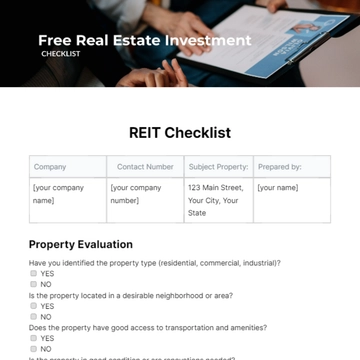

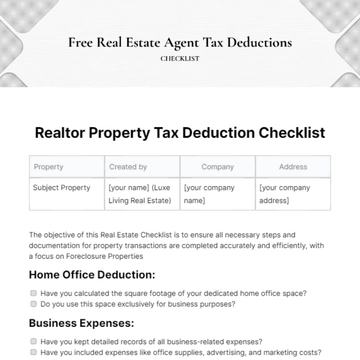

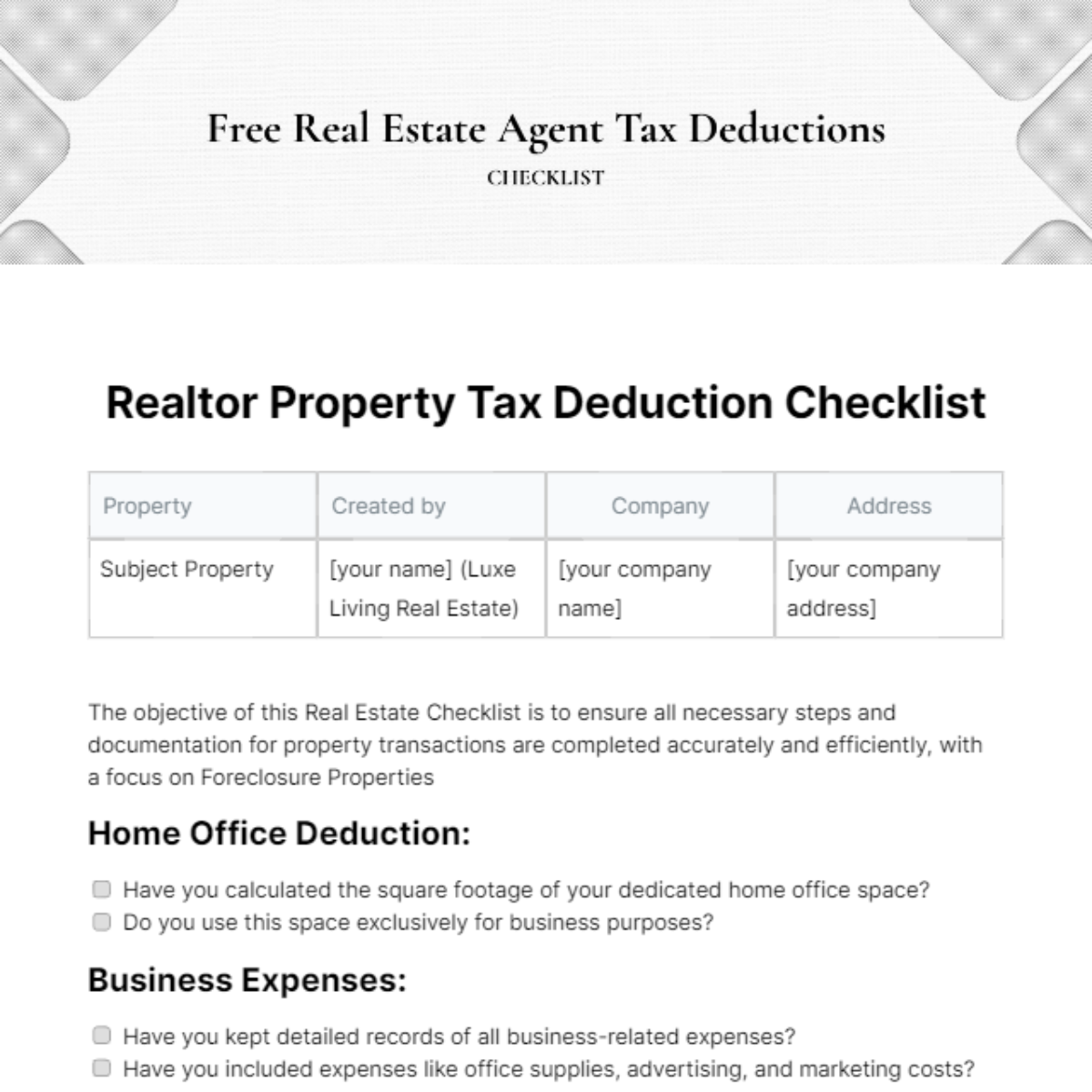

Free Real Estate Agent Tax Deductions Checklist

Property | Created by | Company | Address |

|---|---|---|---|

Subject Property | [your name] (Luxe Living Real Estate) | [your company name] | [your company address] |

The objective of this Real Estate Checklist is to ensure all necessary steps and documentation for property transactions are completed accurately and efficiently, with a focus on Foreclosure Properties

Home Office Deduction:

Have you calculated the square footage of your dedicated home office space?

Do you use this space exclusively for business purposes?

Business Expenses:

Have you kept detailed records of all business-related expenses?

Have you included expenses like office supplies, advertising, and marketing costs?

Vehicle Expenses:

Have you tracked mileage for business-related trips?

Do you have records of vehicle maintenance and repair expenses related to your business?

Professional Development:

Have you deducted expenses related to real estate courses, seminars, or certifications?

Did you attend industry-related conferences or workshops?

Client Entertainment:

Have you documented client meetings and associated expenses?

Have you kept receipts for meals, events, or entertainment with clients?

Home Selling Expenses:

Have you accounted for expenses associated with listing properties, such as photography or staging?

Did you include closing costs and real estate commissions?

Insurance Costs:

Have you claimed deductions for professional liability insurance?

Did you deduct premiums for health insurance as a self-employed individual?

Retirement Contributions:

Are you taking advantage of retirement plans such as a SEP-IRA or solo 401(k)?

Have you maximized your allowable contributions?

Home Utilities:

Are you deducting a portion of your utility bills based on your home office space's size and usage?

Self-Employment Taxes:

Have you calculated and set aside funds for self-employment taxes?

Depreciation:

Have you claimed depreciation on real estate assets like your computer, office furniture, or vehicles used for business purposes?

Real Estate Association Fees:

Have you deducted membership dues and fees for professional organizations related to your field?

Record Keeping:

Do you have organized and well-maintained records for all deductions claimed?

Tax Professional Consultation:

Have you consulted with a tax professional or CPA to ensure you're maximizing your deductions?

Quarterly Estimated Taxes:

Are you making quarterly estimated tax payments to avoid penalties?

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Real Estate Agent Tax Deductions Checklist, exclusively from Template.net! This AI Editable Tool is a game-changer for professionals in the industry. Seamlessly navigate tax season with our customizable and editable checklist, designed to maximize your deductions. Stay ahead of the curve and simplify your financial planning with this indispensable resource. Streamline your taxes today.

