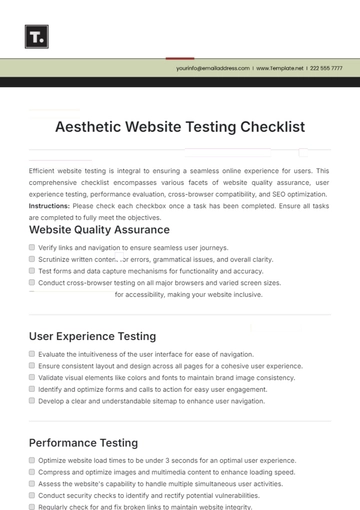

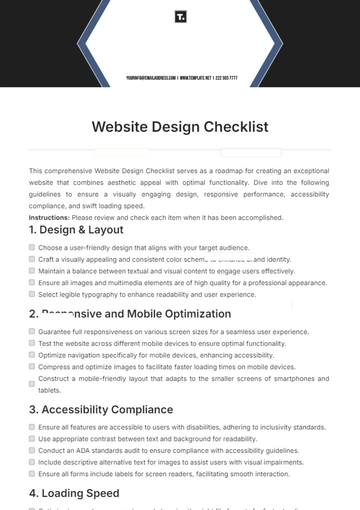

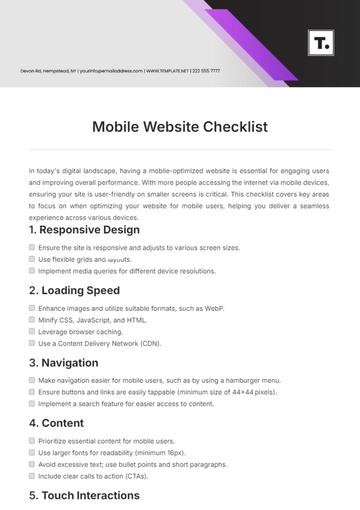

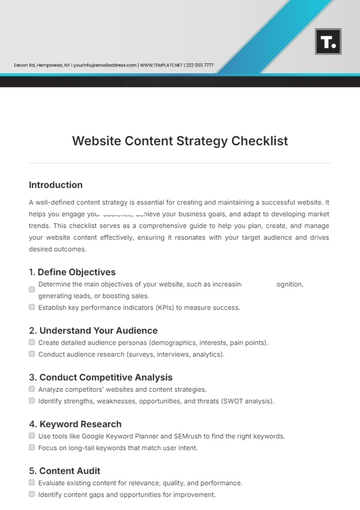

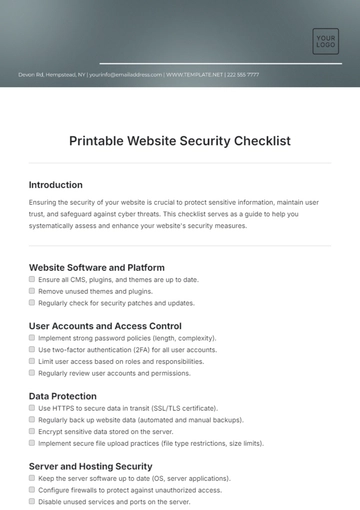

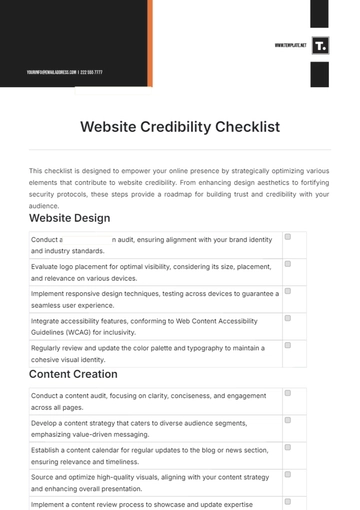

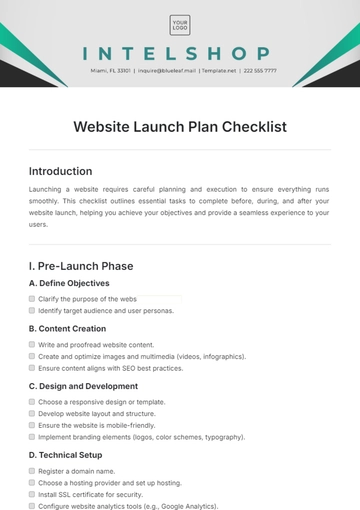

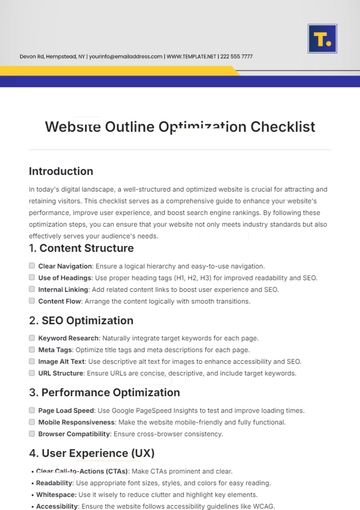

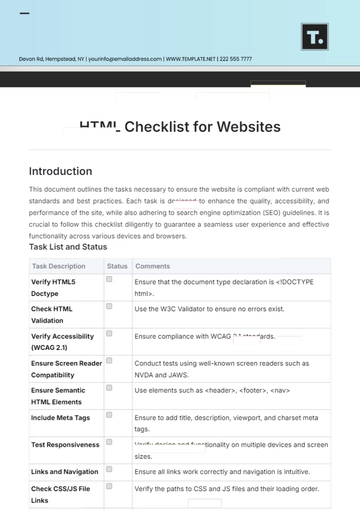

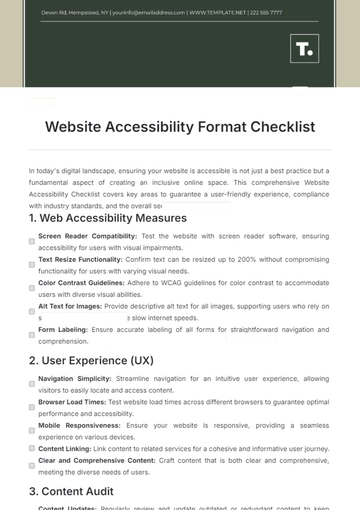

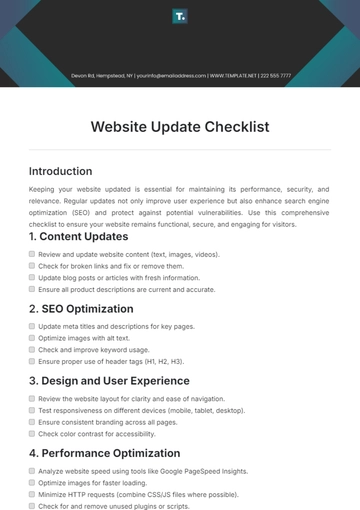

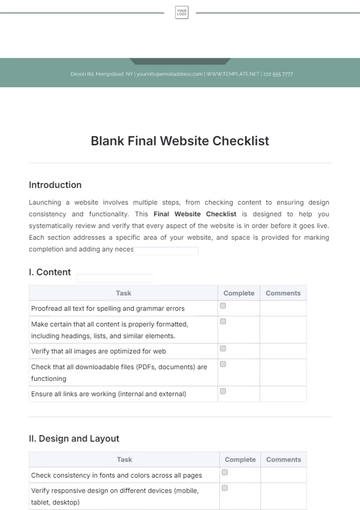

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist