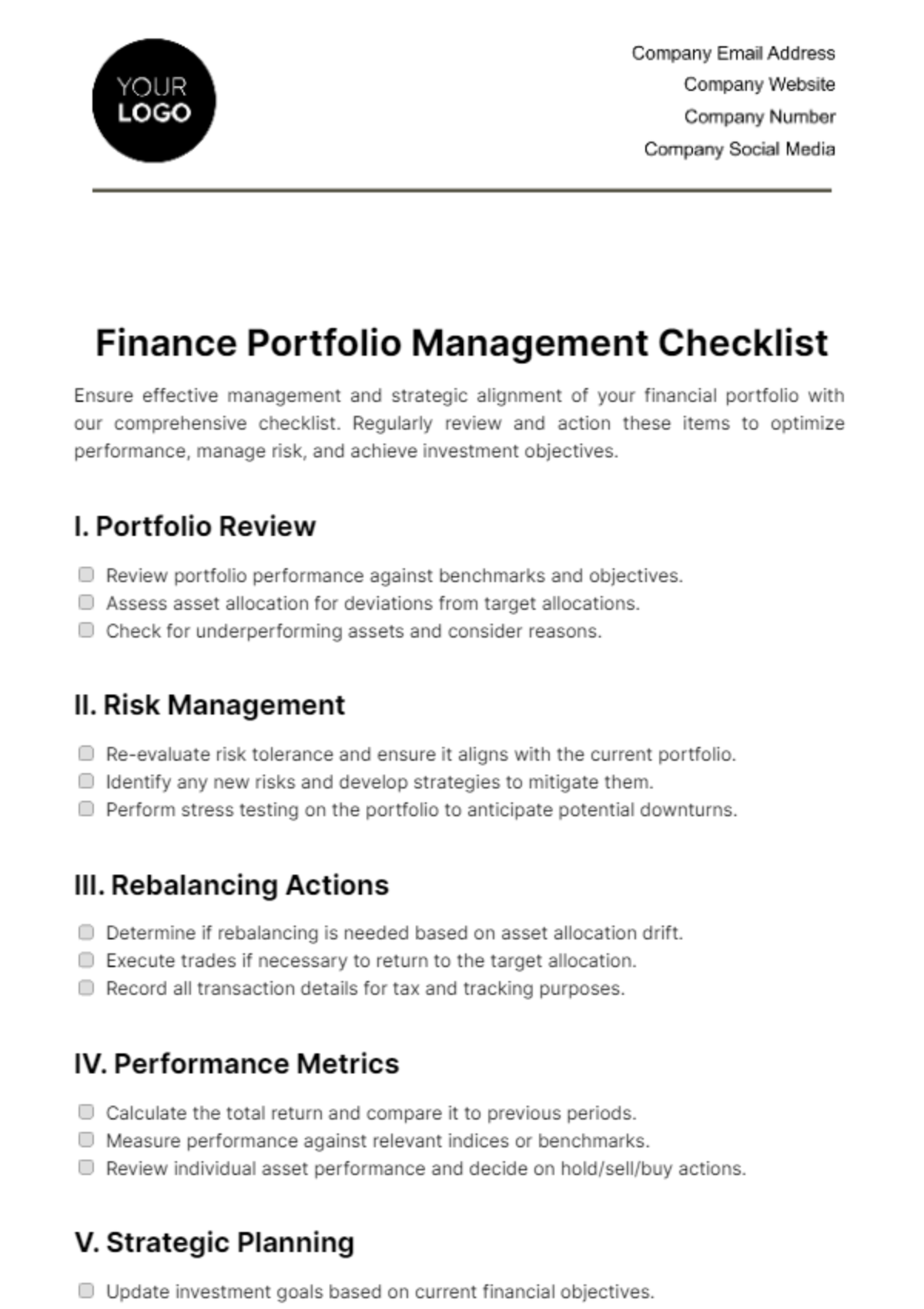

Free Finance Portfolio Management Checklist

Template.net's Finance Portfolio Management Checklist Template, available for editing in our Ai Editor Tool, is the ultimate customizable and editable resource for financial experts. Tailor it to fit your unique portfolio management needs, ensuring a comprehensive and efficient financial strategy. This template is your key to organized and effective financial planning.