You may also like

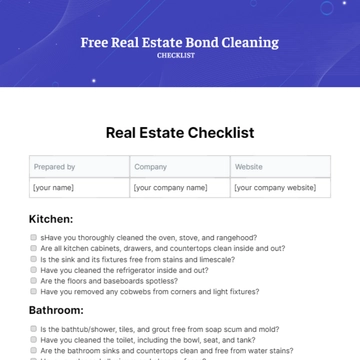

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

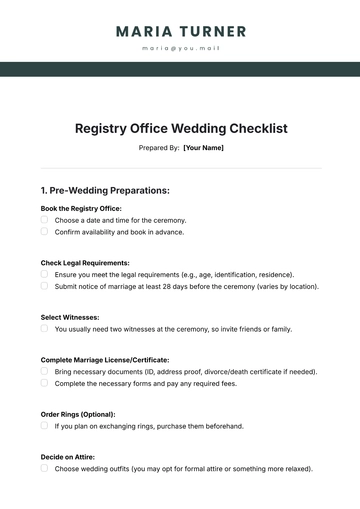

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

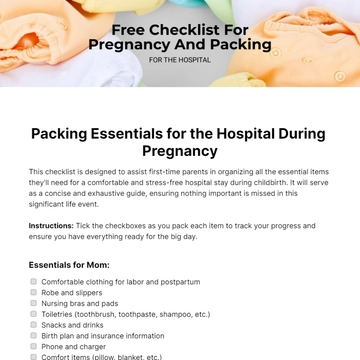

- Packing Checklist

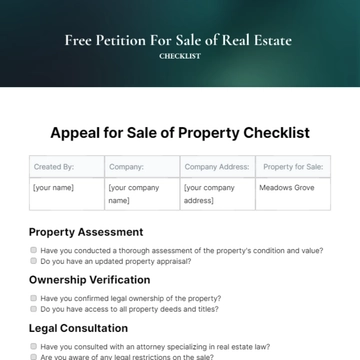

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

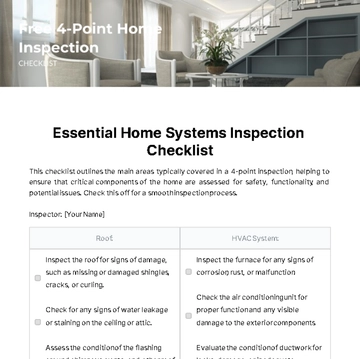

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

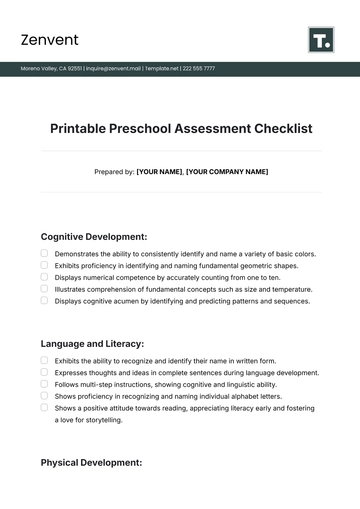

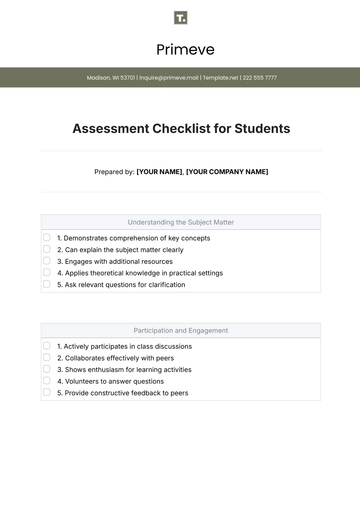

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

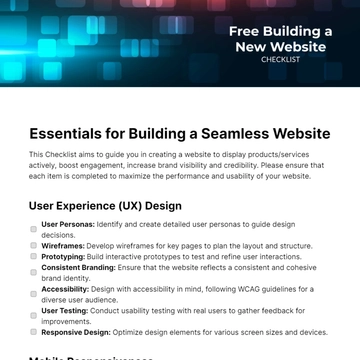

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

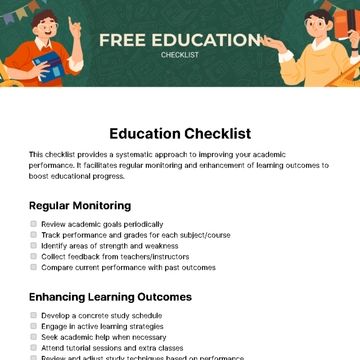

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

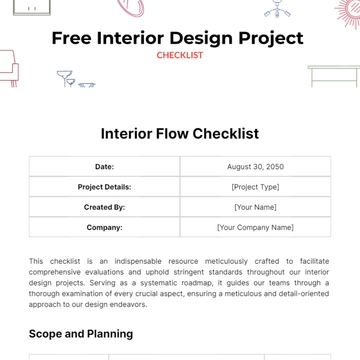

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

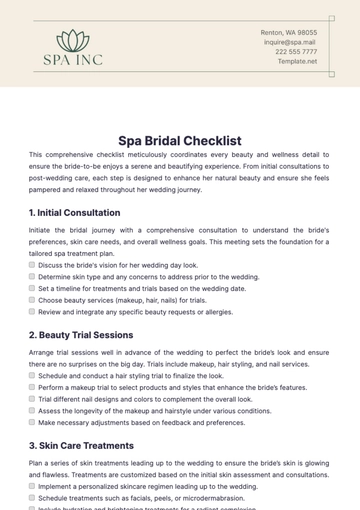

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist