Free Financial Investment Policy Analysis

[Month, Day, Year]

Introduction

The goal of this analysis is to delve thoroughly into the underlying pattern and potential areas of improvement in the Financial Investment Policy. In the course of this examination, we will evaluate the existing policy's implications with the aim of identifying opportunities that can be leveraged to meet tailored financial objectives. This analysis has been prepared by [YOUR NAME] and it embarks on creating dialogue about our financial investment policy at [YOUR COMPANY NAME].

Objectives

The fundamental aim of this analysis is to examine the current scenarios within the financial investment policy and identify areas for improvement. We also envisage to understand the potential implications of investments. Ultimately, it aims at providing actionable strategies that can be employed to improve overall financial investment portfolio courting notable surplus and a composed risk profile.

Methodology

An array of methodologies, including quantitative analysis and risk analysis, have been employed to conduct this analysis. The methodologies are chosen considering their relevance towards our goal of creating strategies for optimal financial portfolio management.

Investment Analysis

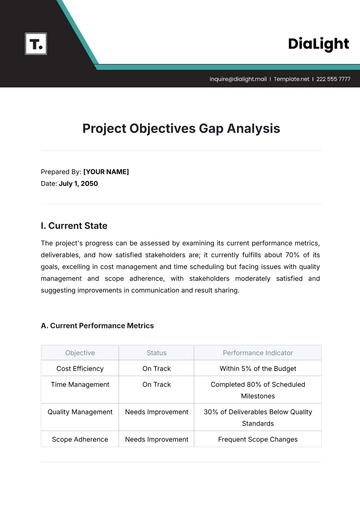

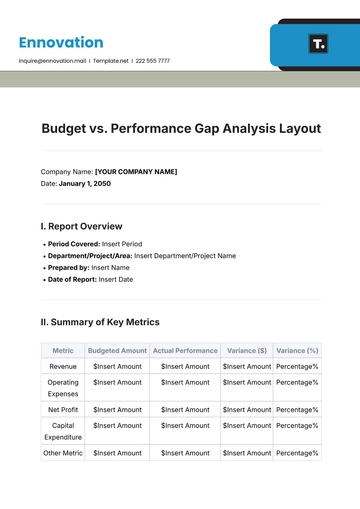

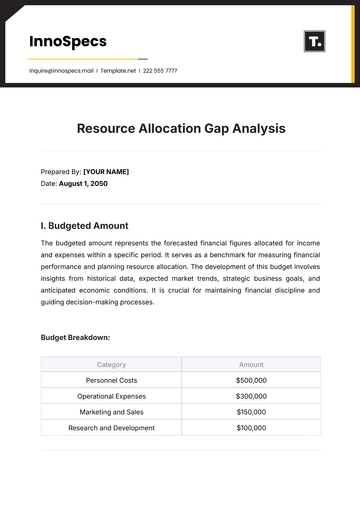

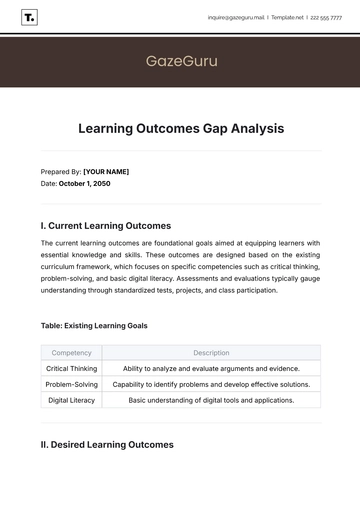

Investment Type | Yield | Risk |

|---|---|---|

Stocks | 15% | High |

Bonds | 8% | Low |

Mutual Funds | 10% | Medium |

Recommendations

Based on our analysis, it is advisable for [YOUR COMPANY NAME] to diversify its portfolio by including a balanced mixture of high, medium, and low-risk investment options. This move will not only provide a shield against potential losses but also ensure respectable earnings. It is also noteworthy to consider leveraged investments – although risky, if managed well, they could provide substantial returns on investment.

Conclusion

To wrap up, this analysis has revealed that a cautious and broad-minded approach towards investment is necessary for achieving desired returns. Furthermore, a well-diversified portfolio coupled with a strategic balance between various levels of risk can lead to effective financial portfolio management. We hope that our findings and recommendations will serve as a firm foundation upon which future prosperity can be constructed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Financial Investment Policy Analysis Template from Template.net offers a comprehensive, easy-to-use framework for crafting effective investment strategies. Aligned with U.S. standards, it balances risk management, asset allocation, and regulatory compliance, tailored for finance professionals seeking streamlined, reliable policy development. Ideal for enhancing client trust and investment decision-making.