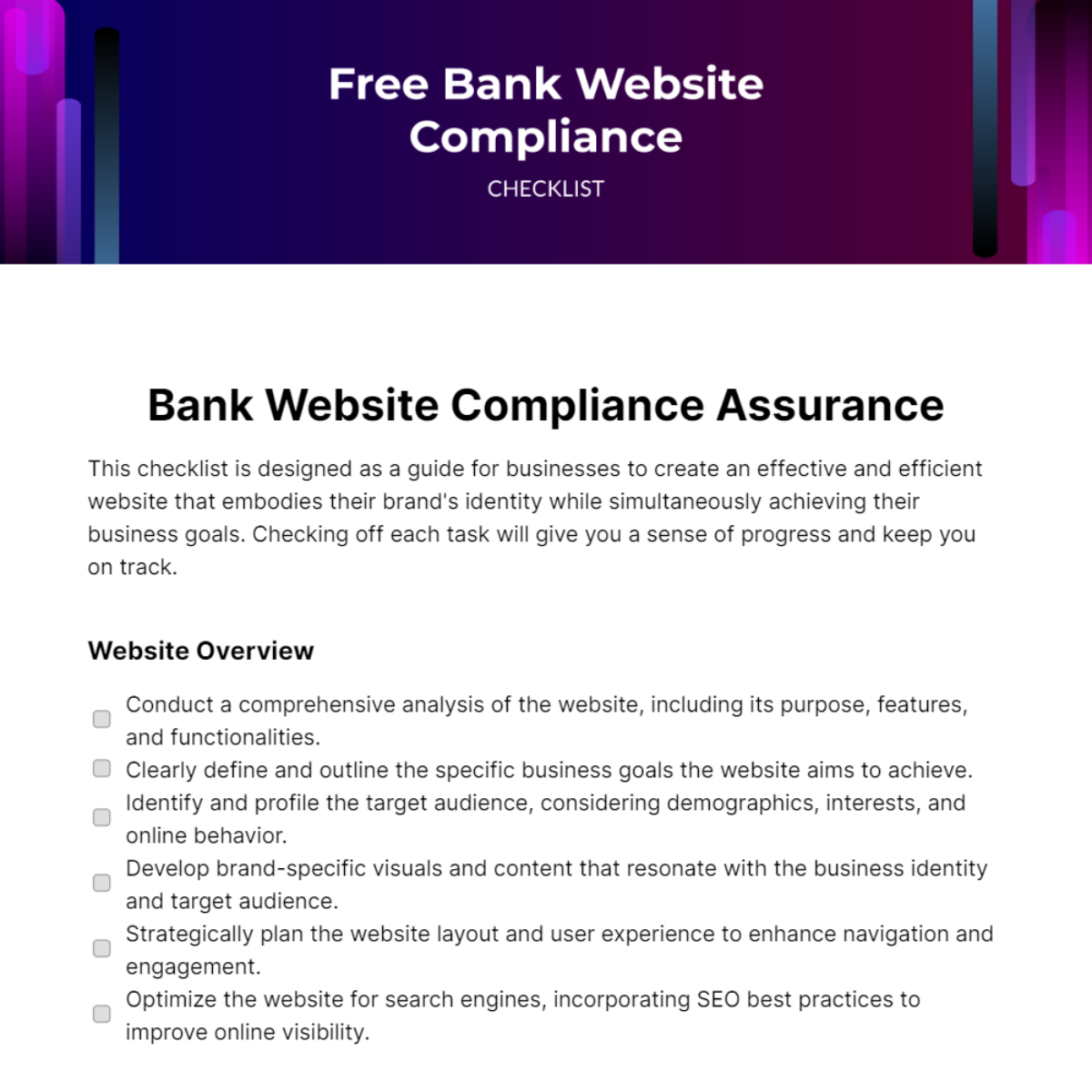

Free Bank Website Compliance Checklist

This checklist is designed as a guide for businesses to create an effective and efficient website that embodies their brand's identity while simultaneously achieving their business goals. Checking off each task will give you a sense of progress and keep you on track.

Website Overview

Conduct a comprehensive analysis of the website, including its purpose, features, and functionalities.

Clearly define and outline the specific business goals the website aims to achieve.

Identify and profile the target audience, considering demographics, interests, and online behavior.

Develop brand-specific visuals and content that resonate with the business identity and target audience.

Strategically plan the website layout and user experience to enhance navigation and engagement.

Optimize the website for search engines, incorporating SEO best practices to improve online visibility.

Regulatory Compliance

Ensure that the website is compliant with the Americans with Disabilities Act (ADA) to provide accessibility for all users.

Post a visible and comprehensive privacy policy detailing data collection, usage, and protection measures.

Implement a cookie consent banner to inform users and obtain their consent for tracking and analytics.

Maintain compliance with the General Data Protection Regulation (GDPR) for EU customers.

Adhere to the California Consumer Privacy Act (CCPA) to meet the privacy requirements for California customers.

Risk Management

Identify potential risks associated with the website, such as security vulnerabilities or data breaches.

Establish and document protocols for addressing identified risks promptly and effectively.

Implement necessary security features to safeguard against cyber threats and unauthorized access.

Ensure regular backup procedures are in place to mitigate data loss and facilitate quick recovery.

Conduct periodic reviews and monitoring of website performance to identify and address issues proactively.

Anti-Money Laundering (AML) and Know Your Customer (KYC)

Implement AML and KYC controls to detect and prevent money laundering activities.

Create a comprehensive AML and KYC policy outlining procedures and compliance measures.

Educate staff on AML and KYC practices, ensuring awareness and adherence to established policies.

Enable robust user authentication protocols to verify the identity of customers.

Regularly review and update AML and KYC policies to align with evolving regulatory requirements.

Data Security

Implement SSL certification to secure data transmission and establish a secure connection.

Ensure data encryption during the transfer process to protect sensitive information.

Regularly update website software and applications to address security vulnerabilities.

Securely store user data, implementing measures to protect against unauthorized access or data breaches.

Maintain and update firewall and other security applications to fortify the website's defense against cyber threats.

[Your Company Name]

[Your Company Address]

[Your Company Email]

Conducted by: [Your Name]

Conducted on: [Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Navigate the complex landscape of regulatory compliance seamlessly using this Bank Website Compliance Checklist Template from Template.net. This editable and customizable resource streamlines compliance processes, offering a detailed guide for your bank's website. Harness the power of customization in our Ai Editor Tool for efficient adaptation to your specific requirements.

You may also like

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

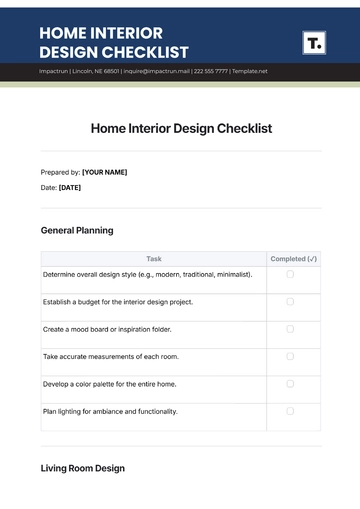

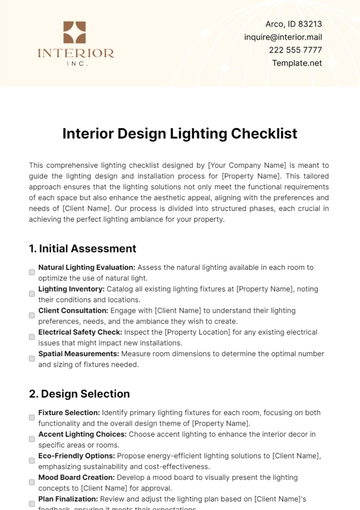

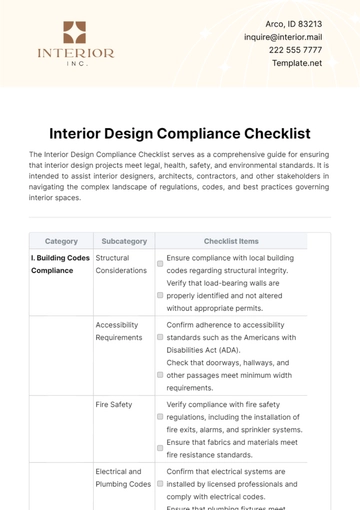

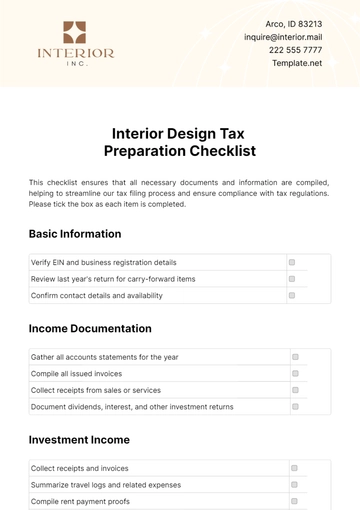

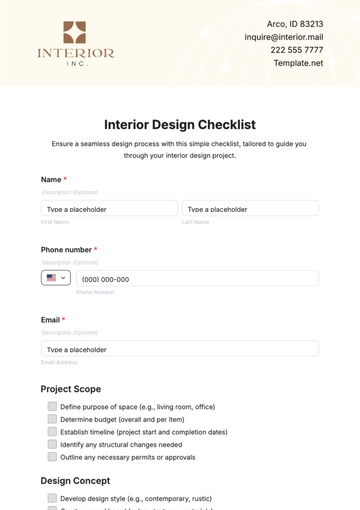

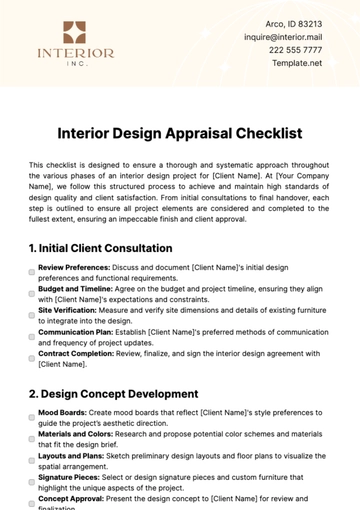

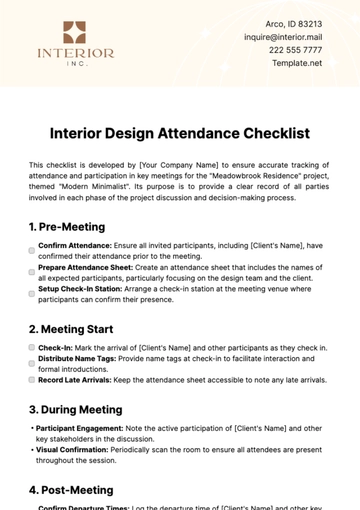

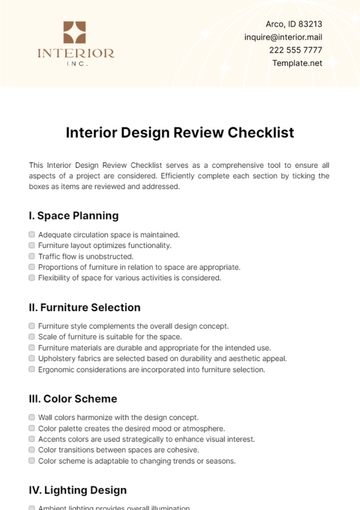

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist